Inside the Markets

The year has started with a bang in both traditional finance (TradFi) and crypto markets. Bitcoin hit a new all-time high of $109,358, the S&P 500 reached record levels, and XRP surged to a seven-year high of $3.40. Meanwhile, Trump’s Presidential Working Group on Digital Assets is setting the stage for regulatory clarity and potential Bitcoin reserves.

With so much happening, our latest edition of Inside the Markets covers everything you need to know, including key trends shaping the months ahead.

📺 Prefer to watch? Tune into the latest video update with Jake Boyle.

📄 Prefer to read? Explore the in-depth research report.

Market Highlights

- President Trump announced a blanket 25% tariff on steel and aluminium imports.

- Trump’s Truth.Fi will launch two bitcoin asset investment products.

- The U.S. SEC reassigned more than 50 staff members from the crypto enforcement unit.

- The FDIC released documents supporting the existence of “Operation Chokepoint 2.0”.

- Franklin Templeton is seeking approval for a new crypto index ETF.

- Grayscale has filed to list an Cardano (ADA) ETF on the NYSE.

Markets Overview

Macro Market Updates:

It was an eventful start to the week. President Trump’s tariffs announcement saw markets decline before his decision to pause Canada and Mexico’s tariffs for 30 days buoyed a slight recovery. The new week is starting with a fresh round of uncertainty as President Trump announced a blanket 25% tariff on all steel and aluminium imports. A formal announcement is expected early this week, with the tariffs expected to go into effect “almost immediately”.

On the data front, the non-farm employment change came in below forecast at 143,000, while the Bank of England lowered rates by 25 basis points to 4.5%. This week, U.S. Federal Reserve Chair Jerome Powell testifies before Congress and the latest U.S. consumer price index (CPI) update will be released.

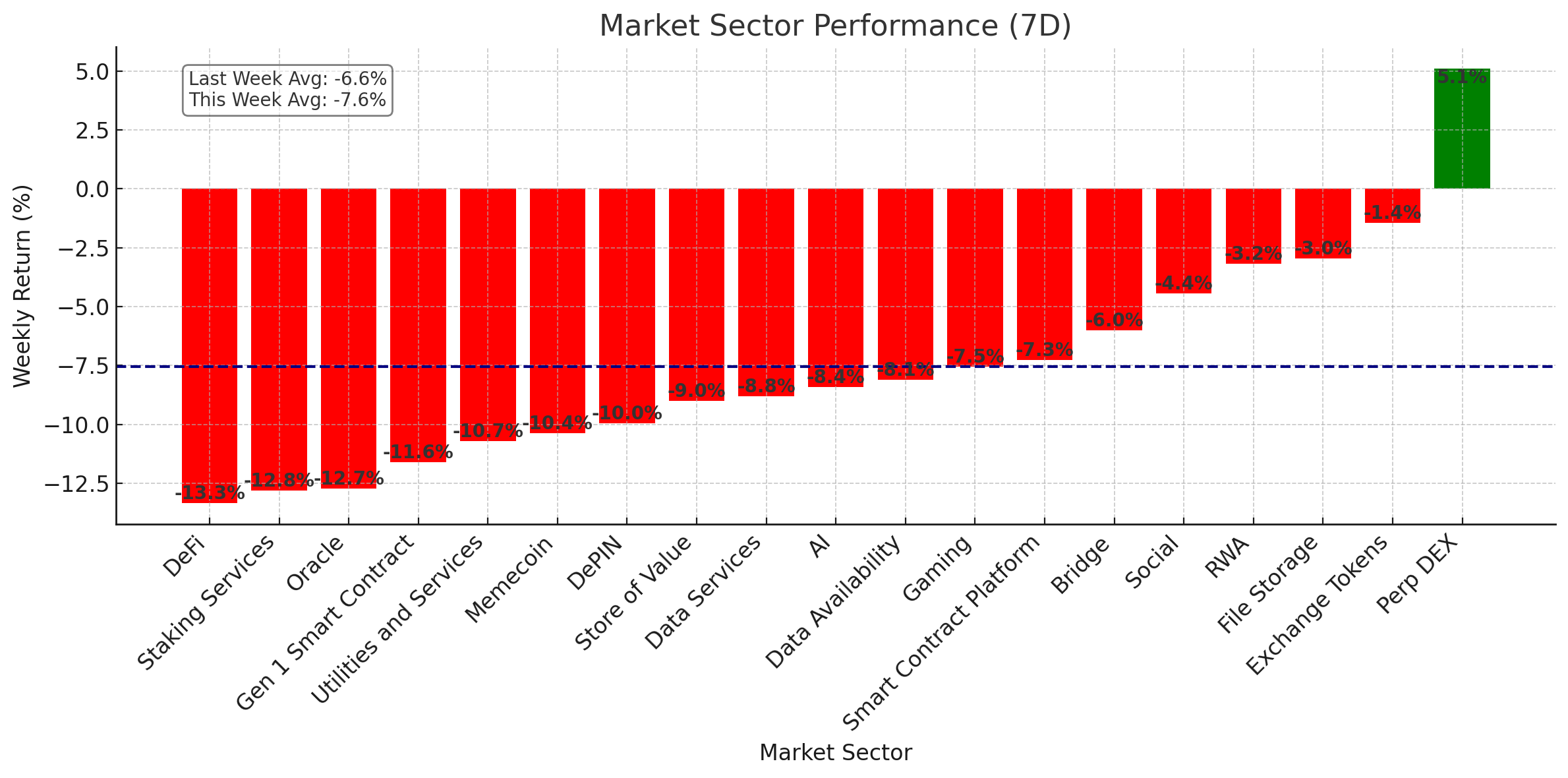

Crypto Market Sector Performance

Perpetual decentralised exchanges (Perp DEX) was the biggest gainer this week. GMX (GMX) led the growth, gaining 32.33% over the last seven days (more on that below). All other sectors declined. These declines are presumably due to macroeconomic headwinds and volatility causing uncertainty across the TradFi and crypto markets.

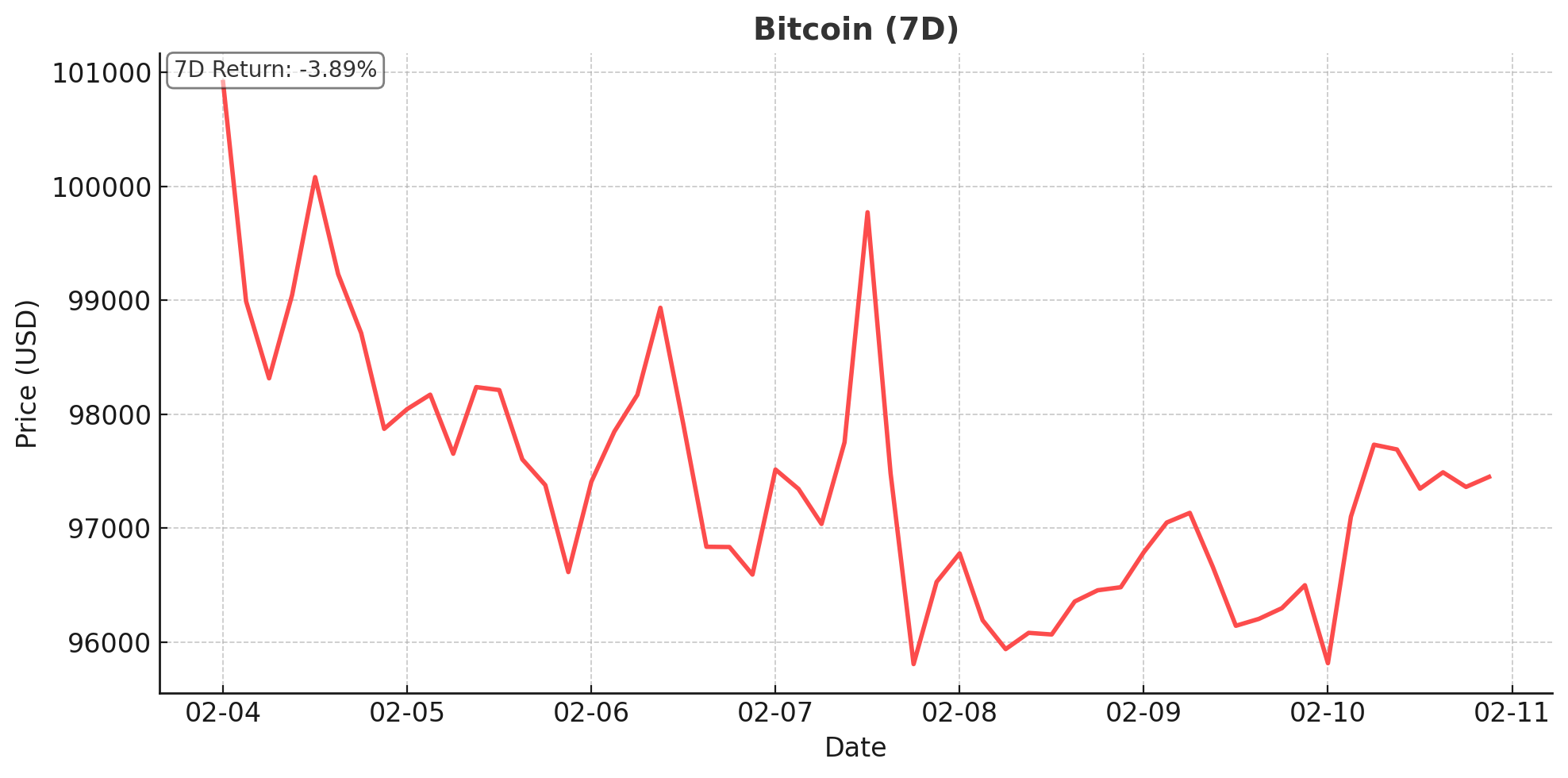

Bitcoin (BTC)

Opening the week at US$97,676, bitcoin declined by almost 11% on President Trump’s initial tariffs announcement for Chinese, Canadian and Mexican imports. The remainder of the week saw bitcoin hovering between US$96,000 and US$98,000, failing to break above US$100,000. The stagnant price action is presumably due to the current macroeconomic uncertainty in markets. Bitcoin is currently trading at US$97,308, a decline of 4.4% on the week.

President Trump’s Truth.Fi is planning to launch bitcoin asset investment products. The company announced six new investment vehicles this week, two of which will be bitcoin funds: the Truth.Fi Bitcoin Plus exchange-traded fund (ETF) and the Truth.Fi Bitcoin Plus separately managed account (SMA). It’s currently unclear what the “Plus” in the fund name represents.

Over 47,000 BTC were removed from exchange reserves last week — the largest withdrawals since the FTX collapse in November 2022. While some of the movement could be internal reorganisation by exchanges, these moves can indicate accumulation by larger market players or financial institutions, which could support upward price momentum.

Three more states have joined the growing list of U.S. states considering legislation to establish a bitcoin reserve. Bills were introduced this week in Kentucky, North Carolina and Maryland, joining the eighteen other states that have introduced similar legislation.

Bitcoin asset investment products saw inflows of US$407 million this week. Exchange-traded products for bitcoin now equate to 7.1% of the current market capitalisation.

Past performance is not a reliable indicator of future results.

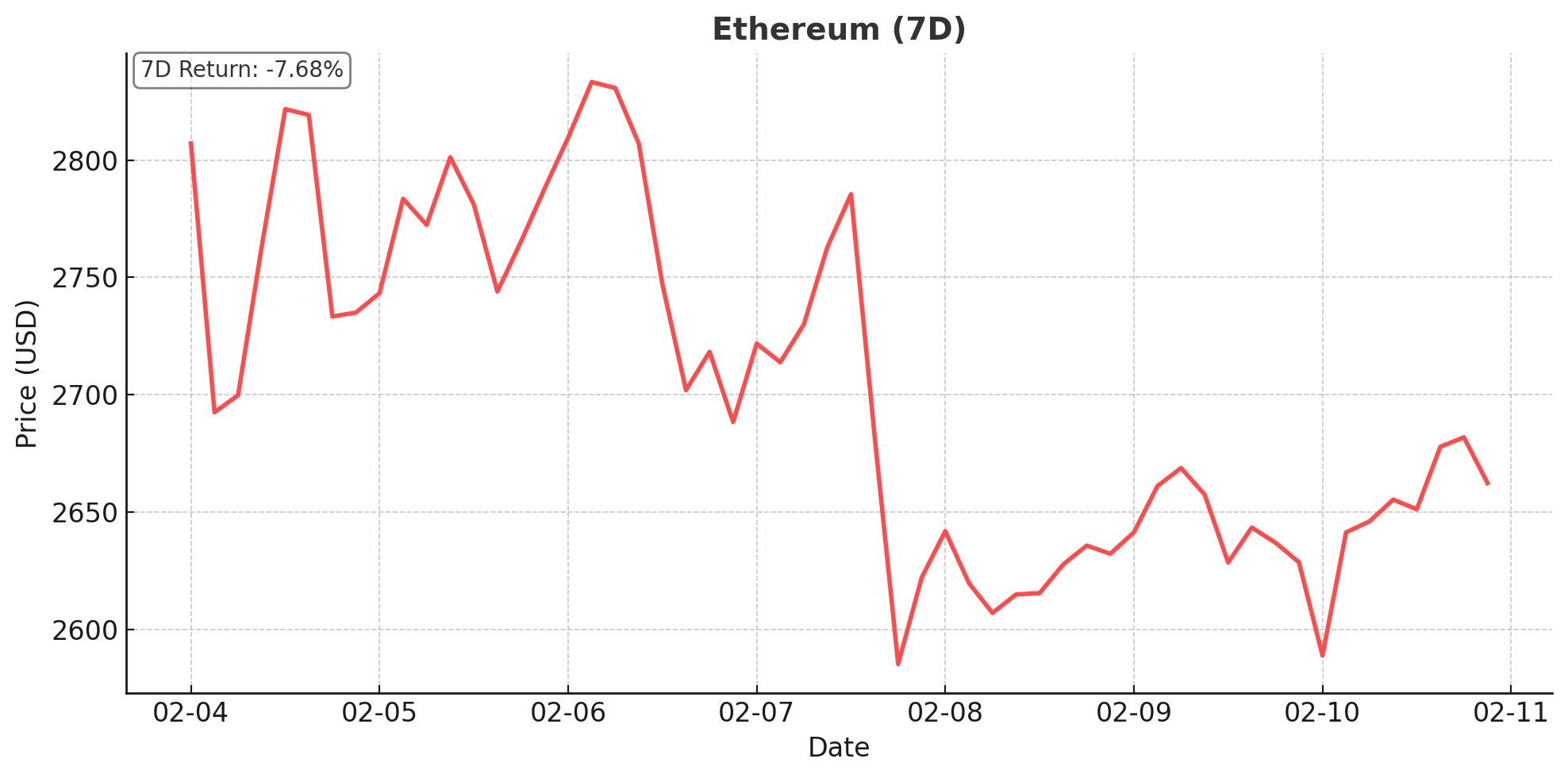

Ethereum (ETH)

Ethereum’s downward trajectory continued this week. Price whipsawed on Monday, 3 February, on President Trump’s tariffs developments, with price continuing to decline by over 12% throughout the week.

This week’s declining prices led to growing investor interest in Ethereum asset investment products, with US$793 million flowing into these products.

Ethereum is currently trading at US$2,671, a decrease of 1.8% on the week.

Past performance is not a reliable indicator of future results.

Altcoins

XRP downtime

- XRP declined by 6.8%, taking its market cap to US$138.2 billion. The losses are presumably because the XRP ledger experienced a halt on Tuesday, 4 February, which saw block production stopped for an hour. Early analysis identified a consensus issue where validations weren’t published. Open interest for XRP is now at a monthly low of US$3.52 billion, a stark contrast to January’s all-time high of US$7.62 billion. Later in the week, the Chicago Cboe Exchange submitted four applications seeking approval to list and trade spot XRP ETFs. The U.S. SEC has 45 days to review the applications.

DeFi gains

- Rocket Pool (RPL) gained 26.4%. This takes its market cap to almost US$170.3 million. The decentralised Ethereum staking protocol found support around US$5.60 and gained throughout the weekend. The gains are presumably due to a successful on-chain initialisation of node operators to revise down two of the network’s Protocol DAO quorums, which should continue to strengthen the network.

Fair exchange

- GMX (GMX) gained 32.3%, which takes its market cap to US$239.9 million. The decentralised perpetual exchange gained almost 55% throughout the end of the week before retracing. These gains are presumably due to its positive January report and the introduction of a new market on the network, BERA/USD, which allows the permissionless trade of the OogaBooga (OOGA) token at up to 50x leverage.

Currency win

- Nano (XNO) gained 51.9%, taking its market cap to US$196.7 million. The eco-friendly DeFi currency network found support around US$0.95 and reached over US$1.30 before retracing slightly. Most of the gains occurred in the second half of the week, presumably due to upward momentum across other DeFi protocols, plus developments such as a community-built tool that enables users to donate XNO to creators on Twitch.

Past performance is not a reliable indicator of future results.

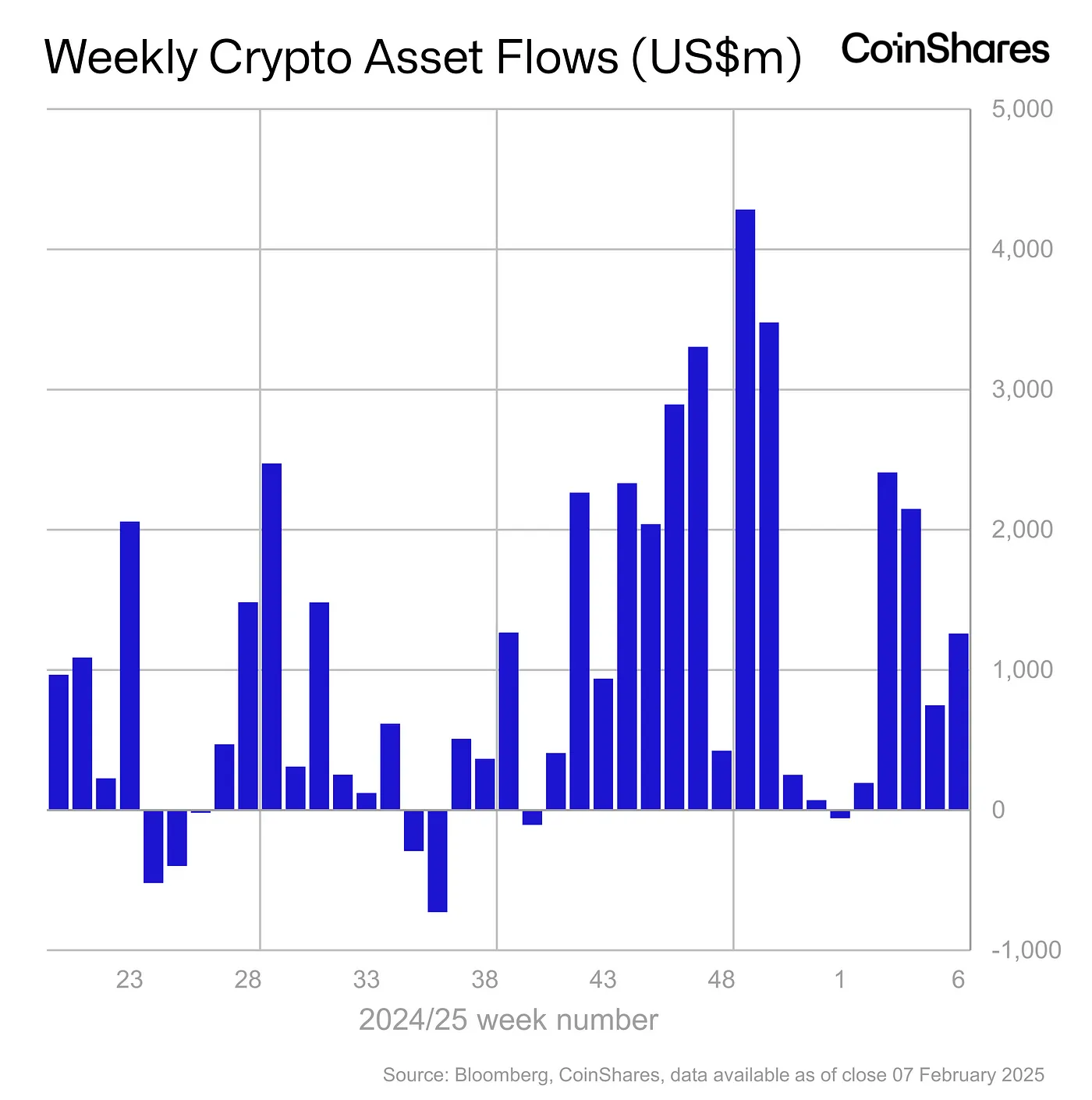

In Other News

Digital asset investment products saw a fifth consecutive week of inflows, with US$1.3 billion going into these products. The pullback across markets last week saw total assets under management (AuM) decline to US$163 billion. Despite weaker sentiment across the markets, trading volume remained steady for digital asset investment products at US$20 billion.

In altcoins, XRP and Solana saw US$21 million and US$11 million of inflows, respectively.

Crypto ETF developments

- The U.S. SEC filed a notice of rule change this week. The rule change, proposed by NYSE Arca, would allow the exchange to list the Grayscale Solana Trust as a commodity-based trust. The filing included a determination that Solana is not a security, making it the first ETF filing for a coin that was previously called a “security” by the SEC. The SEC has until early October to approve the rule change.

- Asset manager Franklin Templeton submitted an updated S-1 filing for the Franklin Crypto Index ETF. The updated form requests approval to add other tokens to the fund over time. The initial asset allocation across the fund will be 86.31% bitcoin and 13.79% Ethereum. The firm hasn’t committed to what other cryptocurrencies it may add to the fund but wants approval to add more tokens as and when the SEC permits.

- Crypto investment firm Grayscale has filed to list a Cardano (ADA) ETF on the New York Stock Exchange. It follows the firm filing to launch Solana and XRP ETFs in recent weeks amid the SEC’s evolving approach to crypto regulation under President Trump. If approved, Grayscale's new crypto ETFs would convert its existing crypto trust products into ETFs, except for an ADA ETF, which would be brand new. ADA gained 1.5% on the news.

Regulatory

- The U.S. Securities and Exchange Commission (SEC) has reassigned more than 50 lawyers and staff members from the crypto enforcement unit to other areas of the agency. The overhaul is part of the Trump administration’s focus on minimising unnecessary government intervention in the sector. It followed a statement from SEC Commissioner Hester Peirce, who is leading the SEC’s crypto task force, saying the previous administration’s approach was impractical and ambiguous.

- White House AI and Crypto Czar, David Sacks, held his first press conference this week. He outlined the Trump administration’s legislative priorities around crypto, teasing two major pieces of legislation that aim to provide clarity to the sector: a markets structure bill and a comprehensive stablecoin bill. Senate Banking Committee Chairman Tim Scott (R-SC) said he intends for these bills to pass the Senate within the first 100 days of President Trump’s term.

- The Federal Deposit Insurance Corporation (FDIC) released a 790-page batch of documents supporting allegations that an “Operation Chokepoint 2.0” was in place throughout the Biden administration. The FDIC’s acting chairman, Travis Hill, said the documents demonstrate that requests from banks were “universally met with resistance,” making it difficult for banks to engage in crypto-related activities.

- Japan’s Financial Services Agency (FSA) is considering stricter disclosure rules around crypto assets. The FSA has started a closed study session with subject matter experts to decide if crypto assets should be classified as financial products and be regulated under similar regulations as those governing the sale of securities in the country. If reforms occur, this may increase the attractiveness of crypto ETFs, given they comply with existing financial product regulations. The FSA aims to announce its regulatory reforms by June.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.