The Game Theory of Cryptocurrency

Basics of Game Theory

Game theory is a fundamental mechanism underlying blockchain technology. It is what allows cryptocurrencies such as Bitcoin to manage and divert disruptions to the network and ensure the reliability of distributed databases.

So, what is game theory?

Broadly, game theory uses mathematics to model human paths of behaviour within an interactive and dynamic environment. Put another way, game theory is the science of strategy that maps out the best path of play for agents to achieve a desired outcome or result. According to game theory we see three core elements of any game:

- Players: The strategic actors within a game

- Strategy: A plan of action a player will take given the circumstances that will arise

- Payoff: The result or outcome a player receives after achieving a certain state. Note that payouts are not always a dollar value but can be any quantifiable form

With these parameters, we can see ‘games’ being played out across a broad range of human activities in the real world, allowing game theory to be applied to military tactics, politics, economics, evolutionary biology and computer science.

Before we employ a game theoretical view of cryptocurrency, we will first see how game theory can be applied in real life.

The Prisoner’s Dilemma

The prisoner’s dilemma is the most common scenario that is used to explain game theory modelling. In this scenario, two criminals have been arrested by police for a crime they are guilty of. The prosecutors interview the criminals separately and offer each a reduced sentence in return for a confession against the other. In this example neither criminal has the means to communicate with each other.

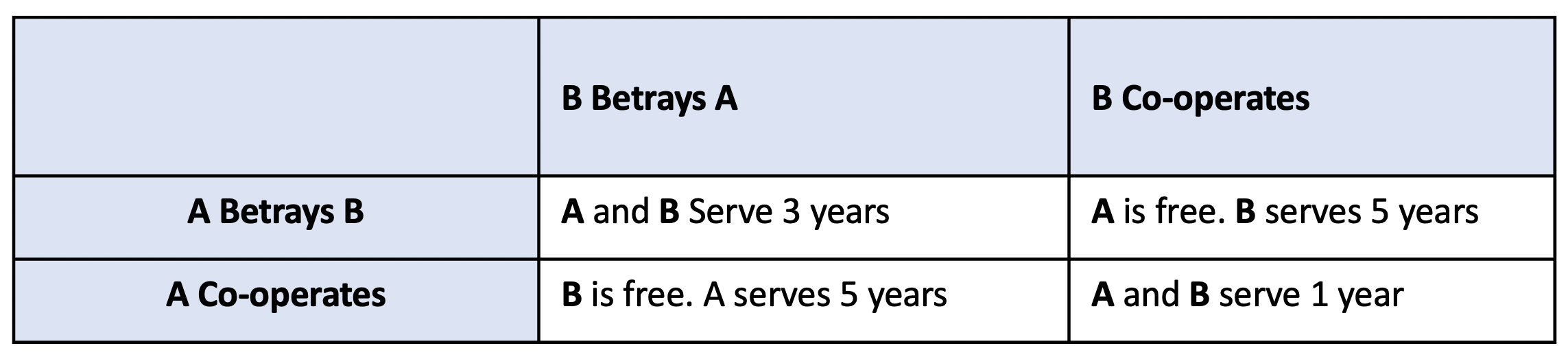

If prisoner A betrays prisoner B, prisoner A is released scot-free and prisoner B is sentenced to 5 years. The same applies for prisoner B (vice-versa). If both A and B betray each other they each receive 3 years. Lastly, If A and B stay silent and co-operate with each other, they will each serve only 1 year. The payoff matrix for this scenario looks like this:

The prisoner’s dilemma shows that if the prisoners pursue their own self-interest the result is sub-optimal as the best option is co-operation. Yet, as the potential consequence of co-operation is so high (5 years in prison) game theory tell us that a rational actor will opt to betray.

This dynamic is often played out in real world marketplaces where an understanding of the balance between competition and co-operation can yield optimal results that are mutually beneficial.

Crypto-Economics

Crypto-economics combines game theory, economics and cryptography in order to understand the incentive models underlying distributed blockchain protocols. Looking through a game theory lens at how rational nodes interact in a network, we can see how it enhances security and sustainability of distributed peer-to-peer systems.

Since blockchain is a distributed synchronised database containing validated blocks (i.e., transactions) miners must reach consensus on which block to validate. In the case of Bitcoin, the validation of each new block is done by miners solving a computationally difficult problem. This is called a Proof of Work puzzle.

Recommended reading: What is Bitcoin? A Beginner's Guide

Consensus Mechanisms

Consensus algorithms such as Proof of Work rely on game theory in order to maintain trust-less co-operation. In a competitive mining environment where solving puzzles is resource intensive, game theory tells us that rational actors are incentivised to act honestly in order to not risk losing their investment.

Bad faith actors are disincentivised to cheat — i.e., accepting invalid transactions or ‘double spending’ — as the consequence would typically involve a loss of resources. This penalty is often referred to as slashing.

Because of this, we can view mining as a repeated prisoner’s dilemma where each node employs a strategy that aims to maximise their payout without considering the strategy of other players. Distributed networks incentivise co-operation between nodes without relying on trust between players. It is players acting in such a way to maximise their payoffs that ensures the stability and security of the network.

In other words, participants acting in their self-interest achieve the best outcome for their fellow miners. Their interests have been aligned so whether they are acting selfishly or cooperatively the outcome is good for all parties and the network.

While Proof of Work remains a cornerstone of Bitcoin's security model, game theory has evolved to underpin a wider range of consensus mechanisms. Proof of Stake (PoS), for example, also uses game theory to incentivize honest behavior.

In this model, validators stake their cryptocurrency as collateral and are rewarded for processing transactions. If they act maliciously, their staked assets can be 'slashed' or forfeited, creating a powerful economic disincentive to cheat. The application of game theory has expanded beyond PoW and PoS to other emerging consensus models like Proof of Intelligence, which aims to incentivize honest contributions to AI computations on the blockchain.

Further reading: Proof of work vs. proof of stake

In the Proof of Work consensus model, we see that distributed databases rely on the behavioural interactions of rational decision makers. That is, game theory enables platform security and trust-less consensus protocols.

It is worth noting that a robust and resilient blockchain is dependent on its protocol and the number of nodes using the network. The larger a distributed network grows the more resilient it is to attacks.

Game Theory & Bitcoin

Here’s a simplified example of Game Theory applied to the Bitcoin network:

Imagine you're in a game where you get candy for solving puzzles. When you solve a puzzle, you get candy, but everyone else also gets a little candy too. In Bitcoin, miners solve puzzles to earn rewards, and by doing so, they keep the network safe and strong, which helps everyone. So, even though they're working for themselves, they end up helping everyone else too.

A more recent, large-scale example of game theory is the concept of "nation-state hashrate." As of mid-2025, governments are increasingly recognising Bitcoin as a strategic asset. The game-theoretic incentive is that in a world where access to a censorship-resistant monetary network becomes a national security concern, a country that controls a significant portion of Bitcoin's mining power (hashrate) gains a geopolitical advantage. This high-stakes "game" is compelling countries to invest in Bitcoin mining, not out of ideology, but as a rational move to secure their position in the global financial landscape.

Key Takeaways

-

Game theory allows us to understand the incentivisation of consensus models and build decentralised systems that are attack resistant. By analysing strategic interactions, we can create a distributed game that: 1) incentivises players toward desired outcomes; and 2) devises a system of trust based on code rather than human mediation.

-

The field of crypto-economics has evolved significantly, moving beyond its early days. Game theory is now a critical component in the design of sophisticated DeFi protocols, such as automated market makers and lending platforms, which use carefully crafted incentive models to ensure liquidity and stability. The foundational principles of game theory are now a driving force in a wide array of blockchain applications, not just consensus mechanisms.

-

Blockchain and cryptocurrency is redefining our understanding of economic incentives and the way that humans interact. With game theory as a strategic map, we will see the social function of these technologies continue to grow.

Recommended reading: Common Crypto Investing Strategies Every Investor Should Know

Make your First Investment with Caleb & Brown

You don’t have to be an expert to start investing in bitcoin or other cryptocurrencies.

Caleb & Brown is the world's leading crypto and bitcoin brokerage for beginner and advanced investors alike, making your entry into the market effortless.

Our personalised broker service makes crypto investing simple. A dedicated member of our broker team is always on hand to guide you along the way, giving you the confidence you need to navigate the world of crypto.

Not to mention key features such as:

- No joining or sign up costs

- Industry-leading storage solutions

- 24/7 customer support

If you are ready to take the next step and invest, contact your crypto broker today.

Not yet a client? Sign up for your free consultation.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.