Market Highlights

- Bitcoin plunged due to growing fears around China’s AI capabilities, sparking a tech sell-off.

- Silk Road Founder Ross Ulbricht was pardoned after spending over ten years in jail.

- The SEC established a new crypto task force to provide regulatory clarity to the sector.

- Asset Manager Bitwise registered a Delaware entity for a potential Dogecoin ETF.

Markets Overview

Macro Market Updates:

It was a big week in geopolitics. President Donald Trump was inaugurated and became the 47th president of the United States, and a ceasefire was agreed in Gaza, though complications have arisen. While many large-cap cryptocurrencies moved sideways, the traditional finance markets gained on the week’s developments. The S&P 500 reached a record high of 6,128 on Friday, 24 January, and the Dow Jones Industrial Average gained almost 409 points. This occurred following President Trump’s virtual address to the World Economic Forum, where he demanded “that interest rates drop immediately” and said he would ask Saudi Arabia to lower the price of oil.

The new highs didn’t last long, though. As the new week started, the growing popularity of DeepSeek, a Chinese artificial intelligence (AI) model, caused a sell-off across tech stocks. Analysts are calling it AI’s “Sputnik moment”. In the week ahead, all eyes will be on the U.S. Federal Reserve as it delivers its first rate decision for 2025 on Wednesday, 29 January.

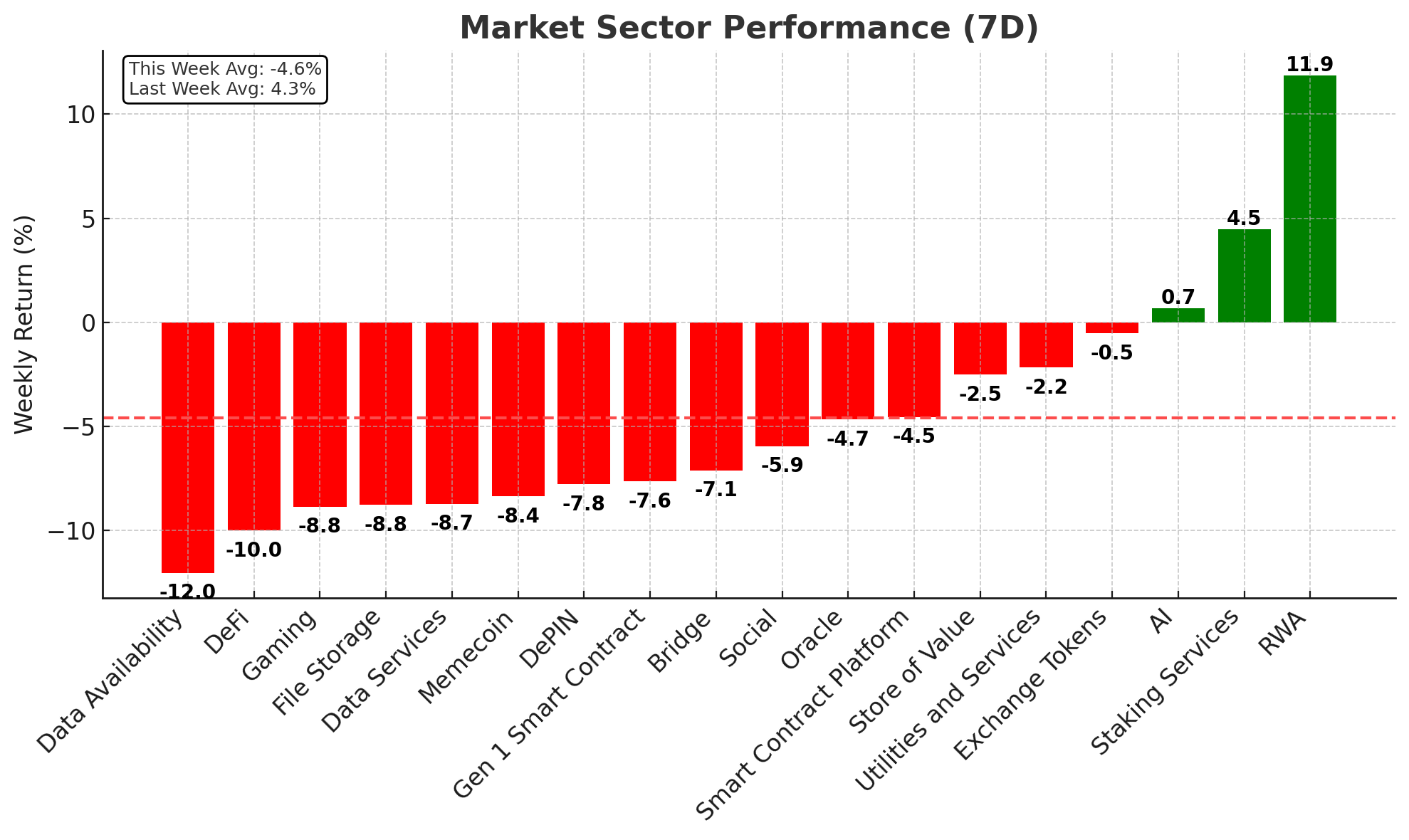

Crypto Market Sector Performance

Real-world assets (RWA), staking services and artificial intelligence (AI) led sector growth this week. The biggest gainer in RWA was MANTRA, which gained 30.7% on the week. The gains are presumably due to BlackRock CEO Larry Fink’s commentary around tokenising traditional finance assets (more on that below). Other gains across the market were marginal, given the wider pullback this week. Amongst some of the biggest pullbacks was RUNE, which plunged 30% as THORChain (DeFi), which mints RUNE to meet its lending obligations, paused BTC and ETH withdrawals, sparking insolvency concerns amongst the community.

Bitcoin (BTC)

Bitcoin made a new all-time high of US$109,358 on Monday, 20 January, as the crypto market responded positively to Donald Trump’s inauguration. Opening the week at US$94,507, price climbed over 18% before retracing back to US$100,000 for support. In the pullback, over US$1 billion in liquidations occurred. These liquidations were split between US$921 million long positions and US$260 million short positions.

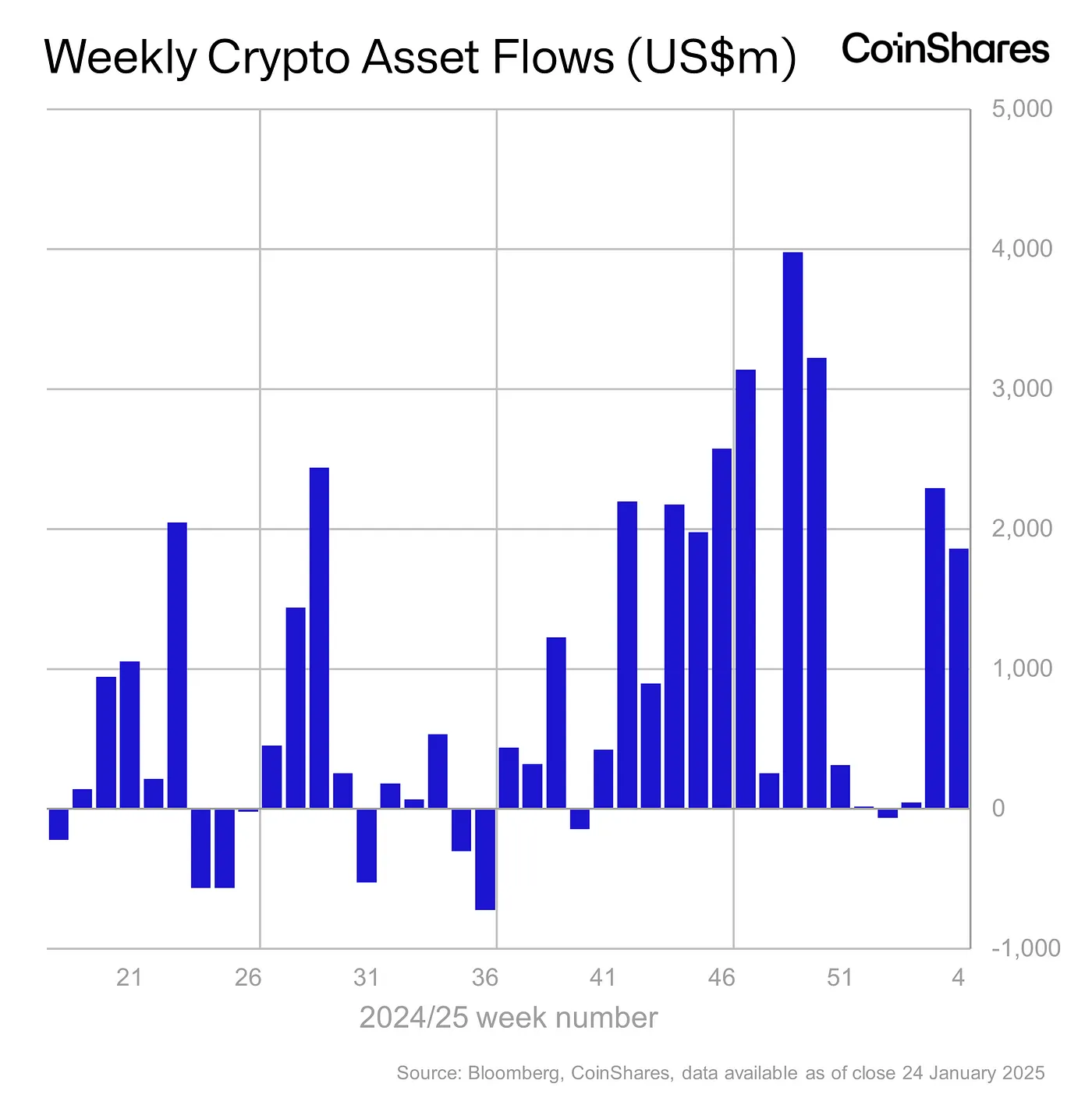

It was another strong week for bitcoin asset investment products, with US$1.9 billion of inflows. This brings year-to-date inflows to US$2.7 billion.

A new filing from the Department of Justice states that the bitcoin stolen in Bitfinex’s 2016 hack should be returned to the platform. Around 75% of the stolen bitcoin, worth around US$9 billion, has been recovered. Following the hack, Bitfinex launched a repayment program where customers were reimbursed with tokens that could be redeemed for U.S. dollars or Bitfinex shares. Some customers say this repayment program isn’t enough, given the surging value of bitcoin in recent years.

Wyoming and Massachusetts joined the growing list of U.S. states that have introduced legislation to establish a bitcoin reserve. Since Donald Trump’s re-election in November, one-fifth of U.S. states have introduced legislation to weigh up whether to invest public funds in bitcoin and other digital assets.

Coinbase has reintroduced bitcoin-backed loans via Morpho, a lending protocol on the Base network. Customers will be able to borrow up to USD$100,000 in USDC stablecoin instantly, with interest rates calculated based on market conditions. There will be no repayment schedules, provided the required loan-to-value ratio is maintained.

Past performance is not a reliable indicator of future results.

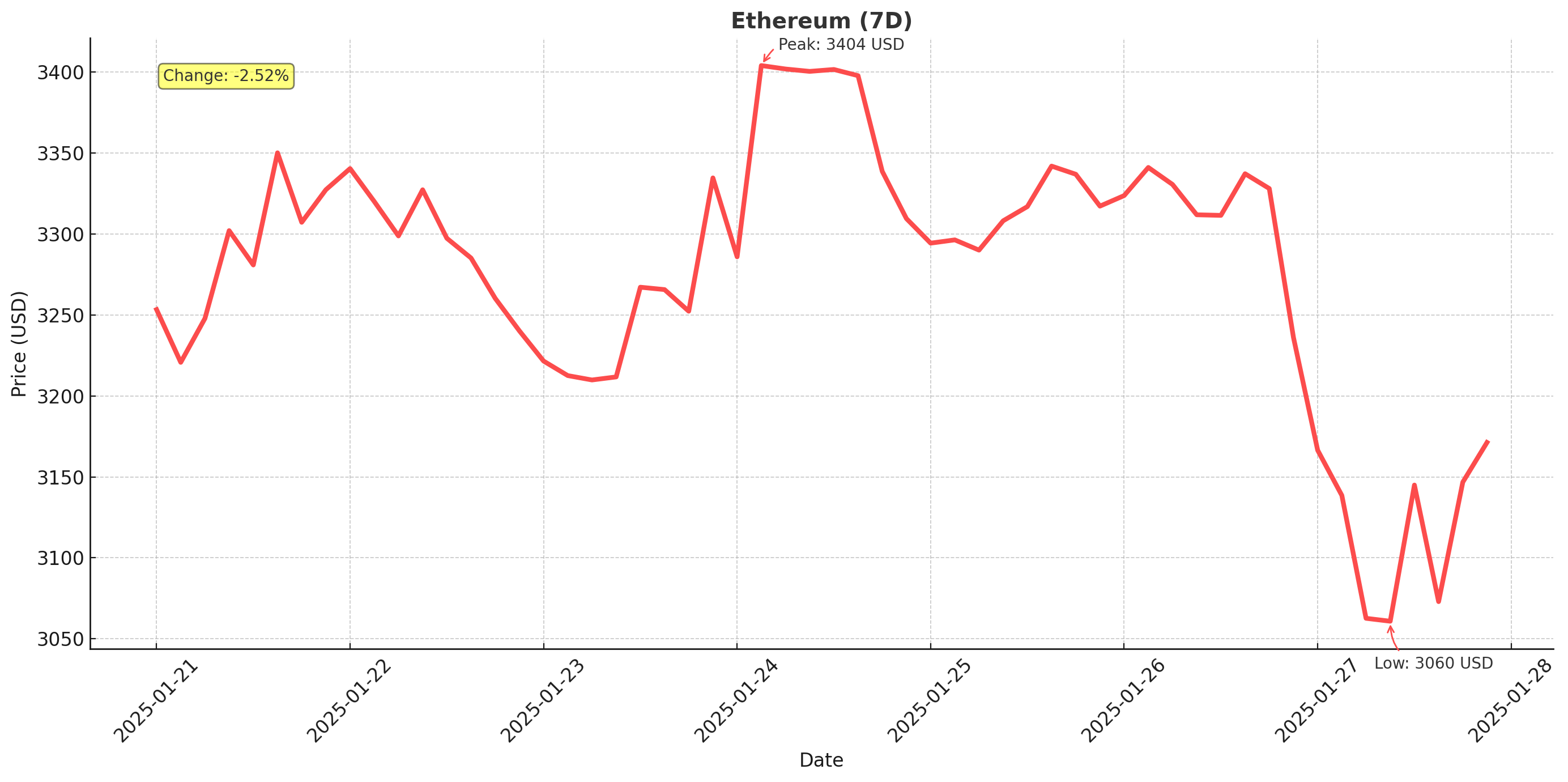

Ethereum (ETH)

It was a similarly lacklustre week for Ethereum. Opening the week at US$3,211, price rallied to break US$3,385 to the upside before declining by almost 9% to the key level around US$3,185.

Ethereum asset investment products continued its streak of inflows, with US$205 million flowing into funds.

Vitalik Buterin, Ethereum’s co-founder, expressed his thoughts on how Ethereum’s blockchain can evolve. With layer-2 networks dominating the blockchain, analysts have said the downside of enjoying layer-2 features, such as low gas fees and fast transaction speeds, is that it derails ETH’s token-burning roadmaps. Buterin suggested that developers focus on boosting Ethereum’s price by making sure layer-2 networks address value accrual. Also this week, Buterin criticised politician-issued coins, saying they are a “perfect bribery vehicle”.

Past performance is not a reliable indicator of future results.

Altcoins

Food for Thort

- VeThor (VTHO) gained 116.6%, taking its market cap to US$424.6 million. The smart contract layer of the VeChain Thor blockchain gained over 450% on Tuesday, 21 January, before retracting. The gains are due to its listing on Upbit, which saw trading volume explode by 88,000%.

Positive MANTRA

- MANTRA (OM) grew by 30.7%. This takes its market cap to over US$4.5 billion. The layer-1 blockchain for RWA gained almost 60% across Saturday, 25 January and Sunday, 26 January, before retracing. It follows BlackRock CEO Larry Fink saying he wants the SEC to approve the tokenisation of bonds and stocks, which may have spurred upward momentum for OM.

Currency gains

- Alchemy Pay (ACH) gained 38.8%, taking its market cap to US$138 million. The fiat-to-crypto payment gateway gained almost 120% across Sunday, 26 January, and Monday, 27 January, before retracing. The gains followed the team’s announcement that its on-ramp is now live on Uniswap.

DeFi-ing the odds

- Spell (SPELL) grew by 58.9%, which takes its market cap to US$225.4 million. Following last week’s run of over 120%, the DeFi network, owned by Abracadabra Money, that enables users to borrow, leverage and earn yield, grew by a further 90% before retracing. This week’s gains are presumably due to the meeting around the proposal of the Abracadabra and MIMSwap (MIM being one of Abracadabra Money’s tokens) deployment on Nibiru.

- Kaon (AKRO) gained 53.7%. This takes its market cap to US$2.9 million. Following declines of over 95% since its December 2024 high and Binance delisting, the layer-1 chain for bitcoin-based capital markets may be recovering. Kaon’s Chief Technology Officer recently penned an open letter to the community addressing criticism of its tech stack.

Past performance is not a reliable indicator of future results.

In Other News

President Trump’s crypto-related executive orders buoyed investor confidence this week, with US$1.9 billion flowing into digital asset investment products. This brings year-to-date inflows to US$4.8 billion. Although markets were largely flat throughout the week, trading volumes remained elevated at US$25 billion over the week, which equates to 37% of trading volumes on trusted crypto exchanges. These volumes indicate that the recent pullback isn’t adversely impacting trader confidence.

Other crypto news

- President Trump signed his first crypto-related executive order this week. The order establishes a Presidential Working Group on Digital Asset Markets. The group will be led by the White House’s “AI and crypto czar,” David Sacks, while agency leaders from the Secretary of the Treasury, the U.S. Securities and Exchange Commission (SEC), and Commodity Futures Trading Commission (CFTC) will also be involved. Notably, the executive order mentions exploring the establishment of a “strategic national digital assets stockpile”, which suggests that it may not be limited to a bitcoin-only reserve.

- One of President Trump’s first moves in office was pardoning Silk Road founder Ross Ulbricht. He spent over ten years in jail for several charges, including distributing narcotics, running a criminal enterprise, conspiring to commit computer hacking, and conspiring to commit money laundering. The Federal Bureau of Investigation (FBI) seized 173,991 bitcoin that were connected to Silk Road, which is now worth over US$18 billion. The FBI still holds these coins.

- Asset Manager Bitwise registered a Delaware entity for a potential Dogecoin ETF. "BITWISE DOGECOIN ETF" was registered as a statutory trust on Wednesday, 22 January. To launch an ETF, the company would still need to file an application with the SEC. Bitwise currently manages over US$12 billion in crypto assets.

Regulatory

- On day one of its new leadership, the SEC established a crypto task force to provide more regulatory clarity to the crypto sector and have a more proactive approach to regulating the sector. The agency’s announcement criticised the SEC’s retroactive and reactive approach under former SEC Chair Gary Gensler, saying the approach caused confusion and implemented untested legal interpretations.

- The SEC has finally rescinded Staff Accounting Bill (SAB) No. 121. SAB 121 was introduced in March 2022 and required companies to record crypto assets held on balance sheets as liabilities. Many critics said the measure created unnecessary complexity. The development follows the successful bipartisan effort amongst U.S. lawmakers in 2024 to overturn the bill in Congress. President Biden vetoed the bill. With SAB 121 rescinded, companies can now record crypto assets under the U.S. GAAP and IFRS standards.

- The U.S. House Oversight Committee announced an inquiry into the alleged “debanking” of crypto and associated companies throughout the Biden administration. It follows recently disclosed correspondence between the Federal Deposit Insurance Corporation (FDIC) and member banks that demonstrated a coordinated effort to deter banks from engaging with companies in the industry. The inquiry will investigate the improper debanking of individuals and companies based on political viewpoints and involvement in industries such as crypto and blockchain.

Media

- Caleb & Brown's CEO, Jackson Zeng, was featured in the Australian Financial Review, sharing insights on how Caleb & Brown stands out in the crypto industry. Read the full story here:

New Asset Listings

Newest Assets available at Caleb & Brown!

- Hyperliquid (HYPE)

- Bluefin (BLUE)

- Magic Eden (ME)

Buy & Sell these crypto assets, or Swap them directly with hundreds of other popular assets through your personal crypto broker.

To see our full list of available assets, visit the client Portal or this article.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.