In this Week's Market Rollup

The Fed sends Wall Street and crypto markets on a rollercoaster ride, Sam Bankman-Fried is arrested and faces eight criminal charges, and Binance is under the microscope as investors try to separate FUD from fact.

Strap in and read on!

Market Highlights

-

Bitcoin (BTC) and the rest of the market took a nosedive on Tuesday after the U.S. Federal Reserve announced its plan to continue raising interest rates into 2023 to combat inflation.

-

Sam Bankman-Fried, the disgraced former FTX CEO, was arrested in the Bahamas on Tuesday at the request of the U.S. Government, based on a sealed indictment filed by the Southern District of New York.

-

The Australian government announced its plan to create a framework to regulate crypto firms, update Australia’s payment systems, and strengthen its financial market infrastructure.

Price Movements

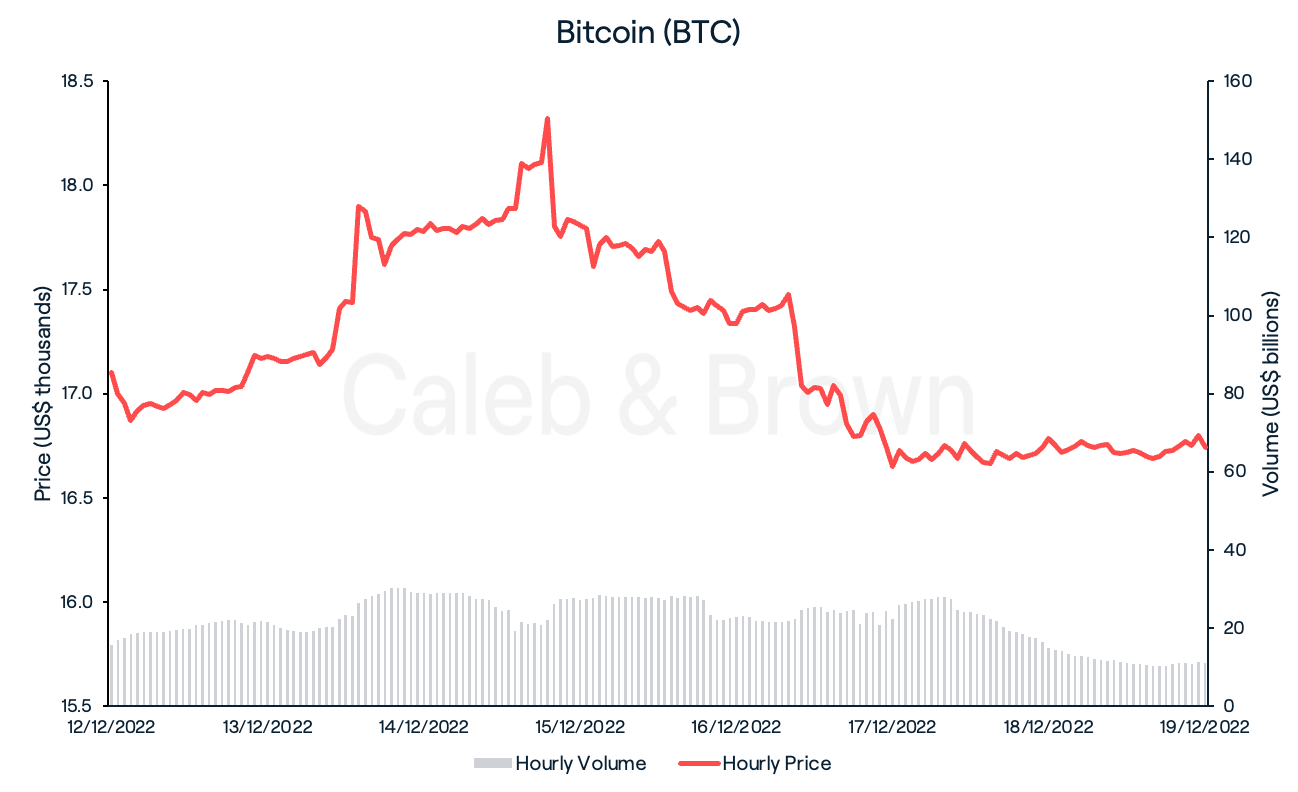

Bitcoin (BTC)

It’s been a rollercoaster week on Wall Street and in the crypto space. Bitcoin (BTC) surged past the US$18,000 mark on Tuesday for the first time since FTX’s collapse on November 8.

The move followed better-than-expected news from the U.S. Bureau of Labor Statistics’ CPI (Consumer Price Index) report on Tuesday, which revealed inflation fell to 7.1% (down from 7.7% in October) in November, beating the 7.3% estimate.

The CPI report measures the rate of change in the price of a basket of goods and is used as one metric to calculate inflation in the economy.

However, the positive sentiment quickly took a turn as the U.S. Federal Reserve approved a 0.5 percentage point interest rate hike the same day. While the rate increase fell in line with expectations, the Fed signaled plans to continue raising rates next year to combat inflation.

BTC immediately fell back below US$18,000 following the announcement, and it continued to decline in price for the remainder of the week. Over US$44 million worth of BTC long positions were liquidated on Friday, which saw BTC’s price fall 2.6% in just two hours, wiping out all mid-week gains. By the end of the week, BTC was trading hands at US$16,785, down 0.9% over the last seven days.

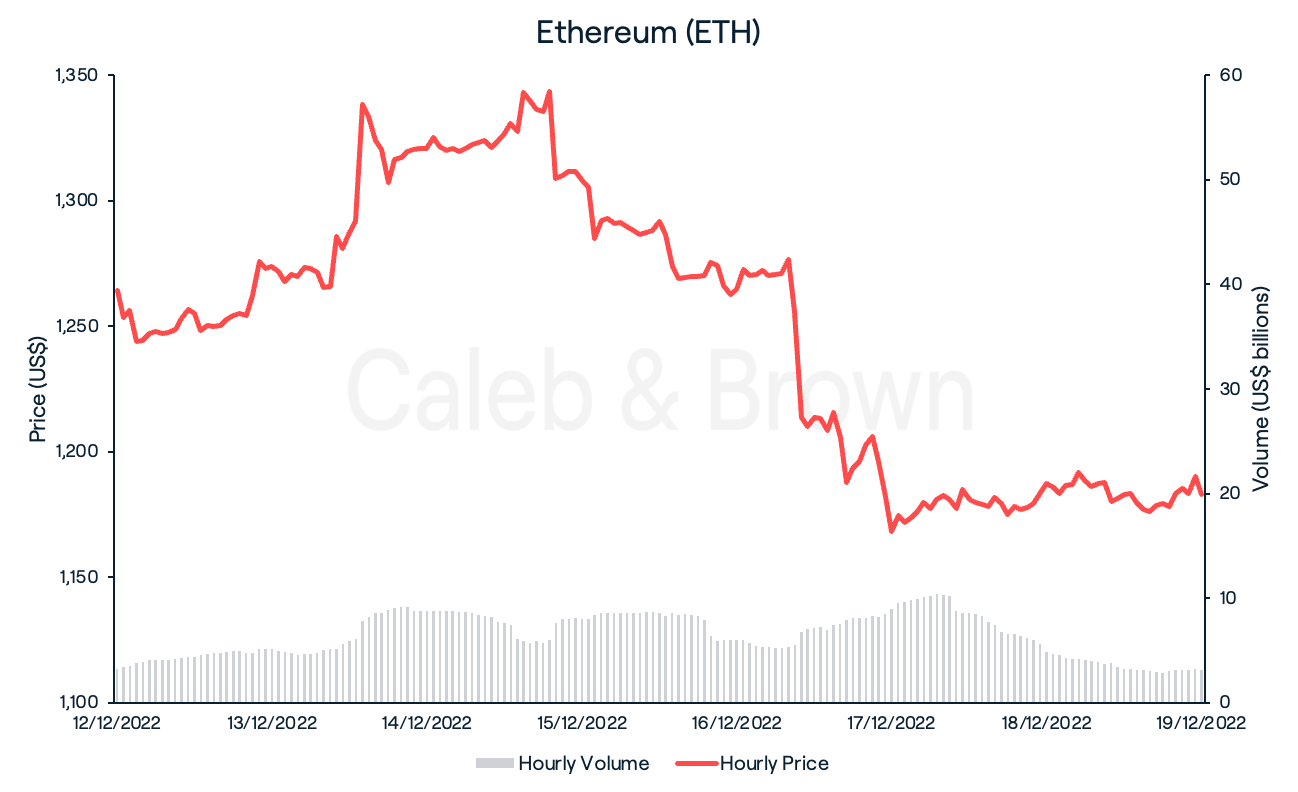

Ethereum (ETH)

Ethereum (ETH) followed in Bitcoin’s footsteps at the beginning of the week, as ETH rallied 7.5% to a five-week high of US$1,352 on Tuesday. Similarly, ETH’s price quickly declined the same night following the Fed’s announcement to potentially maintain its aggressive monetary policy in 2023.

ETH investors also felt pain on Friday after US$62 million of leveraged long ETH positions were liquidated, sending ETH back below US$1,200. Overall, ETH closed the week at US$1,190, shedding 5.0% over the last seven days.

Altcoins

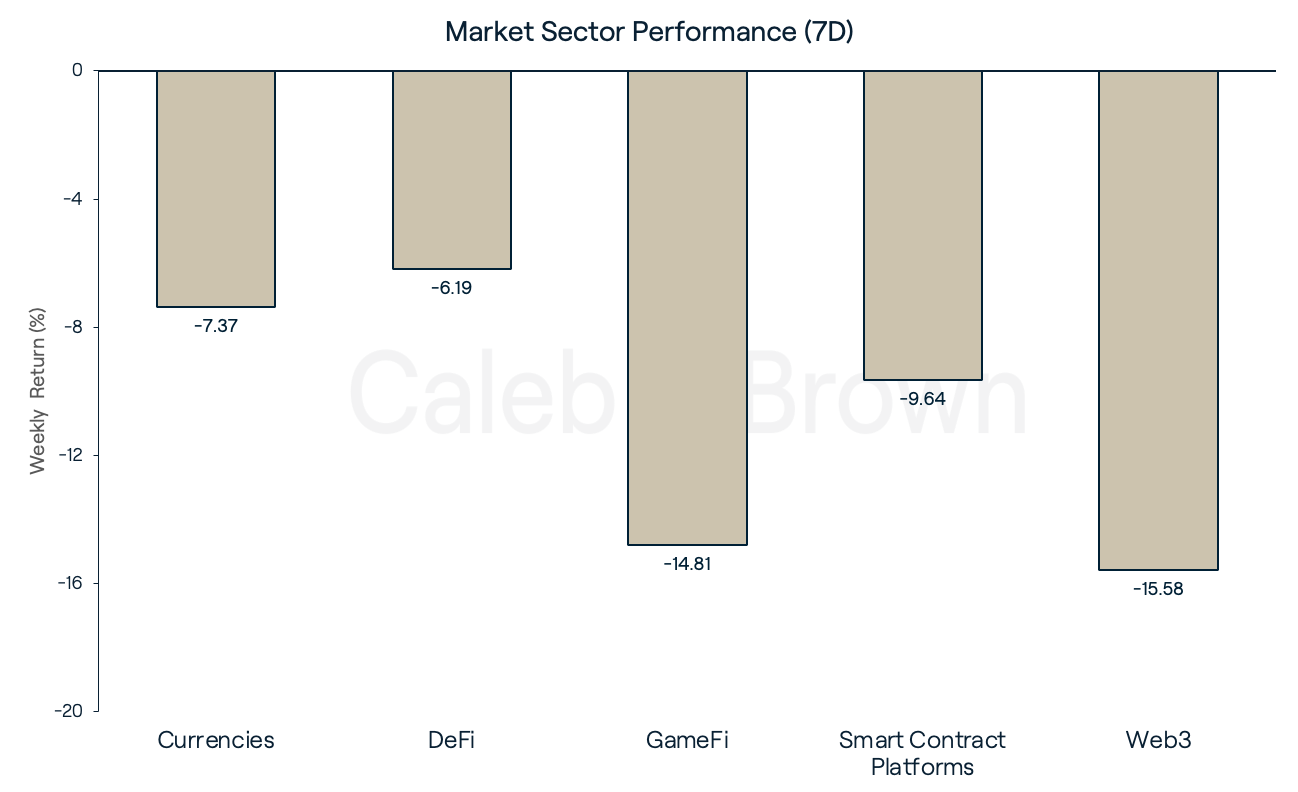

Unsurprisingly, all market sectors finished this week in the red. Web3 and GameFi were the hardest hit, with both posting double-digit losses of 15.58% and 14.81% respectively. Following these were Smart Contract Platforms and Currencies which each decreased 9.64% and 7.37% respectively. DeFi was the least impacted sector, but it still lost 6.19% week-on-week.

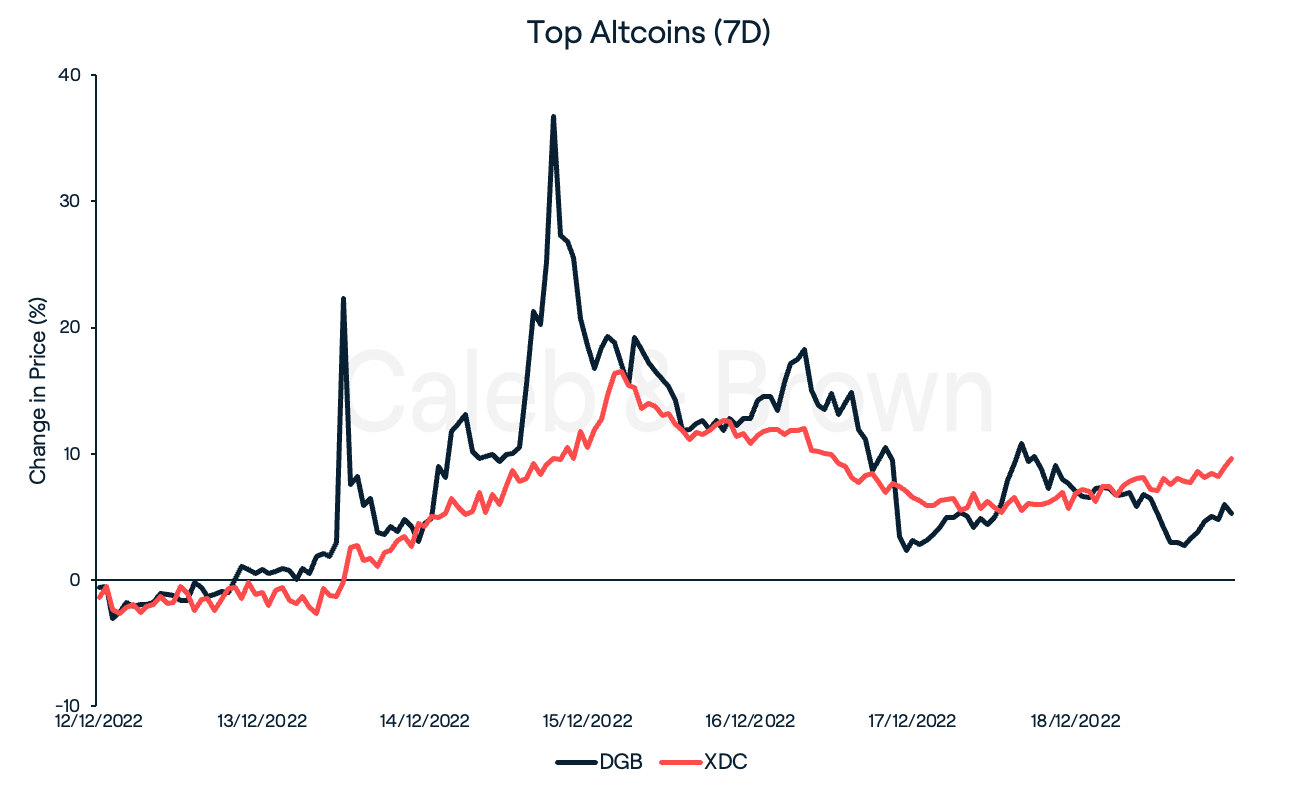

What started out as a strong week for the crypto market quickly turned sour, with most weekly gains wiped out by Friday. However, two tokens managed to emerge out of the rubble and post positive returns: XDC Network (XDC) and DigiByte (DGB).

XDC, the “enterprise-ready” layer-1 protocol, held on for a 10.0% gain this week after the recent launch of its first decentralised exchange, XSwap Protocol. DGB reached a weekly high return of 36.7% following the announcement of its recent partnership with Shell, aiming to improve Shell’s master data management via blockchain technology. Caught in the broader sell-off, DGB held on to a 6.2% weekly return.

In Other News

The Saga Continues...

The FTX saga just got a whole lot more interesting after the disgraced former FTX CEO was arrested in the Bahamas on Tuesday. The U.S. Securities and Exchange Commission served Bankman-Fried with eight criminal charges, including wire fraud and conspiracy to commit money laundering. If he is found guilty of all the charges and the sentences run consecutively, he could be facing over 130 years in prison.

FUD or Fact?

Meanwhile, Global auditing firm Mazars deleted the website that hosted proofs-of-reserves work for cryptocurrency exchanges including Binance, Crypto.com, and KuCoin.

The company told Bloomberg that it is suspending its work with crypto companies on proofs-of-reserves reports going forward. This gave rise to speculation that the audit firm may find working with crypto companies too risky given the current market sentiment.

A subsequent on-chain audit by the blockchain analytics company, CryptoQuant, concluded that Binance’s Bitcoin reserves are sound.

Regulatory

On the regulatory front, the Australian government announced its initiative to introduce a new framework for regulating crypto firms on Wednesday.

A consultation paper will be released in early 2023 to determine what digital assets should be regulated by financial services laws and help put in place appropriate custody and licensing rules via a process called “token mapping.” The Government also outlined plans to update the country’s payment systems and strengthen its financial market infrastructure.

Recommended reading: Timing the Market vs. Time in the Market - Crypto Investing Strategies

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2FqHDKdqs5DaRAcpMoC7xiv%2Fae741a6bbe101ec644b02074c689dc69%2FBlog-Cover__3_.png&a=w%3D400%26h%3D225%26fm%3Dpng%26q%3D80&cd=2022-12-19T02%3A10%3A15.647Z)