Market Highlights

-

Groundbreaking AI chatbot ChatGPT inspires double-digital AI token growth.

-

State Street and BlackRock reveal significant stakes in troubled crypto-friendly bank Silvergate.

-

Ethereum (ETH) sees modest growth while Bitcoin (BTC) experiences slight decline after starting the year up 37% and 42% respectively.

Price Movements

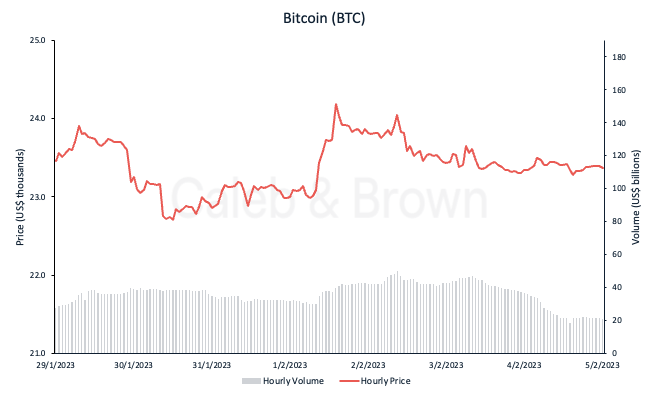

Bitcoin (BTC)

Major cryptocurrencies traded flat over the weekend, with Bitcoin dipping slightly below US$23,000 on Monday morning. Bitcoin fell 1.6% to US$22,745, bringing its losses to 3.4% in the past seven days.

This is tracking a decline in U.S. equities, with FactSet data showing that less than 1% of companies in the S&P 500 reported earning that were above estimates. Investors are also concerned with markets facing further interest rate hikes from the U.S. Fed to cool the economy and reduce inflation.

Bitcoin mining difficulty remains high as miners deploy more hardware. Despite the sector being hit by mounting energy prices and a recent spate of bankruptcies, the hashrate is currently at 316 exahashes-per-second (EH/s), according to MiningPoolStats raw data.

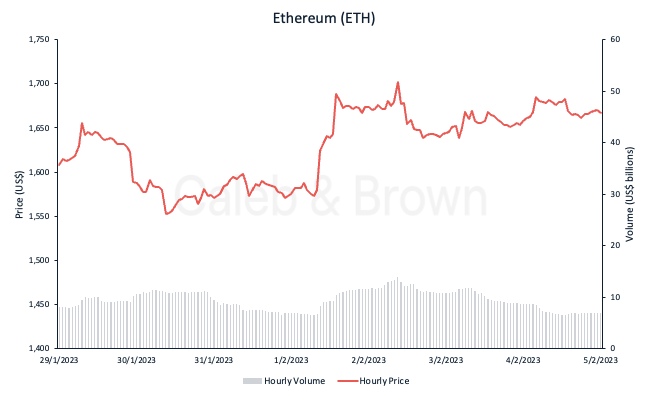

Ethereum (ETH)

Ethereum’s price is sitting higher at US$1,651, rising 1.2% in value over the last seven days.

On Wednesday, the network tested the withdrawal features of its much-anticipated upcoming Shanghai upgrade, which will enable validators to withdraw their earnings.

For context, validators currently have to stake 32 ETH (approximately US$52,000 worth) to validate transactions and earn rewards.

he inability for those with less than 32 ETH to validate transactions on their own has reinforced interest in ETH staking platforms like Lido Dao (LDO) and Rocket Pool (RPL).

The ETH/BTC ratio started the week at approximately 0.069 and has since increased to 0.071, reflecting a 2.89% increase.

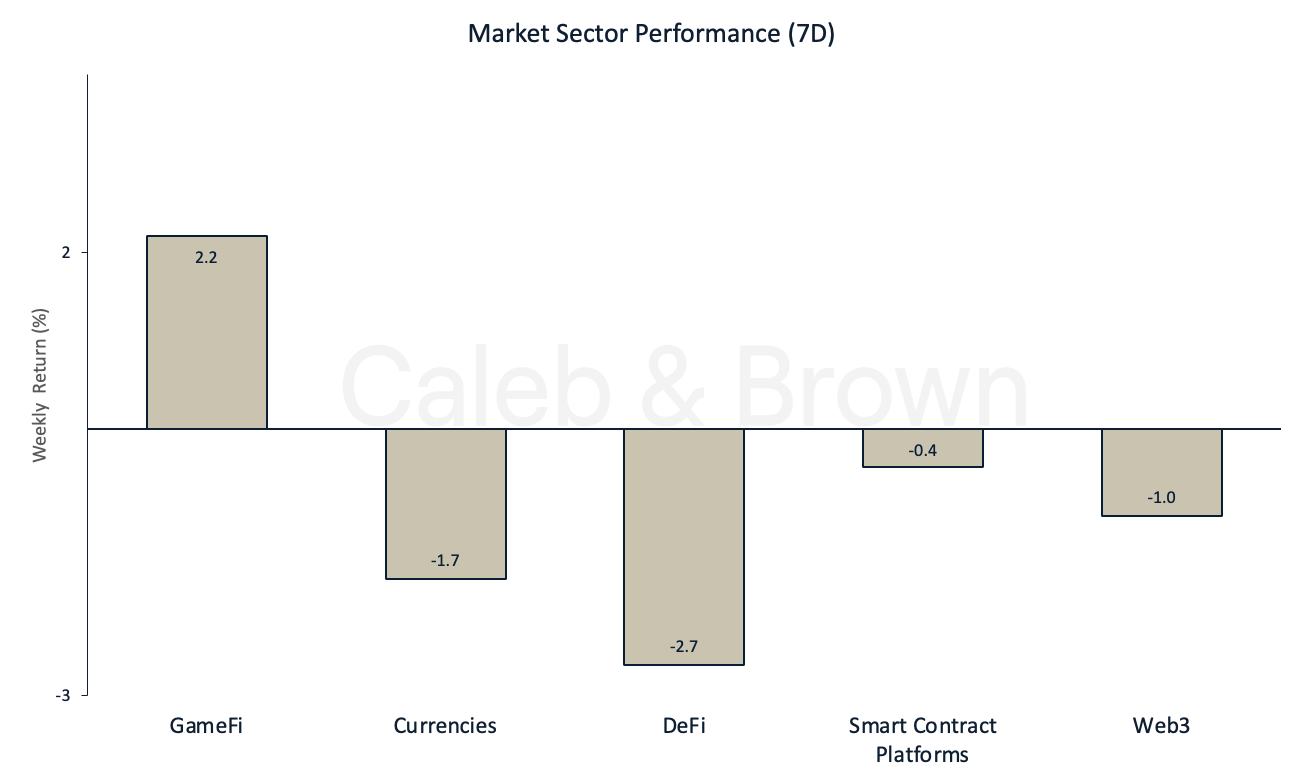

Altcoins

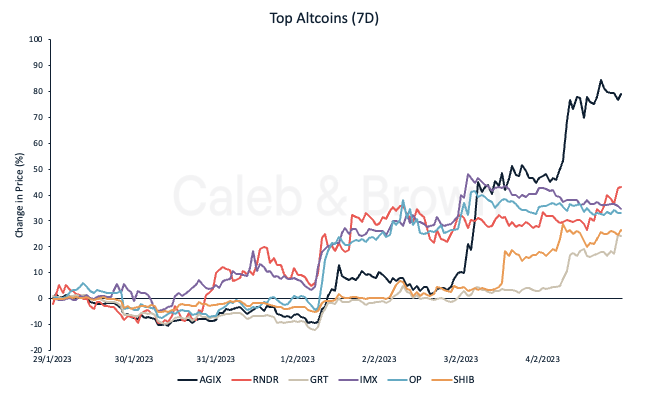

The GameFi market sector has grown by 2.2% this week. A key performer within this sector is Render (RNDR), a blockchain-based rendering solution which surged 45.4% to US$1.88 after a new foundation was formed and DAO voters passed a new tokenomics model.

Meanwhile, with AI becoming mainstream and the influx of investments in the sector by renowned tech giants such as Google and Microsoft, SingularityNET (AGIX) skyrocketed by 119.7% to US$0.4103, growing 20% in the last 24 hours alone.

Other notable top performers for the week are The Graph (GRT), ImmutableX (IMX), Optimism (OP), and Shiba Inu (SHIB), which had weekly price returns of 35.9%, 28.9%, 21.1%, and 19.3% respectively.

SHIB, the second largest meme coin by market cap, is up nearly 80% in 2023, with the meme coin leader Dogecoin (DOGE) up over 30%.

In Other News

(not very) Micro Strategy

The price of stock for Bitcoin-exposed cloud software company MicroStrategy (NASDAQ: MSTR) has risen nearly 100% since the start of 2023 and rallied 12% over the week. MicroStrategy chairman Michael Saylor is a huge Bitcoin bull and has filled the company war chest with 132,500 BTC—worth over $3.1 billion today.

Munger not a Fan

Berkshire Hathaway Vice Chairman Charlie Munger claimed the US should follow in China’s footsteps and implement “a ban of cryptocurrencies.”

The 99-year-old billionaire, legendary investor, and Warren Buffett’s right hand man reminded everyone of his dislike for crypto assets in a piece for the Wall Street Journal last week.

ETH Onside

Premier League gets Ethereum-based digital cards with Sorare partnership: Blockchain-powered fantasy sports firm Sorare has sealed a deal with the English Premier League to mint Ethereum-based digital player cards on its platform.

Sorare mints digital cards of players from the Premier League on the Ethereum blockchain. The platform has long used ERC-721 token standard for its NFT player cards, which fans can collect and trade and use to play on the platform’s free-to-play fantasy sports league.

Silvergate Swinging

Two of the world’s largest financial institutions have revealed growing stakes in the troubled crypto bank Silvergate in recent days.

State Street owned 9.32% of Silvergate stock as of Dec. 31, according to a Thursday filing.

The filing came a few days after a separate disclosure showed that BlackRock, the world’s largest asset manager, upped its Silvergate stake to 7.2%.

Silvergate, one of the biggest banks to feel the impact of the FTX capitulation, disclosed last month it was forced to sell assets at a major loss during Q4 2022 to fulfill US$8 billion of customer withdrawals.

Regulatory

Australia introduces classification for crypto assets: Early this week, the Australian Treasury released a consultation paper on “token mapping,” announcing it as a foundational step in the government’s multistage reform agenda to regulate the market.

The token mapping exercise serves to provide a taxonomy for crypto assets and borrows from the existing financial product framework; it will shortly be followed by a discussion about licensing and custody that is no longer limited to just secondary crypto asset service **providers, unlike in the 2022 Treasury consultation.

It is expected that the Australian Government will undertake further consultation in mid 2023 in relation to a proposed crypto licensing and custody framework.

Recommended reading: Why are Meme Coins so Popular? A Look at Trending Meme Coins of 2023

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F2tWSFpVGjrHwbdcvIzDbSN%2Fb4883b4543095cc9b07cfd4871512fa5%2FBlog-Cover__10_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-02-06T12%3A05%3A48.932Z)