In this Week's Rollup

While trepidation still lingers across crypto markets, the dust looks like it's showing signs of settling following the Terra fiasco. This week saw a complete trend reversal from what was seen in the previous week. Last week’s losses have been recovered for the most part across major market sectors. Solana has once again gone down, having suffered from a bug which stopped blockchain production. The BAYC community have shared misfortune too, as NFTs worth over 200 ETH were stolen from users.

Market Updates

- The 401(k) provider ForUsAll has sued the U.S Labor Department (DOL) for planning to investigate companies offering crypto options products to 401(k) holders.

- Japan’s parliament has just passed a new landmark law clarifying the legal status of stablecoins, essentially defining them as digital money, per a Bloomberg report Friday.

- Binance Labs, the investment arm of Binance, announced a new $500 million Web3 fund. The fund is being backed by investment capital firm, DST Global and global VC firm, Breyer Capital.

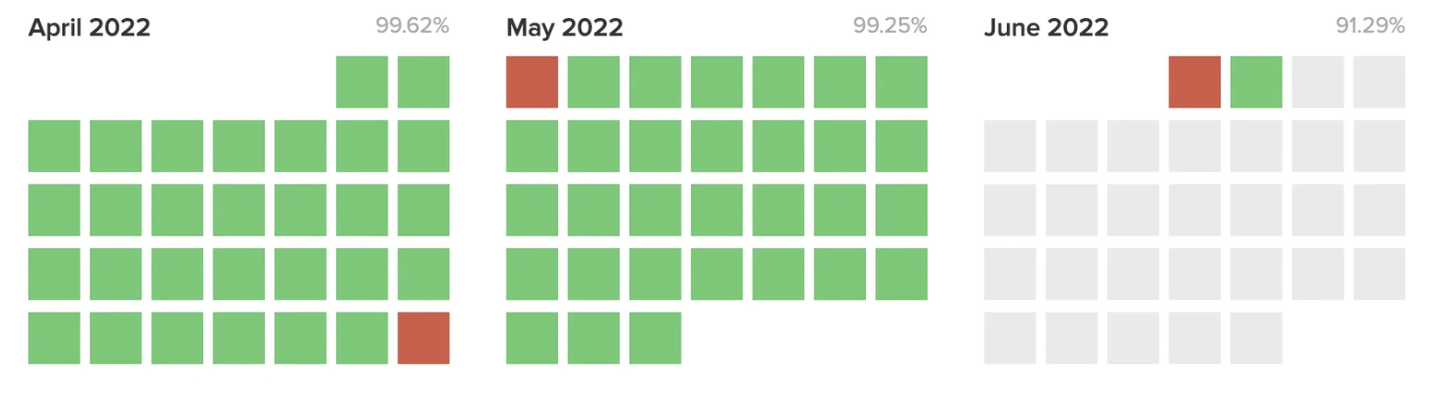

- Solana faced another outage for more than four and a half hours as well as plummeting demand for Solana-based non-fungible tokens (NFTs). The blockchain has struggled to provide 100% uptime (a measure of availability) over the past 3 months.

Price Movement

Bitcoin & Ethereum

June has been a relatively quiet month for Bitcoin and Ethereum. Both majors did see a brief rally in the last few days of May. Bitcoin traded 14% above the lows, while Ethereum increased by 17%. Both assets reached levels that had not been touched in over 3 weeks. However, there was not enough momentum to maintain this move, with BTC now hovering around $30k USD. It’s been another uncertain month for crypto as many are still reassessing their portfolios following the crash of Terra’s LUNA and UST.

This week has seen Ethereum and Bitcoin maintain a high correlation. Ethereum underperformed Bitcoin to start the week, as the ETH/BTC pair traded 6.5% lower. Ethereum has shown some strength against Bitcoin to finish the week, as one can see in the chart below. The volatility in this pair has been quite low this week, reflecting the rangebound conditions in much of the broader market.

Market Sectors

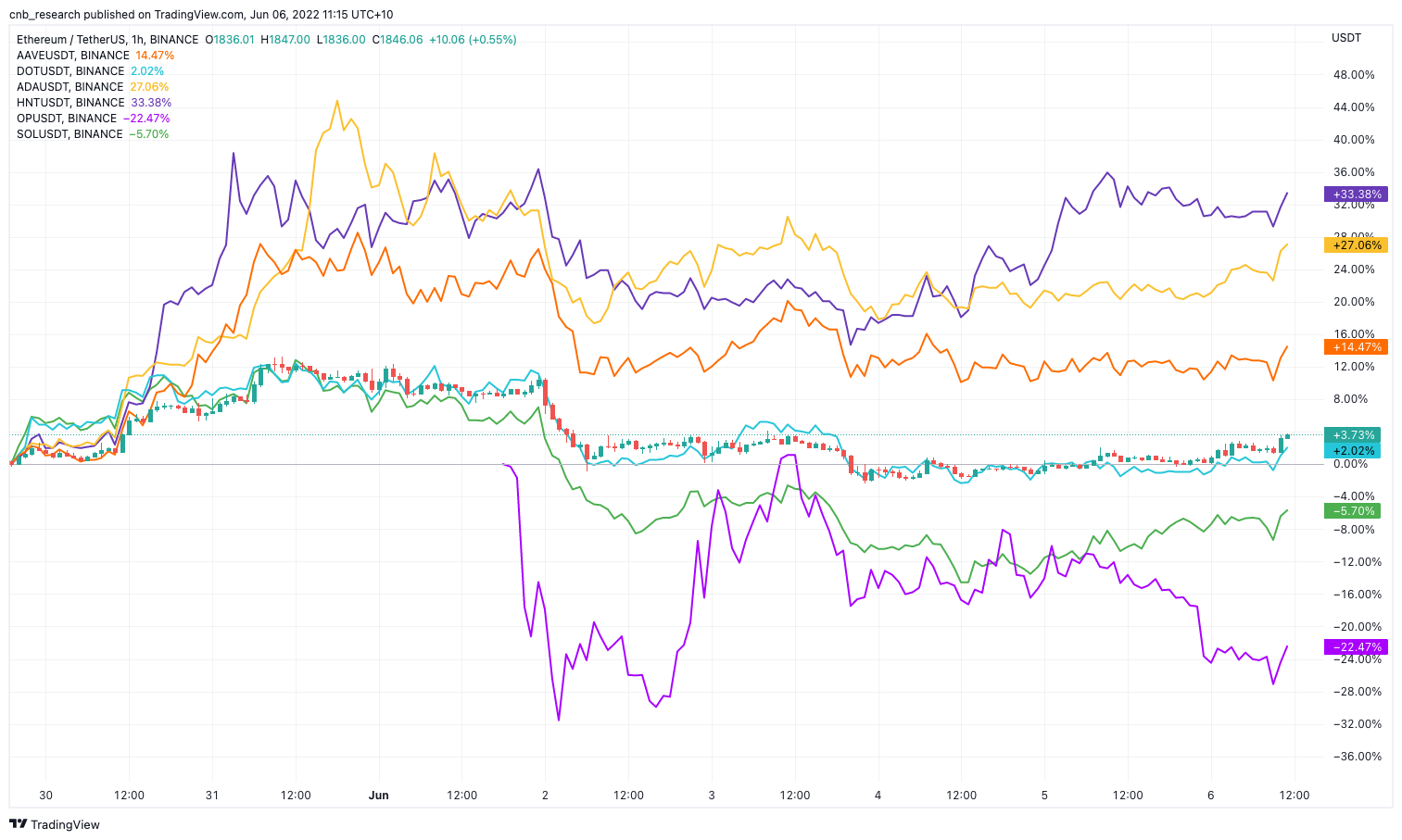

Market sectors saw relief across the board with the Web3 sector leading the pack, up 9.2% for the week. Following Web3 were the DeFi and Smart Contract Platforms up 5.1% and 4.7% respectively. Performing most notably amongst these sectors were Aave (AAVE) up 13.3%, Polkadot (DOT) up 10.3% and both Cardano (ADA) and Helium HNT (HNT) posting an astonishing 23.1% and 20.7% gain, respectively.

The most notable laggers this week were Solana (SOL) and recently launched Layer-2 Scaling solution Optimism (OP). Despite the Smart Contract Platform sector’s performance this week, SOL fell by 8%. The sharp sell off was sparked by yet another blockchain halt on June 1st which lasted over four and a half hours. Additionally, Solana’s NFT market sales have plummeted by over 60% during the last month. Since Optimism’s highly anticipated airdrop at the beginning of the week , OP has fallen 60% from its highs, despite the high network traffic.

Source: Solana Status - Heatmap showing the availability of Solana blockchain.

NFTs

Gordon Goner, the co-founder of the popular Bored Ape Yacht Club NFT collection, lashed out at Discord after their server was exploited again and NFTs worth 200 ETH ($368,600) were stolen from users. Saturday’s exploit wasn’t the first time attackers aimed for BAYC’s social media platforms. In late April, BAYC’s official Instagram account was hacked and a total of $2.8 million was stolen by linking a scam website that pinched NFTs from users’ wallets. Both of these used the same incentive: Otherside Giveaways. Below is a screenshot of the scam message posted on BAYC’s Discord:

Source: Discord

In other news, the price of an NFT collection including Johnny Depp artwork has risen after the actor won a defamation action against ex-wife Amber Heard. The 3,850 piece collection has a floor of 0.35 ETH ($645.40) as of this writing. The collection first launched in January with a starting price of 0.70 ETH.

Regulatory

A topical development in the regulatory cryptocurrency scene is one concerning an OpenSea employee being charged with insider trading. Alma Angotti, former United States SEC lawyer has stated that following this shocking news, NFTs could eventually be legally treated as securities. The employee that was charged was an OpenSea product manger, Nathaniel Chastain, and the charges allege wire fraud and money laundering.

Recommended reading: Bitcoin Lightning Network Explained

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F5gYxSUszzoqOqzUn8IdbP2%2Fd1386c7b90670e9efbd42d029e402ebd%2FWeekly_Rollup_Tiles__3_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-16T23%3A56%3A09.141Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F3Sobj38v4fuCFRecM13TFU%2F584f42d5e1994c900afd5d54dff5bf51%2FWeekly_Rollup_Tiles__2_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-11T05%3A55%3A49.785Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F29XH6Swt4hU18MVWxiKmbh%2F77a0984be554569157a7511843e65340%2FWeekly_Rollup_Tiles__5_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-03-31T22%3A10%3A27.955Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)