Market Highlights

- Bitcoin (BTC) surged passed US$30,000 for the first time since June 2022 after becoming the best-performing asset class in Q1 2023.

- Ethereum’s (ETH) ‘Shapella’ upgrade to go live on April 12, seeing its price rally pass US$1,900 for the first time in eight months.

- Swiss bank, PostFinance has joined forces with Sygnum's B2B (business-to-business) banking platform to offer digital asset services to its 2.5 million customer base.

Price Movements

Bitcoin

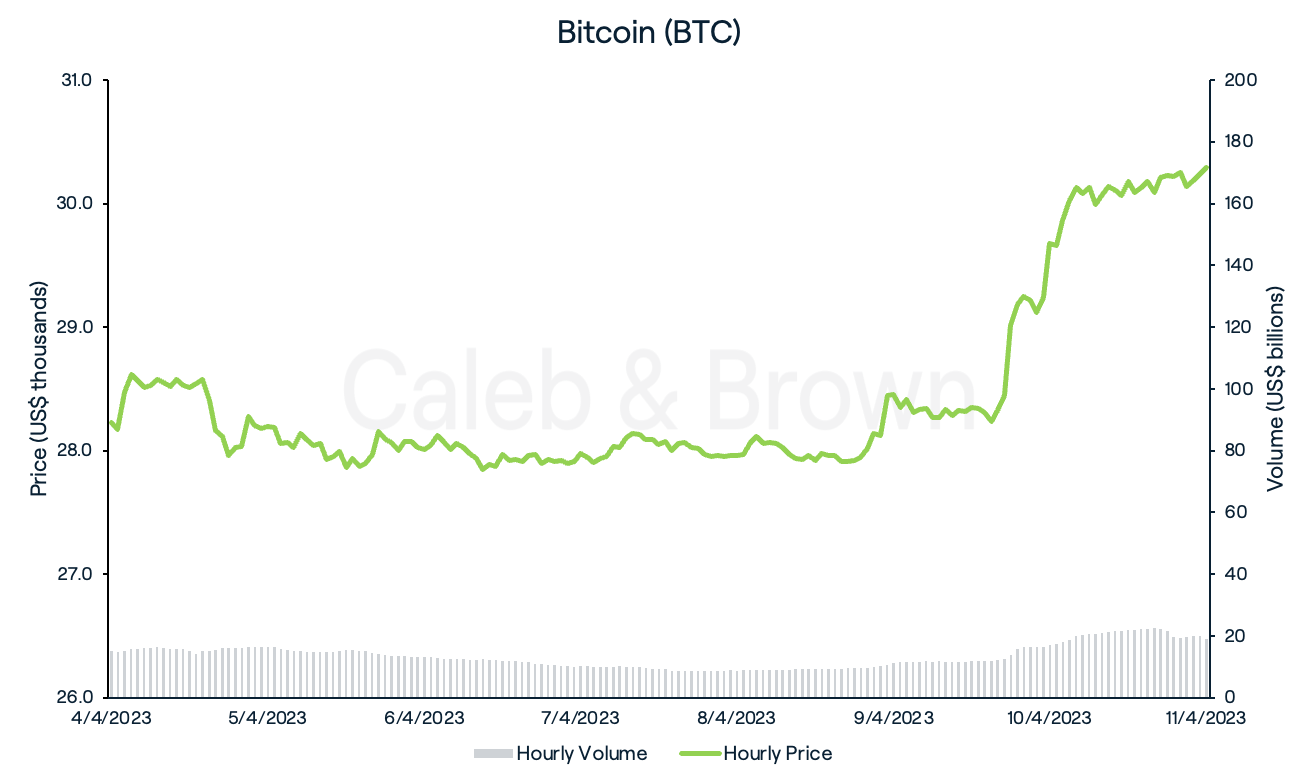

After a rather lacklustre start to the week, Bitcoin (BTC) eventually surged past US$30,000 for the first time since June 2022. BTC spent the majority of the week ranging between US$27,500 to US$28,500 before taking off in the early hours of Tuesday.

While a precise link to the pump cannot be drawn, Bitcoin has been the beneficiary of increased institutional allocations, shown via the ~US$370 million AUM (assets under management) growth of Bitcoin ETPs (exchange traded products) in March 2023. This represents the strongest month of inflows into ETPs since November last year.

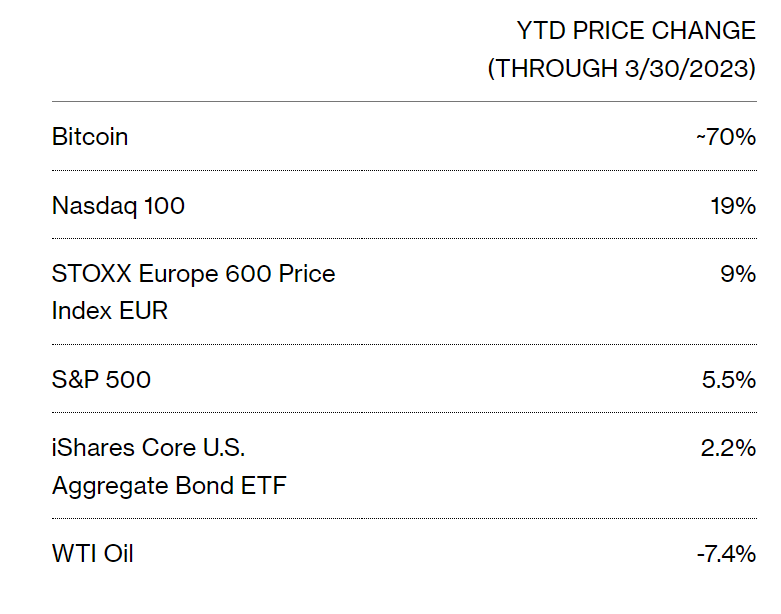

As such, 2023 has marked an excellent start to the year for BTC, climbing 86.5% year-to-date. This has earned it the best-performing asset class of Q1 2023, returning over 3x as much as the Nasdaq100 during the same time period.

Infamous BTC-bull, Michael Saylor, announced on Wednesday that his company Microstrategy (NASDAQ: MSTR) purchased an additional 1,045 BTC at an average price of US$28,016 per BTC- making it the public company with the largest stash of Satoshis in the world. Microstrategy now holds 140,000 BTC acquired for US$4.17 billion placing them in positive territory for the first time this year.

BTC held the line strong and closed the week at US$30,294 for a weekly gain of 7.3%.

Ethereum

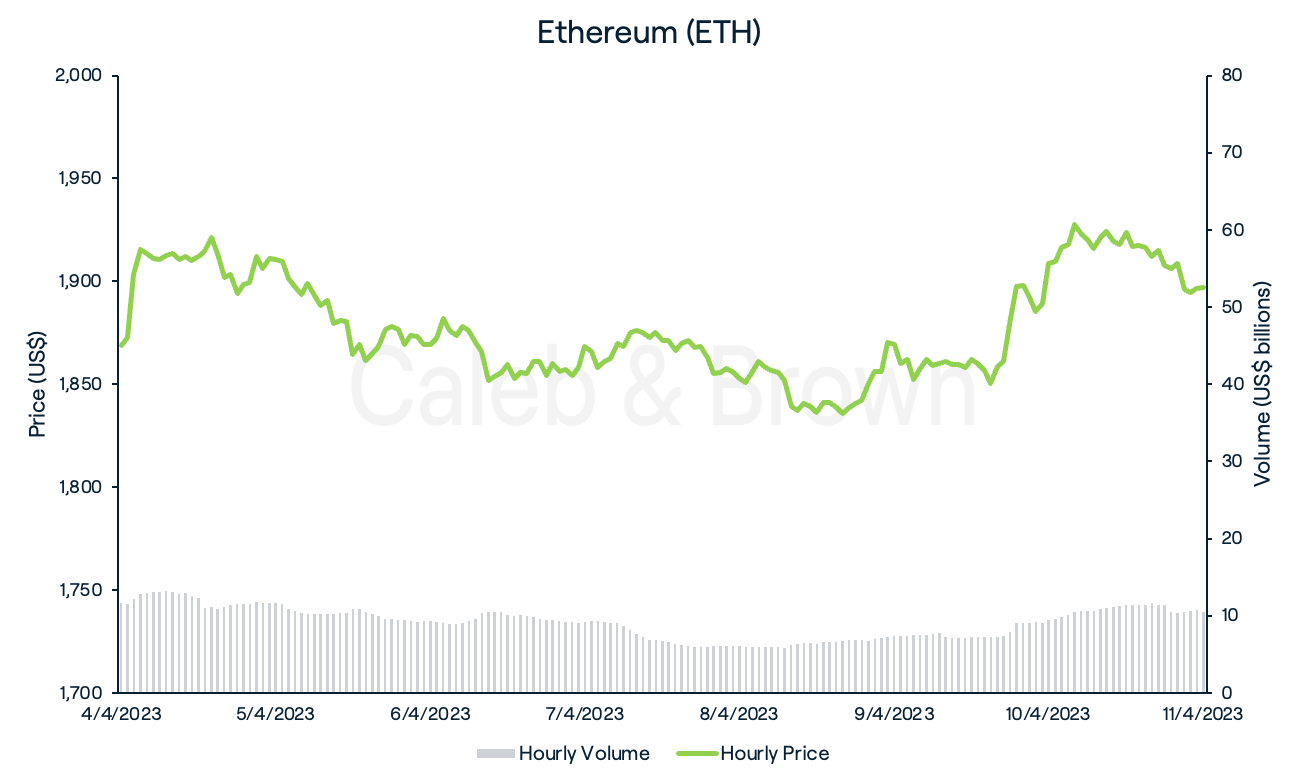

Ethereum (ETH) experienced a much better start to the week compared to BTC and reclaimed the US$1,900 mark on Wednesday for the first time in eight months. After reaching a high of US$1,942 ETH traded with relatively high volatility for the remainder of the week, which may be attributed to the upcoming ‘Shapella’ upgrade scheduled for release on April 12.

The upgrade will enable staked ETH withdrawals which could impact the price of ETH after the event. While the impact on price is uncertain, it is quite likely staked ETH withdrawals will occur over the coming weeks rather than days. Global crypto exchange Coinbase, for instance, announced that it “may take the protocol weeks to months [to] process unstaking requests.” Similarly, liquid staking provider, Lido Finance (LIDO) also announced it could be early-to-mid May before it unlocks withdrawals, due to security audits.

After a volatile week ETH closed the week at US$1,896, up 1.5% over the last seven days.

Altcoins

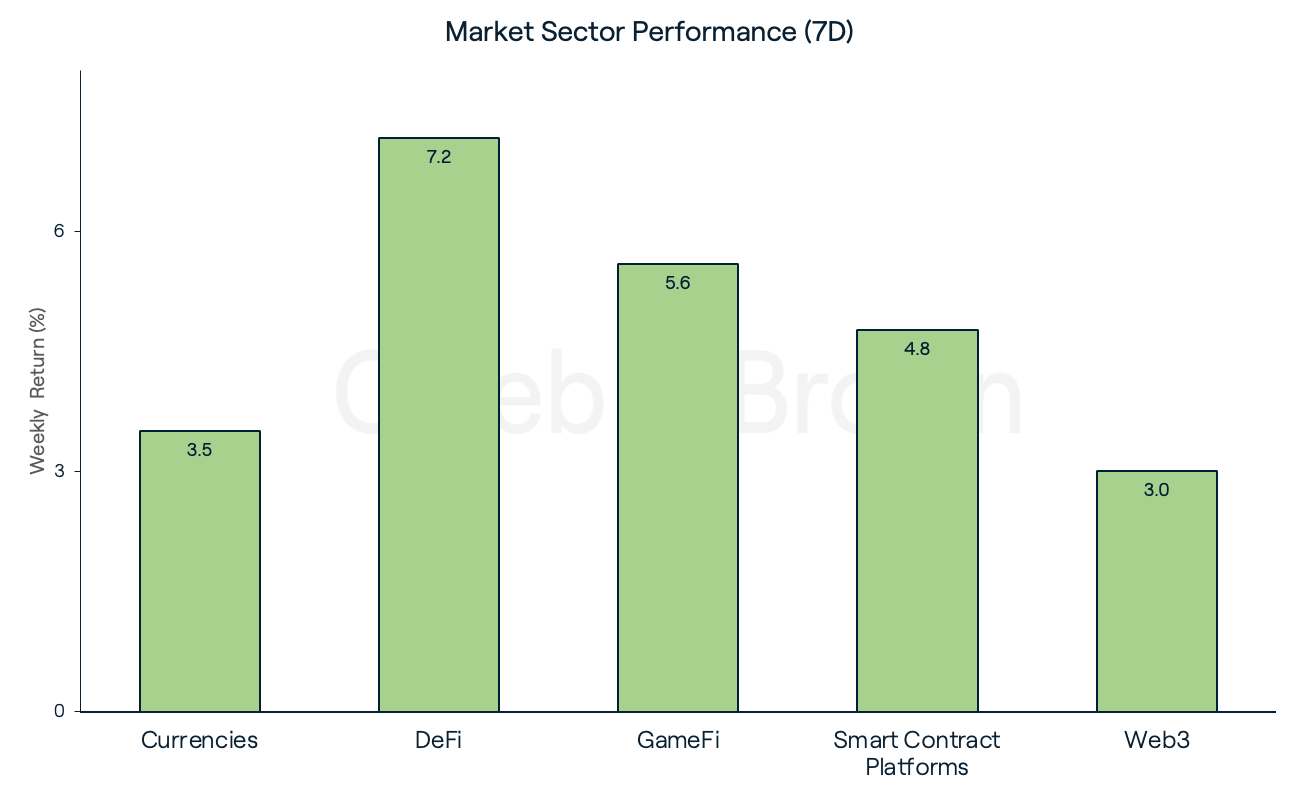

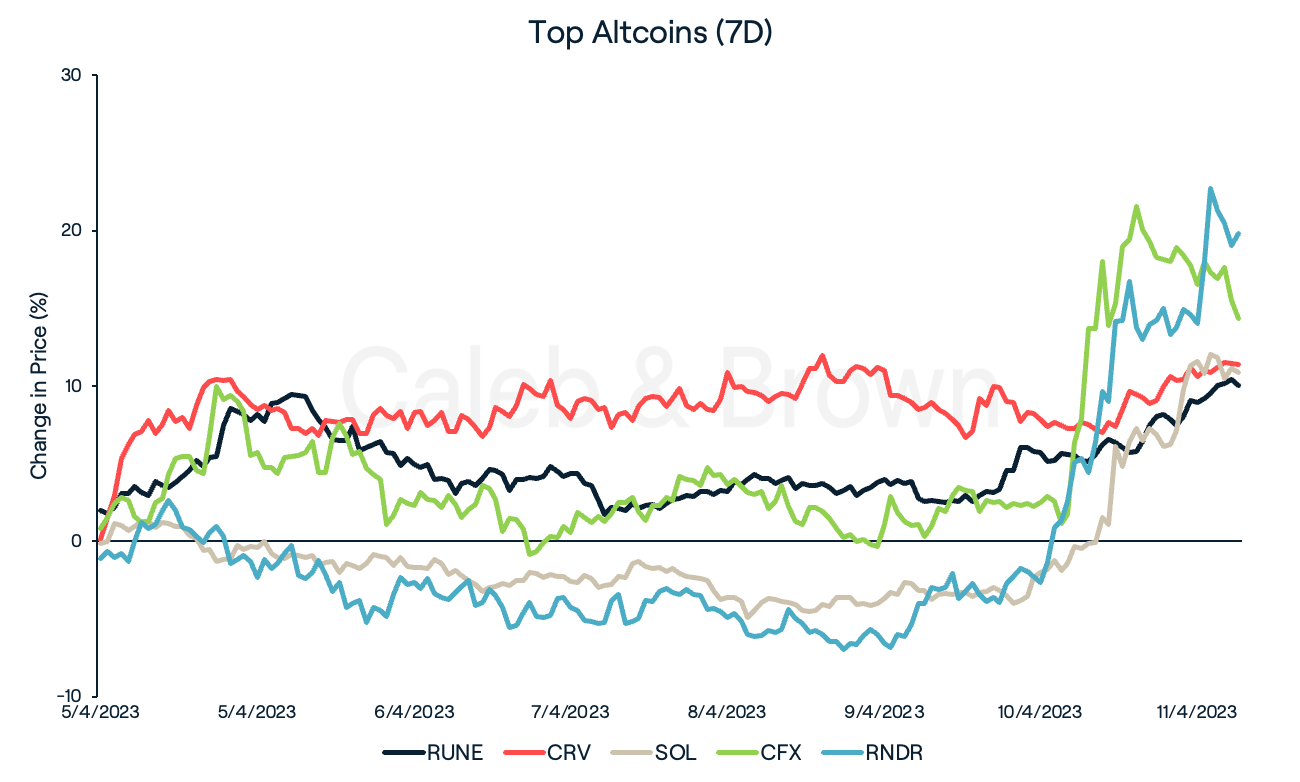

With BTC surging to US$30,000 all market sectors followed and were in the green this week with a number of altcoins securing double-digit gains. DeFi was the best performing sector gaining 7.2% week-on-week. GameFi and Smart Contract Platforms followed closely adding 5.6% and 4.8%, respectively.

Within the DeFi sector THORChain (RUNE), and Curve DAO (CRV) were this week’s winners, each rallying 10.0%, and 11.3% respectively. DeFi picked up again this week after a lawsuit was filed against the world’s leading centralised exchange, Binance. This resulted in an uptick in total value locked (TVL) in RUNE and CRV, according to DefiLlama.

Layer-1 protocol Solana (SOL) rallied 10.8% week-on-week. A factor which may be prompting excitement around Solana is the release of Saga, an Android smartphone powered by the Solana blockchain, on April 13. The phone is expected to let users mint their own NFTs from anywhere and access the wider Solana-based ecosystem of apps and projects.

Conflux (CFX) made a weekly gain of 14.3%. With its mainnet upgrade around the corner, Binance annouced that it will support the integration, proving to be a bullish indicator for investors. CFX is up over 1800% since the start of the year after scoring major deals with China Telecom and Little Red Book.

Render (RNDR), the peer-to-peer GPU marketplace that lets users contribute computational power to 3D rendering projects and earn crypto in return, jumped 19.8% over the past seven days. An improvement proposal that will migrate its network from Ethereum to Solana recently passed, aiming to enhance long term network scalability.

In Other News

Swiss Bank PostFinance to Roll Out Crypto Services for Clients

In another step towards worldwide adoption, Switzerland's government-owned financial services company, PostFinance, has joined forces with Sygnum's B2B (business-to-business) banking platform to provide its clients with a variety of authorised cryptocurrency services.

Through this collaboration, PostFinance's extensive customer base, which includes over 2.5 million individuals, can now purchase, hold, and trade digital assets such as Bitcoin (BTC) and Ethereum (ETH). PostFinance stands as the country's fifth-largest financial services company.

Ralph Lauren is Going Crypto

Ralph Lauren, the US-based fashion brand, revealed its plans to launch a luxury-focused concept store in Miami's Design District on Tuesday. The store will cater to the city's thriving Web3 community and allow customers to make purchases using cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Polygon (MATIC), and Dogecoin (DOGE), thanks to a partnership with crypto payment provider, BitPay.

Notably, this will be the first time a Ralph Lauren store has enabled cryptocurrency payments and will provide further utility for crypto in the tangible world.

Binance Australia Derivatives AFSL Cancelled

On Thursday, the Australian Securities & Investments Commission (ASIC) announced its decision to revoke the Australian financial services licence (AFSL) of Binance Australia Derivatives, which authorised the firm to provide over-the-counter (OTC) derivative products to customers based in Australia.

Importantly, the cancellation follows a request which was first made by the crypto derivatives exchange with the announcement being made by ASIC the day after the request was submitted.

"Following recent engagement with ASIC, Binance has chosen to pursue a more focused approach in Australia by winding down the Binance Australia Derivatives business,” said a Binance spokesperson.

The cancelation will come into effect April 14 but will not effect Binance Australia’s spot exchange product.

Recommended Reading: Common Crypto Investing Strategies Every Investor Should Know

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F3zkHvjjxJmP2hU2P9EG39A%2F8150cbbd364048df222e2a717e6402f3%2FMarch_15__2023__3_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-04-12T12%3A19%3A46.745Z)