How to Measure Crypto Liquidity

Liquidity is the lifeblood of all tradable assets including cryptocurrency.

It is important because it determines how quickly and efficiently market participants can buy or sell cryptocurrencies.

Highly liquid markets enable smooth and efficient trading, while highly illiquid markets can lead to difficulties entering or exiting a position at a desired price. Consequently, every investor needs to understand how to measure crypto liquidity to reduce risk and improve their trading experience.

What is Crypto Liquidity?

Crypto liquidity refers to the ease with which a coin can be converted into cash or other coins, without substantially moving its price up or down. In other words, it is a measure of the number of buyers and sellers present and how easily transactions can be completed.

Cryptocurrencies that are difficult to exchange for cash or other digital assets are considered illiquid assets, while cryptocurrencies that can be traded right away are considered liquid assets.

Liquid markets are characterised by high stability where participants can trade easily, efficiently, and fairly. In liquid markets, there is both high supply and demand for a given asset, making it easier to find a buyer or seller.

On the other hand, illiquid markets are represented by volatility, so investors might struggle to execute buy or sell orders at desired prices. This is because there are fewer market participants and thus fewer available trades at a given price.

Overall, compared to illiquid markets, liquid markets tend to have higher levels of trading activity and a smaller (not extremely wide) spread between the bid and ask orders. Best-practice traders will tend to avoid trading illiquid markets as the potential large spreads, which can negatively impact the price they trade the asset for, puts any possible profits at risk.

What Is the Best Indicator of Market Liquidity?

Trading volume is often considered the best indicator of market liquidity, which is why you’ll hear people use the terms interchangeably. The volume of trade refers to the total number of coins exchanged between buyers and sellers during trading hours on a given day. The volume of trade is a measure of the market's activity and liquidity during a set period of time.

A higher trading volume indicates greater interest in a particular cryptocurrency. Cryptocurrencies with high trading volumes are traded (bought and sold) more frequently and rapidly than the ones with lower trading volumes. As a result, a high trading volume generally coincides with deep liquidity for a particular cryptocurrency in the market.

How Does Liquidity Help Traders?

Highly liquid markets enable frictionless entry and exit from positions at a fair price. This is because a busy market makes it easier to find buyers or sellers on the other side of a trade.

Highly liquid markets also see assets priced closer to the true market value. High levels of both supply and demand help to keep the buy and sell prices close together; the difference between the two is called the bid-ask spread.

This pricing concept represents the difference between the highest price a buyer is willing to pay for an asset and the lowest price that a seller is ready to sell at. The spread is collected as a fee by the market maker, which more often is an exchange facilitating the trade. The size of the bid-ask spread is determined by liquidity – a direct factor of the number of buyers and sellers in the market. The more buyers and sellers, the greater the liquidity and the tighter the spread.

All things considered, traders will generally seek liquid markets as they are associated with lower risk and higher stability; the bid-ask spread is less likely to increase as a result of their trade, which can leave them losing value as the trade fills.

How Much Liquidity Should a Crypto Have?

Unfortunately, there is no perfect answer for how much liquidity a cryptocurrency should have. This is because it largely depends on the investor and their risk appetite, as well as a crypto asset and its supply and demand. As a rule of thumb, more established cryptocurrencies tend to have more liquidity, and newer and more speculative cryptocurrencies tend to have less liquidity.

A potential way to determine whether a cryptocurrency is too illiquid is by comparing its trading volume to Bitcoin’s (BTC) trading volume. This is because Bitcoin is the flagship of the crypto market, surpassing every other cryptocurrency in terms of market capitalization. There are also useful indicators online where you can check what size/value of trade will move the price of an asset and roughly by how much.

More risk-averse investors may only trade cryptocurrencies with larger volumes, like Bitcoin, Ethereum (ETH), or Binance Coin (BNB). Alternatively, investors with larger risk appetites may be comfortable trading cryptocurrencies with significantly smaller trading volumes. This is because the risks associated with low liquidity can be offset by the increased upside of investing in a more speculative cryptocurrency.

Example of Crypto Liquidity

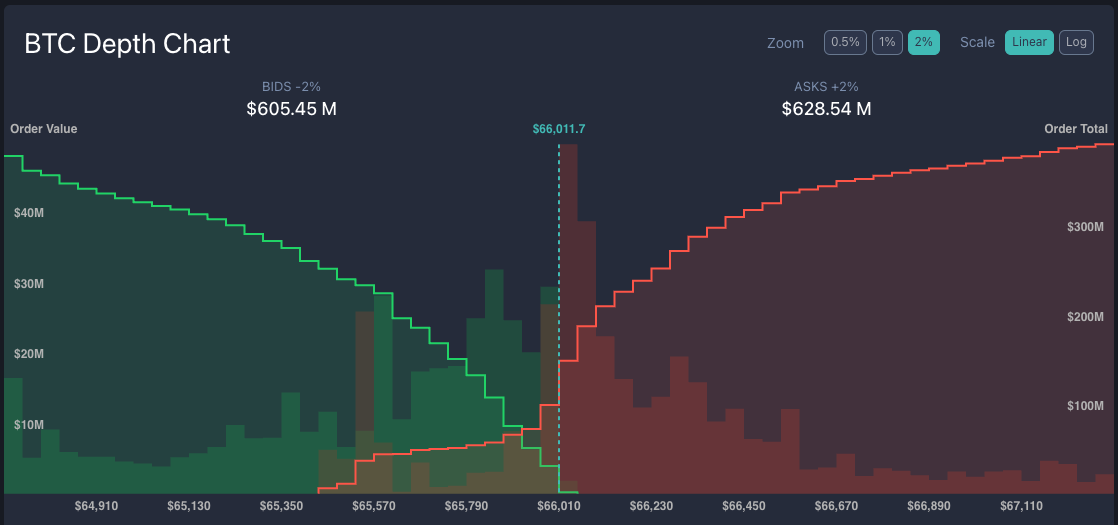

Depth charts are graphical representations of buy and sell orders for a specific asset at a variety of prices. They can provide insight into the liquidity of a cryptocurrency by displaying the amount of supply and demand.

Liquid assets will have depth charts where the green and red sides (buy and sell orders) nearly mirror each other, reflecting almost identical amounts of supply and demand on their respective sides. The following diagram is of a BTC Depth Chart:

The total order value for bids ($610 million) is approximately equal to the total order value for asks ($620 million). This highlights that the BTC market is extremely liquid given the symmetry between supply and demand.

Factors That Influence Crypto Liquidity

Multiple factors contribute to the overall liquidity of a given cryptocurrency. These factors include:

Popularity

Popular cryptocurrencies are generally highly liquid because of the vast volume that is traded every day. They are also in high demand and supply by both small and large investors, further contributing to their high levels of liquidity.

Number of Exchange Listings

Popular cryptocurrencies are typically driven by active development teams, passionate communities, and strong, real-world utilities — all of which are key determinants of the market demand for a cryptocurrency. Nonetheless, as a cryptocurrency becomes more popular, it will likely be listed on more exchanges.

A higher number of exchange listings increases the overall liquidity of a cryptocurrency. This is because it enables investors and traders to choose from several different markets when buying or selling a specific cryptocurrency, allowing them to access the best price.

Market Making

Market makers refer to individuals or broker-dealers that profit by providing liquidity to the rest of the market. They “make the market” by ensuring that traders can always buy and sell. This is done by actively quoting both sides of the market and providing bids and offers. Market makers boost overall liquidity and market depth.

Market Capitalisation

Market capitalisation (also referred to as market cap) is a metric that measures the relative size of a cryptocurrency. It is calculated by multiplying the total number of coins in circulation with the current price of that specific coin.

Market capitalisation is one of the best ways to check for liquidity because large market cap cryptocurrencies tend to have a higher demand in the cryptocurrency market. Alternatively, low market cap cryptocurrencies have lower liquidity as the demand for the cryptocurrency is comparatively lower.

Liquidity Versus Volume

The difference between trading volume and liquidity is widely misunderstood in the cryptocurrency market. Trading volume represents the number of executed trading transactions, whereas liquidity represents the number of available trades at any given price.

Liquidity: It Matters

Overall, traders and investors are encouraged to trade markets with high levels of liquidity. This ensures they won’t encounter obstacles when entering or exiting their trades.

The cryptocurrency market is notorious for its volatility and high level of risk, which makes liquidity an even more important consideration. More prudent traders will almost always assess the liquidity of a cryptocurrency market and avoid trading less liquid assets.

FAQs

Q: Which crypto has the most liquidity?

A: Globally, Bitcoin is known to be the most liquid cryptocurrency.

Q: Can you sell crypto with low liquidity?

A: Cryptocurrencies with low liquidity can be bought and sold, but it won’t necessarily be easy. Buying cryptocurrencies with low liquidity can take more time, and the executed price may deviate further from the desired buy price.

Q: Is crypto more liquid than stocks?

A: The broader stock market is a lot more liquid than the broader cryptocurrency market. This is because the cryptocurrency markets pale in market capitalisation compared to the stock markets.

Make Your First Investment With Caleb & Brown

You don’t have to be an expert to start investing in crypto.

Caleb & Brown is the world's leading crypto brokerage for beginner and advanced investors alike, making your entry into the market effortless.

Our personalised broker service makes crypto investing simple. A dedicated member of our broker team is always on hand to guide you along the way, giving you the confidence you need to navigate the world of crypto.

Not to mention key features such as:

- No joining or sign up costs

- Industry-leading storage solutions

- 24/7 customer support

If you are ready to take the next step and invest, contact your crypto broker today.

Not yet a client? Sign up for your free consultation.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.