How to Measure Crypto Liquidity

Liquidity is the lifeblood of all tradable assets, including cryptocurrency.

It is important because it determines how quickly and efficiently market participants can buy or sell cryptocurrencies.

Highly liquid markets enable smooth and efficient trading, while highly illiquid markets can lead to difficulties entering or exiting a position at a desired price. Consequently, every investor needs to understand how to measure crypto liquidity to reduce risk and maximise returns.

What is Crypto Liquidity?

Crypto liquidity refers to the ease and speed with which a cryptocurrency can be converted into cash or other digital assets, without the trade substantially affecting the asset’s price. In other words, it is a measure of the number of buyers and sellers present and how easily transactions can be completed.

Cryptocurrencies that are difficult to exchange for cash or other digital assets are considered illiquid, whereas cryptocurrencies that can be traded immediately are considered liquid. Typically, coins with a large market cap, such as bitcoin and Ethereum, and those with consistently high trading volume are relatively liquid.

Liquid markets are characterised by high stability, where participants can trade easily, efficiently, and fairly. In liquid markets, there is both high supply and demand for a given asset, making it easier to match buyers with sellers.

On the other hand, illiquid markets are represented by volatility, so investors might struggle to execute buy or sell orders at desired prices. This is because there are fewer market participants, resulting in fewer available trades at any given price.

Overall, compared to illiquid markets, liquid markets tend to have higher levels of trading activity and a narrower spread between the bid and ask orders. More risk-averse traders will tend to avoid trading in illiquid markets, as the potential for large spreads can negatively impact the price they receive for the asset, thereby putting potential profits at risk. In illiquid markets, experienced traders often place limit orders rather than market orders to prevent being burned by slippage.

What Is the Best Indicator of Market Liquidity?

Trading volume is often considered an important indicator of market liquidity, which is why you’ll hear people use the terms interchangeably.

The volume of trade refers to the total number of settled transactions exchanged between buyers and sellers during trading hours on a given day. It’s a measure of the market's activity during a set period of time. You’ll often see the measure expressed in US Dollar terms, based on the number of units traded multiplied by the average price over the time period.

A higher trading volume indicates greater interest in a particular cryptocurrency. Cryptocurrencies with high trading volumes are bought and sold more frequently than those with lower trading volumes. As a result, a high trading volume generally coincides with deep liquidity for a particular digital asset.

How Does Liquidity Help Traders?

Highly liquid markets enable frictionless entry and exit from positions at a fair price. This is because a busy market makes it easier to find buyers or sellers on the other side of a trade. It also results in assets being priced closer to their true market value. High levels of both supply and demand help to keep the buy and sell prices close together. The difference between buy and sell prices is called the bid-ask spread.

The bid-ask spread is the difference between the highest price a buyer is willing to pay for an asset and the lowest price a seller is willing to accept. The spread is collected as a fee by the market maker, which is usually an exchange facilitating the trade. The size of the bid-ask spread is determined by liquidity, a direct factor of the number of buyers and sellers in the market. The more buyers and sellers there are, the greater the liquidity and the tighter the spread. The ask (the price you can buy the asset for) will always be higher than the bid (the price you can sell the asset for).

All things considered, traders will generally seek liquid markets, as they are associated with lower risk and higher stability. In liquid markets, the bid-ask spread is less likely to increase as a result of their trade, which can leave them losing value as the trade fills.

Elsewhere, more liquid markets will generally have buy and sell prices that are closer together across different trading channels for the same assets, giving traders and investors more options about how and where they transact.

How Much Liquidity Should a Crypto Asset Have?

Unfortunately, there is no perfect answer for how much liquidity a cryptocurrency should have. This is because it largely depends on the investor's risk appetite, as well as the crypto asset's supply and demand. As a general rule, more established cryptocurrencies tend to have greater liquidity, while newer and more speculative cryptocurrencies tend to have less liquidity.

A potential way to determine whether a cryptocurrency is too illiquid is by comparing its trading volume to bitcoin’s trading volume. As the crypto with the largest market cap, BTC’s trading volume is so large that it has exceeded US$130 billion in a 24-hour period when risk assets were rallying.

It’s also helpful to check 24-hour trading volume using online indicators that demonstrate an asset’s liquidity. Some resources will allow visitors to sort lists of cryptocurrencies by trading volume, so traders and investors quickly get an indication of high and low trading volumes across the crypto market.

More risk-averse investors may only trade cryptocurrencies with larger volumes, like bitcoin (BTC), Ethereum (ETH), or Solana (SOL). Alternatively, investors with larger risk appetites may be comfortable trading cryptocurrencies with significantly smaller trading volumes. This is because the risks associated with low liquidity can be offset by the increased upside of investing in a more speculative asset.

Example of Crypto Liquidity

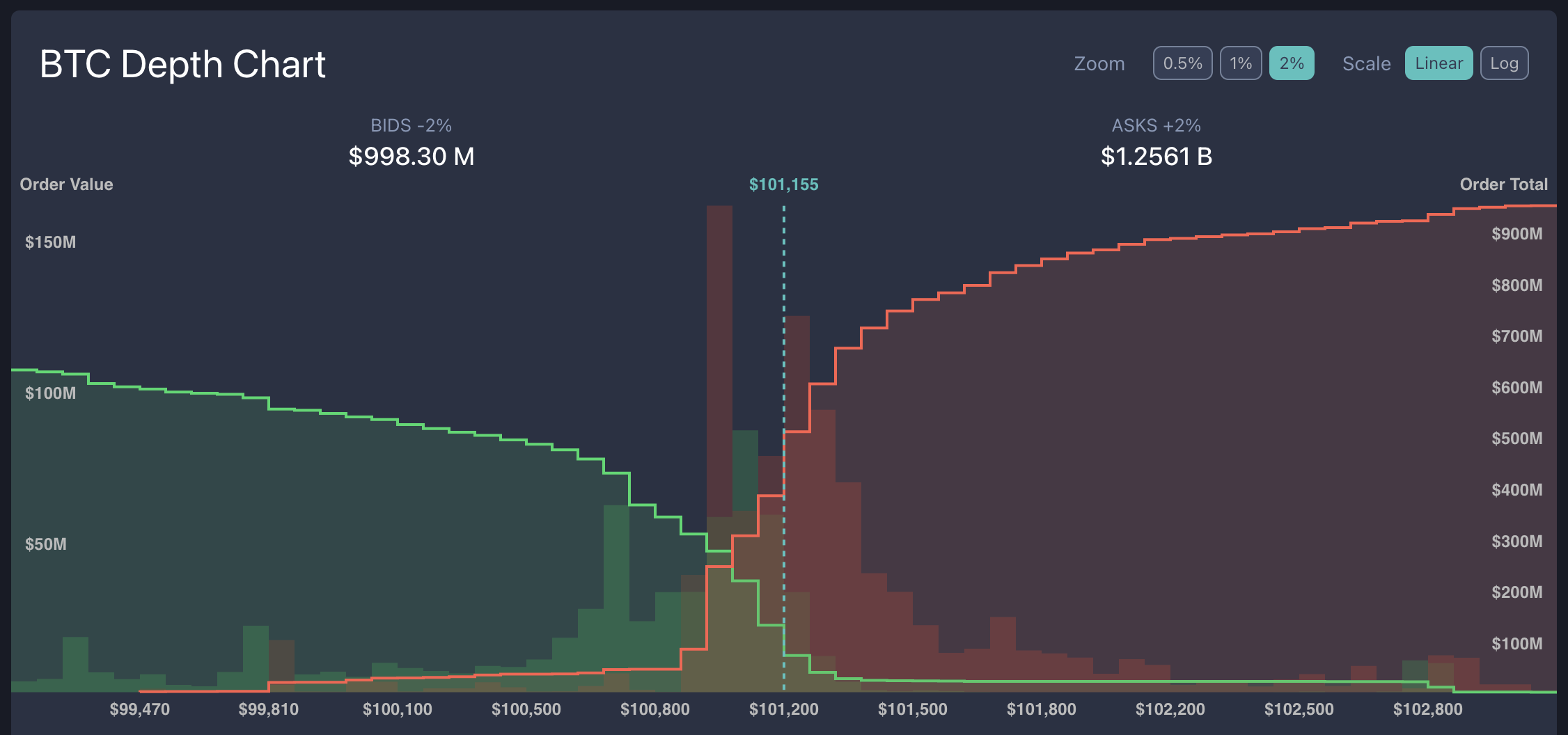

Depth charts are graphical representations of buy and sell orders for a specific asset at various prices. They can provide insight into the liquidity of a cryptocurrency by displaying the amount of supply and demand.

Liquid assets will have depth charts where the green and red sides (buy and sell orders) nearly mirror each other, reflecting almost identical amounts of supply and demand on their respective sides. The following diagram is of a BTC depth chart.

The total order value for bids (US$865.4 million) is lower than the total order value for asks (US$1 billion). This indicates that while BTC is extremely liquid, there are currently more sellers than buyers, which could result in downward price pressure.

Factors That Influence Crypto Liquidity

Multiple factors contribute to the overall liquidity of a given cryptocurrency. We’ve outlined some of these factors below.

Popularity

Popular cryptocurrencies are generally highly liquid due to the vast volume traded every day. They are also in high demand and supply by both small and large investors, further contributing to their high levels of liquidity.

Number of Exchange Listings

Popular cryptocurrencies are typically driven by active development teams, passionate communities, and strong, real-world utilities — all of which are key determinants of the market demand for a cryptocurrency. Nonetheless, as a cryptocurrency becomes more popular, it will likely be listed on more exchanges.

A higher number of exchange listings increases the overall liquidity of a cryptocurrency. This is because it enables investors and traders to choose from several different markets when buying or selling a specific cryptocurrency, allowing them to access the best price.

Market Making

Market makers refer to individuals or broker-dealers that profit by providing liquidity to the rest of the market. They “make the market” by ensuring that traders can always buy and sell at a fair price. This is done by actively quoting both sides of the market and providing bids and offers. Market makers boost overall liquidity and market depth.

Market Capitalisation

Market capitalisation (also referred to as market cap) is a metric that measures the relative size of a cryptocurrency. It is calculated by multiplying the total number of coins in circulation by the current price of that specific coin.

Market capitalisation is one of the best ways to check for liquidity, as large market cap cryptocurrencies tend to have higher demand. Alternatively, low-market-cap cryptocurrencies have lower liquidity because demand for the cryptocurrency is comparatively lower.

Liquidity Versus Volume

The difference between trading volume and liquidity is widely misunderstood in the cryptocurrency market. Trading volume represents the number of executed trading transactions, whereas liquidity represents the number of available trades at any given price. Both are often quoted in dollar or fiat value terms.

Liquidity: It Matters

Generally, traders and investors are inclined to trade markets with high levels of liquidity, as they’re less likely to encounter obstacles and irregularities when entering or exiting their positions. Given the volatile nature of the crypto market, liquidity is often an important consideration for people when they select digital assets. More conservative traders will almost always assess the liquidity of a cryptocurrency market and avoid trading less liquid assets in order to conserve their capital.

FAQs

Q: Which crypto has the most liquidity?

A: Globally, bitcoin is known to be the most liquid cryptocurrency.

Q: Can you sell crypto with low liquidity?

A: Cryptocurrencies with low liquidity can be bought and sold, but it won’t necessarily be easy. Buying cryptocurrencies with low liquidity can take more time, and the executed price may deviate further from the desired buy price.

Q: Is crypto more liquid than stocks?

A: The broader stock market is generally more liquid than the cryptocurrency market. However, cryptocurrencies with a large market cap are generally easy to trade at desired prices, while smaller crypto assets may be more illiquid.

Make Your First Investment With Caleb & Brown

You don’t have to be an expert to start investing in crypto.

Caleb & Brown is the world's leading crypto brokerage for both beginner and advanced investors, making your entry into the market effortless.

Our personalised broker service makes crypto investing simple. A dedicated member of our broker team is always on hand to guide you along the way, giving you the confidence you need to navigate the world of crypto.

Not to mention key features such as:

- No joining or sign up costs

- Industry-leading storage solutions

- 24/7 customer support

If you're ready to take the next step and invest, contact your Caleb & Brown broker today. Not yet a client? Sign up for your free consultation.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.