Cryptocurrency and blockchain technology has worked its way into the cross hairs of the US government once again, this time with sanctions being imposed on the popular ‘Tornado Cash’ protocol. The Treasury Department has issued sanctions against Tornado Cash, an Ethereum coin mixing service, effectively banning Americans from using it. These sanctions have led to strong reactions from the cryptocurrency community surrounding privacy and decentralisation concerns. This has created an interesting discussion as to what constitutes "free speech," how compliant protocols need to be, and the importance of privacy. We explore each of these concepts in the article below.

What is Tornado Cash?

Launched in 2019, Tornado Cash is an open source privacy protocol built upon the Ethereum network. Tornado Cash acts as a coin mixer, which allows users to obfuscate the origins and destinations of transactions. Users send cryptocurrency to the service, have that crypto mixed with other coins or tokens, and then send the equivalent amount of “mixed” coins to a recipient address, hiding the connection between the sender and recipient. In doing so, mixers facilitate anonymous transactions by making it extremely difficult to trace crypto wallets.

Tornado Cash is a community-based project. Developers relinquished control of the protocol in 2020 in order to further decentralise the project. Changes to the protocol are now voted upon by holders of the native token of Tornado Cash, an ERC-20 token known as TORN, and only implemented upon a majority vote.

Why Use a Mixing Service like Tornado Cash?

Most cryptocurrency transactions are recorded on a public ledger known as a blockchain, where the movement of funds can be easily tracked and are visible for anyone to see. This immutable and transparent ledger is one of the amazing features of blockchain technology, and is unlike fiat currency and the legacy financial systems used globally. Because every transaction can be verified by anyone who wishes to do so, assets like Bitcoin provide trustless forms of money.

Though this visibility is a beautiful feature, there are certain circumstances where 100% transparency is not ideal all the time. And that’s where coin mixers come in. There are many legitimate personal and privacy reasons why you may not want everyone to know every detail of every crypto transaction you’ve ever made.

Privacy advocates argue that coin mixers are necessary in cases where a person’s activities - like journalism or protesting - can put that person at risk. An example of the need for financial privacy would include wanting to donate to Ukraine using cryptocurrency. Even if the government where you live is in full support, it’s understandable that you may not want the Russian government to have full details of your actions. There is a greater need for privacy in these types of crypto transactions.

On the flip side of this, coin mixers are also an attractive tool for cybercriminals. They provide a viable way for criminals to launder money using cryptocurrency and services like Tornado Cash to obscure where funds can be traced. They are therefore a target for law enforcement.

Why was Tornado Cash sanctioned?

On August 8, an official statement was released by the US Treasury’s Office of Foreign Assets Control (OFAC), alleging that Tornado Cash laundered more than US$7 billion of cryptocurrency since its inception. The laundered assets include $445 million hacked by the Lazarus Group, a famous North Korean-based hacking entity already subject to US sanctions. Previously, the group was linked to the $625 million Ronin Network hack and the $100 million Horizon Bridge hack.

The Treasury sanctioned Tornado Cash for failing to implement adequate measures to stop hackers from using it for money laundering activities. These sanctions aim to curtail illicit financing that could be deemed a national security threat, stepping up the Treasury’s desire for increased "Anti-Money Laundering" (AML) compliance from crypto financial institutions and services.

Sanction Implications

As a result of these sanctions, addresses associated with Tornado Cash have begun to be blacklisted by crypto industry leaders. Companies such as Circle, which issues USDC, the second largest stablecoin within the cryptocurrency ecosystem, have begun to freeze USDC from wallets that have interacted with the Tornado Cash protocol and prohibit future transactions that interact with this protocol.

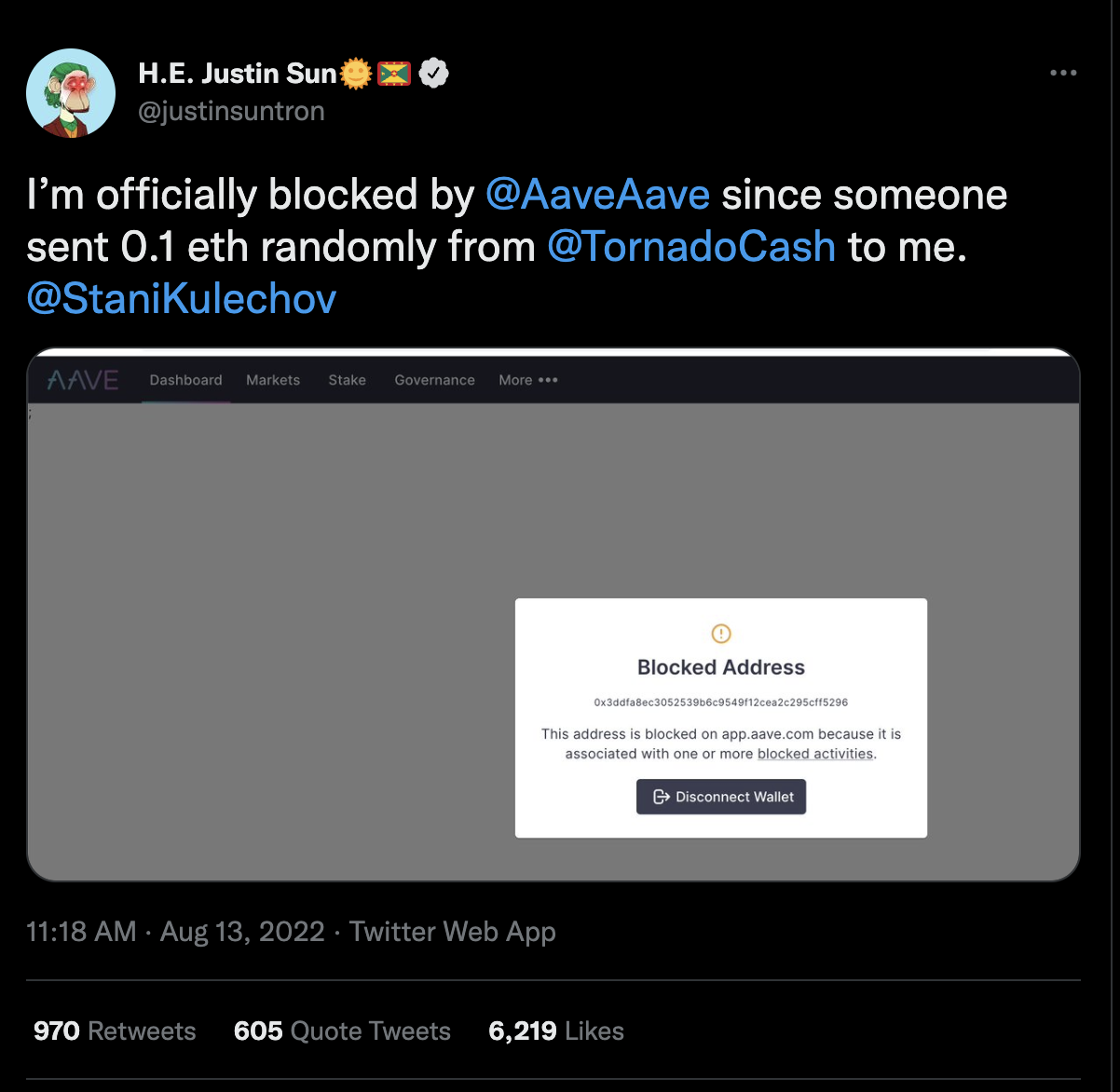

Along with this, the second largest decentralised crypto lender, Aave, also blocked addresses that were associated with Tornado Cash. Justin Sun, creator of the cryptocurrency TRON, expressed his frustrations at having been blocked from using the network after someone had sent funds to him using Tornado Cash.

This presents a difficult scenario whereby funds that have used Tornado Cash may be knowingly or unknowingly sent to addresses without the consent of the user, disabling their ability to use certain protocols. How this is to be avoided or prevented is yet to be seen.

We are approaching an interesting crossroad for many cryptocurrency projects and how they interact or are governed by decisions at the behest of governments. The US government appears to be taking a tougher stance on activities within the cryptocurrency space and attempting to increase oversight in order to prioritise national security. The resiliency of many protocols, their claims of decentralisation, and censorship resistance will now enter the spotlight and be put to the test.

Financial Privacy

As the world moves towards increasingly digitised money, how will privacy look going forward? Till now, we have been the beneficiaries of some financial privacy with the advent of cash and the relative anonymity that comes with it. However, as the Tornado cash situation has shown, this may not be the case going forward.

Jesse Powell, CEO of crypto exchange Kraken, publicly denounced decisions made by the US government with respect to sanctions placed on funds that have interacted with Tornado Cash. Powell argued that many users have interacted with the protocol for legitimate reasons to maintain the privacy of their finances whilst committing no crimes, suggesting that there may be a constitutional battle to come.

The governments ability to censor and control centralised entities within the cryptocurrency space provides areas of the ecosystem that may or may not be highly susceptible to regulatory capture and could centralise powers over time. This provides investors with an interesting dynamic to consider when trying to determine the censorship and decentralised resistance of their investments going forward.

Wrapping Things Up

This case has highlighted many important topics that are still in a state of flux, opening up a range of possibilities for how cryptocurrency and the tools it will create become embedded in our society. Coin mixers like Tornado Cash occupy a grey area between facilitating money laundering and preserving the right to privacy. How this develops with respect to the current power structures we operate in is still highly contentious and no doubt will garner strong reactions all around. It provides an exciting chapter whereby, as a society, we will determine the direction we want to head in with respect to monetary technology and then the implications our decisions will have going forward. No doubt, the Tornado Cash event is not an isolated one, but will form part of a larger movement as cryptocurrency and blockchain technology matures.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.