Market Highlights

- Ethereum’s open interest hit a record high of US$17 billion.

- XRP is trading at over $2 for the first time since 2018.

- Tether stopped minting its Euro-backed stablecoin, EURT, due to regulatory challenges.

- A U.S. court ruled that Tornado Cash (TORN) immutable contracts are not classified as property.

Markets Overview

Macro Market Updates:

This week, the U.S. Federal Open Market Committee (FOMC) released its minutes from the November meeting, where interest rates were cut by 25 basis points to 4.25% to 4.75%. In the minutes, U.S. Federal Reserve Governor Jerome Powell said that the FOMC doesn’t need to rush its rate-cutting agenda. Instead, the central bank says it will gradually move to a “neutral policy stance over time”. Powell didn’t elaborate on what the path toward a neutral stance would look like. The news didn’t spark big market moves, with the S&P 500 gaining 0.6% on Tuesday, 26 November, when the minutes were released.

In other macro news:

- The U.S. Personal Consumption Expenditures (PCE) price index rose by 2.3% in the 12 months to 30 October 2024, accelerating from 2.1% in September.

- U.S. unemployment claims came in near forecast at 213,000.

- China’s manufacturing purchasing managers index (PMI) came in at 50.3.

- The Reserve Bank of New Zealand cut its official cash rate by 50 basis points to 4.25%.

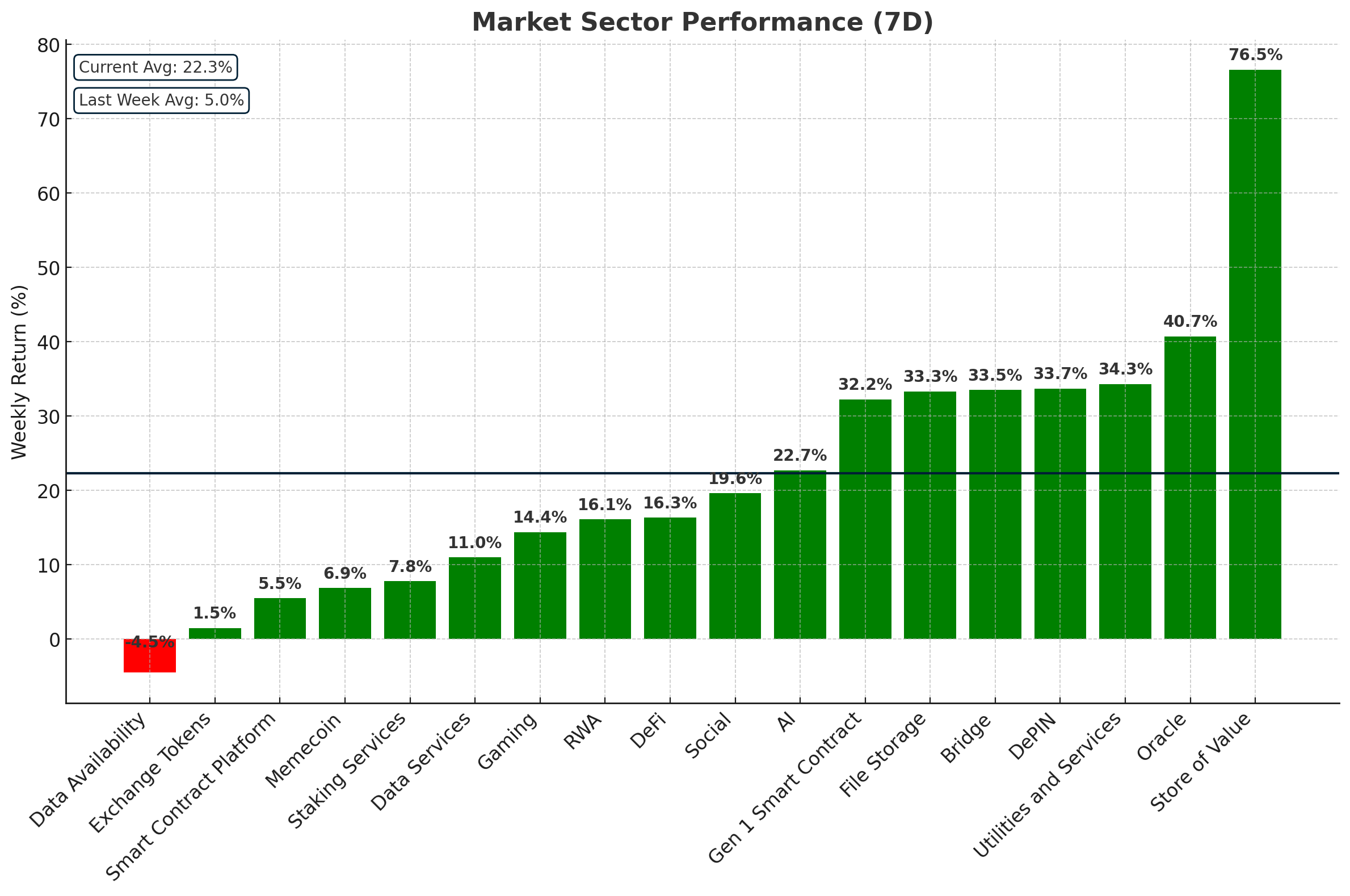

Crypto Market Sector Performance

The average sector performance across the crypto market was 19.5% this week. Store of value led the way, with oracle and utilities and services trailing behind. Some of the biggest gainers across store of value were XRP, Dash and ZCash, which grew by 88.4%, 58.5%, and 52.9%, respectively. ZCash’s gains were presumably due to the ruling in the Tornado Cash case (more on that below), which saw privacy tokens rally.

Data availability was the biggest loser for the week, declining by 4.2%. Both Celestia and Dymension declined throughout the week, with losses of -4.7% and -3.8%, respectively. Although this week was a stagnant one for data availability, this sector has grown by 60.3% in the last month, signalling that it’s still a strong player in this market cycle.

Bitcoin (BTC)

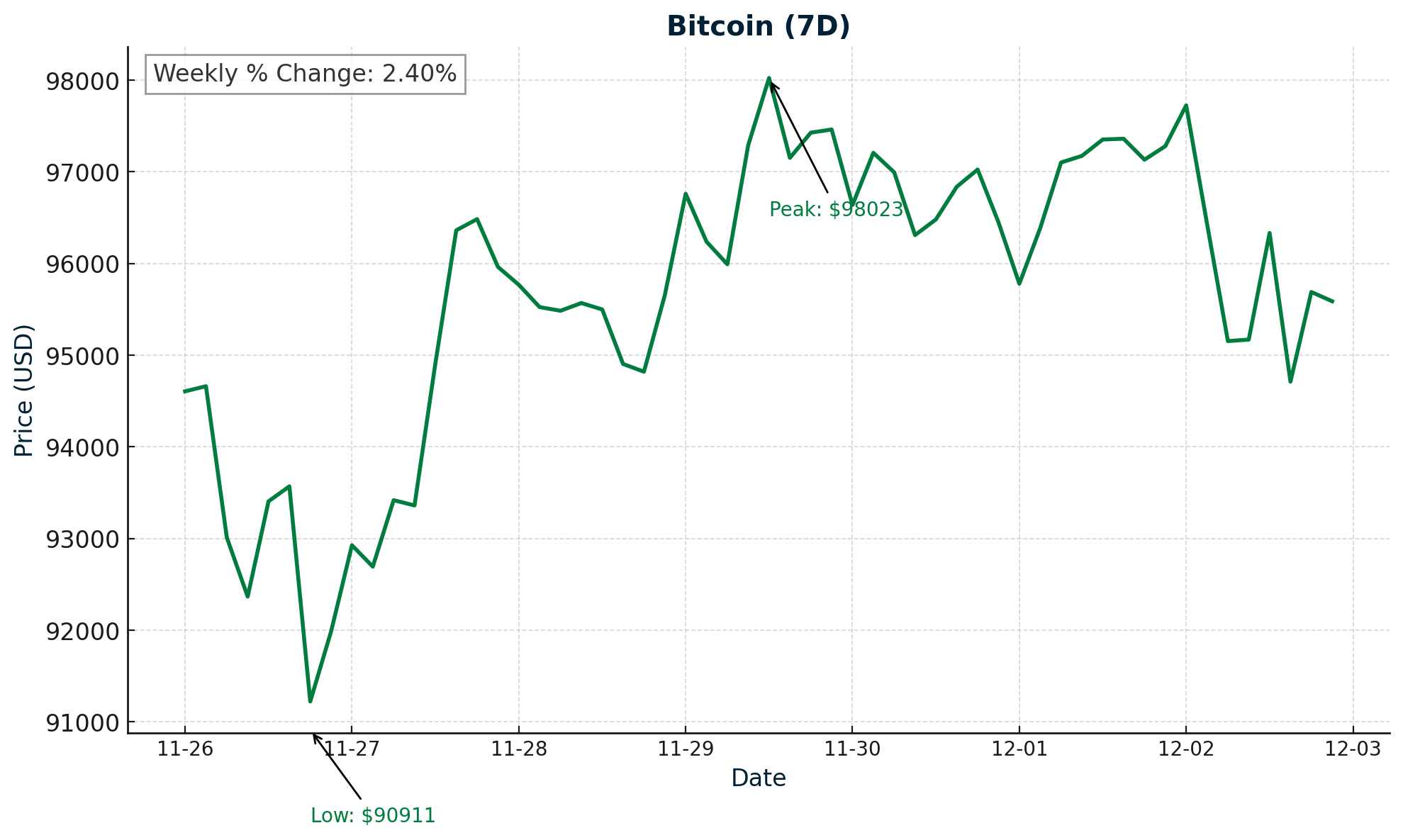

It was a lacklustre week for bitcoin. The biggest cryptocurrency by market cap opened the week at US$97,802, declined to a weekly low of US$90,911, and then re-gained Monday’s losses. Price is still yet to break US$100,000, which is a key level that many traders and investors are presumably watching. Bitcoin opened the new week with a decline of almost 2% on Monday 2 December.

On-chain analytics from the week revealed that bitcoin balances on centralised crypto exchanges have fallen to historic lows. The analysis, released in a note from 10X Research, outlined that supply is constricting as long-term BTC holders aren’t looking to sell. Plus, the amount of bitcoin available to buy on exchanges and bitcoin’s price typically move in a similar direction, but they are currently diverging. Low supply could signal further upside for bitcoin, but low liquidity could make this difficult.

Bitcoin exchange-traded funds (ETFs) saw the first significant outflows since September, with US$457 million leaving these products. The outflows are presumably due to traders and investors taking profit, with bitcoin stagnating just below US$100,000.

MicroStrategy made its biggest bitcoin purchase yet this week, acquiring 55,500 BTC worth US$5.4 billion. This takes the company’s bitcoin holdings to 386,700, which is worth US$37.6 billion. MicroStrategy’s average BTC purchase price is US$56,761 per bitcoin.

Also this week, Metaplanet, the Japanese firm accumulating bitcoin, announced that it will raise US$62 million through a stock issuance to accelerate its BTC purchases. If approved, the stock issuance will occur from 16 December 2024.

SOS Ltd, a China-based and publicly traded cloud computing and crypto mining company, announced it will buy US$50 million worth of bitcoin. The company’s share price almost doubled within minutes of the news.

Bitcoin is currently trading at US$95,629, an increase of almost 0.70% on the week.

Past performance is not a reliable indicator of future results.

Ethereum (ETH)

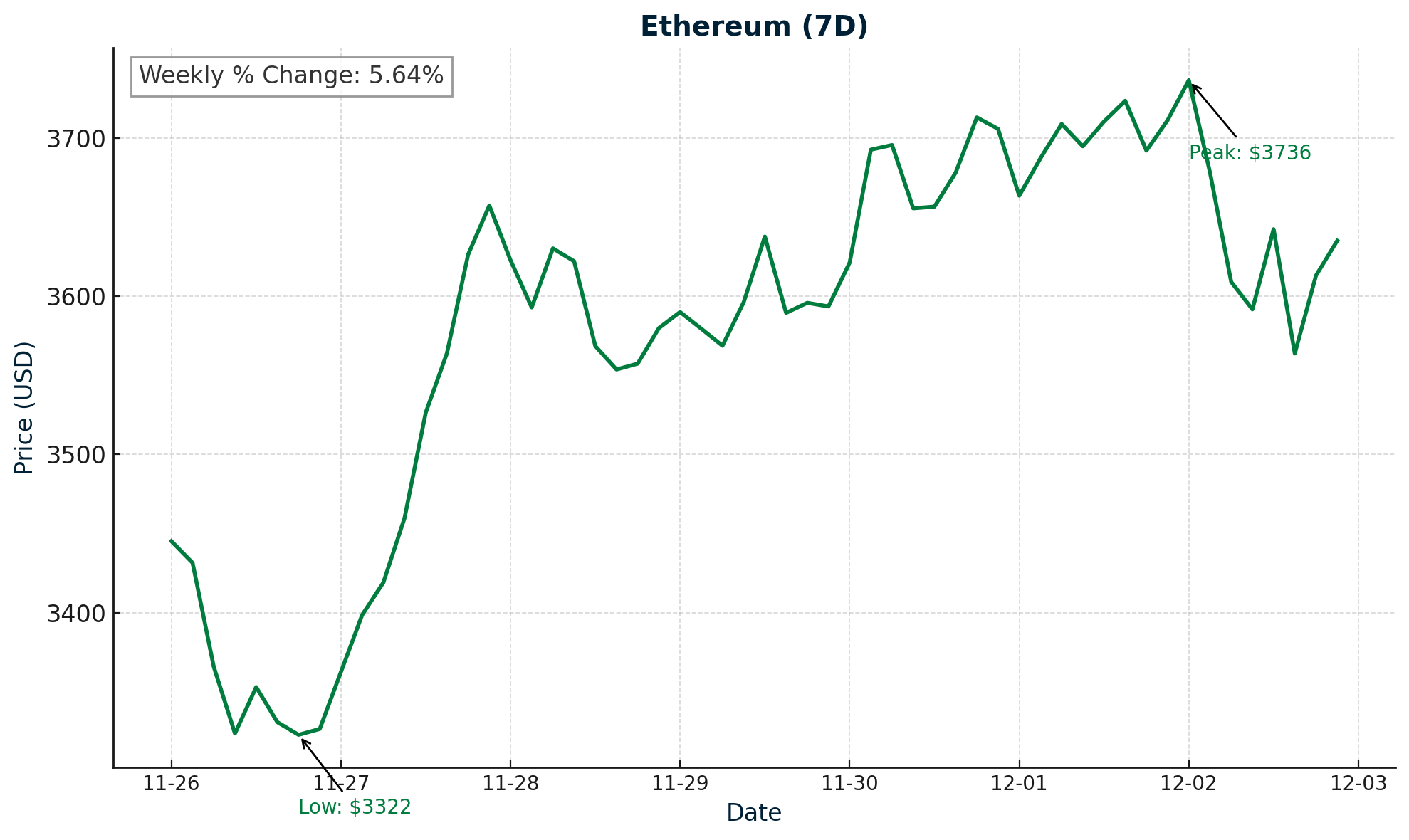

Ethereum had its strongest week since the U.S. presidential election, gaining over 10%. Opening the week at US$3,365.70, ETH saw a retrace before bullish momentum prevailed in the second half of the week. Price has moved well past the key level at US$3,385 to the upside. It’s the first time Ethereum has traded above US$3,500 since July 2024. Ethereum opened the week with a decline of almost 3% on Monday 2 December.

This week’s momentum was presumably fuelled by a flurry of buying activity by whales, with these large holders accumulating 51,450 ETH worth US$188 million in two days. Signalling further upward momentum, open interest for the second-biggest cryptocurrency hit a record high of US$17 billion during the week, indicating that many traders and investors are expecting big moves in the market.

Ethereum asset investment products saw a record US$634 million of inflows this week. This takes year-to-date inflows for these products to US$2.2 billion. The uptick of capital moving into Ethereum ETFs indicates a shift to bullish sentiment, with ETH trading at its highest price in almost six months.

Ethereum is currently trading at US$3,610, an increase of 4% on the week.

Past performance is not a reliable indicator of future results.

Altcoins

Digitise this

- Ethereum Name Service (ENS) grew by 102.7%. This takes its market cap to almost US$1.4 billion. The decentralised naming system on the Ethereum blockchain presumably saw gains this week due to Ethereum's strong price performance. The ENS team also delivered presentations this week that may have piqued investor interest. Katherine Wu spoke at a fireside chat about how ENS builds a single identity for the on-chain economy, and the team shared its vision for user experience.

Show and TEL

- Telcoin (TEL) grew by 92.2%, taking its market cap to US$537 million. This week’s gains built on the momentum seen in recent weeks, where TEL gained almost 190% since the U.S. presidential election. The cryptocurrency payments, trading and staking platform built on the Ethereum network recently posted an update about its application to become the first digital asset bank in the U.S. and the first regulated issuer of stablecoins. A public hearing will occur on Thursday, 5 December 2024, with a charter expected by February, should Telcoin Bank be approved.

Layer-1 gains

- Algorand (ALGO) gained 80.4%, taking its market cap to US$4.1 billion. The high-performance layer-1 blockchain found support at US$0.26, gaining momentum to reach almost US$0.50 by the end of the week. This week’s gains are presumably due to open interest on ALGO reaching a two-year high, while total value locked (TVL) on the network recently grew 26% to almost US$158 million.

- Aleph Zero (AZERO) grew by 65.1%, which takes its market cap to US$185.6 million. The layer-1 blockchain found support on the 50-day moving average and moved to the upside. The gains are likely due to several updates that occurred recently, including its integration with Rarible to enhance its non-fungible token capabilities and its preparations to launch in the U.S. in 2025. This week’s rally in privacy-focused coins due to the ruling in the Tornado Cash case (more on that below) likely fuelled upward momentum, too.

Ripple effect

- XRP gained 70.8%, which takes its market cap to US$138.3 billion. Surpassing Tether’s USDT to become the third biggest cryptocurrency by market cap, XRP has gained over 350% since the start of November and is now trading over US$2 for the first time since 2018. The gains are presumably due to the potential for Ripple Labs’, the creator of XRP, ongoing legal battle with the U.S. Securities and Exchange Commission (SEC) to finally be resolved when SEC Chair Gary Gensler steps down from his role in January. The possibility that spot XRP exchange-traded funds (ETFs) may be approved soon could also be piquing investor and trader interest in XRP. Plus, this week, Ripple, the creator of XRP, said it’s going to invest in Bitwise’s Physical XRP exchange-traded product.

DeFi delight

- Mdex (HECO) (MDX) gained 66.4%, taking its market cap to US$23.4 million. The price of the automated market maker increased by almost 260% on Wednesday, 27 November, before retracing. The gains weren’t made around the time of any specific updates or announcements from the Mdex team, so the momentum may be due to increased trading volume across altcoins this week.

Past performance is not a reliable indicator of future results.

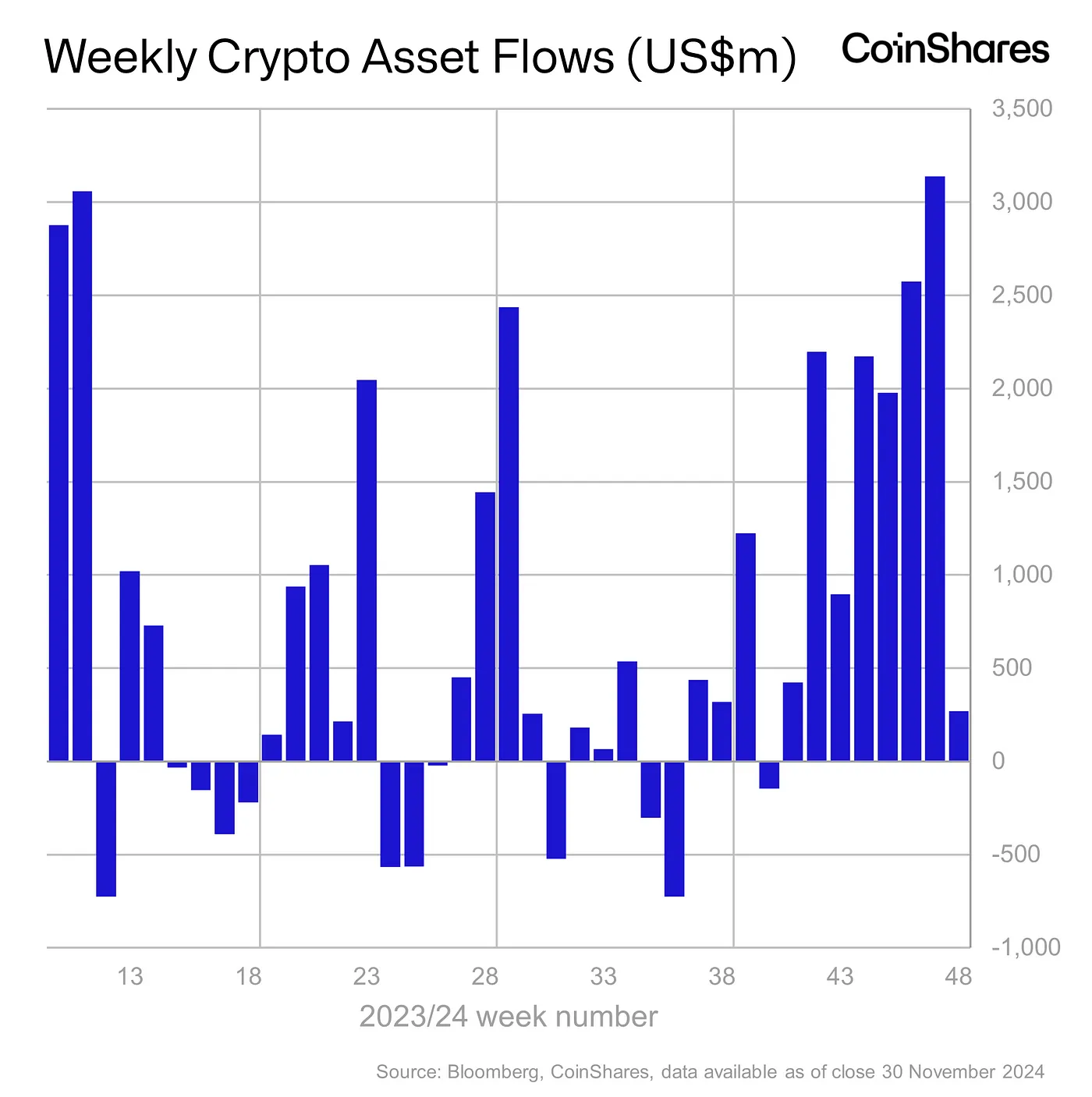

In Other News

Digital asset investment products saw inflows of US$270 million this week, primarily buoyed by the record inflows into Ethereum ETFs. XRP also saw record inflows, with US$95 million entering these products, following strong price action and speculation that approval of a US XRP ETF could be imminent. Total inflows for the year-to-date across all digital asset investment products stand at a record US$37.3 billion.

Other crypto news

- Bitwise has filed with the U.S. SEC to turn its US$1.4 billion crypto index fund into an ETF. The proposed ETF would offer exposure to a basket of cryptocurrencies, including bitcoin (75.14%), Ethereum (16.42%), Solana (4.3%), XRP (1.50%), and Cardano (0.70%). The remainder will be split across mid cap tokens, such as Avalanche (AVAX) and Uniswap (UNI). Key factors such as stable trading volume, proper custody solutions, and zero known security problems will form part of the framework for Bitwise's selection of small-cap tokens for the fund.

- Tether announced that it has stopped minting its Euro-backed token, EURT, due to regulatory challenges. With small trading volumes compared to its US dollar-backed USDT, the EURT faced pressure due to the Markets in Crypto Assets (MiCA) law that came into effect in 2023. Part of MiCA focuses on regulating stablecoins. Earlier in November, Quantoz Payments, a Dutch payment firm, said it was launching a new Euro-backed stablecoin that meets the European Union’s regulatory standards.

- Asset manager WisdomTree has filed to launch an XRP ETF in Delaware. As a first step, the firm has filed its paperwork with the State of Delaware, but it will still need to file with the U.S. SEC for the process to progress. WisdomTree’s application for a bitcoin ETF was previously approved, and the firm has an Ethereum ETF that trades in Europe.

Regulatory

- Privacy coins soared on news that the U.S. Fifth Circuit Court ruled in the case between the U.S. Treasury and crypto mixer Tornado Cash (TORN). The ruling states that immutable smart contracts cannot be classified as “property” under existing legislation. TORN gained 380% on the ruling, which overturned a lower court’s decision. The ruling outlined that because immutable smart contracts that execute without human intervention can’t be owned or controlled, they are exempt from property-based sanctions.

In Case You Missed It

Phishing scams are on the rise—don’t get caught out!

__Quick Tips: __

- Check sender email addresses for legitimacy.

- Be wary of urgent messages or requests for personal info.

- Hover over links before clicking to ensure they’re safe.

Verify Our Brokers: Use our CallerCheck feature in the client portal to confirm identities securely.

Want to know more? Read the full blog for all the details and tips to stay protected.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.