Crypto is volatile. At times, very volatile.

While many traders and investors try to time when an asset will moon, many others prefer to take the guesswork out of timing the market. So they turn to dollar cost averaging.

Keep reading to learn how dollar cost averaging works, and how you can make it a part of your investing strategy today.

Key Points

- Dollar cost averaging (DCA) involves investing fixed amounts of money into a crypto asset at regular intervals.

- DCA is popular among some crypto investors because it works to minimise the impact of volatility on the price of an asset.

- If an investor is confident in the long-term performance of an asset, DCA could be an ideal strategy in both bull and bear markets.

What is Dollar Cost Averaging (DCA)?

Dollar cost averaging (DCA) is a strategy investors use to minimise the impact of volatility without investing additional effort into timing the market.

Using the DCA method, investors continue to invest fixed amounts of money into a crypto asset at regular time intervals (e.g. weekly, fortnightly, monthly). The investment is made regardless of the asset's price at the time of investing.

Why Use DCA?

Takes the Emotion Out of Investing

Crypto markets never sleep. Prices fluctuate, and newsworthy events occur almost daily. If an investor gets emotionally caught up in the cycles and excitement, it could lead to poor decision-making. DCA removes an investor's urge to react to every change in the market.

Instead of being led by fear and or greed, an investor using DCA makes a routine investment regardless of how the market is trending. They don’t panic sell during a downturn or overbet on whatever asset is being touted as the next big thing.

Reduce The Impact of Volatility

Purchasing small amounts of an asset at routine intervals could minimise the impact of short-term volatility.

When markets are down, investors using DCA can acquire more of a select asset due to its lower price.

When markets are up, investors buy less of the asset at a higher price.

As a result, the investor’s acquisition price is averaged out through their time in the market. Their portfolio becomes a reflection of how their acquired assets performed in a given period.

Avoid The Difficulty of Trying to Time the Market

Markets can be cyclical. After every bull market follows a period of decline. Bear markets eventually become bullish. Rather than trying to predict these cycles, DCA investors will purchase the same amount of crypto regardless if the price is high or low.

Even the most seasoned investors can find it very difficult to know when to enter and exit a position. DCA is ideal for beginners who have little experience in timing the market. It could also be ideal for experienced investors who prefer a more passive approach to long-term investing.

How DCA Works (W/ Examples)

Using this strategy investors must first decide on a crypto asset to invest in, and the amount they would like to invest.

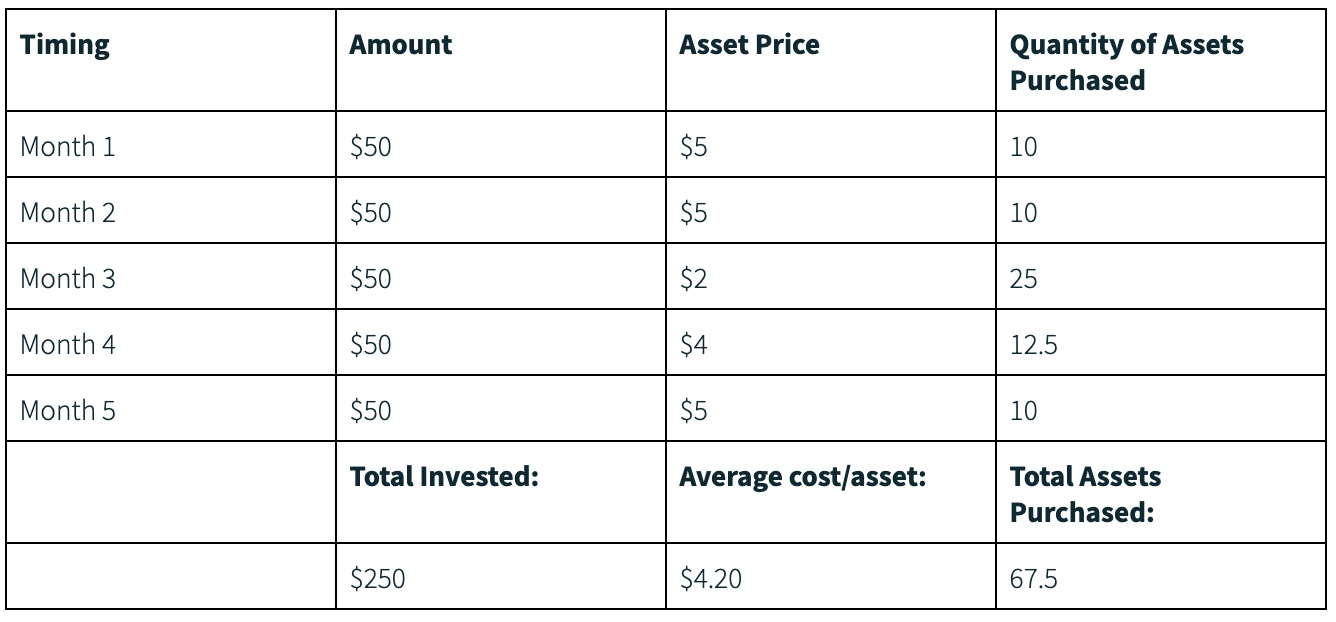

Then, instead of making one lump sum investment, split the amount into smaller equal instalments over a select period. This amount is invested regardless of price fluctuations in the asset over time. The table below demonstrates how a monthly investment of $50 might play out over five months in a changing market.

Using a DCA Strategy

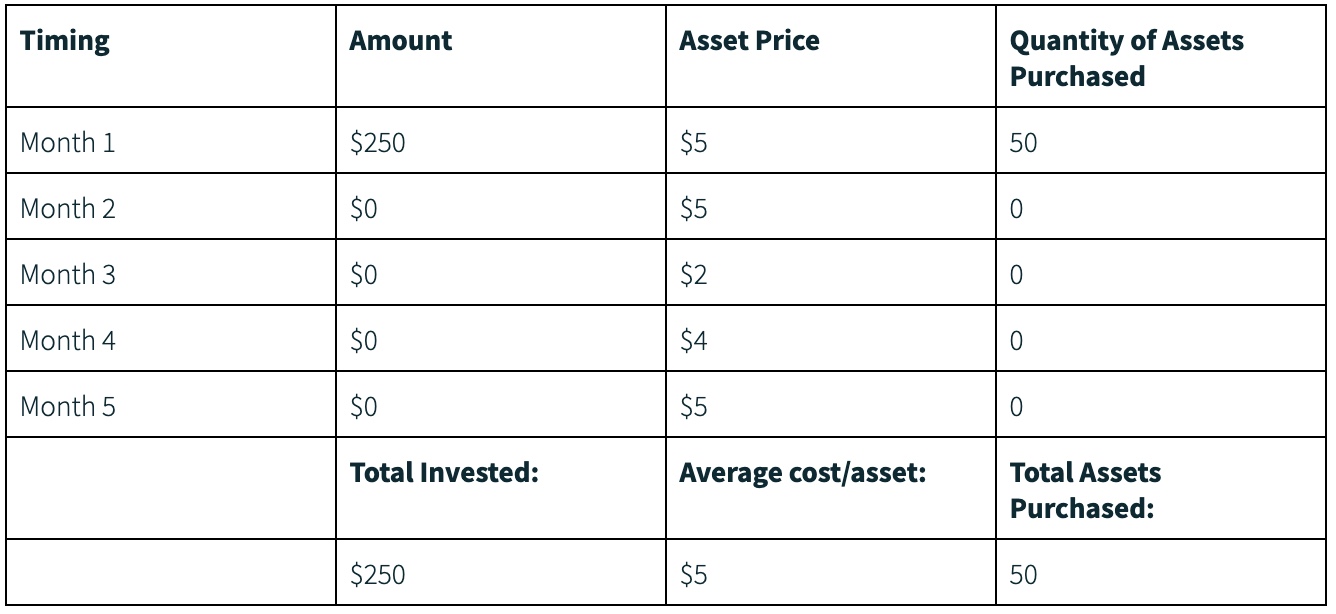

Let’s say that investor takes that same amount of money and invests it all in one lump sum instead of smaller increments:

Investing a Lump Sum

Since the investor locked their investment in Month 1’s price, they couldn’t capitalise on price drops that occurred in Months 3 and 4. As a result, the investor ended up paying a higher average cost/asset and ended up purchasing fewer assets with the same amount of money.

While this is just an example of how a DCA investment could play out, it should be noted that this strategy takes the guesswork out of timing the crypto market, allowing investments to benefit from upswings and dips (if and when they occur).

Recommended reading: Common Crypto Investing Strategies Every Investor Should Know

Special Considerations

DCA could be a particularly effective strategy in a market where prices are fluctuating up and down with relative consistency.

But it’s important to note that if prices are trending up, and continue to go up, an investor using DCA may end up buying fewer shares over time. Likewise, if the price of an asset continues to trend down with no signs of rising, the investor may be forced to exit at a loss if they don’t halt their scheduled investments.

This strategy works assuming you pick an asset that sticks around and performs well in the long term. If the asset price falls to zero, it doesn’t matter when you enter the market. Your investment is a net loss.

Lastly, doing your own research (DYOR) should precede the implementation of any investment strategy—long or short-term. This includes—but is not limited to—reading the white paper, learning about the founder, assessing real-world utility, developer & investor adoption, price history, and ranking.

Recommended reading: How to Invest in Crypto

FAQs

How often should you invest when using DCA?

The selected investment intervals are totally up to you and your investment goals. Some investors choose to invest quarterly, monthly, fortnightly, or even weekly. While not always the case, the size of a routine investment tends to decrease as frequency increases.

While more routine purchases could minimise the effects of short-term volatility, investors should also take into account external factors, such as trading fees. High fees could negatively impact any gains made through frequent purchases. At Caleb & Brown, we use one, transparent flat fee on every trade, which could help you determine how frequent you might want to make DCA investments.

Is DCA a viable trading strategy in crypto?

DCA is one of the more common crypto trading strategies, used by beginners and seasoned investors alike. It can be ideal for those who prefer a more passive, hands-free approach to investing in crypto. It should be noted that you should never invest more than you can afford to lose. Any strategy should not cause serious financial consequences if the value of your investments decreases.

Is DCA the same as HODLing?

DCA is often used in conjunction with HODL (short for ‘hold on for dear life’) as a way to potentially stabilise a longer-term investment. But the two strategies are not entirely the same. A HODLer can choose to enter the market with a lump sum and leave that sum untouched for a long period of time. When using DCA in conjunction with HODL, that lump sum is usually spread out as smaller investments over a period of time. In both cases, the investors choose to remain in the market for a select period regardless of market changes.

Make Your First Trade at Caleb & Brown

You don’t have to learn how to time the crypto market.

Caleb & Brown is the world's leading crypto brokerage for beginner and advanced investors alike, with over 20,000 clients using strategies like dollar cost averaging, HODL, and more.

Our personalised broker service makes crypto investing simple. A dedicated member of our broker team is always on hand to guide you along the way, giving you the confidence you need to navigate the world of crypto. Not to mention key features such as:

- No joining or signup costs

- Industry-leading storage solutions

- 24/7 customer support

If you are ready to take the next step and invest, contact your crypto broker today.

Not yet a client? Sign up for your free consultation.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.