Market Highlights

- Bitcoin and Ethereum started to regain their holiday losses.

- BlackRock’s BUIDL was approved to back Frax’s USD stablecoin.

- Terraform Labs co-founder Do Kwon pleaded not guilty to U.S. criminal charges.

- A Freedom of Information Act (FOIA) disclosure found Federal Deposit Insurance Corporation (FDIC) member banks were discouraged from using public blockchains.

Markets Overview

Macro Market Updates:

The holiday period was relatively lacklustre across markets. On Wednesday, 18 December, the FOMC cut the Federal Funds Rate by 25 basis points to 4.50%. In the meeting minutes, U.S. Federal Reserve Governor Jerome Powell expressed that the central bank’s rate-cutting trajectory will be cautious throughout 2025 due to sticky inflation and the need to wait for market reactions to President Trump’s policies.

Markets originally priced in 50 basis points of cuts in 2025. However, following Powell’s commentary and dissent amongst the U.S. Federal Reserve Board (FOMC member and Cleveland Fed President Hammack wanted to leave rates on hold), markets are now expecting around 35 basis points of cuts throughout the year. Risk-on assets declined on the news, with the S&P 500 losing 2.95% and bitcoin declining by 5.64%. The markets have since recovered slightly, though most risk-on assets remain below the new all-time highs reached in 2024.

In this week’s macro news:

- U.S. unemployment claims came in below forecast at 211,000.

- The U.S. ISM Manufacturing Purchasing Managers Index (PMI) came in slightly above forecast at 49.3.

- China’s manufacturing PMI came in at 50.1.

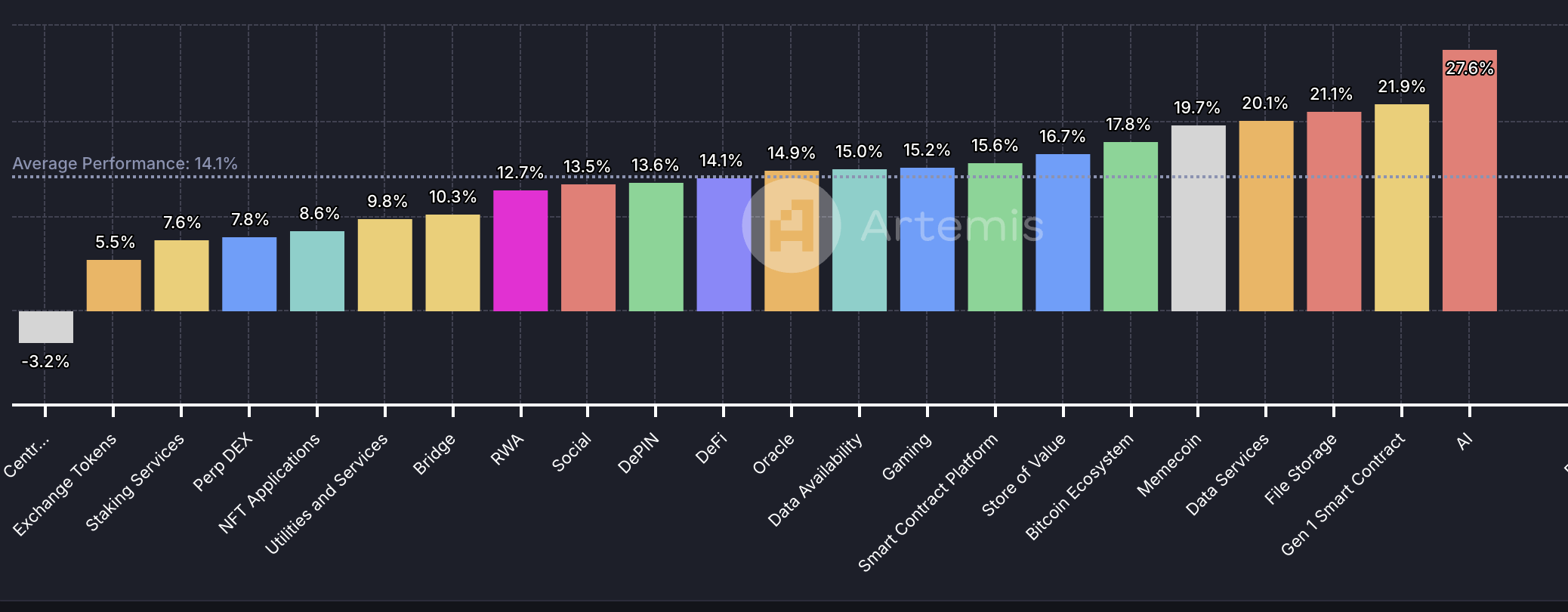

Crypto Market Sector Performance

The average sector performance across the crypto market this week was 14.1%. The sectors that experienced the highest growth were artificial intelligence (AI), generation 1 (gen 1) smart contracts, and file storage. The gains in AI cryptocurrencies leading sector growth this week is to be expected, given the recent growth in AI agents and associated AI meme coins (more on that below). In gen 1 smart contracts, XDC Network, IOTA and Cardano were the biggest gainers, growing by 43.1%, 32.3% and 27.8%, respectively, throughout the week.

Exchange tokens, staking services, and perpetual decentralised exchanges (Perp DEX) had the smallest levels of growth, though no sectors experienced declines this week, which demonstrates that it was a relatively strong week across the board.

Bitcoin (BTC)

Bitcoin regained some of its holiday declines this week. The largest cryptocurrency by market cap opened the week at US$93,563.35 and gained over 10% to break US$100,000 to the upside again. Price still remains below the 17 December all-time high of US$108,388.88, but it appears US$90,950 is providing support.

Throughout 2024, bitcoin asset investment products saw inflows of US$38 billion. This equates to 29% of the total assets under management (AuM). Over the last seven days, these products saw outflows of US$25 million. BlackRock’s iShares Bitcoin Trust (IBIT) saw record-high outflows on 2 January, with US$333 million leaving the fund, presumably due to profit-taking.

Metaplanet Inc. is planning to increase its bitcoin holdings by 470% in 2025, with a goal of holding 10,000 BTC by year’s end. The firm started accumulating bitcoin in April 2024 and currently holds 1,761.98 BTC, worth US$173.6 million. Their average purchase price currently stands at US$75,000.

MicroStrategy’s share price has declined by 45% since its new all-time high of US$543 reached in November. Adding another bitcoin acquisition to its treasury on Monday, 31 December, the firm bought 446,400 bitcoin, worth US$43 billion. This marks the firm’s smallest buy since August, but it’s not slowing down their BTC accumulation plans. This week, the company announced it will raise US$2 billion by selling preferred stock to advance its plan to raise US$42 billion over three years through selling equity and fixed-income securities.

Saturday, 4 January 2025 marked 16 years since Satoshi Nakamoto mined Bitcoin’s genesis block. Mining difficulty has since reached a new all-time high, growing to 109.78 hashes on Monday, 31 December. Network security grows in correlation with mining difficulty, meaning that the Bitcoin network is now stronger than ever.

Bitcoin is currently trading at US$101,947 an increase of 10.8% on the week.

Past performance is not a reliable indicator of future results.

Ethereum (ETH)

After steep declines over the holiday period, Ethereum gained over 8%. Opening the week at US$3,350.24, the second-largest cryptocurrency by market cap broke US$3,385 to the upside again, closing the week at US$3,635.46.

Ethereum asset investment products saw inflows of US$4.8 billion in 2024, equating to 26% of AuM. This is over double the total of 2021 and 60x more than 2023’s inflows. Throughout the last week, these products saw outflows of US$49.6 million, presumably due to persistent selling pressure.

Ethereum continues to experience selling pressure as taker sellers outpace taker buyers by more than US$350 million each day. While price has recovered slightly from its December declines, price still sits around 11% below its all-time high of US$4,109, which was reached on 16 December, 2024. Analysts have indicated that constant short-selling pressure caused Ethereum to make smaller overall annual gains compared to other cryptocurrencies (it grew by 78.5% in 2024) while having difficulty breaking out of its current range.

Ethereum is currently trading at US$3,682, an increase of almost 11% on the week.

Past performance is not a reliable indicator of future results.

Altcoins

Computing gains

- Hive (HIVE) gained 43.8%, taking its market cap to US$267.9 million. Most of the gains occurred on Sunday, 5 January, when price grew by over 70% before retracing. Hive’s no-fee blockchain enables web3 social, gaming, defi and more. This week’s gains could indicate growing investor and trader interest in multi-purpose blockchains.

Currency wins

- XDC Network (XDC) grew by 30.4%, taking its market cap to US$1.4 billion. The layer-1 blockchain presumably saw gains due to its recent growth in Brazil and Fandora’s integration with XDC Network, which allows users to fund content projects, such as films, music and live events. XDC is currently trading around US$0.102.

- Stellar (XLM) gained 30.3%. This takes its market cap to US$13.5 billion. After declining by over 40% since its November 2024 peak of US$0.63, price found support around US$0.33 and regained some of its losses. The price recovery is presumably due to strong technical price action and developments such as Stellar partnering with Fonbnk to help unbanked Africans gain access to a virtual debit card.

Smart contract growth

- AIOZ Network (AIOZ) gained 33.8%, taking its market cap to almost US$1.3 billion. The AI computing infrastructure network presumably saw gains due to the uptick in volume and price across a number of AI cryptocurrencies this week. AIOZ Network is also expanding through integrations with other networks, such as SUI DeSci Agents using AIOZ W3S for its decentralised storage.

- BitShares (BTS) grew by 31.7%. This takes its market cap to US$4.8 million. BTS regained some of the losses experienced since early December, following the announcement that Binance would delist BTS. Price fell over 75% since the delisting but regained over 30% this week.

On a roll

- Sushi (SUSHI) gained 30.8%, taking its market cap to US$362.7 million. This week’s gains are presumably due to a number of positive announcements, including a new chain deployment and the availability of v3 pools on the network. V3 pools allow users to gain concentrated liquidity and higher earnings by focusing on staking capital in specific price ranges. SUSHI is currently trading around US$1.79.

Past performance is not a reliable indicator of future results.

In Other News

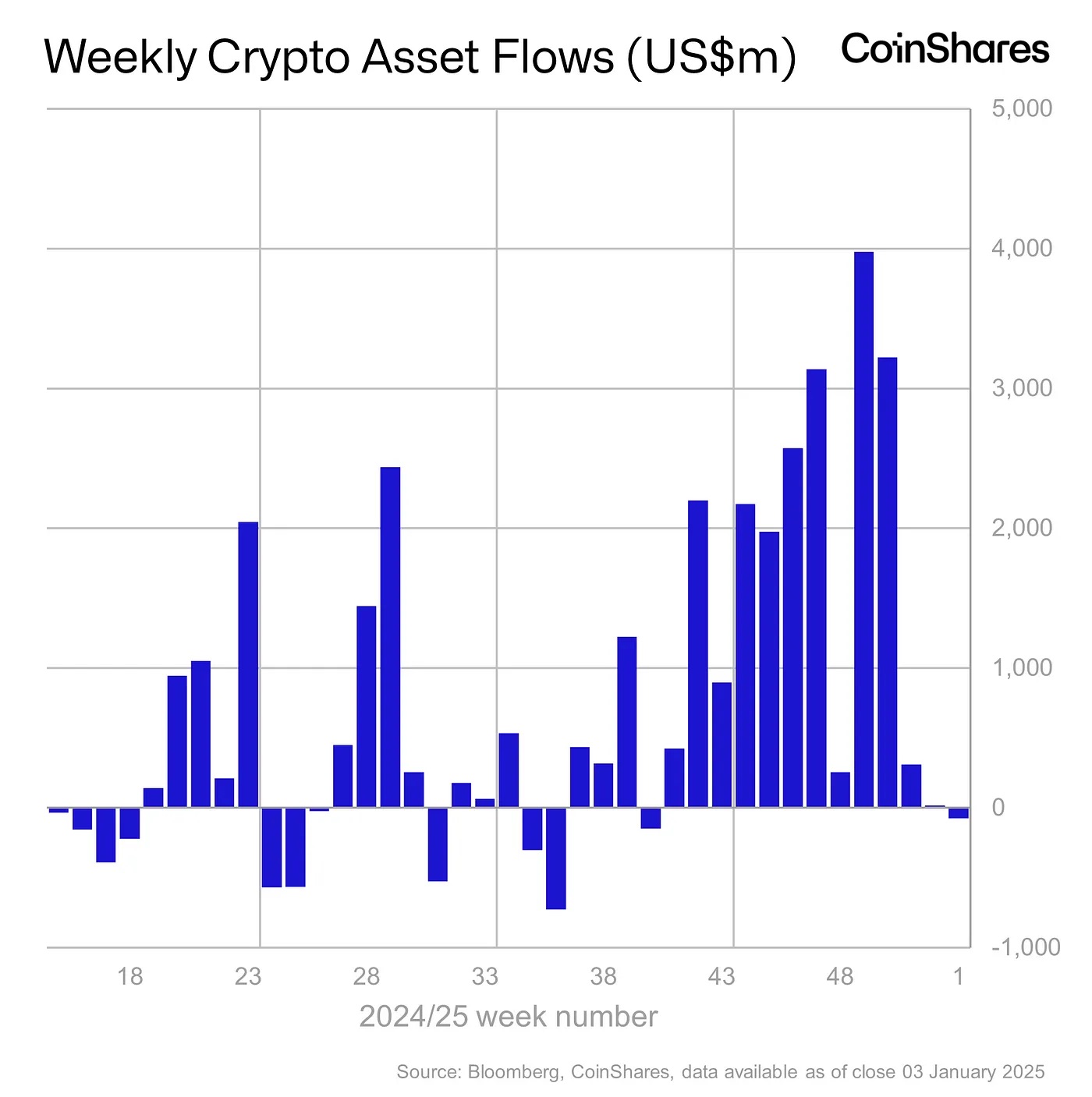

This week saw net outflows of US$75 million from digital asset investment products, which was buoyed by the first three days of the new year seeing US$585 million flowing into funds.

Throughout 2024, record inflows of US$44.2 billion were allocated to digital asset investment products. This is 4x more than the previous record of US$10.5 billion in 2021. The uptick in inflows throughout 2024 was driven by the approval and launch of spot-based ETFs in the U.S., where US$44.4 billion flowed into these products. This figure was offset by large outflows across Canada (US$606 million) and Sweden (US$682 million) as investors sought to switch to US-based funds or take profits.

Other crypto news

- The Solana network has created a quantum-resistant vault to protect users’ funds from quantum computer attacks. The vault, known as Solana Winternitz Vault, uses a hash-based signature system that generates new keys for every transaction. It’s likened to getting a new credit card number for every transaction. The aim is to address a key vulnerability in blockchain technology — that a quantum computer could use the public keys used to sign a transaction to derive a holder’s private keys with an Elliptic Curve Digital Signature Algorithm. The vault is optional for Solana holders.

- AI agent tokens are experiencing strong growth, with AI agents and their associated meme coins topping the best-performing assets of the day on Thursday, 3 January. AI agents are trained on models to perform specific tasks. Aixbt, for example, analyses projects, while some agents also have their own crypto token to raise funds or build their brand. AI16z grew by 176% in the last week, reaching a market cap of over US$2.2 billion. The recent growth in AI agent tokens has markets speculating over whether it’s this crypto bull market’s “metaverse”.

- BlackRock’s BUIDL has been approved to back Frax’s USD stablecoin, frxUSD. The approval comes less than two weeks after Securitize, the broker-dealer for BUIDL, submitted a governance proposal that it be used as backing for frxUSD. Cash, U.S. Treasury bills and repurchase agreements back BUIDL.

Regulatory

- A Freedom of Information Act (FOIA) disclosure has revealed that the Federal Deposit Insurance Corporation (FDIC) discouraged U.S. banks from offering services to customers that are built on public blockchain networks. Crypto exchange Coinbase secured redacted versions of the letter issued to FDIC member banks. One March 2022 letter from the FDIC to a member bank outlines the FDIC’s issue with using a public blockchain to roll out a digital deposit product rather than using a permissioned network that is controlled by administrators. The same letter requests that the bank submit to a new review process before launching future products on public blockchains.

- Terraform Labs co-founder Do Kwon has pleaded not guilty to U.S. criminal charges brought against him over Terra’s collapse. Kwon was charged with nine criminal counts, including securities fraud, wire fraud, commodities fraud, and conspiracy to commit money laundering. Authorities in the U.S. and South Korea allege that Kwon conned investors into buying Terra’s native cryptocurrency, LUNA, which collapsed in May 2022.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.