Market Highlights

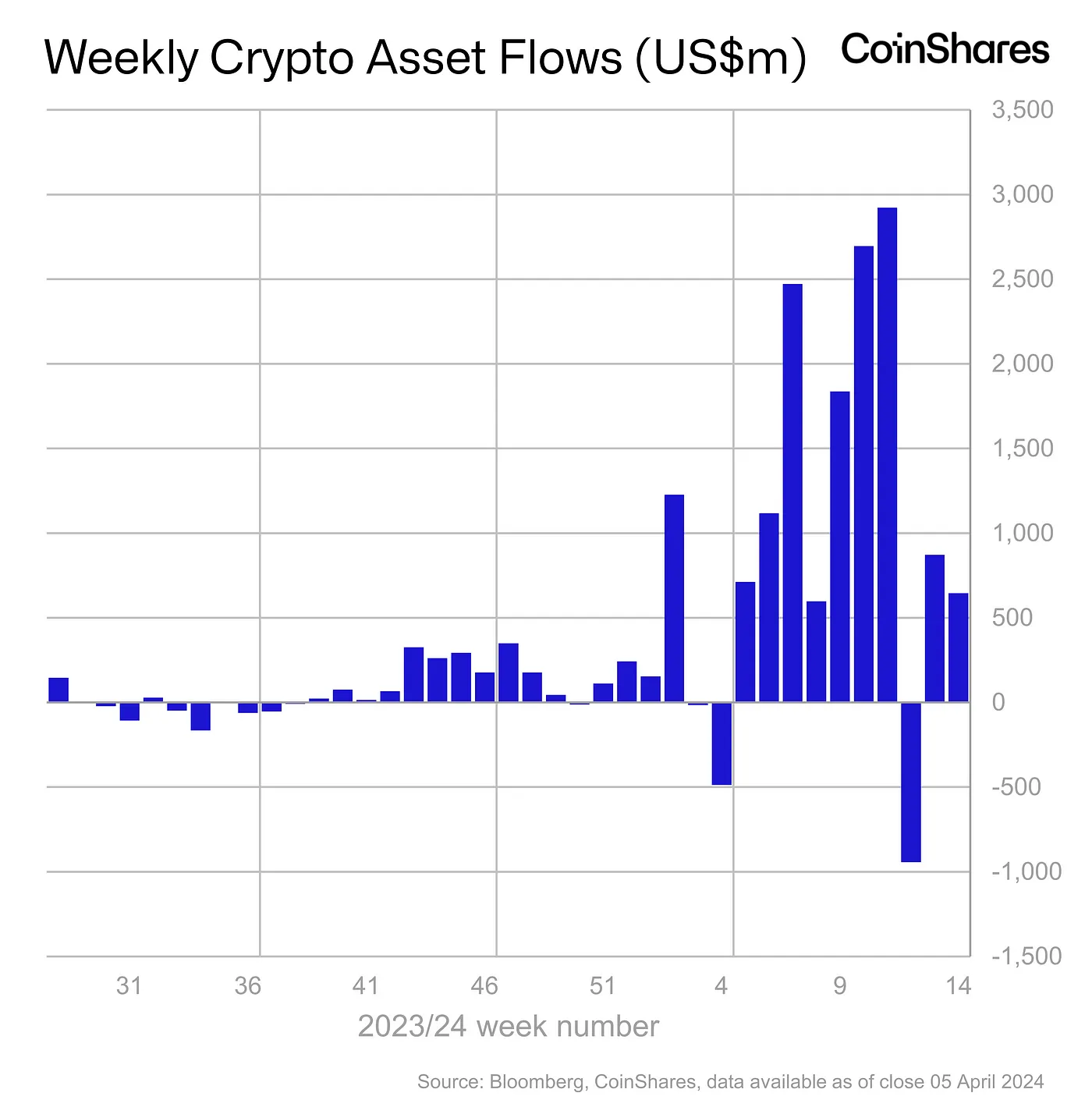

- Digital asset investment products saw a positive inflow of US$648m the past week.

- On Thursday, Ripple unveiled plans to launch its own USD pegged stablecoin which will be 100% backed by dollar deposits and short-term government treasuries.

- Terraform Labs and its founder, Do Kwon were found liable for civil fraud charges on Friday.

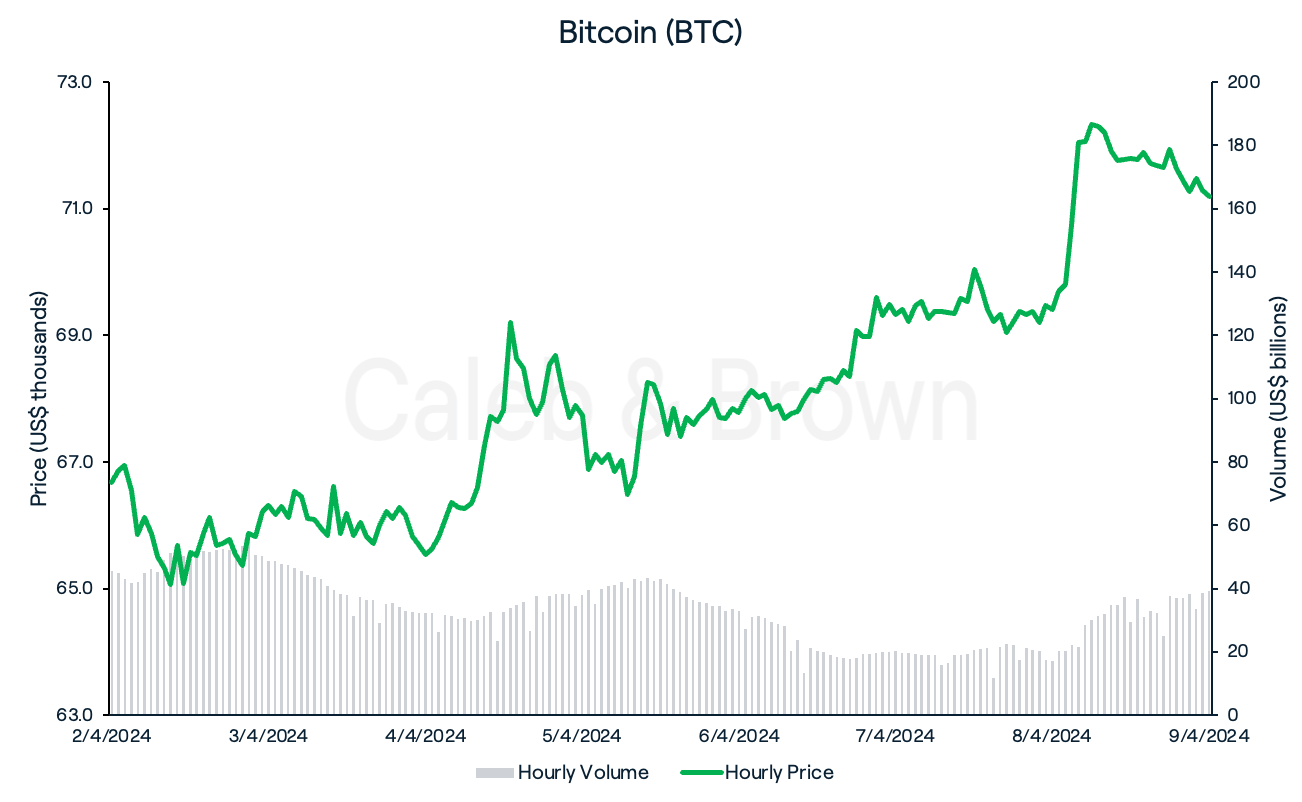

Bitcoin (BTC)

Bitcoin (BTC) along with the rest of the market saw a shaky start to the week as BTC dipped to a low of US$64,550 Tuesday night. The shift in price was likely contributed to by Grayscale’s Bitcoin Trust ETF (GBTC) continued selling of BTC, recording US$302.6m in BTC sales in the past week, bringing their total outflows to over US$15 billion.

This saw a fork of Bitcoin, Bitcoin Cash (BCH) take the spotlight after its halving took place on April 4, 16 days ahead of BTC’s halving event, surging from US$440 to US$700 over the last 30 days.

A late push in the week saw BTC close the week at US$71,189, up 6.8% over the last seven days.

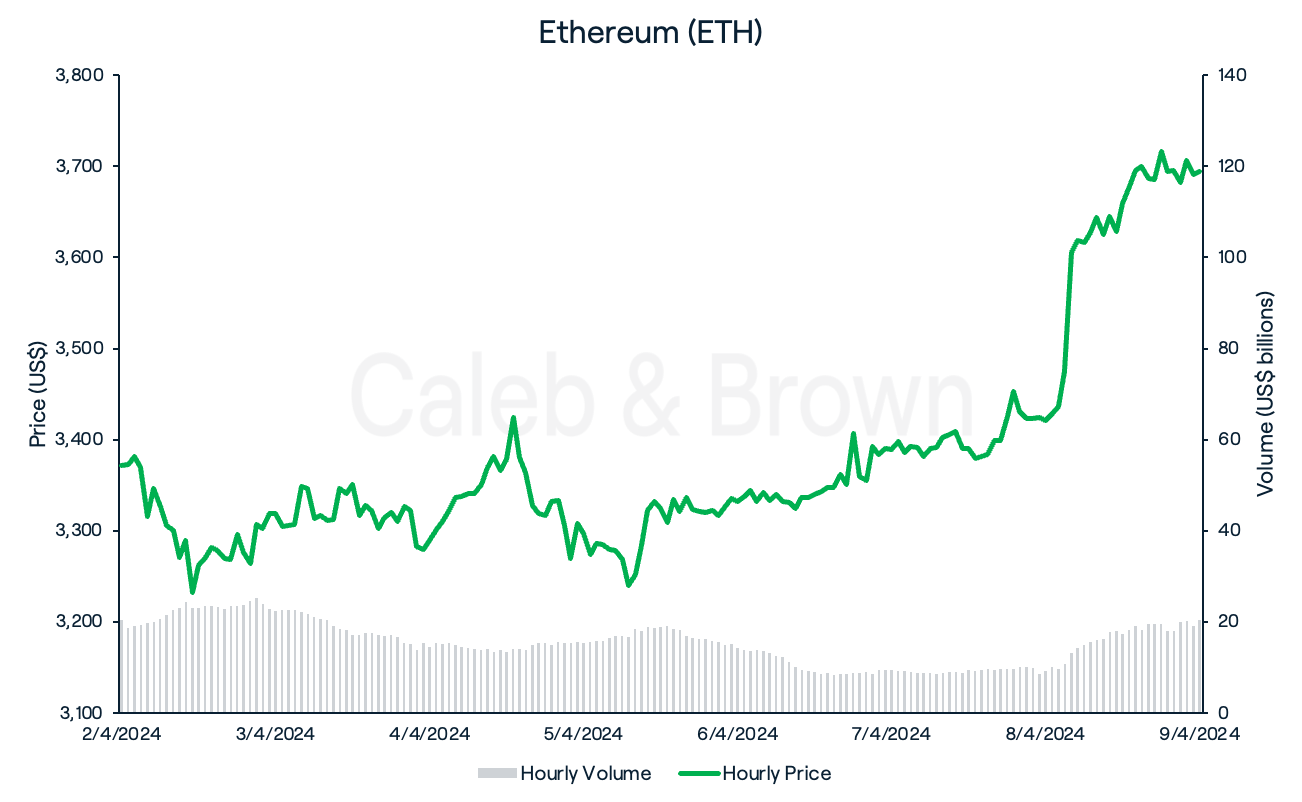

Ethereum (ETH)

Ethereum (ETH) was able to outperform BTC this week, bouncing from its low of US$3,202 on Wednesday to US$3,695, adding on 9.6% throughout the week.

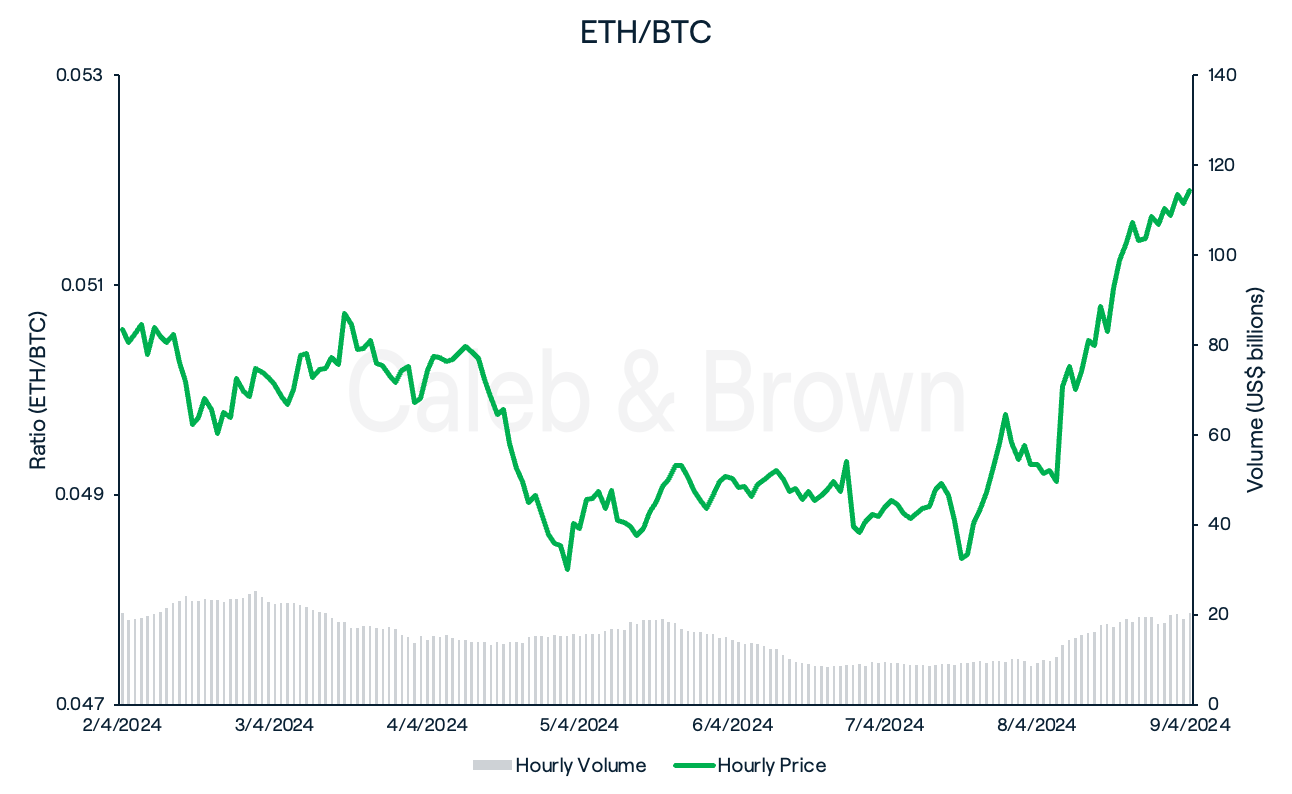

This has given way to a minimal weekly rise of 2.6% for the ETH/BTC ratio, however not before re-testing its major support level near 0.049.

Altcoins

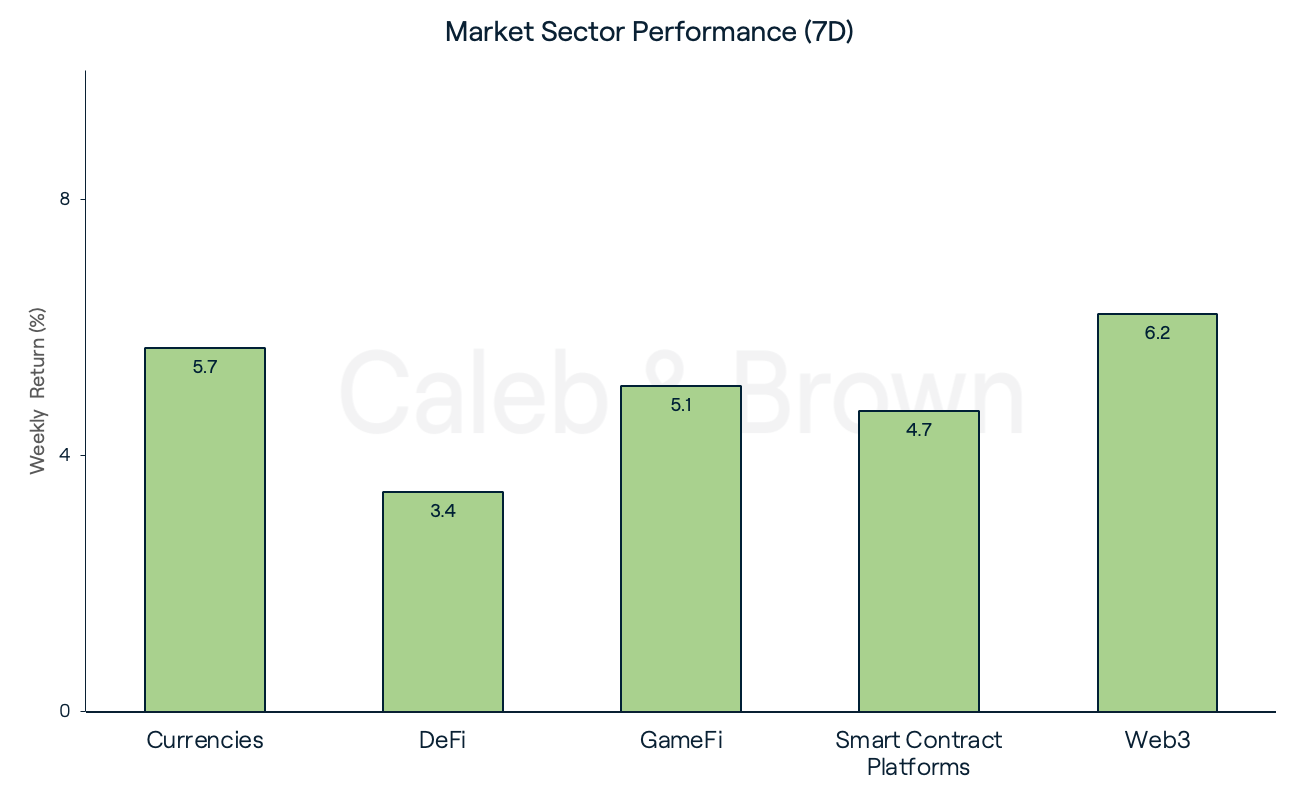

While market sector growth was once again positive across the board, gains have begun to slow down as Web3 took top spot with a 6.2% gain. Currencies and GameFi followed closely, adding on 5.7% and 5.1%, respectively.

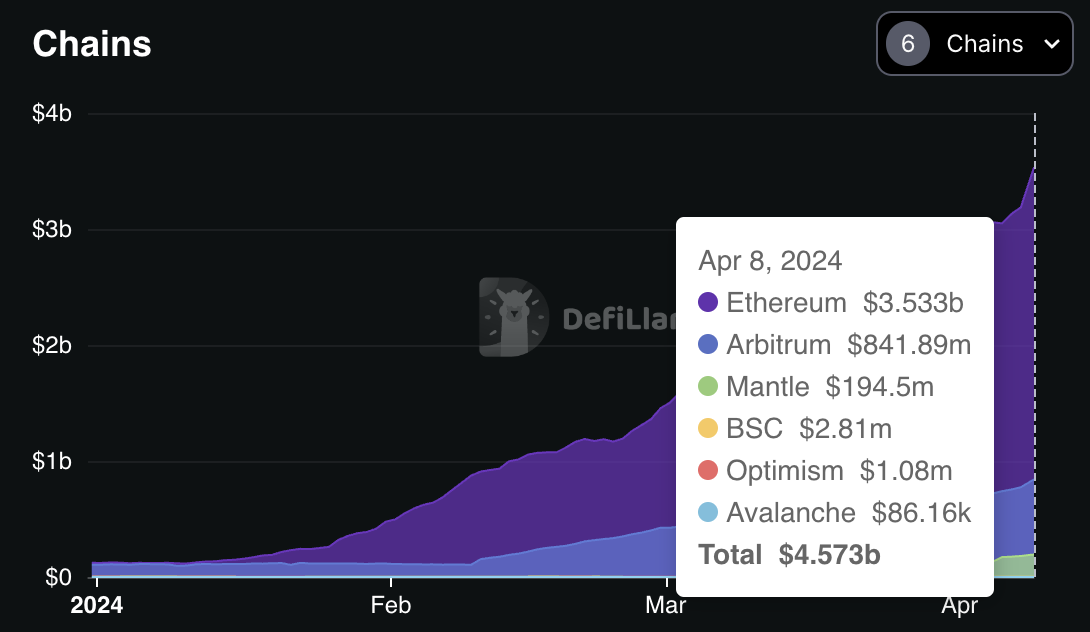

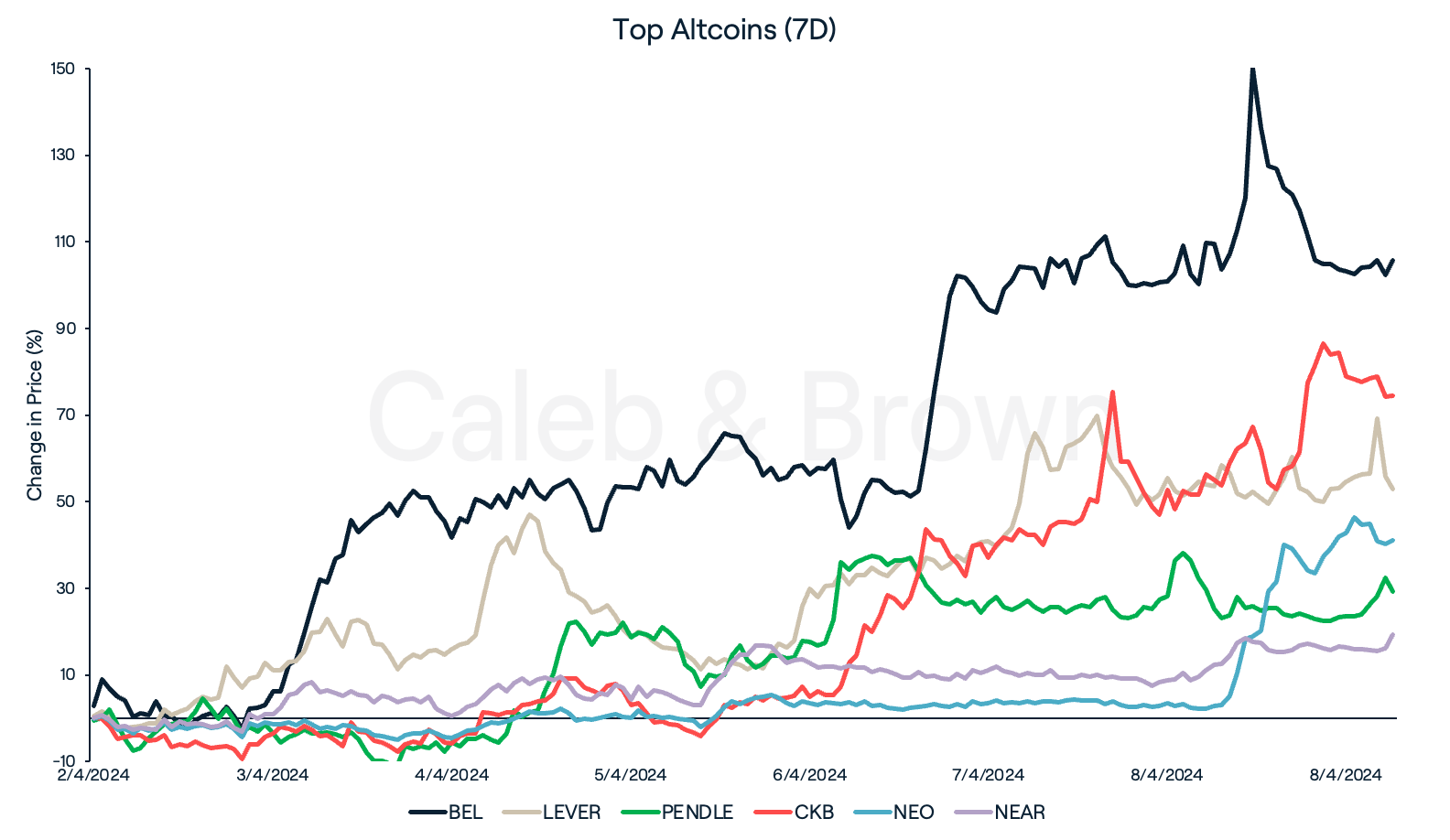

DeFi protocols experienced strong performance in the face of volatility this week with Bella Protocol (BEL), LeverFi (LEVER), and Pendle (PENDLE) producing gains of 105.7%, 52.9%, and 29.3%, respectively. BEL rallied on the news of its recent partnership with Manta Network (MANTA) harnessing MANTA’s expertise in data availability and scalability, while PENDLE surged to all-time-highs after seeing its Total Value Locked (TVL) grow from US$230m to US$4.5b this year alone.

Smart Contract Platforms, Nervos Network (CKB) Neo (NEO), and NEAR Protocol (NEAR) also displayed strong performances, gaining 74.4%, 41.1%, and 19.4%, respectively.

In Other News

- Payment company PayPal announced that customers in the U.S. would now be able to utilise its stablecoin, PayPal USD (PYUSD), to facilitate international payments. According to its press release, the company explained that customers can convert PYUSD to dollars and subsequently transfer funds, with no fees, to "recipients in approximately 160 countries" through its Xoom payment platform.

- On Thursday, Ripple unveiled plans to launch its own USD pegged stablecoin. According to the press release, the stablecoin will peg 1:1 to the US dollar and will be 100% backed by US dollar deposits, short-term government treasuries, and other cash equivalents.

- Digital asset investment products regained a positive flow of funds and saw inflows to the tune of US$648m last week, bringing total inflows for the year to US$13.8 billion.

Regulatory

- Following a two week trial, a New York jury has found Terraform Labs and its founder, Do Kwon liable for civil fraud charges, aligning with the U.S. Securities and Exchange Commission (SEC) on Friday. The SEC is seeking civil financial penalties and orders barring Kwon and Terraform from the securities industry. The collapse of TerraUSD and its linked token, Luna (LUNA), in May 2022 led to losses estimated at more than US$40 billion and caused widespread turmoil in the cryptocurrency market.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.