Market highlights

- Bitcoin reached a new all-time high of US$124,533 on August 14 before wider market sell-off.

- Ethereum became the 27th largest asset in the world as it approached new highs.

- U.S. Treasury exploring budget-neutral ways to buy BTC for Strategic Bitcoin Reserve.

- U.S. Federal Reserve ended monitoring of banks that provide services to the crypto sector.

- ALT5 Sigma is raising US$1.5 billion, part of which will be used to start a WLFI treasury.

Markets Overview

The S&P 500, Nasdaq, and Dow Jones hit record highs again on hopes that the U.S. Federal Reserve will cut interest rates at its September 14 meeting. Market optimism was also supported by a potential U.S.-China trade deal before November 10 and ongoing Ukraine peace talks. However, an above forecast U.S. producer price index (PPI) for July, which came in at 0.9%, triggered a sell-off amid concerns it could delay or reduce a probable September rate cut. Core CPI came in just below forecast at 2.7%, suggesting tariff-driven production costs have not yet reached consumers. Earlier in the week, Treasury Secretary Scott Bessent urged the Fed to consider a 50 basis-point cut in September.

A data-heavy week follows, with the release of the U.S. Federal Open Market Committee’s (FOMC) July meeting minutes, flash manufacturing and services PMI updates from the U.S., U.K., and Europe, and Fed Chair Jerome Powell’s Jackson Hole keynote. A dovish Powell emphasising slowing growth could boost risk assets while pressuring yields and the U.S. Dollar. Conversely, a hawkish stance on persistent inflation could cast doubt on a September rate cut, sending risk assets down and yields up. Traders and investors will presumably eagerly await Powell’s remarks to discern the Fed’s interest rate trajectory in the coming months.

Weekly performance: S&P 500 +0.9%, Dow Jones +1.7%, Nasdaq +0.8%.

Looking ahead:

- FOMC meeting minutes - Aug 20

- August S&P Manufacturing PMI data - Aug 21

- July Existing Home Sales Data - Aug 20

- U.S. Federal Reserve Jackson Hole Symposium - August 21 to 23

- U.S. Fed Chair Jerome Powell Speaks - Aug 22, 10am ET (Aug 23, 12am AEST)

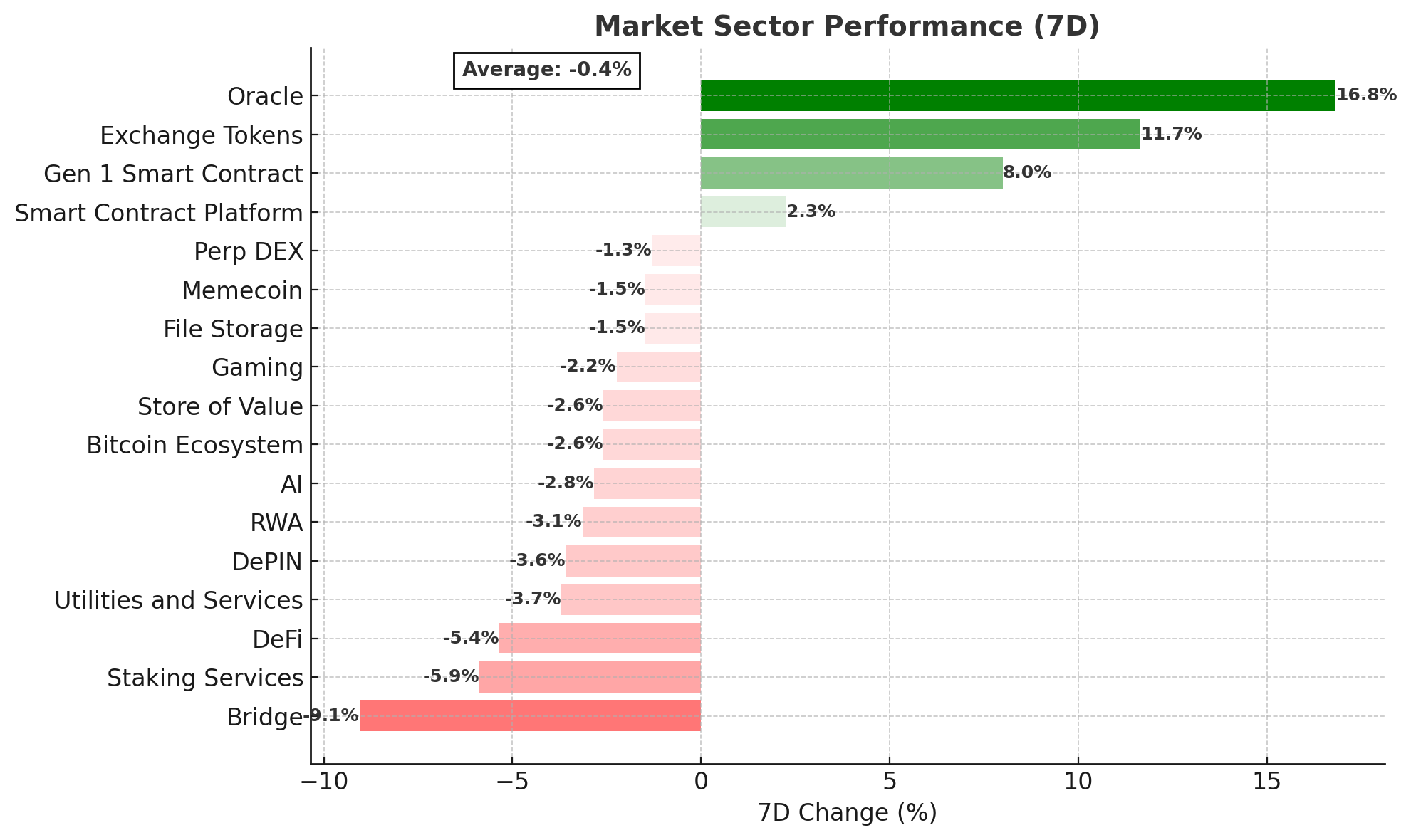

Crypto Market Sector Performance

A small handful of sectors saw growth this week as the wider market pulled back from recent highs on economic uncertainty following the U.S. PPI data release.

Biggest gainer

- Oracle: ChainLink (+25.3%) continued its recent gains driven by the establishment of the ChainLink treasury, a new partnership with Intercontinental Exchange (ICE) and institutional adoption of the protocol.

Biggest loser

- Bridge: LayerZero (-11.2%) declined due to a 25.7 million token unlock, worth US$52.4 million, which placed downward pressure on token value.

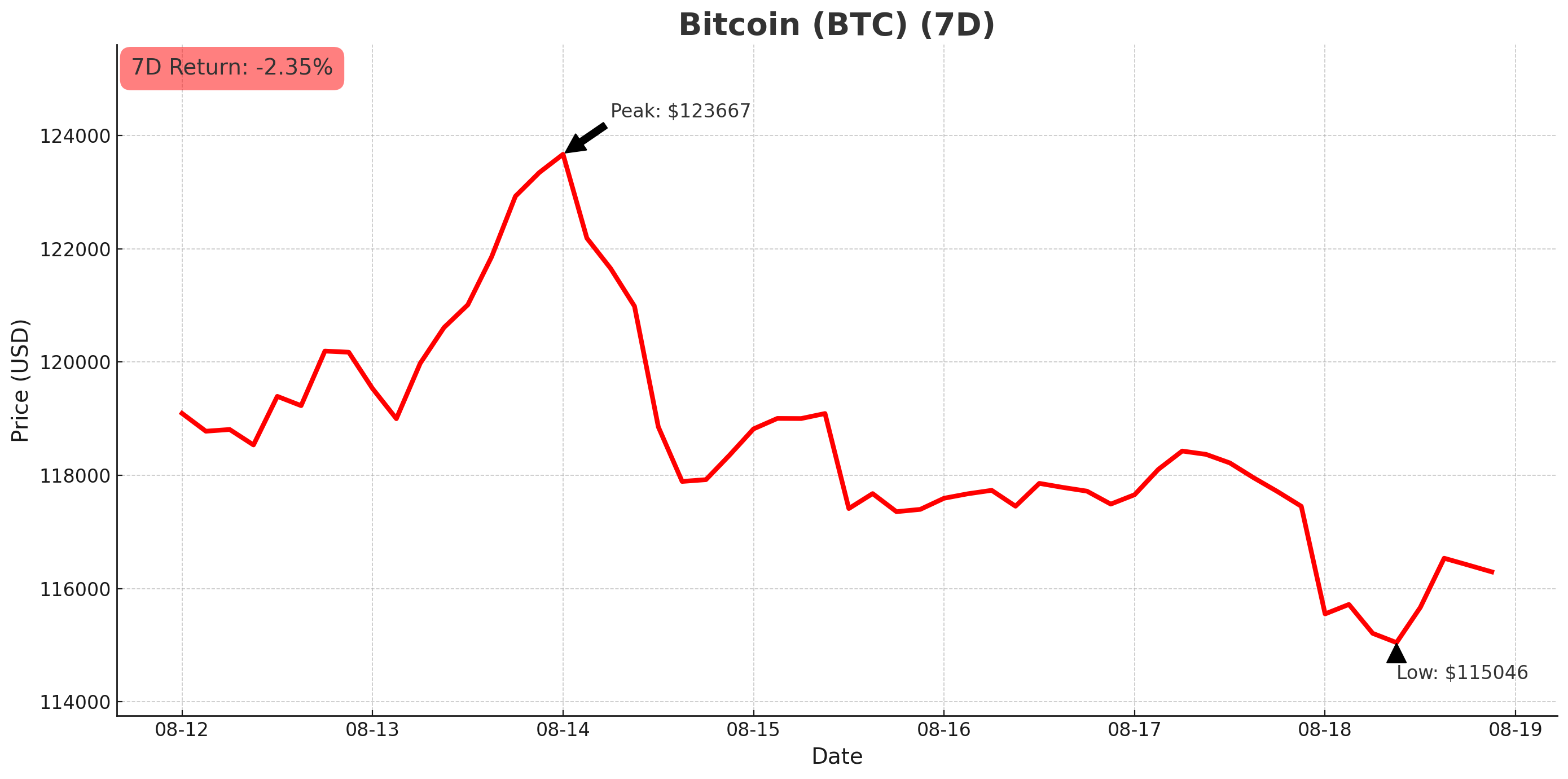

Bitcoin (BTC)

- Opened the week at US$119,309 and rallied to a fresh all-time high of US$124,533 on August 14 before selling off on above-forecast U.S. PPI, as it puts a U.S. September rate cut at risk. US$941 million, predominantly long positions across the crypto market, were liquidated in the sell-off. (-2% 7D)

- BTC dominance increased to 60.8% before declining and closing the week at 59.2%. It’s the first weekly close below this level since November 2024.

- Bitcoin investment products saw US$552 million of inflows this week.

On August 14, U.S. Treasury Secretary Scott Bessent stated the U.S. would not purchase additional bitcoin for its Strategic Bitcoin Reserve, instead capitalising it with BTC seized in forfeiture proceedings. After digesting the market’s reaction, Bessent clarified via social media that the Treasury remains open to acquiring more bitcoin through “budget-neutral pathways”. The reserve currently holds around 200,000 BTC, worth about US$20 billion.

In bitcoin buying news:

- Strategy bought 155 BTC, bringing its total holdings to 628,946, which is almost 3% of total BTC supply.

- BTC holding company Nakamoto and KindlyMD (Nasdaq: NAKA) completed their merger to establish a bitcoin treasury company. KindlyMD raised US$540 million through a private placement in public equity, and is raising a further US$200 million through convertible notes. The company aims to accumulate 1 million BTC for its treasury. NAKA gained 100% on the week.

- Bitcoin Depot, reported a 183% YoY increase in Q2 profit due to its growing BTC holdings. The company currently holds 100 BTC, worth US$11.5 million.

- Lixte Biotechnology (LIXT) announced that it plans to allocate 25% of its corporate treasury to building a BTC treasury. LIXT shares declined 16% on the news.

- WiseLink, a Taiwan-listed company, is leading a US$10M raise for Top Win International (Nasdaq: SORA), a Hong Kong luxury watch trader. It marks the first Taiwanese-backed BTC treasury firm. WiseLink contributed US$2M in three-year convertible notes.

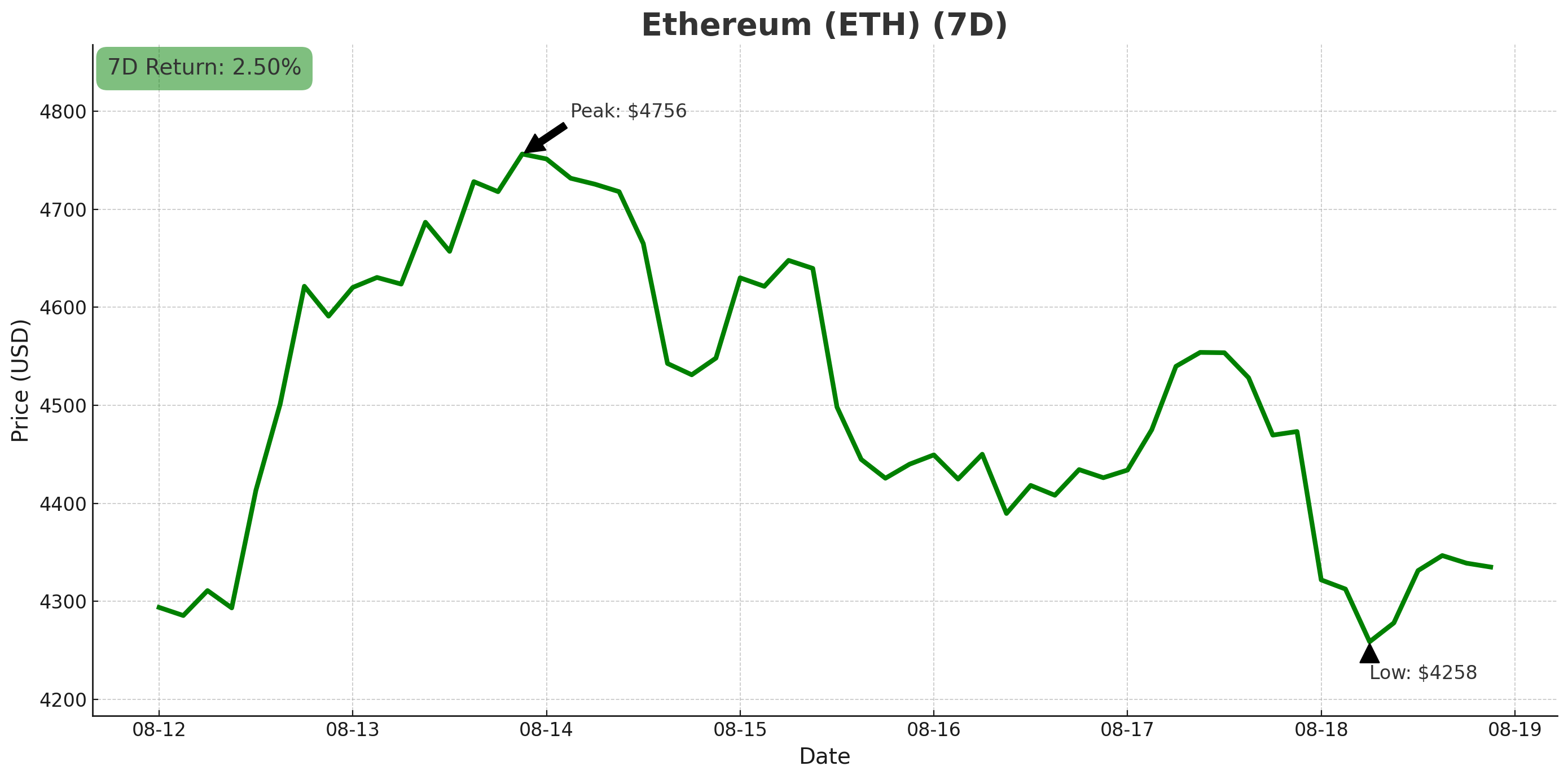

Ethereum (ETH)

- Opened the week at US$4,251, rallied to a weekly high of US$4,792 on August 14 and broke below the key level at US$4,330 (+2.5% 7D).

- Ethereum dominance moved to a high of 14%, followed by a retreat to around 13.5%.

- Ethereum-focused funds saw almost US$2.9 billion of inflows, which represents 77% of total digital asset exchange-traded fund (ETF) inflows for the week.

As Ethereum saw strength throughout the start of the week, it became the 27th largest asset in the world, flipping Palantir’s market cap. At the highs, Ethereum’s market cap sat less than 1% below the market caps of Netflix and Mastercard.

Ethereum’s validator exit queue reached 855,158 ETH on August 15, which is the highest it’s ever been. The tokens, which are worth approximately US$3.7 billion, are set to be unstaked over the coming 15 days. Aside from broader macro uncertainty, this large validator exit queue may increase selling pressure over the coming weeks if validators choose to deleverage, unstake and sell ETH to repay loans.

Nearly 8% of Ethereum’s total supply is now held in ETFs or strategic reserves, up from just 3% at the start of April. Ethereum ETFs alone account for over 5% of circulating ETH, with significant holdings from BlackRock’s iShares Ethereum Trust and Fidelity’s Ethereum Fund, indicating the growing strength of crypto ETFs, particularly ETH ETFs, as Ethereum has gained strength in recent months.

In Ethereum buying news:

- Peter Thiel has backed another Ethereum treasury company, buying a 7.5% stake in 180 Life Science, which recently rebranded to “ETHZilla”. The company’s stock gained 207% on the news and currently holds over US$5 billion worth of ETH.

- BitMine Immersion increased its capital raise target to US$24.5 billion, up from US$4.5 billion, as the common stock shares offered in the company’s raise sold faster than anticipated. The company added 373 million ETH to its reserve this week, worth about US$1.7 billion. The company’s total ETH holdings are now worth US$6.6 billion.

- SharpLink is raising a further US$400 million to fund the purchase of more ETH for its corporate treasury. The company expects its ETH holdings to total US$3 billion following the raise, which would equate to 10% of circulating supply. SharpLink currently holds 598,800 ETH, worth over US$2.5 billion.

Altcoins

Despite the sell-off across crypto towards the end of the week, some cryptocurrencies still made gains, notably CeFi currencies and smart contract protocols. The altcoin season index is currently at 45 (bitcoin season).

New tech + new partnerships

- SKALE (SKL) gained 70.8%. The gasless EVM-compatible modular blockchain for scaling decentralised apps (dApps) rallied on news of a new partnership with media franchise, “It Remains”.

- Mantle (MANTLE) grew by 35.5%. The Ethereum layer-2 blockchain rallied past US$1 per token on news of its ByBit partnership, boosting new wallet addresses and transaction volume due to the companies launching the first MiCA-compliant staking product on Bybit. Plus, its Mantle 2.0 upgrade separates execution and data layers, reducing fees by 90%.

CHEX it out

- Chintai (CHEX) gained 35.6% on speculation that the tokenisation platform for financial institutions may be establishing a partnership with ChainLink (LINK). LINK has seen strong gains in recent weeks on news of its ChainLink reserve and positive sentiment amongst both institutional adopters and retail traders and investors.

Crypto ETF News

Digital asset investment products saw inflows of US$3.8 billion this week. It marks the fourth-largest week of inflows on record as investors continue to allocate capital to digital assets despite some of the economic uncertainties that surfaced in the second half of the week, mainly the unexpected PPI data.

In large-cap altcoins, Solana and XRP saw inflows of US$176.5 million and US$125.9 million, respectively. Litecoin and Ton saw outflows of US$0.4 million and US$1 million, respectively.

Grayscale filed with the U.S. Securities and Exchange Commission (SEC) to launch a spot Dogecoin ETF. If approved, it will be the first memecoin ETF.

The U.S. SEC delayed its decision on approving Solana ETFs by a further 60 days. This brings the deadline to October 16 for pending Solana ETF applications.

Other crypto news

- The U.S. Federal Reserve has ended its Novel Activities Supervision Program, which, since 2023, had required banks to notify the Fed before engaging in crypto and fintech services. Going forward, oversight of services like crypto custody, stablecoin issuance, and blockchain partnerships will be absorbed into the Fed’s standard supervisory framework.

- New York Assembly member Phil Steck introduced Bill A0966, proposing a 0.2% excise tax on all digital asset transactions, including cryptocurrencies, NFTs, stablecoins, and staking income. Steck estimates the levy could generate US$158 million annually, with proceeds earmarked for substance abuse prevention programs in upstate schools.

- Following concern from an announcement earlier in the week, Google clarified that its updated Play Store policy for crypto apps, effective October 29, applies only to custodial wallets, which will require jurisdiction-specific licenses. Non-custodial (self-custody) wallets are explicitly exempt.

- Financial firm ALT5 Sigma announced plans to raise US$1.5 billion by selling 100 million shares at $7.50 each, closing on August 12. The proceeds will be used to buy World Liberty Financial (WLFI) tokens, settle litigation, pay debts, and support operations. Eric Trump will join ALT5’s board as director upon closing of the capital raise.

- Ethereum wallet provider, MetaMask, is set to launch a new stablecoin, mmUSD, in partnership with Stripe. The stablecoin aims to become the primary trading pair within MetaMask's ecosystem. The initiative follows a deleted Aave governance proposal and is supported by stablecoin platform M^0.

- Andreessen Horowitz (a16z) and the DeFi Education Fund have formally requested that the U.S. SEC establish a "safe harbour" to protect developers of dApps from being classified as broker-dealers. The proposal outlines conditions under which dApp developers, regardless of their affiliation with centralised entities, would be exempt from broker-dealer regulations.

- Qubic, an AI protocol, claimed to have briefly achieved a 51% hash rate control over Monero's network, describing the event as an "experiment" intended to "help" the privacy chain. In a 51% attack, the attacking entity can reorganise blocks, stop transactions and attempt double-spending. The QUBIC token gained 25% on the news, while Monero’s XMR declined by 6%. Some experts noted a lack of independent verification of the Monero attack, while other reports suggest Qubic will do the same thing to Dogecoin next.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.