Market Highlights

- Bitcoin finally hit US$100,000.

- Ethereum reached a 2024 high of US$4,096.

- President-elect Donald Trump appointed Paul Atkins to be the next SEC chair.

- Grayscale Investments filed to convert its Solana Trust into an ETF on the NYSE Arca.

Catch up on the latest episode of Inside the Markets with Caleb & Brown! Jake Boyle recaps November’s biggest crypto and macro moments while providing insights into what December might have in store.

🔑 Highlights:

- $1 Trillion Added to the Crypto Market Cap in November

- The Comeback of "Dinosaur Tokens" (Litecoin, Cardano & more)

- XRP’s Stunning Rally: Breaking $2 for the first time since 2018

- Retail’s Slow Return: What signals to watch for

- Gensler’s Exit from the SEC and what’s next

💡 Strategies for profit-taking included! Stay ahead of the market with Caleb & Brown.

Markets Overview

Macro Market Updates:

There was more strong employment data out of the U.S. this week. JOLTS job openings came in above forecast at 7.74 million, and the non-farm employment change came in above the forecast 218,000 at 227,000. These figures will likely provide further support for the U.S. Federal Open Market Committee (FOMC) not to deliver anything larger than a 25-basis-point cut at its 19 December meeting. According to the platform Kalshi, the chance of a 25-basis-point cut in December currently stands at 74%.

In other macro news:

- The U.S. ISM Manufacturing Purchasing Managers Index (PMI) came in at 48.4.

- U.S. unemployment claims came in above forecast at 224,000.

- Australia’s gross domestic product (GDP) for the third quarter of 2024 came in under forecast at 0.3%.

- Canada’s unemployment rate came in higher than forecast at 6.8%.

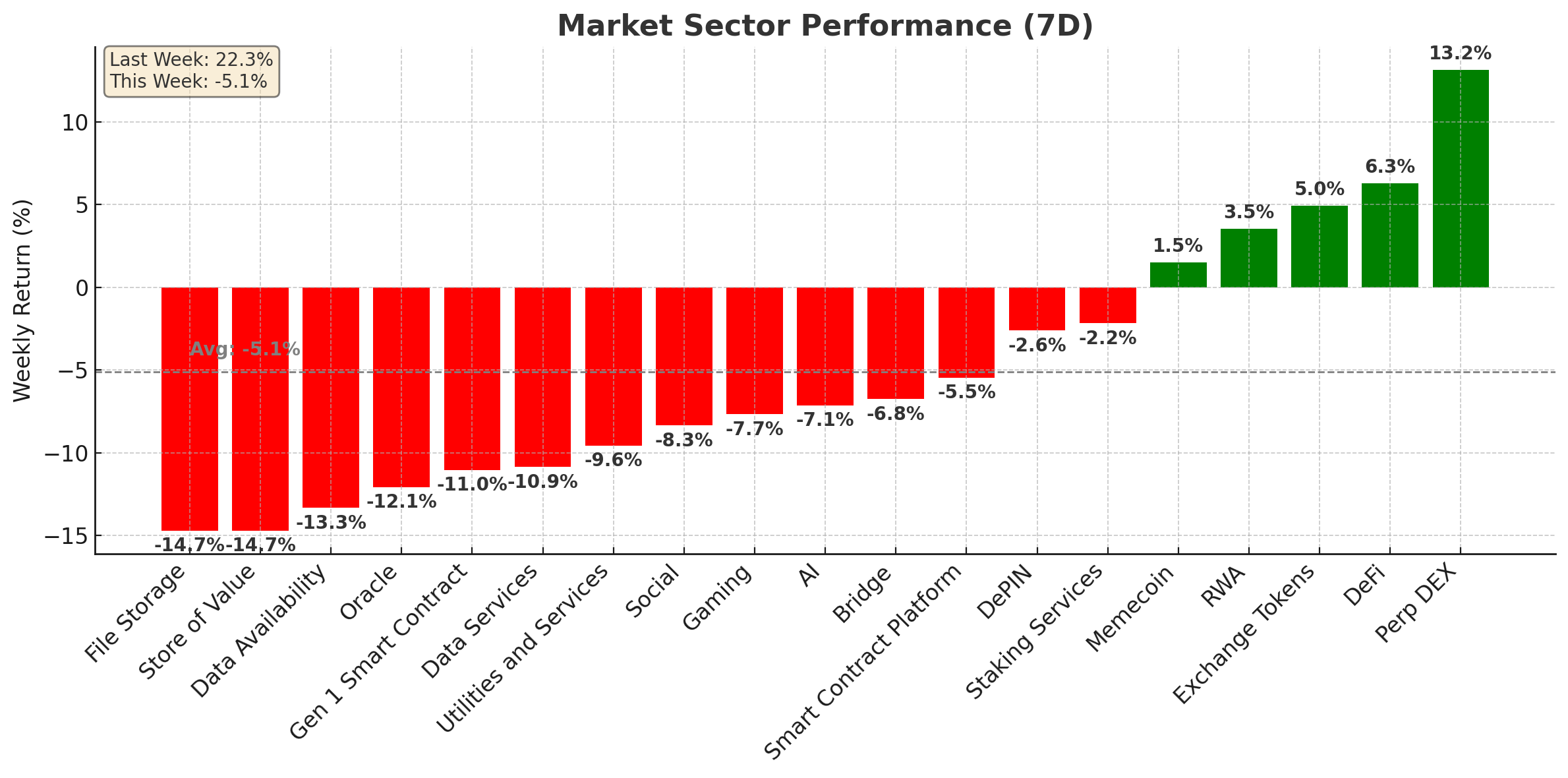

Crypto Market Sector Performance

The average sector performance across the crypto market was subdued at -5.1% this week. Perpetual decentralised exchanges (Perp DEX) was the biggest gainer, followed by decentralised finance (DeFi) and exchange tokens. The gains across DeFi protocols isn’t surprising given the upward momentum across the crypto market earlier in the week, where traders and investors may have looked to leverage their positions or stake their holdings to maximise their gains. In Perp DEX, the tokens dydX and GMX grew by 13.5% and 14%, respectively.

File storage was the biggest loser for the week, declining by 14.7%. Cryptocurrencies in this sector saw significant losses, with Filecoin, Chia and Storj losing 14%, 19.9% and 9.8%, respectively. The losses in this sector may be due to the concentration of capital toward trading and leveraging gains across crypto this week.

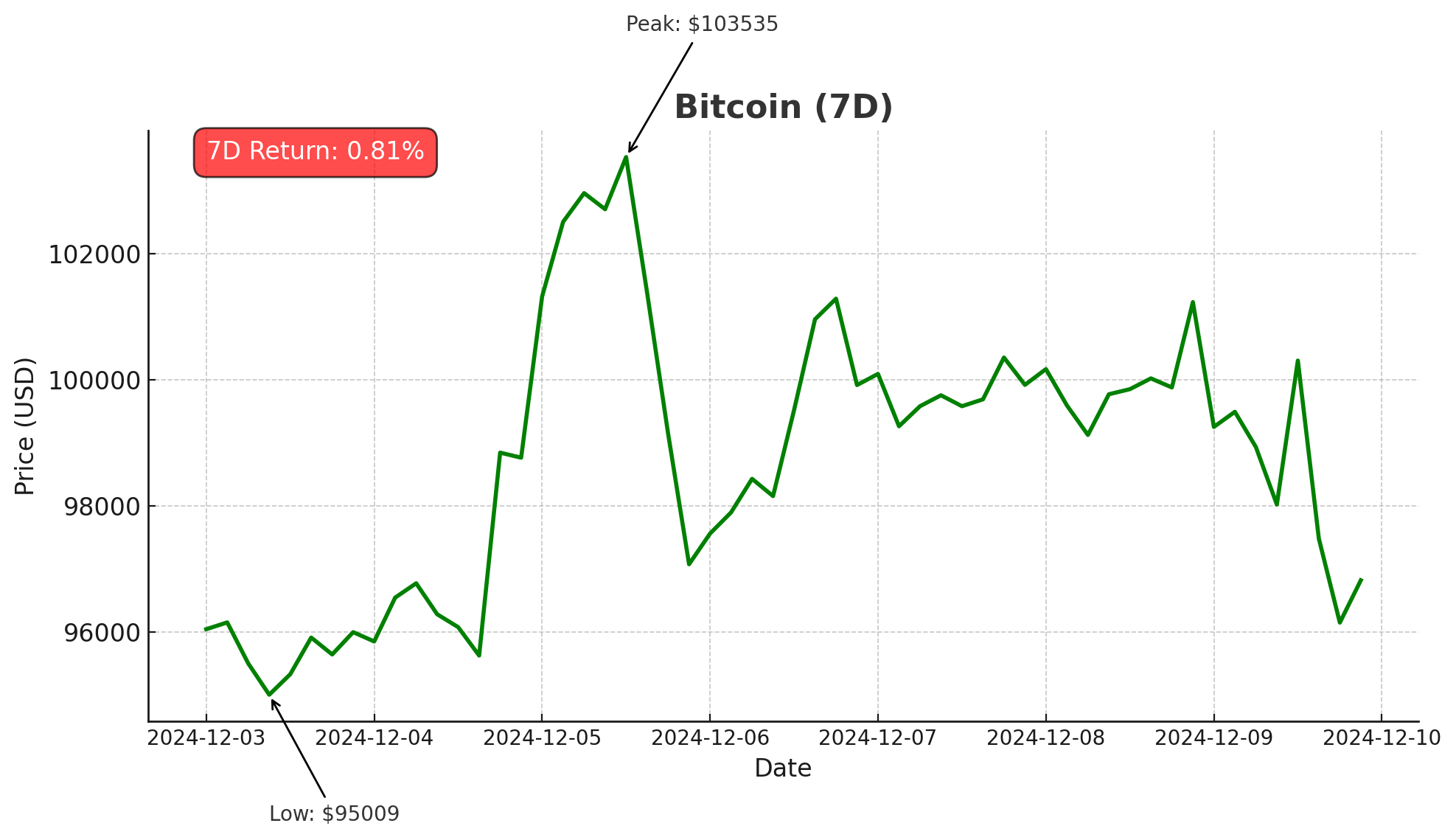

Bitcoin (BTC)

While bitcoin’s price didn’t move a great deal this week, the biggest cryptocurrency by market cap broke above the key level at US$100,000 on Thursday, 5 December. Opening the week at US$97,259, bitcoin had a small retrace before gaining to make another new all-time high. Price has since retraced, with bitcoin declining by over 4% on Monday, 9 December, to hover around US$97,000.

Bitcoin’s break above US$100,000 this week was presumably driven by institutional capital flowing into bitcoin exchange-traded funds (ETFs), increased buying activity from companies like MicroStrategy, which has recently ramped up its BTC accumulation, and the regulatory shifts expected in the U.S. following Donald Trump’s election.

Bitcoin exchange-traded funds (ETFs) saw inflows of US$2.5 billion this week. Short bitcoin saw inflows of US$6.2 million. After previous all-time highs, inflows to bitcoin ETFs have typically been higher, signalling that investors are being cautious.

After bitcoin made a new all-time high this week, the U.S. Government moved nearly US$2 billion worth of BTC seized from Silk Road to Coinbase. Bitcoin’s price declined by over 2% on the news as investors become cautious of selling pressure when large amounts of cryptocurrency are moved to centralised exchanges for possible liquidation. Further into the week, over US$1 billion in bitcoin positions were liquidated within three minutes, presumably due to the increase in funding rates when BTC broke US$100,000 and leveraged long positions being taken out when price retraced below this key level.

Spot bitcoin ETFs now hold more bitcoin collectively than pseudonymous founder Satoshi Nakamoto. At market close on Thursday, 5 December, bitcoin ETFs held over 1.1 million bitcoin, worth US$100 billion at current prices. The rapid growth of these ETF products, which are less than a year old, indicates how strong institutional interest is in bitcoin.

This week, a summary of Michael Saylor’s presentation of his company's bitcoin strategy to the Microsoft (NASDAQ: MSFT) board was circulated. The presentation urged Microsoft’s board to improve their treasury strategy by investing directly in bitcoin rather than completing stock buybacks or distributing dividends to lower shareholder risk and increase company value. Microsoft’s board will vote on whether they implement a bitcoin strategy at its 10 December shareholder meeting.

Also this week, the National Centre for Public Policy Research recommended that Amazon adopt a BTC strategy, citing how MicroStrategy’s stock outperformed Amazon’s by 537%, presumably due to its bitcoin strategy.

Past performance is not a reliable indicator of future results.

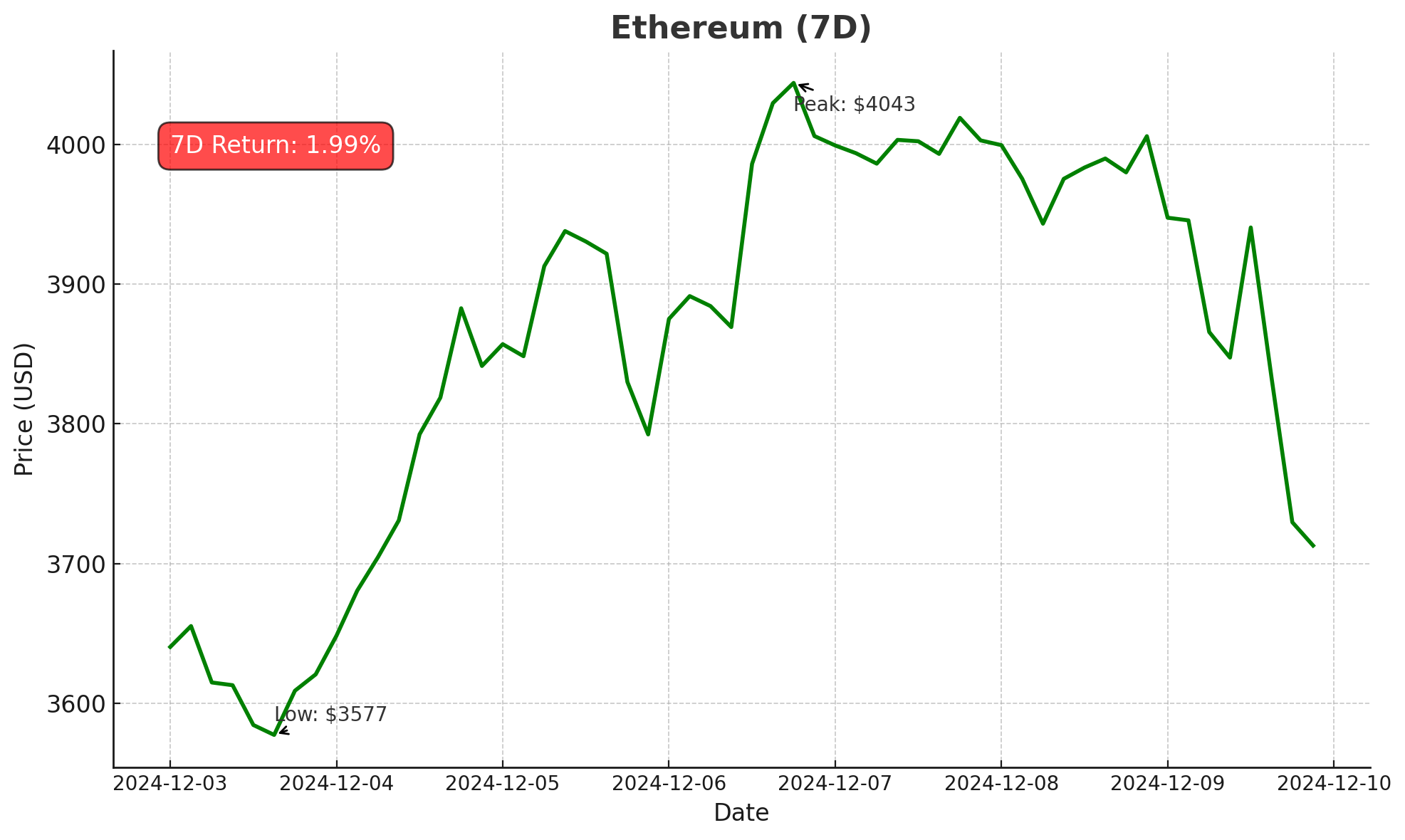

Ethereum (ETH)

It was another strong week for Ethereum. The second largest cryptocurrency by market cap opened the week at US$3,710 before retracing slightly, then rallying to break US$4,000 to the upside on Friday, 6 December, to make a yearly high of US$4,096. Since breaking this key level, price has retraced by over 8% to around US$3,670. This retrace is presumably due to profit taking after the most recent rally, and the potential that long positions have been liquidated due to the retrace, which has increased sell-side pressure.

This week’s gains were presumably driven by a 300% surge in transaction volume on the Ethereum network as ETH reached its 2024 high. Growing activity on the network demonstrates that institutional and high-net-worth investors are transacting now before retail crowds spur any further bull runs. Also this week, active addresses on the Ethereum network grew by 36% to 417,000 as more certainty around crypto’s regulatory future and bullish technical price action fuel upward momentum.

Ethereum asset investment products saw record weekly inflows of US$1.2 billion — the highest inflows since Ethereum ETFs launched in July. Assets under manangement (AuM) in ETH products now stands at US$19.6 billion.

Past performance is not a reliable indicator of future results.

Altcoins

Outstanding oracle

- XYO Network (XYO) gained 174.6%, taking its market cap to US$362.2 million. Price found support around US$0.0085 before rallying over 400% and then retracing. The gains on the decentralised physical infrastructure network (DePIN) are presumably due to speculation of a pending partnership with Tesla. Scott Scheper, XYO Network’s co-founder posted on X to announce that he’s visiting a Tesla hardware centre on Thursday, 12 December for the “XYO cybertruck.”

Cross-chain currency

- VGX Token (VGX) grew by 97.6%. This takes its market cap to US$22.7 million. The cross-chain gaming token has seen significant declines since August following the announcement of its delisting from Binance. VGX has since found support at the 50 EMA and rallied up to around US$0.0246. The VGX Foundation recently posted on X addressing questions that users and investors had about its new minting process, stating that new tokens minted were to establish a treasury and weren’t in circulating supply.

DeFi dominates

- IDEX (IDEX) gained 86.9%, taking its market cap to US$87.8 million. Price gained gradually throughout the week following the team’s “Ask Me Anything” (AMA) session on 29 November. The omnichain perpetual decentralised exchange (DEX) presumably made gains throughout the week due to its announcement of a new buy-and-lock liquidity initiative that’s launching on the network this week.

- Sushi (SUSHI) grew by 83.8%. This takes the automated market maker’s (AMM) market cap to US$480.4 million. The gains for the multi-chain DEX are presumably due to wider growth across the DeFi sector, as well as the announcement of trading competitions and referral program deals launched to attract more users to the network.

- Orca (ORCA) gained 80.2%, taking its market cap to US$326.9 million. Price rallied over 120% on Friday, 6 December, before retracing. The gains are likely due to ORCA being listed on crypto exchange MEXC and Binance announcing it will also list ORCA.

Past performance is not a reliable indicator of future results.

In Other News

This week saw the largest inflows on record for digital asset investment products, with US$3.85 billion flowing into funds. Year-to-date inflows now stand at US$41 billion, while the total assets under management (AuM) has reached a new high of US$165 billion. Around the world, the U.S. saw the largest inflows at US$3.6 billion, while Switzerland, Germany, Canada and Australia saw inflows of US$160 million, US$116 million, US$14 million, and US$10 million, respectively.

Other crypto news

- Grayscale Investments filed to convert its Solana Trust into an ETF on the NYSE Arca. The Trust manages US$134.2 million, which represents 0.1% of SOL in circulation. In converting the fund, the investment firm aims to improve access to Solana (SOL), improve SOL’s price tracking compared to its current over-the-counter trust, and eliminate the inefficiencies of having an unlisted structure. This latest move by Grayscale follows VanEck and 21Shares filing to launch spot Solana ETFs, Canary Capital applying to launch a Solana-based ETF in October, and Bitwise Asset Management applying to launch a spot Solana ETF in November.

- Correspondence between the Federal Deposit Insurance Corporation (FDIC) and member banks proved that the U.S. government instructed banks to refrain from offering banking services to firms that offer crypto products and services. The 23 letters, which were circulated in 2022, were released under a freedom of information request submitted by Coinbase. Paul Greal, Coinbase’s chief legal officer, took to X (formerly Twitter) on Friday to say the letters are evidence that there was an “Operation Chokepoint 2.0” aimed at making it difficult for companies in the crypto sector to access banking services in the U.S. While the letters don’t explicitly request that banks halt “crypto-related activities,” Greal argues that the correspondence could have been enough for banks to proactively stop offering its services to crypto companies and executives so they didn’t lose FDIC backing.

Regulatory

- President-elect Donald Trump made two crypto-friendly appointments this week. Venture Capitalist David Sacks has been appointed to be the White House A.I. & Crypto Czar. Sacks will be tasked with setting a policy guide for AI and crypto in the U.S. and having direct communication with federal regulators, such as the Securities and Exchange Commission (SEC). When current SEC Chair Gary Gensler steps down in January, Paul Atkins, a pro-crypto former SEC commissioner, will be in charge of the agency. Atkins is currently the CEO of Patomak Global Partners, which is a financial services consultancy firm.

- Attorneys for Roger Ver, known as “Bitcoin Jesus” amongst the crypto community, filed a motion to dismiss his criminal indictment. Ver was charged by the U.S. Department of Justice with tax evasion in April for failing to pay US$50 million in taxes. The motion cites unclear regulation, selective quotations of communications with the grand jury, and rights violations as reasons for Ver’s case to be dismissed. In May, Ver paid bail of US$160,000 to be released from prison in Spain before being extradited to the U.S.

In Case You Missed It

Phishing scams are getting smarter, but spotting the signs can help keep your information safe.

Quick Tips:

-Check Sender Details: Look for slight errors in email addresses. We always contact you from the calebandbrown.com domain.

- Beware of Urgent Language: Scammers use fear to push you into action.

- Avoid Suspicious Links: Hover over links to verify their authenticity before clicking.

- Stay Secure: We never ask for sensitive info via email. Communicate securely via our portal with 2FA enabled.

Unsure about a message? Use CallerCheck in the client portal to verify.

Want the full breakdown? Read the blog and stay protected.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.