In this Week's Market Rollup

A huge week for Altcoins, a much-needed plan to reduce ETH gas fees, and did the latest Fed meeting minutes hint at an imminent pivot?

We’ve got you covered with the latest crypto news.

Market Highlights

- Following the release of the U.S. Federal Reserve's November meeting minutes on Wednesday, the cryptocurrency market edged upward, which led to a 5.2% increase in Bitcoin (BTC) the following day.

- A new proposal that could reduce gas fees by as much as 100x on the Ethereum network was unveiled after the latest Ethereum core developer call. The proposal (EIP-4844) is being considered for inclusion in Ethereum’s next upgrade, scheduled for September 2023.

- Litecoin (LTC) surged to a six-month high with its third halving event set to take place in August 2023.

Price Movements

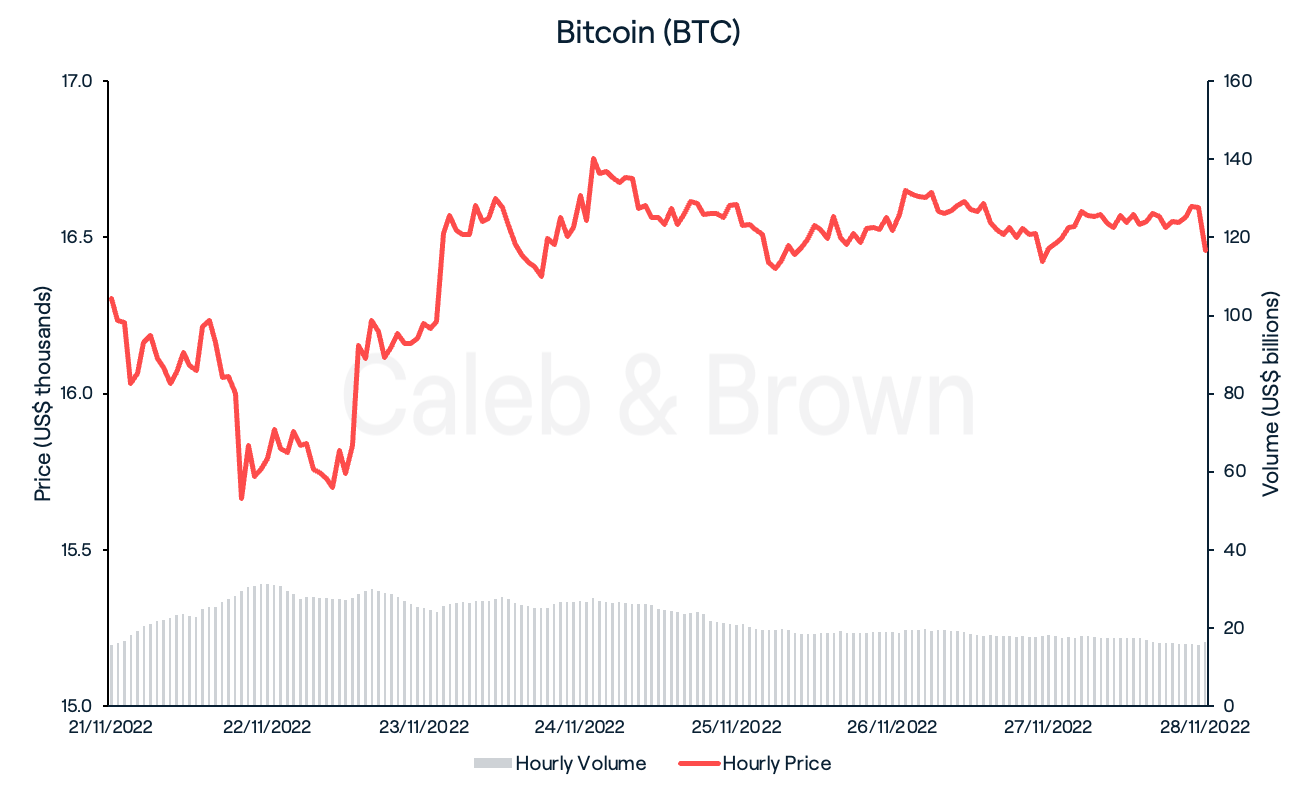

Bitcoin (BTC)

Cryptocurrency prices were a mixed bag this week, with BTC falling to a two-year low of US$15,665 on Monday. The price of BTC began to recover on Wednesday, however, after the U.S. Federal Reserve released minutes from its November meeting. The captured discussion indicated the central bank may look to decrease future interest rate rises following a cycle of interest rate hikes this year, including three 75-basis-point increases — the steepest since 1994. Investors took to the news with a dovish sentiment as both the crypto and stock markets ticked up in response, with BTC bouncing 5.2% off its low during the next 24 hours. BTC managed to hold above US$16,400 for the remainder of the week, reaching US$16,464, up 1.2%.

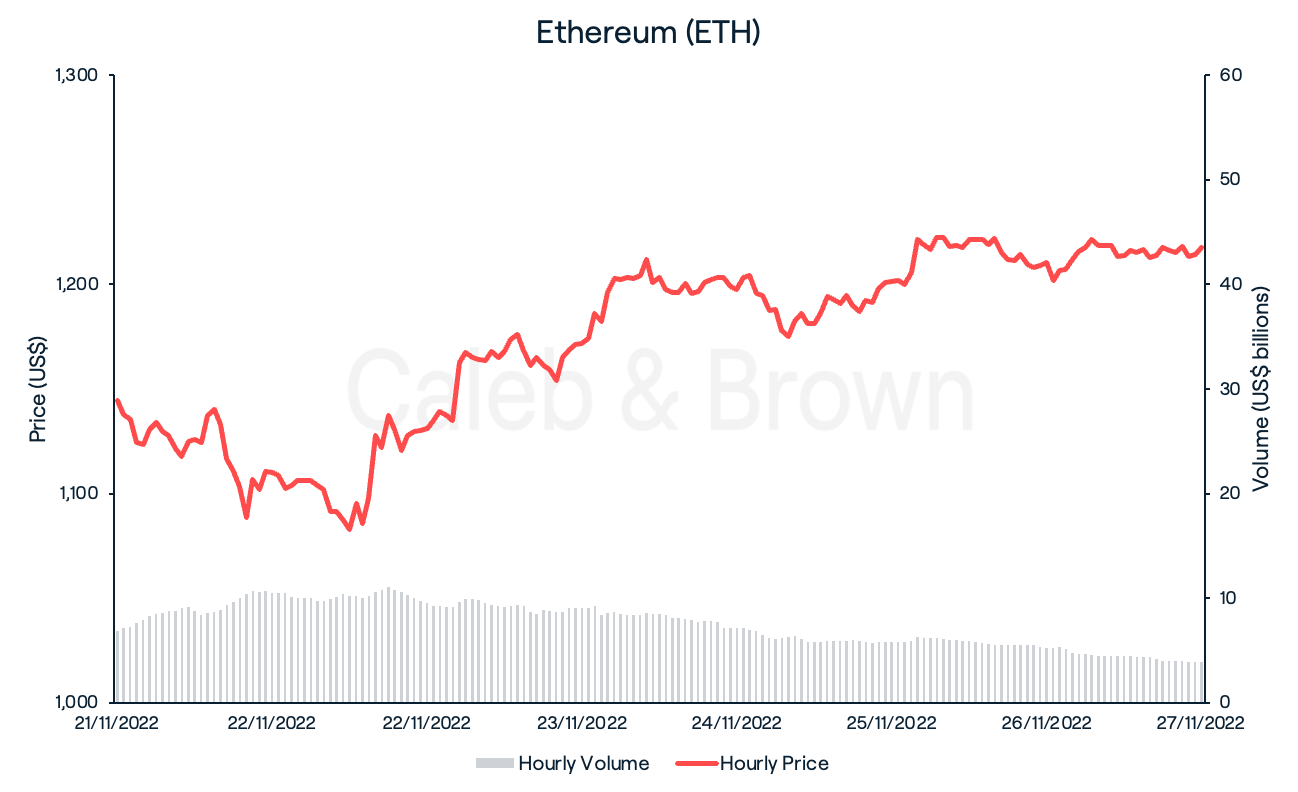

Ethereum (ETH)

Ethereum (ETH) started the week in similar fashion to BTC, as news of the FTX hacker splitting up 180,000 ETH (worth approximately US$200 million at the time of writing) between 12 wallets spread throughout media outlets Monday morning. The fear of a major ETH sell-off loomed as ETH marked a low of US$1,075 on November 22 before joining the market in its recovery on Wednesday. ETH closed the week at US$1,181, an increase of 3.5%.

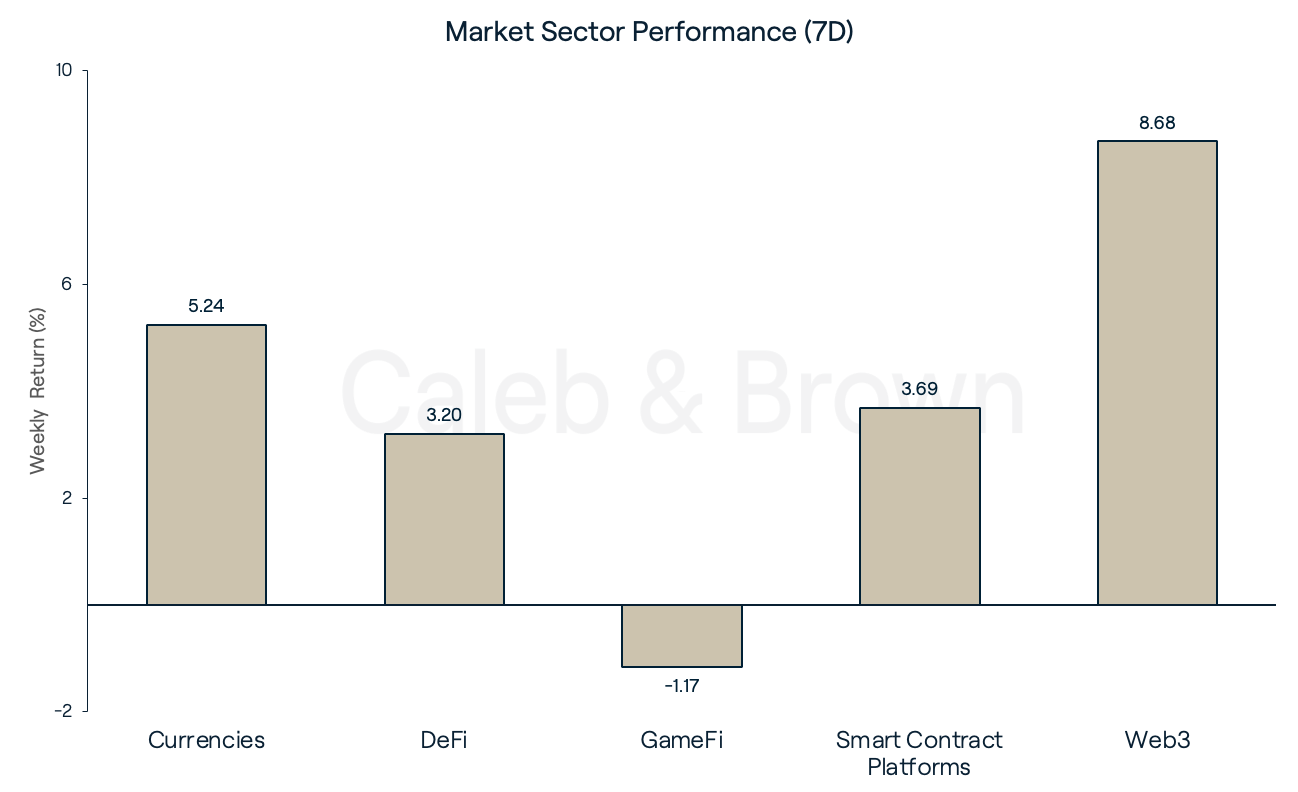

Altcoins

Due to the positive response to the Fed’s meeting last Wednesday, all market sectors with the exception of one have rallied this week. Web3 led the pack, increasing by 8.68%. This was followed closely by Currencies, Smart Contract Platforms and DeFi, which added 5.24%, 3.69%, and 3.20% respectively. GameFi was the odd one out, decreasing by 1.17%.

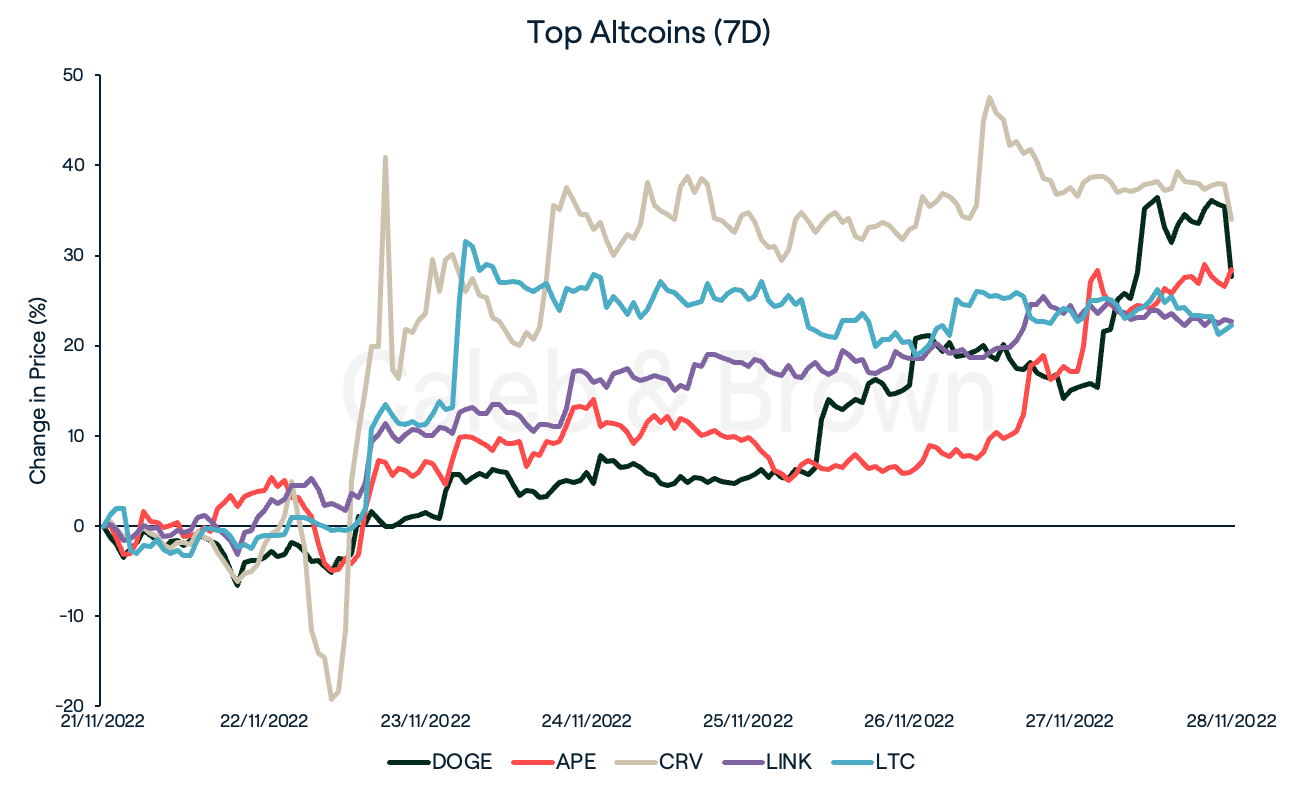

ApeCoin (APE) was the most notable performer in the Web3 sector, rallying 28.4% this week. ApeCoin DAO, the community-led decentralised autonomous organisation, launched its own NFT marketplace on November 24. The marketplace will facilitate the trade of Yuga Labs’ NFTs as well as “include unique features” for NFT holders.

The decentralised exchange CurveDAO (CRV) enjoyed a 34.0% surge in price after releasing its algorithmic stablecoin (crvUSD) whitepaper on November 22. CurveDAO plans to implement an automated self-liquidation algorithm that aims to smooth out the liquidation process over a continuous range, aiming to prevent cascading liquidation events.

Chainlink (LINK) has benefited from the imminent launch of its native staking service. Staking will kick off in December with an aggregate size of 25 million LINK tokens in the initial pool. The market reacted positively, with LINK’s price increasing by 22.7%.

Now only eight months out from its third mining-reward halving, Litecoin (LTC) has made a bullish turn as it rallied 22.2%, hitting a six-month high. The rewards paid to miners are cut in half after a certain number of blocks, and halving events are frequently linked to a "pre-halving" rally.

Also enjoying a double-digit rally was Dogecoin (DOGE). DOGE pumped 15.0% on Black Friday and closed the week up 27.3%. While no clear indication for the Black Friday rally exists, market participants speculated on a viral tweet suggesting Elon Musk and Vitalik Buterin “might work together to upgrade DOGE” the same day.

Web3

A recap of the most recent Ethereum core developer call was shared on Twitter last Friday. The recap suggested EIP-4844 (Ethereum Improvement Proposal-4844) be considered for inclusion in Ethereum’s next major upgrade, Shanghai. Liam Horne, CEO of Ethereum scaling solution Op Labs, unpacked the proposal in a lengthy thread, claiming the proposal could lower fees on the network by as much as 100x. Since the Shanghai upgrade will allow users to withdraw their staked ETH from the beacon chain, newly added improvements must be carefully considered in their impact on the upgrade.

Recommended reading: Common Crypto Investing Strategies Every Investor Should Know

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.