In this Week's Market Rollup

BTC reaches five month high, ETH’s next upgrade at risk, and hands up who has heard of Bitzlato?!

Another weird and wacky week in crypto…

Market Highlights

-

Bitcoin (BTC) enjoys its third consecutive green week as it reaches a five-month high of US$23,370.

-

The DoJ sends a short-lived scare to markets by announcing action against a crypto exchange starting with B.

-

The SEC swoops in and charges Nexo Capital for selling unregistered securities after Bulgarian authorities raided its office last week.

Price Movements

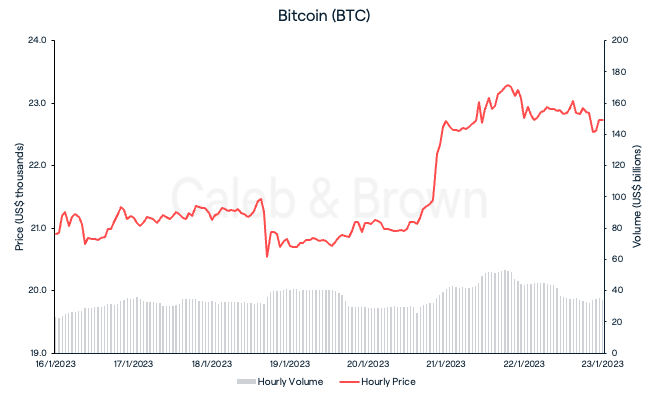

Bitcoin (BTC)

The third full week of 2023 was also the third consecutive week of market-wide gains for the top cryptocurrencies. BTC kept on pace for another strong performance and reached a high of US$23,370 on Saturday, bringing BTC dominance back above 40.0%. The last time BTC traded at this price level was five months ago in August 2022, shortly after the collapse of Terra (LUNA).

However, the price action was not without hiccups as BTC dipped 4.6% mid-week in anticipation of a mysterious U.S. Department of Justice (DOJ) announcement concerning a ��“major international cryptocurrency action.” Fortunately for investors, the federal prosecutors did not announce criminal charges against any major players but rather a small Hong Kong-based cryptocurrency exchange called Bitzlato.

BTC closed the week at US$22,700 for a weekly gain of 8.2%.

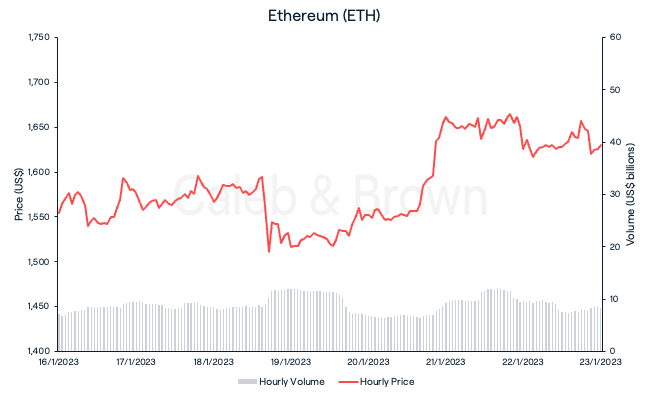

Ethereum (ETH)

ETH’s price also dipped mid-week as it shed 5.0% in the hours leading into the DOJ announcement on Wednesday. As the anxious frenzy faded ETH was able to recover over the weekend, closing the week at US$1,635, up a healthy 5.1% over the last seven days.

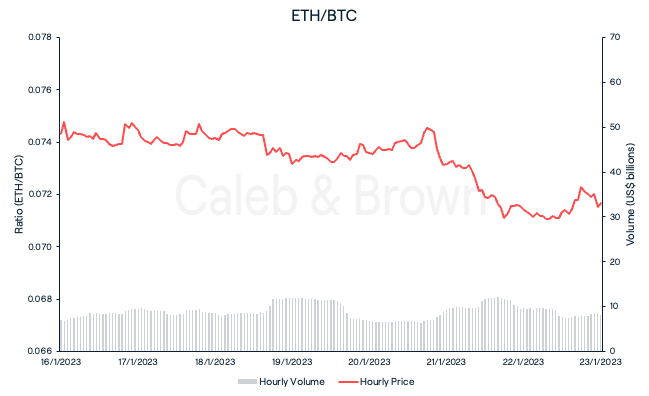

Despite ETH’s strong performance, ETH has been outpaced by BTC for the second consecutive week, losing 6.9% of its relative market share in the same time period.

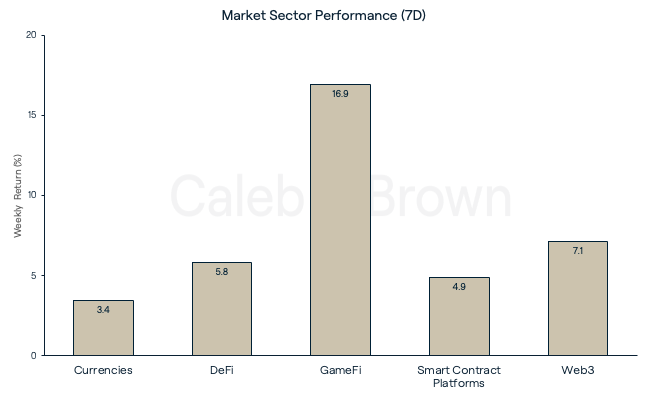

Altcoins

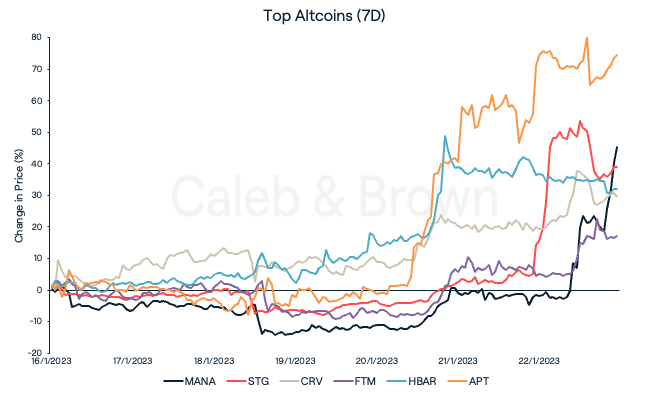

After three consecutive weeks of rallying, investors continue to gain confidence as funds keep pouring into altcoins. GameFi outpaced all other market sectors for the third week running, adding 16.9% over the last seven days.

Axie Infinity (AXS) emerged as the sector’s top performer, gaining 42.1% week-on-week. Despite the great performance, Axie Infinity’s monthly player count recently hit a two-year low.

The DeFi sector returned a relatively humble 5.8% this week, however included two tokens which significantly outperformed the market with Stargate Finance (STG) and Curve DAO (CRV) soaring 40.7% and 30.5% respectively. Stargate Finance is a decentralised exchange which focuses on multichain interoperability and staking while Curve DAO is a decentralised exchange focusing on stablecoin swaps. A large portion of STG’s move came after Stargate announced the addition of Metis to its protocol.

Smart Contract Platforms also enjoyed modest gains this week, returning 4.9%. Hedera (HBAR) and Fantom (FTM) both managed to outperform the sector, rallying 33.8% and 17.5% respectively.

However, the sector’s leading asset, and this week’s largest gainer, was recently launched Aptos (APT). APT exploded in price over the weekend and rallied an incredible 74.6% after Binance announced it was adding two APT liquidity pools (APT/BTC and APT/USDT) to its liquid swap product, further enhancing the asset’s liquidity and exposure.

In Other News

Bitcoin Miners Back in Black

After one of the least volatile months in history, BTC has seen an explosive rally back above US$22,500, placing the average BTC holder, and mining firm back into profitable territory. According to Glassnode, BTC's realised price, the average price that current investors paid for BTC, is around $19,700, while costing miners roughly US$18,800 to mine. Now that BTC is trading above these prices, closed mining firms could be encouraged to restart operations.

Trouble in Ethereum?

With the majority of the Ethereum network’s current narrative surrounding staked ETH unlocks and the Shanghai upgrade, there is a lot at stake for the core developers working on the upgrade.

As it stands, Shanghai appears ready to launch by March. But recently, a vocal minority of Ethereum’s core developers have begun voicing concerns that the upgrade is being rushed out of fear of public scrutiny and could burden the network with long-lasting technical costs. Given the Ethereum Foundation’s history of delayed upgrades, your Weekly Rollup will keep you abreast of any announcements.

Nexo Next to Settle with SEC

Following last week’s police raid, money laundering and tax offence accusations, Nexo Capital has now been charged by the U.S. Securities and Exchange Commission (SEC) for selling unregistered securities through its lending product “Earn Interest”. In settling with the SEC, Nexo has agreed to cease offering the interest program and pay a US$22.5 million penalty, plus an additional US$22.5 million to settle with state regulators.

Recommended reading: Crypto Portfolio Basics: The Key to a Well-Balanced Portfolio

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F3jLKpDQ5Kzvenrr4mpvkfJ%2F31a32387b4b5312741643f7fc72d250d%2FBlog-Cover__8_.png&a=w%3D400%26h%3D225%26fm%3Dpng%26q%3D80&cd=2023-01-23T12%3A02%3A44.160Z)