In this Week's Market Rollup

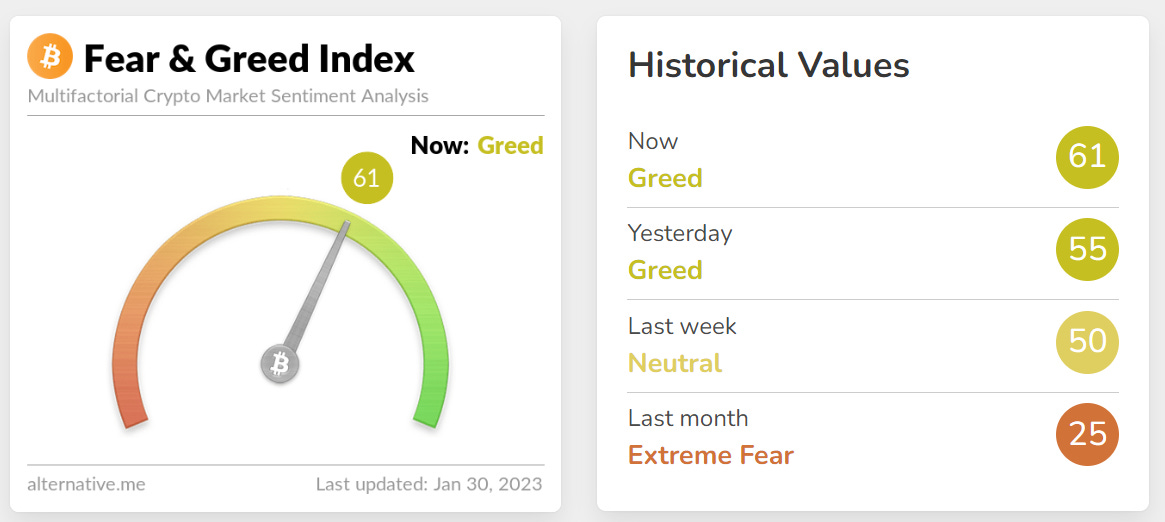

BTC price highest since August 2022, Musk eyes payments, and a famous crypto index signals ‘Greed’.

Read below to get in the know.

Market Highlights

- The Crypto Fear & Greed Index signals ‘Greed’ for the first time in months as the global crypto market steadies at US$1.08 trillion.

-

Bitcoin (BTC) dominance is at 40.9% while Ethereum (ETH) dominance sits at 17.5%.

-

Twitter CEO Elon Musk announces the social media platform will enter payments, which many believe is bullish for his ‘pet’ Dogecoin, as well as Bitcoin.

Price Movements

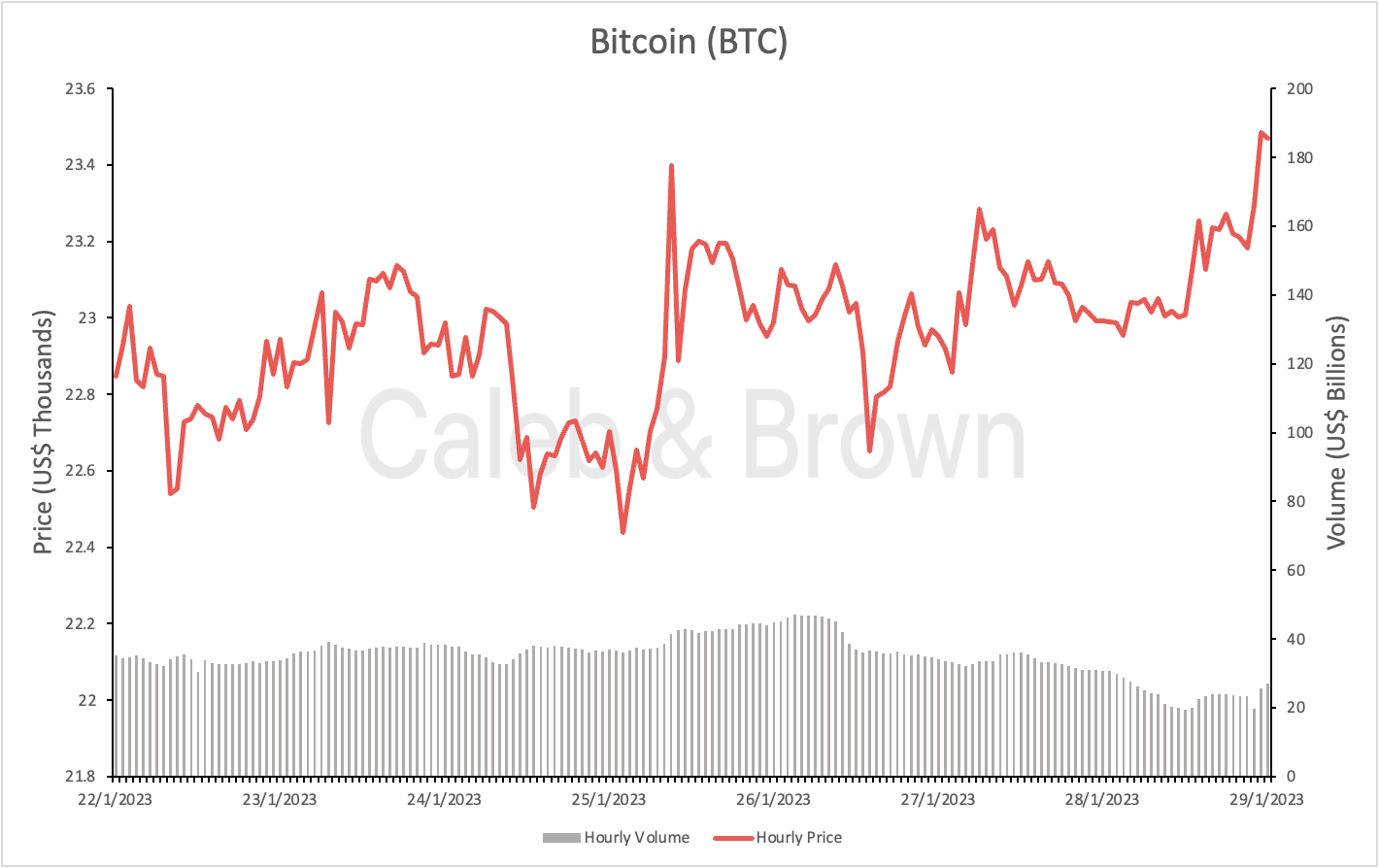

Bitcoin (BTC)

Bitcoin (BTC) had a successful rally for the fourth consecutive week, increasing 4% on the weekly to US$23,730, with most of the growth coming on Sunday (3.8%).

Its peak for the week, US$23,800, was BTC’s highest price since mid-August.

In BTC mining news, data from resources including MiningPoolStats confirms that Bitcoin’s hash rate hit new all-time highs on 26 January. Hash rate, which is an expression of the processing power dedicated to the network by miners, is currently at 321 exahashes-per-second (EH/s), according to MiningPoolStats raw data.

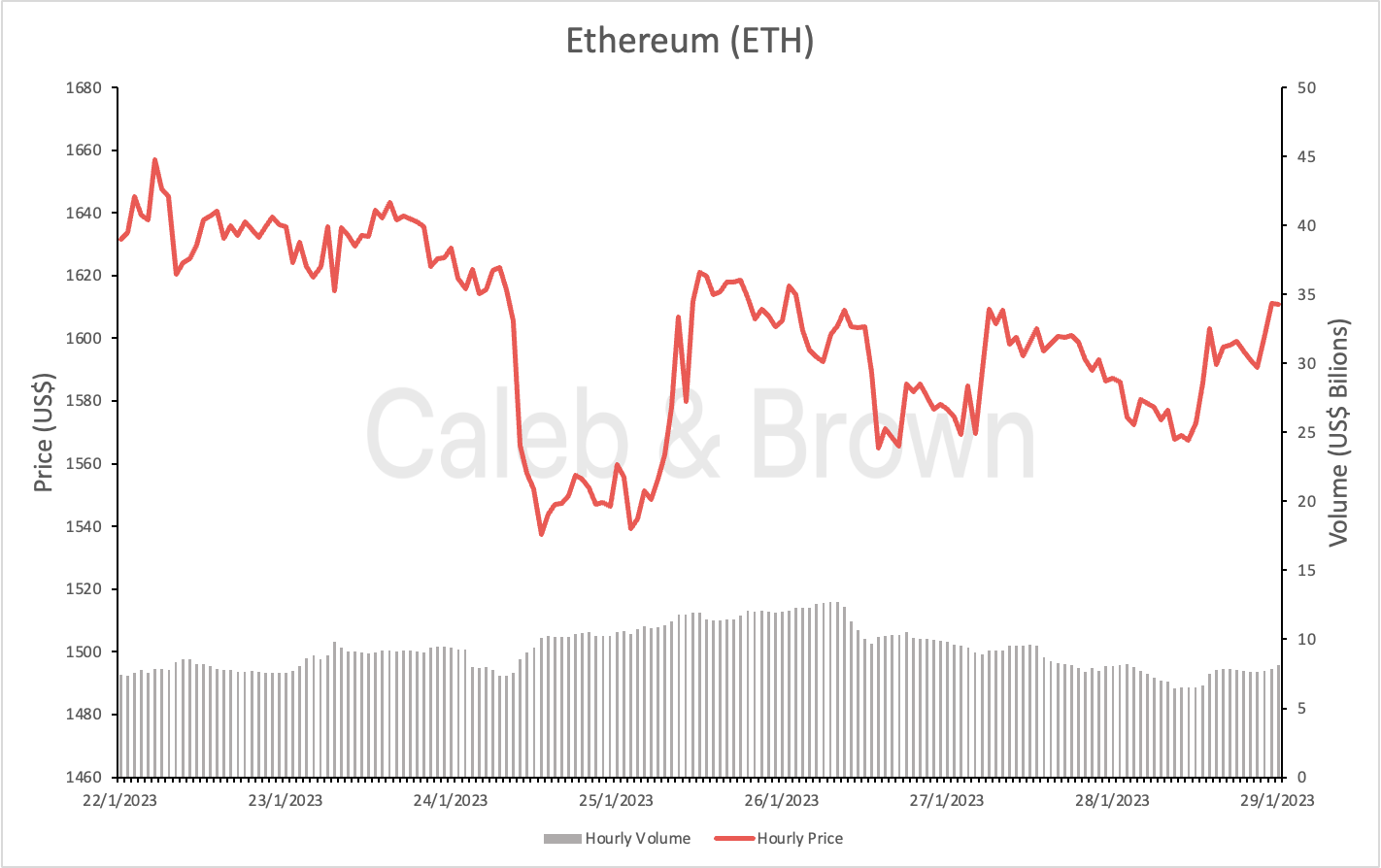

Ethereum (ETH)

Ethereum (ETH) started the week at US$1,630 but has since declined slightly to US$1,602, lagging behind Bitcoin. This takes ETH/BTC below 0.069, a ratio many investors are eyeing as a key support level.

In other news, Ethereum developers have established a "shadow fork" to test the requirements for staking withdrawals. This new testnet is a preparation for a future ETH staking event and allows developers to test the conditions necessary for successful withdrawals.

Altcoins

The Smart Contracts sector market cap increased by 1.6% this week. Amongst the notable performers are Solana (SOL) which is up 12% over the weekend, and 5% weekly.

Avalanche (AVAX) has also added to its year to date strength, with a 17% rally over the weekend (up 93%), and up 19% over the week. Avalanche DeFi volumes have been healthy, outperforming Arbitrum and Optimism (OP), with a total TVL in the ecosystem closing in on $1b (only Ethereum, Tron, BSC, Arbitrum, and Polygon are currently in the US$1 billion TVL club). Joining the list is Polygon (MATIC) which rose 8% over the weekend, and 16.5% on the weekly (up 55% YTD).

The DeFi sector market cap increased 4.2% this week. DYDX rallied 39.1% and is closing in on the brief highs of last week after the plans for more than 150-million token unlock for early investors and founding team members to be delayed until December. Other notable performing tokens are Loopring (LRC), GMX (GMX), and Convex Finance (CVX), which are up 18.2%, 17.9%, and 16.4% respectively.

The best performing sector is GameFi, with the market cap increasing by 4.9% this week. Top performers in the sector include GALA (GALA), Ultra (UOS), and ApeCoin (APE) which have shown price returns of 19.5%, 17.5%, and 11.2% respectively.

In Other News

Signed, Unsealed, Delivered

The names of two co-signers of former FTX CEO Sam Bankman-Fried's (SBF) bond are due to be unsealed after a judge approved a request by news organisations. SBF faces numerous criminal allegations, including fraud, and is set to go on trial in October. Joseph Bankman and Barbara Fried, SBF’s parents, co-signed his $250 million bond in December, while two additional signers, with previously redacted names, signed bonds of $500,000 and $200,000.

Twitter to Enter Payments - Bullish for Doge?

Twitter is determined to enter the payments industry to compete with PayPal and Apple Pay. CEO Elon Musk prefers fiat currencies as the main payment option, but the payments system is designed to allow for future integration of cryptocurrency. On Monday, news of this push caused a surge in the price of Dogecoin (DOGE), a meme coin frequently endorsed by Musk, from $0.08 to $0.09 according to CoinGecko.

Musk’s electric car company, Tesla, also holds Bitcoin worth approximately US$184 million on its balance sheet.

Regulatory

The US Fed denied Custodia Bank’s application to join the Federal Reserve System. The Fed stated that the application was “inconsistent with the required factors under the law.” The bank, formed to be a compliant bridge between digital assets and the U.S. dollar payments system, and a custodian of digital assets, filed for the application in 2019 and sued the US Fed in an effort to speed up the decision.

Recommended reading: Cryptocurrency Market Cap Explained

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2FrOf2CTLuUXZr3Ka210Wte%2F07845835718c515e2a9f0678ffaaaabe%2FBlog-Cover__9_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-01-31T11%3A00%3A23.347Z)