Market Highlights

- Risk assets declined on Trump’s tariffs announcement before a pause fuelled a recovery.

- President Trump signed an executive order to establish a U.S. sovereign wealth fund.

- The launch of Chinese AI chatbot DeepSeek caused a tech and crypto selloff.

- Grayscale filed to convert its XRP Trust into an ETF.

- Binance is being investigated by French authorities for money laundering and other charges.

- KuCoin pled guilty to charges, and its co-founders stepped down.

Markets Overview

Macro Market Updates:

It was a week of interest rate decisions before President Trump’s tariffs announcements saw risk assets sell off then recover. The U.S. Federal Reserve left rates on hold at 4.5%. In the central bank’s statement, U.S. Federal Reserve Governor Jerome Powell cited continued economic expansion and stabilisation of the unemployment rate as key reasons for leaving rates on hold. The Bank of Canada and European Central Bank lowered their rates to 3% and 2.9%, respectively.

Over the weekend (February 1), President Trump said he would impose 25% tariffs on Mexican and most Canadian imports. Goods from China will be subject to 10% tariffs. The announcement resulted in immediate downward pressure across crypto and traditional finance markets. Prices recovered on Monday, 3 February, when it was announced that Canada and Mexico's tariffs would be paused for at least 30 days.

On Monday afternoon (February 3), President Trump also signed an Executive Order to establish a U.S. sovereign wealth fund, saying it could own part of Chinese social media platform TikTok as part of its investments. This presumably buoyed markets as the new week started and could fuel upward momentum in assets the fund invests in provided the fund gets congressional approval.

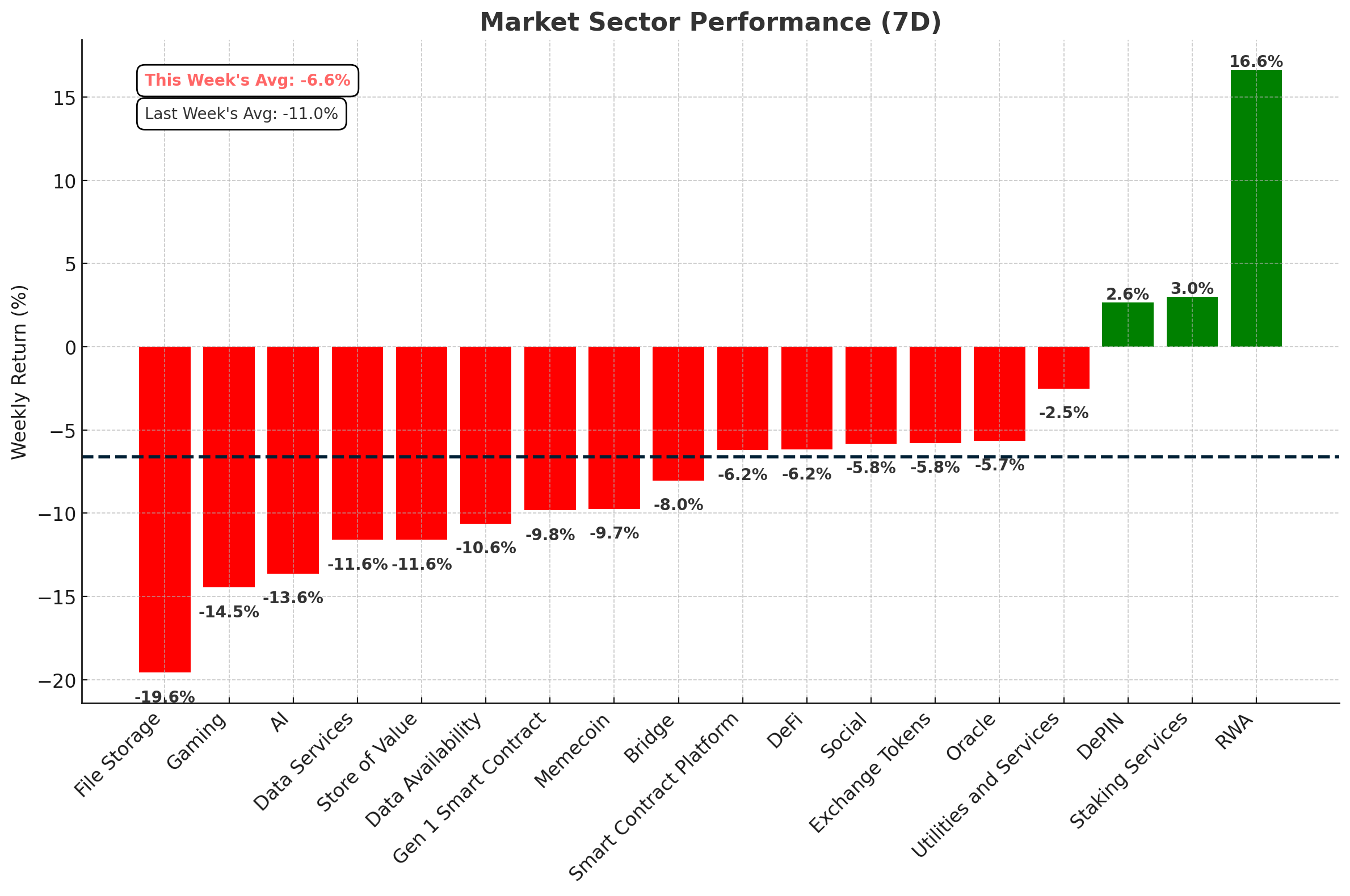

Crypto Market Sector Performance

Real-World Assets (RWA) was the only sector to post gains this week, led by Mantra (OM), which surged 27.5% following news of its partnership with DAMAC Properties to tokenise US$1 billion in real estate assets. Most other sectors saw declines driven by new US trade tariffs. Bitcoin’s growing dominance, now over 60% of the total crypto market cap, reflects a shift in investor preference toward more resilient assets during this period of heightened volatility.

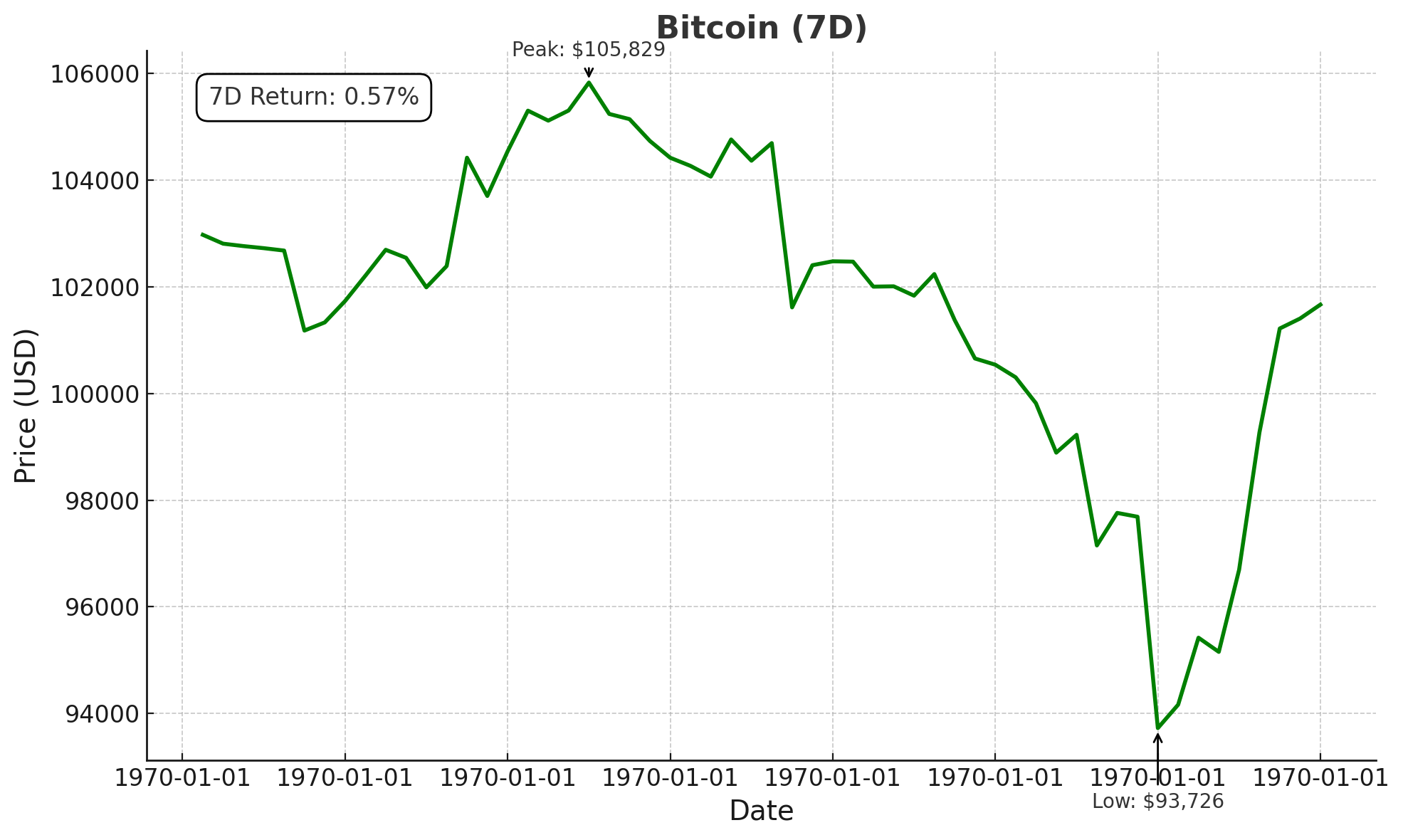

Bitcoin (BTC)

Bitcoin traded around US$104,000 throughout the week before declining over 11% on Trump’s tariffs announcement, which saw the cryptocurrency decline to around US$93,000. Markets later recovered by almost 7% following the news that he will pause Canada and Mexico’s tariffs implementation for at least 30 days.

This week saw inflows of US$474 million to bitcoin asset investment products. Short bitcoin had its second consecutive week of inflows, with US$3.7 million flowing into these products.

El Salvador passed legislation to scale back its pro-bitcoin legislation as part of a deal struck with the International Monetary Fund (IMF) in December 2024. In exchange for a US$1.4 billion loan from the IMF, El Salvador agreed to stop accepting tax payments in bitcoin and to unwind Chivo Wallet, El Salvador’s government-issued crypto wallet.

Tether’s stablecoin, USDT, will be integrated into the Bitcoin and Lightning networks. Announced at the bitcoin conference in El Salvador, it marks a significant milestone for all networks involved as the functionality and trading of stablecoins continue to grow. USDT has a market cap of over US$139 billion, making it the world’s largest stablecoin. USDT is also available on 17 other networks, including Ethereum and Solana.

Illinois joined the growing list of states in the U.S. to propose legislation that would allow for a bitcoin reserve. House Bill 1844 (HB1844), if passed, will allow the Illinois State Treasurer to manage the fund. All bitcoin deposits would be held for a minimum of five years before the state can transfer, sell or convert the bitcoin to another cryptocurrency.

Tesla has revalued its bitcoin holdings under new accounting rules that allow companies to value digital assets at current market prices each quarter. The adjustment takes the value of Tesla’s bitcoin holdings from US$184 million to over US$1 billion.

Past performance is not a reliable indicator of future results.

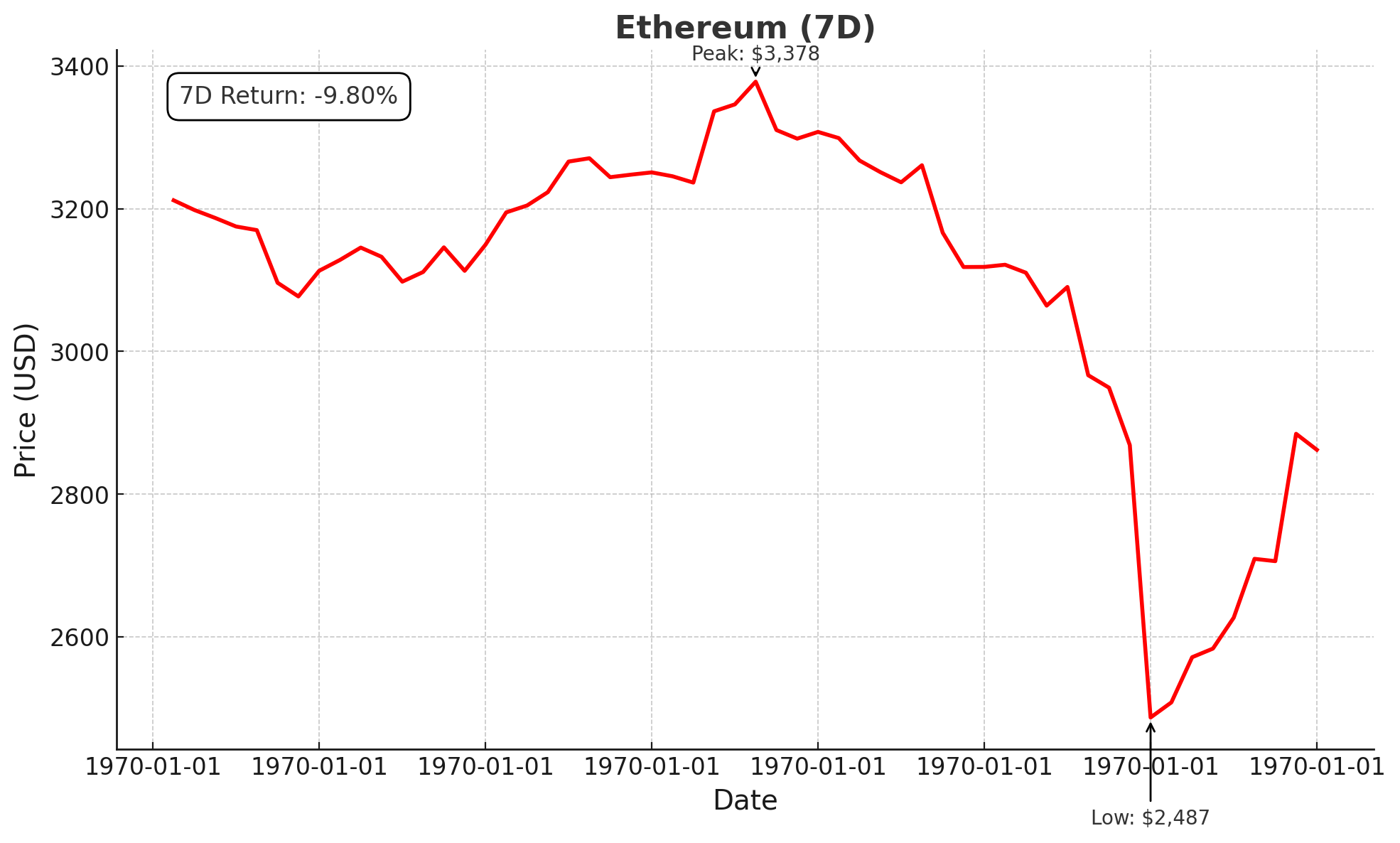

Ethereum (ETH)

Ethereum’s price movements were similar this week, though more pronounced than bitcoin. The cryptocurrency opened the week at US$3,231, reached a high of US$3,438 and then declined over 30% to reach a low of US$2,150. Price has since regained around 25% of these losses as markets recover following a pause on Mexico and Canada’s tariffs.

Ending the week with net zero flows, Ethereum asset investment products saw large outflows at the start of the week, presumably due to its exposure to the technology sector amidst the launch of DeepSeek.

Past performance is not a reliable indicator of future results.

Altcoins

Big payoff

- Alchemy Pay (ACH) gained 58%, taking its market cap to almost US$178.8 million. The fiat-to-crypto payment gateway found support at US$0.02 and gained almost 190% before retracing on President Trump’s tariffs announcement. This week’s gains are presumably due to Alchemy Pay receiving Australian Transaction Reports and Analysis Centre (AUSTRAC) approval as a digital currency exchange provider in Australia.

AI curumba!

- Artificial Superintelligence Alliance (FET) declined by 42.7%, taking its market cap to just under US$1.7 billion. The network that develops, deploys and orchestrates multi-agent systems saw declines as a result of the DeepSeek-fuelled selloff and President Trump’s tariff announcement.

- AIOZ Network (AIOZ) lost 44.4%, which takes its market cap to US$559.2 million. The decentralised physical infrastructure network (DePIN), which is focused on AI computing infrastructure, saw a decline of almost 40% following the launch of China’s AI-powered chatbot, DeepSeek, which caused a selloff across tech stocks and some AI cryptocurrencies. The wider market selloff over the weekend caused further declines.

Layer 1 losses

- Dymension (DYM) declined by 42%, taking its market cap down to US$134.2 million. The network that connects users and liquidity with modular blockchains (RollApps) has seen over eight weeks of declines following its delisting from Binance. This week’s losses come as part of the selloff across markets, where losses amongst smaller altcoins were more pronounced.

DeFi declines

- THORChain (RUNE) lost over 53%, which takes its market cap to US$436.1 million. The cross-chain swap protocol has declined over 70% since mid-January, when solvency concerns were raised. It follows last week’s 30% drop in RUNE as THORChain suspended THORFi’s operations while it launched Proposal 6, a 90-day restructure initiative to address its US$200 million debt. Stakeholders have approved the proposal, which involves converting the debt into equity through a new token. This new token will receive 10% of network revenue in perpetuity.

Past performance is not a reliable indicator of future results.

In Other News

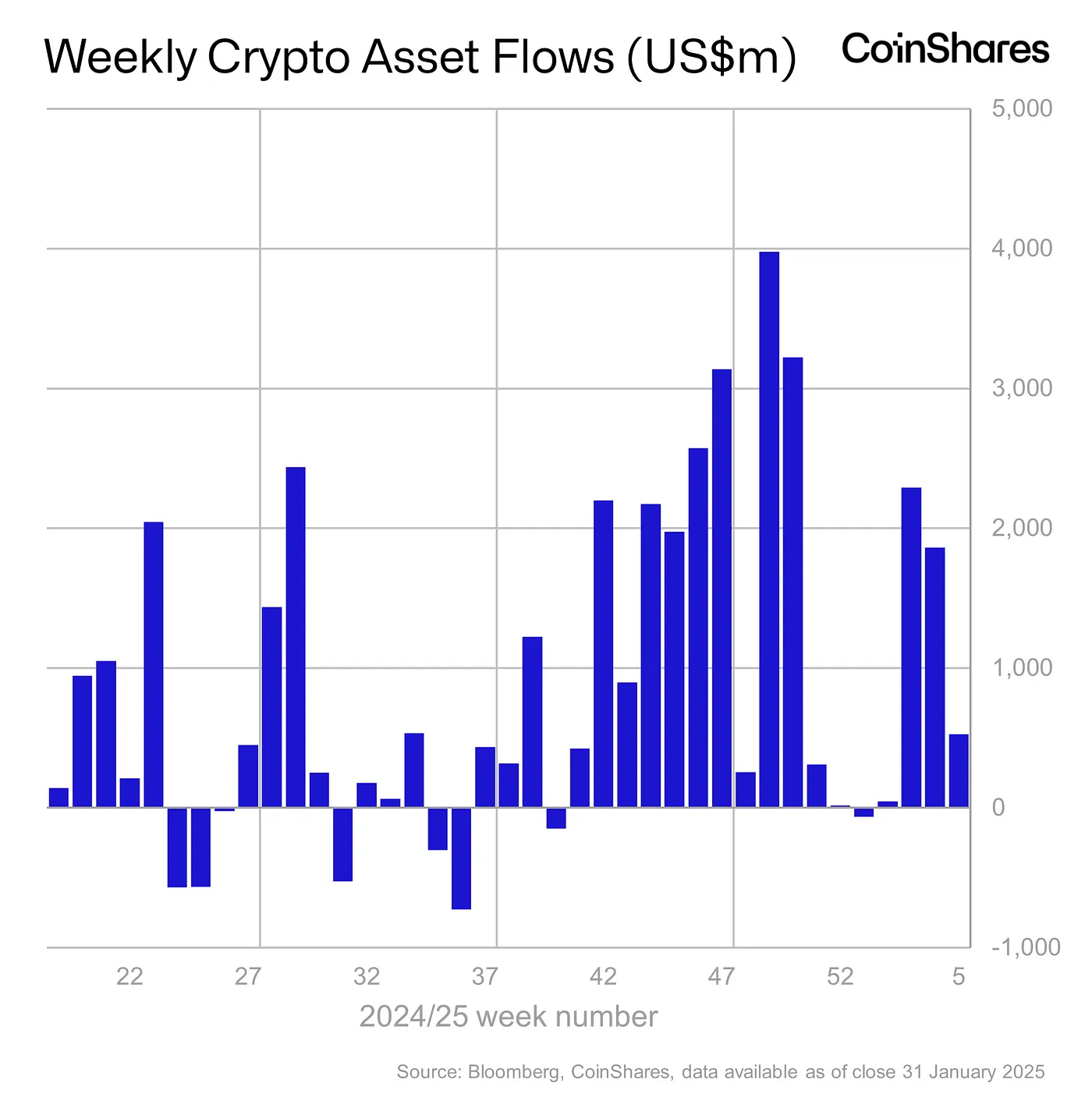

Digital asset investment products saw inflows of US$527 million this week. Fluctuations in inflows throughout the week represented waxing and waning investor sentiment following the launch of DeepSeek and the initial shock of President Trump’s tariffs announcement. The launch of DeepSeek saw US$530 million in outflows on Monday, 27 January.

Amongst altcoins, XRP is the second best-performing altcoin, with US$105 million inflows in the year to date and US$15 million of inflows throughout the last week.

Other crypto news

- Trump Media and Technology Group launched Truth.Fi, a financial services and fintech arm of the group. Truth.Fi will buy bitcoin and other digital assets using US$250 million cash custodied by Charles Schwab. The announcement was made on President Trump’s social platform, Truth Social, on Wednesday.

- The U.S. Securities and Exchange Commission (SEC) is fast-tracking the approval of Bitwises’s Bitcoin-Ethereum exchange-traded fund (ETF). Offering investors exposure to bitcoin and Ethereum, the fund’s asset allocation is composed of 83% bitcoin and 17% Ethereum. Weighting is determined by multiplying each asset’s pricing benchmark by its circulating supply. Before trading can begin, Bitwise still needs the SEC to approve its Form S-1 registration.

- Grayscale has filed to convert its XRP Trust into an ETF. The New York Stock Exchange (NYSE) Arca filed an application with the SEC for approval of the conversion. The Trust currently has around US$16.1 million in assets under management (AuM). This marks the latest in several of Grayscale’s funds that have been converted into ETFs following the launch of bitcoin and Ethereum ETFs by other financial institutions throughout 2024.

Regulatory

- Crypto exchange Binance is being investigated by French authorities for money laundering, tax fraud, and drug trafficking, amongst other charges. The investigation began in 2023, and France’s National Jurisdiction for the Fight against Organised Crime (JUNALCO) has referred the case to the French judiciary. Further investigations will now determine if Binance complied with Europe’s money laundering regulations. Binance has denied the allegations.

- KuCoin, the Seychelles-based crypto exchange, pleaded guilty this week to operating as an unlicensed money-transmitting business. As a result, the company will pay almost US$300 million in fines and forfeitures. The charges are a result of the March 2024 indictment against KuCoin’s founders, Chun Gan and Ke Tang. Gan has stepped down from his roles at the company as part of his settlement agreement. Prosecutors said Tang will also no longer have a rule in KuCoin’s management or operations moving forward.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.