In this Week's Market Rollup

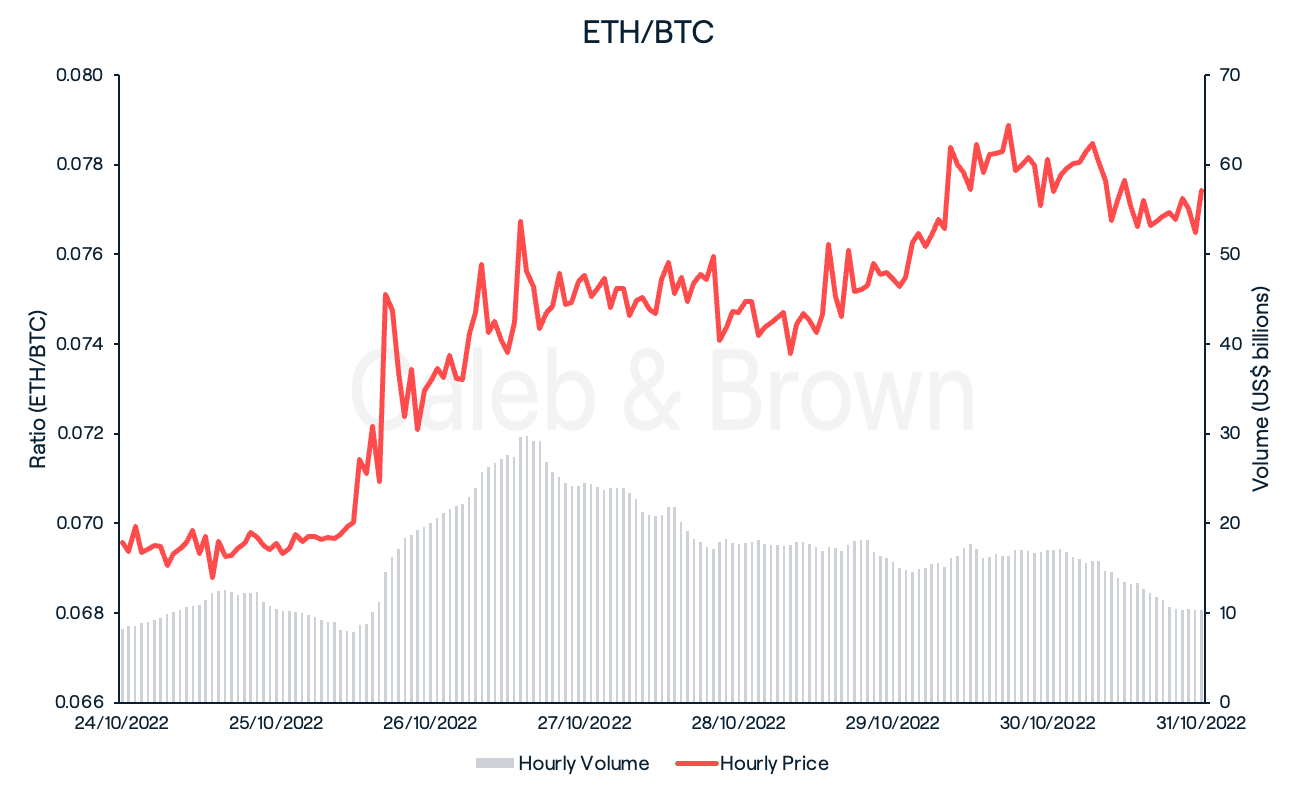

The famous “Uptober” meme appears to have manifested once again, as crypto markets have rallied significantly over the last seven days to help the month close positively. October has historically been one of Bitcoins’s strongest months, recording monthly gains ten times out of the last 13 years, and this year is no different. Together with Ethereum (ETH), the crypto market’s two leading assets have enjoyed their strongest weekly performance in months, helping catapult the overall crypto market into green. Meanwhile, Elon Musk’s favourite cryptocurrency Dogecoin (DOGE) has gone barking-mad following his successful acquisition of Twitter.

Market Highlights

- Bitcoin (BTC) crosses the US$20,000 mark as it breaks out of its monthly range to the upside, pushing the total crypto market cap past US$1 trillion.

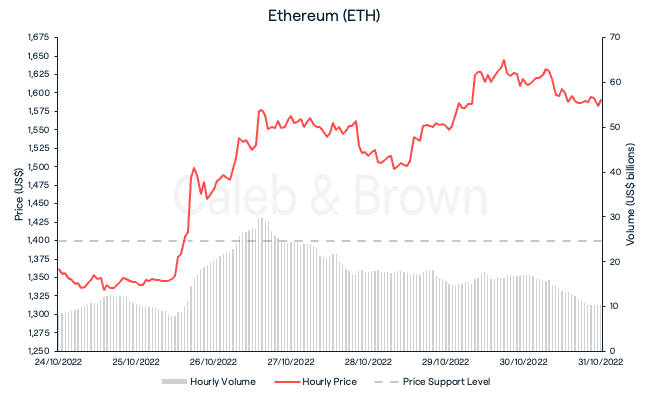

- Over US$700 million worth of short positions were liquidated on October 25, with ETH rallying 14.0% the same day.

- DOGE soars as high as 130% in response to Elon Musk purchasing social media app, Twitter.

Price Movements

Bitcoin (BTC)

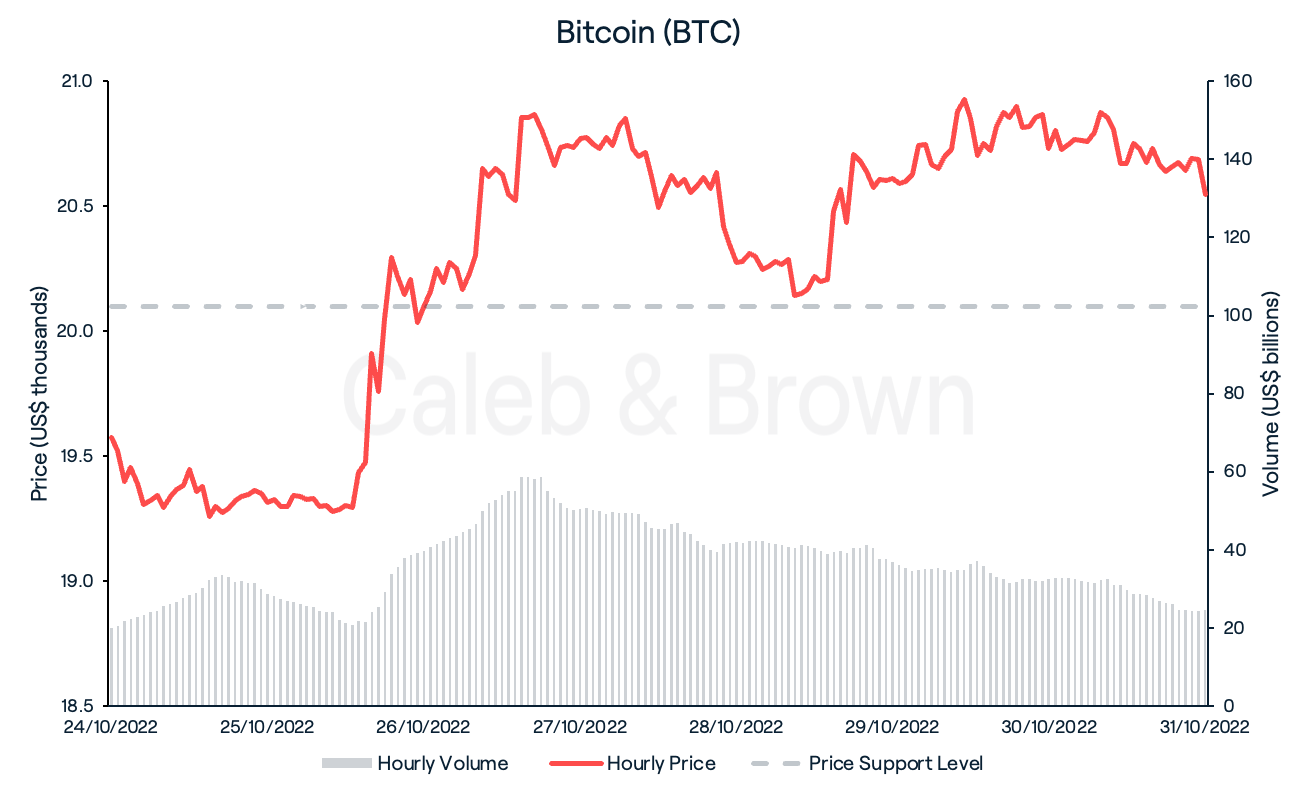

After almost two months of tight rangebound price action, BTC finally moved to the upside with a 5% surge on October 25 helping it break the psychologically significant US$20,000 resistance level and reclaim it as support. Despite re-testing the level twice in the days that followed, investors successfully stepped in to help BTC close the week at US$20,522 for a total weekly gain of 5.29%.

BTC’s price surge resulted in a slew of liquidations across the crypto market over the past seven days which consequently contributed to further price surges. On October 25, over US$700 million worth of short positions were liquidated as BTC rallied and brought the rest of the market with it. With traders being forced to cover their positions and buy back the borrowed assets, this may have squeezed BTC’s price higher.

Ethereum (ETH)

Altcoins

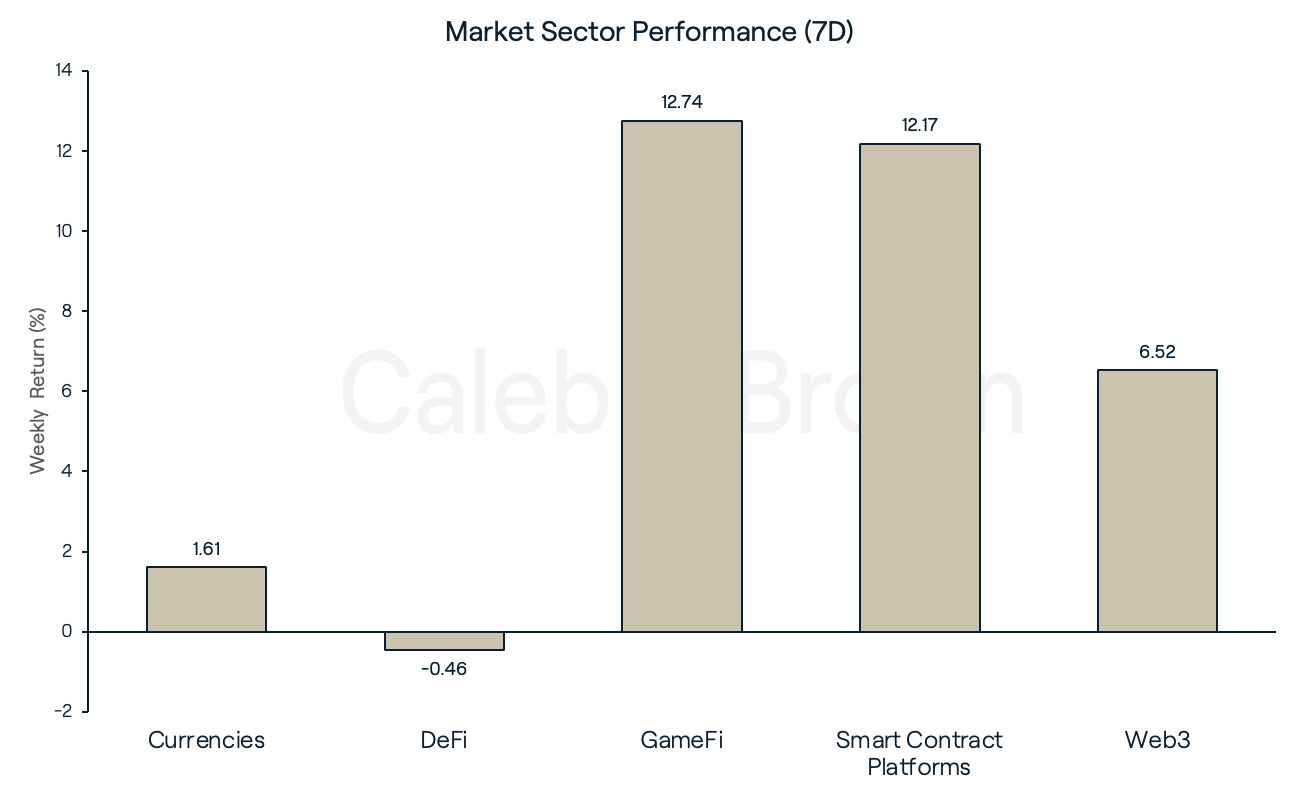

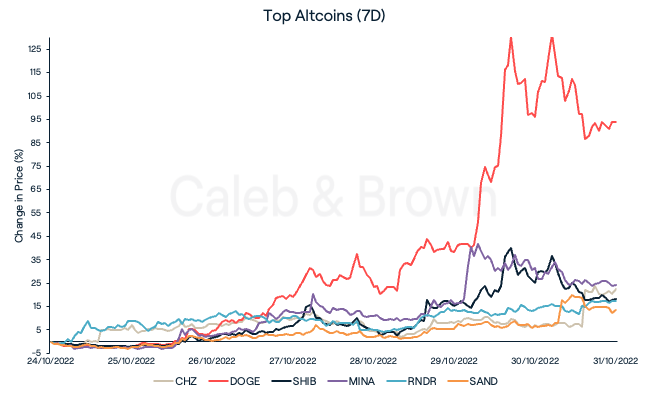

The resurgence of crypto’s two leading assets this week also brought wider relief to the rest of the market. Almost all market sectors enjoyed positive price performance, with DeFi being the exception. The GameFi and Smart Contract Platform sectors both enjoyed double-digit gains, returning 12.74% and 12.17% respectively. This was followed by Web3, which increased 6.52%, and the Currencies sector which just managed to stay above water, returning 1.61%. In contrast to last week’s strong performance, DeFi was this week’s biggest loser, losing 0.46% in value over the last seven days.

DOGE has made its way back into the headlines this week, after leaping 95.7% in price. This sudden price action came in response to Elon Musk’s US$44 billion acquisition of social media app Twitter on October 28. While Musk did not directly mention DOGE during the acquisition, his longtime affiliation with the asset and recent interaction with tweets from Billy Markus, a Dogecoin developer, caused traders to speculate on the token. Other dog-themed meme coins enjoyed positive gains too, with Shiba Inu (SHIB) rallying 16.2% alongside it. DOGE’s rally brought it back into the top 10 coins by market cap, jumping ahead of Cardano (ADA) and Solana (SOL) in the process.

Other top performing tokens this week were The Sandbox (SAND) and, for the second week in a row, Render (RNDR). SAND enjoyed a 14.8% week-on-week price increase while RNDR rallied 20.1%. Render was recently listed on “The Information’s 50 most promising startups” list, placing 5th.

Leading the Smart Contract Platform sector was MINA Protocol (MINA), which increased by 25.6%. While no major developments have been made on the network recently, the Mina Foundation announced a 75,000 MINA grant (approx. US$50,000) that will go towards validators, developers, and the community. The sports fan engagement platform, Chiliz (CHZ) also found itself amongst the top performers, gaining 24.1% as the 2022 FIFA World Cup quickly approaches.

Web3 News

In stark contrast to the dwindling bear market, crypto trademark applications have hit an all-time-high in 2022, seeing over 4,300 U.S. trademark applications in the digital currency space, compared to the 3,500 seen last year. Adding to that list this week were financial services giants Visa, PayPal and Western Union which all filed for patents for “software” that will enable the “storage, trade and monitoring” of digital assets, further expanding blockchain technology into regular use cases.

Amidst Musk’s Twitter takeover, Twitter announced that it will let users display and trade NFTs through tweets thanks to a new partnership with four select marketplaces: Magic Eden, Rarible, Dapper Labs and Jump.trade. The new NFT Tweet Tiles feature—which is currently still being tested—displays NFT artwork in a panel in the tweet and includes a button to take users to a marketplace listing.

Recommended reading: A Guide to Dollar Cost Averaging in Crypto

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.