A Deep Dive into Ethereum

Ethereum, the second-largest cryptocurrency in the world, set a historic all time high of $1,459 last week in succession to a remarkable early-year rally. Even with Bitcoin’s success, Ether left it dead in its tracks in 2020, returning 650% in the past year. With the project looking to travel down a bright direction, it is a great time to assess Ethereum’s performance as we move forward into a captivating 2021.

The ETH/BTC chart sets quite a bullish case for Ethereum (see below). Historically, price points below 0.04 have acted as resistance. But, when the price last broke out of this region, Ethereum managed to outperform Bitcoin by approximately 200% in the following weeks. We are currently floating above this resistance once again, and it is possible that we could see similar price action and an outperformance over Bitcoin in the foreseeable future.

Ethereum Performance Reaches New Heights

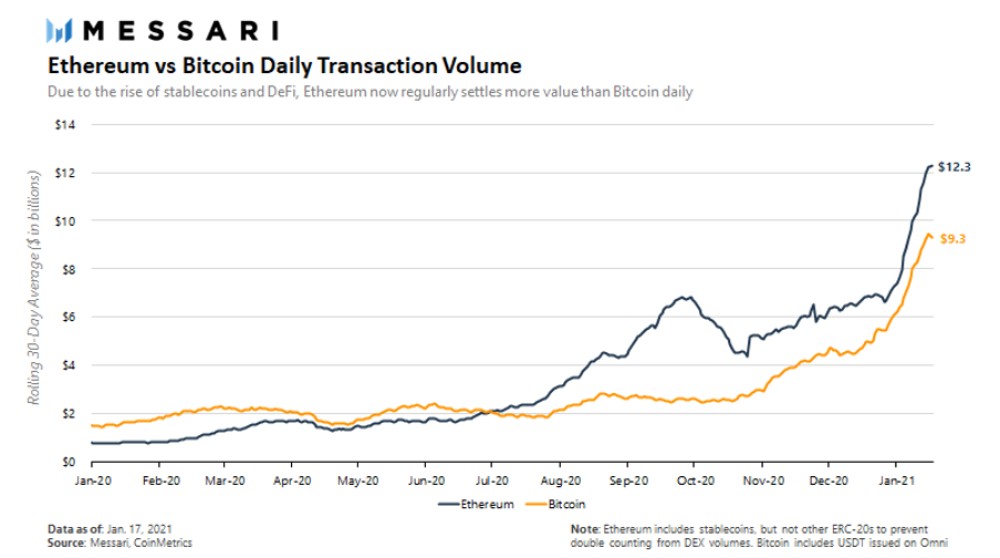

Ethereum saw transaction volume over $1.5 trillion in 2020, surpassing Bitcoin’s volume since the latter of the year. The project is currently processing more than $3 billion in transactional volume compared to Bitcoin, according to recent data published by Messari.

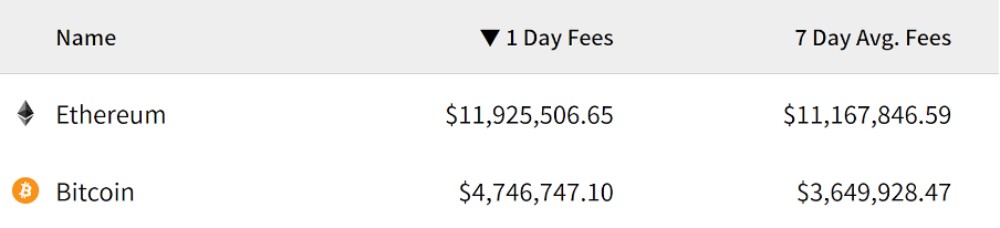

This rise in volume has also meant that Ethereum is now generating more in overall fees than Bitcoin and any other smart platform. For comparison, other smart contract platforms such as Cardano and Tezos generate approximately $1000 per day compared to Ethereum’s $10+ Million. Generated fees signify the willingness to use and pay for a project, alluding to the perceived utility that the Ethereum platform and its overlying projects represent to its consumers.

A lot of this growth is coming from Ethereum's expanding Decentralised Finance ecosystem. Over 200 different DeFi projects listed on DeFi Prime are built on the Ethereum blockchain, and a vast proportion of these projects saw significant accomplishments rolling over from 2020, such as yearn.finance, Synthetix Network, and Uniswap. With an expanding user base and over $27 billion in Total Value Locked (TVL), DeFi’s increasing appeal is reinforcing Ethereum’s supremacy as both an incubator and a competitor for other projects on the playing field.

The Ethereum Merge

In its essence, Ethereum now incorporates Proof-of-Stake (PoS) - executed in September 2022 - and Shard Chains (to be rolled out in 2023) in the platform. The transition comprises several phases, and its current standing at Phase 1 inolved the merging of the new Beacon Chain PoS consensus layer and the previous Proof of Work (PoW) layer. PoW mining was phased out and staking became the sole method of conensus.

Currently, the Ethereum network’s transaction fees are determined based on a system in which the highest fee-paying users have their actions prioritised. However, this results in extremely high fees in periods of increased volatility and trading activity. Ethereum’s founder Vitalik Buterin and some of its lead developers wish to improve the way in which transactions fees are decided and optimise overall user experience. This new proposal, EIP 1559, removes the auction-style fee system and introduces a base fee for all actions depending on the amount of network activity at the time, with the ability to tip miners if a user wishes to process transactions faster. This new change comes with an interesting change for Ethereum’s supply; all transaction base fees will be “burnt”, or removed from existence, and thus reducing circulating supply. This proposed change will encourage a deflationary Ethereum ecosystem, hopefully boosting prices over time. It is anticipated to occur as early as February.

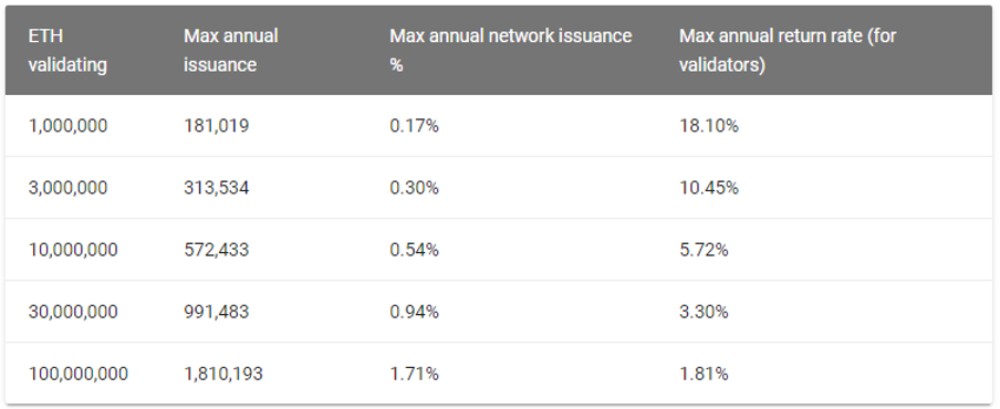

Eth2 staking returns will likely be 5-15% APY, depending on how much ETH will be staked. As people will be interested in getting these types of returns from such a trusted network, Ethereum’s demand will continue to rise, and the reduced supply will potentially increase Ethereum’s price.

CME Ether Futures Launching in February

The Chicago Mercantile Exchange (CME), one of the world's largest derivatives platforms, plans to launch Ethereum futures by February 8th. The group launched Bitcoin derivatives more than three years ago, harnessing their capacity to hedge risk exposure in the crypto market. Ether futures will enable investors to buy and sell Ethereum at a predetermined quantity and price at a predetermined time in the future.

Whether Ethereum futures will result in a rally or a decline remains ambiguous, but there is no denying that its inception will further intertwine traditional financial products with cryptocurrencies, opening new doors for investors of all sizes to participate in the market in a different way.

Social Metrics Signal Growth Potential

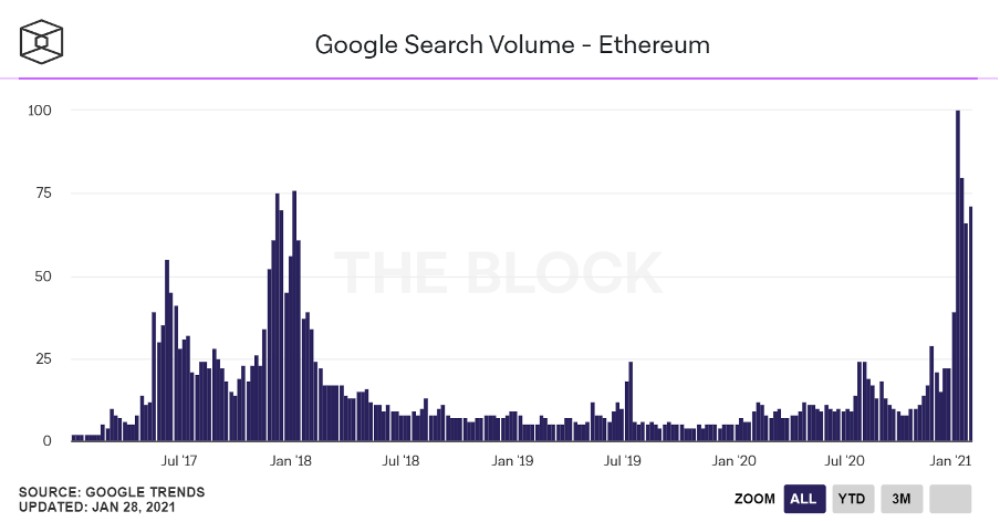

Ethereum’s social metrics have seen an exponential spike in the last few weeks, marking an unprecedented peak in worldwide search results since early 2018.

Whilst news of Ethereum’s newfound ATH is naturally the primary determinant of this growth, there also happened to be a pronounced interest in the Grayscale Ethereum Trust, with the trust quote rising by 22% at the time. Although the long-term implications are few, what can be said is that online communities are showing signs of being increasingly receptive to the crypto market, and greater public support can and will have a direct effect on Ethereum’s trajectory.

Exchange Data

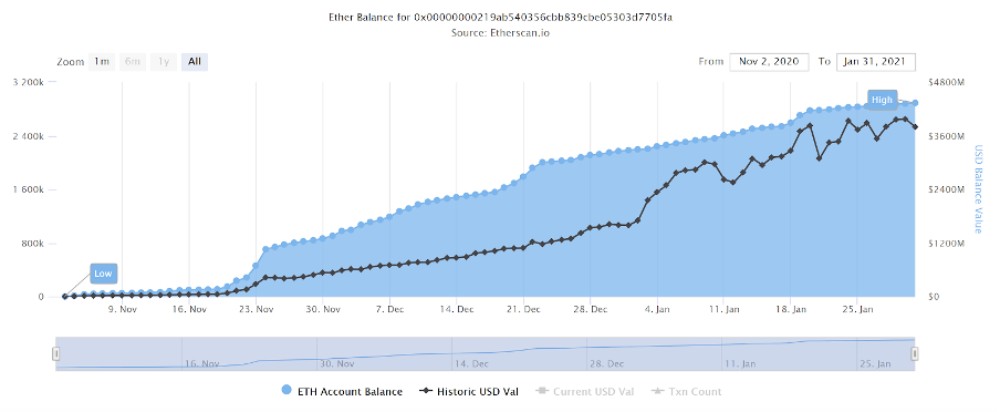

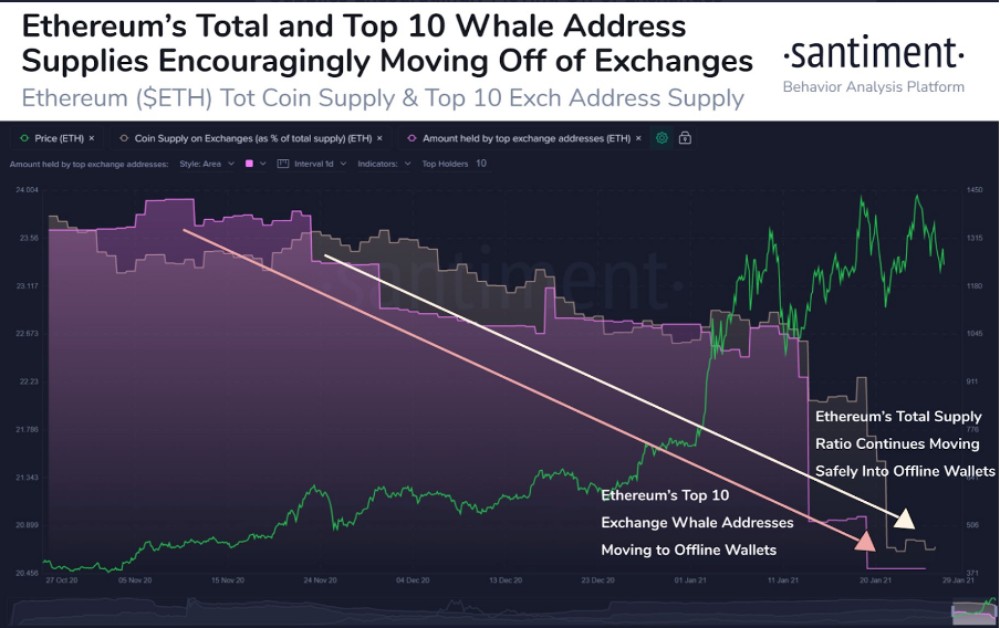

Chain analysis indicates that a lot of Ethereum is moving off exchanges, which highlights that investors are likely holding out for higher prices. Total coin supply on exchanges has fallen significantly, and this reduction in supply has resulted in a sharp price increase.

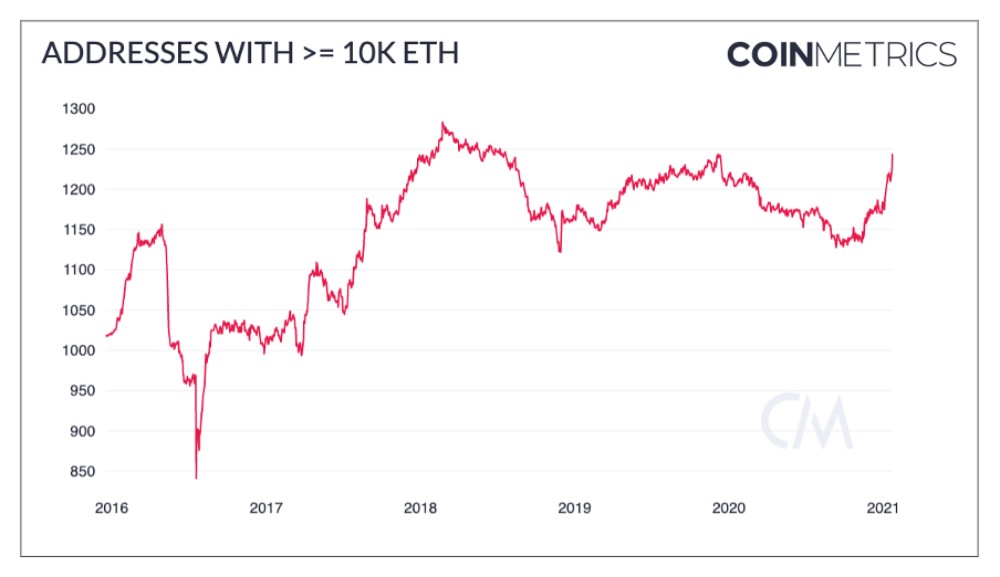

Interestingly, addresses with more than 10,000 ETH have increased significantly over the past few months, meaning that whales and institutional investors are accumulating more and more Ethereum, unfazed by current prices.

Final Remarks

From a compelling start to the year and several unique developments that lie just around the corner, the path ahead will be watched with great global interest and intrigue. As both the predecessor and rival to hundreds of projects in the space, not only does Ethereum set a tall standard to match, but if its plans for the year and beyond are executed smoothly, Ethereum could take the cryptocurrency market to a whole new level. As we roll into February, the remnants of Ethereum’s success in the past month leave a positive impression behind for investors to take along into the year ahead.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.