In this Week's Market Rollup

The crypto market has enjoyed a strong start to the month of November. Despite news of another 75 basis-point rise in interest rates delivered by the U.S. Federal Reserve, investors have remained upbeat, with the latest U.S. employment data triggering a wave of positive price movements across the market into the weekend. Bitcoin (BTC) and Ethereum (ETH) have taken a backseat to other impressive performances this week, with Polygon (MATIC), Arweave (AR), Chiliz (CHZ), and many others enjoying eye-catching double-digit gains.

Market Highlights

- The market rallied on November 4 following the unexpectedly robust jobs report from the U.S. Labor Department which showed that U.S. payrolls added 261,000 jobs in October, beating economist forecasts for 200,000. This news helped push Bitcoin (BTC) past US$21,000 for the first time since September.

- Binance CEO Changpeng "CZ" Zhao announced that Binance will liquidate its FTX (FTT) holdings as a means to manage risk. Despite CZ emphasising how he would minimise market impact on the token’s price, FTT fell more than 15% the following day.

- Meta’s Instagram announced several major partnerships with the launch of its NFT marketplace. Polygon and Arweave greatly benefited from the announcement, with both tokens posting double-digit returns over the week.

Price Movements

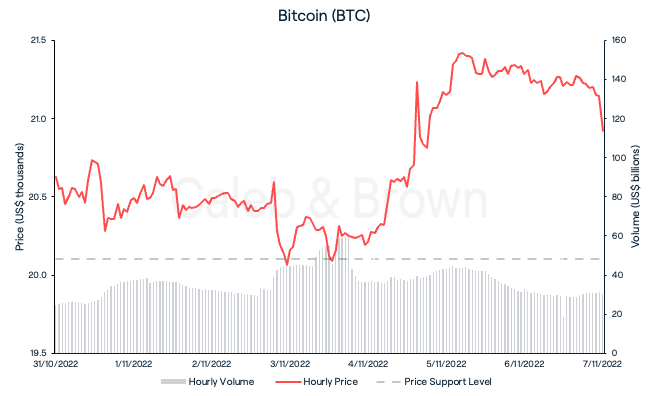

Bitcoin (BTC)

BTC has enjoyed another green week after successfully holding the line above the key US$20,000 support level over the past seven days. Hopes of a second consecutive week of positive returns appeared to be dashed mid-week following the U.S. Federal Reserve’s announcement on November 2 of yet another 0.75% interest rate hike, the fourth this year. However, investors reacted positively to the tone of the latest jobs report released from the U.S. Labor Department on November 4, with the BTC price rallying past US$21,000, reaching a seven-week high. BTC closed the week at $20,960, with a modest 1.9% gain.

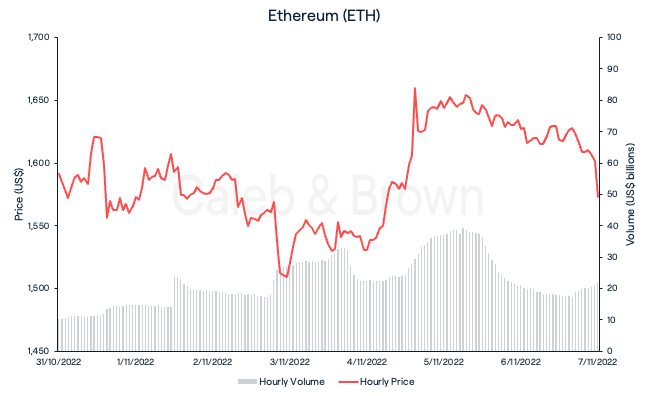

Ethereum (ETH)

After a strong performance over the last fortnight, Ethereum (ETH) ran out of steam and returned some of its recent gains back to the market this week. In similar fashion to BTC, the ETH price responded negatively to the Fed’s mid-week rate hike announcement and then proceeded to rally over 10.0% following the Labor Department’s report. However, this price rally could not be sustained, as ETH closed the week down 0.5%, trading at US$1,582 at the time of writing.

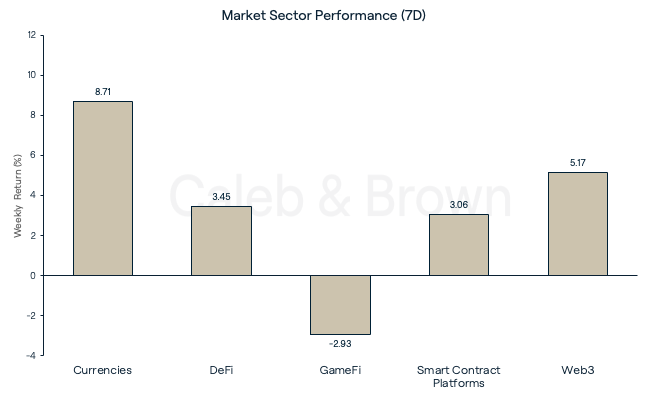

Altcoins

While crypto’s two leading assets have traded relatively flat this week, the rest of the market has taken the reins. Nearly all market sectors enjoyed positive price performance, with GameFi being the laggard. Currencies was the market leader this week, gaining 8.71%. This was followed closely by Web3, DeFi, and Smart Contract Platforms, which returned 5.17%, 3.45%, and 3.06%, respectively. After leading the market last week, GameFi was this week’s worst performing sector, losing nearly 3% in value.

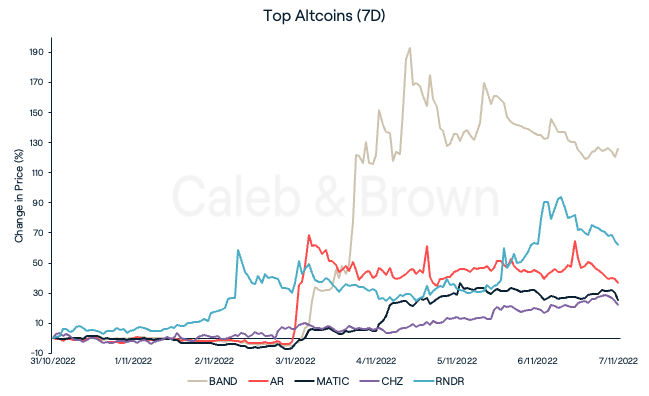

Band Protocol (BAND), a decentralised oracle, has skyrocketed to the top of the best-performing assets this week, gaining a staggering 131.2%. The sudden increase in price follows a mainnet-upgrade announcement that aims to improve user experience through increased network throughput and upgraded gas fee calculations.

Both Polygon (MATIC) and Arweave (AR) appear to have benefited from recent partnerships with Meta, as both tokens rallied 40.2%, and 35.5% respectively, over the last seven days. Polygon will provide the infrastructure for Instagram’s NFT marketplace, while Arweave will provide decentralised data storage for the collections.

Sports-fan engagement platform, Chiliz (CHZ) has found itself among the top performers again this week after posting a 28.6% gain. With the 2022 FIFA World Cup around the corner, investors continue to speculate on the token. Render (RNDR) deviated from the rest of the GameFi sector returning 60.5%. CHZ and RNDR are up 50.6% and 90.3%, respectively, over the last 14 days.

Web3 News

In other news, MakerDAO’s (MKR) co-founder, Nokilai Mushegian, was found dead on a beach in Puerto Rico last week. The news of Mushegian’s death came just hours after he sent a tweet claiming the CIA was running a “sex trafficking entrapment blackmail ring” and would “torture” him to death. While the investigation is ongoing, San Juan police records indicate no foul play in Mushegian’s death.

Binance CEO Changpeng "CZ" Zhao recently tweeted that Binance will be liquidating its FTT holdings, the native token of its rival exchange, FTX. Binance received the FTT as part of its exit from an early equity position in FTX. To minimise the market impact on FTT, however, CZ explained that the liquidation would be expected to take a few months. Nevertheless, investors flocked to sell their holdings as FTT’s value dropped 15.6% the following day.

Payments giant, Mastercard, welcomed seven new crypto startups to its global startup engagement programme called Mastercard Start Path. Receiving in excess of 1,500 applications every year, Mastercard’s startup programme has helped more than 350 companies raise over US$3.5 billion in funding. This year’s cohort has brought in Loot Bolt, Quadrata, and Uptop from the U.S., as well as intakes from Singapore, Abu Dhabi, Colombia, and Dubai. By merging various firms from various crypto sectors, Mastercard’s Start Path aims to catalyse innovation in the space and accelerate the hybridisation of Web3 and traditional finance.

Recommended reading: A Guide to Dollar Cost Averaging in Crypto

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.