In this Week's Market Rollup

Following weeks of positive price action, both BTC and ETH have cooled off over the past seven days in a rather uneventful week. However, many altcoins have enjoyed major moves as investors rotate into alternative ‘ETH Killer’ Layer 1 protocols. Market participants seemed relatively unfazed by two fresh major exploits, affecting both the Nomad bridge and Solana ecosystem.

Market Highlights

- Michael Saylor will step down as CEO of MicroStrategy after 33 years leading the company.

- Nomad, a cross-chain bridge, was exploited for US$200 million on August 1, bringing the total amount stolen from cross-chain bridges this year to US$2 billion.

- Popular Solana wallets Slope and Phantom were the targets of another attack this week which resulted in US$6 million in losses.

- News of Instagram’s plans to integrate with the Flow blockchain to expand its NFT offerings globally caused the price of FLOW to rise by 50%.

Price Movements

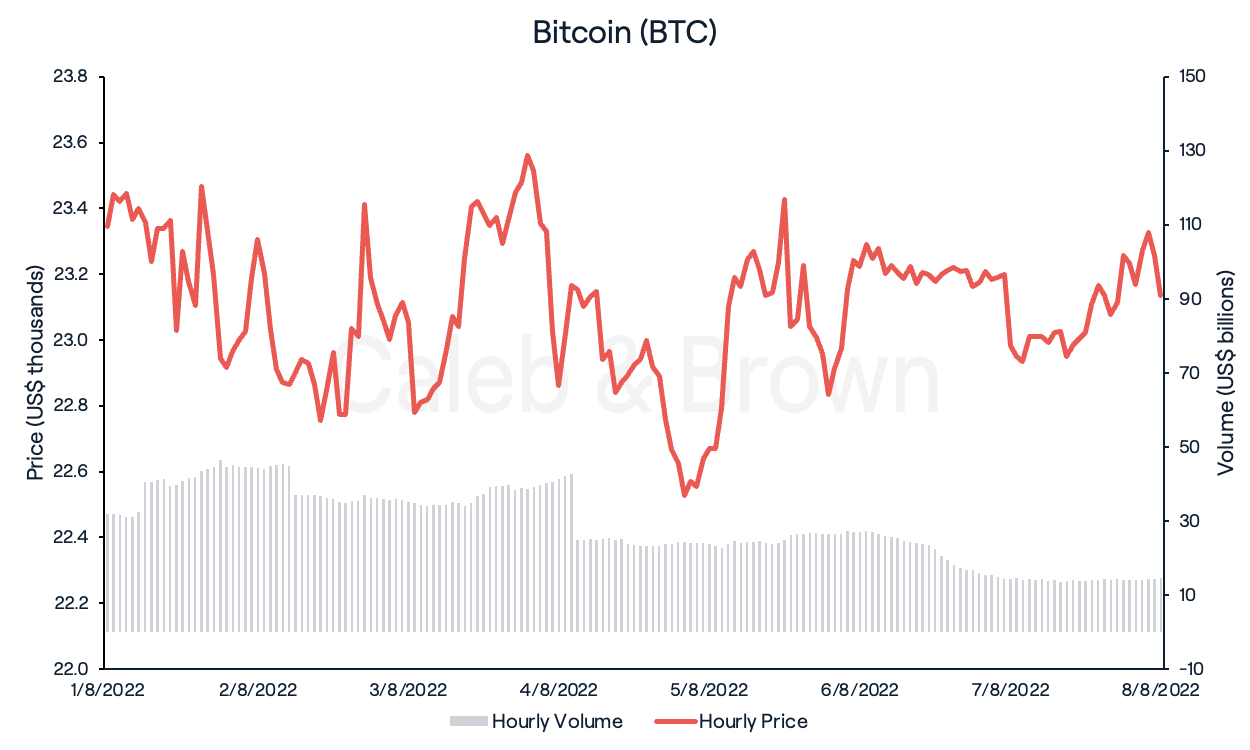

Bitcoin (BTC)

After rallying over 20% in July, Bitcoin (BTC) remained relatively steady this week, ranging between US$22,500 and US$23,500. It closed the week down 0.2% at US$23,199, where volume trended down as BTC remained in this tight range.

MicroStrategy’s self-proclaimed Bitcoin maximalist, Michael Saylor, announced on August 2 that he will be stepping down as CEO after 33 years. The announcement followed MicroStrategy’s second quarter earnings report which revealed a US$917 million loss due to impairment charges related to its Bitcoin holdings. MicroStrategy’s president, Phong Le, was elected to fill Saylor’s position and Saylor will now serve as Executive Chairman, shifting his focus solely to the company's Bitcoin strategy. Despite the sudden change in leadership, MicroStrategy’s shares (NASDAQ: MSTR) rose nearly 15% on August 3.

On August 3, Binance announced it will be partnering with Mastercard to launch a new prepaid (debit/credit) card in Argentina. Issued by Credencial Payments, the new Binance card will allow Argentinians to pay for bills and purchase goods using cryptocurrencies such as BTC and BNB. The product will be the first of its kind to be launched in Latin America and will provide an alternative payment system to residents who are stuck with a native currency facing extremely high inflation rates (64%), further encouraging BTC adoption and wider cryptocurrency usage.

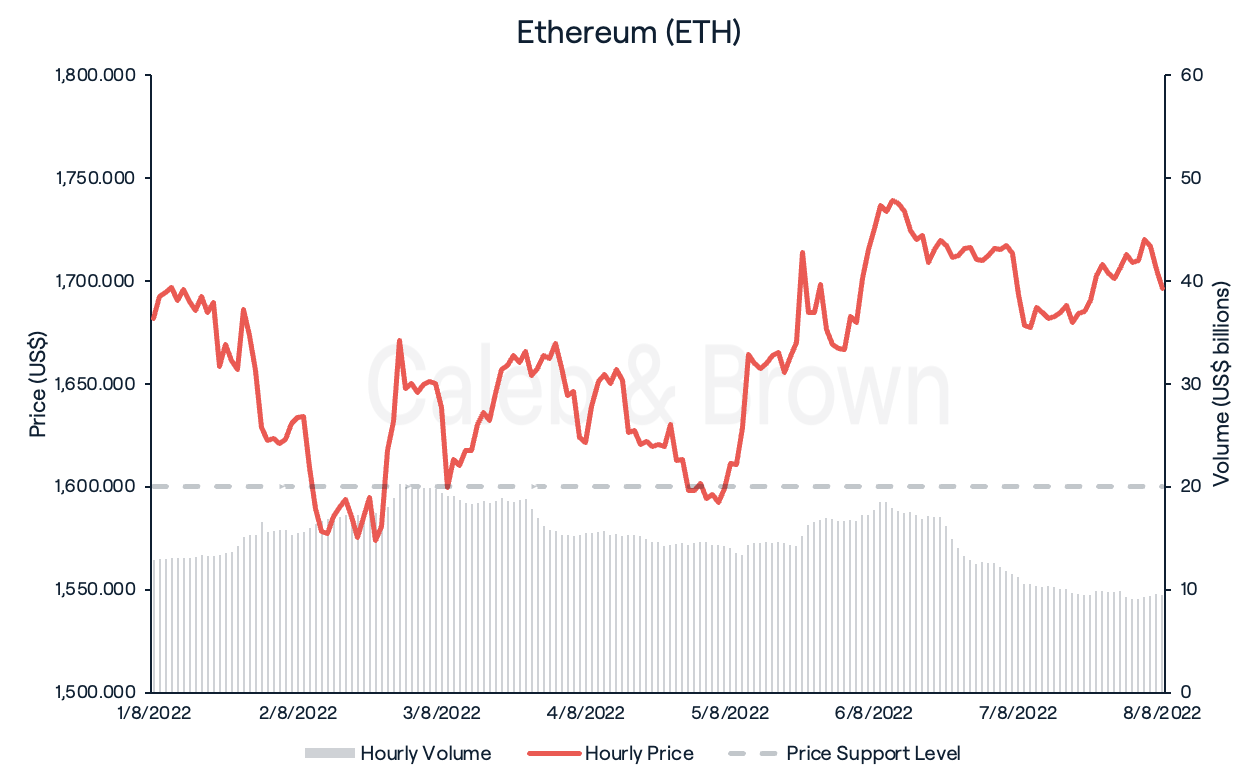

Ethereum (ETH)

Following weeks of considerable positive price action, Ethereum (ETH) has cooled off over the past seven days, only gaining 1% to close the week at $US1,705. By holding its price above $US1,600, ETH seems to have flipped this previously established resistance level into a support level for the time being.

Looking forward, Ethereum is now approaching the final stretch of its long-awaited merge from Proof of Work (PoW) to Proof of Stake (PoS). The final Goerli testnet is underway and is scheduled to take place between 6-12th August. If the testnet merge is successful, the final merge is expected to occur in September. To learn more, check out our earlier article explaining the nuances of the Merge and what it means for Ethereum as a protocol going forward here.

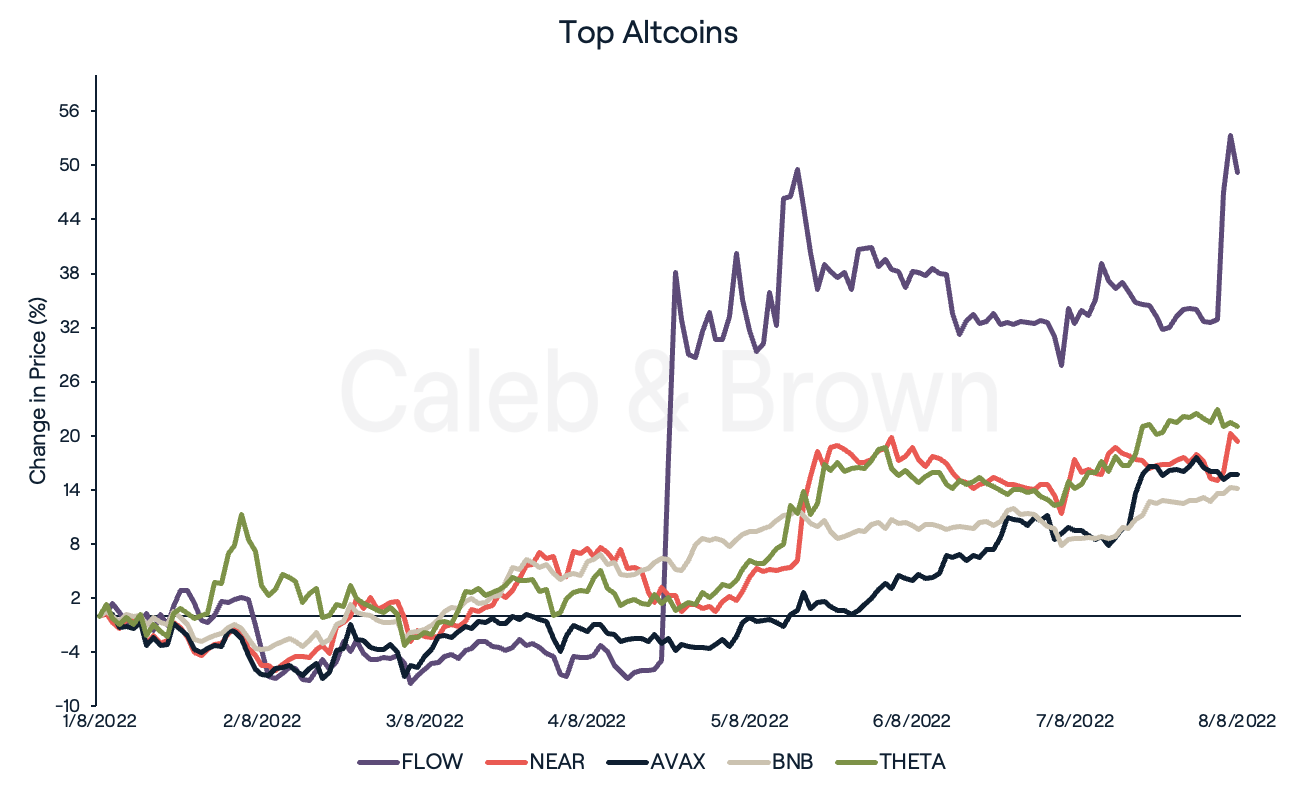

Altcoins

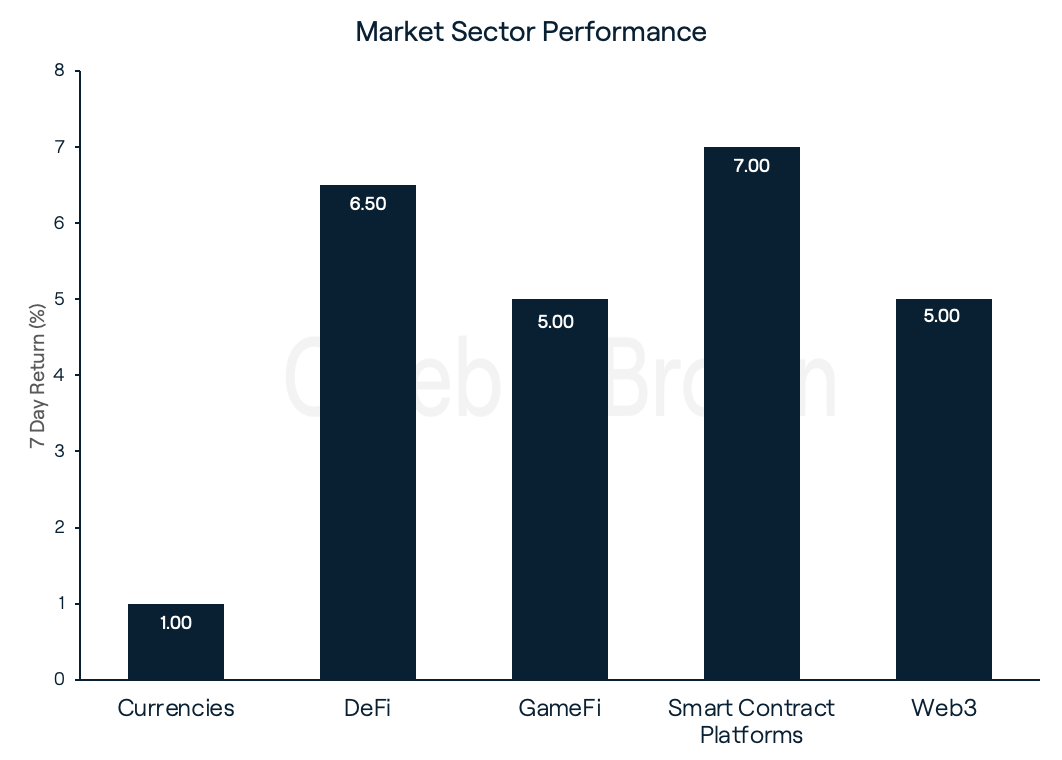

While the month of July saw Ethereum-related altcoins and DeFi assets outperform the rest of the market, investors seem to have rotated into alternative Layer 1 protocols or ‘ETH killers’ over the past seven days. The strongest performing sector of the week was Layer 1 protocols, returning 7%. Near (NEAR), Avalance (AVAX), and Binance Coin (BNB) were among the strong performing smart contract platforms, increasing by 19.3%, 15.7%, and 14.1% respectively.

Theta Network (THETA) had the highest positive performance of all Web3 tokens, increasing by 21% this week as the Theta 4.0 mainnet launch inches closer. The testnet launch is scheduled to take place on October 1, 2022 and the general launch is expected to take place on December 1, 2022. The Theta mainnet upgrade will introduce the “Metachain,” also known as the chain of chains. More information on the Theta 4.0 network upgrade can be found here.

The DeFi sector had another solid week, increasing by 6.5%. The GameFi and Web3 sectors increased 5%, while the Currencies sector lagged behind, increasing by just 1% in the last seven days.

Two major hacks rippled across the crypto space this week. The first hack relates to the Nomad bridge, which is a decentralized cross-chain bridge protocol supporting asset transfers across chains. This US$190 million exploit was the 5th largest crypto hack ever. A flaw in a Nomad smart contract allowed users to spoof transactions and withdraw money from an open vault on the bridge.

The latest update in the Nomad bridge saga is that Nomad has recovered US$425,142 in ETH and US$21.9 million in other Ethereum-based tokens from hackers. This happened after Nomad announced that they would pay a 10% reward to hackers who returned the tokens, and that no legal action would be taken for those who did so.

The second hack this week took place within the Solana ecosystem, affecting at least 8,000 Solana wallets with total losses of up to US$6 million, particularly popularly-used wallets like Phantom, as well as Slope and Trust. This hack is believed to be linked to the Slope Mobile Wallet. Slope allegedly stored wallet seed phrases on a centralised event logging service which was then exploited by hackers.

Recommended reading: What is Ethereum? A Beginner's Guide

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.