Market Highlights

- XRP reached a 7-year high of US$3.4 due to meme coin volume and XRP ETF hopes.

- SOL gained over 30% as official Trump meme coins, $TRUMP and $MELANIA, soared then plummeted.

- The DoJ recommended that the bitcoin recovered from the 2016 Bitfinex hack be returned to the platform.

- VanEck has filed for a new exchange-traded fund (ETF), the Onchain Economy ETF, which will offer exposure to crypto infrastructure companies.

Markets Overview

Macro Market Updates:

This week saw fresh consumer price index (CPI) data in the U.S. and the U.K.. CPI for the 12 months to 31 December 2024 in the U.S. came in as forecasted at 2.9%. The ten-year yield was down around 10 basis points on the news, given the data came in at forecast. However, with inflation still nearing 3% on a year-on-year basis, analysts don’t expect the decline in yields to last long. Similarly, in the U.K., CPI for the last 12 months came in just under forecast at 2.5%. The data shows that inflation still remains above many central bank’s target ranges, which could prompt the consideration of further rate cuts in 2025. As the new week starts, traders and investors will presumably be watching for signals of the U.S. Federal Reserve’s rate decision (on 30 January 2025) and how markets respond to President Donald Trump’s inauguration.

Crypto Market Sector Performance

Oracle, store of value and DeFi led sector growth this week. Chainlink was one of the biggest gainers, growing by 31.9% on the week, presumably due to World Liberty Financial’s US$5.6 million investment in the network. XRP led the growth in store of value, gaining 24.6% and reaching a new all-time high (more on that below). The biggest gainer in DeFi was Raydium, which gained 58.3% on the week, which is outlined in more detail below.

Crypto Market Sector Performance (7D)

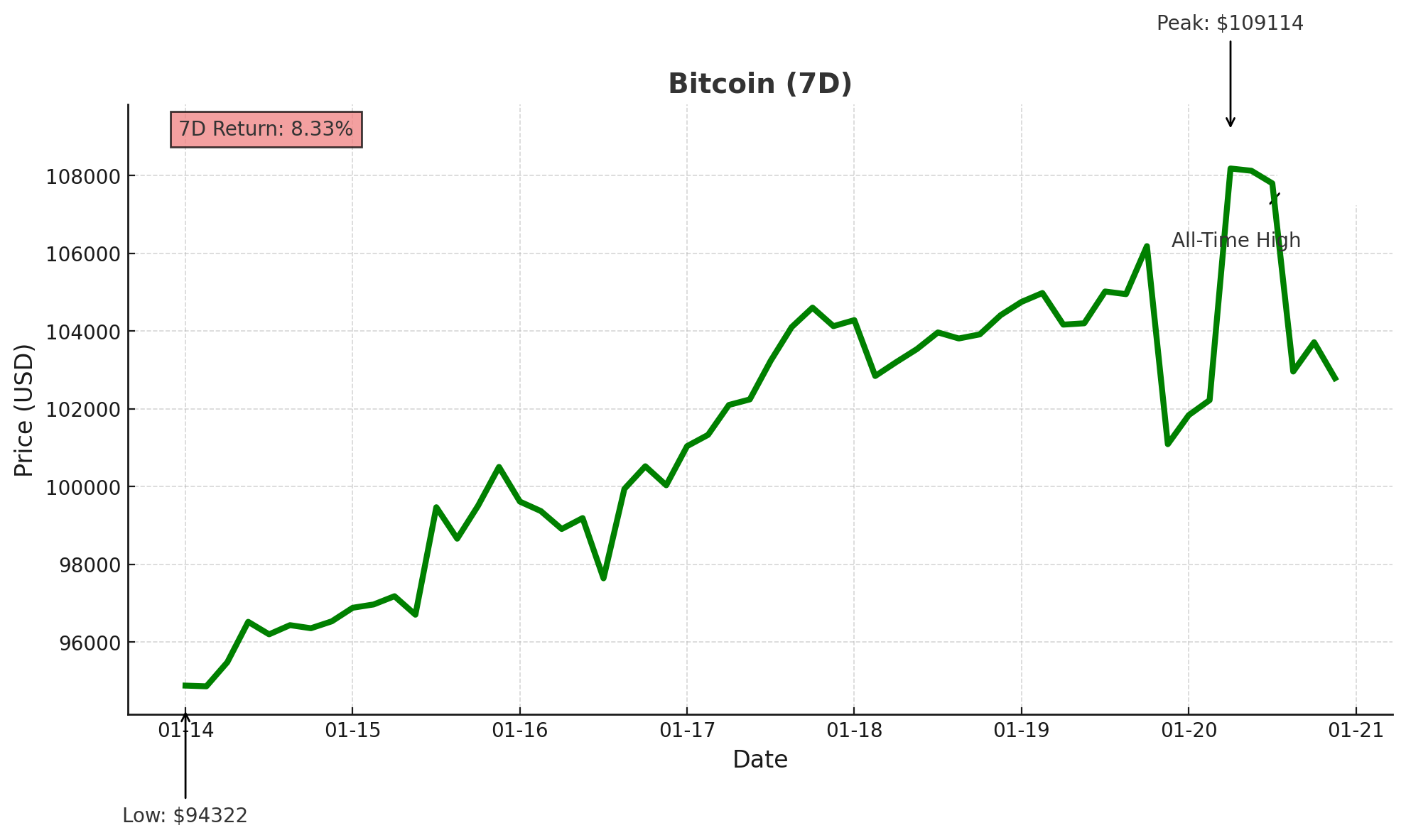

Bitcoin (BTC)

Bitcoin made a new all-time high of US$109,358 on Monday, 20 January, as the crypto market responded positively to Donald Trump’s inauguration. Opening the week at US$94,507, price climbed over 18% before retracing back to US$100,000 for support. In the pullback, over US$1 billion in liquidations occurred. These liquidations were split between US$921 million long positions and US$260 million short positions.

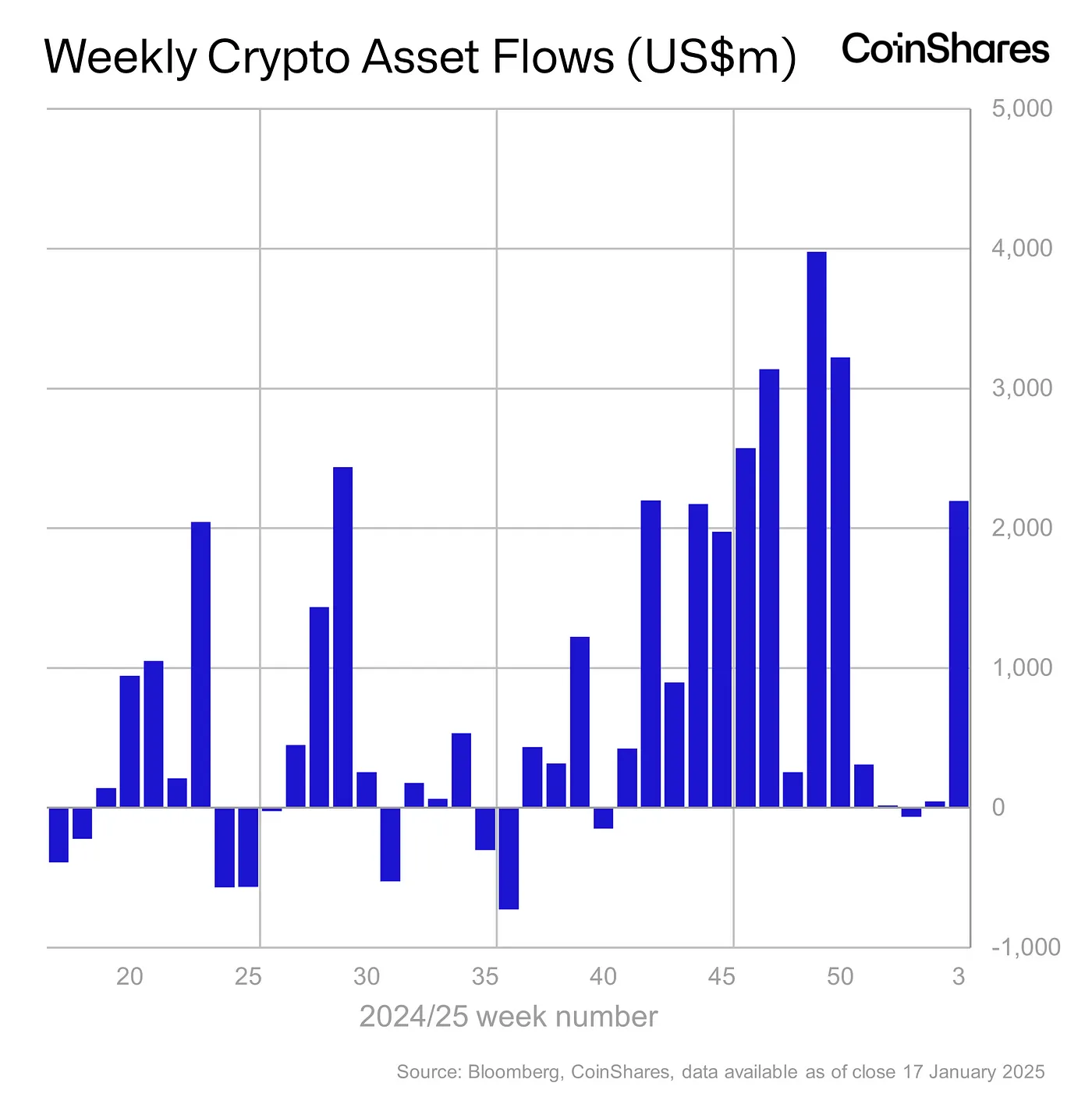

It was another strong week for bitcoin asset investment products, with US$1.9 billion of inflows. This brings year-to-date inflows to US$2.7 billion.

A new filing from the Department of Justice states that the bitcoin stolen in Bitfinex’s 2016 hack should be returned to the platform. Around 75% of the stolen bitcoin, worth around US$9 billion, has been recovered. Following the hack, Bitfinex launched a repayment program where customers were reimbursed with tokens that could be redeemed for U.S. dollars or Bitfinex shares. Some customers say this repayment program isn’t enough, given the surging value of bitcoin in recent years.

Wyoming and Massachusetts joined the growing list of U.S. states that have introduced legislation to establish a bitcoin reserve. Since Donald Trump’s re-election in November, one-fifth of U.S. states have introduced legislation to weigh up whether to invest public funds in bitcoin and other digital assets.

Coinbase has reintroduced bitcoin-backed loans via Morpho, a lending protocol on the Base network. Customers will be able to borrow up to USD$100,000 in USDC stablecoin instantly, with interest rates calculated based on market conditions. There will be no repayment schedules, provided the required loan-to-value ratio is maintained.

Bitcoin is currently trading at US$103,608, an increase of 10% on the week.

Past performance is not a reliable indicator of future results.

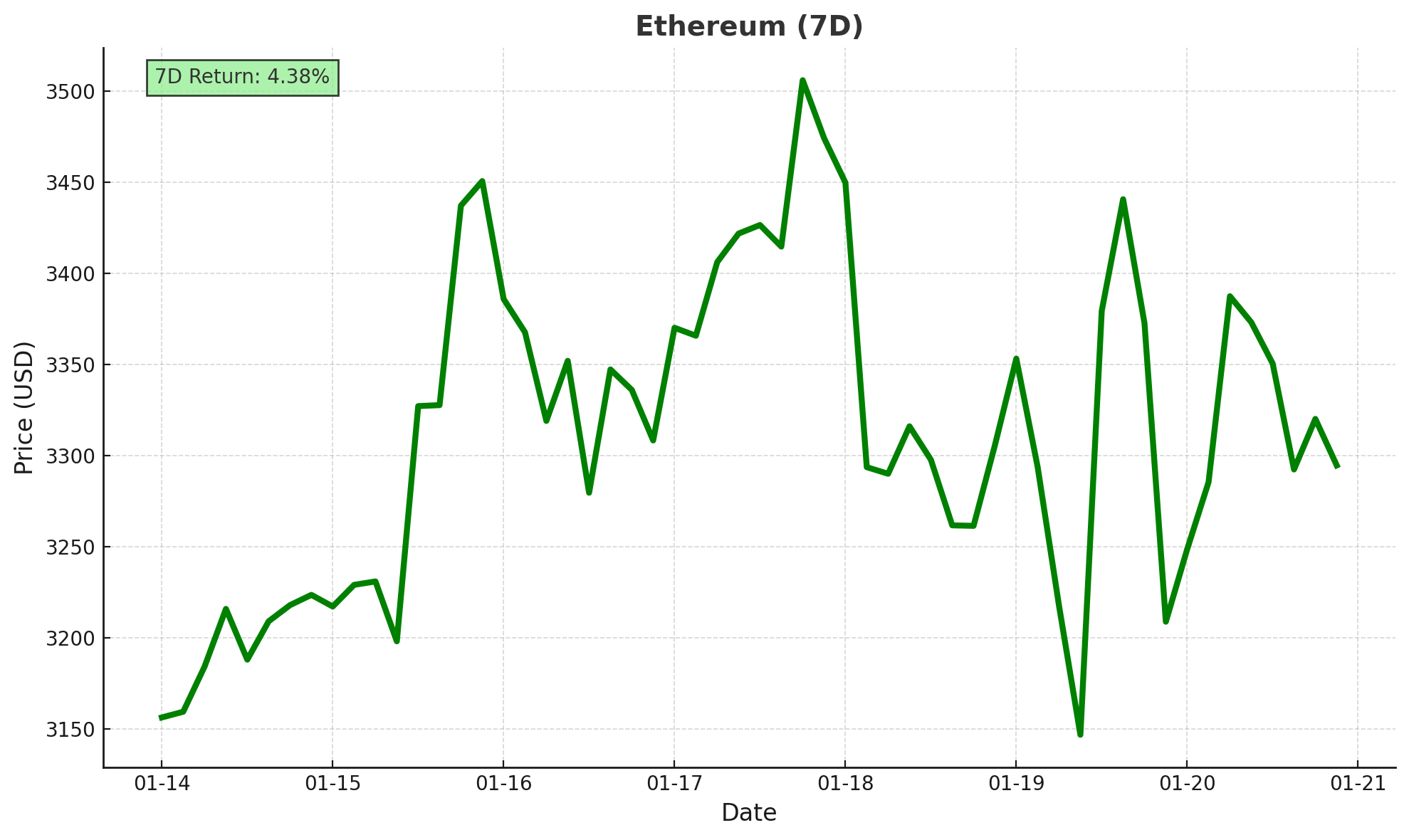

Ethereum (ETH)

Ethereum saw marginal gains this week. It opened on Monday, 13 January, at US$3,266, broke the key level at US$3,385 to the upside, and then retracted to around US$3,300.

Ethereum asset investment products saw US$246 million of inflows this week, correcting some of last week’s outflows.

Petra, the next big upgrade for the Ethereum network, has a target release date of March, as announced by the network’s developers this week. The upgrade combines eight major improvement proposals aimed at delivering speed and efficiency improvements.

Data from IntoTheBlock has revealed that Ethereum whales hold 43% of the total circulating supply of ETH. In early 2023, whales held 22% of the total circulating supply. While this level of concentration could spark price manipulation concerns, the in-depth data shows that 61.09 million ETH are held across three whale addresses that are used for staking on the network. This means they are generating yield while taking circulating supply off the market, which can constrict supply and buoy prices.

This week, World Liberty Financial (WLF), the organisation linked to the Trump family’s crypto tokens, bought US$48 million worth of Ethereum in a 48-hour period. It brings Trump-linked Ethereum holdings to 28,612 ETH, which is worth about US$109 million at the time of writing.

Past performance is not a reliable indicator of future results.

Altcoins

XRP’s new highs

- XRP reached a seven-year high of US$3.4 this week. The gains are presumably due to an uptick in meme coins on the XRP Ledger, growing optimism around the approval of an XRP ETF, and President Donald Trumps’ crypto-friendly administration. Over the last two months, XRP’s holder base has also grown substantially, with more than 500,000 new addresses added to the network. It has also become cheaper to mint meme coins on the XRP Ledger, which could also be fuelling prices. In December, the reserve price to maintain an account on the XRP Ledger was cut by 90%. XRP is up almost 20% on the week.

SOL many meme coins

- Solana (SOL) gained 32.2%, taking its market cap to US$119 billion. Opening the week at US$188, price gained over 70% before retracing. This week’s gains are due to the uptick in trading volume on Trump-related meme coins, including those created by the Trump team. Total value locked on the network has surpassed US$10 billion for the first time since FTX’s collapse.

- President Donald Trump’s team launched two meme coins this week ahead of his inauguration. $TRUMP surged from less than US$10 to almost US$75 within 48 hours, taking its market cap to over US$7.9 billion. Similarly, $MELANIA saw a rally that pushed its market cap to almost US$1 billion before a correction.

Layer-1 wins

- XDC Network (XDC) gained 27.4%, taking its market cap to US$1.9 billion. The layer-1 blockchain has seen several weeks of gains following the U.S. presidential election. This week, price found support at US$0.10 and gained over 70% before retracing. The gains are presumably due to a number of announcements, including the integration of XDC Network with PillarX and the launch of the ERC-4337 shared mempool.

Show and TEL

- Telcoin (TEL) grew by 29.5%, taking its market cap to US$530.9 million. The payments company found support again at US$0.0048 this week. This week’s gains are presumably due to strong technical price action and optimism around an early-February update on the application for its banking charter to become the first digital asset bank in the U.S..

CHEX mate

- Chintai Token (CHEX) gained 51.5%, taking its market cap to US$487.3 million. Price found support around US$0.32, before gaining over 100% and then retracting. CHEX powers Chintai Nexus, a compliance-focused layer-1 blockchain for real-world assets (RWA).This week’s gains are presumably due to strong technical price action and continued investor interest in tokenising RWA.

DeFi gains

- Raydium (RAY) gained 58.3%, which takes its market cap to US$1.8 billion. Breaking 2024’s high of US$6.51, the automated market maker (AMM) gained over 80% throughout the week before retracing. The gains are presumably due to positive sentiment following a strong move past last year’s high, the listing of TRUMP token futures on the network, and Raydium flipping Tether for fees generated in 24 hours.

- Kamino (KMNO) gained 31.4%, taking its market cap to US$172.9 million. Price found support around US$0.01 before gaining upwards momentum towards US$0.15 and then retracing. The gains are presumably due to the positive response to Kamino removing the utilisation cap on SOL lending. Also this week, Kamino surpassed US$4 billion assets lent via the network.

Past performance is not a reliable indicator of future results.

In Other News

This week marked the largest week of inflows for the year-to-date as US$2.2 billion flowed into digital asset investment products, presumably due to renewed confidence leading up to Donald Trump’s inauguration. Total assets under management (AuM) are now at an all-time high of US$171 billion, while trading volumes across exchange-traded products remain elevated at 34% of total bitcoin trading volumes. This signals ongoing interest in gaining exposure to crypto through global asset management firms.

Other crypto news

- Asset management firm VanEck has filed for a new exchange-traded fund (ETF), the Onchain Economy ETF. The new fund will target companies that are building crypto infrastructure. According to an SEC filing, the ETF will allocate at least 80% of its capital to “digital transformation companies”, such as crypto exchanges, payment gateways, mining operations, and infrastructure firms.

Regulatory

- Digital Currency Group will pay US$38 million to settle the SEC’s charges against the company over its bankrupt Genesis Global Capital lending unit. The company was accused of negligence and misleading investors following a larger borrower, Three Arrows Capital, defaulting on a margin call in June 2022, which had broader impacts on the fund’s solvency.

- U.S. Senator Cynthia Lummis (R-WY) made a scathing assessment of the Federal Deposit Insurance Corporation (FDIC) this week. Lummis has alleged misconduct in the FDIC’s handling of digital asset oversight and whistleblowers. In a letter sent to FDIC Chair Martin Gruenberg, Lummis said whistleblowers alleged the FDIC destroyed materials relating to the agency’s crypto operations to hide evidence that “Operation Chokepoint 2.0” existed. She also demanded specific categories of documents be preserved.

New Asset Listings

Newest Assets available at Caleb & Brown!

- Onxycoin (Onyx)

- Limewire (LMWR)

- Yiel Guild Games (YGG)

Buy & Sell these crypto assets, or Swap them directly with hundreds of other popular assets through your personal crypto broker.

To see our full list of available assets, visit the client Portal or this article.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.