Market Highlights

- Bitcoin (BTC) surpassed US$50,000 for the first time since 2021, as markets witnessed US$1.1 billion in fund inflows over the week.

- Total crypto market cap crossed US$2.0 trillion, up 14.0% this week.

- Ethereum (ETH) announced the launch date of its highly anticipated Dencun upgrade for March 13

- Solana (SOL) experienced another major network outage, down for 5 hours last Tuesday.

Bitcoin

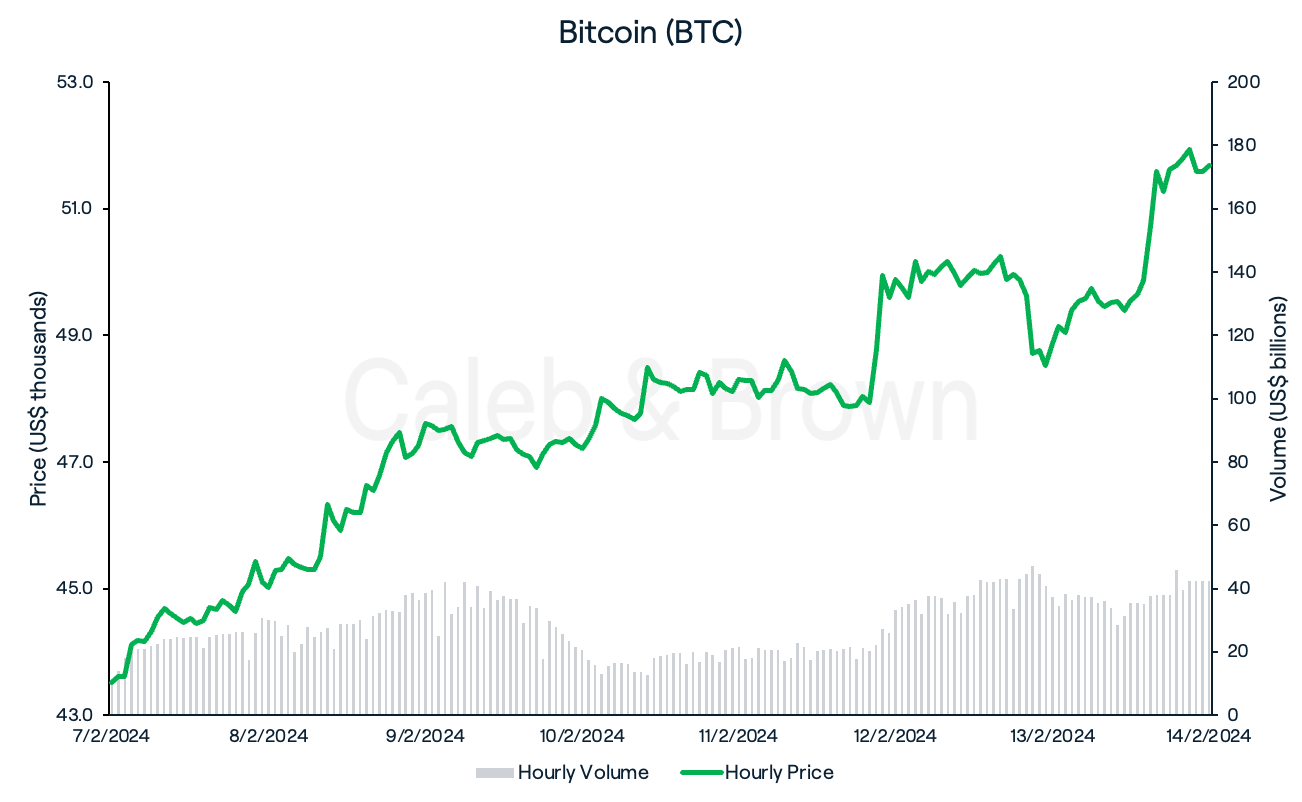

Bitcoin (BTC) exploded out of the gates this week, exceeding US$50,000 for the first time since 2021’s bull run, reaching a high of US$52,043!

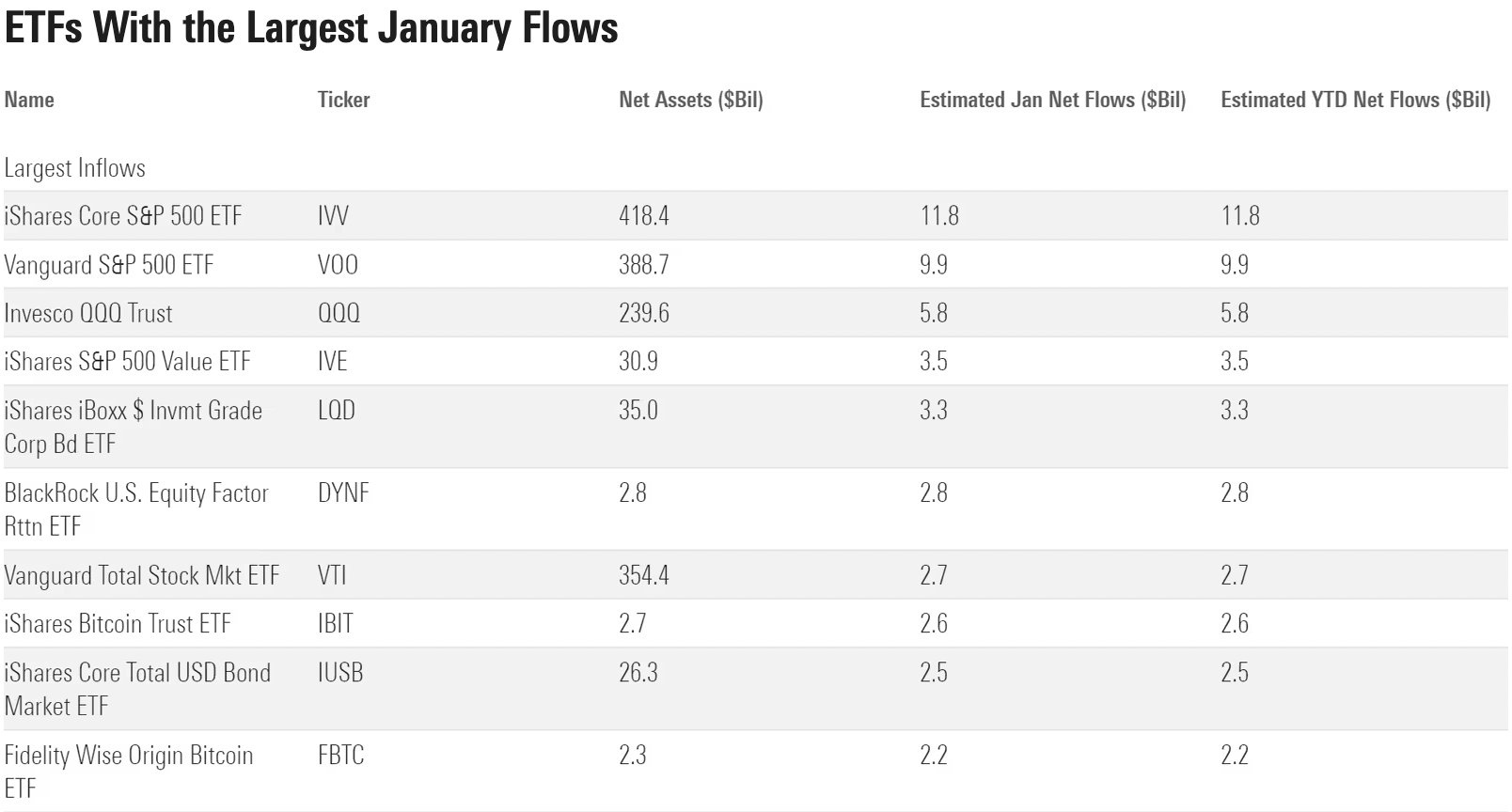

It was a slow start to the month however, as a halt on interest rates by the U.S. Federal Reserve on Jan 31 stagnated prices in the crypto space. Nevertheless, as the uncertainty surrounding the fourth consecutive halt on rate policy began to dissipate, funds flooded back into digital asset investment products which saw inflows to the tune of US$1.1 billion over the past week. This landed BlackRock and Fidelity's spot Bitcoin ETFs in the top 10 for all ETFs by net asset flows for the month of January.

BTC’s price move was further validated by bullish on-chain metrics such as an all-time-high mean hash rate (indicating more people are interested in securing the network), increased exchange inflows/outflows (indicating high trading volume and interest in the asset), and most importantly increased realised cap (indicating true on-chain inflows into BTC). All of which signal a healthy price move, unlike a highly leveraged spike in price.

BTC closed the week at a strong US$51,678, up a staggering 18.8% over the last seven days.

Ethereum

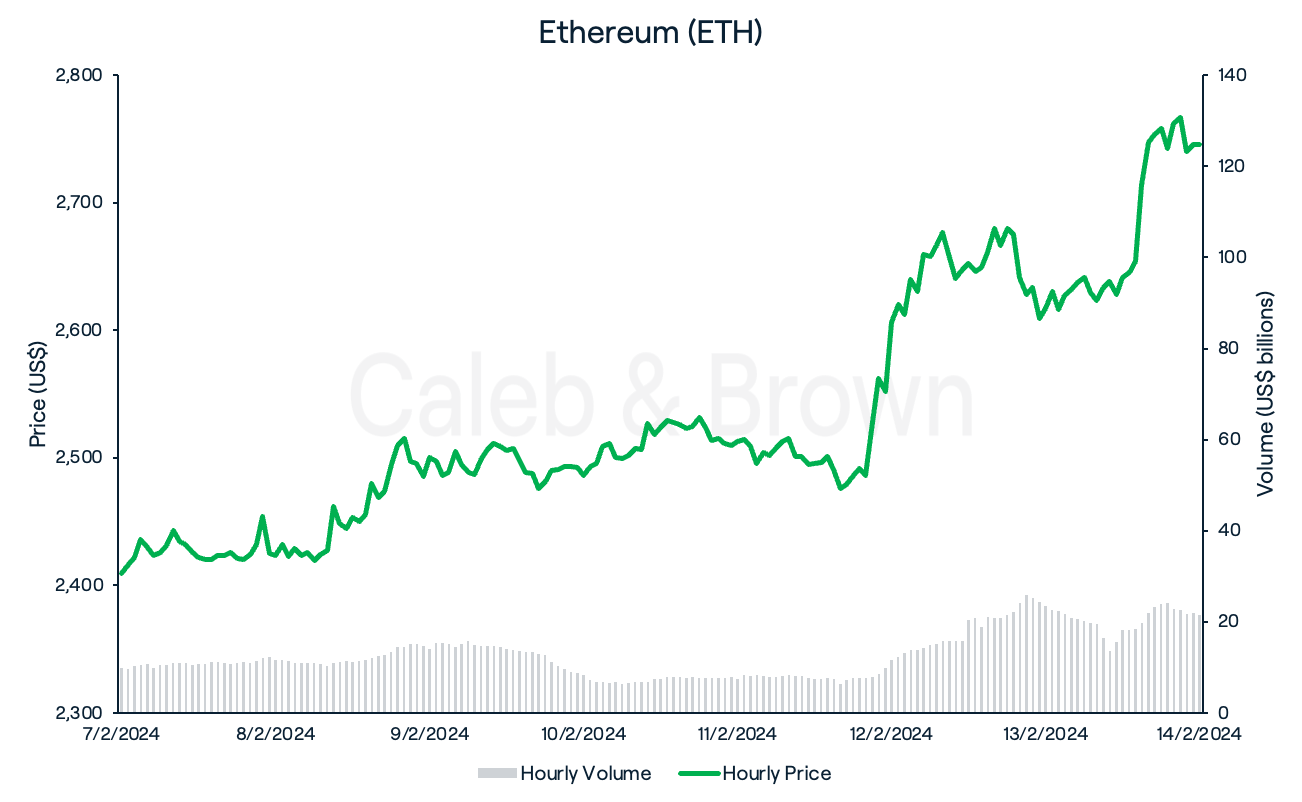

Ethereum (ETH) was able to keep up the pace with BTC thanks to a major announcement. On Thursday, Ethereum core developers revealed after a suite of successful test runs, that the network’s landmark Dencun upgrade would be officially deployed on March 13. The upgrade will introduce proto-danksharding, a set of tools designed to increase transaction speeds and reduce costs for layer-2 transactions.

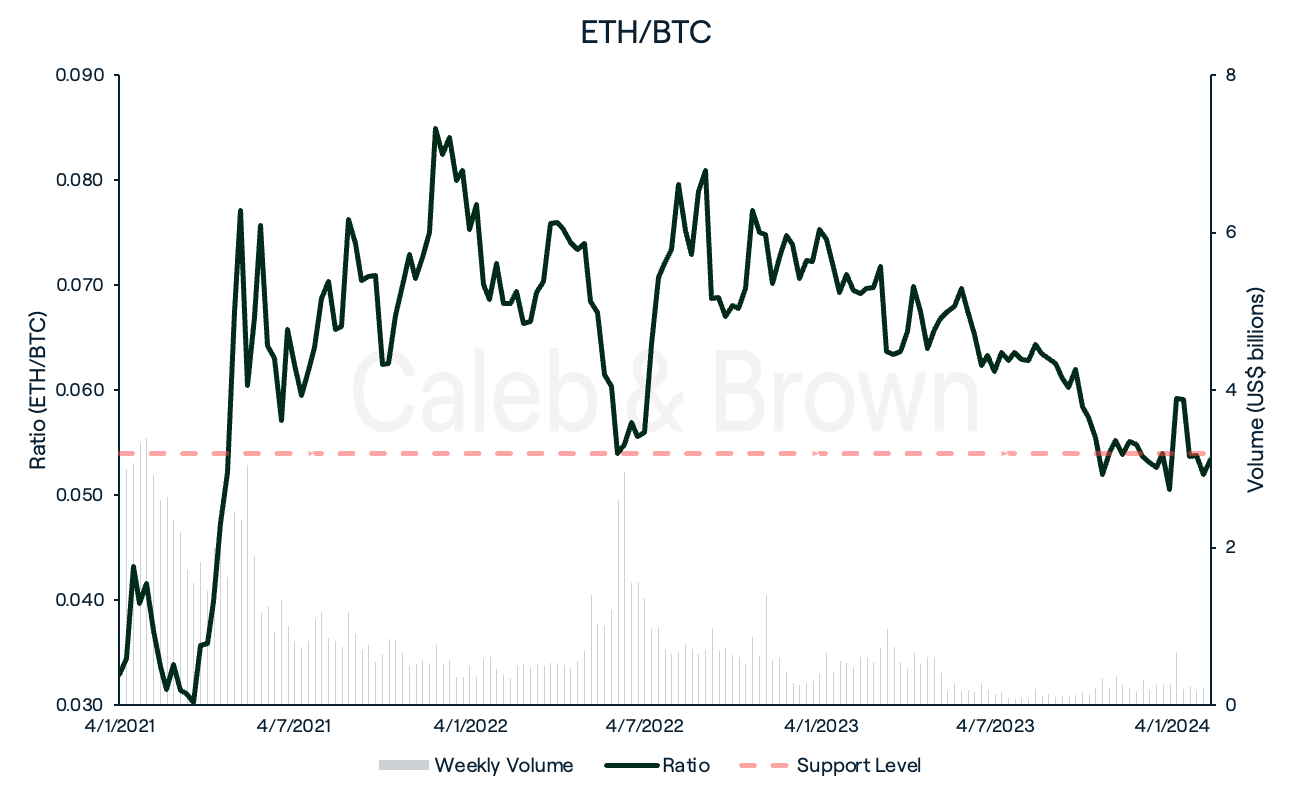

This saw the ETH/BTC ratio track towards its multi-year support level, shedding 4.1% over the week.

Altcoins

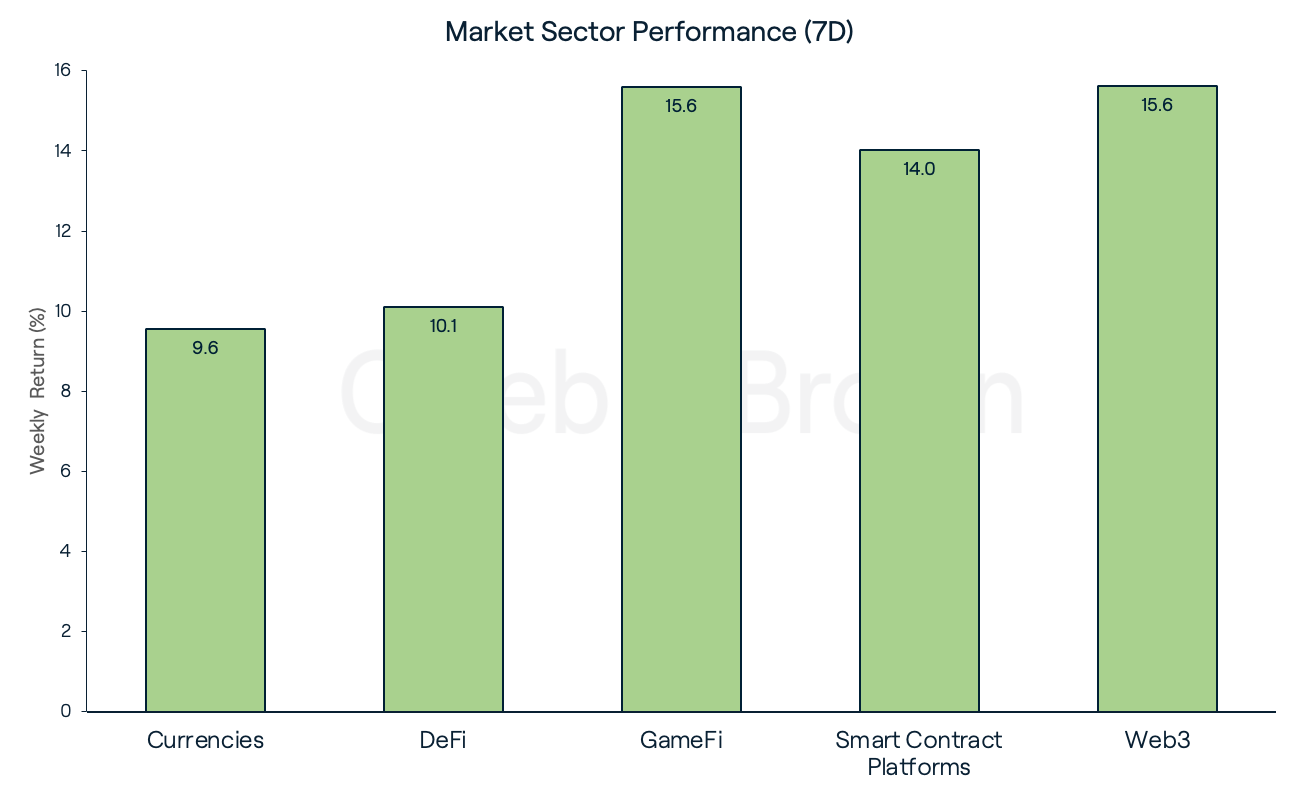

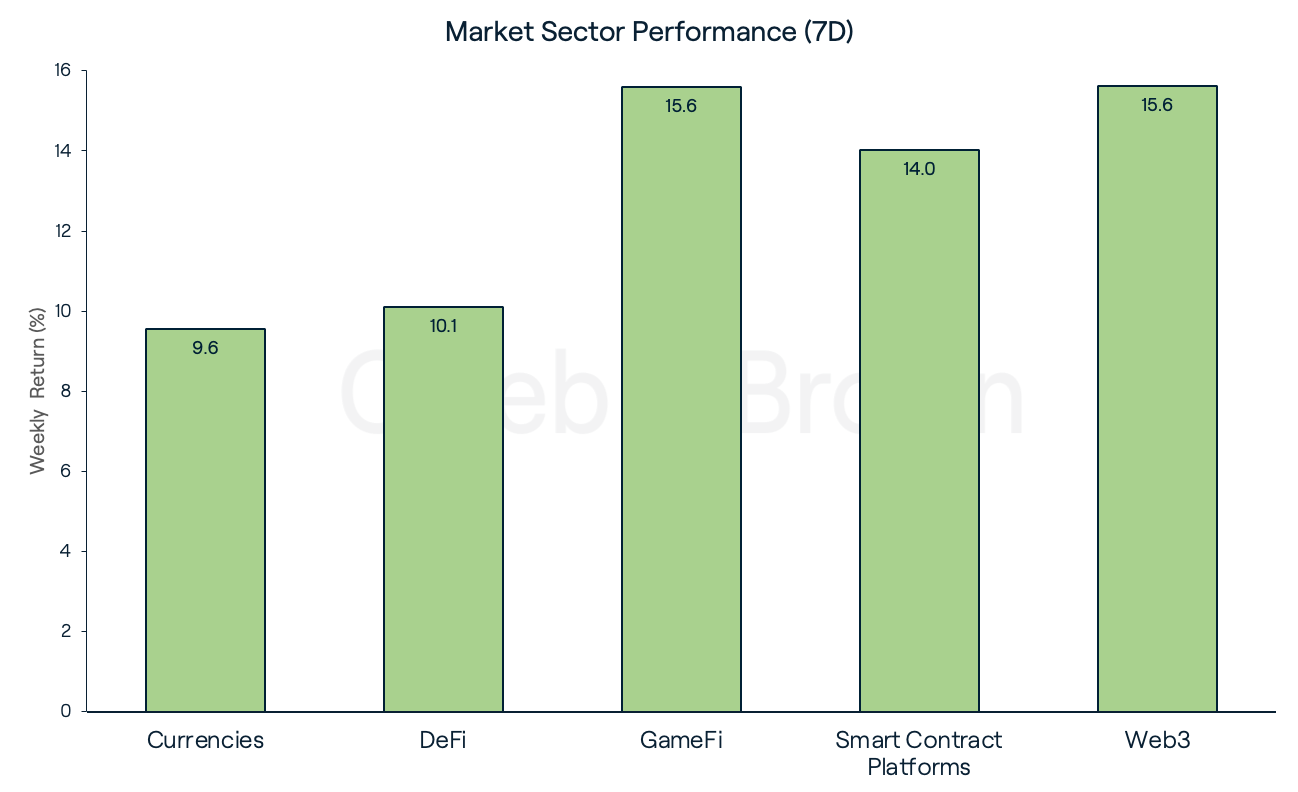

As BTC led the charge, all market sectors pushed forward with major gains this week. GameFi and Web3 tied for best performing sectors with each rallying 15.6%. This was followed closely by Smart Contract Platforms, surging 14.0%.

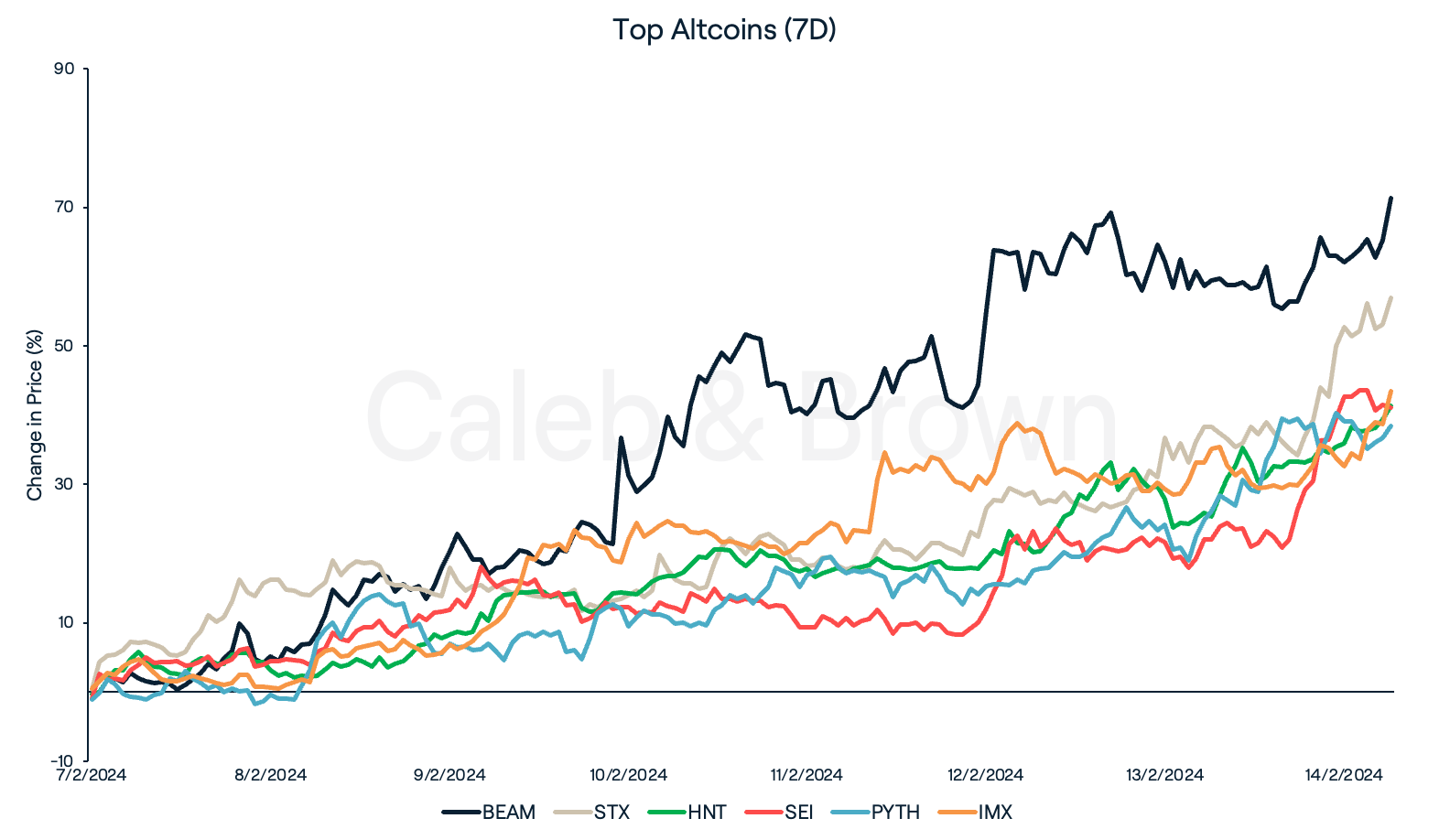

Securing top spots this week were Avalanche-based gaming protocol, Beam (BEAM), and BTC layer-2, Stacks (STX), which gained 71.3% and 57.0%, respectively. Beam reached a new all-time-high of US$0.30 while establishing record active wallet addresses and total-value-locked into the protocol. Stacks on the other hand was the biggest beneficiary of BTC’s surge in price.

Other top performers this week were spread amongst Layer-1 Sei (SEI) which gained 41.0%, and Web3 solutions Pyth Network (PYTH), Helium (HNT) and Immutable (IMX) which surged 38.5%, 41.4% and 43.5%. Sei has recorded increased user activity related to its recent price movement. Pyth Network revealed a second wave of token airdrops and Helium unveiled the successful implementation of two new Helium Improvement Proposals- HIP84 and HIP106.

In Other News

- By the end of February, a considerable amount of previously locked ApeCoin (APE), Avalanche (AVAX), Aptos (APT), Optimism (OP), and The Sandbox (SAND) will be released onto the market, amounting to hundreds of millions of dollars in value. In some cases this influx may significantly increase token supply, potentially generating sell pressure.

- Last Tuesday, Solana (SOL) experienced another major outage, going offline for about 5 hours. Solana nearly made it a full year without a major outage, and while disappointing, Solana’s developers stated that “this is what happens when you’re building on the bleeding edge of tech”, and given the price action following the outage, it appears sentiment was not materially damaged in this instance.

Regulatory

- The U.S. Securities and Exchange Commission (SEC) delayed its decision on another high-profile spot Ethereum ETF last Tuesday. According to the filing, the SEC pushed back its decision on the jointly proposed product from asset management giant, Invesco, and crypto company, Galaxy Digital, after both firms filed the application last September. Notably, VanEck’s Spot Ethereum ETF approval has a final deadline of 23 May 2024, which would represent a key date for all spot Ethereum ETFs.

- On Tuesday, a judge approved a settlement regarding the counterclaims between the bankrupt crypto hedge fund, Three Arrows Capital and the defunct crypto lender, BlockFi. The details of the settlement however are currently sealed, as ordered by New Jersey Bankruptcy Court Judge Michael Kaplan.

New Asset Listings

New Asset Listings at Caleb & Brown!

Shrapnel (SHRAP) Router Protocol (ROUTE) Bittensor (TAO) Myro (MYRO) Manta Network (MANTA) Jupiter (JUP) Ondo (ONDO) AltLayer (ALT) Chainlfip (FLIP) Celestia (TIA)

Buy and sell these crypto assets, or swap them directly with hundreds of other popular crypto assets through your personal crypto broker.

To see our full list of available crypto assets, visit the client Portal.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F7J7KdeSsugGlsiAITWGHaF%2F4abf1bed83b519dfd8a55fe9f1ae4bb5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-02-15T05%3A15%3A52.337Z)