Market Highlights

- Bitcoin’s (BTC) bull run was setback nearly 10.0% this week after a report was released from Matrixport, predicting the rejection of all spot Bitcoin ETF applications by the U.S. SEC in January.

- Celsius Network (CEL), a bankrupt crypto lender, announced preparations for asset distributions.

- Solana (SOL) achieved a significant milestone in December by surpassing Ethereum (ETH) in monthly NFT volume for the first time.

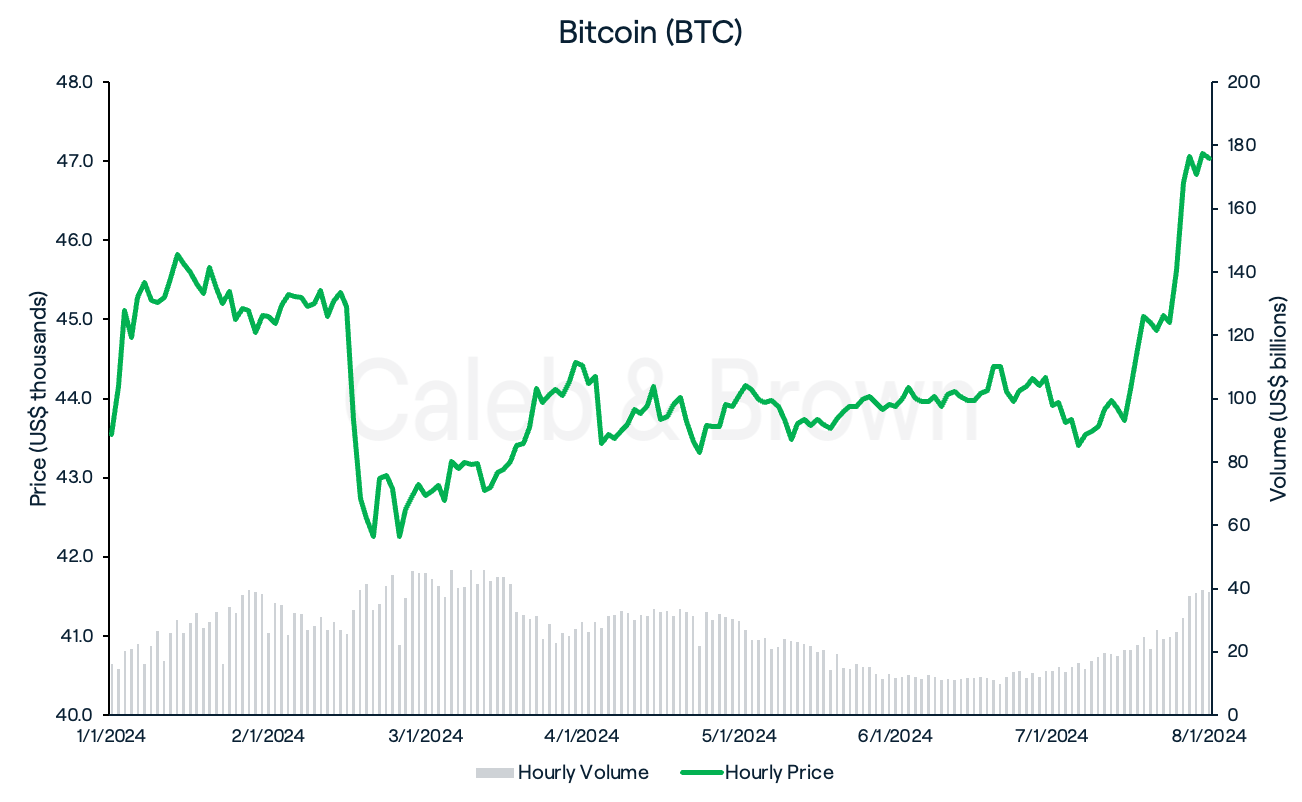

Bitcoin

Crypto investors were in a panic after Bitcoin’s (BTC) bull run was brought to a screeching halt on Wednesday, falling nearly 10.0% to a low of US$40,750, and erasing all of last week’s gains.

The sudden drop in price was linked to an ominous report from digital asset manager Matrixport, whose analysis concluded that the U.S. Securities and Exchange Commission (SEC) would reject all spot Bitcoin ETF applications in January.

However, experts, such as Bloomberg ETF analyst, Eric Balchunas were quick to reply to the paper, citing improper sourcing and faulty analysis.

Calmed by these reassurances, BTC was able to fully recover and extend its rally, closing the week at US$47,029 for a gain of 8.0%.

Recommended reading: What is a Spot Bitcoin ETF?

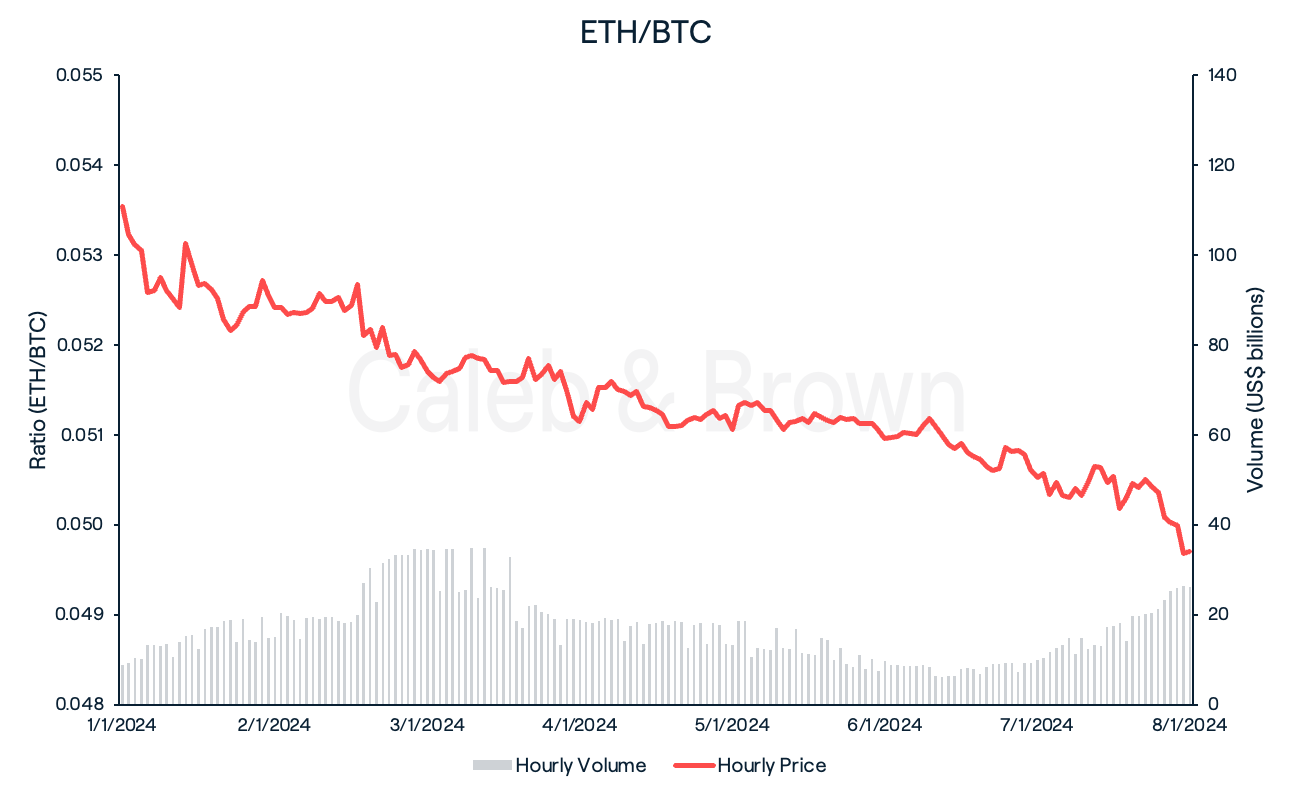

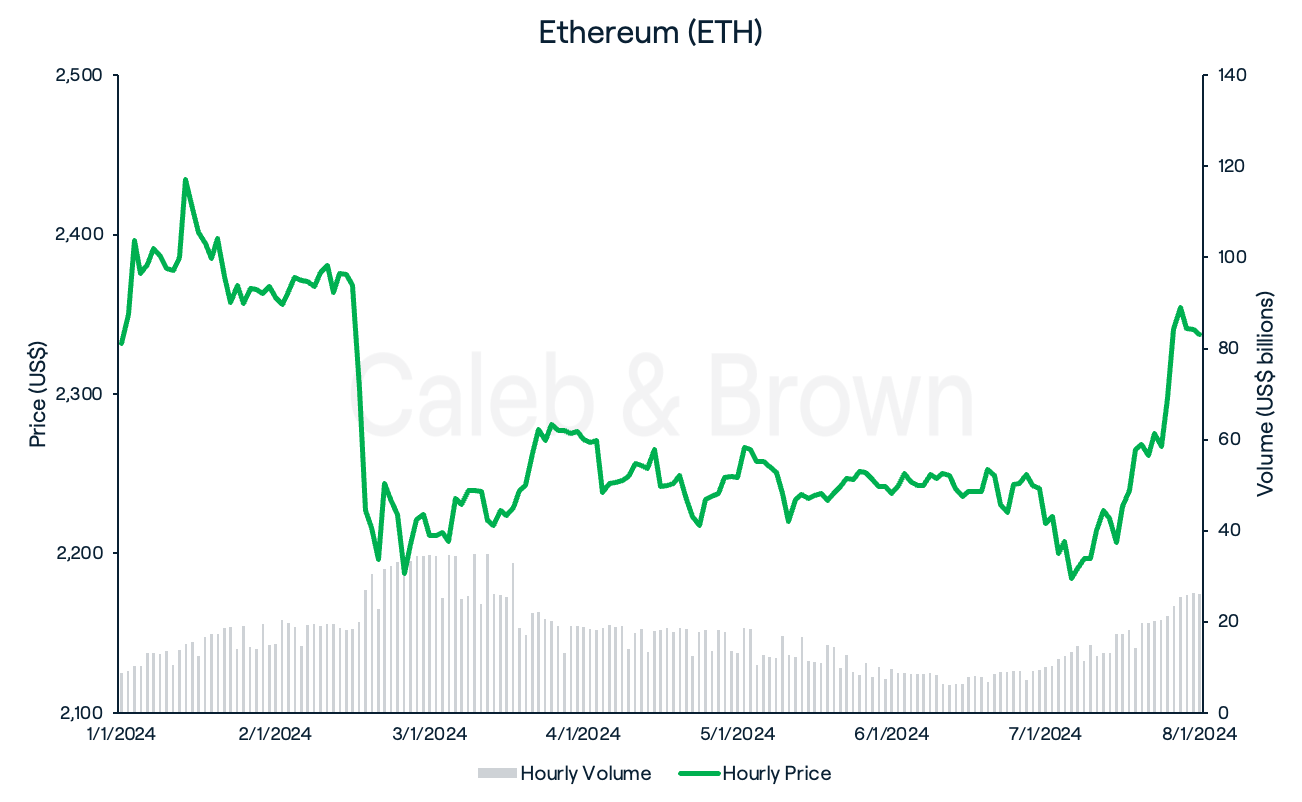

Ethereum

Ethereum (ETH) followed in BTC’s footsteps, falling 11.1% to a low of US$2,100 on Wednesday. ETH was also able to recover however to a lesser extent, losing 7.2% relative market share against BTC throughout the week.

ETH eventually closed the week at US$2,337, up a slight 0.2% over the last seven days.

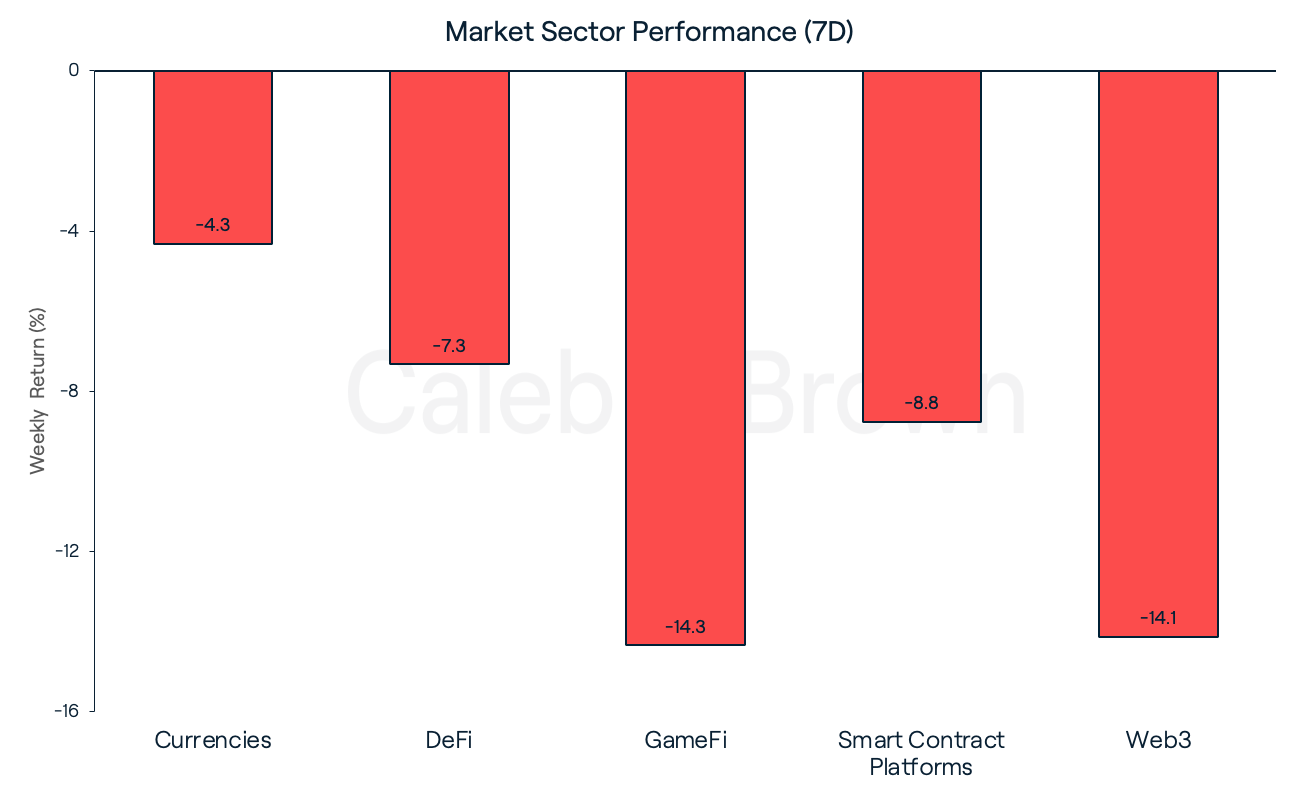

Altcoins

Despite BTC and ETH making a full recovery, the rest of the market remained in the red with GameFi and Web3 taking the hardest hits, losing 14.3% and 14.1%, respectively. Currencies held on strongest, falling just 4.3% in comparison.

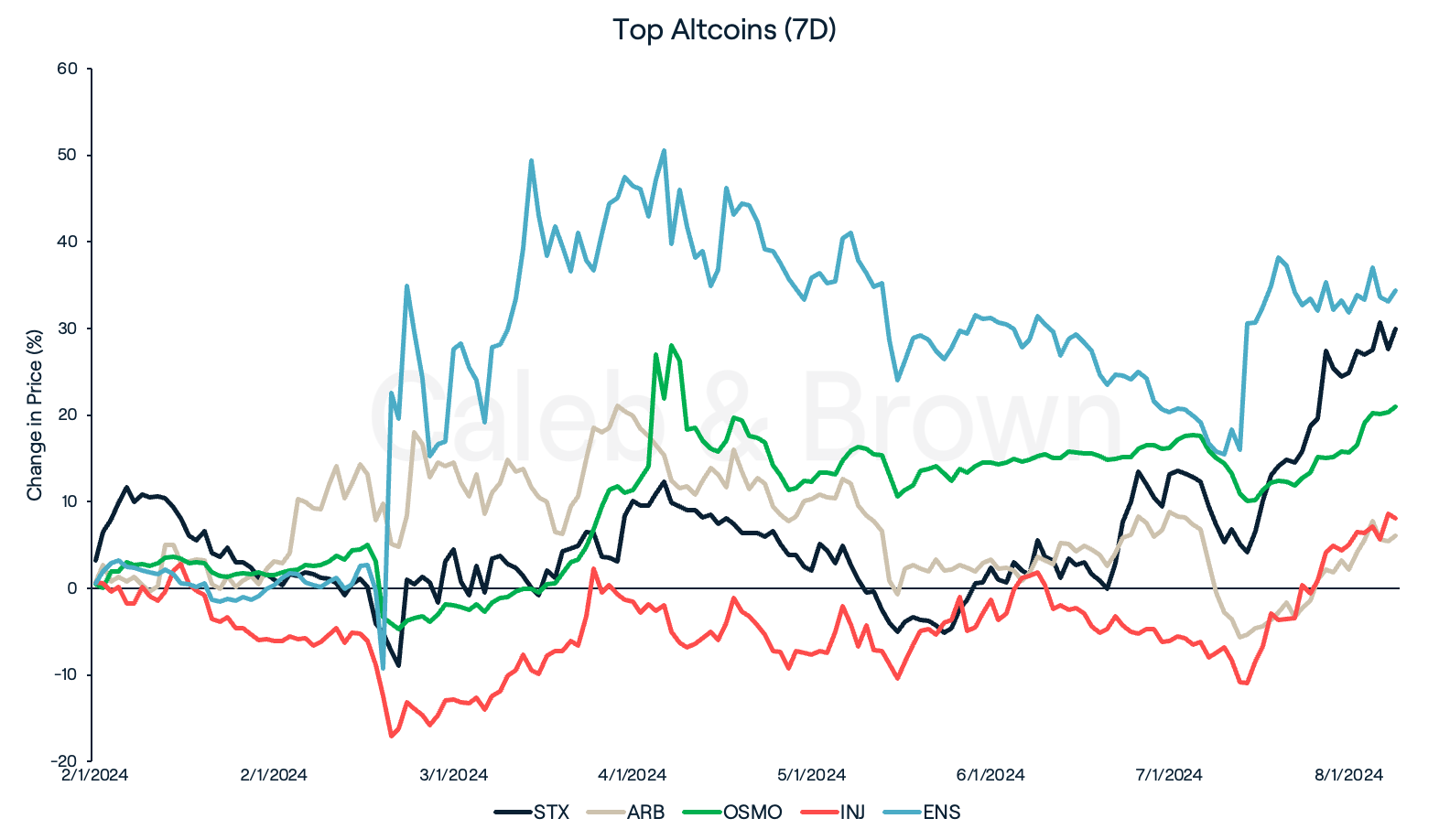

While majority of the crypto space experienced a tumultuous week, a handful of tokens managed to secure double-digit gains.

Scaling solutions, Stacks (STX) and Arbitrum (ARB) each gained 29.9% and 6.1%, respectively. STX continues to rise ahead of the anticipated BTC ETF approval news while ARB just crossed US$2.5 billion in TVL (total value locked), an all-time-high.

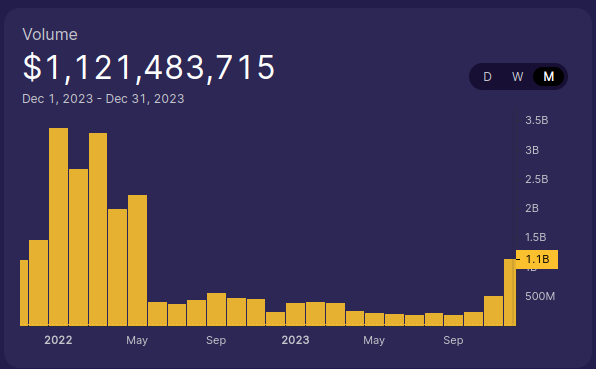

Leading the DeFi sector this week were Osmosis (OSMO) and Injective (INJ) which added on 21.0% and 8.0%, respectively. OSMO’s monthly trading volume past US$1 billion for the first time since May 2022.

Securing top spot this week was Ethereum Name Service (ENS) which rallied 34.4% after Ethereum co-founder, Vitalik Buterin highlighted the protocol’s importance to the Ethereum ecosystem.

In Other News

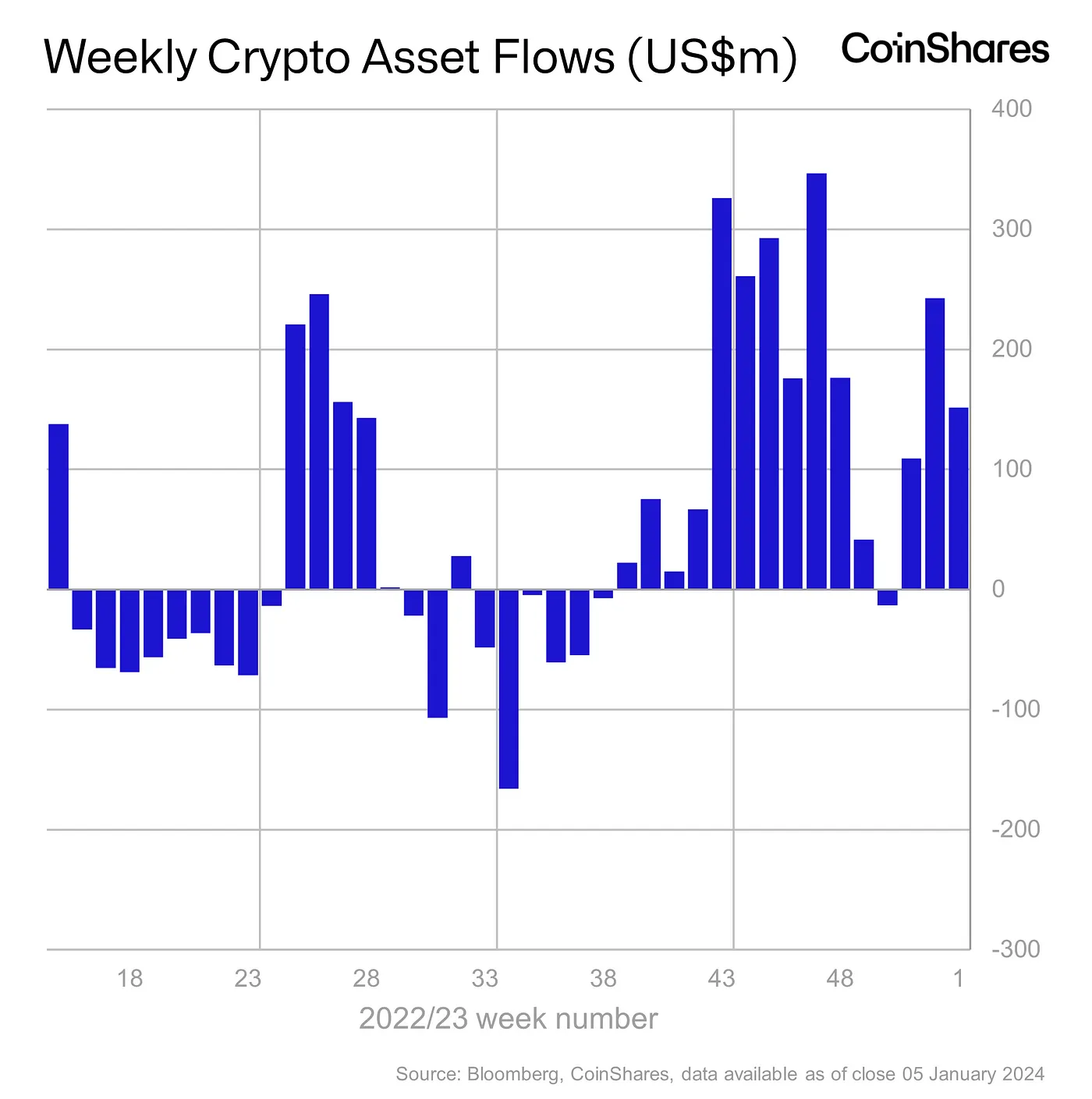

In the initial week of 2024, digital asset investment products saw inflows amounting to US$151 million. Since the Grayscale vs. SEC lawsuit, the cumulative inflows have now reached US$2.3 billion.

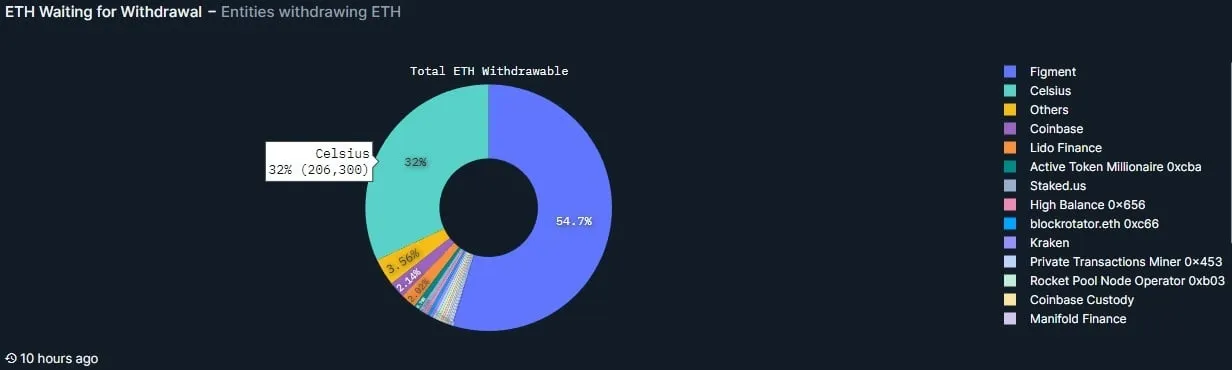

In preparation for asset distributions, bankrupt crypto lender, Celsius Network (CEL) recently announced that it had started the process of recalling and rebalancing assets. CEL added that it would un-stake its existing ETH holdings, "to offset certain costs incurred throughout the restructuring process". CEL currently accounts for 32% of ETH awaiting withdrawal, worth approximately US$460 million.

Solana (SOL) remains on a winning streak, achieving a new milestone in December by surpassing Ethereum in monthly NFT volume for the first time ever. Solana's NFT sales reached US$366.5 million, exceeding Ethereum's US$353.2 million. This performance nearly matched Solana's previous all-time high of US$373.5 million in October 2021. Notably, the number of unique buyers and sellers on Solana doubled during the same period.

New Asset Listings

We routinely add to our long list of almost 300 crypto assets for you to buy, sell, and swap directly!

Our recent additions include: Celestia $TIA Beam $BEAM Kaspa $KAS Bonk $BONK Jito $JTO Pyth Network $PYTH AIOZ Network $AIOZ

Click here to see a list of Caleb & Brown’s recently added crypto assets, and visit our Portal to see all 250+ assets we offer.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F6C0TZA6ohrkw1Vs0m2w2q1%2Fd7fb6e9688d436e961d23089f900f40a%2FWeekly_Rollup_Tiles__30_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-01-09T05%3A24%3A17.739Z)