Market highlights

- Federal Reserve Chair Jerome Powell’s August 22 Jackson Hole address saw risk assets rally.

- Ethereum reached a fresh all-time high of US$4,953 on August 24.

- A long-dormant BTC whale opened US$75 million worth of leveraged long ETH positions.

- The Philippines introduced legislation to establish a BTC reserve of 10,000 BTC.

- U.S. House Republicans inserted a provision into a national defence bill to ban CBDCs.

Markets Overview

Risk assets predominantly traded sideways until Federal Reserve Chair Jerome Powell’s address at the Jackson Hole symposium on August 22. Equities and crypto rallied on Powell’s dovish tone, which hinted that the Federal Reserve may begin cutting interest rates at its September 17 meeting. The probability of a 25 basis-point rate cut is now 87%, up from 75% the prior week. Throughout the rally, the Dow Jones Industrial Average soared over 800 points to close at a new all-time high. The U.S. ten-year yield fell by almost 10 basis points to 4.3% following Powell’s address.

Looking to the week ahead, traders and investors will presumably be awaiting the July U.S. core personal consumption expenditures (PCE) index on Friday, August 29. As the Federal Reserve’s preferred inflation measure, an unexpectedly high reading may cause risk-off sentiment. The PCE index is expected to rise to 2.9% year over year, up from June’s 2.8%. The second half of the week will also see Nvidia, Dell and Marvel Technology report their Q2 earnings.

Weekly performance: S&P 500 +0.3%, Dow Jones +1.5%, Nasdaq -0.6%.

Looking ahead:

- U.S. preliminary GDP q/q - August 28

- U.S. core PCE price index m/m - August 29

- Q2 earnings - Nvidia (NVDA) on August 27; Dell (DELL) and Marvell Technology (MRVL) on August 28

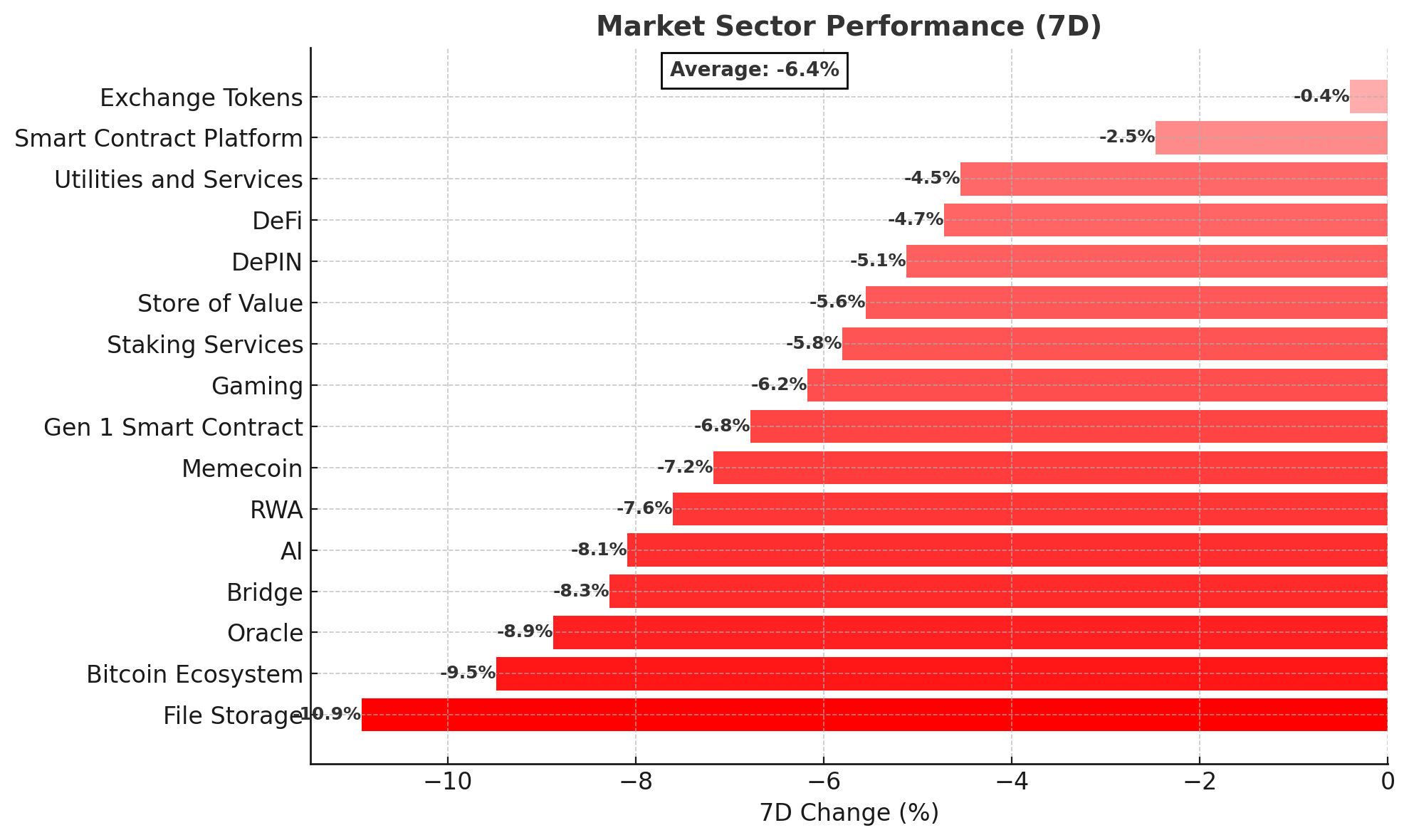

Crypto Market Sector Performance

Despite the rally across crypto on August 22, all crypto sectors saw declines this week as tokens retreated from recent local highs, presumably due to profit taking, US$770 million in short positions being liquidated, capital rotation into Ethereum, and uncertainty over U.S. interest rates.

Biggest loser:

- File storage: Filecoin (-11.4%) declined as its bearish trend, seen since December 2024, continued.

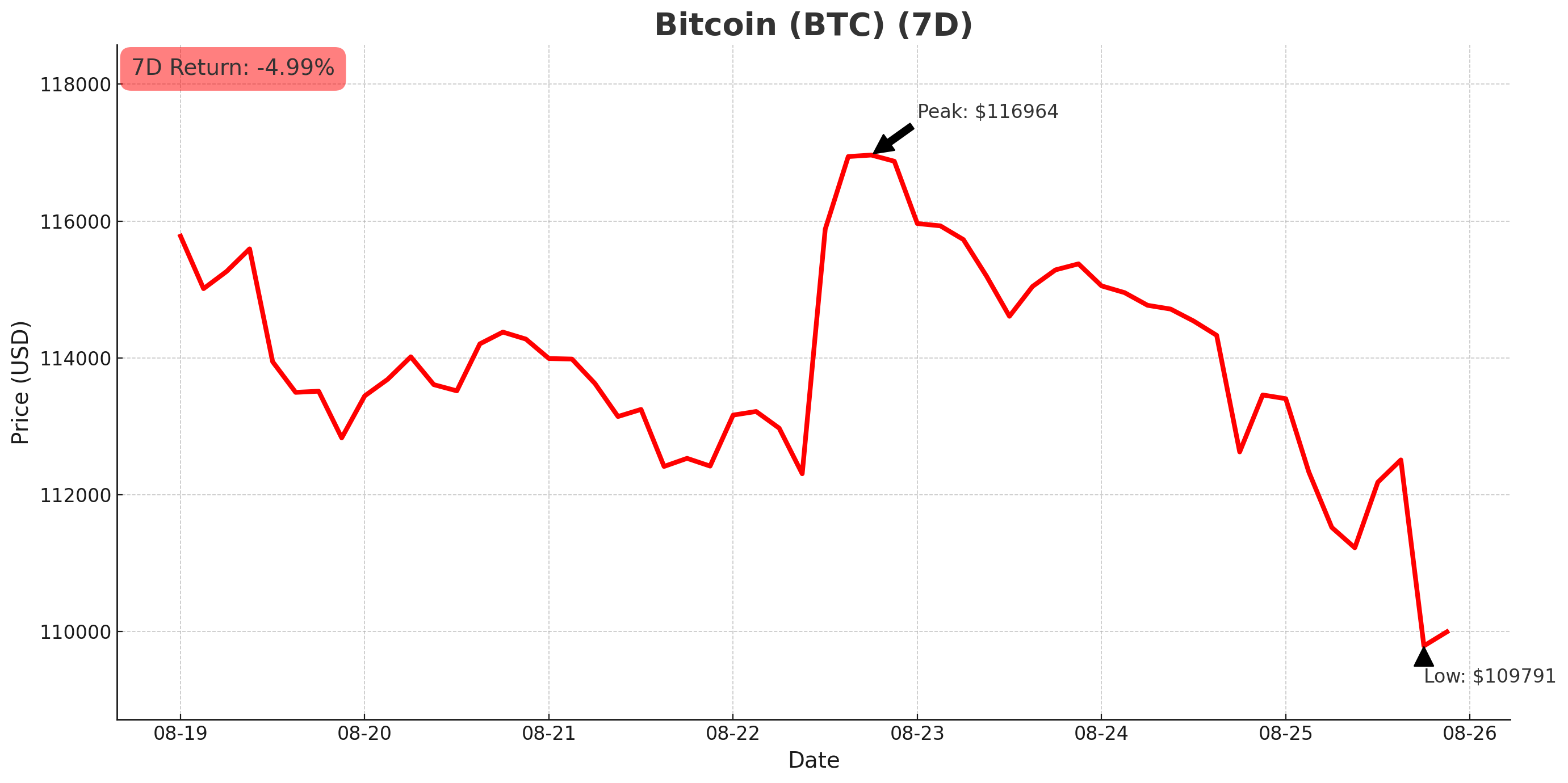

Bitcoin (BTC)

- Opened the week at US$117,455, declined to US$111,649 and rallied about 4.3% on Powell’s Jackson Hole address.

- Price has since declined to around US$110,000, presumably due to a long-dormant BTC whale selling almost 25,000 BTC (US$2.7 billion worth) on August 25, causing a flash crash.

- As BTC declined to a key area around US$110,000, US$235.5 million in long BTC positions were liquidated (-5.4% 7D).

- BTC dominance continued to fall this week, reaching a low of 58% on August 24, though it has since rebounded slightly to 59%.

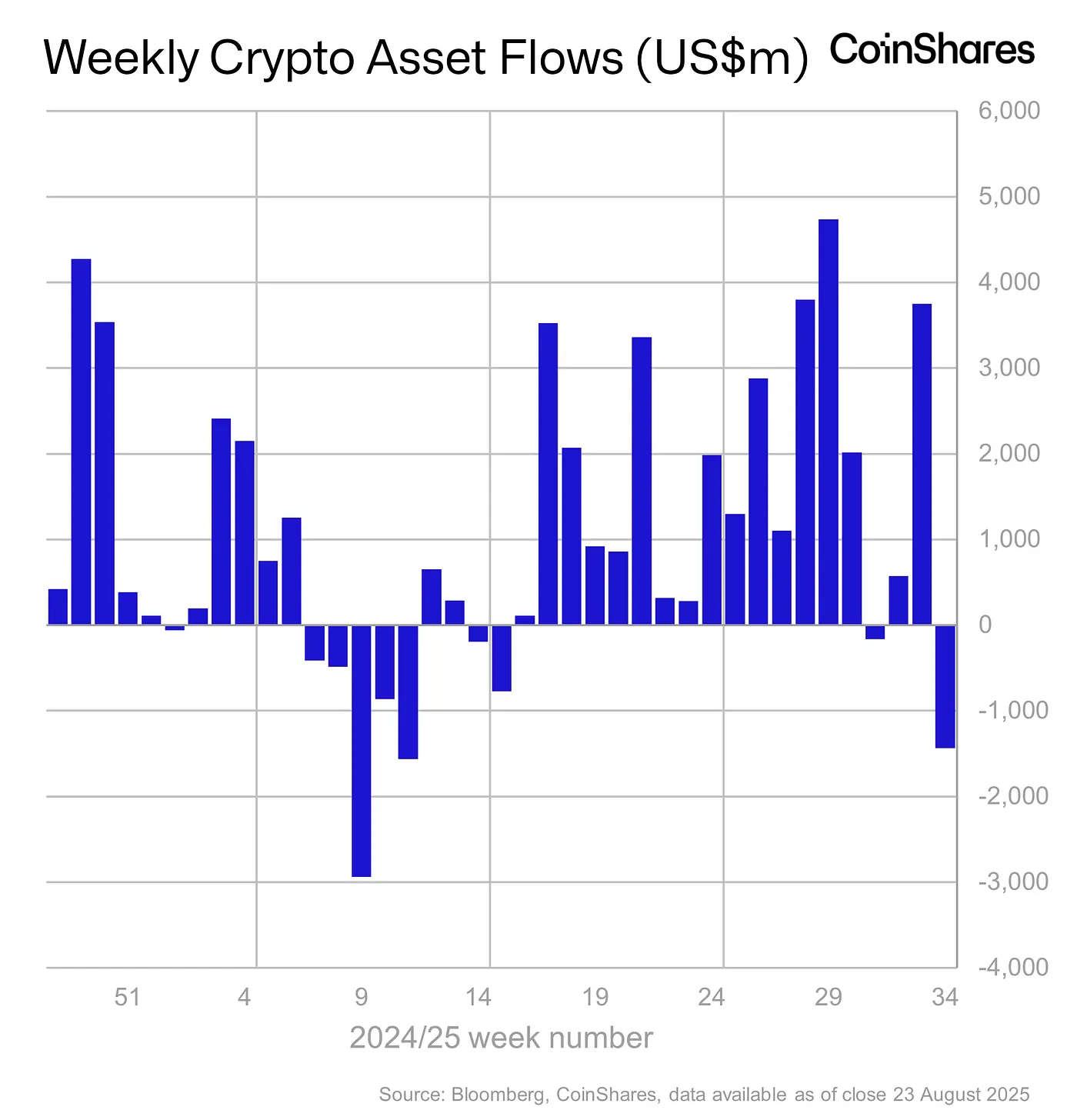

- Bitcoin investment products saw US$1 billion in outflows this week due to uncertainty over the Fed’s monetary policy stance ahead of Powell’s August 22 address.

The Philippines introduced the Strategic Bitcoin Reserve Act (House Bill 421). It provides a mandate for the Bangko Sentral ng Pilipinas to purchase 2,000 BTC annually over five years. The total of 10,000 BTC would have a minimum 20-year holding period, with sales only permitted to pay down government debt.

In bitcoin buying news:

- Strategy bought 3,081 BTC, bringing its holdings to 632,457 BTC.

- KindlyMD made its first BTC buy of 5,743 BTC via its wholly owned subsidiary, Nakamoto Holdings. The company’s shares have declined by 13% since announcing the purchase.

- Metaplanet bought 775 BTC last week, plus a further 103 BTC on August 25, bringing its holdings to 18,991 BTC, worth approximately US$2.1 billion.

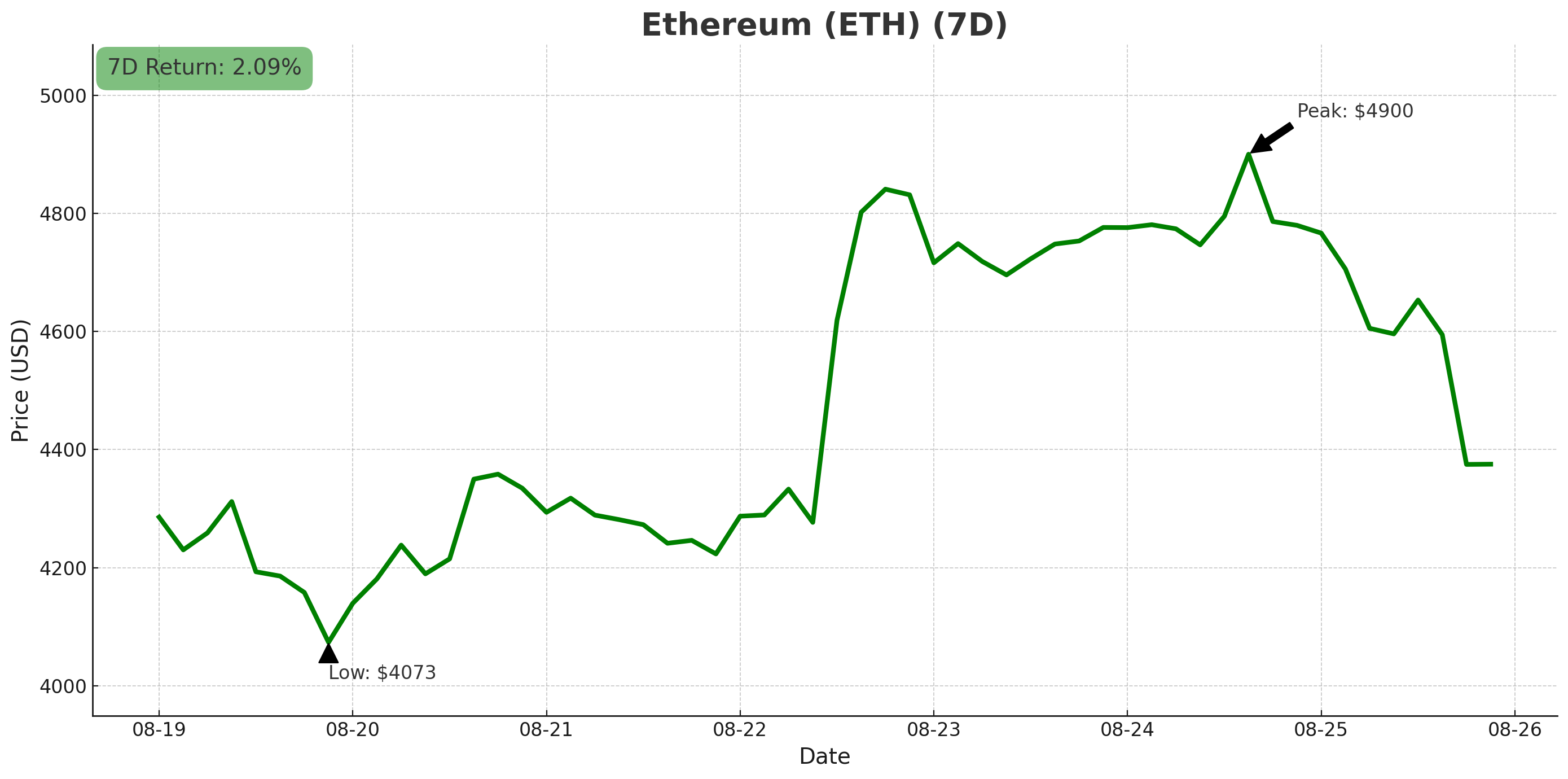

Ethereum (ETH)

- Opened the week at US$4,475, rallied to a new all-time high (ATH) of US$4,953 on August 24, and has since pulled back to a key area of support at US$4,330, presumably due to the BTC flash crash increasing risk-off sentiment and a surge in Ethereum unstaking (1.2 million ETH remain in the queue for withdrawal). (+1.5% 7D).

- Ethereum dominance rallied to a weekly high of almost 15% on August 24, coinciding with ETH’s new ATH.

- Ethereum-focused funds saw US$440 million of outflows as markets deleveraged ahead of Powell�’s Jackson Hole speech.

Following an 8% rally on Federal Reserve Chair Jerome Powell’s address on Friday, August 22, Ethereum made a new ATH of US$4,953 on Sunday. It’s the highest ETH has traded since November 2021, driven by September rate cut hopes, signs of capital rotation from bitcoin to altcoins, record ETH exchange-traded fund (ETF) inflows, and growing ETH accumulation by Ethereum treasury companies.

A long-dormant bitcoin whale, holding 14,837 BTC, worth almost US$1.7 billion, moved 670 BTC into four wallets, worth US$75 million, to open leveraged long positions on Ethereum, three of which include 10x leverage. It signals a strategic shift toward capital rotation into ETH as its recent rally continues.

Singapore’s DBS Bank debuted tokenised structured notes on the Ethereum blockchain, available to accredited and institutional investors via ADDX, DigiFT, and HydraX. These notes, fractionalised into $1,000 units, offer crypto-linked participation gains with downside protection, previously available only to private clients, now broadened via public blockchain distribution.

In Ethereum buying news:

- BitMine Immersion Technologies bought 373,000 ETH, worth US$1.7 billion, making it the second largest corporate cryptocurrency treasury behind Strategy’s BTC reserve.

- SharpLink is planning to complete up to US$1.5 billion in common stock buybacks. Co-Executive Officer Joseph Chalom says the program is a potential resource for when SharpLink’s shares are trading at a discount to its ETH holdings. The company currently owns 740,000 ETH, worth over US$3.5 billion.

Altcoins

While a sell-off throughout the weekend saw many altcoins decline, a handful of tokens across DeFi, smart contract platforms and computing oracles saw substantial gains. The altcoin season index is currently at 44 (bitcoin season).

Multi-chain gains

- Neon (NEON) grew by 52.2%. The blockchain, which enables Ethereum Virtual Machine (EVM) capabilities on Solana, presumably gained as traders and investors sought to move assets on the Solana and ETH chains throughout this week’s price movements.

- Qtum (QTUM) gained 46.5% as the bitcoin fork approached its second halving.

- Ontology (ONT) gained 43.4% as its Ontology Africa launch gained investor interest due to the potential to develop validator nodes and onboard local developers across the country.

Good oracle

- Api3 (API3) grew by 45.9%. The decentralised oracle network that runs on Ethereum has made large gains following its recent Upbit listing.

- Band (BAND) grew by 27.3% on its rebrand and v3 mainnet launch. The mainnet upgrade introduces one-second block times and enhanced security measures.

Crypto ETF News

Digital asset investment products saw outflows of US$1.4 billion this week, marking the largest outflows since March. The majority of outflows occurred prior to Fed Chair Jerome Powell’s Jackson Hole address, as uncertainty over the central bank’s interest rate policy for the coming months saw traders and investors seek to de-risk.

In altcoins, XRP, Solana and Cronos saw inflows of US$25 million, US$12 million and US$4.4 million, respectively. In contrast, Sui saw outflows of US$12.9 million, while Ton saw outflows of US$1.5 million.

The U.S. Securities and Exchange Commission (SEC) delayed its decision on several crypto ETFs. A decision on the Truth Social Bitcoin and Ethereum ETF is expected on October 8. Decisions on XRP funds from Grayscale, Bitwise, CoinShares, Canary Capital and 21 Shares, Dogecoin ETFs, Litecoin ETFs, and a proposal to add staking to the 21Shares Core Ethereum ETF have also been delayed.

VanEck filed with the U.S. SEC to launch a JitoSol ETF, a Solana liquid-staking token. The move follows U.S. regulators’ determination that native staking is not a securities transaction and growing investor interest in staked crypto ETF products.

Grayscale filed with the U.S. SEC to launch an Avalanche ETF.

Other crypto news

- U.S. House Republicans have inserted a provision into the 2026 National Defence Authorisation Act that bans the Federal Reserve from developing, testing, or issuing a central bank digital currency (CBDC). The measure includes an exception for open, permissionless, dollar-denominated stablecoins that “…fully preserves the privacy protection of United States coins and physical currency”.

- The Commodity Futures Trading Commission (CFTC) launched the third phase of its "Crypto Sprint," expanding beyond spot trading to address broader digital asset regulatory recommendations. Public input is open until October 20, 2025, on issues including custody, leveraged trading, stablecoin regulation, and anti-money laundering standards. Visit the CFTC’s page here for more information.

- In stablecoin news, Coinbase added **World Liberty Financial’s USD1 stablecoin** to its listing roadmap. Wyoming’s Frontier Stable Token (FRNT) launched on Ethereum, Solana and Avalanche. Ripple and SBI Holdings signed a memorandum to launch Ripple USD (RLUSD) in Japan, with distribution via SBI VC Trade. Finally, MetaMask introduced mUSD, its native stablecoin issued by Stripe subsidiary Bridge and fully backed by dollar-equivalent assets.

- Three NYSE-listed companies under AMTD Group have introduced a crypto-for-stock conversion program. The program would allow investors to exchange bitcoin, Ethereum, USDT, BNB, and USDC for newly issued shares.

- Thumzup Media, a company backed by the Trump family, is set to acquire a Dogecoin and Litecoin mining firm. The acquisition aims to bolster Thumzup's crypto treasury and diversify its digital asset holdings. Details of the transaction are yet to be disclosed.

- Tether has appointed former Trump administration crypto adviser Bo Hines as a strategy adviser. In the role, Hines will help to shape and execute Tether’s U.S. market entry.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.