In this Week's Market Rollup

A glimmer of hope that inflation is waning, an audacious hack, famous crypto companies caught in FTX contagion, and a bleak statistic we’ve not seen since January 2021.

Read on...if you dare.

Market Highlights

- A lower-than-expected Producer Price Index (PPI) gave hope that inflation is waning, and caused BTC and the rest of the market to surge last Tuesday, but the positive price action was short-lived.

- A large number of cryptocurrency companies revealed their exposure to FTX, either through holdings of the exchange's FTT token, through assets held on the FTX platform, or through loans.

- The global cryptocurrency market cap today is the lowest it’s been since January 2021, at approximately US$834 billion.

Price Movements

Bitcoin (BTC)

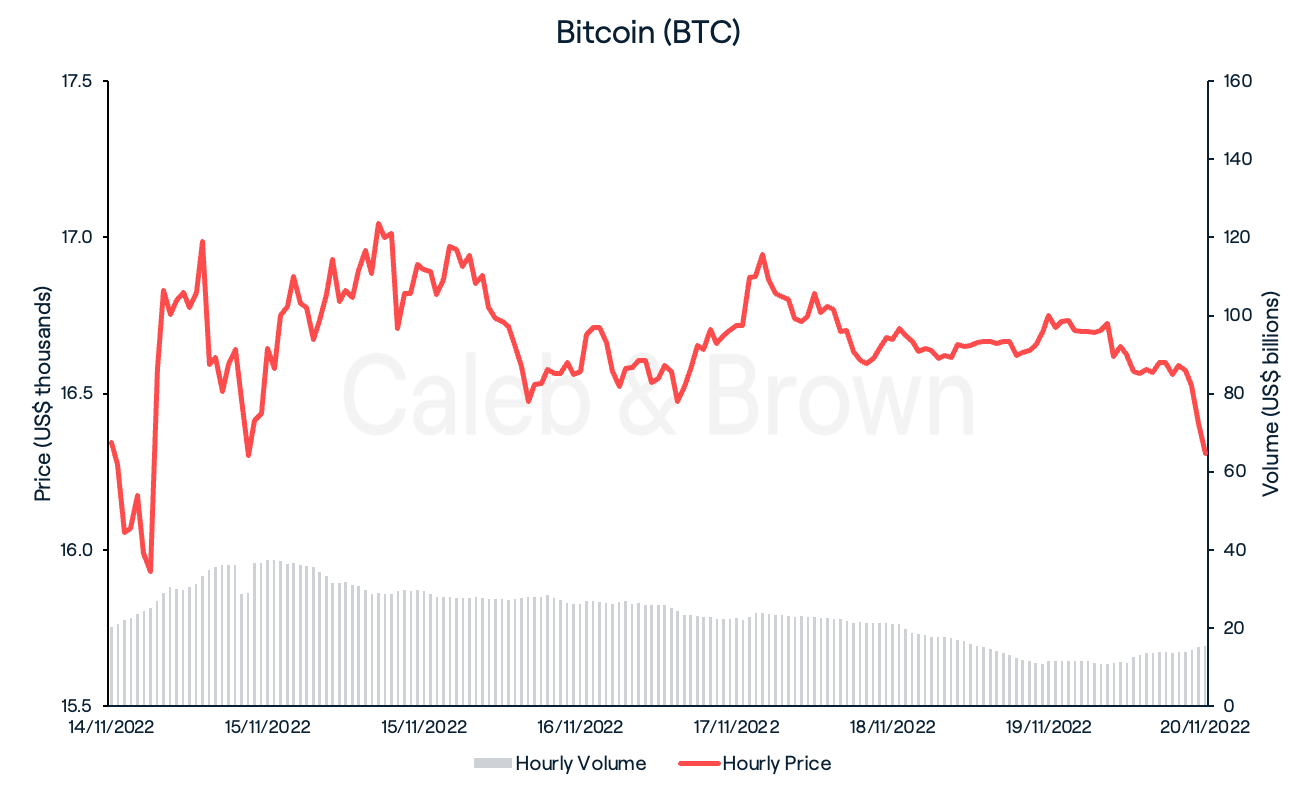

The downfall of FTX over the last two weeks has been nothing short of astonishing. With millions of customers affected, the crypto market has had a chance to stabilise after last week’s bloodbath. BTC commenced the week briefly dipping below US$16,000 before sharply rebounding 6.42% after the U.S. Labor Department's latest PPI report on November 15. BTC spent the remainder of the week hovering between US$16,400 and US$17,000, until a small sell-off on Sunday saw BTC close the week at US$16,268, up 1.1%.

Year-over-year, PPI, measured 8.0%, down from the 8.4% increase seen in September. Investors took well to the report as BTC shot past US$17,000 in the hours that followed, suggesting positive sentiment towards U.S. inflation data. A calming inflation figure could encourage the U.S. Federal Reserve to ease some of its tight fiscal policies. Despite the news, uncertainty still remains in the market as contagion from the FTX collapse looms over investors’ minds and we discover which major players have been affected by the ordeal.

Ethereum (ETH)

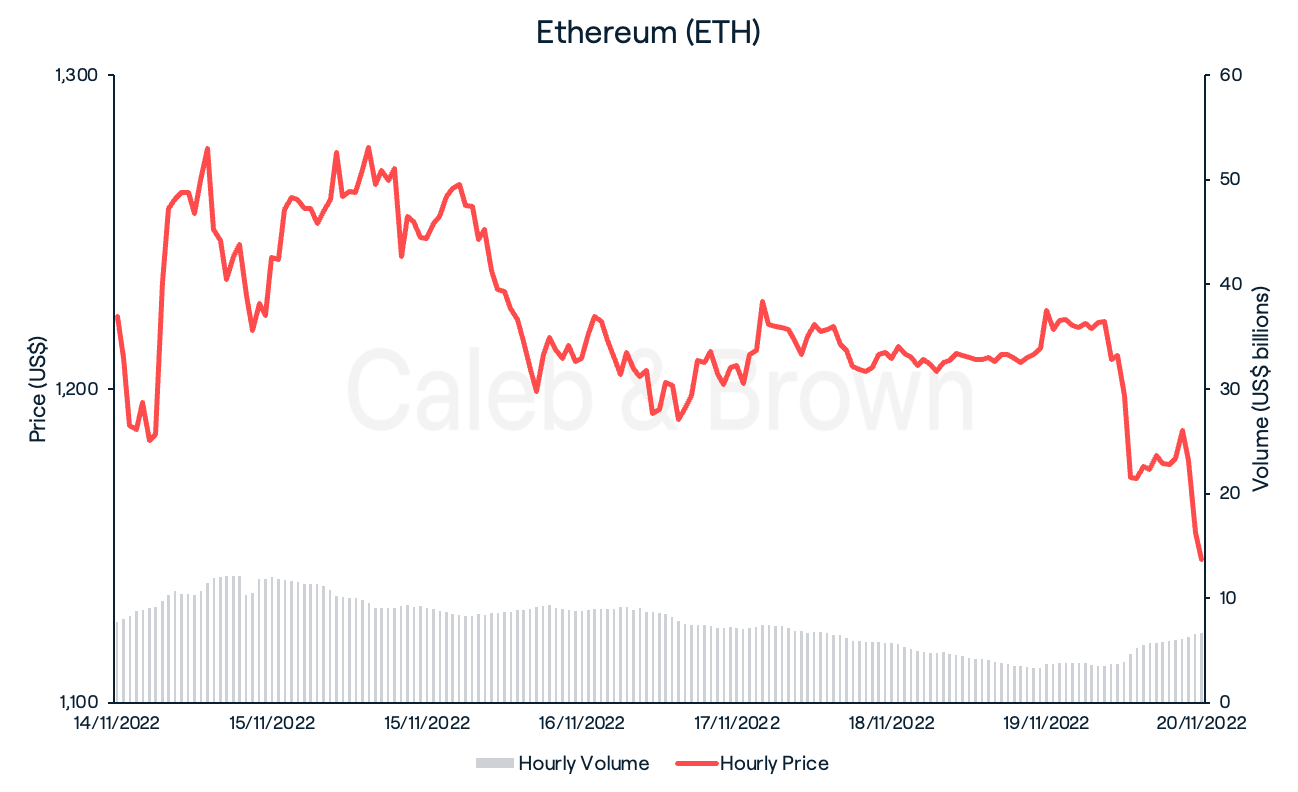

ETH spent the first half of the week in lockstep with BTC as it rallied 7.7% after Tuesday’s PPI report. This move could not be sustained, however, as ETH’s prices tumbled back down in the following days, sending ETH into negative territory. Another sharp decline over the weekend brought ETH near last week’s lows, where it now sits at US$1,135, down 4.9%.

Sunday’s dip in price was triggered by a large ETH sell-off from funds stolen from FTX. The stolen funds were initially thought to be taken by the Securities Commission of The Bahamas. Instead, blockchain analysis company, Chainalysis, took to twitter to reveal how the FTX hacker was moving the funds, in an attempt to freeze and recover the assets. The hacker sold roughly US$15 million ETH to renBTC in 30 minutes, with US$270 million worth remaining to sell. Funds are yet to be recovered with the hacker still on the loose.

Altcoins

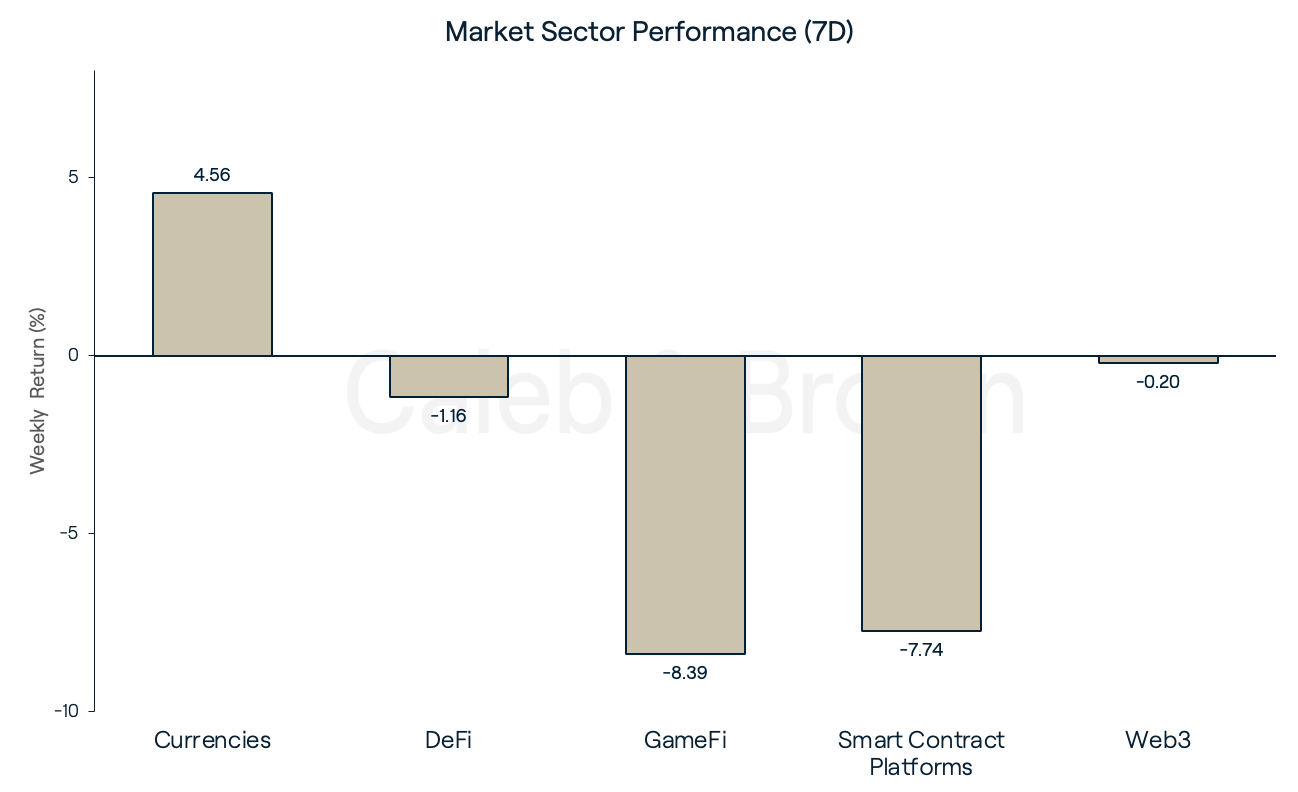

While the cascading effects of FTX’s collapse continue unfolding, fear and uncertainty plague the market with no clear direction in sight. Consequently, GameFi and Smart Contract Platforms took the biggest hit, with the sectors falling 8.39% and 7.74% respectively. Taking less of a hit, but still in the red were DeFi and Web3, declining 1.16% and 0.20% respectively. Currencies was the only sector to post a positive gain this week, returning 4.56%.

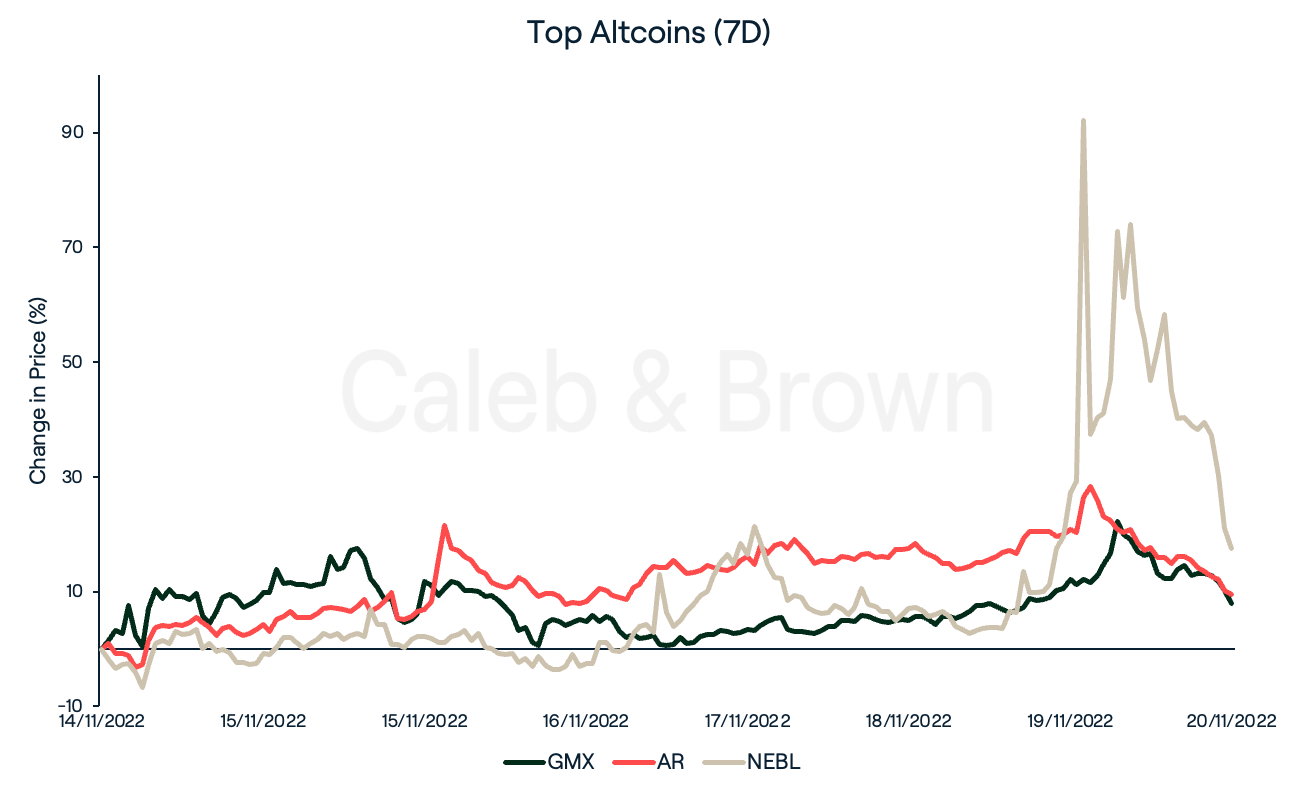

Despite fear and uncertainty looming over the market, a few tokens managed to see gains. Continuing to capitalise on the narrative shift from centralised to decentralised platforms was GMX (GMX). GMX is a decentralised perpetual trading platform that gives users access to leveraged trading and cheap trading fees via the Arbitrum Layer-2 network. GMX is up 8.7% over the last seven days.

Arweave (AR), a decentralised storage solution, returned 10.1% this week, also benefitting from the decentralised narrative shift. Arweave recently announced a partnership with Meta’s Instagram as well as a new archiving platform that rewards contributors for permanently storing data on the Arweave protocol.

The largest gainer was Neblio (NEBL), which soared as high as 92.0% mid-week. It has since returned most of its gains and today sits 17.5% higher than it was one week ago. NEBL’s surge in price was brought about by its official sponsorship of Binance Football Fever 2022. The highly anticipated 2022 FIFA World Cup began last Sunday, creating the ideal conditions for a price increase.

FTX Follow-up

As prices stabilised this week, there were a raft of revelations within the industry as companies stepped forward to declare the extent of their exposure to the bankrupt FTX.

Crypto lender BlockFi suspended withdrawals after citing “significant exposure” to the collapsed exchange. While BlockFi denies claims that the majority of its assets were tied up in FTX, the company is considering filing for Chapter 11 bankruptcy.

Travis Kling, the founder of crypto hedge fund Ikigai, revealed in a tweet that the “large majority” of its assets were tied up in FTX. Along with many others, Ikigai is unable to withdraw funds from the failed exchange, leaving it with a grim near-term future.

The Solana Foundation published a blog post revealing that it had US$1 million in cash or equivalent assets stuck in FTX. Furthermore, FTX and Alameda had purchased 50.5 million SOL worth approximately US$666 million at the time of writing.

In an alarming reveal on Wednesday morning, crypto prime broker Genesis announced that it would be suspending withdrawals from its lending arm, citing “unprecedented market turmoil” due to the FTX bankruptcy. In face of this, Genesis maintains that “operating capital and net positions in FTX are not material to our business. Circumstances surrounding FTX have not impeded the full functioning of our trading franchise."

With a number of companies now revealing the extent of their exposures, the fear of counter-party risk and the potential for cascading effects is amplifying.

Recommended reading: Caleb & Brown's Approach to Risk Management and Client Protection

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.