Market Highlights

- Prices across the market were up to start the week, followed by a small sell-off.

- Bitcoin and Ethereum are down 0.2% and 2.7%, respectively.

- Franklin Templeton applied to the US Securities and Exchange Commission to launch a new crypto ETF.

- Mastercard launched a debit card in partnership with MetaMask.

Markets Overview

Macro Market Updates:

Crypto markets were relatively quiet this week. Minor losses were seen across most currencies — a contrast to the recent sell-off triggered by a storm of macroeconomic headwinds. This week, the RBNZ lowered its cash rate by 25 basis points to 5.25%, and year-on-year consumer price index (CPI) data came in at 2.9% in the US, slightly lower than the forecast of 3%. Between so few surprises in macroeconomic news and minor losses in crypto markets this week, investors are presumably enjoying this period of consolidation, though questions remain over whether the US Federal Reserve will deliver a September rate cut.

- The RBNZ lowered the official cash rate to 5.25%.

- The UK's consumer price index (CPI) came in at 2.2% for the 12 months to July 2024.

- Australia’s employment change for July came in much higher than forecast at 58,200.

- Unemployment claims in the US came in lower than forecast at 227,000.

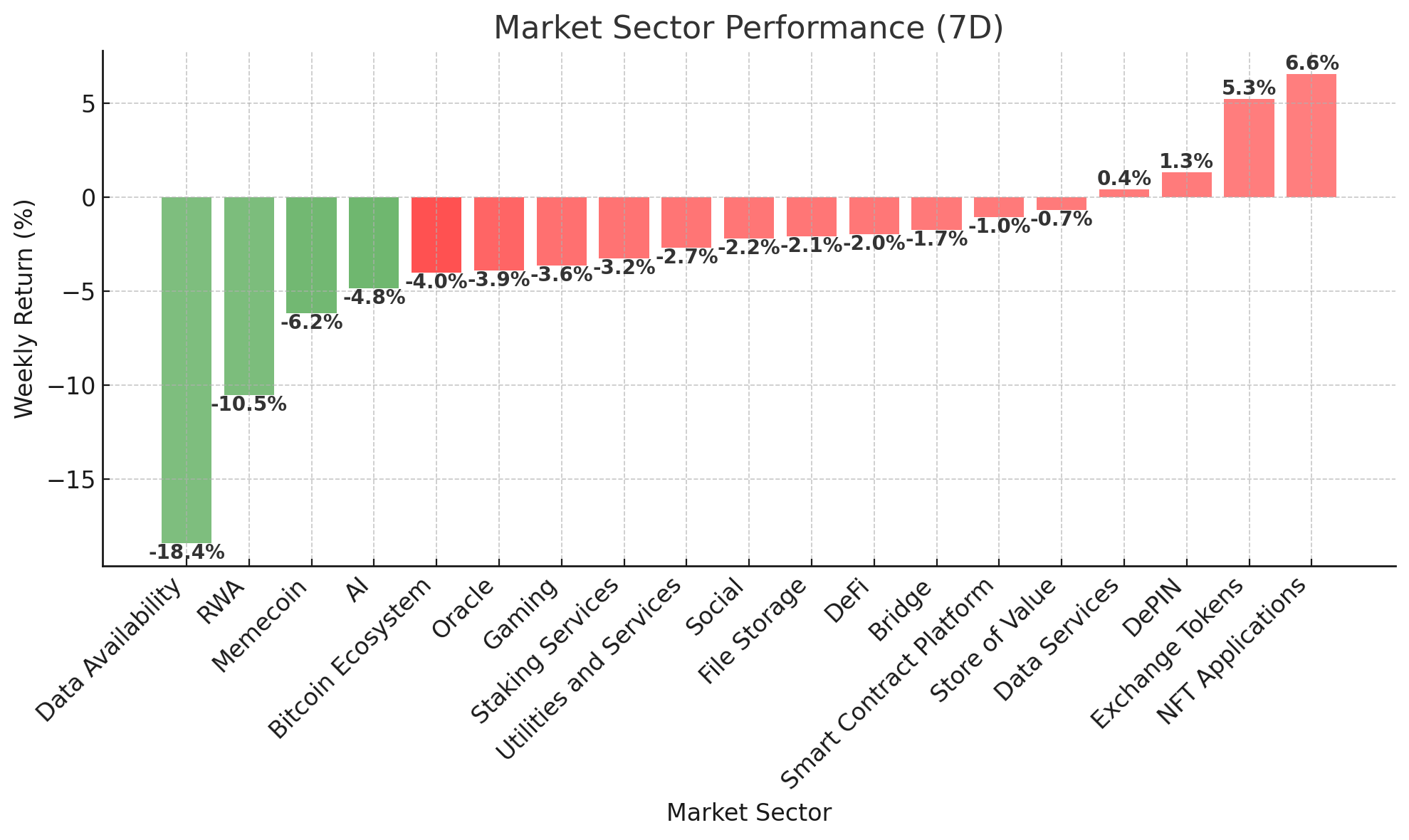

Crypto Market Sectors:

Sector growth was mixed this week. NFT applications, exchange tokens and DePIN experienced the biggest growth. SuperRare (RARE), a digital art market on Ethereum, grew by 156% this week, likely driving some of the expansion seen in NFT applications. Similarly, investor interest in DePIN platforms continues to increase, with projects like Helium (HNT) making significant steps forward in their technological capabilities. This has presumably driven growth in the DePIN sector this week.

Data availability and real world assets (RWA) fared the worst this week. In data availability, issues such as Optimism Foundation’s problems with implementing permissionless proofs (more on this below) are highlighting the challenges in the sector. The vision may be there, but projects are working on how to deliver the technology and identify bugs without the need to halt transactions.

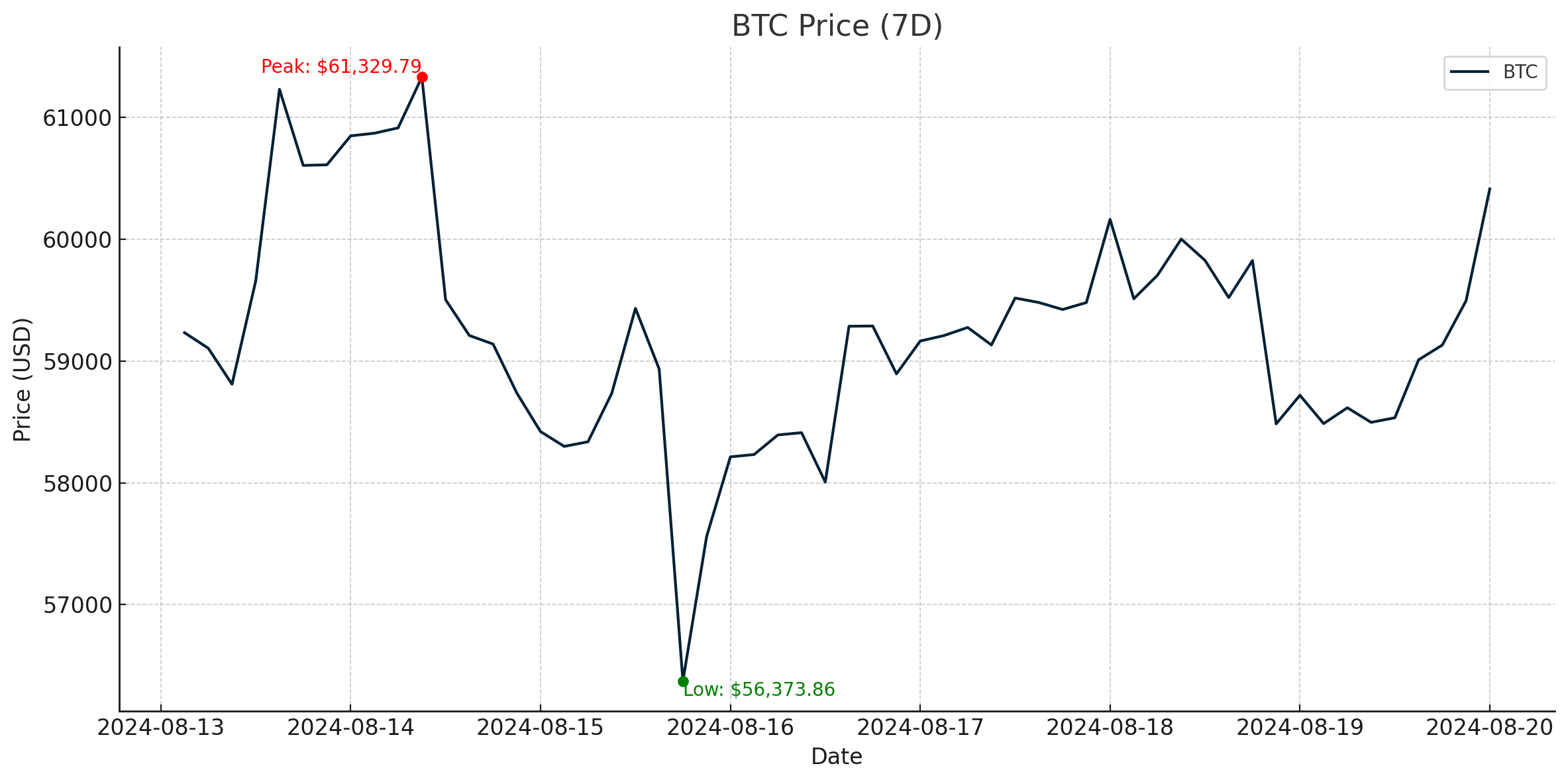

Bitcoin

Bitcoin started the week with sideways consolidation, hovering around US$60,000 before a small sell-off in the second half of the week. The price of bitcoin is down 8% from the same time last month and about 20% from its March high of US$73,747.

This week’s small sell-off was presumably due to the US Government moving US$600 million of bitcoin seized from Silk Road to a wallet on Coinbase. It’s unclear whether the assets will be sold or custodied. This latest transaction follows the US$2 billion of Silk Road bitcoin moved by the US Government in July.

Bitcoin asset investment products saw modest inflows of US$42 million this week. Short-bitcoin ETFs had another week of outflows totalling US$1 million.

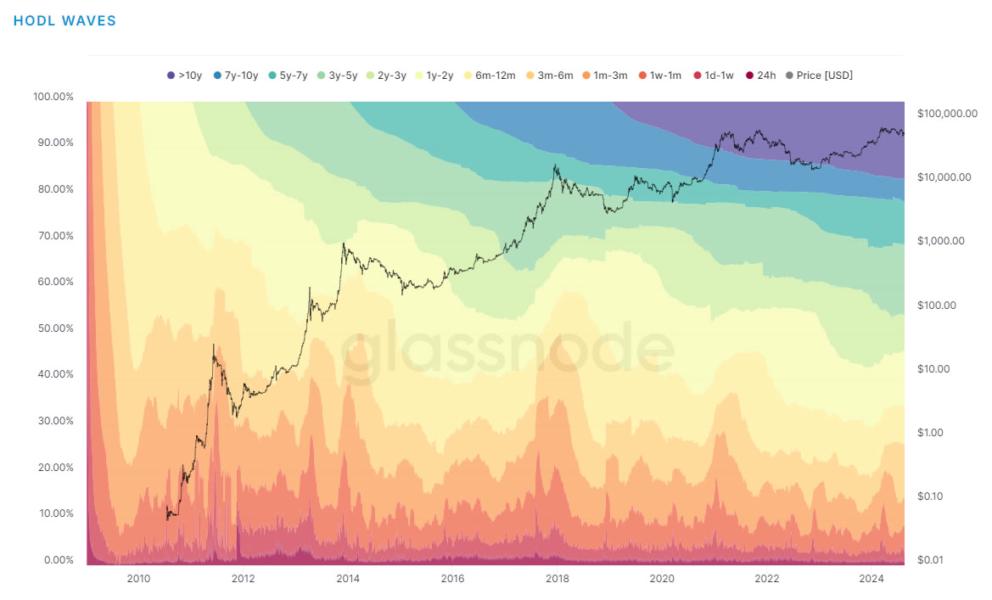

New data from Glassnode indicates that almost 75% of circulating bitcoin hasn’t been moved for over six months. This suggests that those *HODLing* are long-term investors who may see bitcoin as a store of value. By holding for a long time, bitcoin’s supply is reduced, which can have a positive impact on price growth. On the flip side, a post on X made the case that over 80% of short-term holders (those who have held for less than 155 days) are currently in the negative with their bitcoin holdings. If these holders decide to sell, it may place downward pressure on bitcoin’s price.

Ethereum

Ethereum started the week strong, with over 17% gains on Monday 12 August. Price has since retraced, with the second biggest cryptocurrency by market cap trading around US$2,730 to US$2,560. In the last 30 days, Ethereum is down by around 23%.

Modest net inflows came into Ethereum investment products this week. At a total of US$4.2 million, it doesn’t tell the full story, though. New providers saw US$104 million inflows, compared to Grayscale, which saw US$118 million outflows, likely due to investors exiting its newly converted ETF product that previously operated like a closed fund.

Also this week, Ethereum co-founder Vitalk Buterin registered the domain name, *dacc.eth.* It follows a blog post he shared in late 2023, calling for a balanced approach to technological development. In the article, he explored the idea of defensive accelerationism (also known as d/acc). Buterin’s idea is that d/acc is a strategy to prevent AI dominance or unintentional developments that can harm humanity. It’s a counter idea to the concept of effective accelerationism (e/acc) that many tech leaders hold.

New financial disclosures from former President Donald Trump revealed that he holds over US$1 million worth of Ethereum, making up part of his US$5 million cryptocurrency portfolio.

Altcoins

DeFinitive growth

- Velo (VELO) gained 35.9%, taking its market cap to US$89.9 million. Price for the Web3+ ecosystem presumably grew due to recent announcements, including a partnership with the Laos Government to create a clearing house for its digital gold transactions and another with U Power Limited to progress electric vehicle battery technology in Thailand. VELO has also piqued investor and trader interest due to its recent bullish technical price action.

- THORChain (RUNE) grew by 24.9%, which takes its market cap to US$1.3 billion. While RUNE is down 60% from its May highs, the layer-1 liquidity protocol’s team posted updates this week that have increased its daily revenue by almost 100%. Node operators on THORChain recently approved a proposal to increase the swap fee to 0.05% for layer-1 native exchanges.

- Aave (AAVE) gained 21%, taking its market cap to $1.7 billion. The price of AAVE, the lending platform’s native token, is up over 65% since the start of the year. This week’s run is presumably due to the number of Aave weekly borrowers reaching an all-time high. According to Dune analytics data, weekly active borrowers came in at 40,00, and weekly depositors are almost at an all-time high.

DeFi supply

- Reserve Rights (RSR) gained 24.4%, taking its market cap to US$236.9 million. The permissionless 1:1 asset-backed securities protocol announced that RSR emissions and supply curves will be hard-coded to emulate bitcoin. Investors and traders presumably welcomed the news as price grew by almost 28% in the second half of the week before retracing slightly.

Hotspotting

- Helium (HNT) grew by 23%. This takes its market cap to US$1.3 billion. This marks another strong week for the decentralised physical infrastructure network (DePin) platform following its 64% run last week. The momentum has presumably continued from the positive results of its Carrier Offload beta going live. Almost 60,000 new users from two major US carriers were offloaded on Helium Mobile using just 89 hotspots.

In Other News

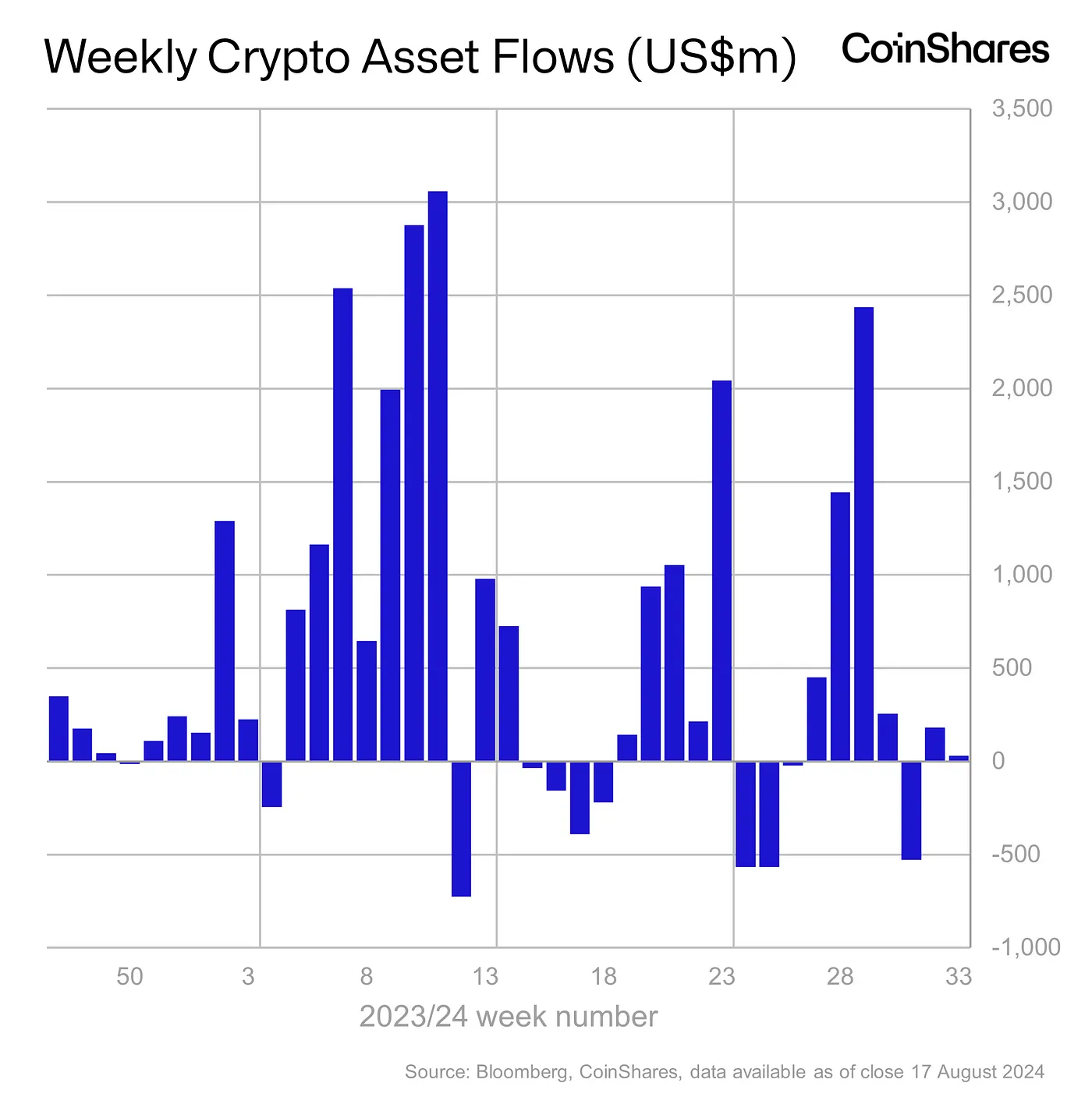

Digital asset products saw modest inflows of US$30 million this week. Some analysts attribute the low inflows to macroeconomic data that supports the case for the US Federal Reserve to delay a potential interest rate cut in September. Solana saw its biggest outflows on record. Over US$39 million left funds, likely due to a decline in trading volume for meme coins, many of which are developed and traded on the Solana network.

- Asset manager Franklin Templeton has filed an application to launch a new exchange-traded fund (ETF). The Franklin Crypto Index ETF (EZPZ) would provide exposure to digital assets in the CF Institutional Digital Asset Index, an index that provides cryptocurrency data to firms. Upon launch, the fund would hold Bitcoin and Ethereum. Coinbase is the proposed custodian for the new fund.

- Marathon Digital Holdings (NASDAQ: MARA), a company that uses digital assets to support energy transformation into more sustainable practices and technologies announced that it intends to launch a private offering of US$250 million of convertible notes. The offering will be available to institutional buyers, and the notes will mature on 1 September, 2031. As unsecured, senior obligations of MARA, the notes will bear interest in arrears semi-annually on 1 March and 1 September each year, from 1 March, 2025.

- Mastercard has made a move into crypto by launching a debit card in partnership with MetaMask. The card allows holders to spend their self-custodied cryptocurrency anywhere Mastercard is accepted. Importantly, the card is only compatible with dominant stablecoins, such as USDT and USDC and wrapped Ethereum. In the future, Mastercard’s blockchain and crypto team is aiming to create an alternative to stablecoins, both to make it easier to use cryptocurrency for everyday transactions and to keep the company and other TradFi firms at the centre of transactions.

- The Optimism Foundation has disabled permissionless fraud proofs after two months due to numerous vulnerabilities found in the system through “community-driven audits”. Optimism contributor OP Labs proposed a hard fork on Optimism’s Layer-2 network to address the problems. The permissionless fraud proofs were meant to help all users contest potentially fraudulent or incorrect transactions on layer-2 networks, compared to permission fraud proofs, where only trusted proposers are allowed to query transactions. The findings from the audits were outlined in a post on X, sharing that the vulnerabilities didn’t put users’ assets at risk. If approved, the proposal to upgrade, including the layer-2 hard fork, will happen on 10 September 2024.

Regulatory

The Australian Securities and Investments Commission (ASIC) revealed that it has coordinated the removal of over 600 crypto scams over the last year. Amongst the removals were 5,350 fake investment platform scams, 1,065 phishing scam hyperlinks, and 615 crypto investment scams. The scams resulted in $1.3 billion in losses that used fake news articles or deepfake videos of public figures to lure victims.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.