Market Highlights

-

US$200 million (5%) wiped off the market after crypto bank, Silvergate postponed its annual 10-K report, sending shock waves through the market.

-

Ethereum launches ‘smart accounts’, a new account abstraction standard which will enable features like gasless transactions and seed phrase-less wallets.

-

NFT monthly trading volume hits US$2 billion in February, a 9-month high.

Price Movements

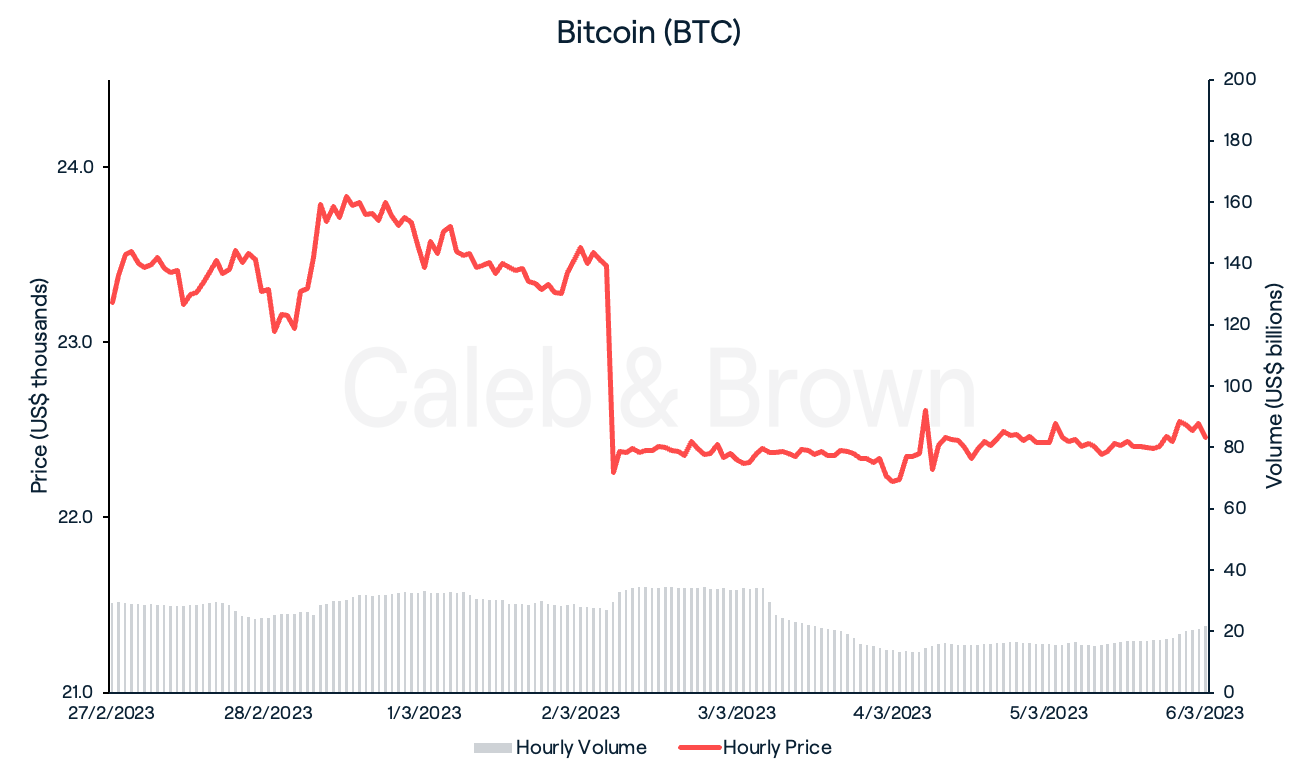

Bitcoin

It was the second consecutive week of straight losses for leading cryptocurrencies. Bitcoin (BTC) spent the majority of the week trading between US$23,000 and US$24,000 before abruptly dropping 5.5% on Friday morning.

The market downturn observed this week seems to have been prompted by the announcement that crypto bank, Silvergate had postponed submitting its annual 10-K report to the U.S. Securities and Exchange Commission (SEC), resulting in a 57% decline in its stock price and over US$200 million of longs liquidated.

As a consequence, various crypto companies, including Coinbase and Tether, swiftly terminated their associations with the struggling financial institution.

BTC closed the week at US$22,450, shedding 4.9% over the last seven days.

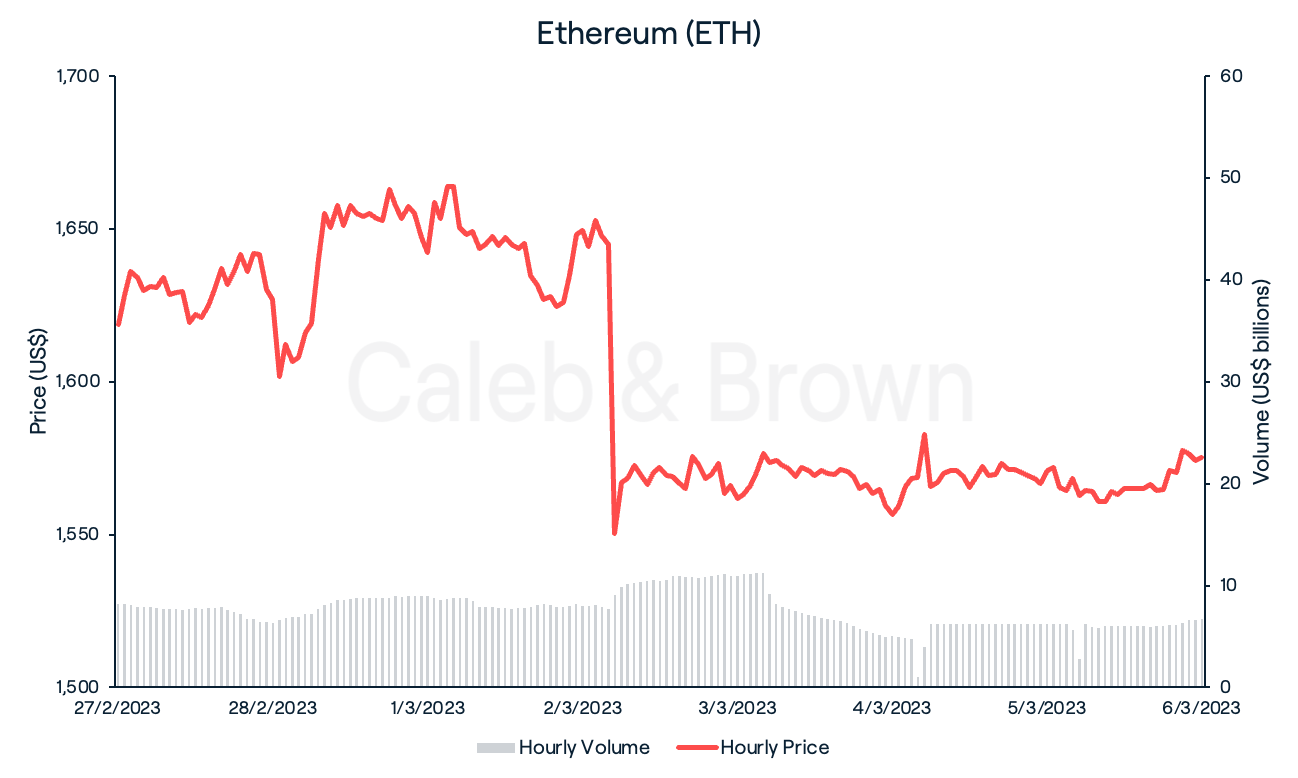

Ethereum

Ethereum (ETH) weathered the news slightly better, only falling 4.7%, to close the week at US$1,575.

On Thursday, during an Ethereum core developer call, it was decided that the highly anticipated Shanghai upgrade, which will allow staked ETH to be withdrawn, will be delayed by a month. The developers have now set a date of March 14 to launch the Goerli testnet, which will serve as a full dress rehearsal for the Shanghai upgrade. Assuming that the testnet goes well, the actual software update for Shanghai will be launched in mid-April.

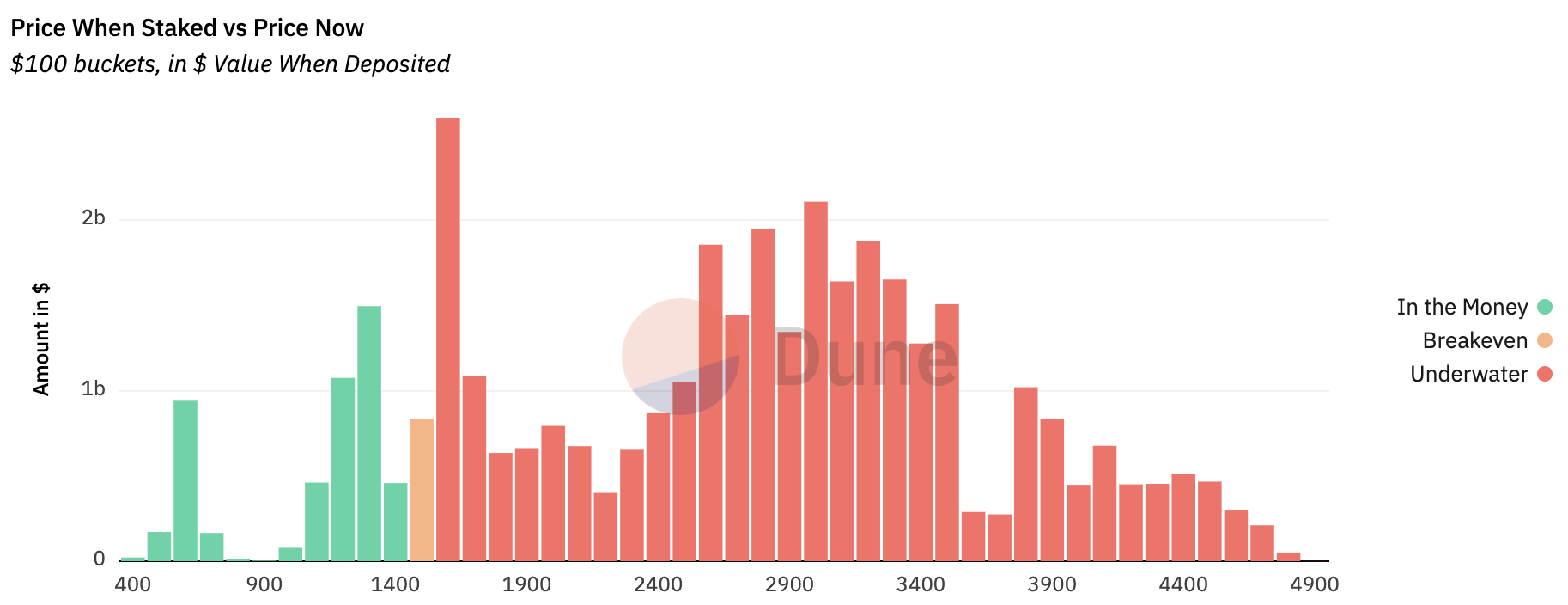

While no one can predict the outcome for ETH after Shanghai goes live, a recent Dune analytics dashboard has shown that only 16.5% of ETH stakers remain in profit, potentially indicating a major sell-off event to be less likely.

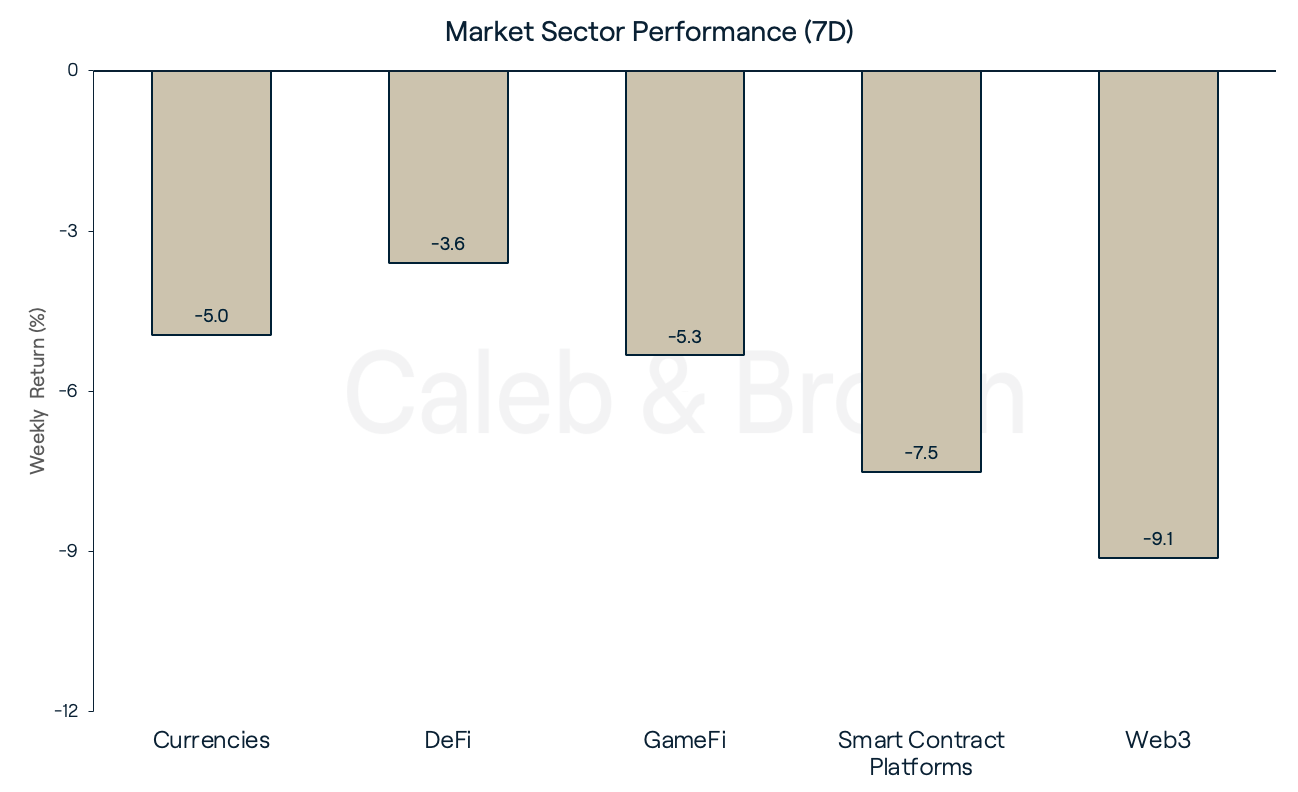

Altcoins

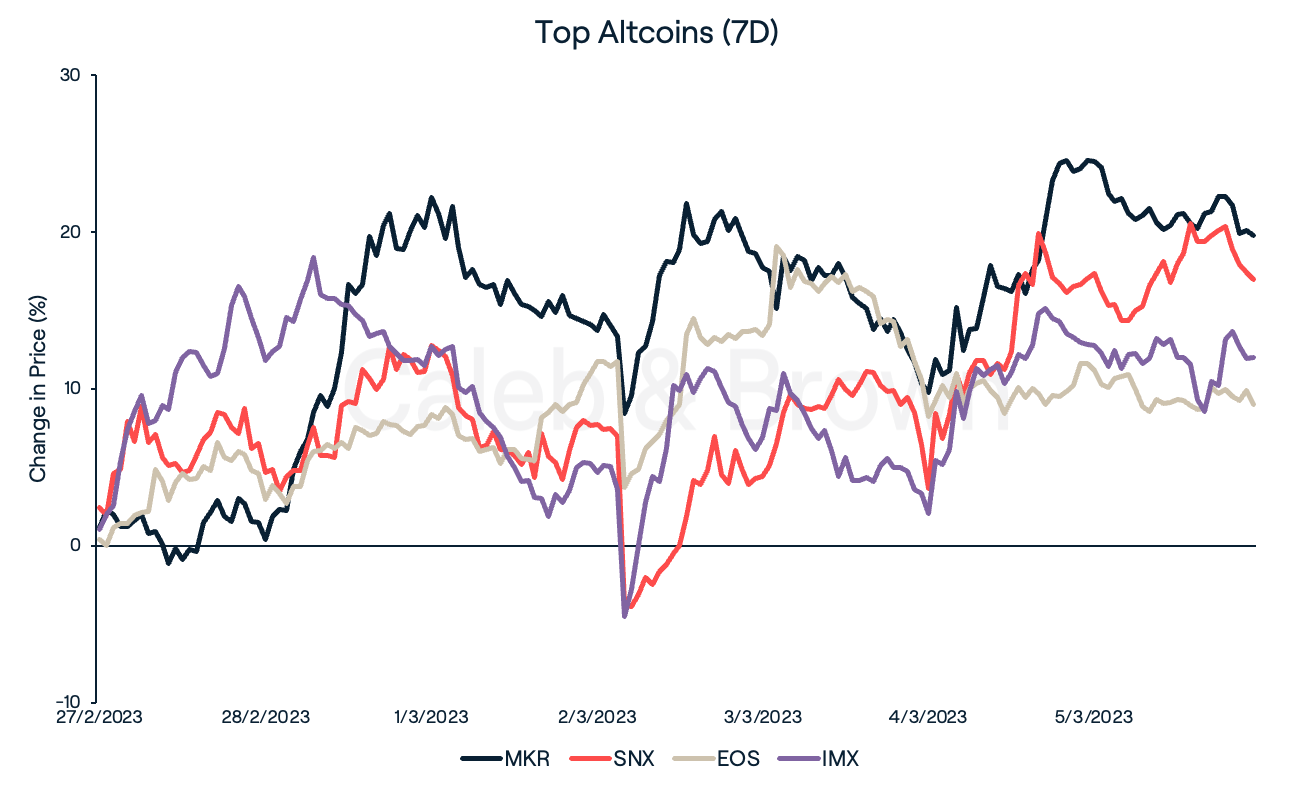

While the majority of the market sunk along with BTC and ETH this week, a few tokens managed to come out on top.

DeFi protocols held the line relatively strong this week with Maker DAO (MKR) and Synthetix (SNX) each returning 19.7%, and 16.9%, respectively. SNX’s surge in price likely stems from the recent deployment of its major v3 upgrade. Synthetix v3 will have more efficient architecture to allow developers to create faster, complex and more optimised DeFi applications on the protocol.

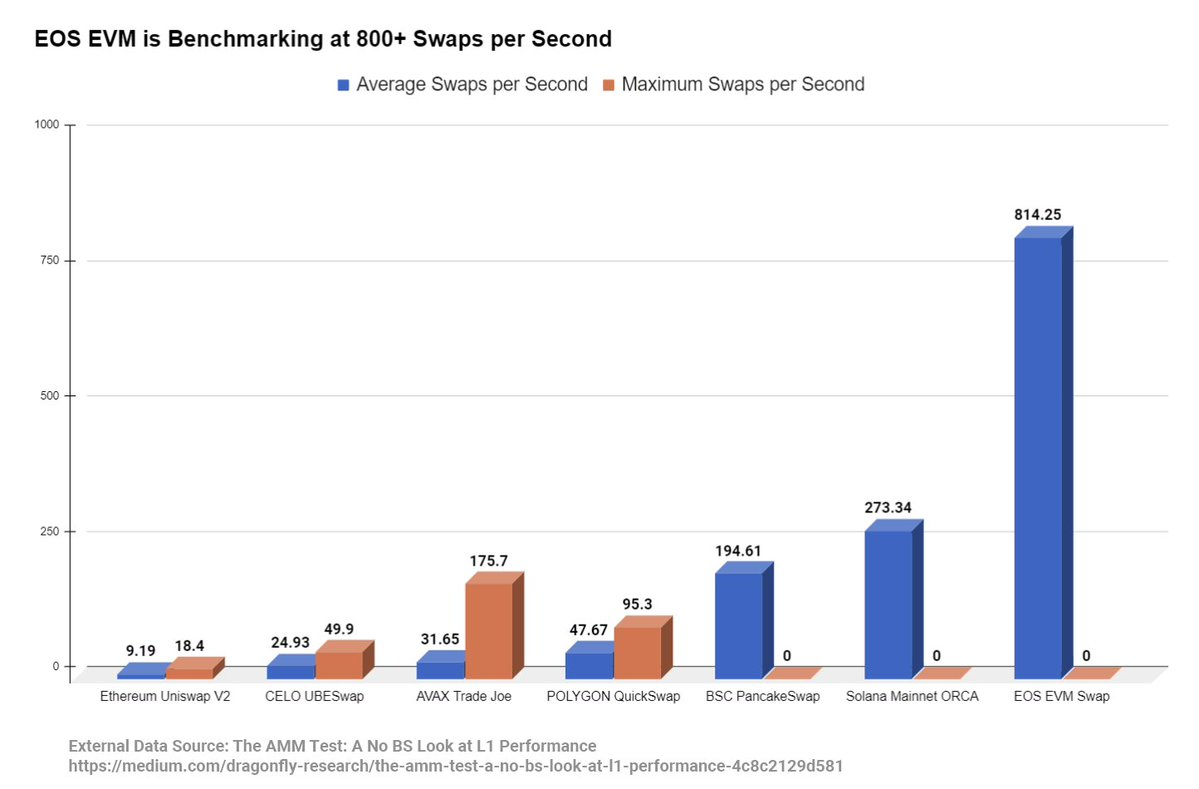

EOS was up 9.0% after the launch of EOS EVM (Ethereum virtual machine) was announced for April 14, on Thursday. CEO of EOS, Yves La Rose claimed that the EVM could transact 3x faster than Solana (SOL) and 25x faster than Avalanche (AVAX), as shown below.

NFT layer-2 solution, Immutable X (IMX) gained 11.9% after it announced it would be officially running as a Unity Games verified solution. The move will take advantage of Unity’s 1.5 million user base and will provide gaming studios a means to seamlessly integrate Web3 technology into their games.

In Other News

Ethereum Launches Smart Accounts

Ethereum has introduced the ERC-4337 account abstraction standard, which could be a key catalyst responsible for mainstream adoption. The process of onboarding new users into DeFi will no longer require them to learn about complicated seed phrases or the technicalities of setting up a wallet. The update will enable such features as; gasless transactions, bundled transactions, and seed phrase-less wallets, which will be more easily recovered. Importantly, this is a giant leap in how users will interact with blockchains.

NFT Trading Volume Soars to a Nine-Month High

NFT trading volume soared to a staggering US$2.04 billion in February, representing a 117% increase from January's US$941 million. This marks the best performance the NFT market has seen since last May, just before Terra's implosion caused the crypto economy to crash, taking the NFT market down with it.

However, the surge in the NFT market's trading volume appears to be primarily due to the influence of a single, controversial source - Blur. This emerging NFT marketplace has overtaken OpenSea in trading volume, largely due to its incentive programs, which financially reward users for remaining loyal to Blur. Rewards are given to users who trade as many high-value NFTs as possible, and also for those who do not list their items on any other platform, to question what some say are anti-competitive practices.

Australia Announces CBDC Pilot for eAUD

On Wednesday, Australia moved closer to the possibility of creating a central bank digital currency (CBDC), as the Reserve Bank of Australia (RBA) announced a pilot phase for its digital version of the Australian dollar, known as the eAUD. In collaboration with Australia's Digital Finance Cooperative Research Centre, the RBA has invited a select few companies, such as ANZ and Mastercard, to participate in the program and explore 14 use cases for the eAUD. These use cases include facilitating offline payments, tokenising invoices for businesses, and conducting livestock auctions, among others.

Recommended reading: What is Tokenomics? Understanding What Makes a Token Valuable

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F7vynyJjukSx9gK6MxZZkJL%2Fc0b3104fee3a00bc0b7c80dc143ab566%2FBlog-Cover__17_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-03-07T02%3A16%3A55.923Z)