Market Highlights

- The Federal Reserve raised interest rates by 25 bps on Wednesday, bringing them to the highest level in 22 years.

- Coinbase-backed layer-2 protocol Base saw its volume skyrocket due to a memecoin frenzy.

- CME's bitcoin futures market recorded higher volumes for July, surpassing its previous peak in April.

- Litecoin’s (LTC) block reward halving is just a day away now.

- Curve suffered an attack resulting in over US$24 million worth of crypto being stolen.

- Binance's Changpeng Zhao put forward a motion to dismiss the lawsuit by the Commodity Futures Trading Commission (CFTC).

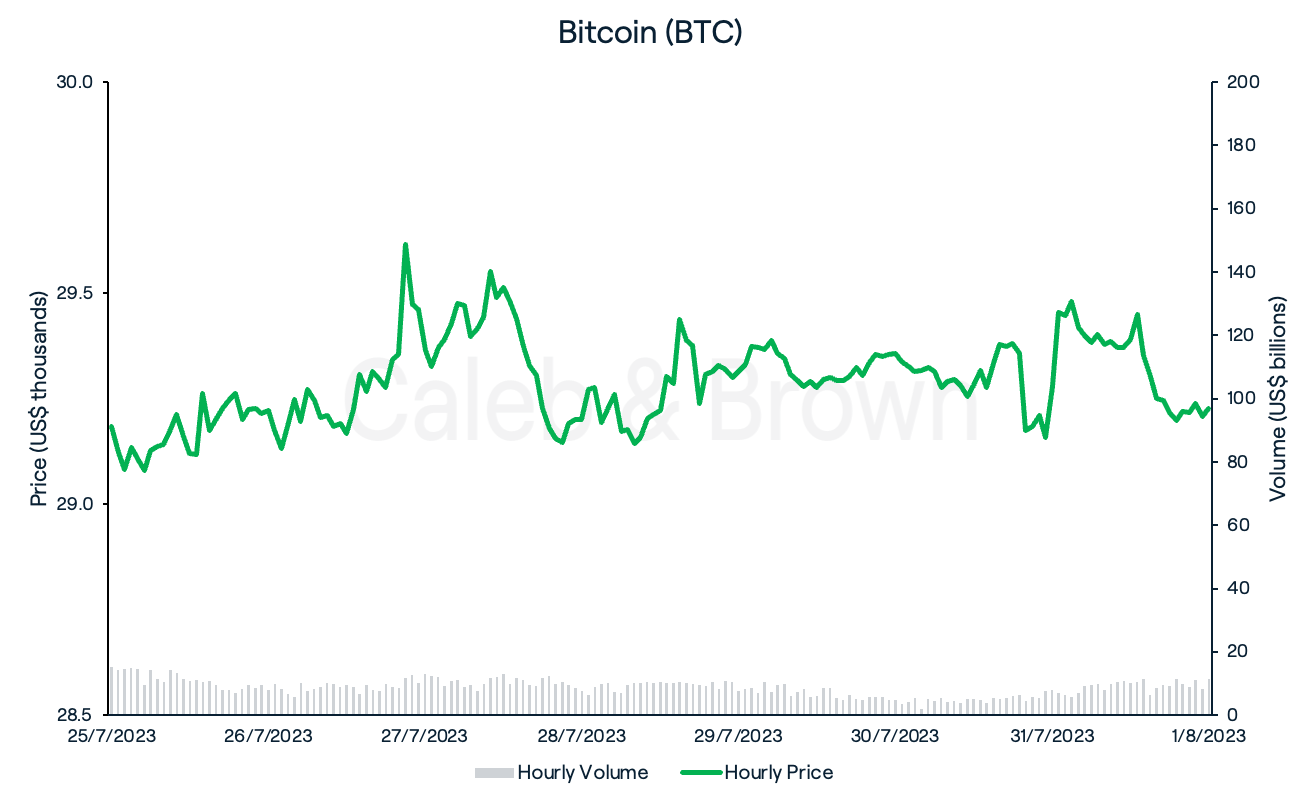

Bitcoin (BTC)

Crypto markets experienced another lacklustre week as they seemed to carefully factor in the impact of the Federal Reserve's latest interest rate hike on Wednesday. Although the increase was a modest 25 basis points, it pushed U.S. interest rates to 5.25%-5.5%, the highest level in 22 years.

Bitcoin (BTC) remained flat in response to the news as it traded rangebound between US$29,000 to US$29,600 for majority of the week. This marked the fifth consecutive week of underwhelming price performance, however a small weekend rally saw BTC close at US$29,225, up a slight 0.1%.

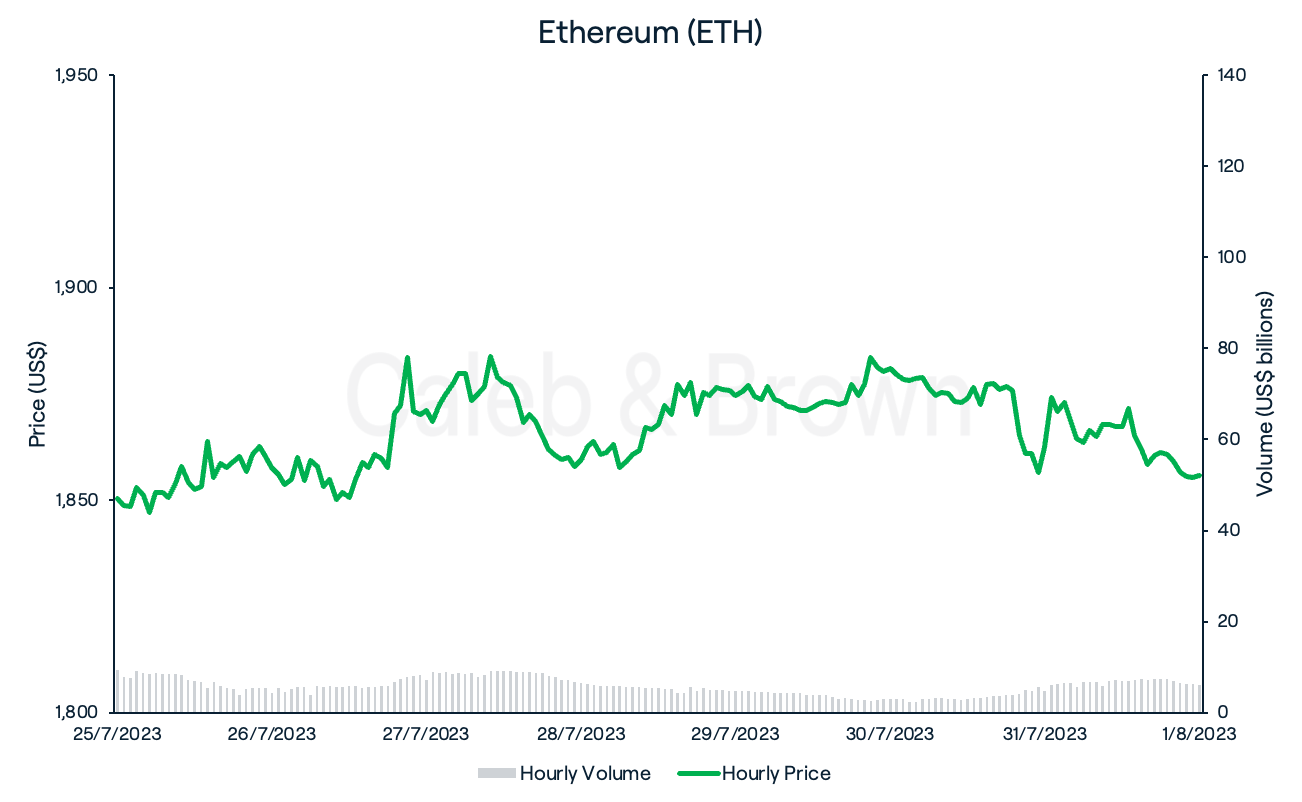

Ethereum

Ethereum (ETH) saw moderately higher volatility as it enjoyed its eighth birthday on Sunday, bouncing between US$1,850 to US$1,880 throughout most the week where it eventually closed at US$1,855, up 0.3%.

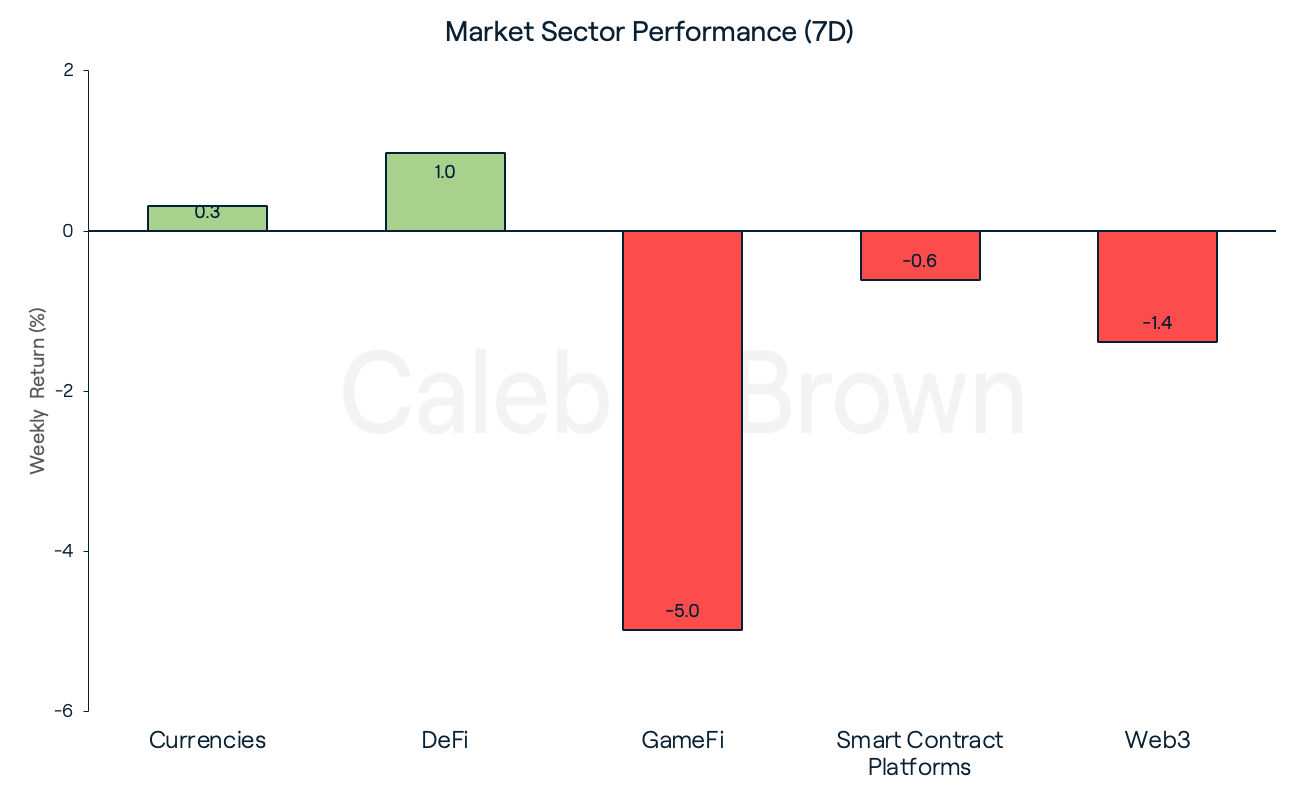

Altcoins

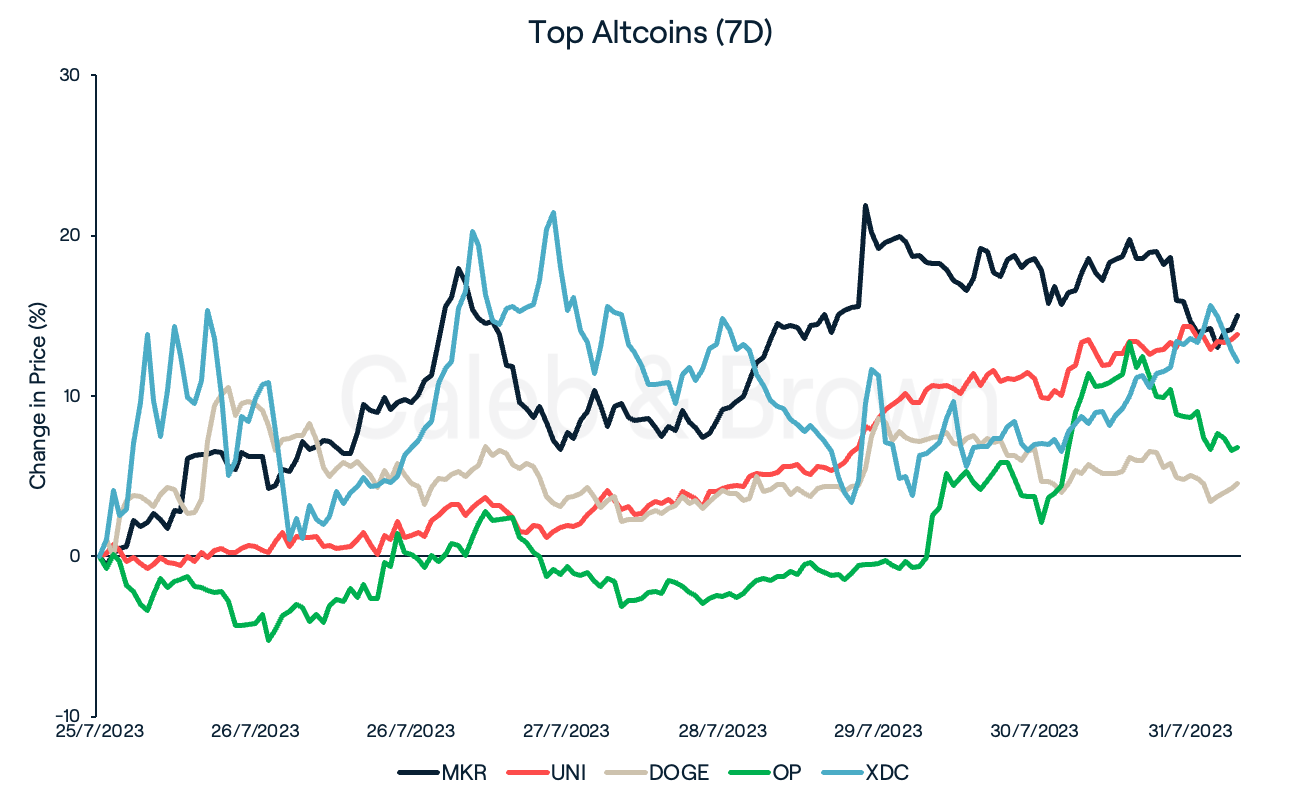

Another underwhelming week of trading saw most market sectors remain flat with GameFi taking the largest hit of 5.0%. DeFi and Currencies treaded above water this week adding on 1.0% and 0.3%, respectively.

Amongst the DeFi sector Maker (MKR) and Uniswap (UNI) were this week’s top performers with each rallying on 15.0% and 13.9%, respectively. MKR was in the spotlight after the Fed’s recent rate hike brought attention to Maker’s US$1.73 billion reserve in Treasury Bills, while Uniswap recently released beta-testing for its newest protocol, UniswapX.

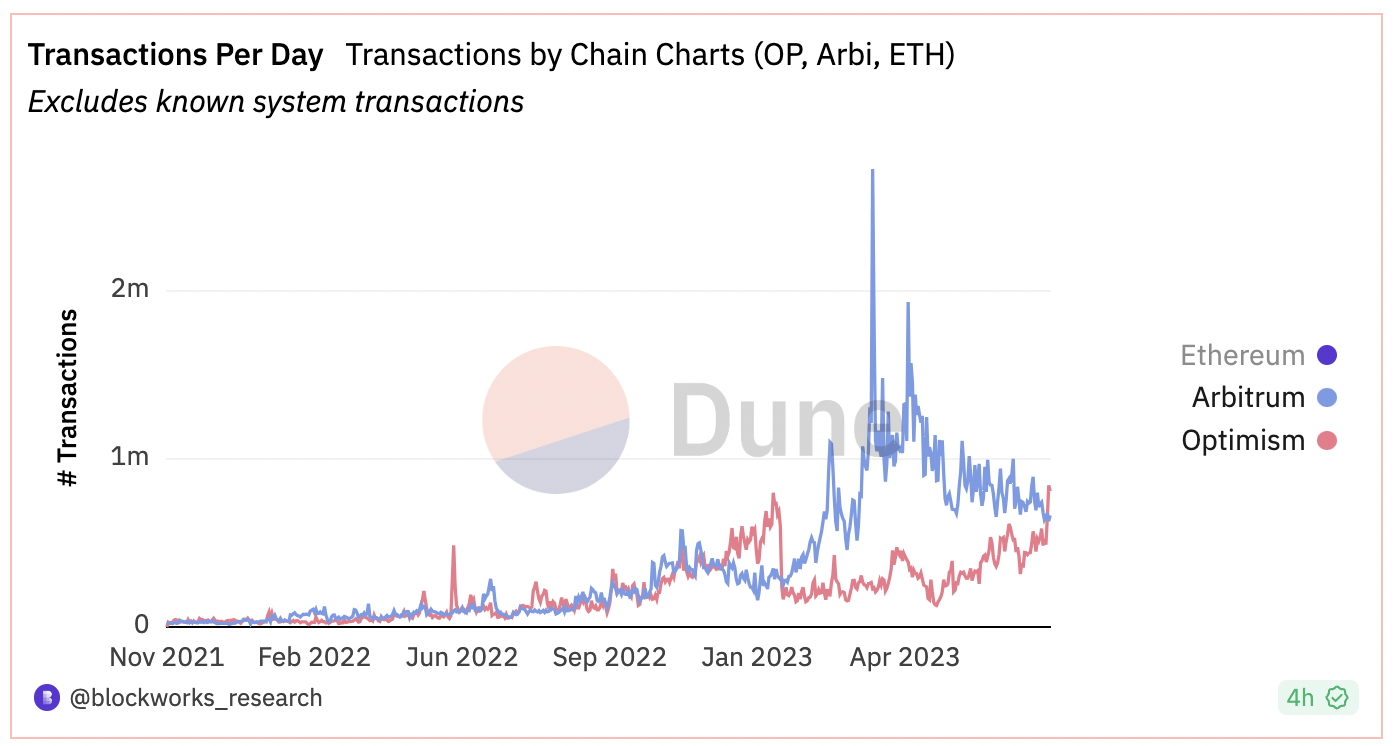

Dogecoin (DOGE) added 4.6% after Elon Musk rebranded Twitter to X while layer-2 Optimism (OP) jumped 6.8% after the launch of Worldcoin (WLD) last Monday. The launch generated over 840,000 transactions on Optimism that day, surpassing Arbitrum’s (ARB) daily transaction count for the first time in six months.

XDC Network (XDC) surged again this week after partnering with Singapore's Infocomm Media Development Authority's TradeTrust. This has seen XDC surge 12.2% this week and 81.6% over the last 30 days.

In Other News

Coinbase-backed layer-2 protocol Base, unexpectedly saw its volume skyrocket on Sunday, with over 276,000 transactions recorded. The surge was attributed to its network-exclusive memecoin frenzy, which saw tokens like BALD (referring to Coinbase’s CEO Brian Armstrong) experience an astonishing 20,000x increase in value within that same day. A potential rug-pull has since plummeted BALD back to nearly zero.

CME's bitcoin futures market recorded higher volumes for July, surpassing its previous peak in April. The exchange achieved a total volume of US$53.33 billion with one day remaining in the month, outperforming the $53.06 billion worth of contracts traded in April.

Litecoin’s (LTC) block reward halving is just a day away now which could effect its price as well as other Proof-of-Work (PoW) coins.

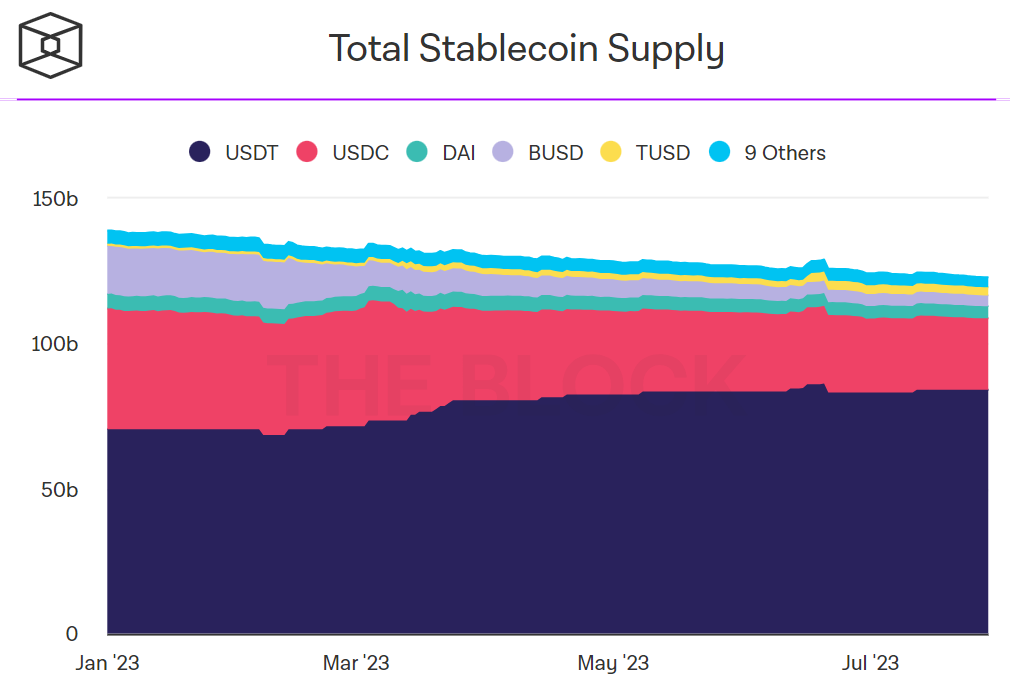

Stablecoin supply has decreased by 12% year-to-date likely influenced by factors such as the BUSD wind down, USDC de-pegging, and a more cautious approach prompted by the evolving regulatory environment.

On Sunday, Curve (CRV), the automated market maker, suffered an attack resulting in over US$24 million worth of crypto being stolen. The attackers took advantage of a vulnerability in the liquidity pools on Curve resulting in a 23% drawdown in the protocols governance token that same day. An ethical hacker was able to return 2,879 ETH (approx. US$5.4m) back to the protocol utilising a front-running bot against the malicious hacker.

Regulatory

In its ongoing case with the Commodity Futures Trading Commission (CFTC), Binance’s Changpeng Zhao put forward a motion on Thursday to dismiss the lawsuit, primarily alleging the CFTC to have exceeded its regulatory authority.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2FiJMNybpE311D6Ih6U70k6%2Ffe209447520aa17af892ac92ff4e247d%2FWeekly_Rollup_Tiles__7_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-08-02T12%3A03%3A28.787Z)