Market Highlights

- Bitcoin (BTC) breaks $57,000 for the first time since late 2021, bringing the total crypto market cap to nearly US$2.25 trillion!

- Hong Kong based crypto exchange, BitForex has suspended withdrawal for the past three days without an explanation.

- Defunct crypto exchange, FTX was recently approved to sell its US$1 billion Anthropic stake, in a bid to reimburse its creditors following FTX’s collapse late 2022.

Bitcoin

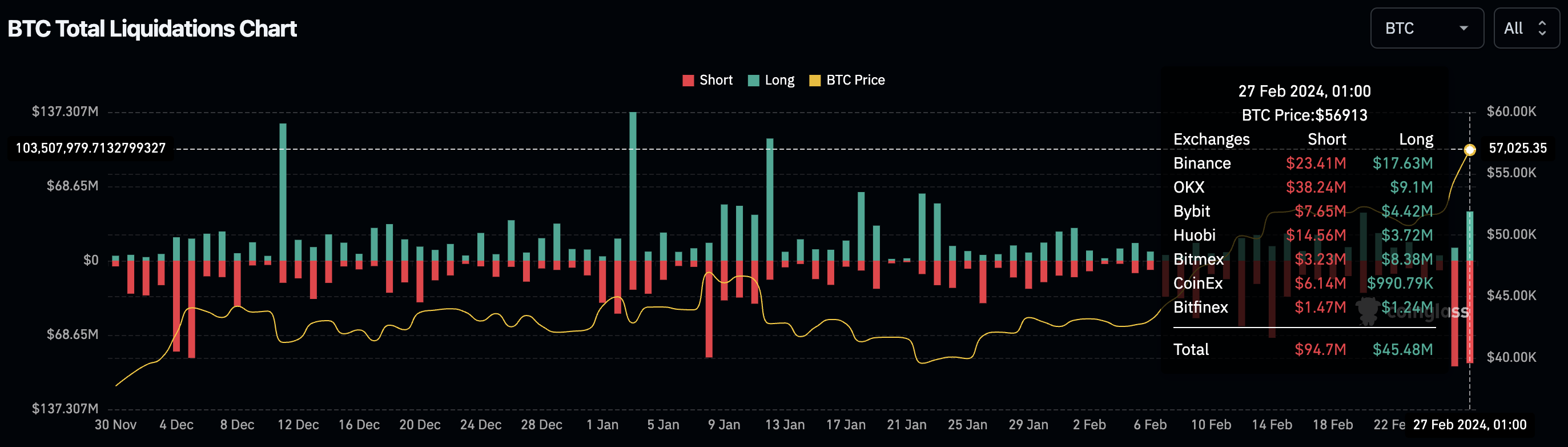

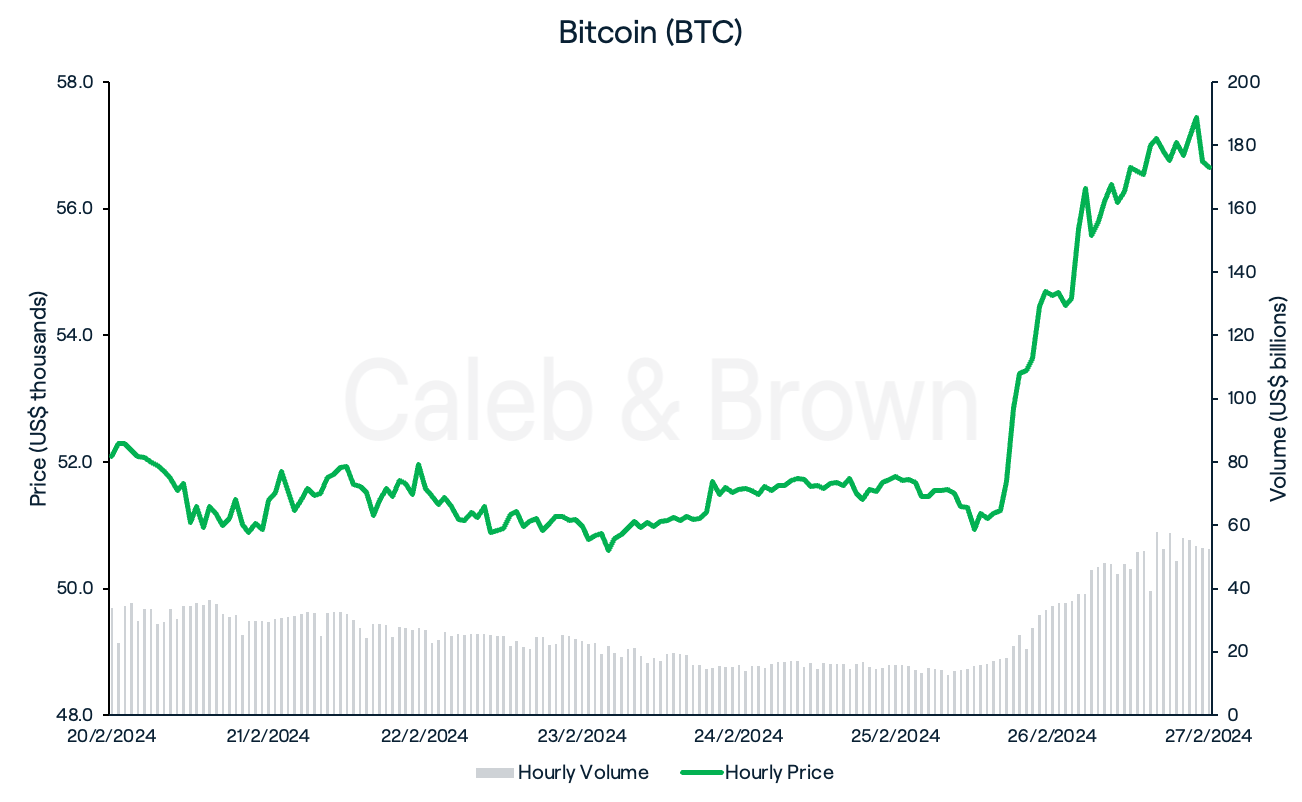

After a week of rangebound trading, Bitcoin (BTC) awakened from its lull to rise above US$57,000 for the first time since late 2021. This feat however, was not brought upon by any major events or news, but more likely traders front-running the upcoming halving event in April, as well as nearly US$200 million in leveraged BTC short liquidations over the past two days.

BTC started the week flat in response to last Thursday’s weekly jobless claims report by the U.S. Department of Labor, which revealed a drop of 12,000 claims, down to 201,000. While this signals an overall strengthening economy, it provides the Federal Reserve with more time to lower interest rates, generally resulting in stagnated market prices. This is indicated in the CME FedWatch tool which reveals just 2.5% of investors believing interest rates will drop in March, and 50% in June.

Nevertheless, BTC held above the line, closing the week at US$56,650, up 8.8% over the last seven days.

Ethereum

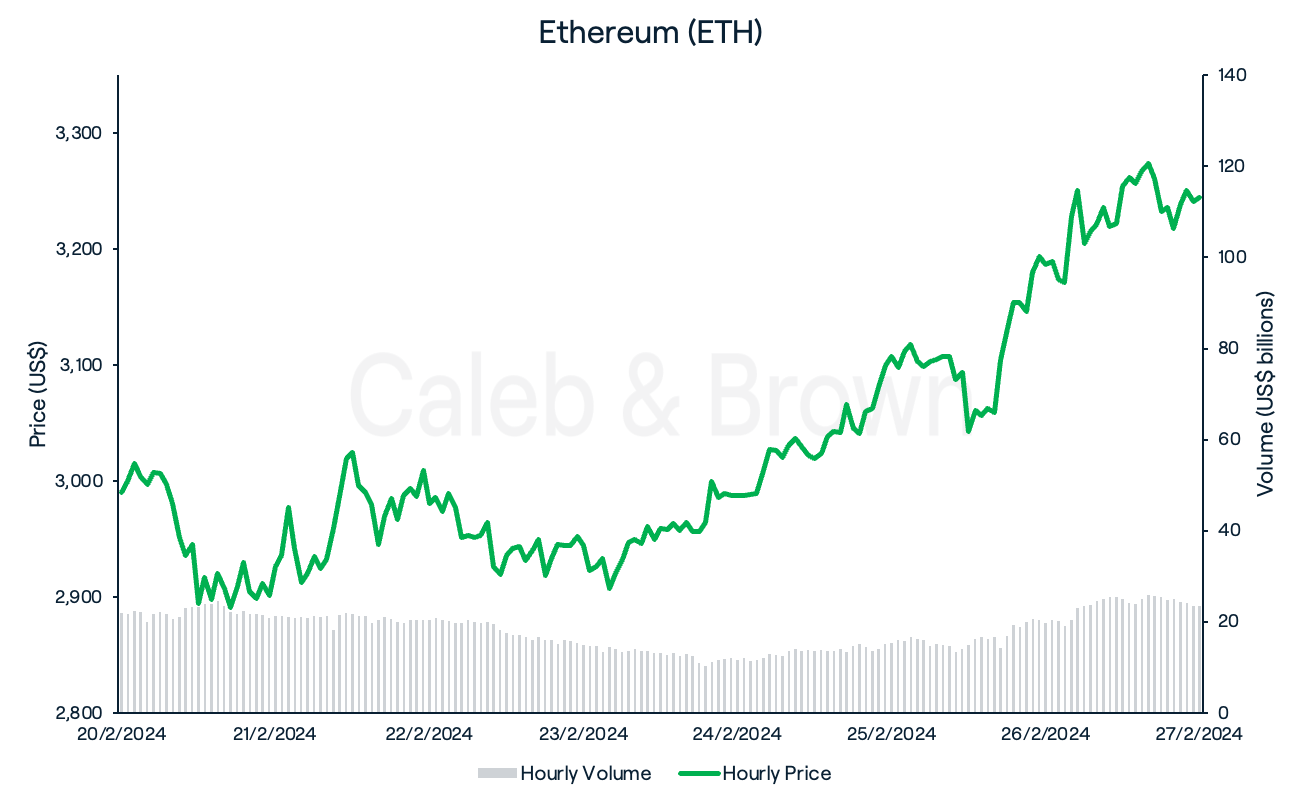

Ethereum (ETH) was able to follow in last week’s footsteps as it steadily increased past the US$3000 mark, after falling just short last week. ETH reached a high of US$3,288 before closing the week at US$3,244, up 8.5%.

Altcoins

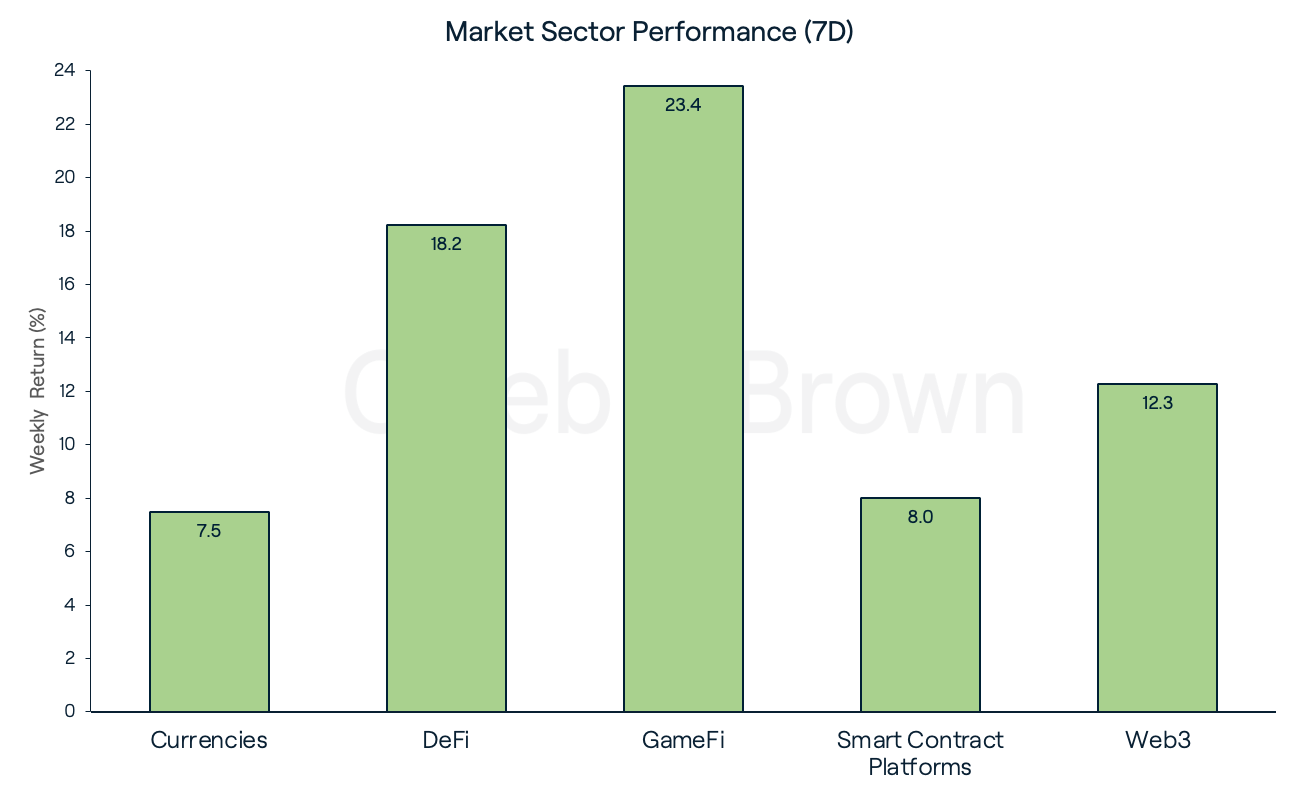

Coming as no surprise, market sector performance was positive once again this week, with GameFi gaining 23.4% to take top spot. This was followed closely by DeFi and Web3 which surged 18.2% and 12.3%, respectively.

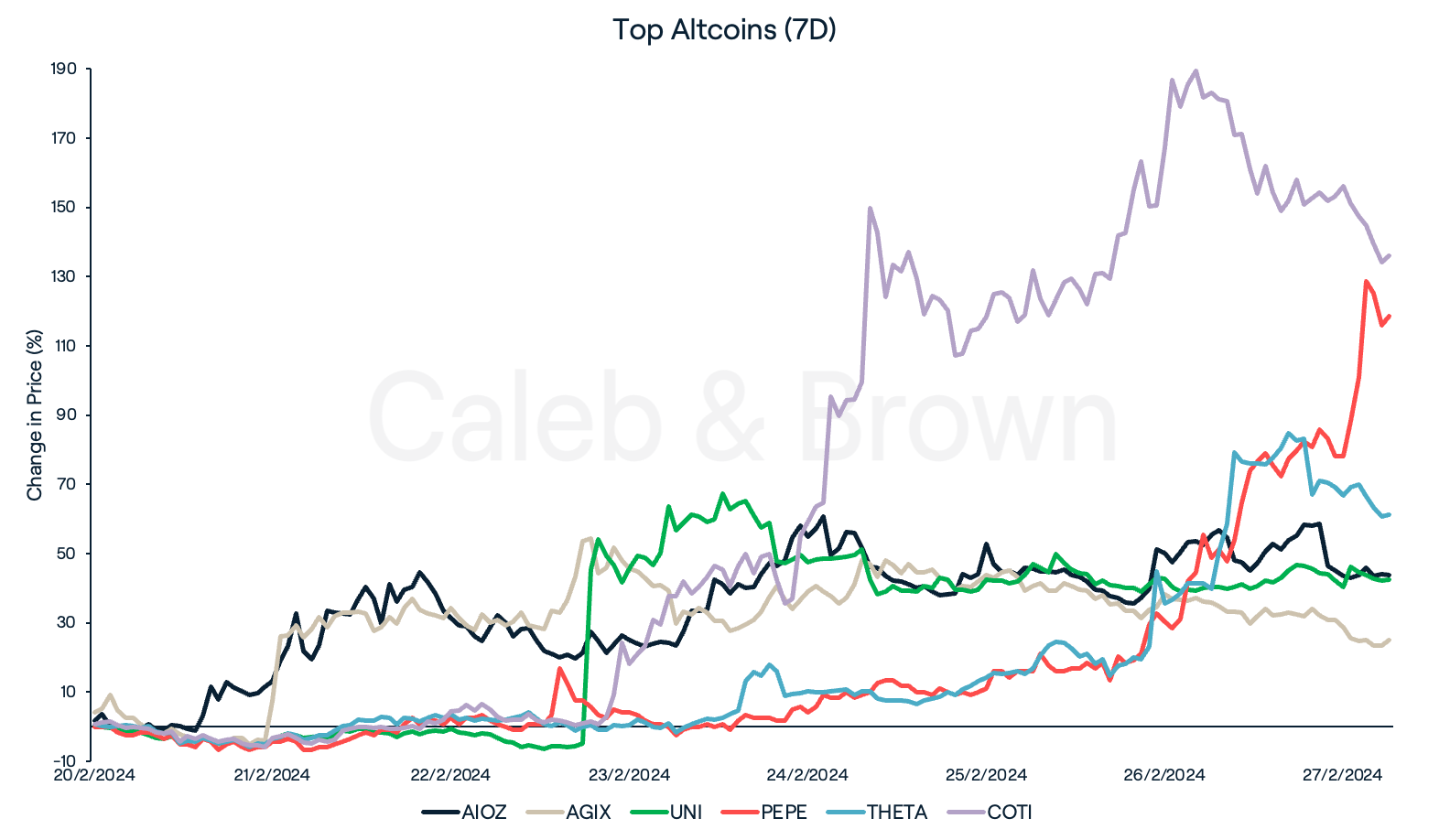

Altcoin performance was dominated by artificial intelligence (AI) protocols this week with AIOZ Nerwork (AIOZ) and SingularityNET (AGIX) each rallying 43.9% and 25.1%, respectively. AI linked tokens are still going strong, buoyed by the current momentum within the AI industry, which is sparking increased investor interest and activity in related digital assets.

DeFi giant, Uniswap (UNI), memecoin, Pepe (PEPE), and Theta Network (THETA) also surged this week, adding on 42.4%, 118.5% and 61.2%, respectively. Uniswap rallied following a proposal by the Uniswap Foundation to introduce staking, rewarding users who pledge their tokens to the network, while Theta jumped on its recent announcement of Theta EdgeCloud.

Securing top spot this week however was decentralised payment solution, COTI (COTI) which rallied an astounding 136.0% after it deployed Garbled Circuits, a privacy preserving mechanism that performs computations using a fraction of the required processing power and memory.

In Other News

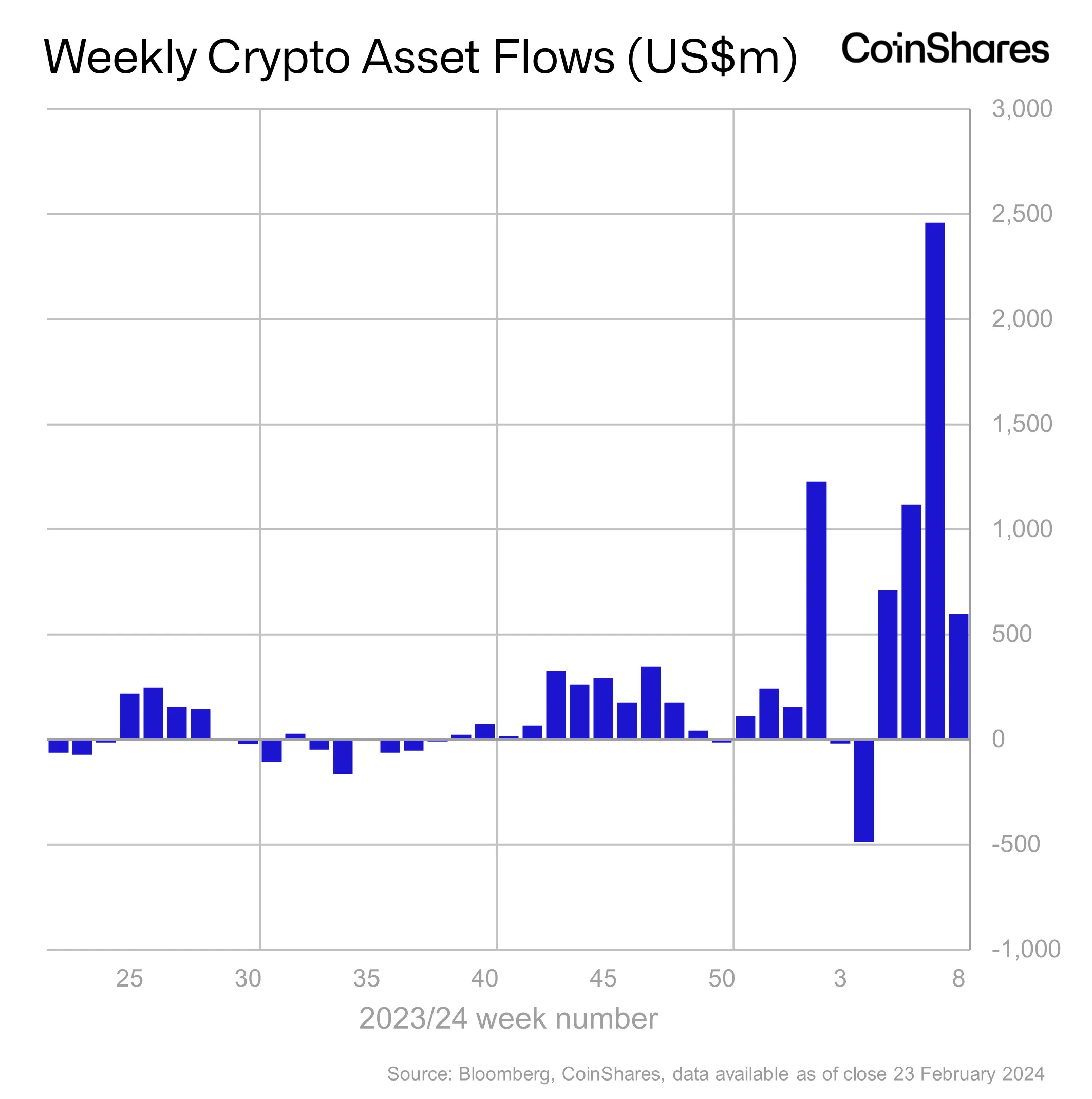

Digital asset investment products extended its inflow streak to four consecutive weeks after seeing another US$598 million in weekly inflows.

- Two personal crypto wallets belonging to Jeff Zirlin, the co-founder of Sky Mavis, the company behind the popular play-to-earn (P2E) game Axie Infinity (AXS) were compromised last week, resulting in over US$10 million worth of Ronin (RON) and Wrapped Ethereum (WETH) being stolen. This follows the devastating attack in 2022 which saw US$625 million in stolen funds from AXS, however Zirlin assured this hack was limited to his personal addresses only.

- BitForex, a cryptocurrency exchange headquartered in Hong Kong, has suspended withdrawals for three days with no explanation. Prior to the suspension, approximately US$56 million worth of cryptocurrency had been withdrawn from the exchange's wallets. Furthermore, the exchange's X account has not been updated since May 2023.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F6KbiaLlIB8Tm3DJwtdfgDv%2Fd222d0acf493a72e192ac68ad237b66b%2FWeekly_Rollup_Tiles__3_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-03-07T00%3A32%3A51.082Z)