Market Highlights

- Bitcoin (BTC) and Ethereum (ETH) give up last week’s gains as fears of another interest rate hike loom.

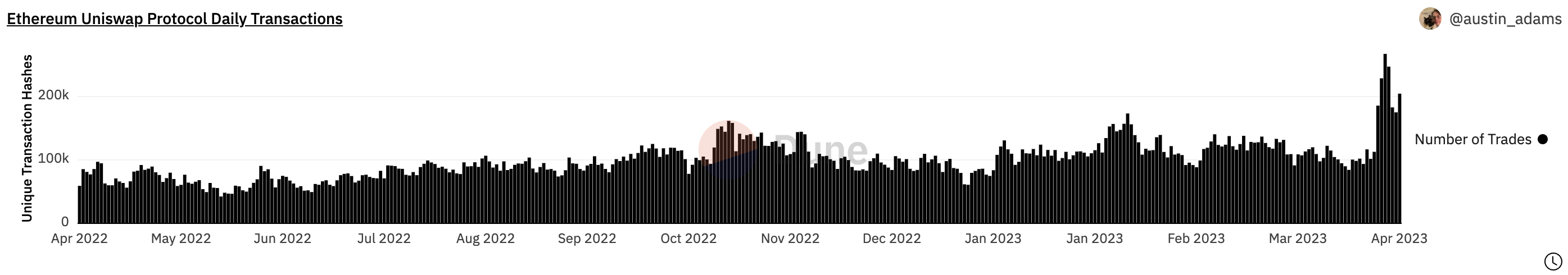

- The largest DEX (decentralised exchange) by volume Uniswap (UNI), sees a 66% spike in daily transactions from its peak after ‘memecoin frenzy’ sweeps market.

- The U.S. Securities and Exchange Commission (SEC) continued its regulatory crackdown after it filed a motion against centralised exchange Bittrex and its and its co-founder and former CEO William Shihara for “operating an unregistered national securities exchange, broker, and clearing agency”.

Price Movements

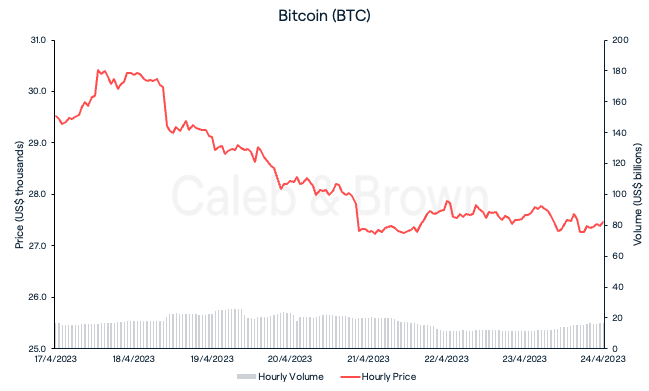

Bitcoin

This week, markets were at the mercy of macroeconomic factors as some at the Fed (U.S. Federal Reserve) had indicated support for another rate hike next month, stalling last week’s rally. BTC attempted to hold above US$30,000 at the beginning of the week but dipped suddenly on Wednesday, dropping 3% in just an hour. This saw over US$50 million in leveraged long BTC positions liquidated the same day and over US$260 million liquidated across the market.

BTC continued to trend down for the remainder of the week and closed it at US$27,457, down 7.0% over the last seven days.

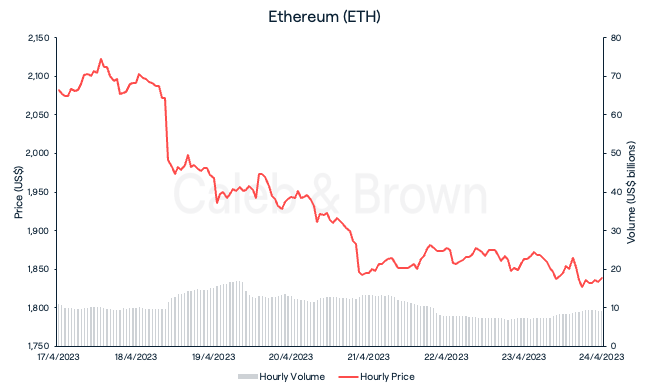

Ethereum

Ethereum (ETH) also performed poorly this week, losing all of last week’s gains after the successful Shapella upgrade rally. Similar to BTC, ETH held above US$2,000 for the first part of the week but fell promptly on Wednesday. ETH shed 5.0% in less than an hour to bring it back below the US$2,000 mark. ETH slowly bled for the rest of the week where it closed at US$1,838, losing 11.7% week-on-week.

Despite the poor price performance, the largest DEX (decentralised exchange) by volume, Uniswap (UNI), built on Ethereum, saw a large spike in transaction count this week. Trades on the exchange were up more than 66% from last peak, and were likely due to the recent ‘memecoin’ frenzy which saw one user turn US$250 to US$1 million in four days with the coin, PepeCoin (PEPE).

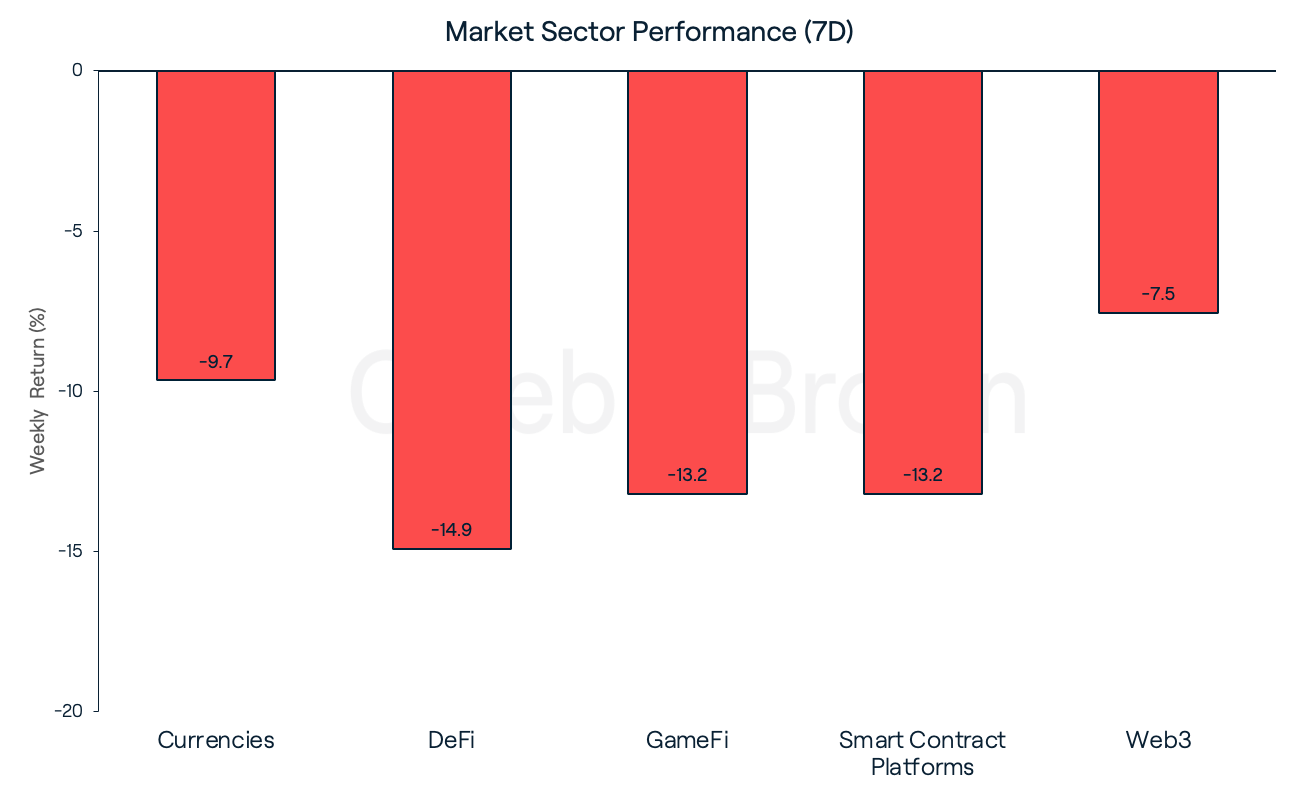

Altcoins

It was a bloodbath across all sectors this week with DeFi taking the biggest hit, losing 14.9% over the last seven days. GameFi and Smart Contract Platforms followed with both falling 13.2%. Web3 held on the strongest decreasing 7.5% week-on-week.

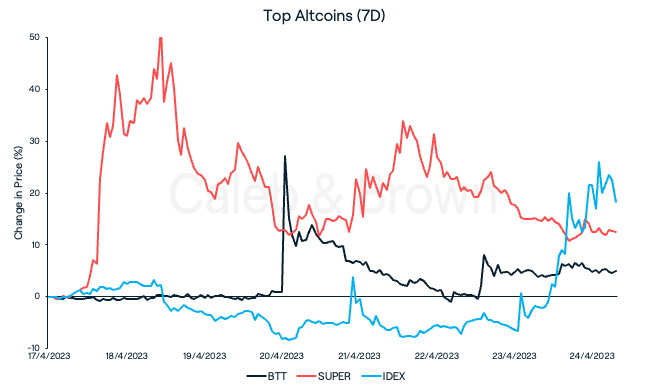

Not many tokens saw positive returns this week but two that emerged on top were BitTorrent (BTT) and SuperVerse (SUPER), each returning 4.9% and 12.3%, respectively. BTT is a utility token built on the Tron (TRX) network that allows holders to use its decentralised file sharing protocol. BTT recently updated its Storage3 app which facilitates web3 website and application hosting.

Important to note, BTT, TRX, and owner Justin Sun are the subjects of an SEC complaint for the “unregistered offer and sale of crypto asset securities.”

IDEX (IDEX), a decentralised perpetual exchange that aims to bring centralised functionality with decentralised custody jumped 18.3% this week. IDEX just released v4 of its product and is currently testing its mainnet launch scheduled for this quarter.

Helium (HNT), a wireless network powered by crypto, has completed its transition from its own layer-1 blockchain platform to Solana (SOL). According to the founders and supporters of Helium, this move to Solana has the potential to enable increased speed, stability, and scalability.

In Other News

Institutional Investors Flock to Ethereum Staking Following Shanghai Upgrade

The demand for Ethereum staking products by institutional investors has boomed since the successful Shanghai upgrade went live on April 12. Inflows to top institutional staking providers has so far been three times larger in April compared to last month’s total. About 80% of April’s total inflows came after the Shanghai upgrade, showing strong trust and approval of the upgrade. While significant, the unlock of 18 million tokens (worth approx. US$35 billion) was largely expected to be staked, as shown by Kiln’s survey, whereby 68% of institutional investors on the platform said they intend to start staking or increase their staked amount after Shanghai.

Gemini to Join Coinbase, Launch Products Outside of the U.S.

Centralised exchange Gemini announced that it will be looking to launch products outside of the U.S., which has been its domicile since its inception in 2015. The company says its first derivative product will be a BTC perpetual futures contract. This follows Coinbase’s announcement last month stating it will also be looking to base more products outside of the United States, sighting a poor regulatory environment.

SEC Sets Its Sights on Bittrex

The U.S. Securities and Exchange Commission (SEC) has taken action against Bittrex in its most recent move to regulate the crypto industry. The SEC alleges that Bittrex and its former CEO Bill Shihara intentionally evaded the registration requirements of federal securities laws by directing issuers of crypto assets to remove specific statements from their offering materials that would classify them as securities. Bittrex had previously announced its intention to terminate operations in the United States by the end of April due to regulatory ambiguity.

Regulatory

Europe to Bring Regulatory Clarity as MiCA Crypto Law Passes

The European Parliament approved a significant cryptocurrency legislation that will establish new regulations for the industry across all 27 member states.

Markets in Crypto Assets (MiCA) passed with a vote of 517 in favour, 38 against, and 18 abstentions during a meeting held in Strasbourg on Thursday, after two and a half years of discussions and adjustments. MiCA primarily concerns crypto-asset providers and their obligation to disclose information around matters such as transparency and environmental impact. It will also impose substantial requirements for stablecoin issuers, such as maintaining sufficient cash reserves.

Most importantly, it aims to provide clarity in the harsh regulatory environment that currently exists, attracting institutional investors and larger firms to the European crypto market, leading to increased investment and growth opportunities for the space.

Recommended Reading: Bitcoin's Market Cycle

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F64eYlwC3kPT3vRJ8haY6ic%2F4cf3de7d210dd8e0ceef292b53791174%2FMarch_15__2023__5_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-04-26T03%3A50%3A09.072Z)