In this Week's Market Rollup

BTC rallies 2%, ETH’s next upgrade is booked in, and data shows developers keep building on blockchains despite 2022’s crypto market cap pullback.

Read on for the full story!

Market Highlights

- Bitcoin (BTC) rallied 2.0% after the U.S. Labor Department’s weekly jobless claims report was released on Thursday. The report revealed jobless claims had risen to a 10-month high.

- Ethereum (ETH) developers have unveiled a timeline of March 2023 to enable ETH staking withdrawals in the Shanghai upgrade.

- The U.S. Securities and Exchange Commission released guidelines for companies making financial disclosures to ensure they provide a more detailed record of their exposure to the crypto industry.

Price Movements

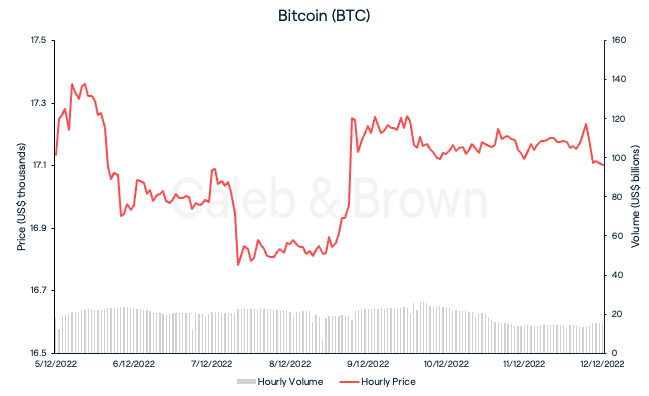

Bitcoin (BTC)

Bitcoin (BTC) experienced a shaky start to the week after recession forecasts and job cut announcements from major U.S. bank executives led stocks to tumble on Tuesday. BTC then fell more than 2% the following day until a positive response to the U.S. Labor Department’s weekly jobless claims report sent BTC above the US$17,000 mark Thursday night. BTC remained above this price level over the weekend, closing the week at US$17,083, an increase of 0.47% week-on-week.

Thursday’s report revealed that unemployment rolls or ‘jobless claims’ had risen to a 10-month high of 230,000 in the week ending December 3. The number of weekly jobless claims increased by 4000 from last week’s revised level, falling in line with economists expectations and below the 270,000 threshold. Generally, rising unemployment rates could suggest people are less likely to spend, eventually driving the price of goods and services down, therefore potentially driving inflation down. This sentiment reverberated throughout the crypto market as BTC recovered 2.45% following the announcement.

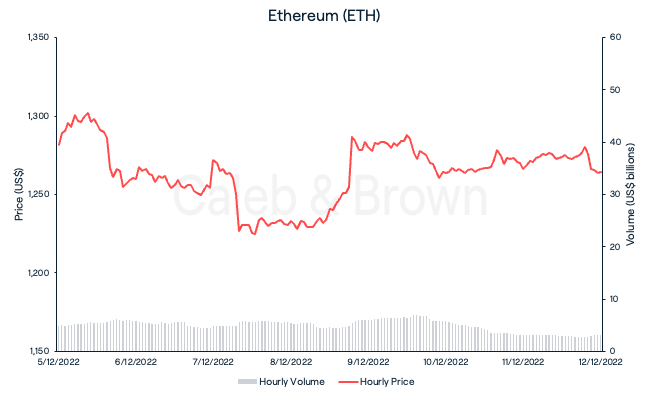

Ethereum (ETH)

Ethereum (ETH) spent the majority of the week rangebound, trading between US$1,225 and US$1,300. Comparably, ETH dipped alongside BTC at the beginning of the week before ETH joined BTC in its recovery Thursday night, topping out at US$1,296. It was unfortunately downhill from there as ETH failed to sustain the move and closed the week at US$1,274, ultimately holding on to just a 0.1% weekly gain.

Almost three months have passed since Ethereum’s highly anticipated Merge to a proof-of-stake consensus mechanism which allowed users to stake their ETH onto the new beacon chain. Currently, with US$19 billion worth of ETH staked on the network, Ethereum developers have unveiled a tentative timeline to enable staked ETH withdrawals in the next upgrade, named Shanghai. While a scope of topics were discussed in the latest Ethereum core developer call, staked ETH withdrawals were prioritised for a potential March 2023 launch.

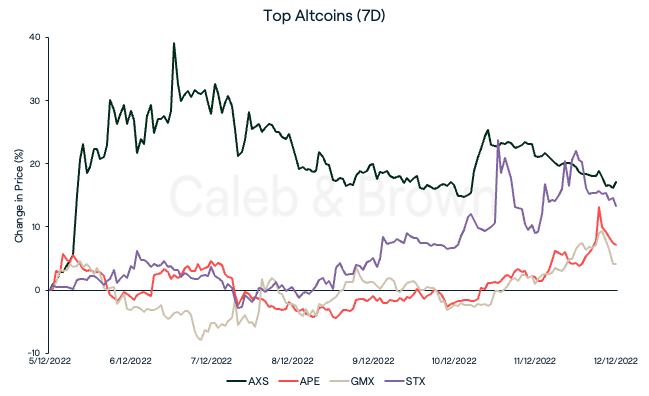

Altcoins

Making headlines this week was Axie Infinity (AXS) which surged 15.6% over the last seven days. This week’s spike was largely contributed to the launch of the project’s Axie Contributors initiative. Roughly 700 “committed” members of the community will earn formal roles within the game’s governance model.

ApeCoin (APE) rallied 8.9% during the week as investors looked to position themselves ahead of APE’s staking rewards on December 12. Nearly US$32 million worth of APE was deposited on to the official staking contract since Yuga Labs’ announcement on November 30. APE is up 32% over the last two weeks.

GMX (GMX) continues to benefit from the current narrative shift towards decentralised platforms. Up 5.1% over the last seven days, GMX has rallied for the fourth consecutive week and is only 10.5% down from its all-time-high.

Topping the list this week was Bitcoin layer-1 solution, Stacks (STX), returning an impressive 24.2% . While no official announcements have been made, a few big developments unfolded including the launch of a native USDC-xUSD bridge and first Decentralised Exchange (DEX) on Bitcoin.

Regulatory

The UK government announced on Monday a package of more than 30 reforms to financial regulation, including the extension of tax breaks for investment managers to cover crypto assets. The measures are designed to replace EU regulation covering areas such as disclosure for financial products and explore relaxing capital rules to reduce the burden on smaller banks.

In the United States, the SEC has unveiled new guidelines for companies making financial disclosures, which call on them to provide a more detailed record of their exposure to the crypto industry in the wake of recent market chaos. The guidelines include exposure to third-party crypto market participants, ability to obtain financing, and risks related to “legal proceedings”.

In Other News

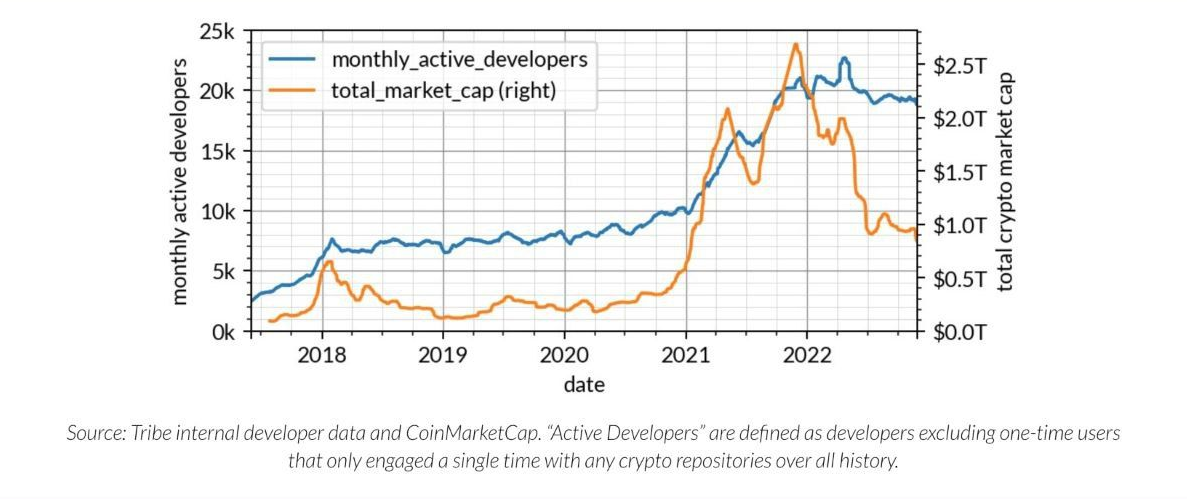

Despite the crypto market downturn, developers continue contributing to building on a variety of blockchains. As the chart below shows, there has only been a slight decline in monthly active developers despite a 67% pullback in the entire cryptocurrency market cap.

The number of active contributors is a key metric reflecting the strength of blockchain networks. With the rise in popularity and use cases of certain blockchains, they also tend to attract more regular contributors.

Recommended reading: 6 Types of Altcoins and Their Use Cases

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1FpooZI2tdLfGti3UIo3So%2Fab7b87d52b28df726659d1f5d9625d08%2FBlog-Cover__2_.png&a=w%3D400%26h%3D225%26fm%3Dpng%26q%3D80&cd=2022-12-12T11%3A20%3A00.971Z)