The Broad Economic Climate

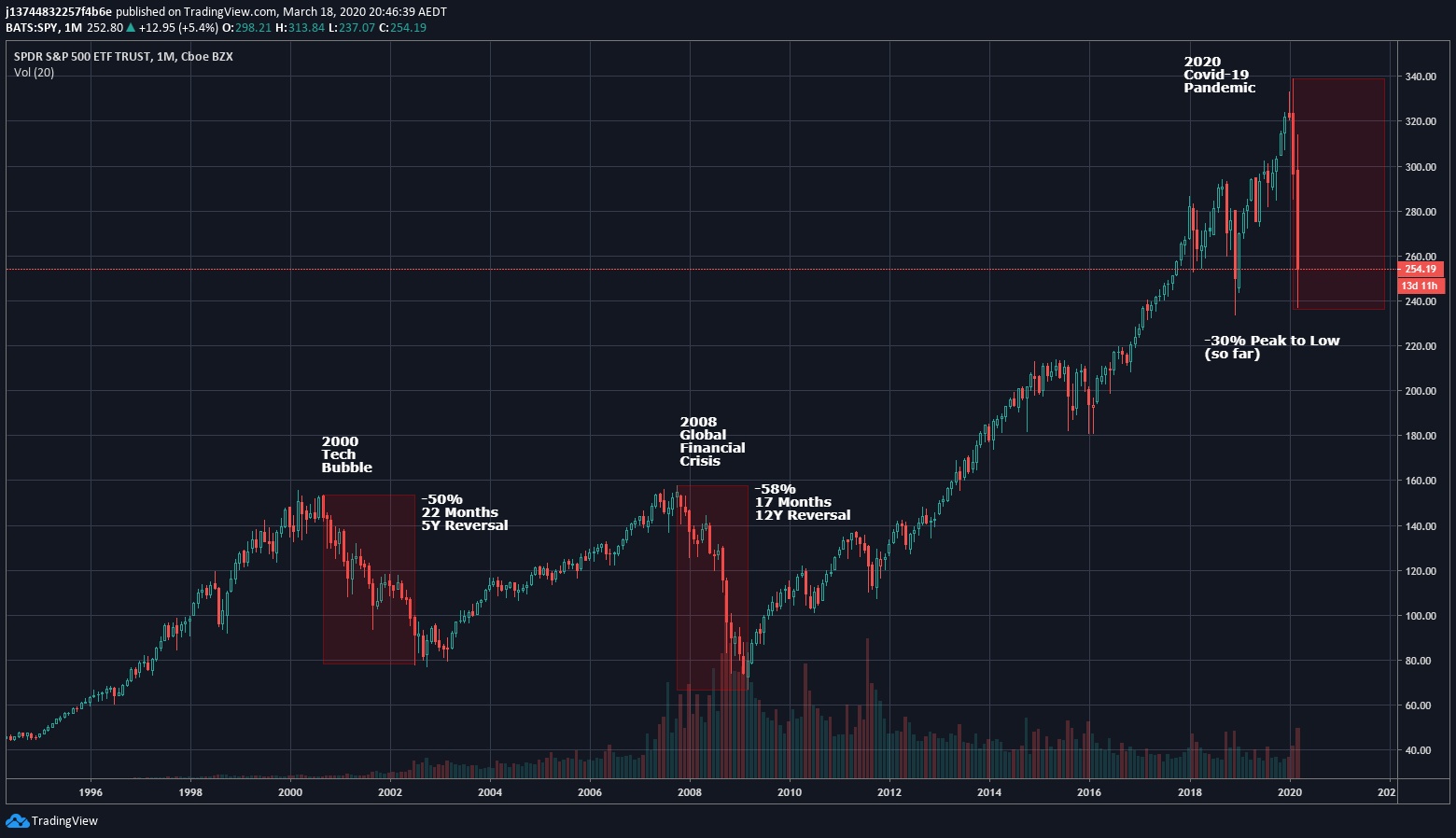

While it is not certain that we see an exact rerun of the previous stock market crashes, it is insightful to compare the current economic climate with past events. It should be noted that the previous bubbles were acutely fueled in a single sector (tech companies and the housing market) while the bull market, leading up to this point, is spread more broadly across all asset classes.

To compare the last two stock market crashes so that we can understand our current situation in context, there are two noticeable differences. Firstly, our current crash is unfolding in a much faster manner than the crashes of the 2000 Tech Bubble Burst and 2008 Global Financial Crisis. This is likely due to the far more interconnected nature of the global markets as well as the speed of dissemination of information. Secondly the bull markets leading up to the previous crashes occurred at a much slower rate, meaning they were wiping out roughly 5 years of growth. Despite the 30% drop already, we have only really reversed 12 months. The markets will likely find a way to produce the maximum amount of pain before recovering, and a single year reversal means there are plenty of people who are not even in panic selling territory yet.

Now back to Bitcoin

We’ve seen over a 60% drop from local peak ($10,500 USD) to below $4000 USD. A key observation is that the Mayer Multiple (MM) is at 0.6 and we haven’t had opportunities to buy at such a low MM since Dec 2018 at the very bottom of the previous cycle. Volume profile shows $4000 representing a strong support level dating back to the 2018 lows, however, it is by no means a reliable bottom in the current economic climate as investors are running to cash and de-risking their portfolios.

At times like these it is vital to remember that Bitcoin was designed specifically to tackle the current economic climate. As central banks are forced to ramp up quantitative easing (printing money), gold and Bitcoin will become the only safe havens from inflation. The next 12-24 months will be the first time in history where a digitally scarce and sufficiently recognized asset class is easily accessible for investment during a global recession and its recovery. Global liquidity shocks are enormous wealth generation opportunities so it is important to position carefully and remember that trying to time the exact bottom is extraordinarily difficult, so allocate your capital when you see an opportunity and hold patiently for this pandemic to blow over. After the initial sell-off, this cycle is Bitcoin’s time to shine.

Key takeaways:

-

Previous bear markets lasted over 12 months

-

Our current crash is unfolding in a faster and more volatile manner

-

Previous bear markets reversed 5 years of growth

-

We have currently only reversed 1 year of growth

-

Stock market crashes can be the greatest wealth creation opportunity in a lifetime

-

Bitcoin was created as a solution for this exact economic climate

-

Mayer Multiple is at 0.6, (indicating a time-based interpretation of price as “cheap”)

-

Volume Profile showing support at $4000, but not a reliable bottom

Stay safe and stay healthy.

Message about Covid-19 from Dr Prash

We live in turbulent times.

The onset of the Covid-19 and the resultant impact on the economy and financial markets has led to a lot of uncertainty. I'd like to take this opportunity to offer both my clinical assessment of the situation and a note on the impact on the markets to come.

-

Covid-19 is no flash in the pan scenario and looks set to stay, impacting the health of your self and your community as well as the economy for likely the next 6 months at a conservative projection.

-

For any who doubt the gravity of the situation, I implore you to look to the countries who went before yours in terms of infection rates. Their plight is the natural history of this virus, which is now, in every landmass in the world.

-

Low detection rates in your area is no indication of presence of absence of the virus. All it implies is that testing is not keeping pace and this is particularly true now that we know that there is a universal lack in detection kits and that testing is being reserved for symptomatic and high-risk population groups. Equally, the vast majority of vectors and sub-symptomatic individuals are unlikely to even be presenting for testing.

-

The hardest hit will be the older population with mortality rates estimated at 4% in 60-69 age bracket and doubling to 8% in the 70-79 age bracket.

-

Whilst the young may only experience mild flu-like symptoms and hence may see it largely pass them by, they remain vectors of the virus and will continue to perpetuate its spread.

-

Our duty to our communities then, is to limit the rate of this spread to allow for health services to cope with the rate of infection and in particular those who need intensive care and respiratory support. That is the only way we will be able to positively impact the mortality rate and maintain access to emergency services for the most vulnerable.

As such, even if you are well, please endeavor to follow the infection control guidelines being put out by your state health services. Self isolation, hand washing/sanitizing, contact tracing protocols and avoidance of public transport and social events whilst inconvenient, could perhaps be considered the sacrifice we make to protect our grandparents, our sick and our vulnerable. They won't survive this on their own and without our conscientious effort. I thank you for playing your part and demonstrating our mettle as a society coming together to demonstrate our humanity. With this context of what appears to be a disruption to our way of life that looks set to last the better part of the rest of the year, the current financial downturn needs to be considered not purely as an acute event, but one with chronicity. For our clients who have been watching the volatility impact their portfolios, please contact your broker to have a discussion about how you may want to act in preparation.

from Caleb & Brown Cryptocurrency Brokerage.