A firm or organisation that invests money on behalf of its clients or members is known as an institutional investor. Hedge funds, mutual funds, and endowments are among examples. These are often seen as 'smarter' investors than members of the general public and they have begun to enter the Bitcoin market. Some of these funds favour longer-term client time horizons over swing trades (short in and out trades), demonstrating a long-term belief in the asset class's growth.

The ability of cryptocurrencies to serve numerous objectives is one possible factor behind their adoption by huge organisations. This gives institutions a variety of reasons to keep the coins or provide related services. According to one viewpoint, cryptocurrencies such as Bitcoin could serve as a long-term store of value. In addition, other cryptocurrencies may be able to provide functions that Bitcoin does not, such as decentralised exchange platforms and NFTs. Furthermore, stablecoins (whose value is pegged to fiat currencies) could enable faster transactions for certain financial services without relying on ageing financial infrastructure.

Since 2020, the cryptocurrency market cap has increased from around $200 billion to $1.89 trillion (approximately a ninefold increase). The rapid growth of this asset class has both signified and enabled larger investors (institutional) to enter the market more easily. Along with this market expansion, the enhanced regulatory framework and financial instruments produced inside this asset class (Grayscale shares, Bitcoin futures ETF) have helped to legitimise this asset class. The rising market cap and liquidity of this market allow institutions to enter this space more effortlessly and this trend will only intensify as the market develops.

The Trailblazers of Institutional Adoption

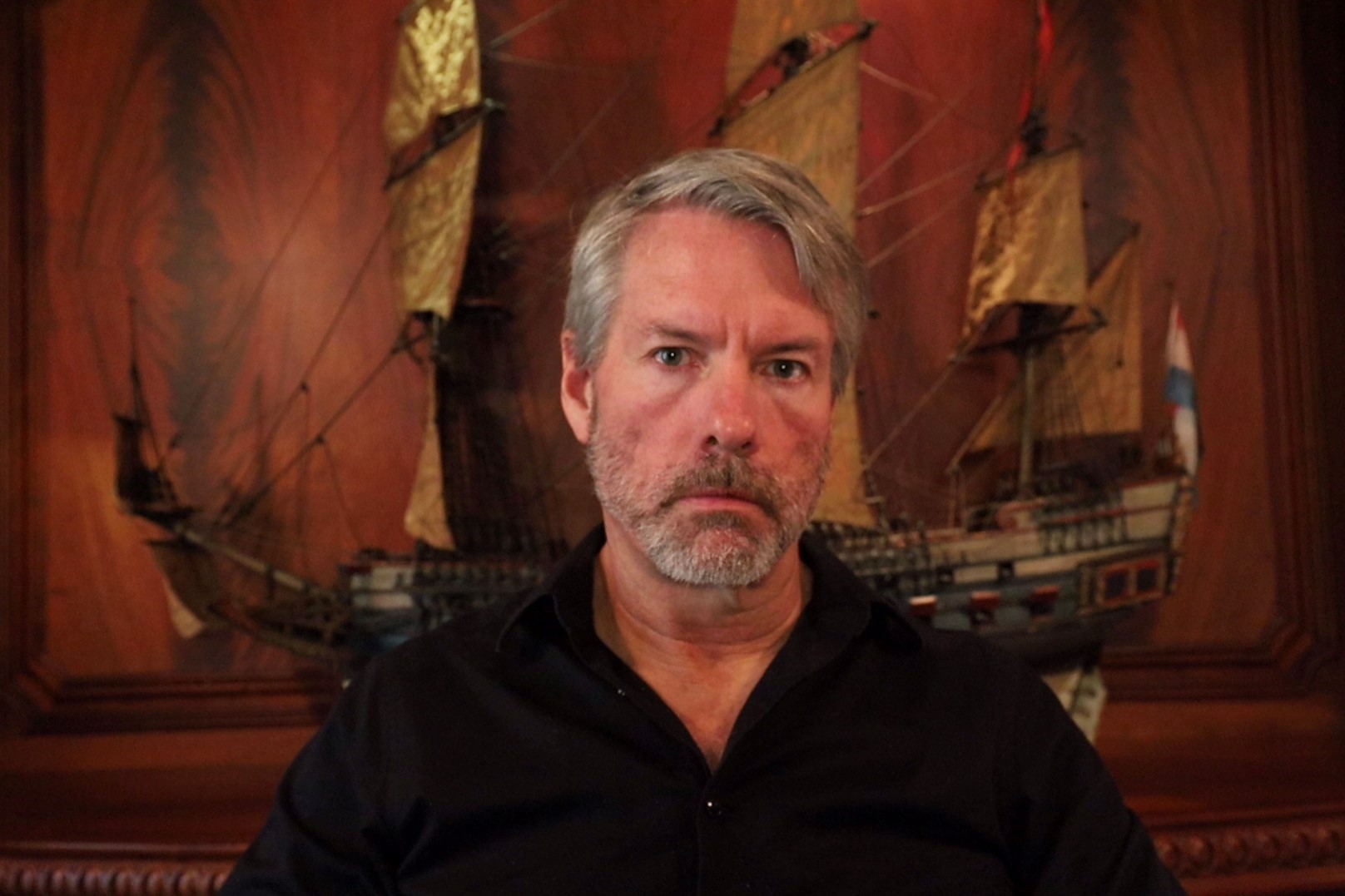

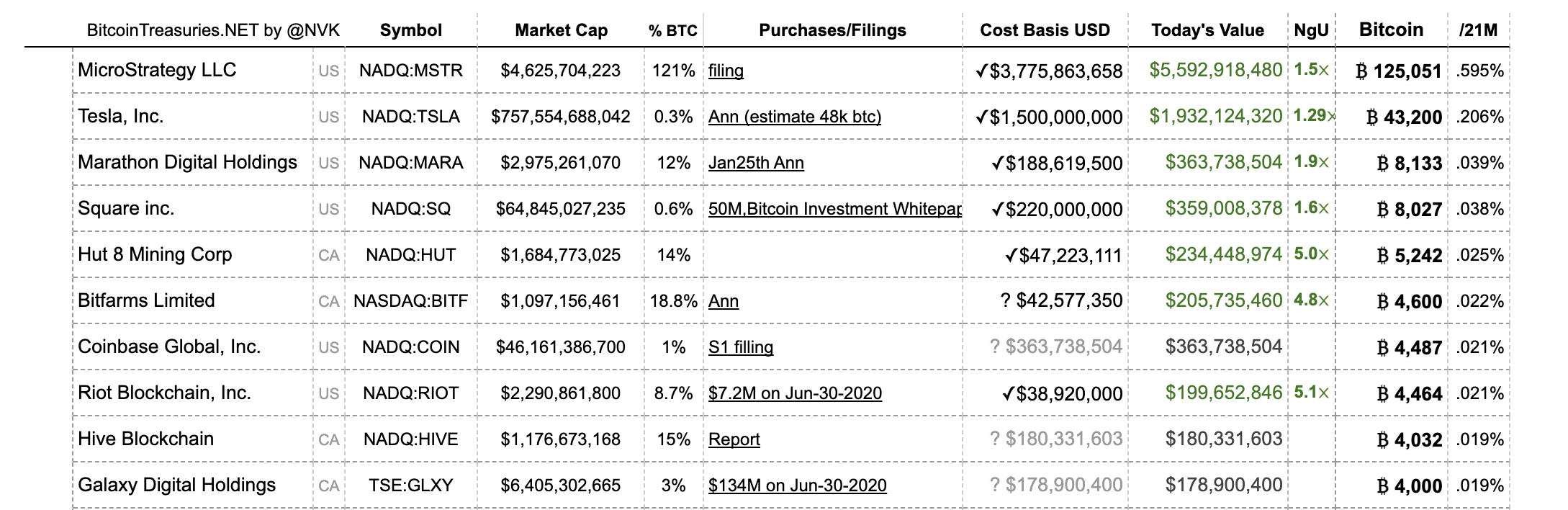

By becoming one of the first large US publicly traded corporations to invest in Bitcoin, MicroStrategy (MSTR:NASDAQ) exemplified this institutional shift into this market. MicroStrategy announced its first Bitcoin purchase in August 2020, paying around $250 million for 21,000 coins. The argument adopted by Michael Saylor (CEO of MSTR) was that expanding the money supply would diminish the real worth of the cash stored at the company, thus he tried to transform this into a harder asset to hedge his company against inflationary pressures. MicroStrategy has continued to accumulate Bitcoin and now holds upwards of 120,000 coins. They have also held a number of conferences demonstrating why other companies should consider holding Bitcoin on their balance sheets. The MicroStrategy conference in 2022 also featured guest speaker Jack Dorsey, co-founder of Twitter, who emphasised the transparent financial world being established on the Bitcoin network and how enterprises will have to integrate their services with it.

Interestingly, as MicroStrategy began to accumulate Bitcoin, its stock became a proxy and a way to gain exposure to bitcoin price movement through a traditional finance investment vehicle. As 2021 progressed, Bitcoin mining companies became publicly listed on the NASDAQ, providing for greater exposure to Bitcoin and improved access to finance markets for the mining companies themselves. With improved access to capital markets, there is less of a need for them to sell Bitcoin to finance costs, and they may keep their coins longer, further drying up the supply side dynamic.

Tesla adding Bitcoin to their balance sheet - adding 43,200 coins to their reserves to diversify from their cash holdings - was one of the greatest and most influential institutional movements of 2021. With Elon Musk at the helm of Tesla and the firm being considered as extremely inventive and at the forefront of electric car manufacturing, this might be seen as a foresighted entrepreneur setting the precedent of adopting this technology. This statement also demonstrated the profound effect such a filing may have on markets, as the price of Bitcoin rose by an astounding 20% in a short amount of time after this information became public.

Valkyrie, a crypto asset management firm, recently listed a Bitcoin Miners ETF under the symbol WGMI, with 80 percent of the fund invested in companies that make half or more of their income from Bitcoin mining. This ETF provides investors with exposure to a diverse selection of Bitcoin mining companies through a single product that can be traded on the standard stock market.

A Bitcoin spot ETF has yet to be approved, and attempts to form one by institutions such as Grayscale, BitWise, Fidelity, Gemini, and many more have either been rejected outright or postponed by the SEC. So far, futures ETFs have been allowed, but a spot ETF is considered as a significant product that will allow investors to more readily access the industry and signify a full embrace of Bitcoin by US regulatory authorities, with other western financial regulatory organisations expected to follow suit.

More recently, KPMG (Canada) announced the addition of BTC and ETH to their corporate treasury as part of their commitment to emerging technologies and asset classes. As a result, they have become one of the most well-known organisations to invest in cryptocurrencies. KMPG has also indicated that their investment allows them to share their journey, experiences, and issues with customers in order to help them navigate the world of cryptocurrency assets.

As opposed to the United States, Canada has been more receptive of digital assets, such as by authorising crypto exchange traded funds. Furthermore, KPMG's U.S. business serves as an auditor for MicroStrategy. The relevance here is that MicroStrategy is the most vocal corporate proponent of purchasing BTC and has included it into its strategy.

What Does 2022 Hold for Institutional Adoption of Crypto?

As the year progresses, the institutional players’ participation in this market should rise in terms of products supplied and their own exposure to this asset class. It appears that we are at a critical juncture, ushering in an era of early majority adoption of this type of technology, with increased public trust and perception as a result.

from Caleb & Brown Cryptocurrency Brokerage.