Market Highlights

- Total crypto market cap crosses US$1.2 trillion, reflecting a 15.8% increase over the last seven days, and 46.6% since the beginning of 2023.

- Bitcoin (BTC) soaks up market share as BTC dominance climbs to 45.0% and price shoots past US$28,000 for the first time in nine months.

- Swiss banking giant UBS, acquires its ailing rival Credit Suisse, to prevent a crisis of confidence from spreading throughout the world's financial markets.

Price Movements

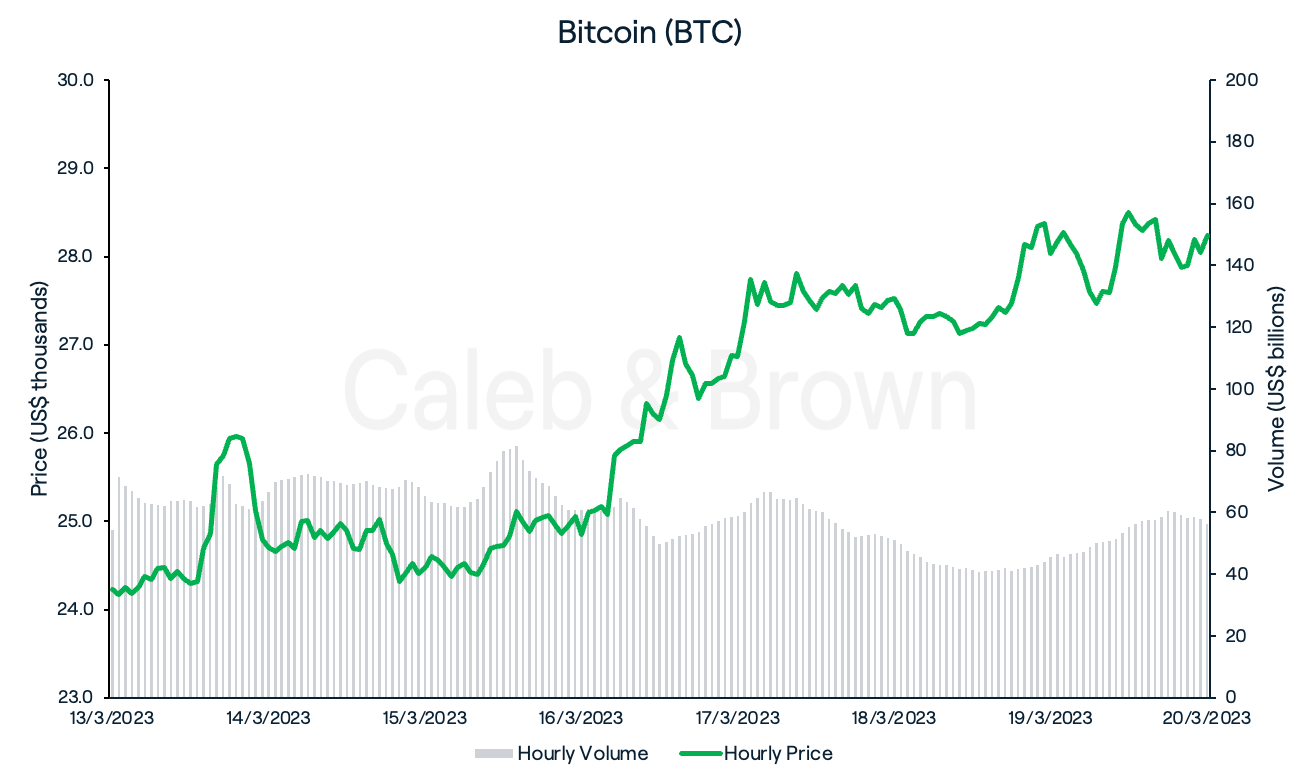

Bitcoin

The crypto market has had a colossal week, rallying 15.8% over the last seven days to bring the total market cap back above US$1.2 trillion.

Bitcoin (BTC) surged back to life beginning last Sunday night after the Federal Reserve, U.S. Treasury, and FDIC announced they would step in to backstop all deposits at Signature and Silicon Valley Bank.

Then on Tuesday, the Bureau of Labor Statistics reported that Consumer Price Index (CPI) had fallen to 6.0% for the year ending in February. This was down from 6.4% in January, falling in line with expectations and marking the eighth consecutive month of falling annual CPI. Inflation also slowed down on a monthly basis, falling from 0.5% in January to 0.4% in February.

Given the relatively positive CPI report as well as the the recent bank crashes, the market reduced expectations and predicted a 76.8% chance for a 25 basis-points hike in the upcoming March Fed meeting, instead of the 50 basis-points hike initially predicted. This gave investors a renewed appetite for risk as they speculated on the Fed easing monetary policy and went “risk-on”.

However, with dwindling consumer confidence in centralised exchanges, custodians and now banks, investors are left with fewer options to park their cash. This has placed BTC back in the centre of attention as the original alternative payment system, and strongly correlated with BTC’s significant rise in price and dominance the past week.

As such, BTC skyrocketed 27.8% to a nine-month high and closed the week at US$28,239.

BTC is also up 70.0% since the beginning of 2023.

BTC dominance, BTC’s market cap relative to total market cap, rose from 42.2% to 45.0% during the same period.

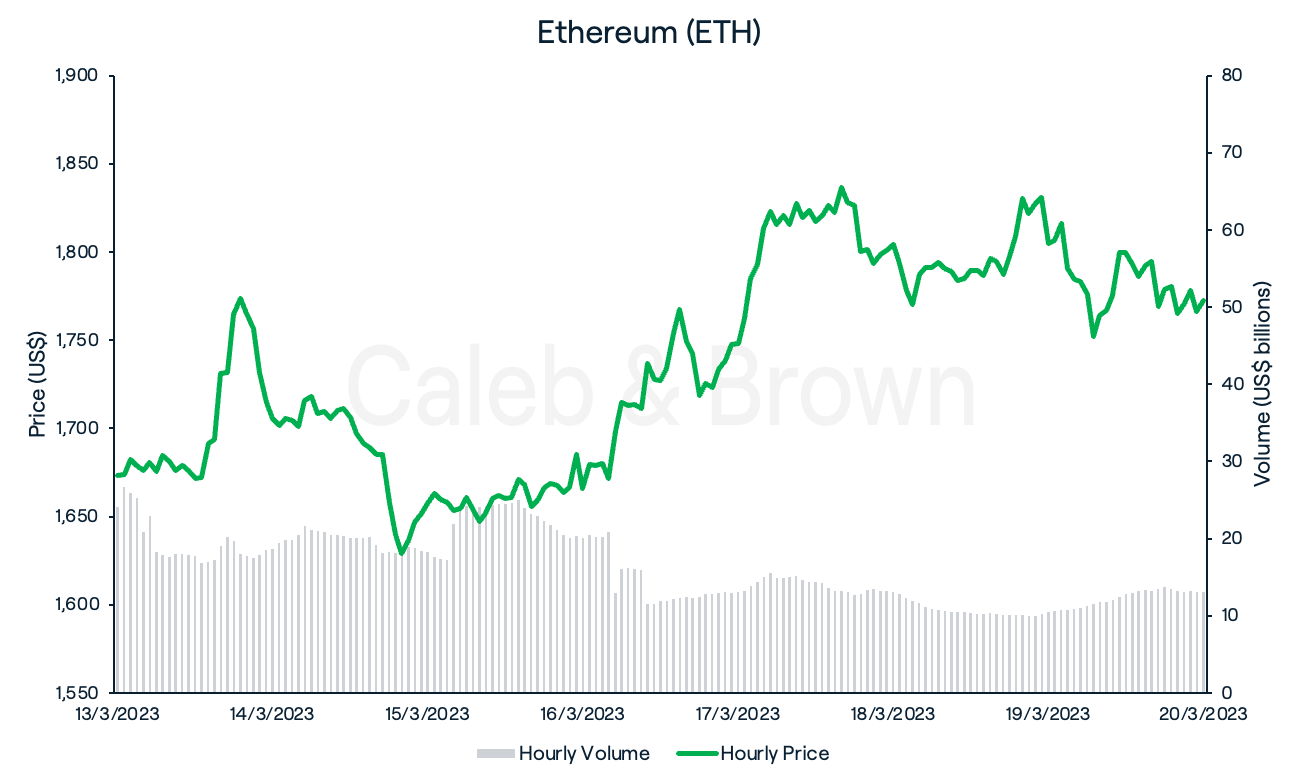

Ethereum

Ethereum (ETH) also exploded in price this week, however could not keep up with the market leader. Starting the week at US$1,564, ETH traded as high as US$1,841 on Sunday before closing the week at US$1,772. This represented a weekly gain of 11.1% and ETH’s highest weekly close since August 2022. ETH is up 47.1% since the beginning of 2023.

Despite the positive performance, the ETH/BTC ratio fell significantly from ~0.069 to ~0.062, with ETH giving up 9.9% of its relative market share.

Ethereum's highly anticipated Shanghai upgrade, which includes the ability to withdraw staked ETH, has reached the final stage of development leading up to its scheduled launch on April 12, as confirmed by the network's core developers.

The Goerli testnet, which served as a full rehearsal for the Shanghai upgrade, was launched on Tuesday and finalised within 90 minutes, with only a minor delay caused by some validators running older versions of clients. However, this was quickly resolved, and the testnet's functions worked flawlessly.

With no other noteworthy issues, an Ethereum Foundation developer declared on Twitter:

Goerli has successfully upgraded to Shapella! 🦉

— parithosh | 🐼👉👈🐼 (@parithosh_j) March 15, 2023

We had some validators running older versions of clients, once that was fixed the attestation rate went back up and we are currently finalizing! #GoerliShapella

Mainnet comes next!

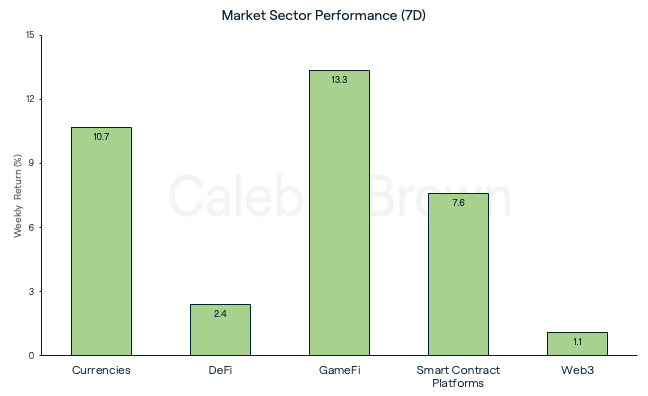

Altcoins

Market sectors were green across the board this week with GameFi adding on 13.3% week-on-week to secure top spot. Currencies and Smart Contract Platforms were next and gained 10.7% and 7.6%, respectively. DeFi and Web3 traded relatively flat over the past seven days, increasing by 2.4% and 1.1%, respectively.

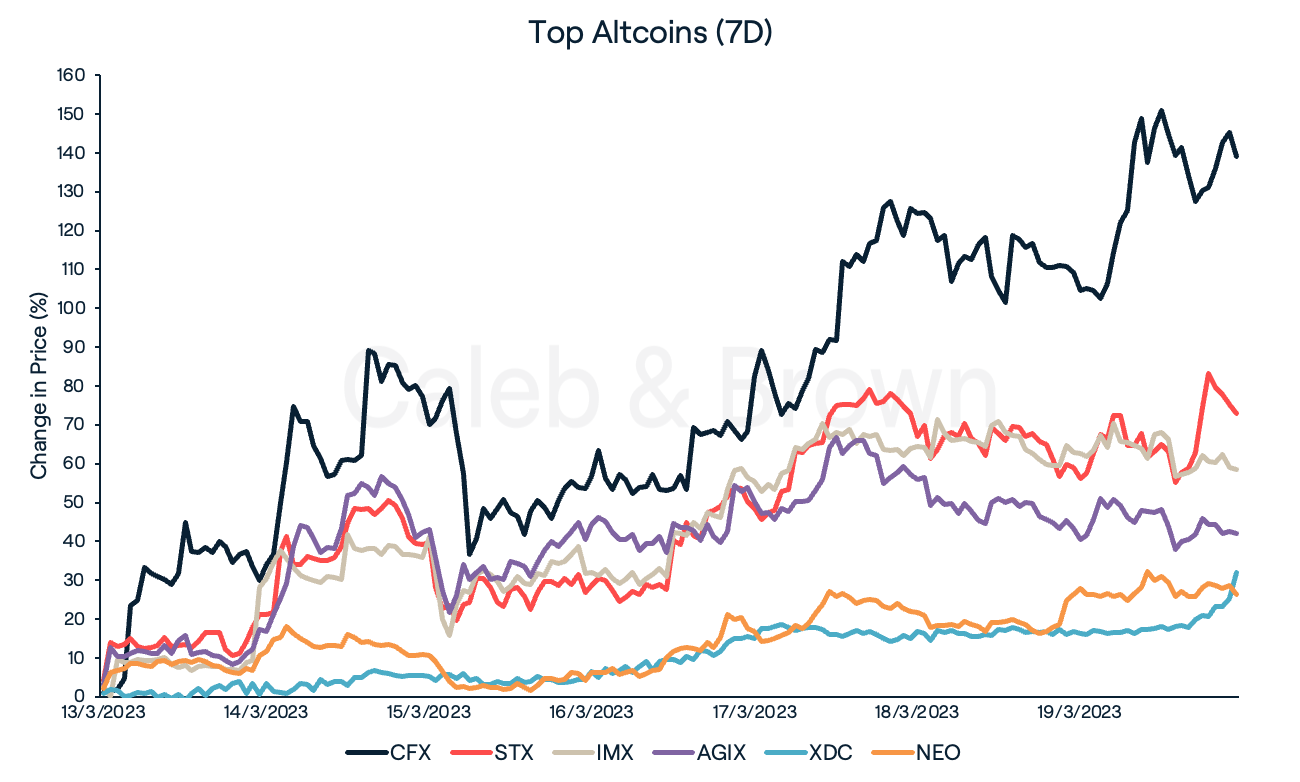

While the majority of the top 20 coins enjoyed double-digit gains this past week, a few have emerged above the rest.

NFT layer-2 solution ImmutableX (IMX), and Bitcoin’s smart layer network, Stacks (STX) jumped 73.0% and 58.4%, respectively. IMX’s rally may be tied to its upcoming token changes and partnership announcement scheduled for March 21 while STX have revealed a major network upgrade. The upgrade will improve on connections to the Bitcoin network as well as implement Bitcoin-native assets.

SingularityNET (AGIX), XDC Network (XDC), and NEO (NEO) were other notable performers. AGIX has once again benefitted from OpenAI’s most recent development, ChatGPT-4. With ChatGPT-4 trending all over social media, AGIX surged 41.9%. XDC and NEO increased 32.0% and 26.2%, respectively.

This week’s best performer was Conflux (CFX) which rallied an astonishing 139.0%. CFX’s rapid rise can be linked to its major partnerships with big-name Chinese enterprises, formed this year. CFX has integrated with “Little Red Book”, the Chinese equivalent of Instagram, as well as “China Telecom”, aiming to deliver Web3 enabled mobile devices powered by blockchain-powered SIM cards.

Conflux is also China’s first government approved chain and is potentially well positioned for Hong Kong’s plans to legalise retail crypto trading in Hong Kong. CFX is up 190.0% over the last 30 days.

In Other News

Layer-2 Arbitrum (ARB) Airdrop Confirmed

Arbitrum, the popular layer-2 scaling solution for Ethereum, has announced plans to airdrop a new governance token called ARB to users of its platform on March 23. This move comes as part of the platform’s transition to a decentralised autonomous organisation (DAO) model. The ARB token will give power back to the holders by providing voting rights within the Arbitrum DAO.

UBS to Buy Credit Suisse in Historic Deal

In an unprecedented move facilitated by the government, Swiss banking giant, UBS, has agreed to acquire Credit Suisse to prevent a crisis of confidence from spreading throughout the world's financial markets. The acquisition is an all-share deal with significant government guarantees and liquidity provisions. UBS is paying 3 billion francs (US$3.25 billion) for Credit Suisse which is less than half of Credit Suisse's market value of 7.4 billion francs at the end of trading on Friday. Additionally, Credit Suisse’s “tier-one bonds” will be written to zero as part of the deal, wiping out US$17 billion from bond holders. This may explain the hesitancy recently seen in the corporate bond market.

UBS Chairman Colm Kelleher said “Let me be very specific on this: UBS intends to downsize Credit Suisse’s investment banking business and align it with our conservative risk culture,” at a press conference announcing the deal.

DeFi Lender Euler Finance Drained of $197M In Flash Loan Exploit

In another major blow to DeFi (decentralised finance), Euler Finance, a lending platform, was reportedly subjected to an exploit of roughly US$200 million on Monday. The attacker managed to steal US$8.7 million in DAI, US$18.5 million in Wrapped Bitcoin (WBTC), US$135.8 million in Staked Ethereum (stETH), and $33.8 million in USDC. The exact vulnerability that led to the attack is still unknown, but the attacker utilised six flash loans to carry out the attack. Flash loans are a type of crypto-based loan where the user borrows and returns funds in the same transaction.

Euler has since announced it is working with security professionals and law enforcement in attempt to recover funds.

Recommended Reading: What is Crypto Liquidity? Why does it Matter?

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.