The depreciation of Nigeria’s naira as well as a shortage of U.S dollars has seen a reliance on bitcoin and other cryptocurrencies as a medium of settling cross border payments and remittances in the country.

According to a report published by Blockchain.com, Nigeria has increased its usage of their web wallet by 60% since April 2020 and has topped global wallet downloads, ahead of the U.S, over the past week. The pivot toward bitcoin is a reaction to the economic insecurity spurred on by the global pandemic and the associated restrictions on movement that have occurred; impelling Nigerians to seek alternative methods for international transactions. The shift appears to have acquired real momentum as data taken from Usefultulips.org shows they are leading the African continent in peer-to-peer traded bitcoin volumes that have been recorded as US $34.4 million in the second quarter of 2020.

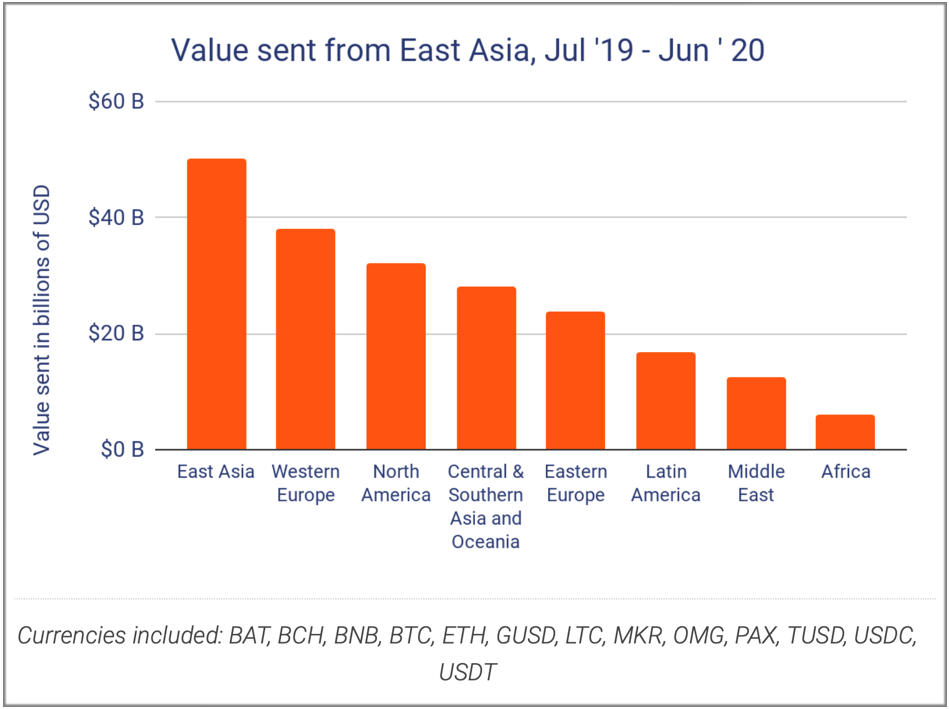

While the uncertainty surrounding the depreciation of the naira has created one of the fastest emerging crypto markets, so too has the weakening of the yuan help bolster crypto demand in the most well established market. The Chainalysis.com‘2020 Geography of Cryptocurrency Report’ asserted that over the last twelve months, with China’s economy suffering due to trade wars and devaluation of the yuan at different points, we’ve seen over $50 billion worth of cryptocurrency move from China-based addresses to overseas addresses.

Notably, East-Asia itself is currently the world’s largest cryptocurrency market accounting for 31% of all cryptocurrency transactions in the last year. East-Asia based addresses have received upwards of US $100 billion worth of cryptocurrency which is nearly 80% more than Western Europe, accounting for the second highest receiving region. This disparity is as a result of mining activity between the two regions as China alone controls 65% of the total computing power that goes toward mining bitcoin (known as hash rate). This means that most of the newly mined bitcoin is sent out from addresses originating in Asia which in turn also gives the market an enormous liquidity boost. Nevertheless, uncertainty in the world’s major economies is a driving force for the widespread adoption of bitcoin in East-Asia and the rest of the globe.

The damage to financial markets that has been triggered by COVID-19 is re-defining the way in which people view the entire financial system. Accordingly, we have seen more people willing to hold and trade bitcoin and global interest in cryptocurrency has surged. As we have seen in Nigeria, bitcoin is increasingly being turned to as a safe-haven when local currencies lose their store in value. The main factors for its adoption in Nigeria are:

- Frictionless cross border trading

- Foreign exchange difficulties (exacerbated by restricted supply of U.S dollars)

- Inflation

Like most countries in our globalized world, Nigeria is import heavy and businesses are more and more relying on bitcoin as a means to bypass trade hurdles with foreign parties. It pays to remember that bitcoin has been specifically designed for these purposes so it is no surprise that it is filling the void made by the naira’s shortcomings.

As global financial markets continue to be shrouded with instability, more people are seeking a way to sidestep traditional institutions and are becoming privy to the technologies of blockchain and cryptocurrency. While distrust of major financial institutions and economic uncertainty continues to mount, reliance on cryptocurrency as a vehicle for global trade will continue to flourish. Crypto is leading the charge of technological innovation in finance and is revolutionizingthe way in which we relate to money. As with any frontier, the masses are often slow to adapt, but while the institutions of yesterday are stuck in the mud, crypto and blockchain technology are plotting their future trajectory.