Market Highlights

- Microsoft shareholders voted against adding bitcoin to its treasury.

- U.S. House Representative French Hill (R-Ark.), a crypto supporter, has been selected to lead the Financial Services Committee.

- A Satoshi-era bitcoin investor, Frank Richard Ahlgren III, has been sentenced to two years in prison for misrepresenting his capital gains in tax filings.

- Superform, a crypto yield marketplace, launched SuperUSDC, which is designed to provide automated yield.

Markets Overview

Macro Market Updates:

It was a week of inflation data releases in the U.S. and interest rate decisions by central banks globally. In the U.S., the consumer price index (CPI) for the 12 months ending 30 November 2024 came in slightly above forecast at 2.7%. News sources say significant increases in specific food products, such as eggs, coffee, beef and non-alcoholic beverages, are the cause of the CPI uptick. Unemployment claims came in 21,000 above forecast at 242,000. This inflation and employment data out of the U.S., coupled with other central banks lowering their interest rates this week, points to a likely 25-basis-point cut by the U.S. Federal Reserve at its meeting on Wednesday, 18 December.

In other macro news:

- The Bank of Canada lowered its overnight rate by 50 basis points to 3.25%.

- The European Central Bank cut its main refinancing rate by 25 basis points to 3.15%.

- The Swiss National Bank lowered its policy rate to 0.50%.

- The Reserve Bank of Australia was the only central bank to leave rates on hold this week at 4.35%.

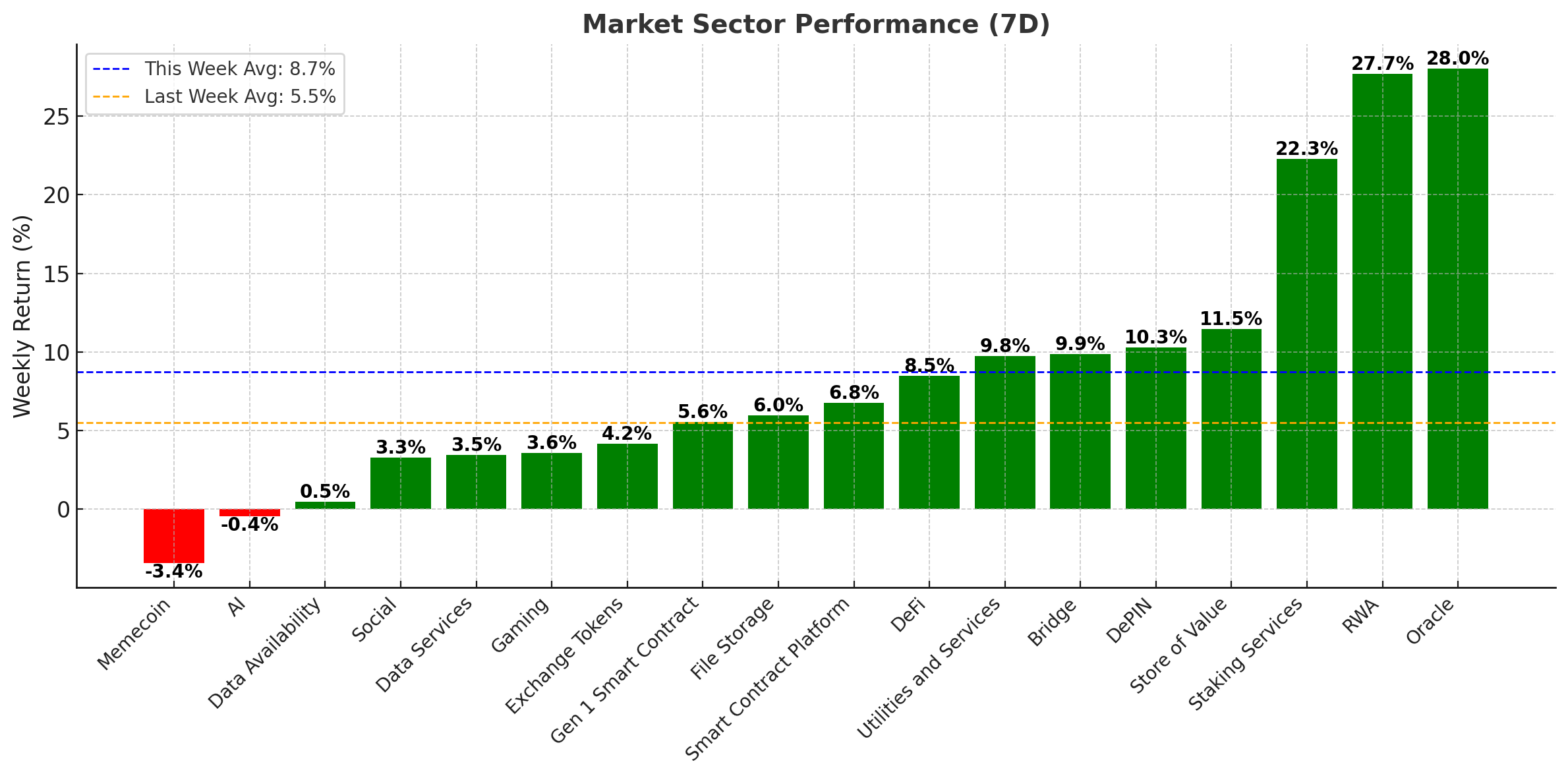

Crypto Market Sector Performance

The average sector performance across the crypto market this week was 10.1%. Oracles, real-world assets and staking services led the way, each with growth of over 20%. The biggest gainer in oracles was Chainlink (LINK), which grew by 30.3% on the week. These gains are presumably due to the Trump family’s World Liberty Financial providing financial backing to the decentralised oracle network. The biggest gainer in real-world assets this week was Ondo (ONDO), which is to be expected given the growing investor interest in accessing traditional financial instruments on the chain.

The biggest losers of the week were meme coins, artificial intelligence and data availability. Many meme coins saw larger losses than other crypto sectors in the flash crash at the start of the week, with some popular coins losing over 20%. Steeper losses are to be expected in market sectors like meme coins, where volatility is typically higher.

Crypto Market Sector Performance (7D)

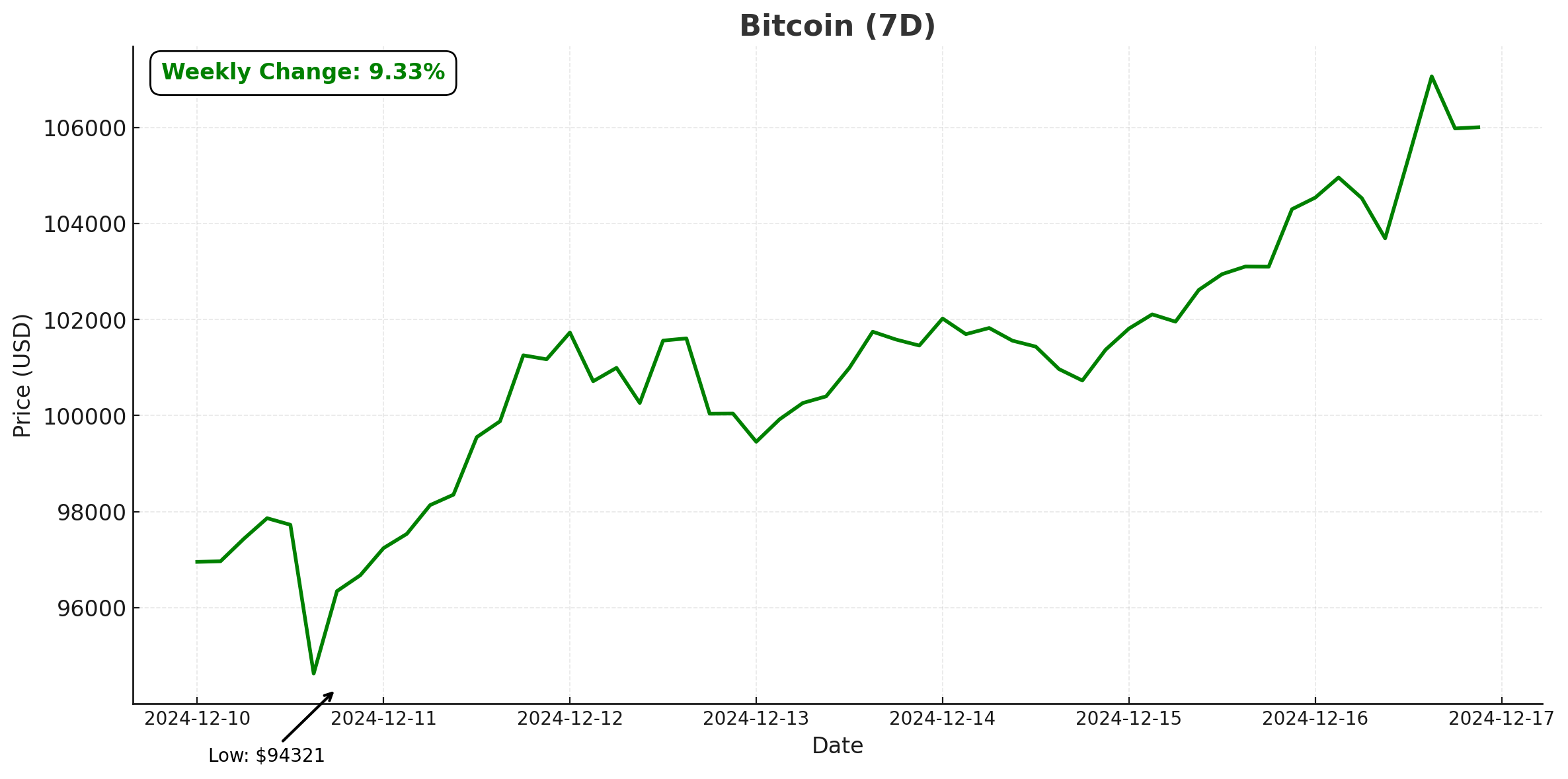

Bitcoin (BTC)

After starting the week with a decline of over 4% on Monday, 9 December, bitcoin found support around US$96,000 to break and close above US$100,000 on Wednesday, 11 December. Price has since hovered just above this key level. The week’s gains mark the longest weekly run of price growth since 2021, driven by the expectation of crypto-friendly regulatory developments under Donald Trump, renewed hopes of the U.S. establishing bitcoin as a reserve asset, and the likelihood of another rate cut by the U.S. Federal Reserve on 18 December. On Monday, 16 December, bitcoin reached a new all-time high of US$107,857.

Bitcoin exchange-traded funds (ETFs) saw inflows of US$2 billion this week. This brings total inflows since the U.S. presidential election to US$11.5 billion. Across all bitcoin asset investment products, the average daily trading volume for 2024 stands at US$8.3 billion, which is twice the daily volume traded on the FTSE 100.

Microsoft’s shareholders voted against implementing a bitcoin strategy similar to the one adopted by MicroStrategy. Just 0.55% of shareholders voted in favour of adding bitcoin to the tech giant’s treasury.

MicroStrategy Inc. joined the Nasdaq 100 Index this week, which could increase interest in the biggest cryptocurrency by market cap. The interest is expected to come through index funds that may buy MicroStrategy shares, which will help the company continue raising funds to buy more bitcoin.

Ray Dalio, the founder of hedge fund Bridgewater Associates, said that “hard money” like bitcoin and gold are preferred in the debt crisis he sees evolving in major economies. In his speech at Abu Dhabi Finance Week, Dalio cited “unprecedented levels” of debt in the U.S. and China playing a role in the debt crises he expects in the coming years.

Satoshi Hamada, a House of Councillors member in Japan, submitted a formal request for the government to launch a national bitcoin reserve. It follows growing discussions in the U.S. on the topic, plus similar calls by elected representatives in Russia, Brazil and Poland to establish bitcoin reserves in their own countries. Also this week, Texas State Representative Giovanni Capriglione introduced a bill to establish a state bitcoin reserve.

BiT Global is suing Coinbase after the exchange announced it will delist the Wrapped Bitcoin (WBTC) token. The company is alleging the exchange is delisting WBTC to promote its own wrapped bitcoin token, cbBTC.

Past performance is not a reliable indicator of future results.

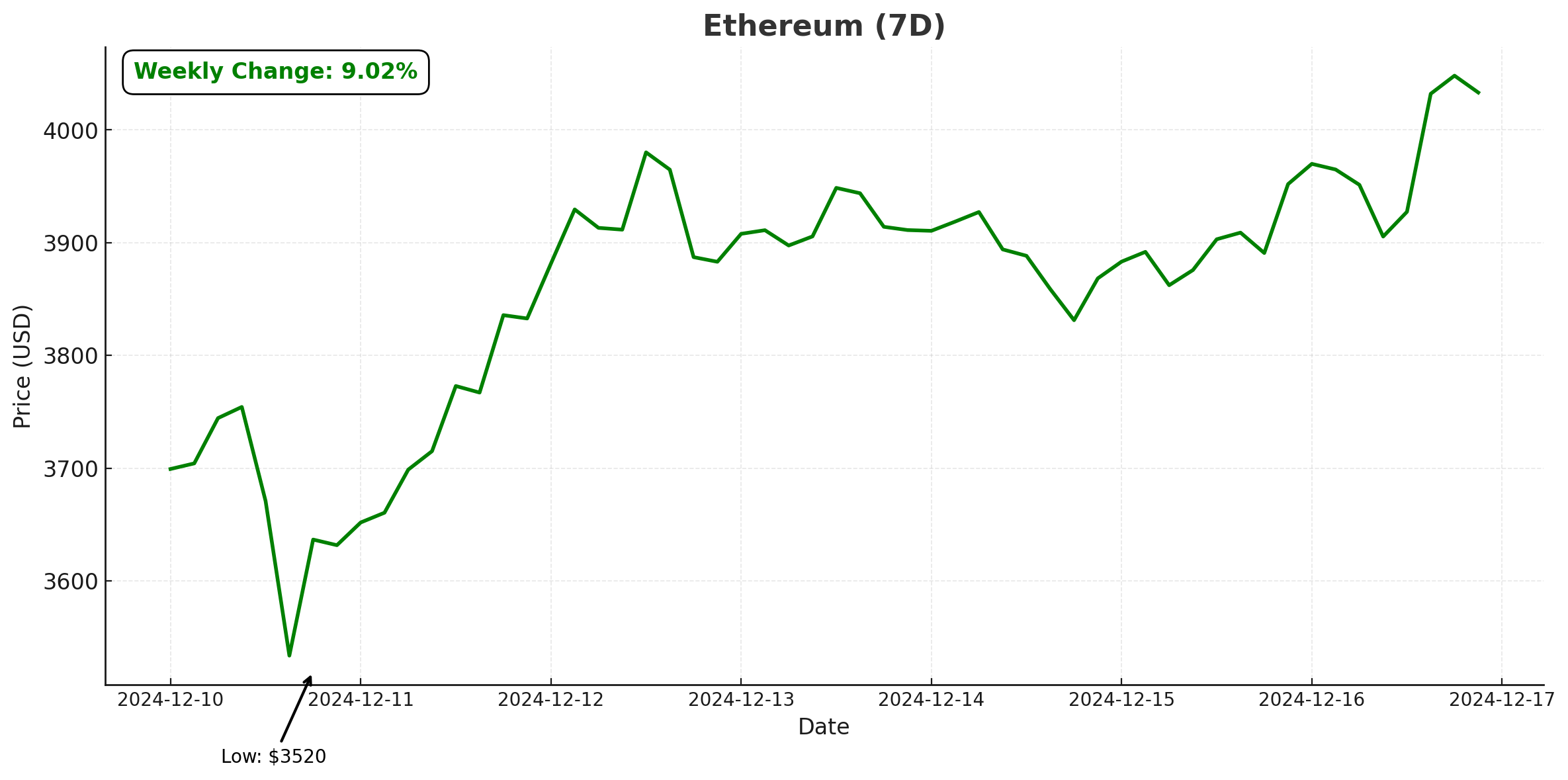

Ethereum (ETH)

It was a quiet week for Ethereum. The second largest cryptocurrency by market cap opened the week at US$4,007.38, declined to around US$3,500 and then regained the losses to close the week just below US$4,000. The sell-off to begin the week occurred with the flash crash across the wider market. Since this crash, price rebounded to make a new all-time high of US$4,109 on Monday, 16 December.

Despite record levels of capital entering Ethereum exchange-traded funds (ETFs) in recent weeks, price hasn’t rallied significantly. This is presumably due to the growing number of net short positions on the Chicago Mercantile Exchange (CME), where 6,349 futures contracts are open short positions.

Record-breaking inflows for Ethereum asset investment products continued this week. The BlackRock Ethereum ETF saw US$200 million of inflows on Thursday, 12 December, taking its inflows since 20 November to US$1.5 billion. Across the board, Ethereum asset investment products saw inflows of US$1 billion this week, marking the seventh consecutive week of inflows for these products.

Ethereum is currently trading at US$4,043, an increase of 8.9% on the week.

Past performance is not a reliable indicator of future results.

Altcoins

Currency

- AVA (Travala) (AVA) gained 162.9%, taking its market cap to US$119.3 million. The majority of the week’s gains occurred on Thursday, 12 December, when price rallied by almost 350% before retracing. The rally was due to former Binance CEO Changpeng Zhao (CZ) revealing that Binance was an early investor in the crypto travel platform. The announcement from CZ coincided with Travala growing to surpass US$100 million gross annual revenue.

DeFi gains

- Velodrome Finance (VELO) grew by 56.6%, taking its market cap to US$219.8 million. The gains occurred when Binance announced that it would list Velodrome Finance on Friday, 13 December. VELO surged by almost 200% throughout the week following the announcement before retracing.

- Aave (AAVE) gained 32.3%. This takes the DeFi lending network’s market cap to US$5.48 billion. The gains are presumably due to an influx of dormant tokens to the lending platform. This happened simultaneously with the “Mean Dollar Invested Age” on the platform declining, which means that large AAVE holders are moving more of their tokens back into circulation to generate yield.

- Ondo (ONDO) grew by 27.2%, which takes its market cap to US$2.9 billion. This week’s gains follow recent weeks where price for the on-chain institutional-grade finance network grew by over 100%. The gains are presumably due to its focus on tokenising U.S. Treasury Bonds as investor and trader interest in tokenised real-world assets grows.

- Velo (VELO) gained 24.6%, taking its market cap to US$249.3 million. The utility token for the Velodrome Finance network grew due to its listing on Binance this week. Price found support around US$0.024 before rallying to around US$0.034.

Past performance is not a reliable indicator of future results.

In Other News

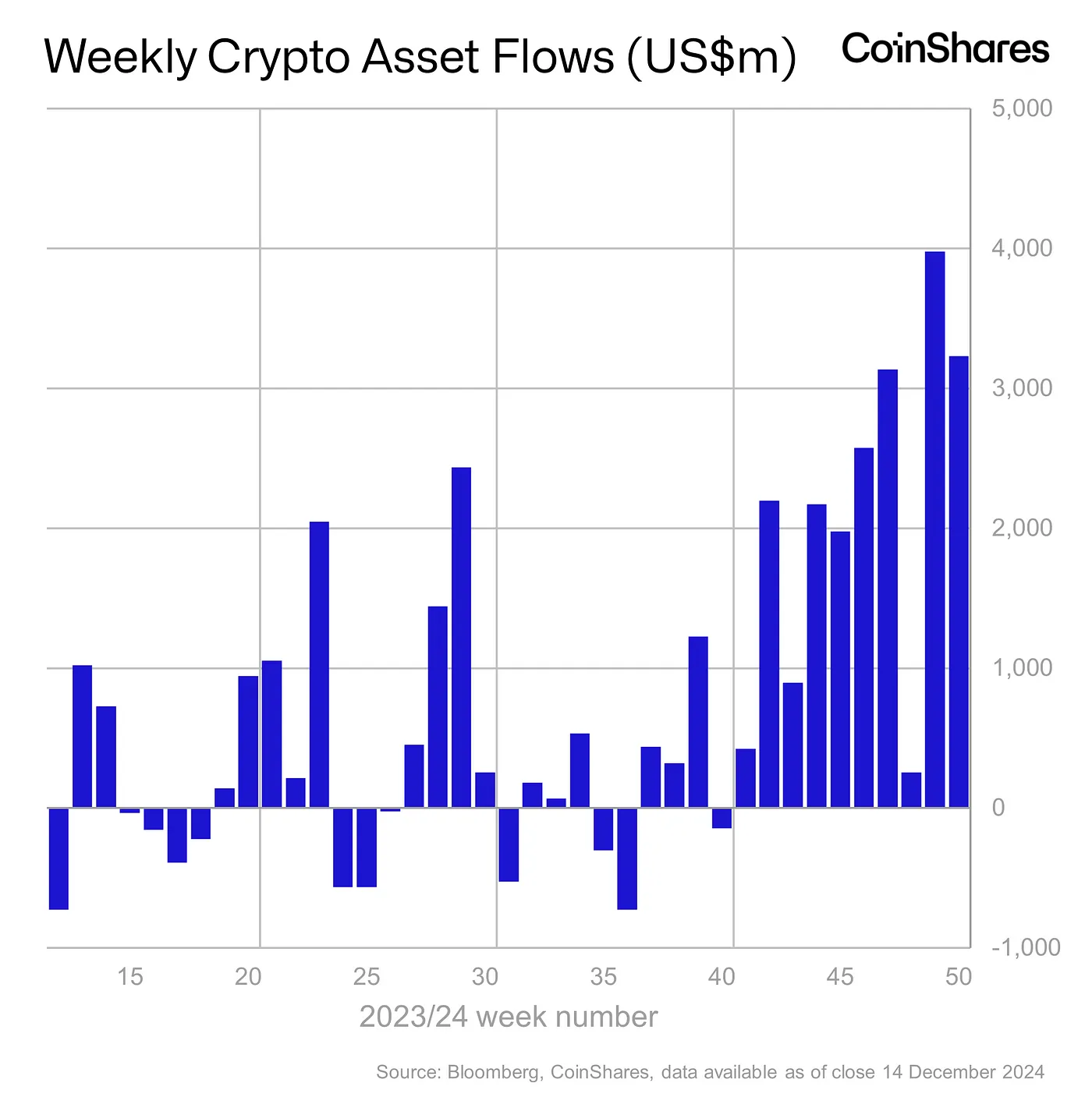

It was another strong week for digital asset investment products, with US$3.2 billion of inflows, bringing year-to-date flows to US$44.5 billion. It marks the tenth consecutive week of inflows for these products, where trading volumes have averaged US$21 billion per week. Around the world, the most notable inflows occurred across the U.S., Switzerland, Germany and Brazil, which saw US$3.1 billion, US$36 million, US$33 million and US$25 million, respectively.

XRP had a strong week of inflows totalling US$145 million, driven by investor hopes of a US-listed ETF.

Other crypto news

- Ripple, the blockchain closely related to the XRP Ledger (XRP), has received regulatory approval to launch its stablecoin, RLUSD, on Tuesday, 17 December. The RLUSD is backed by U.S. dollar deposits, government bonds, and cash equivalents which aim to keep its price at US$1.

- Superform, a crypto yield marketplace backed by Circle and VanEck, has launched a new product that automatically finds decentralised finance (DeFi) yield opportunities on Circle’s stablecoin. SuperUSDC has been designed to provide “automated, non-custodial yield management” to users. The product was developed in response to over 100,000 digital wallets interacting with the Superform platform since its launch earlier this year. SuperUSDC is part of the platform’s SuperVaults product, which automatically allocates digital assets to generate yield opportunities.

- An AI-based investment project has launched with the aim of changing how crypto communities invest, govern and operate. Not to be confused with Marc Andreessen’s a16z, AI16z DAO is a decentralised autonomous organisation (DAO) that uses AI to manage capital like a hedge fund. In traditional hedge funds, only accredited investors can allocate funds, whereas AI16z DAO allows investors to gain exposure by simply buying the token, while AI agents manage the fund. The DAO currently holds over US$10 million in assets, and it's still in the testing phase.

- U.S. House Representative French Hill (R-Ark.) has been selected to lead the Financial Services Committee. Hill currently chairs the committee’s digital asset panel, supporting several crypto bills in this role. The Financial Services Committee has jurisdiction over the Federal Reserve, Wall Street regulation, and growing responsibility for crypto oversight. Hill was one of the supporters of overturning the Staff Accounting Bill 121, where the U.S. Securities and Exchange Commission (SEC) required banks to record their customers’ crypto holdings as liabilities on their balance sheets.

Regulatory

- Frank Richard Ahlgren III, a bitcoin investor who bought the cryptocurrency back in 2011, was sentenced to two years in prison for underreporting the capital gains made on selling US$3.7 million worth of bitcoin. Between 2017 and 2019, Ahlgren sold his bitcoin for US$4.35 million but misrepresented the gains made in his tax filings. The U.S. Department of Justice estimated its tax loss at US$1 million. Beyond the prison sentence, Ahlgren has also been ordered to serve one year of supervised release and pay restitution of US$1,095,031. The sentencing marks the first ever for crypto tax evasion.

- The U.S. Supreme Court has dismissed Nvidia’s motion to drop the investor-led class action against the company for allegedly understating its revenue made from mining-related GPU sales. The ruling, made on 11 December 2024, means the case will proceed after initially being dismissed by a California district court in March 2021. Nvidia made US$155 million from cryptocurrency mining-related sales in Q1 of 2021. This preceded the company launching a line of dedicated products for crypto miners and unsuccessfully trying to boost the performance of its GPUs for crypto mining.

In Case You Missed It

Scammers don’t just rely on tech—they manipulate emotions to trick you into sharing sensitive information.

Spot the Tactics:

- Impersonation: Scammers pose as someone you trust.

- Urgency & Pressure: Phrases like “Act now!” push you to respond quickly.

- Emotional Manipulation: Fear, sympathy, or excitement can cloud your judgment.

Protect Yourself:

- Pause and verify before acting.

- Be cautious of online relationships that feel one-sided.

- Use CallerCheck in our client portal to confirm Caleb & Brown representatives securely.

Want to learn more? Read the full blog and stay ahead of scammers.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.