Market Highlights

- The crypto market recovered as geopolitical tensions between Israel and Iran eased this week.

- Spot Bitcoin and Ethereum ETFs to Launch After Hong Kong SFC Approval

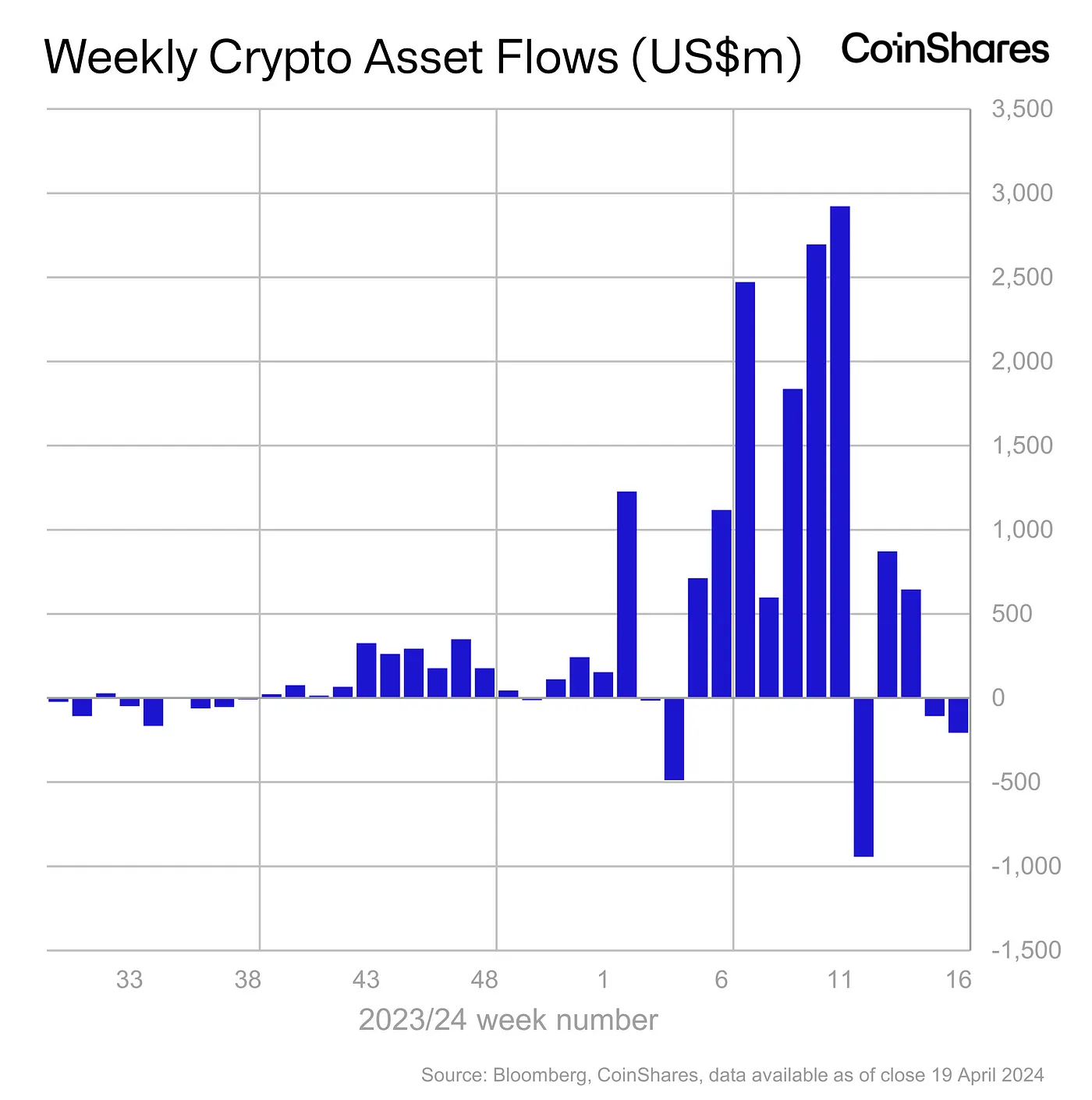

- Digital asset investment products experienced outflows totalling US$206 million.

Bitcoin (BTC)

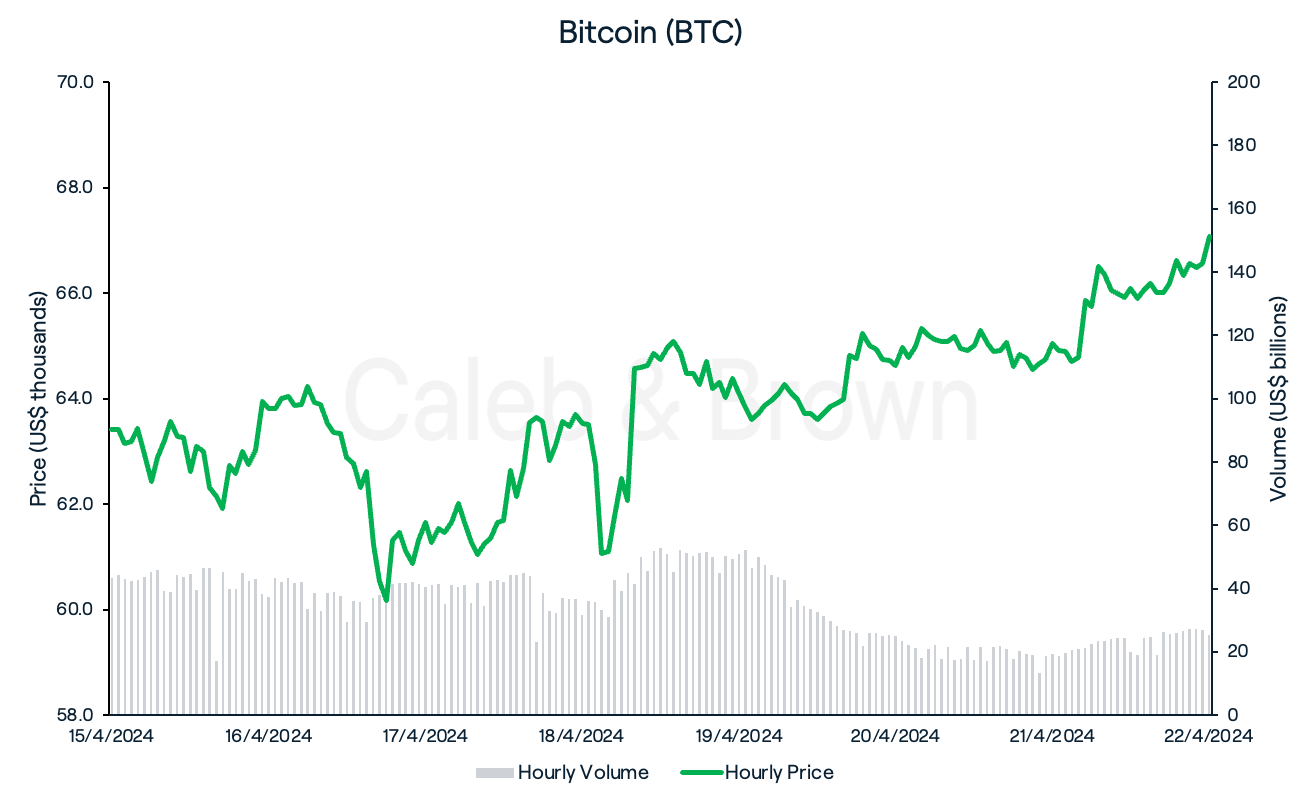

It was another rollercoaster week for Bitcoin (BTC) and the broader crypto landscape, with most eyes fixed on the quadrennial Bitcoin halving finally executing early Saturday morning, on 4/20.

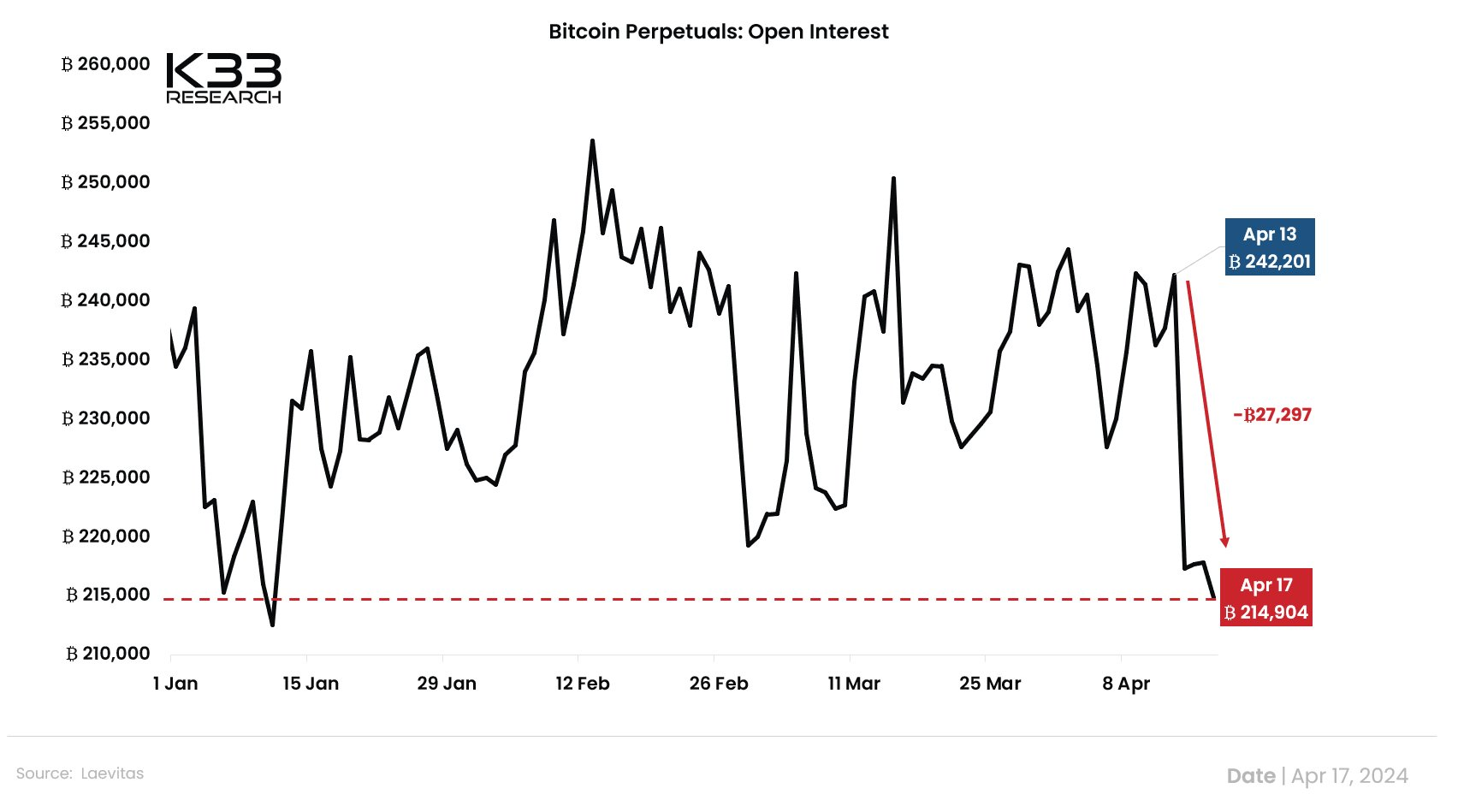

Israel launched missiles into Iran early Friday in a retaliatory strike, causing a stir in global markets, and BTC to dip below US$60,000 for the first time since late February. This saw a cascade of liquidations and sudden drop in BTC futures Open Interest, possibly signalling a “deleveraging event.”

Prices were quick to rebound however after Iran downplayed the airstrikes in a potential attempt to de-escalate the conflict, as BTC quickly shot back up nearly 6.0%.

A continued rally over the weekend saw BTC close the week at US$67,067, up 5.8% over the last seven days.

Past performance is not indicative of future results.

Ethereum (ETH)

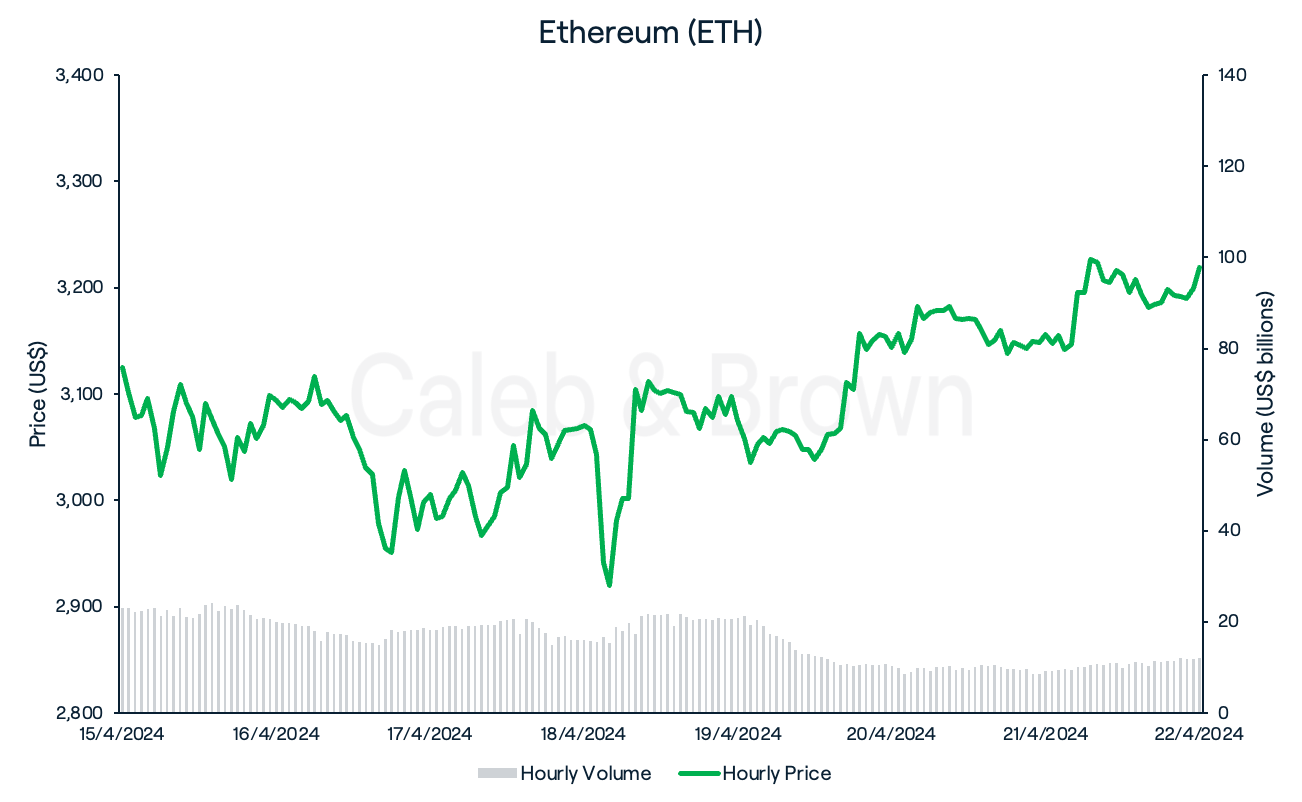

Ethereum (ETH) experienced similar levels of volatility this week, dipping as low as US$2,865 before a strong recovery over the weekend placed it back above US$3,200.

The volatility seen this week may be tied to Hong Kong joining the digital asset ETF (exchange traded fund) party, after three ETF providers received regulatory approval by Hong Kong’s Securities and Futures Commission (SFC) to launch spot Bitcoin and Ethereum ETFs.

While Bloomberg ETF analyst, Eric Balchunas provided a list of reasons to not expect a sudden pour of inflows, it is believed that these approvals could lead to more progressive regulation in China and “…set a precedent for other financial markets in Asia”.

Despite the volatility ETH closed the week at US$3,219, up 3.0%.

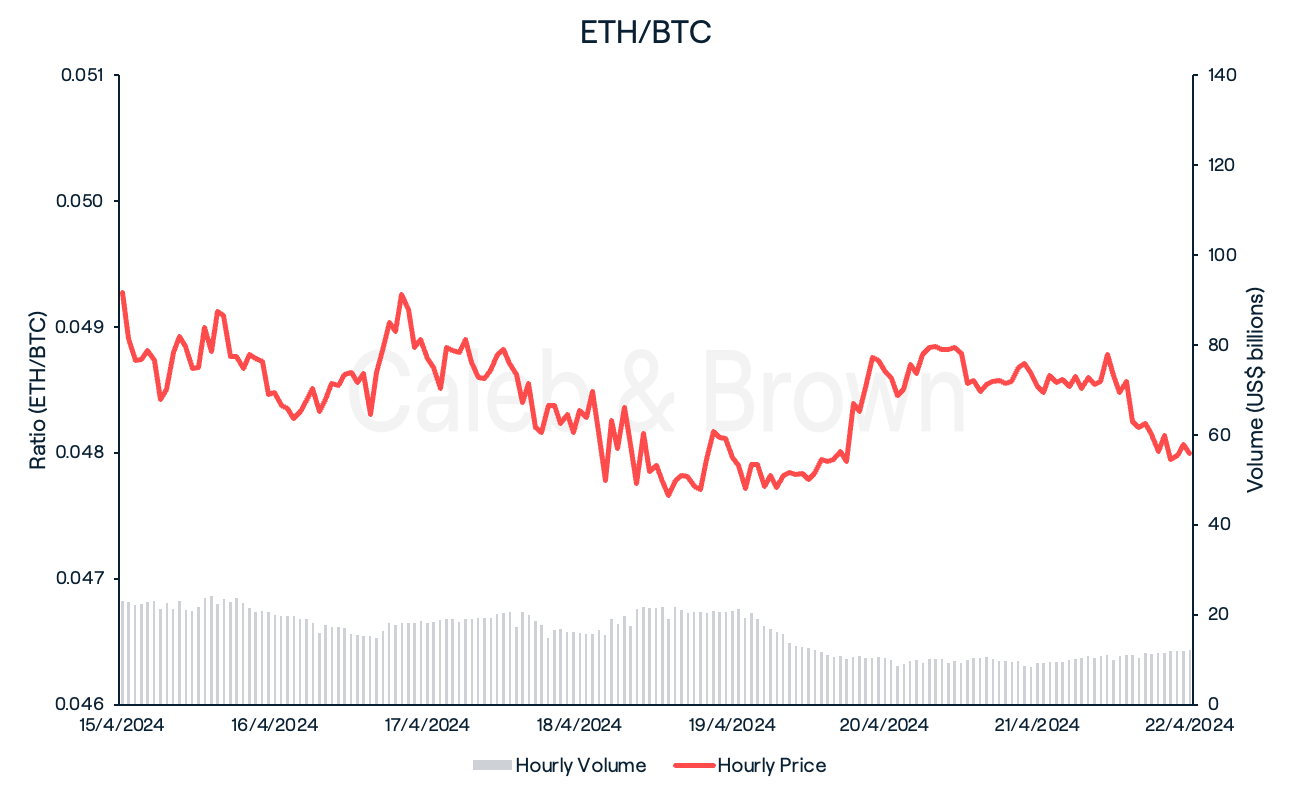

This saw ETH underperform BTC again this week as the ETH/BTC ratio fell 2.6%.

Past performance is not indicative of future results.

Altcoins

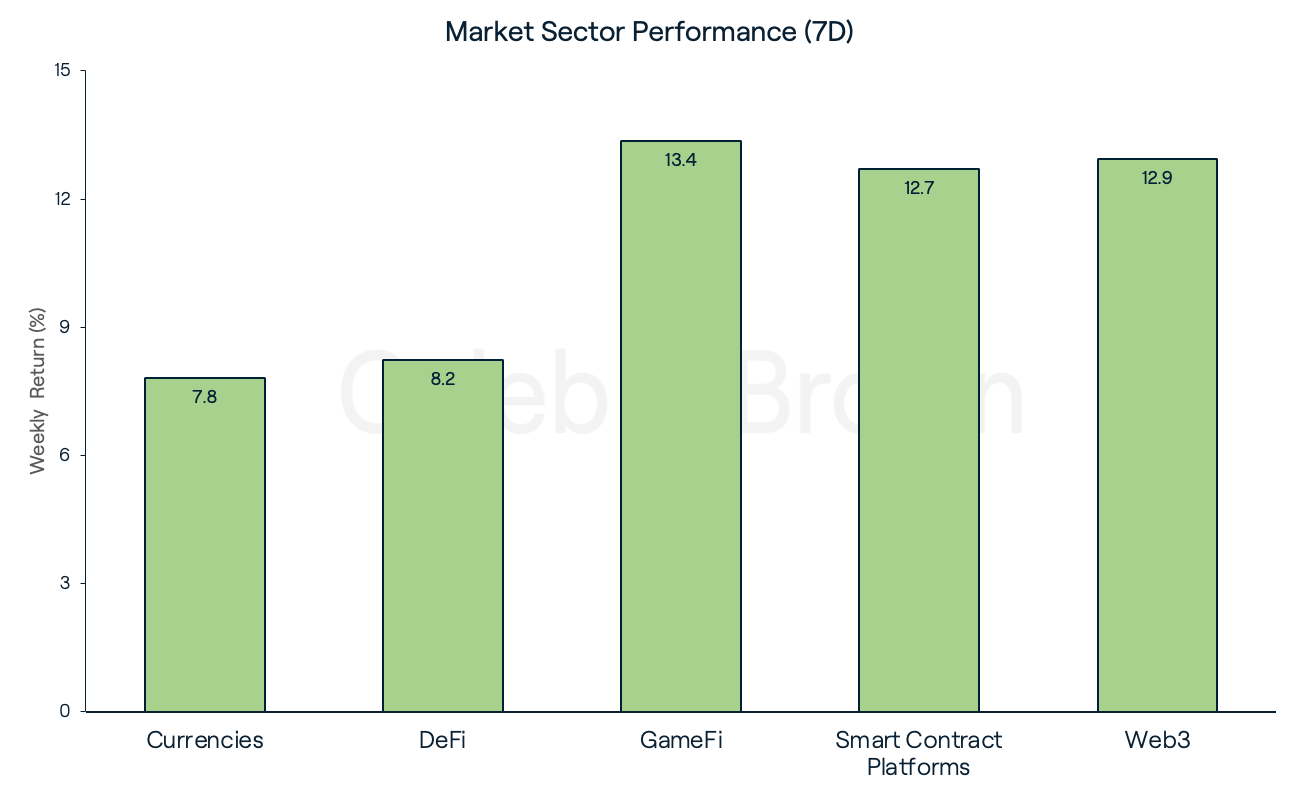

GameFi, led market sector performance this week, rallying 13.4%. This was followed closely by Web3 and Smart Contract Platforms which added 12.9% and 12.7%, respectively.

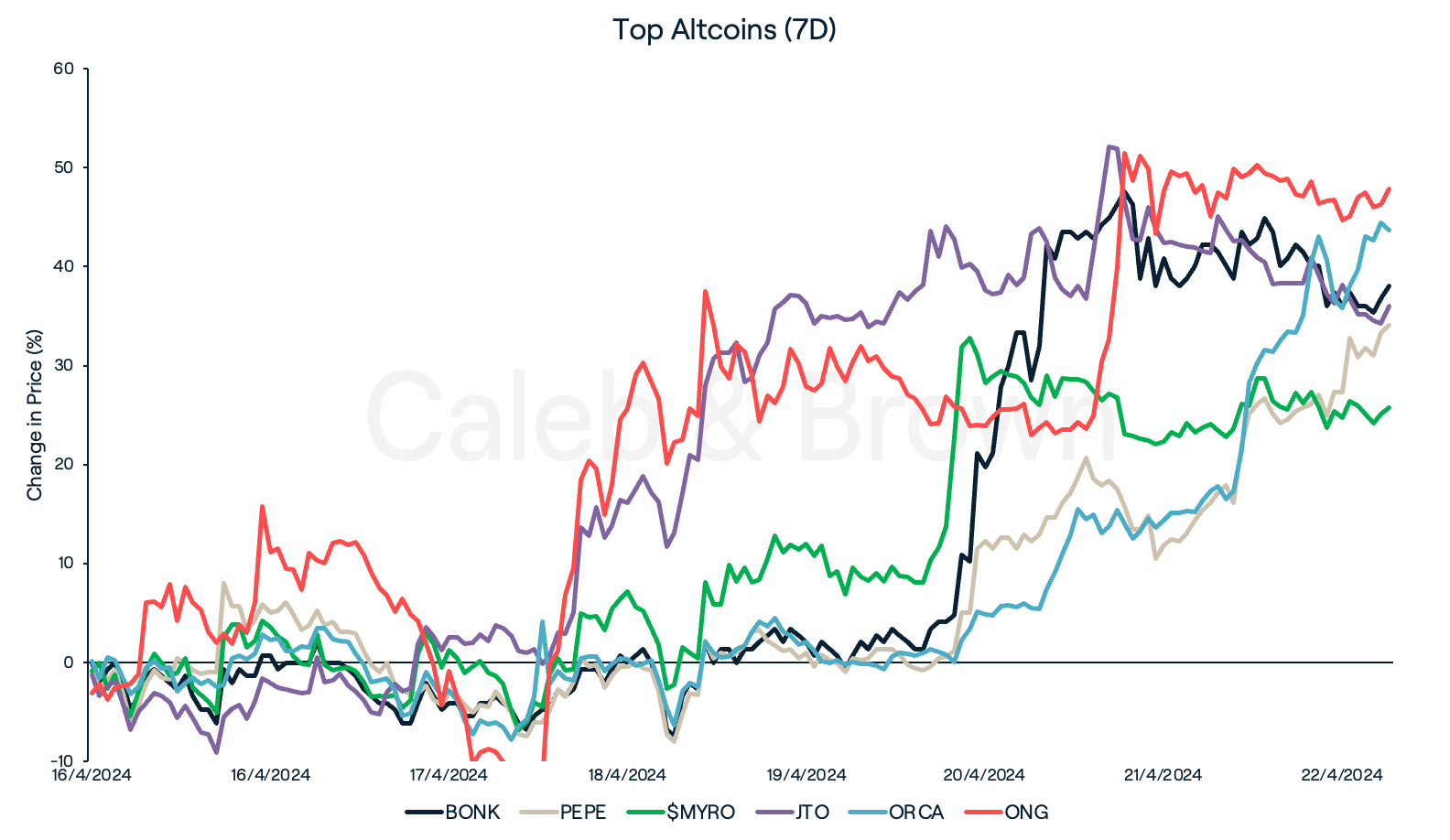

After a large market-wide sell-off last week, memecoins rebounded aggressively with Bonk (BONK), Pepe (PEPE), and Myro ($MYRO) running away with 38.1%, 34.1%, and 25.7% gains, respectively.

Solana-based DeFi protocols, Jito (JTO) and Orca (ORCA) also displayed a strong performance this week after rallying 36.0% and 43.7%, respectively. Jito surged on the news of its StakeNet user interface update while Orca users were recently allocated a portion of Bitget Wallet’s token airdrop.

Ontology Gas (ONG) was the top performer for the second consecutive week, surging 47.9% over the last seven days, and 93.9% over the last 30.

Past performance is not indicative of future results.

In Other News

-

Now entering Bitcoin’s fifth epoch, a new era of digital scarcity has been ushered in. But what can we expect from here? In a recent blog post, VanEck’s Head of Digital Assets Research, Matthew Sigel wrote that Bitcoin’s “most explosive gains” typically occur 180 days after the halving, and has, on average, risen 427% from 30 days before the halving to 180 days after. It is important to note that past performance is not indicative of future results.

-

For the second consecutive week, digital asset investment products experienced outflows totalling US$206 million, as the market expects interest rates to remain stagnated in the coming months.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.