Market Highlights

- Bitcoin traded sideways after the US Bureau of Labor of Statistics released its July jobs report.

- KPMG released a report on how Bitcoin's protocol can positively contribute to the ESG investing framework.

- 13 new ETH futures ETF applications were filed over the last week.

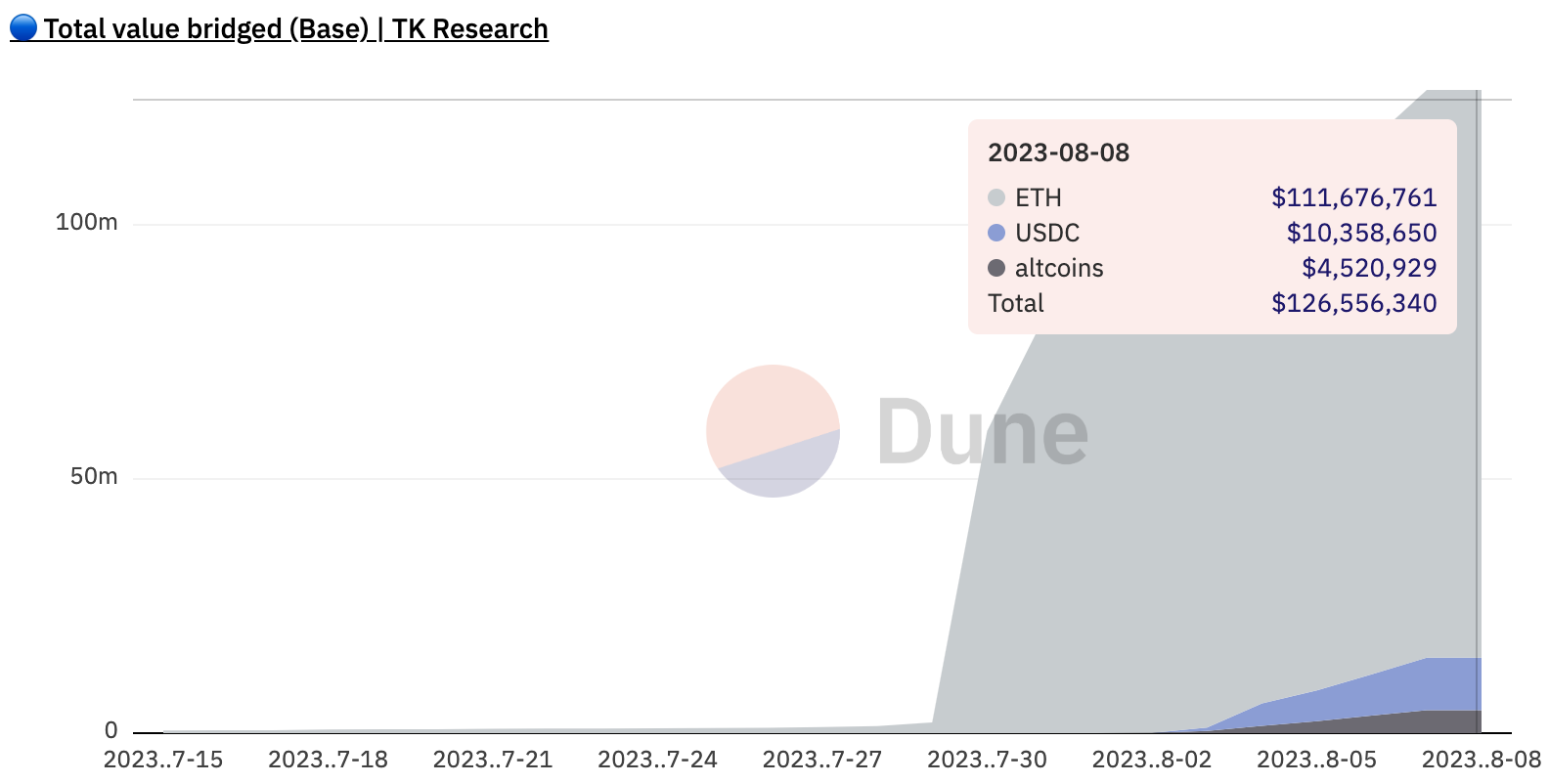

- Coinbase’s layer-2 protocol brings in over US$120 million of funds ahead of its public release on Wednesday.

- The Bitfinex Bitcoin/Stablecoin ratio, a leading indicator for Bitcoin price action, spiked to yearly highs.

- Bloomberg Intelligence's ETF analysts have increased their estimates of a US Bitcoin spot ETF launch from 50% to 65%.

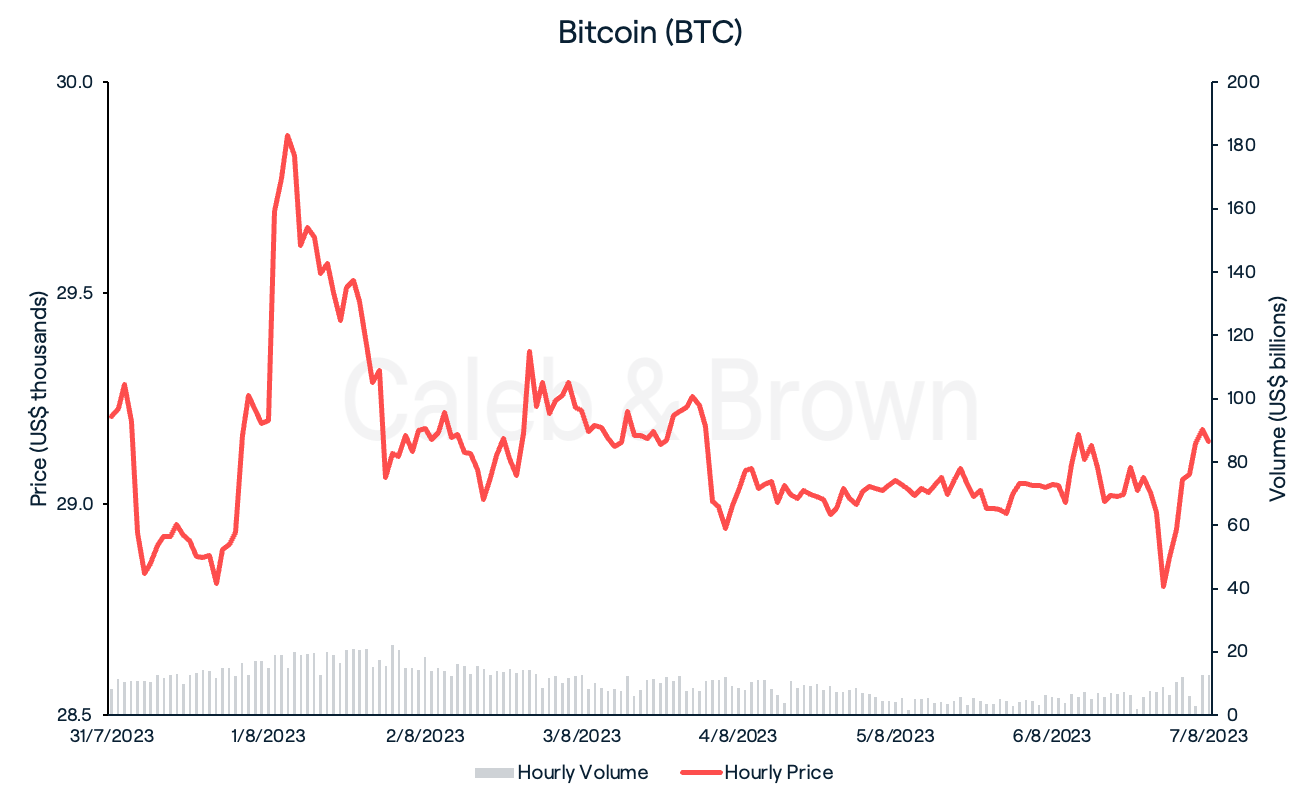

Bitcoin

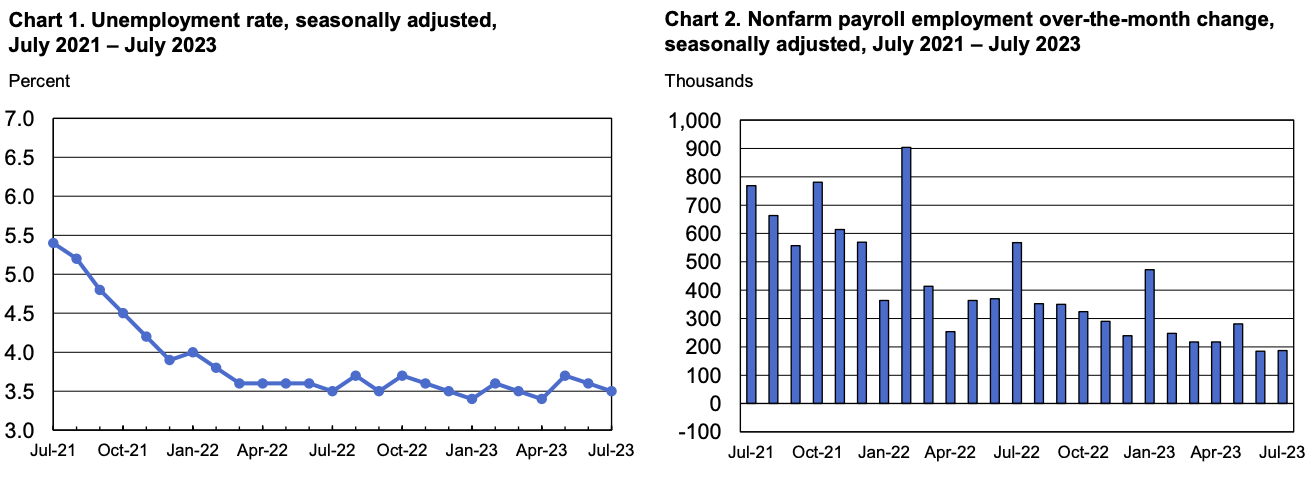

It was the sixth consecutive week of underwhelming price performance for the crypto space. Bitcoin (BTC) traded sideways after the U.S. Bureau Labor of Statistics released its July jobs report, revealing 187,000 new jobs in July (missing estimates of 200,000) and a tick down in unemployment rate to 3.5%, from 3.6% in June.

In a milestone event, KPMG, one of the ‘big four’ worldwide accounting firms, recently released a report pertaining to how Bitcoin’s protocol can positively contribute to the ESG investing framework; environmental, social, and governance. Bitcoin’s role in the ESG imperative represents the first instance of a mainstream financial institution conducting a comprehensive due diligence process on Bitcoin.

Overall, BTC closed the week at US$29,148, down a slight 0.2%.

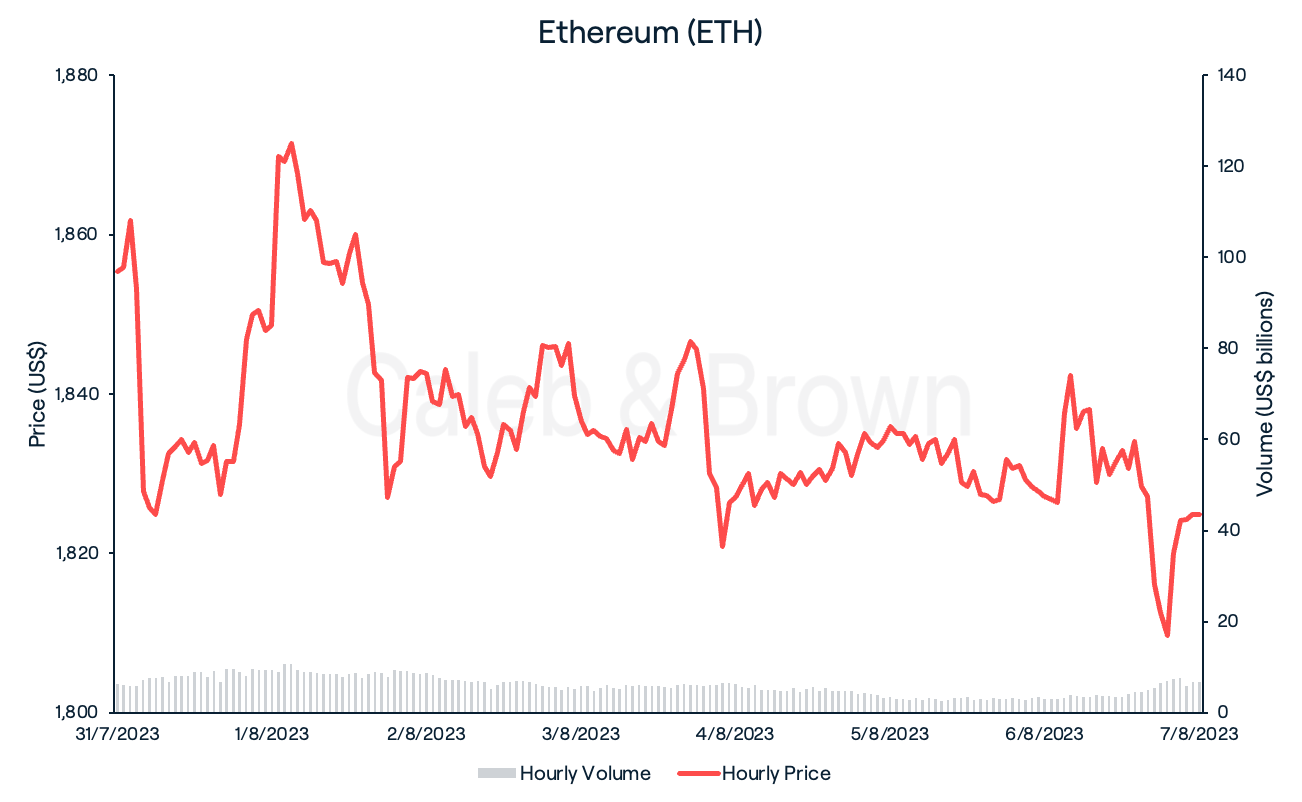

Ethereum

Ethereum (ETH) responded to the jobs report with more volatility, falling 1.7% after its release. ETH recovered slightly over the weekend to close the week at US$1,824, down 1.6%%.

On a more positive note, thirteen new ETH futures ETF (exchange traded fund) applications were filed over the last week. The SEC (Securities and Exchange Commission) has yet to approve an ETH futures ETF however, if the SEC does not deny any of the applications the Volatility Shares ETF will be first to launch on October 12.

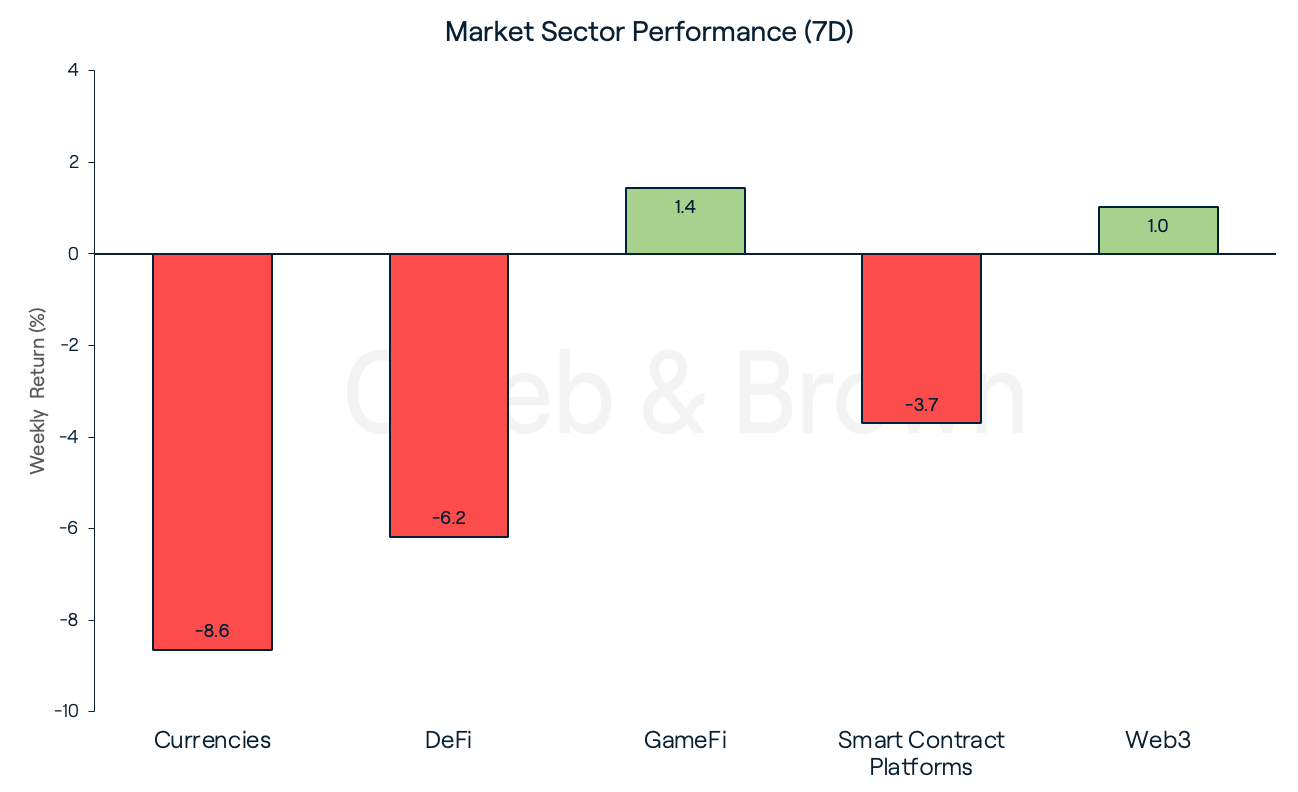

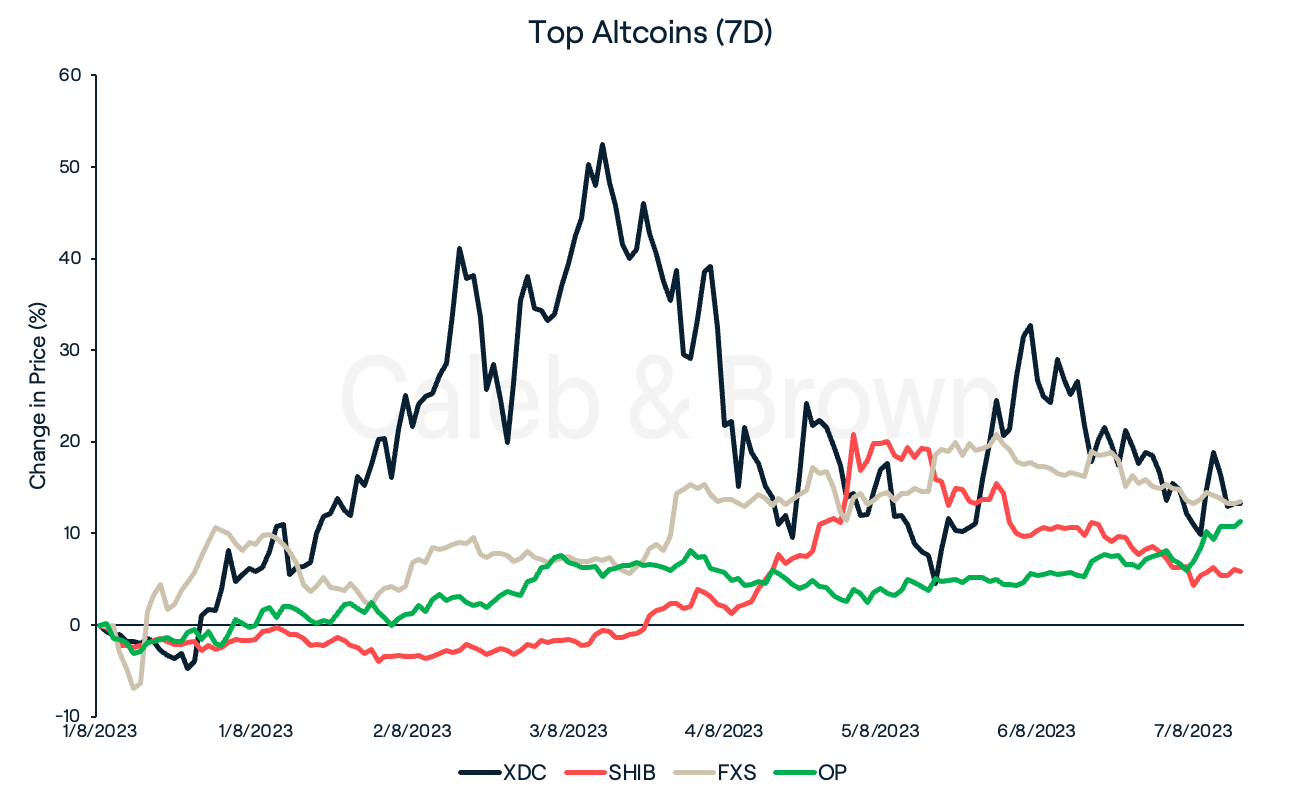

Altcoins

Market sector performance was mostly in the red this week with Currencies giving back most of the gains made over the last few weeks, losing 8.6%. GameFi and Web3 managed to stay afloat with each gaining 1.4% and 1.0%, respectively.

XDC Network (XDC) has continued its rally for the third consecutive week, peaking at a top of US$0.091 on Friday to close the week up 13.3%. More about the importance of last week’s partnership with Singapore’s Infocomm Media Development Authority's (IMDA) TradeTrust can be found here.

Memecoin Shiba Inu (SHIB) was up 5.8% this week after its team announced a new identity protocol which will integrate Self-Sovereign Identity (SSI), solidifying its status as a major DeFi player.

Frax Share (FXS), the fractional-algorithmic stablecoin protocol was also up 13.5% while Ethereum-based scaling solution Optimism (OP) enjoyed a 11.3% rally leading into the public launch of Base— a layer-2 protocol built on the OP stack.

In Other News

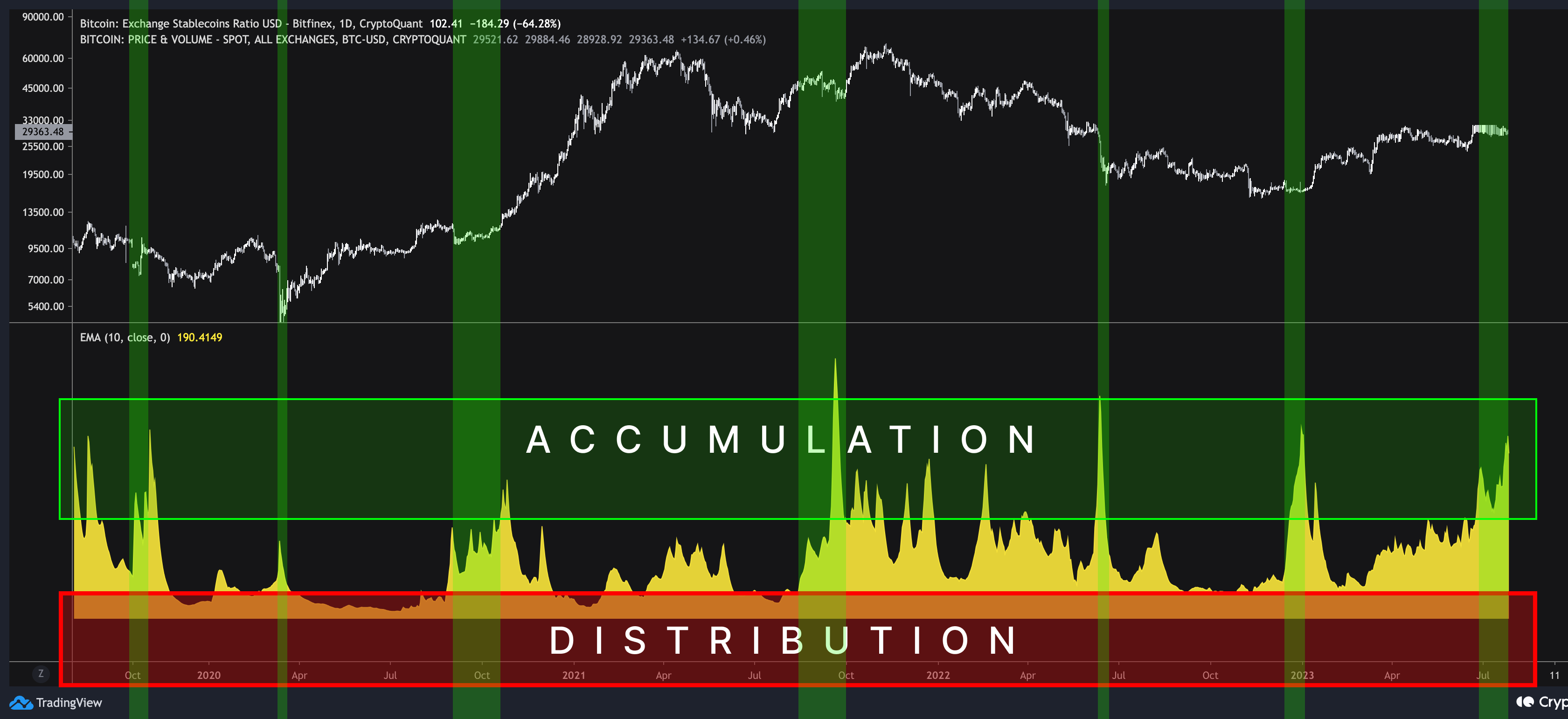

The Bitfinex Bitcoin/Stablecoin ratio, a leading indicator for Bitcoin price action, has spiked to yearly highs as shown in the chart below. A spike in the ratio typically identifies an accumulation phase proceeded by a surge in BTC price.

- Bloomberg Intelligence's ETF analysts have increased their estimates of a U.S. Bitcoin spot ETF launch from 50% to 65%, citing the approval of Coinbase’s BTC trading platform as a positive indicator.

- Ushering in a new wave of builders and liquidity, Coinbase’s layer-2 protocol, Base has opened bridges to its protocol ahead of its public launch on Wednesday. With big names such as Coca-Cola, Atari, and OpenSea already onboard, over US$120 million in liquidity has bridged over the past week, celebrating an “on-chain summer.”

Last week’s Curve DAO (CRV) exploit exposed DeFi to potentially higher risks after Curve’s founder, Michael Ergorov’s loans neared liquidation prices. If CRV dropped to US$0.35 his ~US$110 million in loans, across multiple DeFi platforms, would have been liquidated, saddling lenders with bad debt. Fortunately, Ergorov made numerous Over-the-Counter (OTC) deals to recoup the debt, preventing a disastrous outcome.

Regulatory

While Hong Kong took a significant step forward in embracing crypto, by implementing a new licensing regime in June, it could cost exchanges up to US$20 million to obtain a license.

Learn with Caleb & Brown: What is Tokenomics? Understanding What Makes a Token Valuable

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F3wsBJScy5tjSYFwOjjS711%2F0b66bff722b493a6101982fb880e2ed1%2FWeekly_Rollup_Tiles__8_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-08-08T02%3A55%3A33.011Z)