Market Highlights

- Binance and its CEO Changpeng ‘CZ’ Zhao were sued by the U.S. Commodity Futures Trading Commission (CFTC) on Monday, sowing the seed for another volatile week in the crypto space.

- Ethereum (ETH) confirmed its next major upgrade, Shapella (Shanghai + Capella) to roll out on April 12. The upgrade will allow eligible users to un-stake their staked ETH for the first time.

- Dogecoin pumps on the back of more Elon Musk Twitter shenanigans.

- Bittrex, a major cryptocurrency exchange revealed its plan to terminate its operations in the United States, citing a poor regulatory environment.

Price Movements

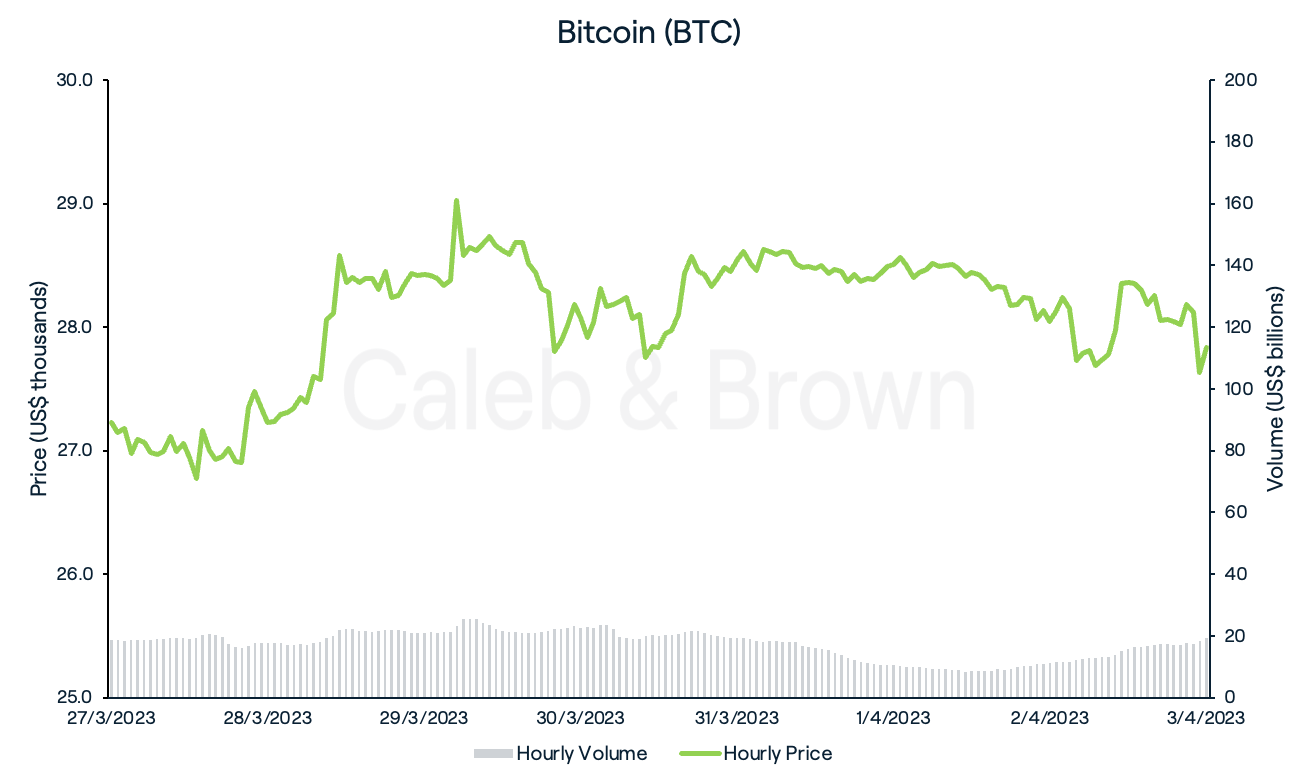

Bitcoin

Bitcoin (BTC) experienced another volatile week as it ranged from US$26,500 to US$29,000, similar to the week before. BTC dipped 3.3% on Monday after the largest crypto exchange by volume, Binance, and its CEO Changpeng Zhao were sued by the U.S. Commodity Futures Trading Commission (CFTC). The U.S. regulator alleged that Zhao and his company violated derivatives trading rules, according to a lawsuit filed by the CFTC in the U.S. District court for the Northern District of Illinois.

Zhao expressed his disappointment towards the lawsuit claiming that they had cooperated with the CFTC for the last two years. Consequently, Binance saw a net outflow of US$850 million in the 24 hours following the announcement. However this is a relatively small figure compared to the outflow of US$3 billion seen late last year after Binance paused USDC withdrawals.

As such, BTC was able to recover over the following few days as it surged 7.8% to a high of US$29,184. BTC fell slightly over the weekend to close the week at US$27,832 for a weekly gain of 2.2%.

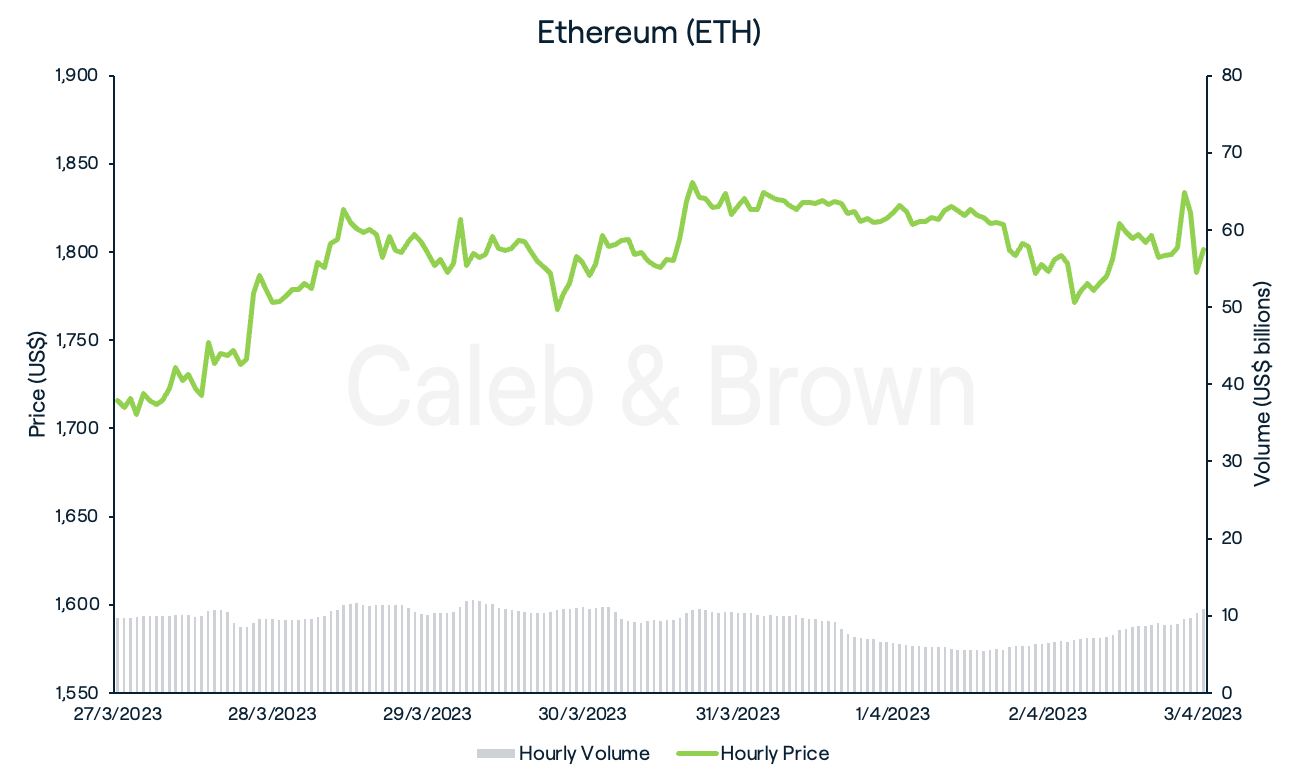

Ethereum

Ethereum (ETH) reflected similar price action to BTC this week however was able to hold the line slightly stronger, falling just 3.0% on the Binance news. ETH also traced back its losses over the next few days as it shot up 8.6% to a high of US$1,825 Friday night.

The ETH//BTC pairing ratio increased slightly from ~0.0633 to ~0.0648, taking back 2.9% relative market share from the market leader.

ETH closed the week at US$1,801 representing a week-on-week gain of 5.0%.

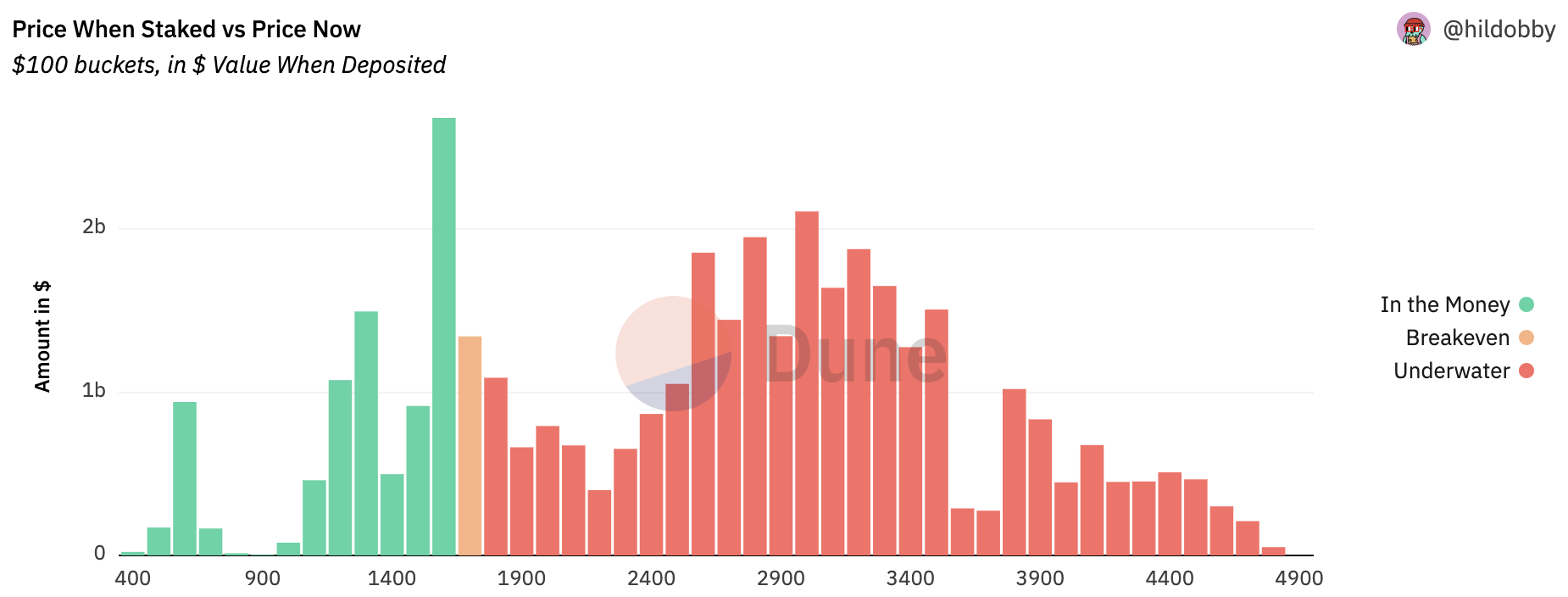

Six months since The Merge, a date for the next major upgrade, Shapella, has finally been confirmed. On April 12, 10:27pm UTC, the long-awaited Shapella fork will come into effect, allowing eligible users to withdraw their staked ETH.

With over 18 million ETH currently staked on the Beacon Chain, this means US$32 billion (at a market rate of US$1,780/ETH) worth of ETH will be incrementally unlocked after the 12th. While this could point to a massive selling event it should be noted that roughly 75% of stakers remain underwater.

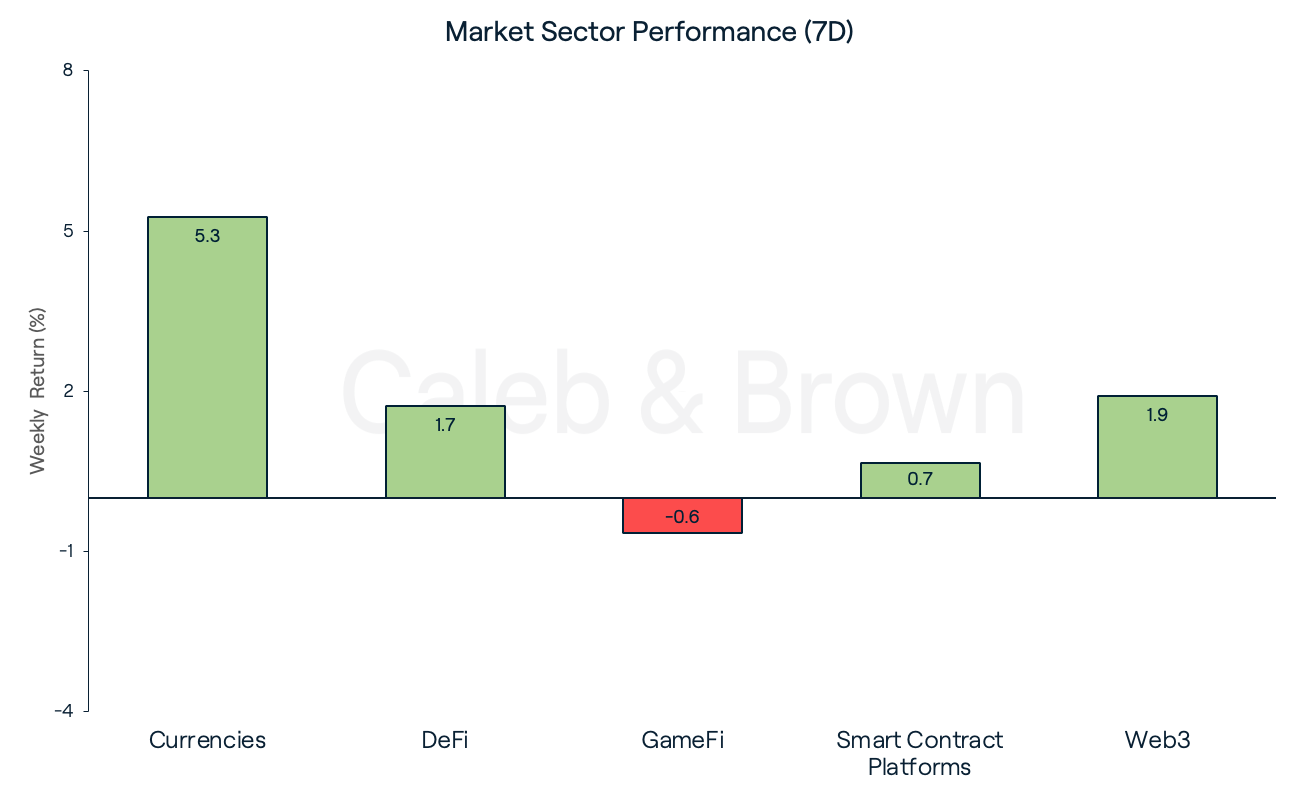

Altcoins

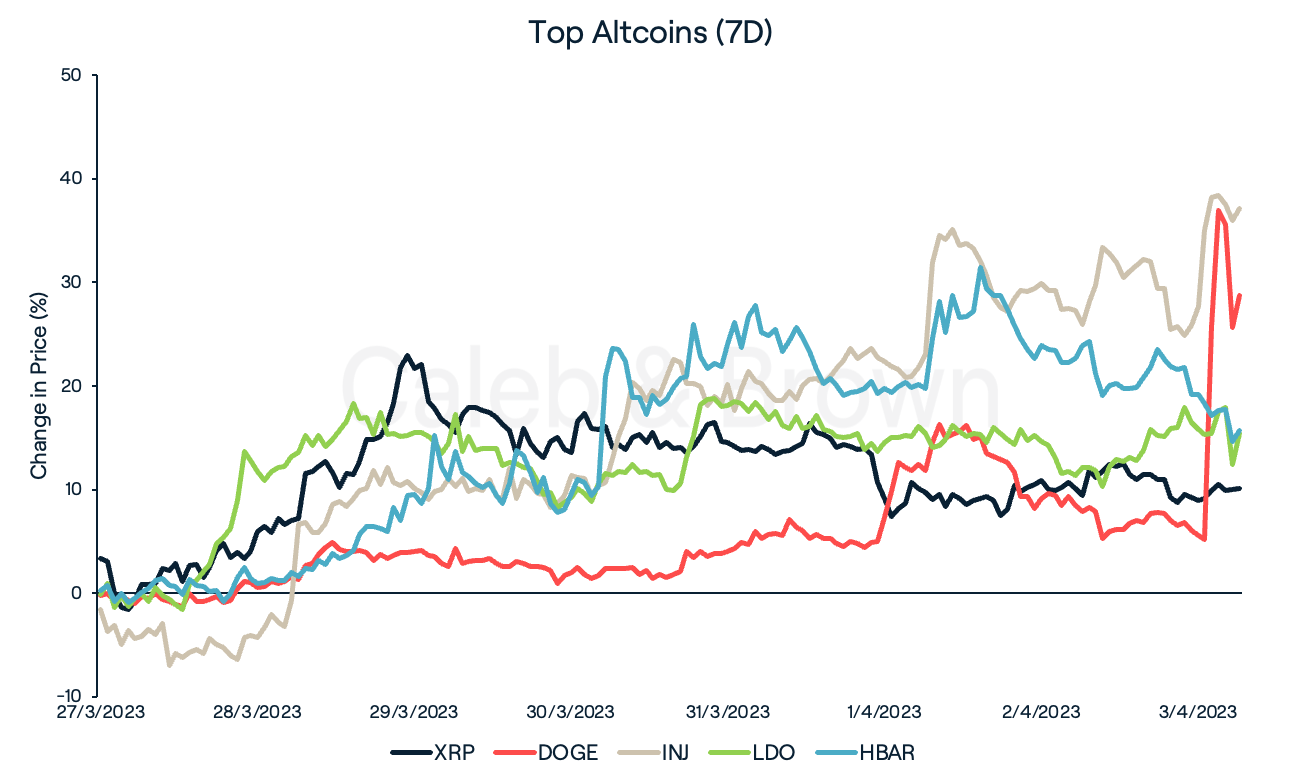

There was generally little price movement across sectors this week with all sectors moving less than 2.0%, except for Currencies. Currencies gained 5.3% over the last seven days followed by Web3 and DeFi which added 1.9% and 1.7%, respectively. GameFi was down for the second week in a row, shedding 0.6%.

Currencies’ performance was largely attributed to XRP (XRP) and Dogecoin (DOGE) which rallied 10.1% and 28.7%, respectively.

This is the second consecutive week XRP has surged double-digits and is now up nearly 50.0% since January. XRP’s recent price performance can to be tied to investors speculating on Ripple winning its legal battle with the U.S. Securities and Exchange Commission.

DOGE’s price increase came on the back of antics from Elon Musk, the crypto asset’s most famous holder and supporter. Musk changed the iconic Twitter blue bird logo on the social media platform to the DOGE logo, and posted several memes in reference to the change.

As promised pic.twitter.com/Jc1TnAqxAV

— Elon Musk (@elonmusk) April 3, 2023

Other notable performers include layer-1 protocols Injective (INJ) and Hedera (HBAR), as well as liquid staking solution, Lido DAO (LDO) with each gaining 37.1%, 15.7%, and 15.4%, respectively over the last seven days. HBAR surged on the news that a major Mastercard-backed blockchain app, Fresh Supply Co will migrate from Mastercard’s private blockchain to the Hedera network. LDO surged on the Shapella upgrade date confirmation which will allow users to freely stake and un-stake their ETH on the platform.

In Other News

Ticketmaster Debuts NFT-Gated Ticket Sales

On Tuesday, Ticketmaster declared the activation of its Ethereum NFT token-gating feature for artists, which was created in collaboration with the famous heavy metal band, Avenged Sevenfold, that possesses its own NFT collection called the Deathbats Club.

By using this feature, owners of the 10,000 Deathbats Club NFTs were given the opportunity to purchase tickets early for the band's forthcoming arena shows in June, taking place in New York City and Los Angeles.

According to frontman Matt Sanders, about 1,000 total tickets were purchased between the two shows using the NFT-gating feature, displaying one the first successful applications of web3 technology at an institutional level.

Bittrex Shuts Down US Crypto Exchange Due to 'Regulatory Environment'

On Friday, the American cryptocurrency exchange, Bittrex revealed its plan to terminate its operations in the United States. According to the exchange, customer funds are secure and must be withdrawn by April 30th, while trading services will remain available for clients until April 14th. Additionally, the exchange stated that it would sustain the operation of its Bittrex Global platform, which serves non-US clients.

Bittrex co-founder and CEO Richie Lai said on Twitter that it was not "economically viable" to continue to run the exchange in the "current U.S. regulatory and economic environment.”

Recommended Reading: Why are Meme Coins so Popular? A Look at Trending Meme Coins of 2023

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F12cqNuMilQEZ6pYstTnDr6%2F6f55fe7295b54f08f2fd0b36890548cc%2FMarch_15__2023__2_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-04-04T03%3A51%3A56.005Z)