Market Highlights

- Crypto markets saw declines this week due to renewed inflation concerns and other macro headwinds.

- New Hampshire and North Dakota are the latest U.S. states to consider buying bitcoin.

- The SEC’s case against Coinbase was paused due to conflicting crypto rulings.

- Crypto-friendly Cynthia Lummis will lead the first-ever U.S. Senate Crypto Subcommittee.

Markets Overview

Macro Market Updates:

It was a week of purchasing manager index (PMI) updates around the world, plus the U.S. non-farm employment change indicated continuing strength in the world’s biggest economy. Coming in well above forecast at 256,000, this increases the likelihood that the U.S. Federal Reserve will continue its pause on lowering interest rates. Further signs of strength showed in the U.S. ISM services PMI, which came in at 54.1 (a number above 50 indicates economic expansion). These data points, combined with President-elect Donald Trump’s trade and immigration policies, may cause inflation to remain higher than the U.S. Federal Reserve's 2% target, buoying the Fed’s hesitation to deliver large rate cuts in 2025 and a culprit for the current jitters across markets.

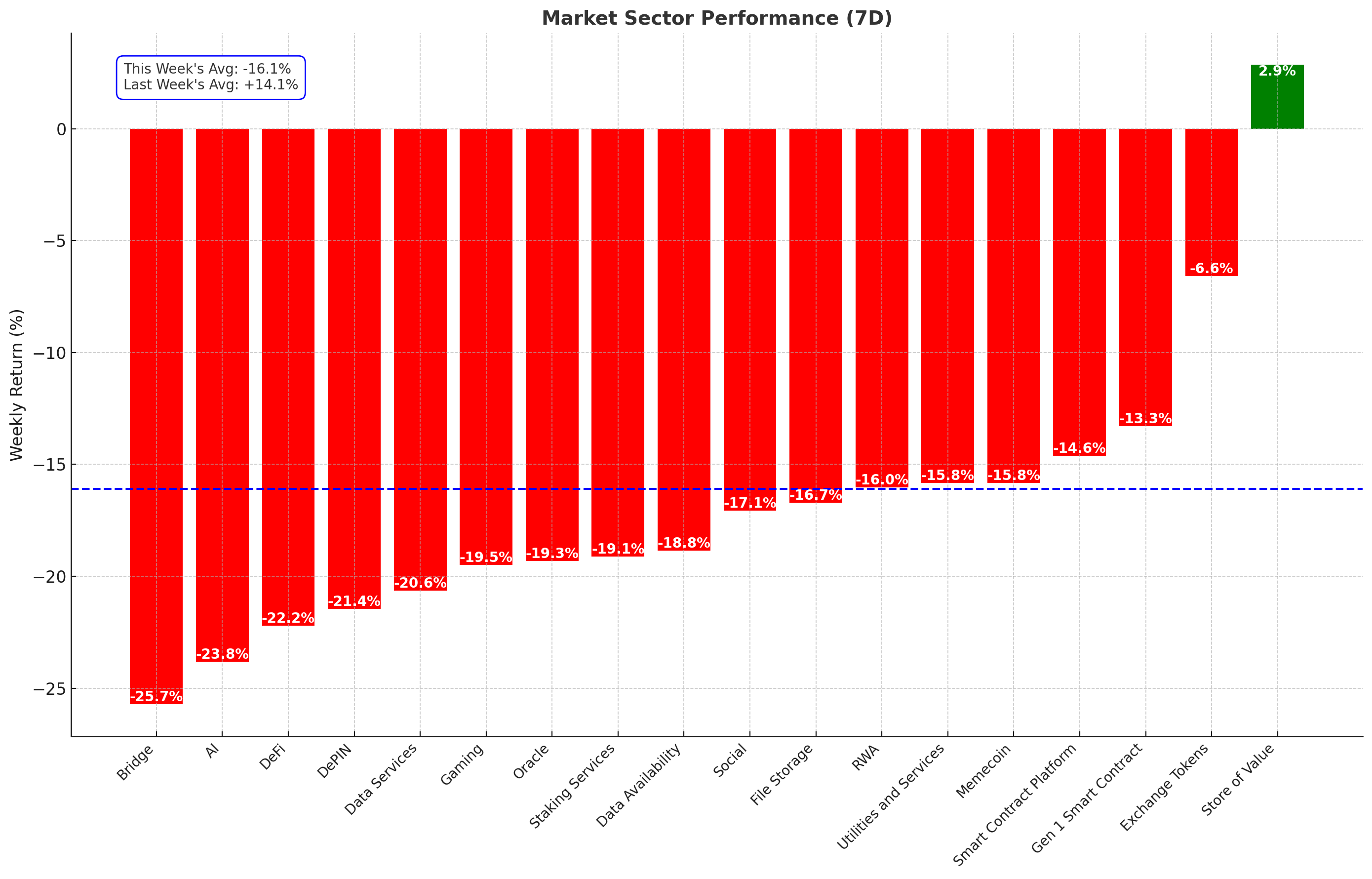

Crypto Market Sector Performance

Minor gains were seen in store of value tokens this week, with XRP gaining 4.7% throughout the last seven days. All other coins within this sector declined as the wider market experienced a sell-off. Bridge and AI tokens saw the largest declines, presumably due to traders and investors looking to reduce their exposure to crypto sectors with the highest volatility.

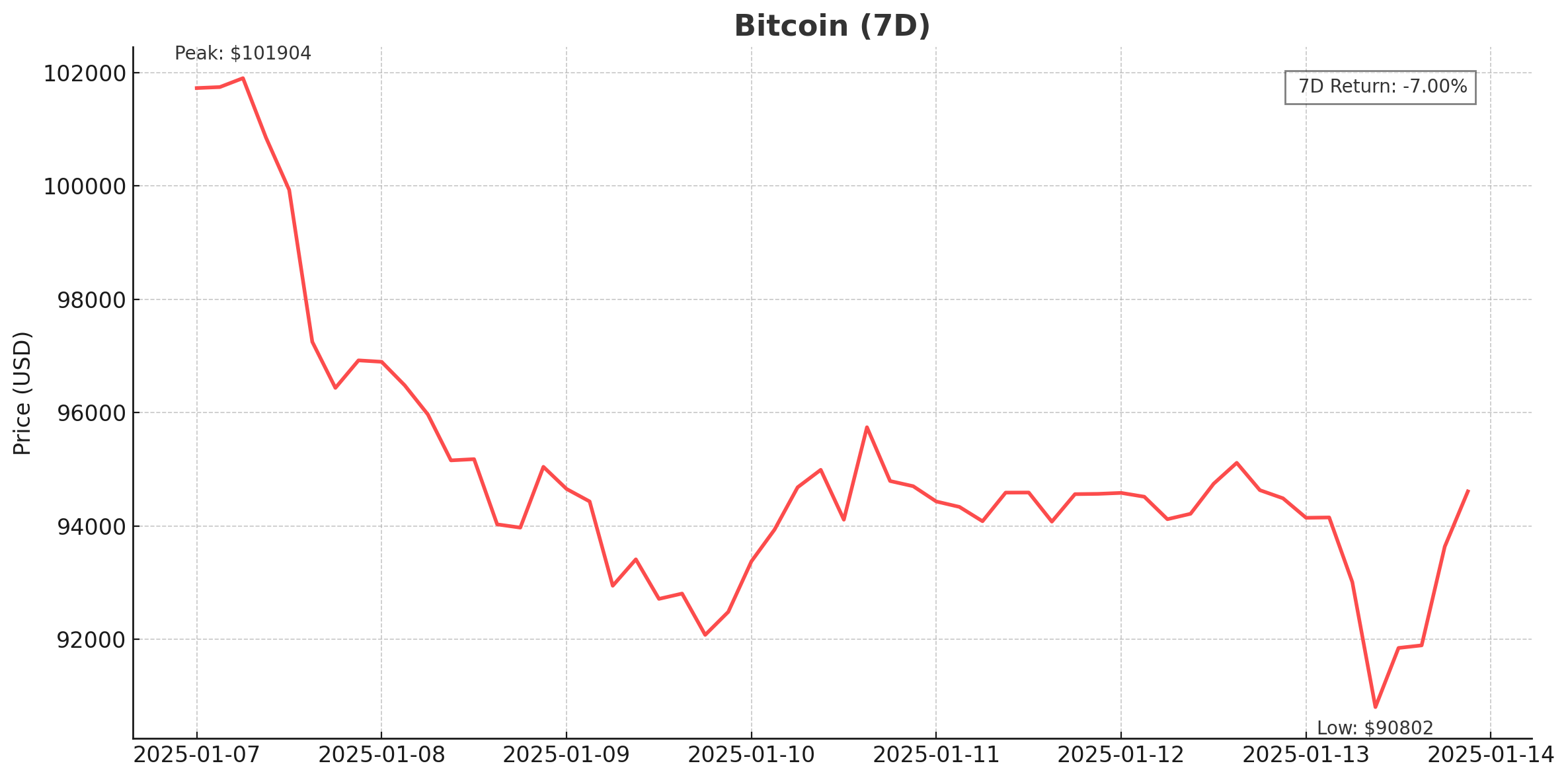

Bitcoin (BTC)

Bitcoin had a lacklustre week. After failing to make a strong break and close above US$100,000, it declined by over 7% to the next key level at US$90,950 to find support. The declines are presumably due to the strengthening U.S. dollar despite December’s rate cut, a spike in the ten-year treasury yield, renewed inflation concerns and the waning of post-election hype as the start of President-elect Donald Trump’s term nears.

A federal judge also approved the U.S. government’s move to sell 69,370 Bitcoin (valued at approximately US$6.5 billion) seized from the Silk Road marketplace in 2020. While such sales are typically staggered to minimise market disruption, the news has sparked concerns about increased market volatility.

Inflows to bitcoin asset investment products totalled US$214 million this week. Despite the wider market sell-off and this week’s ETF outflows in other assets, bitcoin asset investment products lead all other crypto assets with inflows of US$799 million for the year to date.

More companies and governments are considering adding bitcoin to their treasuries and balance sheets. Nasdaq-listed Heritage Distilling said it will start to hold bitcoin as a strategic asset and accept bitcoin payments. And in the U.S., New Hampshire Representative Keith Ammon proposed a bill to establish a bitcoin treasury reserve, while the State Legislature in North Dakota is assessing Resolution 3001, a bill aimed at investing state funds in digital assets and precious metals to manage the impact of inflation.

Bitcoin is currently trading at US$94,554, a decrease of 7% on the week.

Past performance is not a reliable indicator of future results.

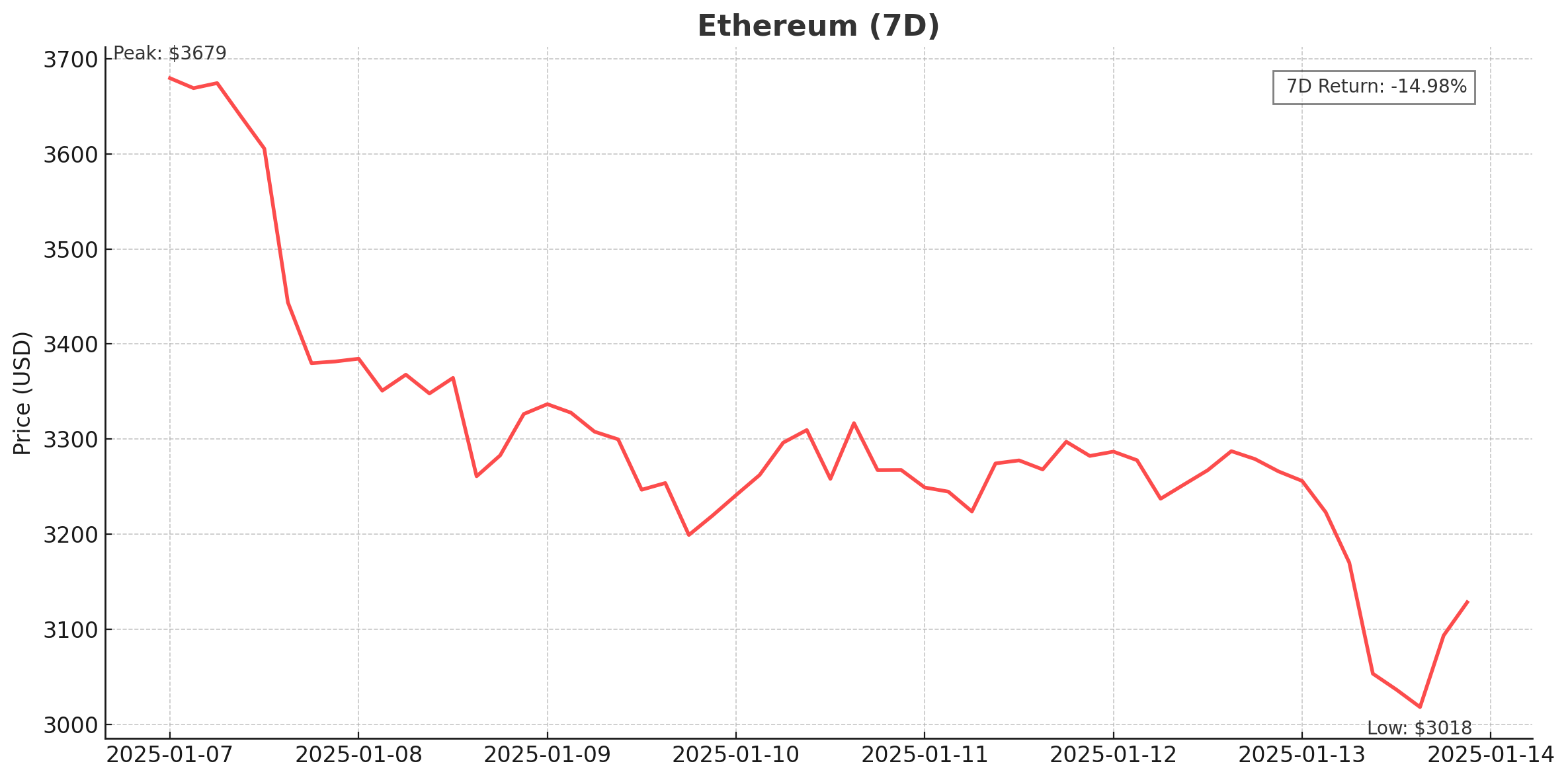

Ethereum (ETH)

Ethereum had a similarly lacklustre week, declining by over 10%, presumably due to macroeconomic headwinds. Opening the week at US$3,635, a steep sell-off saw price retrace back to the key level around US$3,190.

On Wednesday, US$159 million was withdrawn from Ethereum ETFs in the largest single day of outflows for these products since July 2024. By the end of the week, outflows totalled US$256 million.

Ethereum is currently trading at US$3,133, a decrease of over 14% on the week.

Past performance is not a reliable indicator of future results.

Altcoins

DeFi declines

- THORChain (RUNE) declined by 30.4%, taking its market cap to US$1.2 billion. The DeFi exchange and infrastructure network has seen volatility since it migrated to its own blockchain in 2022. This week’s declines are presumably due to the wider market sell-off, with traders and investors likely deleveraging by liquidating positions on DeFi protocols. The network’s annual report was also released this week, detailing US$56 billion in swap volume and US$40.6 million in liquidity fees.

- Velodrome Finance (VELO) lost 29%, which takes its market cap to US$117.7 million. The automated market maker (AMM) declined to around US$0.12, presumably due to the wider market sell-off. In its Q3 2024 report released this week, the team highlighted its significant growth and ecosystem expansion, including integrating BlackRock’s BUIDL fund via Securitize into USDV.

- Kamino (KMNO) declined by 36.4%. This takes its market cap to US$134.4 million. This week, the DeFi lending and borrowing network announced that it’s removing its SOL utilisation cap in Kamino’s Main Market to establish a free market environment for SOL suppliers and borrowers. Although this week saw a sell-off, the removal of the SOL utilisation cap may increase liquidity and usage on the platform.

- TokenFi (TOKEN) lost 28.5%, taking its market cap to US$92.3 million. The crypto and real-world asset tokenisation platform saw a sell-off down to under US$0.05 this week. Despite the sell-off, BAD Coin ($BADAI), an AI agent platform on the BNB chain, had a presale on TokenFi this week. The presale sold out in less than 12 hours, indicating the platform’s strength in facilitating token launches.

- Kaon (AKRO) saw losses of 33.7%, which takes its market cap to just under US$1.9 million. AKRO has seen steep declines since early December following the announcement that it would be delisted from Binance. The team is building the first native bitcoin layer with Ethereum virtual machine (EVM) compatibility. Kaon released its first public testnet in December.

Past performance is not a reliable indicator of future results.

In Other News

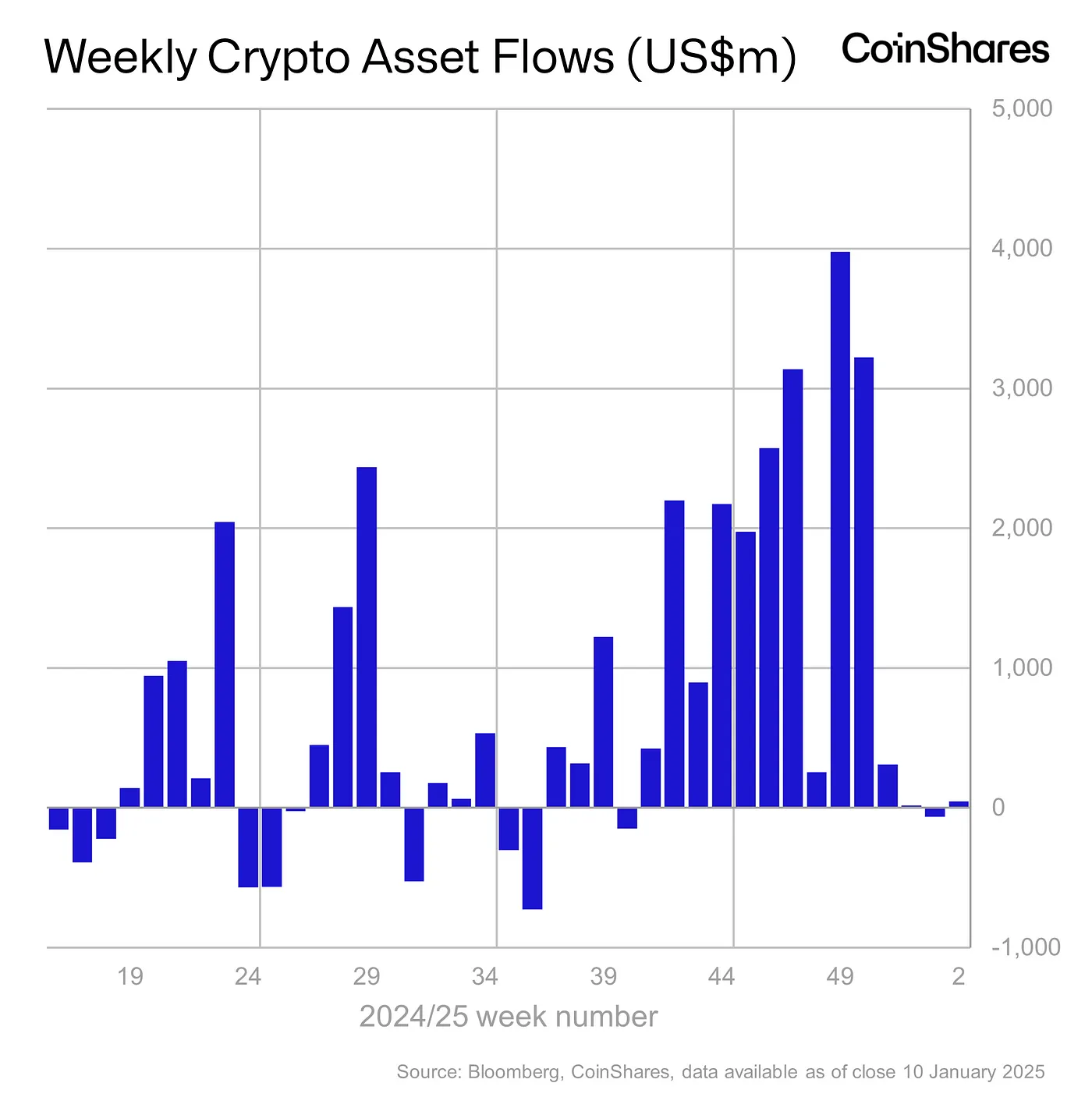

This week’s macro headwinds saw minor inflows of US$48 million to digital asset investment products. While US$1 billion flowed into funds to start the week, strong economic data out of the U.S. and the Fed’s hawkish December meeting minutes led to US$940 million of outflows in the second half of the week. The strong reaction to this week’s macroeconomic developments indicates that crypto asset prices are once again more correlated with the macro environment than President-elect Donald Trump’s election promises.

Other crypto news

- Wyoming Senator Cynthia Lummis will reportedly lead a new Senate subcommittee focused on digital assets. The new crypto subcommittee sits under the Senate Banking Committee and aims to provide greater focus to the sector while increasing the capacity for more timely hearings so developments can proceed faster. Wisconsin’s Bryan Steil will chair the House Subcommittee on Digital Assets, Financial Technology and AI, indicating that Donald Trump is capitalising on the Republican majority in the House and Senate to progress crypto innovation and strengthen regulatory frameworks.

- Grayscale announced the reorganisation of its Digital Large Cap Fund to make space for Cardano. Bitcoin and Ethereum make up 90% of the fund, while the remaining 10% is split between XRP, Solana and Cardano. Avalanche has been removed from the portfolio due to weak performance in the current bull market.

- Ripple executives met with President-elect Donald Trump, sparking fresh optimism that the approval of XRP ETFs may happen soon. XRP was up 4% in the 24 hours following the news. Investment firms, including 21Shares and Bitwise, have filed to launch XRP ETFs.

Regulatory

- U.S. District Judge Katherine Failla ruled that the SEC’s ongoing lawsuit against Coinbase will be paused. The crypto exchange argued that courts across the country are coming to conflicting conclusions around the regulation of crypto and will now proceed to pursue an interlocutory appeal. The SEC’s ongoing stance has been that the sale of many crypto assets is illegal under current securities laws. The case will proceed to the Second Circuit Court of Appeals to determine if it will continue in Judge Failla’s courtroom or be dismissed.

- A federal judge has ordered early bitcoin investor Frank Richard Ahlgren to surrender his encryption keys to unlock US$124 million in crypto to recover US$1 million in restitution as part of his December sentencing for tax evasion. The order also mandates that Ahlgren identify his crypto storage devices while prohibiting the transfer or hiding of digital assets without court approval.

New Asset Listings

Newest Assets available at Caleb & Brown!

- Akash Network (AKT)

- Virtuals Protocol (VIRTUAL)

- Stader (SD)

Buy & Sell these crypto assets, or Swap them directly with hundreds of other popular assets through your personal crypto broker.

To see our full list of available assets, visit the client Portal or this article.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.