Market Highlights

- U.S. inflation figures beat expectations with Consumer Price Index (CPI) rising 5.0% annually and 0.1% monthly.

- Ethereum’s (ETH) “Shapella” upgrade successfully launched on Wednesday seeing ETH shoot to an 11-month high.

- SEC Chair Gary Gensler under scrutiny after he proposed legal definition changes to “securities exchange” to include decentralised digital asset exchanges.

Price Movements

Bitcoin

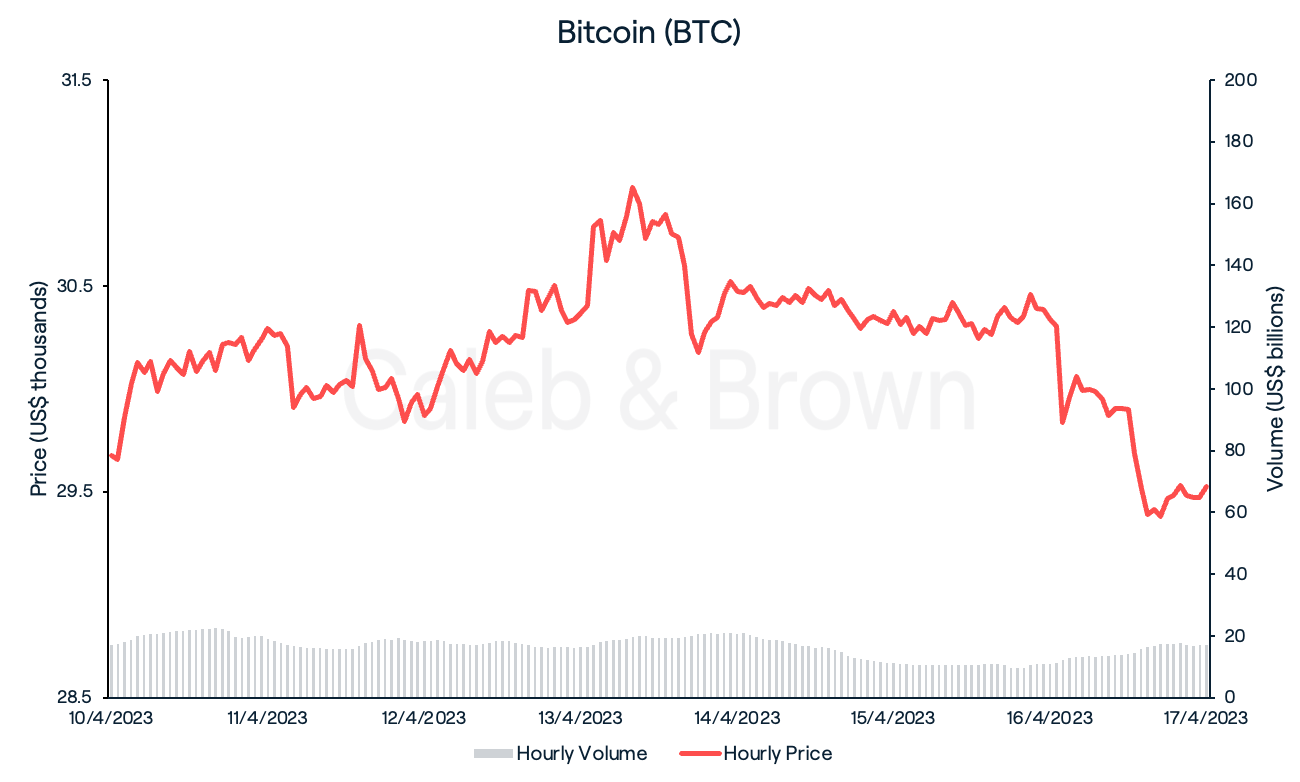

After an explosive week which brought Bitcoin (BTC) back above US$30,000 for the first time in ten months, BTC has cooled-off for a relatively flat week of trading. BTC was able to hold onto its gains for the most part, reaching a high of US$31,000 Friday morning before dipping below US$30,000 briefly over the weekend.

BTC closed the week at US$29,526, tracking down a slight 0.5%.

A key driver for Bitcoin’s recent price action was the release of the latest U.S. inflation figures by the Bureau of Labor Statistics on Wednesday. Consumer Price Index (CPI), a widely followed measure of the costs for goods and services in the U.S. economy, rose 5.0% in the 12 months through March, beating forecasts of 5.1%. On a monthly basis, the index rose 0.1%, a notable deceleration from 0.4% in February.

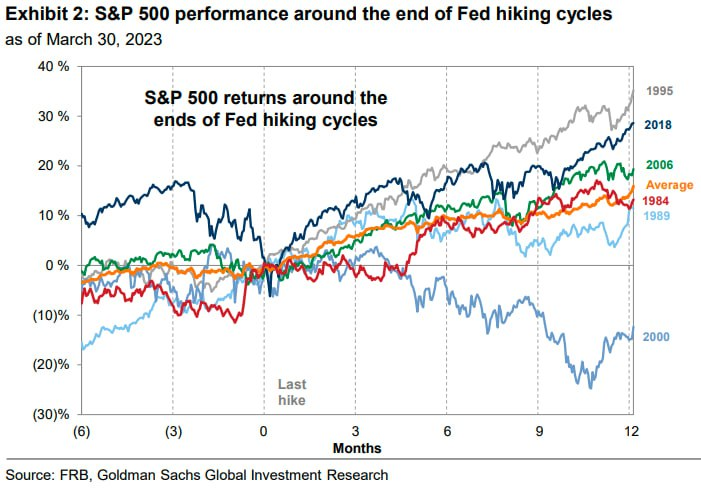

This latest reading is a potential indicator that the Fed could back down from its policy of raising interest rates, with economists at Goldman Sachs no longer expecting the U.S. Federal Reserve (The Fed) to raise interest rates in June.

What could this mean?

Historically, with the single exception of 2000, the S&P 500 has recovered strongly in the twelve months following the ends of Fed interest rate hiking cycles. While this may not directly translate to the crypto market, BTC remains 63% correlated to the S&P500 today.

Ethereum

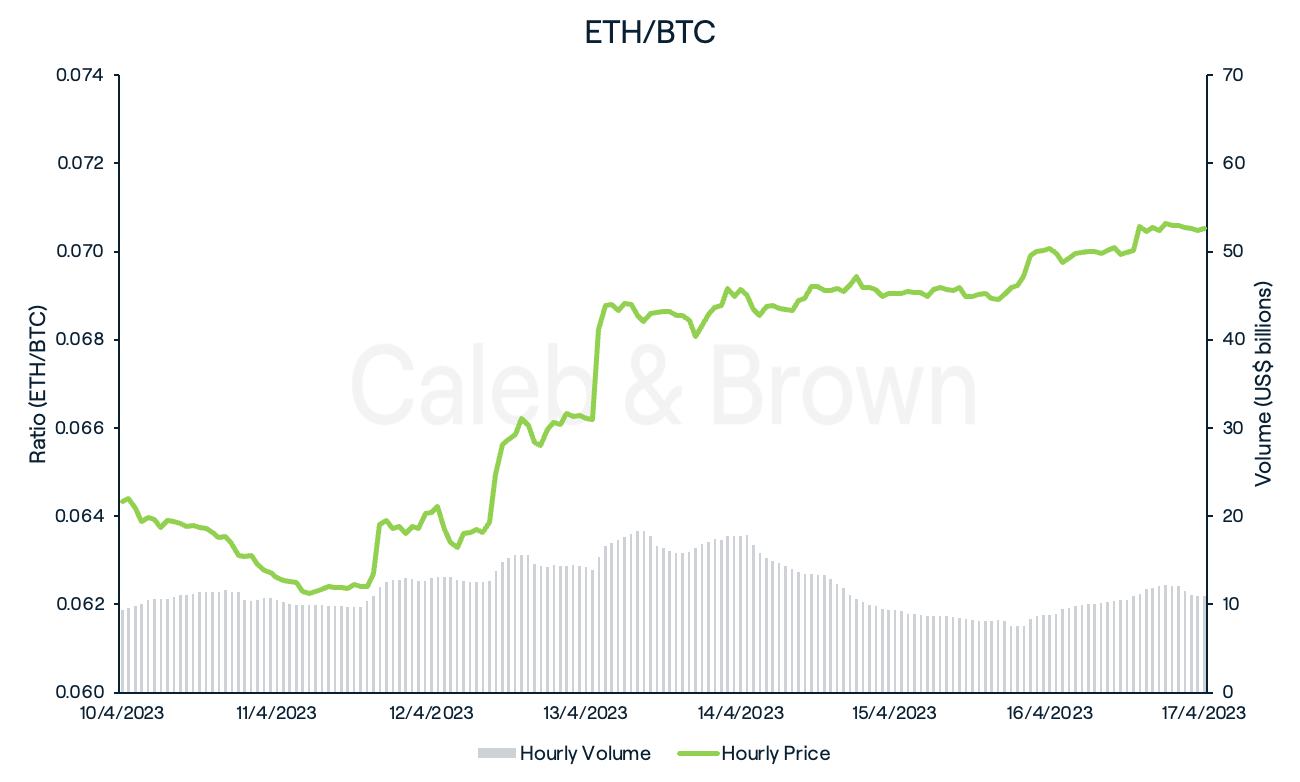

Taking the spotlight away from BTC this week was Ethereum (ETH) which grew a fantastic 9.1% over the last seven days.

The catalyst for this price surge was the successful launch of the highly anticipated “Shapella” upgrade, which went live on Wednesday. This means the network behind the world’s second-largest cryptocurrency by market cap will finally allow users to withdraw the ETH that has been locked-up over the past two years.

While some analysts believed the huge unlock (over 18 million ETH) would not cause a major selling event, very few anticipated a sharp increase in price either, with ETH reaching an 11-month high of US$2,141. In fact, 27,145 ETH (approx. US$56 million) of net deposits were staked onto the Beacon Chain over the last 24 hours (at the time of writing). Having no lock-up period on staked ETH may now allude to the potential rise in institutional interest in staking ETH, meaning in the long-term more ETH could be staked on the network, rather than less.

Lachlan Feeney, founder and CEO of Australian blockchain consultancy Labrys said, “Previously, institutional investors would likely have been reluctant to lock their assets without the option to withdraw. Now that such an option exists, it de-risks their investment, removing the deterrent that previously existed.”

ETH closed the week at US$2,082. The ETH/BTC ratio climbed from ~0.0643 to ~0.0705, taking back 9.6% relative market share against BTC.

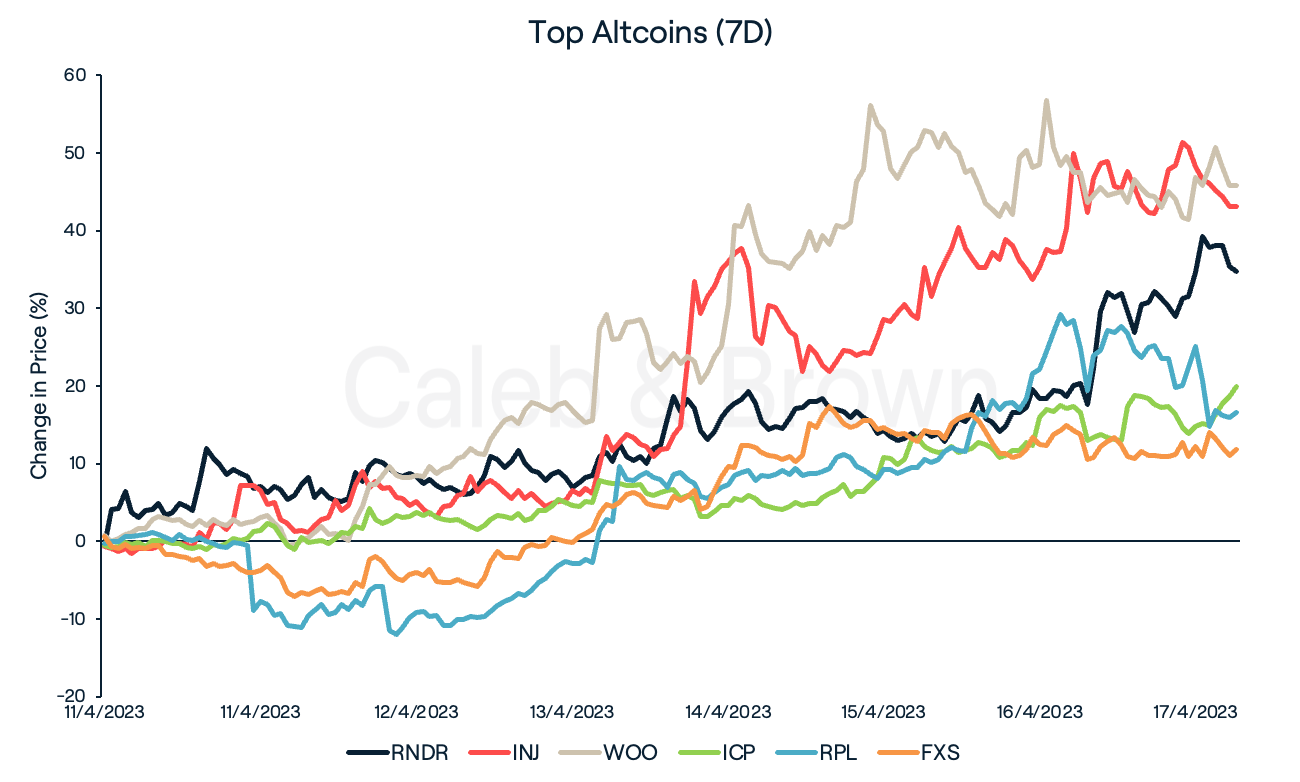

Altcoins

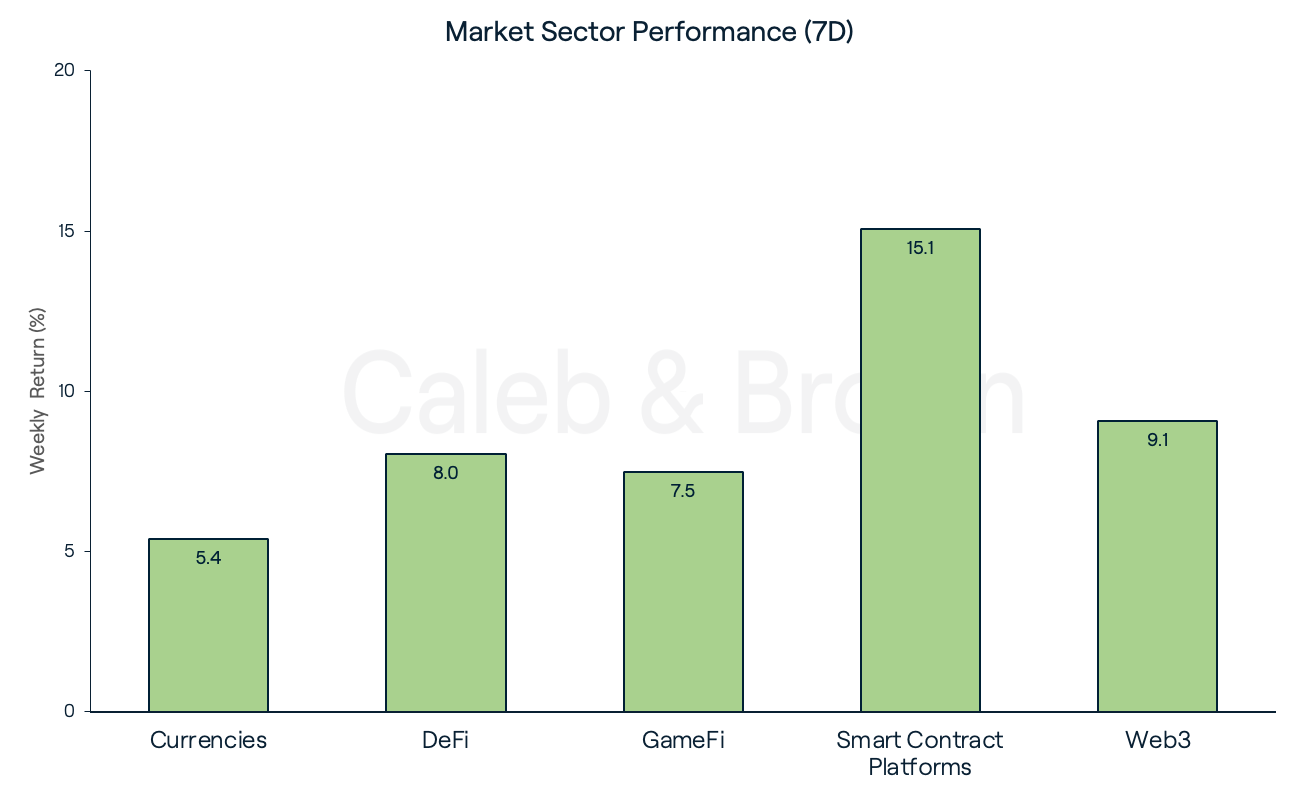

Market participants retained a bullish sentiment this week with all sectors staying in the green for two weeks running. Smart Contract Platforms exploded over the week, adding on 15.1% while Web3 and DeFi followed closely, surging 9.1% and 8.0%, respectively.

Render (RNDR) found itself amongst the top performers for the second consecutive week, rallying 34.7% over the last seven days. RNDR was behind many of the 3D visuals shown at the recent NFT NYC event, including renowned digital artist Beeple, who displayed live interactive art using the technology.

Behind DeFi’s performance this week were Injective (INJ) and WOO Network (WOO) which grew 43.1% and 45.8%, respectively. Both protocols have grown in popularity recently with major crypto exchange Kraken, integrating the INJ native token last week while WOO grew to become the second most active DeFi protocol, measured by unique active users.

Other notable performances include internet-of-things (IoT) protocol, Internet Computer (ICP) which rallied 19.9% week-on-week. Ethereum staking solutions, Rocket Pool (RPL) and Frax Shares (FXS) also managed to secure double-digit gains, benefitting from the successful launch of the “Shapella” upgrade earlier this week. RPL and FXS each rallied 16.6% and 11.7%, respectively.

In Other News

Elevating the Next Generation of Music: Priceless

Payments giant MasterCard, unveiled the MasterCard Artist Accelerator Program on Wednesday, which included complimentary Polygon-based NFTs. This program offers music and NFT enthusiasts several benefits like exclusive music content, while also equipping participating musicians with the necessary resources and support to launch their own NFTs.

Singapore-based Crypto Exchange Bitrue Hacked, US$23 Million Drained

In another blow to centralised players, Bitrue, a centralised crypto exchange, declared that it had discovered a vulnerability in one of its hot wallets. This flaw enabled a perpetrator to withdraw digital assets worth around US$23 million, comprising of Ethereum (ETH), Quant (QNT), GALA (GALA), Shiba Inu (SHIB), Holo (HOT), and Polygon (MATIC). Despite holding less than 5% of the exchange's total funds, Bitrue has temporarily halted withdrawals from the platform until April 18.

Recommended reading: Crypto Security Part 1: Best Practices

Regulatory

SEC Chair Gary Gensler to Face U.S. Congress After Proposed Amendments to Exchange Act Rule 3b-16

Securities and Exchange Commission (SEC) Chair Gary Gensler is scheduled to testify before the full U.S. House Committee on Financial Services on the topic of "Oversight of the Securities and Exchange Commission" on Tuesday. The Subcommittee on Digital Assets, Financial Technology and Inclusion will also review draft legislation concerning stablecoins the following day.

Gensler is encountering opposition from an SEC colleague over his regulatory actions. On Friday, SEC Commissioner Hester Peirce objected to Gensler's recent policy change, which broadens the legal definition of a securities exchange to include digital asset and cryptocurrency exchanges. Gensler argued that revising the definition of "exchange" in the federal Exchange Act Rule is necessary for regulating crypto asset securities trading platforms, such as DeFi systems. He contended that "a considerable number of crypto trading platforms already meet the existing definition of an exchange.”

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2FLxHNnZGUCxRzz9ZpaBC50%2F56b5b19c1c96a2ea61c66162d11795ed%2FMarch_15__2023__4_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-04-18T01%3A32%3A08.704Z)