In this Week's Market Rollup

Crypto’s two largest assets, BTC and ETH, have both enjoyed positive gains in price over the past seven days, despite carnage across the U.S. stock market in trading. This positive price action from the industry leaders carried across the market, with all sectors enjoying positive gains for the first time in a month. However, one of the industry’s largest blockchains, Binance Smart Chain (BSC), appears to have escaped calamity this week following a major exploit, which forced the chain to go down.

Market Highlights

- The Bitcoin network experienced a growth in hash-rate of over 10%, helping it reach an all-time-high of 258.33 EH/s, ensuring increased network security.

- Fidelity, one of the world’s largest asset managers, launched a new Ethereum Index Fund, expanding its crypto offerings for its 34.4 million accredited investors.

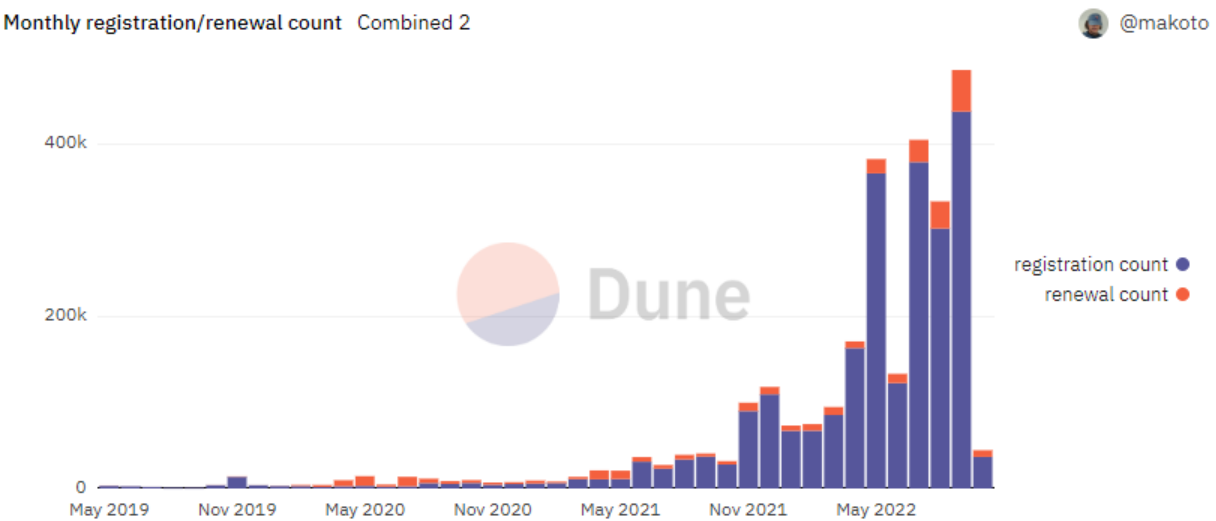

- Ethereum network activity continues to grow, with the number of newly-issued Ethereum Name Service (ENS) addresses reaching a new all-time-high, causing the ENS token to soar 25.3%.

Price Movements

Bitcoin (BTC)

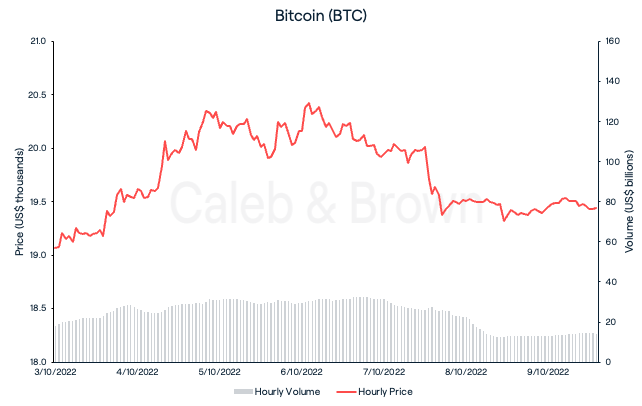

Bitcoin (BTC) has enjoyed a humble, yet positive start to October. The past week began strongly, with BTC rising 7.1% during the initial four days. However, this price move proved unsustainable, and BTC retraced the position in the days that followed. Investors appeared to react negatively to a Jobs Report published by the United States Labor Department on October 7, which indicated employment was below target. Nevertheless, BTC closed the week up 1.23% at US$19,438, marking the second week in a row of positive price performance.

The aforementioned Jobs Report revealed a slower growth in new jobs for the month of September compared to previous months, lowering the U.S. unemployment rate to 3.5% (down 20 basis points). Many investors took it as a sign that the Federal Reserve will continue cautiously tightening the nation’s purse strings, and are preempting the likelihood of further interest rate hikes at the Fed’s October meeting. U.S. stock markets bled across the board over the weekend in response, with BTC also shedding 2.9% post-announcement.

In stark contrast to BTC’s rangebound price movement, the Bitcoin network’s hash-rate hit an impressive all-time-high over the weekend. A network’s hash-rate indicates the total computing power contributed to validating transactions and therefore securing the network. The Bitcoin network’s recent high of 258.33 EH/s (7-day moving average) suggests more miners and mining resources are being deployed to secure its network. Interestingly, a potential reason for this increase may be due to Ethereum’s recent upgrade to a Proof-of-Stake (PoS) network, as Proof-of-Work (PoW) mining rigs have become more readily available and cheaper on the market due to miners selling their mining equipment.

Ethereum (ETH)

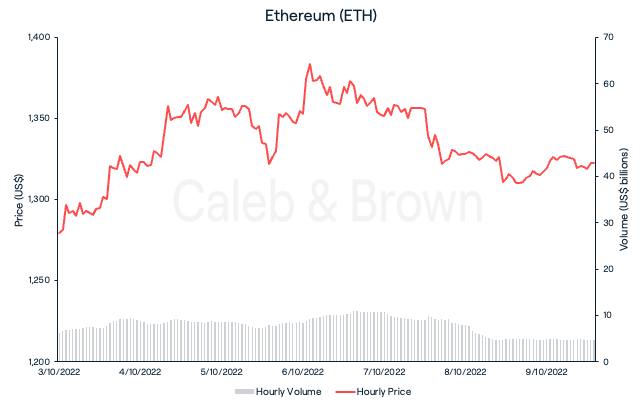

Ethereum (ETH) displayed very similar price action to BTC over the past seven days. The price of ETH rallied 7% by October 6, but it was unable to find a new support level and tumbled into the weekend following the release of the U.S. Department of Labours market data. However, the ETH price managed to perform stronger than BTC and closed the week at US$1,330, up 4.25%. Significantly, this positive close breaks ETH’s three-week downward price trend.

Fidelity Investments unveiled a new Ethereum Index Fund after submitting a filing to the U.S. Securities and Exchange Commission (SEC) on October 4. Fidelity currently has more than US$9.9 trillion in assets under management and plans to extend its crypto offerings through the fund to U.S.-based accredited investors. This is Fidelity’s second crypto-fund endeavour after launching Bitcoin-accessible 401(K) retirement accounts in April this year.

Altcoins

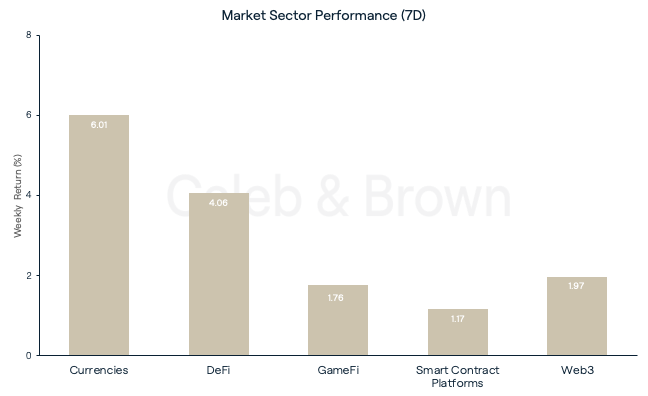

All market sectors were up across the board this week, with Currencies breaking away from the pack, gaining over 6%. This performance was followed by DeFi and Web3 which returned a weekly gain of 4.06% and 1.97%, respectively. The Smart Contract Platform sector was the lagging sector for the week, gaining just over 1%.

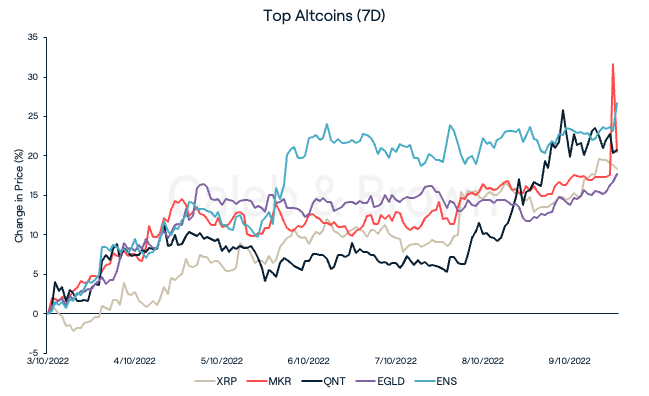

The Currencies sector performance was largely carried by XRP (XRP) this week. Although the sector as a whole traded up, XRP outperformed the sector and rallied 19% over the last seven days. XRP’s price action continues after Ripple and the SEC filed motions for summary judgement of their US$1.3 billion lawsuit in late September. XRP is trading 48.7% higher over the last 30 days.

Leading the DeFi sector for the second week in a row was Maker (MKR), which gained 20.9% over the last seven days. Elrond (EGLD) and Quant (QNT) were amongst the top performers again this week, rising 17.1% and 18.4%, respectively.

This week’s largest gainer was Ethereum Name Service (ENS), which rallied over 25%. ENS is the crypto-equivalent of the Domain Name System (DNS). ENS’s price action follows a Dune analytics count which reported an all-time-high for newly-issued ENS addresses last month.

Web3 News

The Binance Smart Chain (BSC) was halted on October 7 when a potential vulnerability was detected after a spike in irregular network activity. The exploit had the potential to be the largest exploit in crypto history as the hacker was able to send 1,000,000 BNB (approx. US$277 million) from a BNB bridge to a controlled account, twice. Due to the quick and decisive actions taken by the community as well as halting transactions, Binance later announced that the hacker was able to remove US$100 million worth of assets from BSC, with US$7 million being frozen.

Celsius (CEL) co-founder, Daniel Leon, stepped down as Chief Strategy Officer on October 5. The news follows a slew of financial and legal issues that saw Celsius file for bankruptcy in July 2022. With former CEO, Alex Mashinsky, resigning the week before, Celsius’ future appears bleak as the firm enters the latter stages of bankruptcy and looks to auction off its remaining assets.

Regulatory

In a statement released on October 6, the European Union placed a blanket ban on all crypto services to Russian entities and cross-border crypto payments between Russians and the EU. This statement includes the prohibition of “all crypto-asset wallets, accounts, or custody services, irrespective of the amount of the wallet.”

This round of EU sanctions represents an escalation from previous restrictions on crypto. The original limit, established in April this year, allowed the services mentioned above to continue servicing Russian wallets holding €10,000 or less.

Recommended reading: Common Crypto Investing Strategies Every Investor Should Know

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.