Market Highlights

- Malicious code found on crypto hardware wallet, Ledger, which could allow hackers to drain balances caused some mid-week volatility.

- El Salvador's planned Bitcoin ‘Volcano Bonds’ finally received regulatory approval from the country's Digital Assets Commission (CNAD).

- Major crypto exchange Binance, filed for the dismissal of its ongoing lawsuit with the Securities and Exchange Commission (SEC) after a recent settlement of US$4.3 billion with U.S. regulators.

Bitcoin

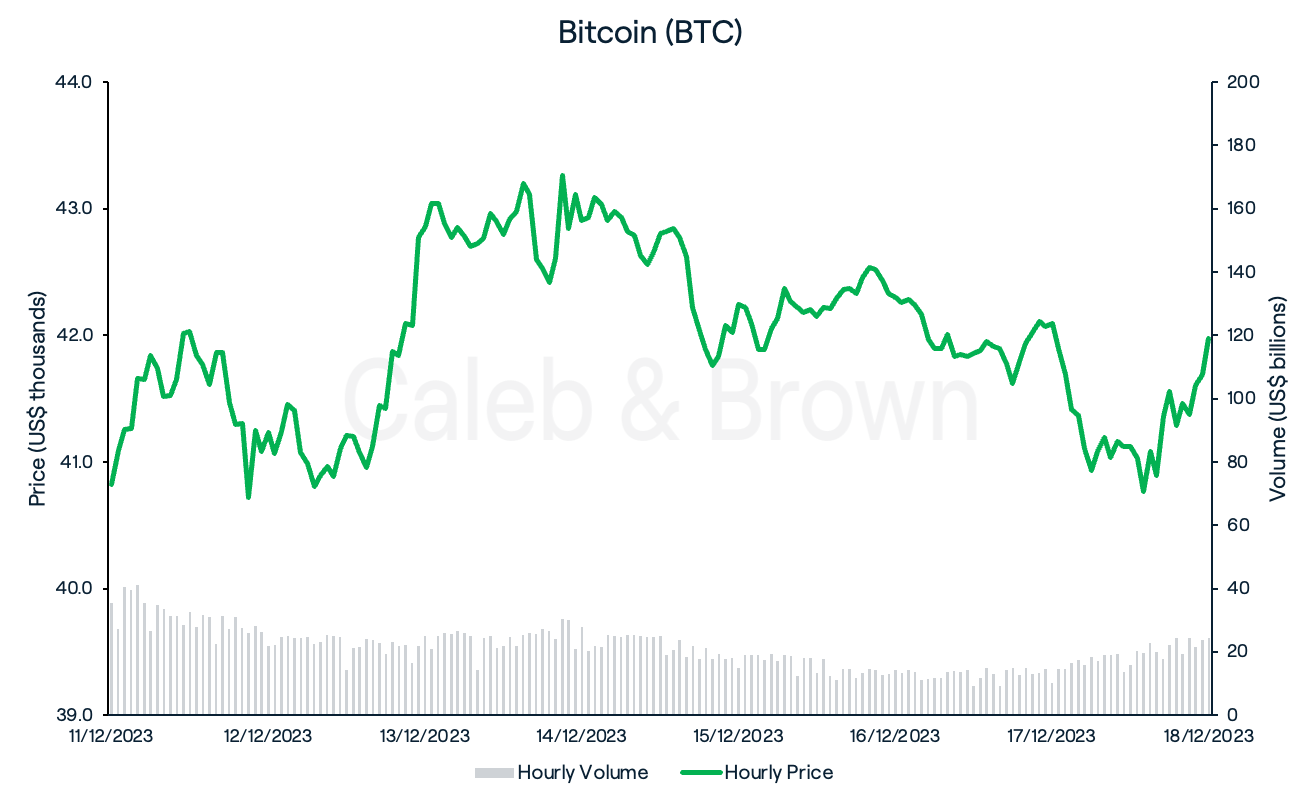

Bitcoin (BTC) has settled in price after a large downward swing towards the end of last week, trading the majority of the week between US$40,000 to US$43,000.

The dip in price in the middle of the week was linked to malicious code found on crypto hardware wallet, Ledger, which could allow hackers to drain balances from user’s Ledger devices. Ledger have since identified and replaced the malicious file, but warn users not to interact with DeFi apps just yet.

🚨We have identified and removed a malicious version of the Ledger Connect Kit. 🚨

— Ledger (@Ledger) December 14, 2023

A genuine version is being pushed to replace the malicious file now. Do not interact with any dApps for the moment. We will keep you informed as the situation evolves.

Your Ledger device and…

BTC closed the week at US$41,976, holding on to a weekly gain of 2.8%.

Ethereum

Ethereum (ETH) experienced similar price action to BTC, falling over the weekend to close the week at US$2,186, down a slight 0.4% over the last seven days.

Altcoins

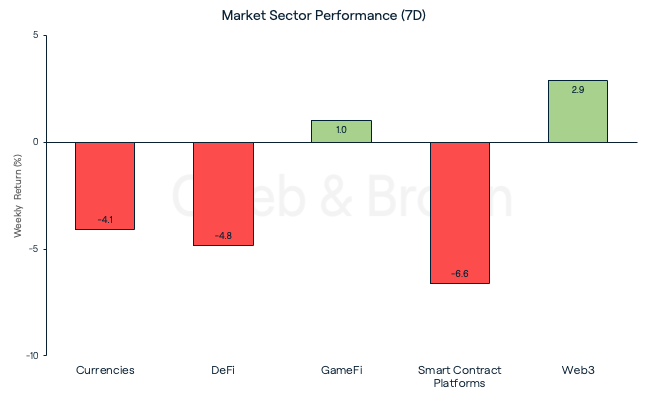

While the majority of the market cooled-off this week, Web3 and GameFi both held on to respective gains of 2.9% and 1.0%, over the last seven days. Smart Contract Platforms was the biggest hit sector, losing 6.6%.

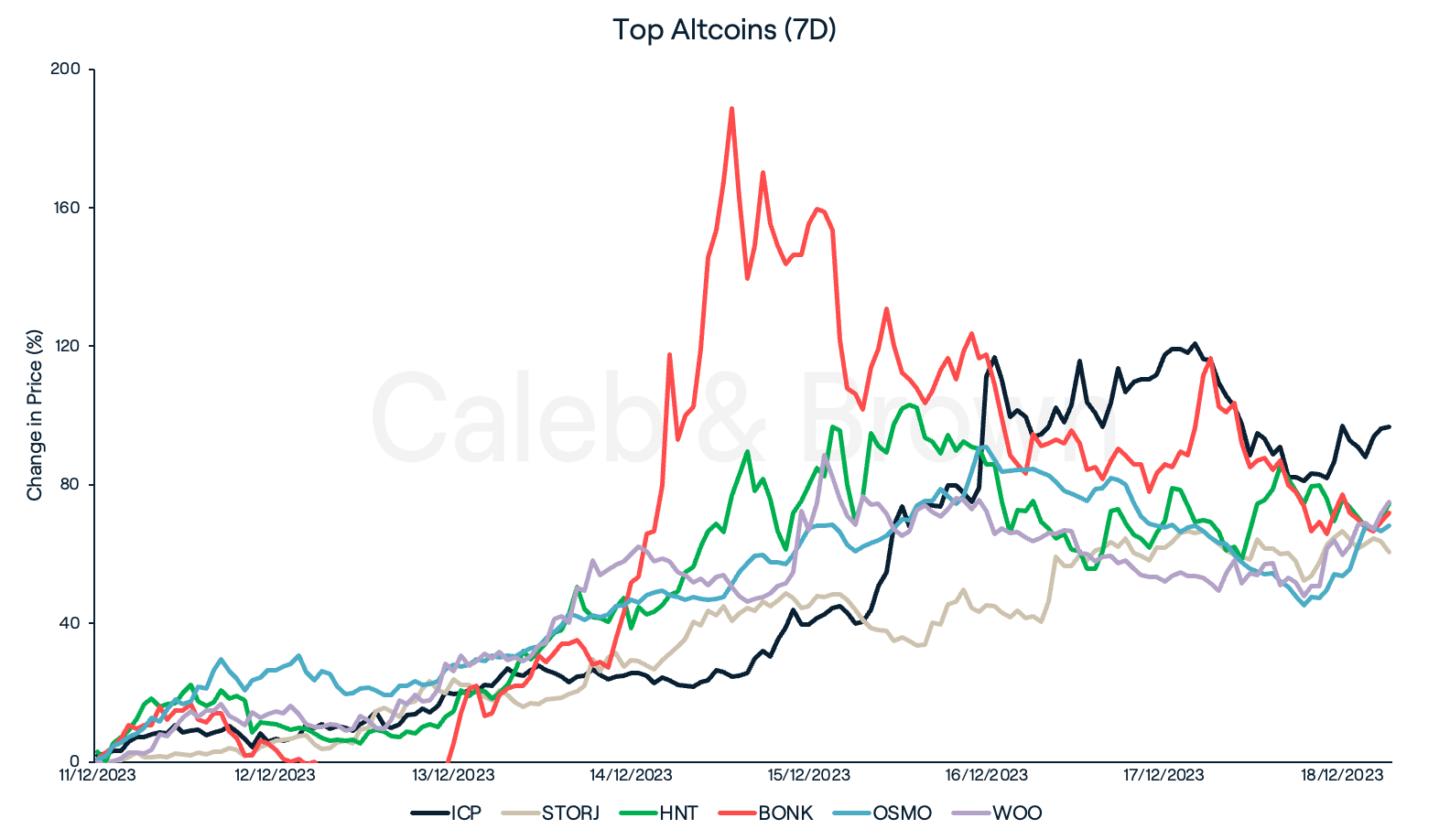

The top performers amongst the Web3 sector were Internet Computer (ICP), Storj (STORJ) and Helium (HNT) which each gained 96.8%, 60.6%, and 74.4%, respectively. ICP’s surge can be linked with the rising popularity of Ordinals inscriptions and its Ordinals marketplace, Bioniq, while HNT has extended last week’s rally and is up 275% over the last 30 days.

Solana (SOL) based memecoin, Bonk (BONK) also continued to rise another 71.9% this week after it was listed on major exchange, Binance, last Friday. DeFi protocols Osmosis (OSMO) and WOO Network (WOO) also gained 68.2% and 75.0%, respectively.

In Other News

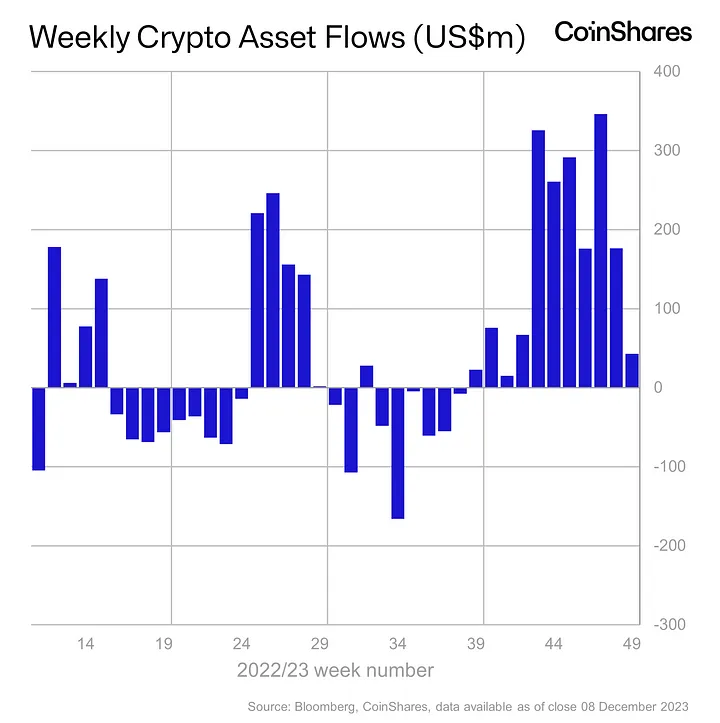

Despite the large fall in funds received this week, digital asset investment products posted its 11th consecutive week of inflows at US$43 million.

- El Salvador's planned Bitcoin ‘Volcano Bonds’ finally received regulatory approval from the country's Digital Assets Commission (CNAD). Issuance of the bonds can be expected in Q1, 2024 after a number of delays due to unfavourable market conditions.

- On Wednesday Woo Network (WOO) announced a partnership with crypto market making firm, Wintermute. The partnership follows a recent hack which left WOO US$25 million out-of-pocket.

Regulatory

- After settling with other U.S. regulators for US$4.3 billion, crypto exchange Binance has filed for the dismissal of its ongoing lawsuit with the Securities and Exchange Commission (SEC), claiming that the SEC has applied a "novel, contorted interpretation" of securities laws, accusing the regulator of "territorial aggrandisement.”

- On Friday, the SEC denied a petition by Coinbase to clarify new crypto rules for the digital assets industry, citing that “the existing securities regime appropriately governs crypto asset securities”. Coinbase’s Chief Legal Officer Paul Grewal, publicly responded, stating Coinbase would take the SEC to court once again.

Learn with Caleb & Brown

The Financial Accounting Standards Board has officially adopted Fair Value Accounting for Bitcoin for fiscal years beginning after Dec 15, 2024.

Famous Bitcoin Bull, Michael Saylor, stated, “This upgrade to accounting standards will facilitate the adoption of $BTC as a treasury reserve asset by corporations worldwide."

Here we teach you all about Fair Value Accounting, and how might it benefit Bitcoin and other Crypto assets.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F3LjYUdJapO2NjW2UnTS35B%2F6eefaffb3c6772697bdc1a2eddfa4014%2FWeekly_Rollup_Tiles__28_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-12-20T03%3A04%3A01.183Z)