Market highlights

- Macro headwinds caused US$900 million of crypto liquidations, most of which were long positions.

- Bitcoin whales acquired almost 1% of BTC supply over the last four months.

- Ray Dalio said investors should allocate at least 15% of their portfolios to gold and bitcoin.

- President Trump’s crypto working group released its 164-page crypto report.

- The U.S. SEC launched Project Crypto, a sweeping initiative to modernise crypto regulation.

Markets Overview

Following a rally throughout late July, TradFi assets declined on President Trump's executive order, signed on July 31, which imposes reciprocal tariffs on dozens of the country’s trading partners. The tariffs, ranging from 10% to 41% go into effect on August 7. To start the week, President Trump has been negotiating with Switzerland and India, with tensions reportedly escalating. The deadline for the U.S. and China to reach a trade deal is August 12. Sentiment declined further when July’s non-farm employment change came in below forecast at 73,000 vs. 150k expected.

The Bank of Canada, Bank of Japan, and U.S. Federal Reserve each left rates unchanged last week. The U.S. Federal Funds Rate remains at 4.5%, with Powell citing slowing H1 economic growth and the impact of President Trump’s tariffs as reasons for a “modestly restrictive” stance.

Fed appointees Chris Waller and Michelle Bowman dissented, voting for an immediate 25-basis-point cut. Trump has continued his criticism of Powell, most recently in a video where he misstated the cost of Fed renovations. This follows repeated threats to fire “Jerome ‘Too Late’ Powell” in 2025 over rate cut delays. The President later announced that, in the coming days, he will name a new Federal Reserve Governor to replace Powell after his term finishes in May 2026 and a new head of the Department of Labor Statistics. These tensions are likely to weigh on markets this week.

Weekly performance: S&P 500 -2.4%, Dow Jones -2.9%, Nasdaq -2.2%.

Looking ahead:

- U.S. ISM Services PMI - August 6

- Bank of England Official Bank Rate decision - August 7

- U.S. reciprocal tariffs take effect - August 7

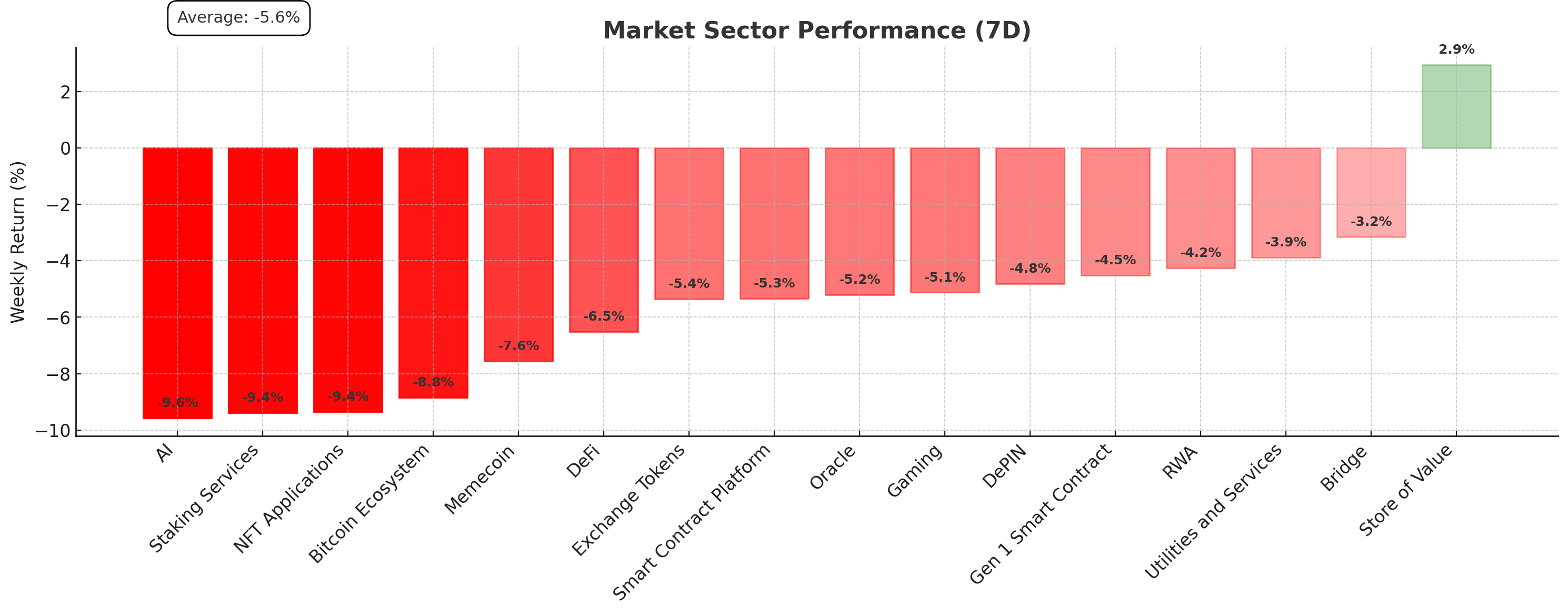

Crypto Market Sector Performance

All sectors saw declines this week, with the exception of store of value, which had modest gains.

Biggest gainer

- Store of Value: Litecoin (+10.7%) gained, presumably as the U.S. Securities and Exchange Commission’s delay in making a decision on Litecoin exchange-traded funds (ETFs) until October 10 provided clarity.

Biggest loser

- AI: Golem (-14.1%) saw the biggest declines as traders and investors withdrew capital from riskier assets. The team announced this week that a preview version of its vanity Ethereum address generator project is progressing, which could pique investor interest if it’s successful.

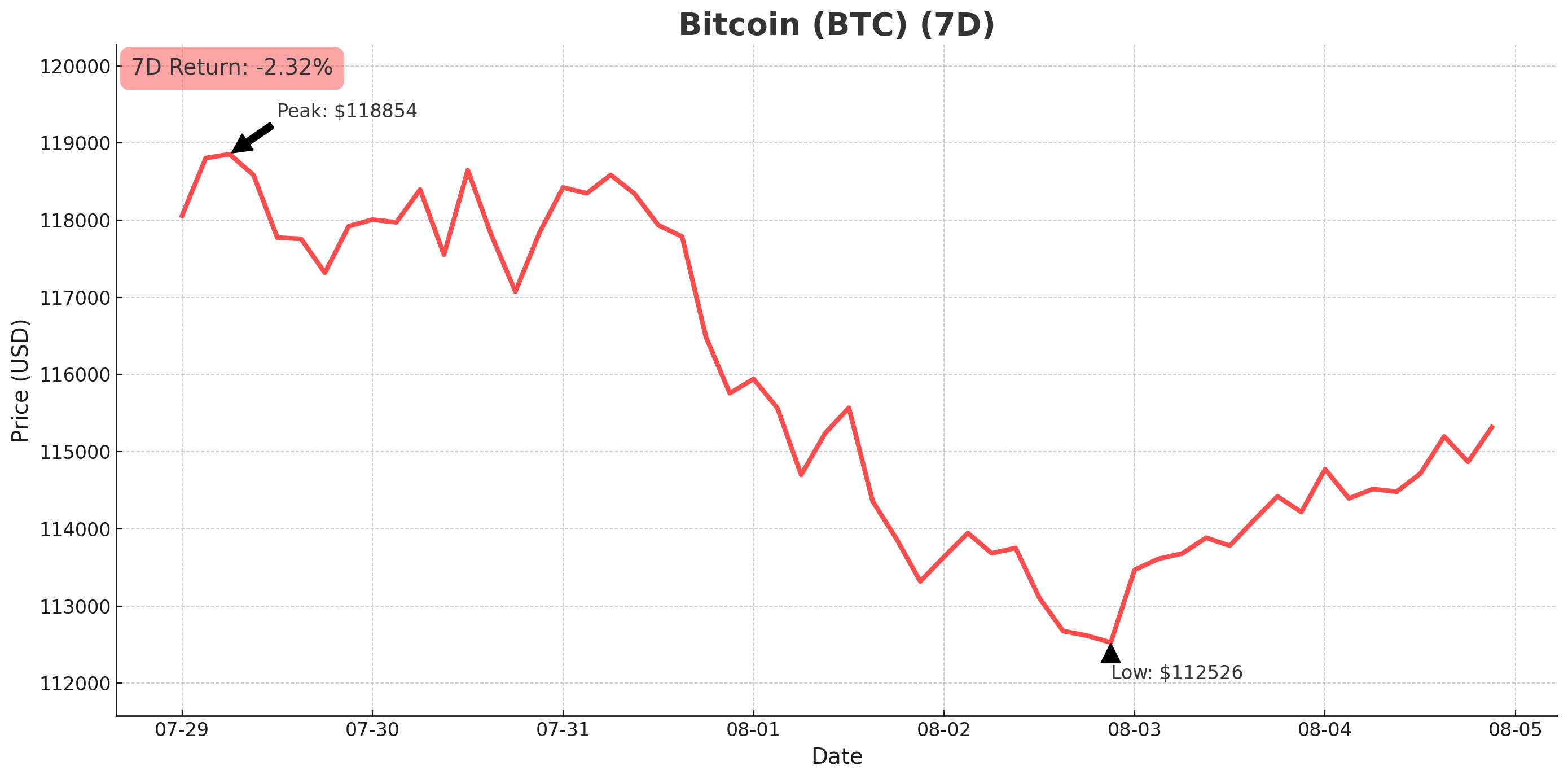

Bitcoin (BTC)

- Opened the week at US$119,465 and sold off to a weekly low of US$112,000 on macro headwinds (tariffs, weak jobs data, interest rates) and whale profit taking. total crypto liquidations reaching US$900 million on Friday, August 1 (-2.5% 7D)

- Bitcoin investment products saw US$404 million of outflows, though year-to-date inflows remain strong at US$20 billion.

As macro headwinds re-emerged this week, Ray Dalio, the billionaire founder of Bridgewater Associates, said that investors should allocate at least 15% of their portfolios to gold and bitcoin. Dalio’s thesis is that rising government debt has not been priced into global markets, so investors need a hedge against macroeconomic risks.

Blockstream launched Simplicity, a secure smart contract language on its Bitcoin sidechain, Liquid. Designed to be safer than Solidity and more powerful than Bitcoin Script, it supports high-assurance applications like vaults and tokenised assets. Simplicity prioritises security and formal verification, but it’s also facing scrutiny over Liquid’s federated governance structure, which goes against Bitcoin’s decentralised ethos.

Despite some Satoshi-era wallets and bitcoin whales selling their BTC in recent weeks, some whales have also bought up 1% of the circulating supply over the last four months. The buying activity suggests that many whales still have conviction in the asset. Plus, over 97% of the circulating supply is in profit, equating to US$1.4 trillion in unrealised gains.

In bitcoin buying news:

- Strategy, which saw US$10 billion of profit in Q2, announced during its earnings call that it plans to raise another US$4.2 billion to buy more BTC. Chairman Michael Saylor says he wants Strategy to have the largest corporate treasury on record and aims to own up to 7% of the total BTC supply. Saylor has also been marketing the company’s STRC preferred stock to retirees, touting 9.5% yields and collateral backing that will cover payments even if BTC declined by 80%. The company bought a further 21,021 BTC on July 29, bringing its total holdings to 628,791 BTC.

- Metaplanet plans to raise US$3.7 billion over two years through a preferred stock offering, paying up to 6% dividends. The capital will be used to reach the company’s goal of owning 210,000 BTC by 2027. The proposed offering will go to a shareholder vote on September 1. Metaplanet currently holds 17,132 BTC.

- Twenty One Capital increased the amount of BTC it will hold when it begins trading after Tether added a further 5,800 to the company’s holdings. The firm, which is founded by Tether, Bitfinex, Cantor Fitzgerald and SoftBank, will hold 43,500 BTC, worth about US$5.1 billion.

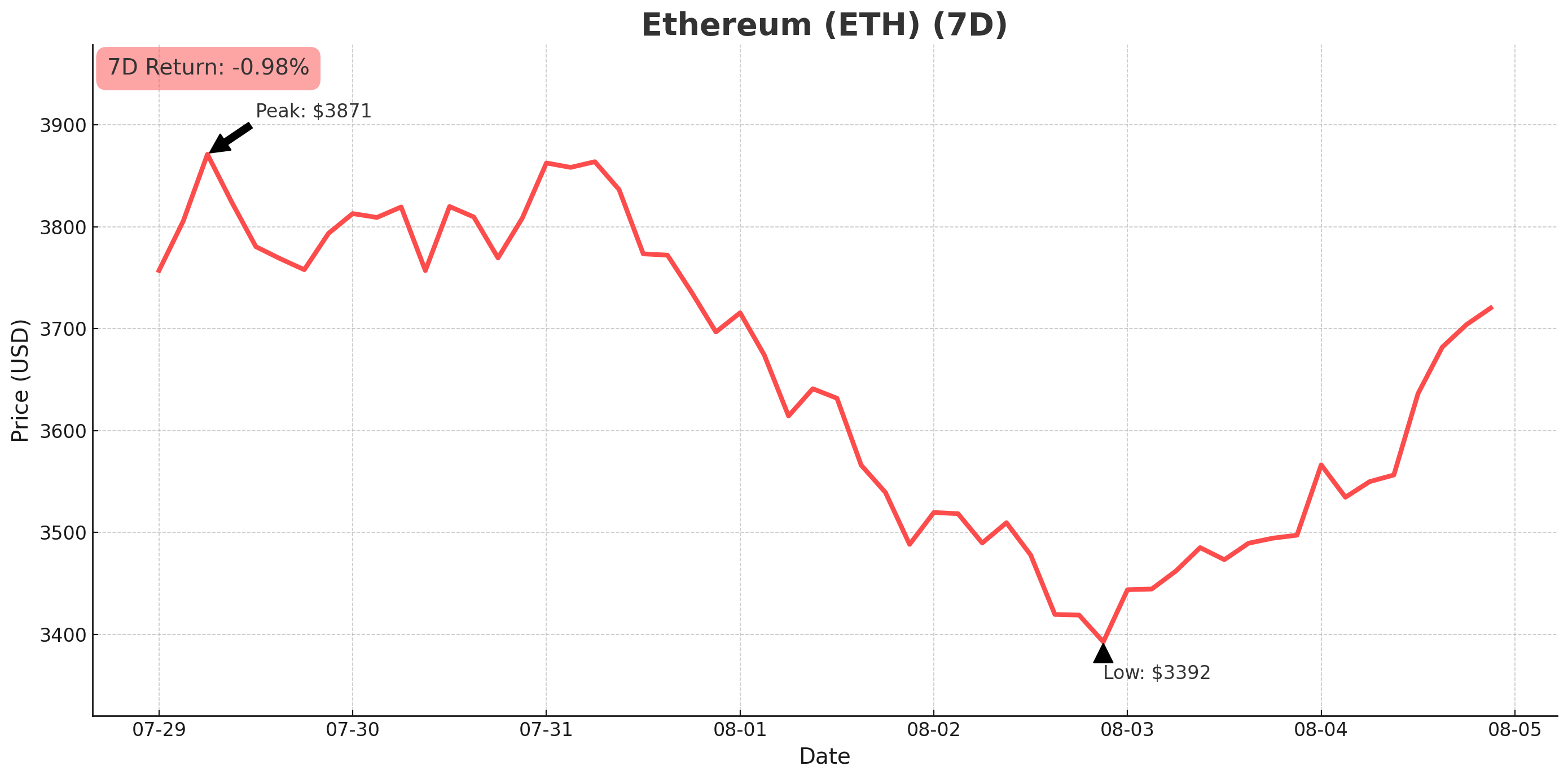

Ethereum (ETH)

- Opened the week at US$3,873, pulled back to US$3,385 on declining sentiment and rebounded to begin the new week (-1.6% 7D).

- Ethereum-focused funds saw their 15th consecutive week of inflows, with US$133 million entering funds.

Layer-2 network, Linea, announced that it’s planning to launch a LINEA token. The token will have an associated ecosystem fund, which the company wants to fund through a group of Ethereum-aligned companies, such as SharpLink Gaming, Consenys, Eigen Labs and Status, who will be responsible for “thoughtfully distributing” LINEA tokens to support layer-2 developments. Linea also aims to bring new ecosystem mechanics to the base layer through native yield on bridged ETH and ETH burns.

In Ethereum buying news:

- Bitmine Immersion Technologies approved a plan to complete a US$1 billion common stock buyback to support the growth of its Ethereum treasury. The buyback is open-ended and approves periodic repurchases of BitMine’s common stock.

- SharpLink Gaming bought US$780 million worth of Ethereum in July. This brings the company’s holdings to 438,200 ETH.

- The Ether Machine bought 15,000 ETH, valued at US$56.9 million, bringing its ETH holdings to almost US$1.3 billion and overtaking the Ethereum Foundation’s holdings.

Altcoins

Most of the crypto market pulled back this week, with the exception of a few altcoins, which made notable gains on new exchange listings and migration to new networks. The altcoin season index is currently 43, indicating that it is still bitcoin season.

Bridging the gap

- LTO Network (LTO) gained 259%. The layer-1 network that bridges real-world and digital ownership rallied after its successful migration to the Base network.

OMNIpresent

- Omni Network (OMNI) gained 64.4%. The layer-1 blockchain that connects rollups to eliminate liquidity fragmentation between layer-2 networks saw significant gains on news of its Upbit listing.

Computer says yes

- IoTEX (IOTX) saw gains of 32.1%. The open-source blockchain that enables IoT devices to interact with real-world data gained on news of its HashKey exchange listing.

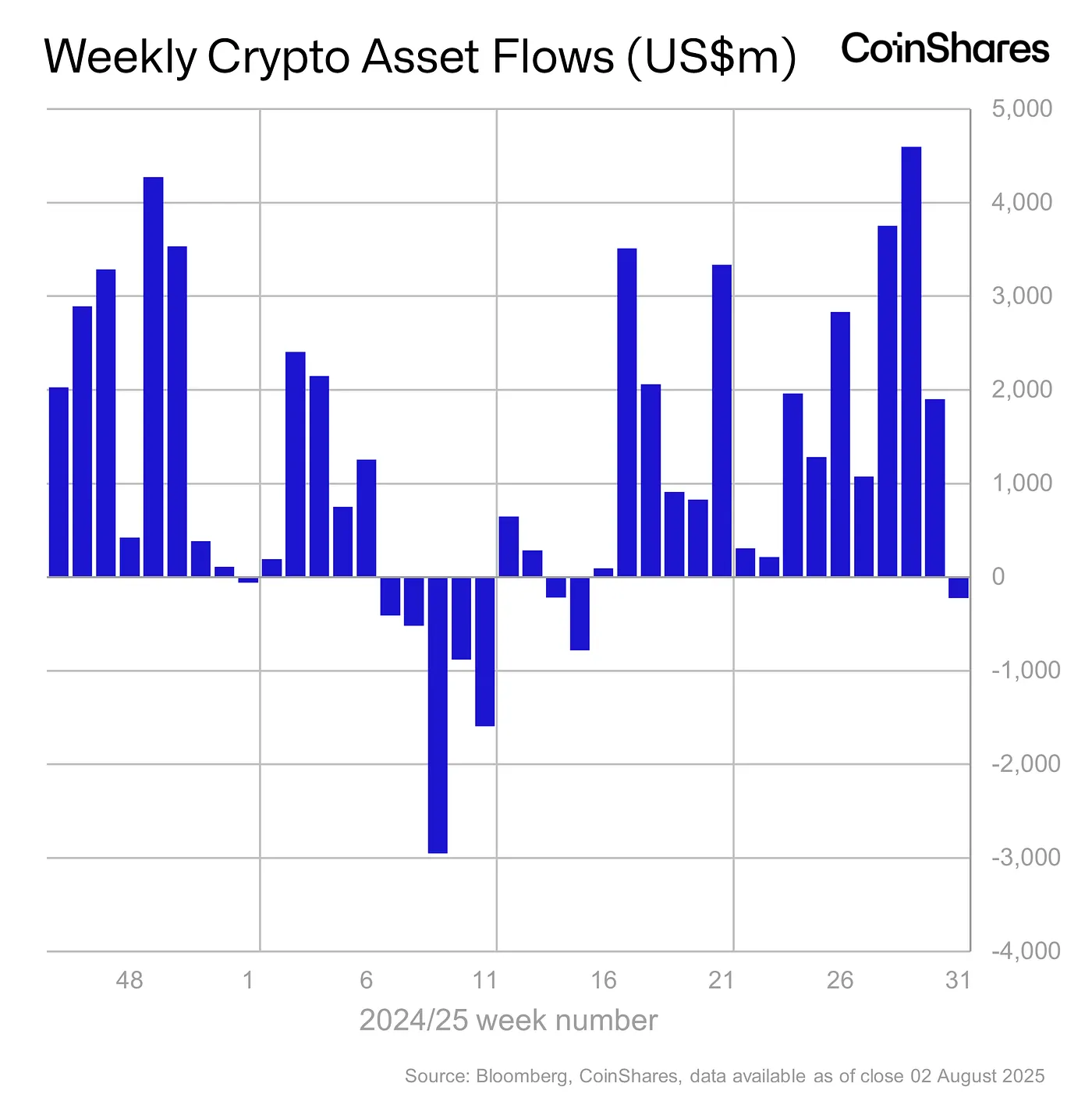

Crypto ETF News

Digital asset investment products saw the first outflows in 15 weeks this week, with US$229 million leaving funds. The outflows are presumably due to tariffs, the shift in macro sentiment following the FOMC meeting and profit taking given the recent highs across crypto assets.

In altcoins, XRP, Solana and SEI saw US$31.2 million, US$8.8 million and US$5.8 million of inflows, respectively. Similarly, Aave saw inflows of US$1.2 million, and Sui gained minor inflows of US$0.8 million.

The U.S. SEC approved in-kind redemptions of BTC and ETH for institutional investors who hold spot bitcoin and Ethereum ETF products. This means investors can swap their shares for the BTC or ETH backing them instead of selling their shares for cash.

The Cboe and NYSE Arca filed proposals to approve a rule change that would shorten the approval process for future crypto ETFs. The rule change seeks to allow specific crypto ETFs to be listed without being subject to the SEC’s review process under Rule 19b-4, which requires exchanges to submit rule changes every time an issuer applies to list an ETF.

The Cboe BZX filed with the U.S. SEC to list the Invesco Galaxy Solana ETF. The filing argues that the ETF should be approved without a futures market surveillance agreement due to its US$2 billion daily trading volume across centralised exchanges. Critics are concerned that Solana’s centralisation poses a risk of market manipulation.

The U.S. SEC acknowledged the Nasdaq’s proposal to permit staking on BlackRock’s Ethereum ETF (ETHA). The SEC has 45 days to make a determination, though this timeline can be extended if required.

Other crypto news

- President Trump’s Working Group on crypto released the "Strengthening American Leadership in Digital Financial Technology” report. It recommends granting the Commodity Futures Trading Commission (CFTC) oversight of non-security crypto spot markets, enacting regulatory sandboxes, preserving self‑custody rights, clarifying tax rules, and solidifying legal frameworks for DeFi, stablecoins, and bank access. The report also outlines that a national crypto stockpile will be established using assets gained through forfeiture proceedings.

- U.S. SEC Chair Paul Atkins launched Project Crypto. The initiative proposes tailored disclosures, exemptions, and safe harbours for initial coin offerings (ICOs), airdrops, and network rewards. It also seeks to clarify token classification, arguing “most crypto assets are not securities.” Additionally, the SEC will introduce pathways for DeFi platforms, enable integrated services such as staking and lending under unified licensing, and support U.S.-based capital raising for crypto projects previously forced offshore.

- In crypto corporate treasury news, Nasdaq-listed Mill City Venture III is raising US$450 million via a private placement to establish a SUI corporate treasury. The company’s shares gained 270% in the five days following the July 28 announcement. Similarly, Tron Inc. has filed to raise up to US$1 billion to fund the acquisition of further TRON (TRX) tokens for its corporate treasury.

- Visa has expanded its stablecoin settlement platform to support PayPal USD (PYUSD), Paxos’s Global Dollar (USDG), and Circle’s euro‑pegged EUR. The company also added compatibility with the Avalanche and Stellar blockchains. These enhancements aim to broaden Visa’s multi-coin, multi-chain infrastructure, facilitating faster, interoperable stablecoin payments across Ethereum, Solana, Stellar, and Avalanche. Similarly, PayPal announced that small businesses in the U.S. are now able to accept about 100 cryptocurrencies, including BTC, ETH and SOL for payments.

- Hong Kong’s Stablecoins Ordinance took effect on August 1, 2025, establishing a comprehensive licensing regime for fiat-referenced stablecoin issuers regulated by the Hong Kong Monetary Authority (HKMA). Issuers must meet strict requirements, including full reserve backing, redemption at par, client fund segregation, AML/CFT compliance, disclosure, and governance standards. Approvals are expected from early 2026.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.