Market Highlights

- Bitcoin reached a new yearly high of US$31,500 after BlockRock refiled its spot BTC ETF.

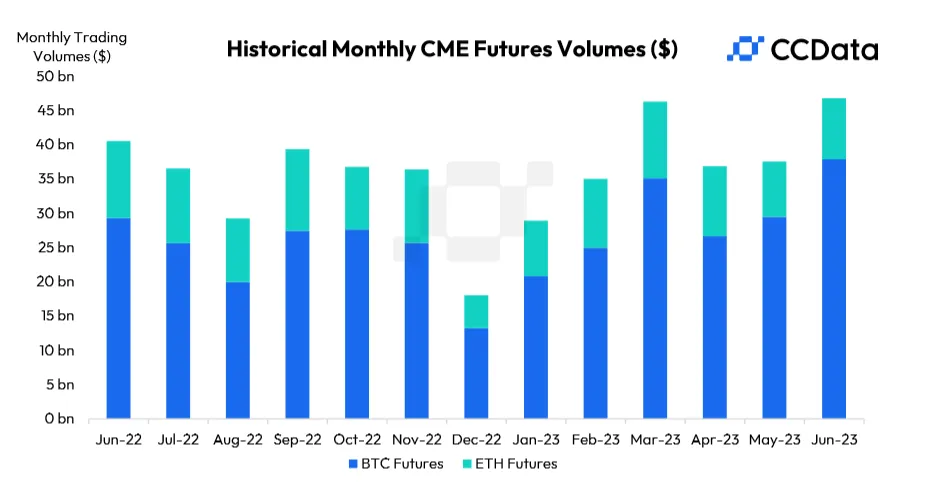

- Chicago Mercantile Exchange (CME) experienced its most successful June ever in terms of Bitcoin futures volumes, rising 28.6% to US$37.9 billion.

- Ethereum core developers highlighted the next big upgrade, dubbed "Dencun," is nearing its final stages of planning which will include the new proto-danksharding feature.

- Gemini filed a lawsuit against Digital Currency Group (DCG) and its CEO Barry Silbert.

Price Movements

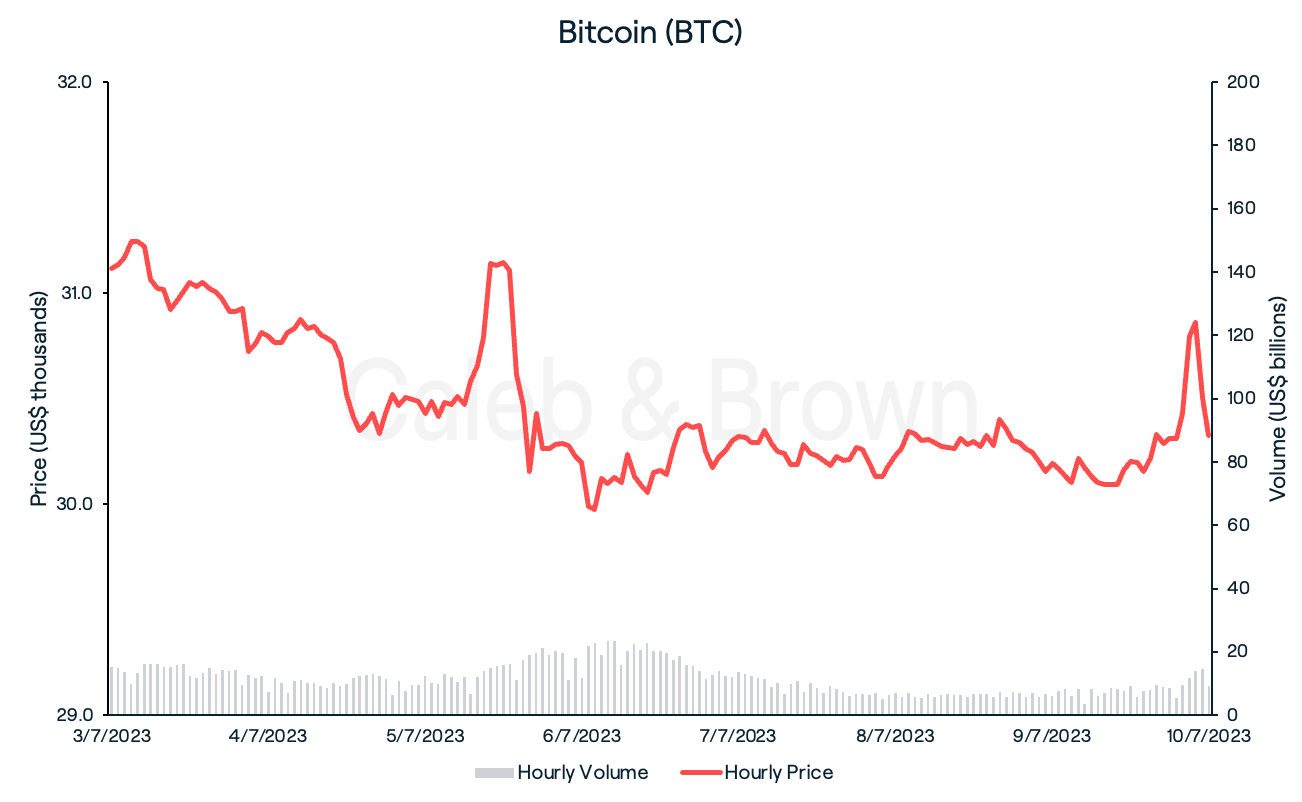

Bitcoin

Bitcoin (BTC) edged towards a new yearly high of US$31,500 this week after BlackRock, the world’s largest asset manager refiled its spot BTC ETF (exchange traded fund), amending its surveillance agreement with Coinbase (COIN).

This was short-lived however after the U.S. Department of Labor released strong unemployment data for June, hinting at an increased likelihood for another rate hike in July— bringing prices down.

Despite this, Chicago Mercantile Exchange (CME) saw its best June for Bitcoin futures volumes, rising an astounding 28.6% to US$37.9 billion, as reported by CCData.

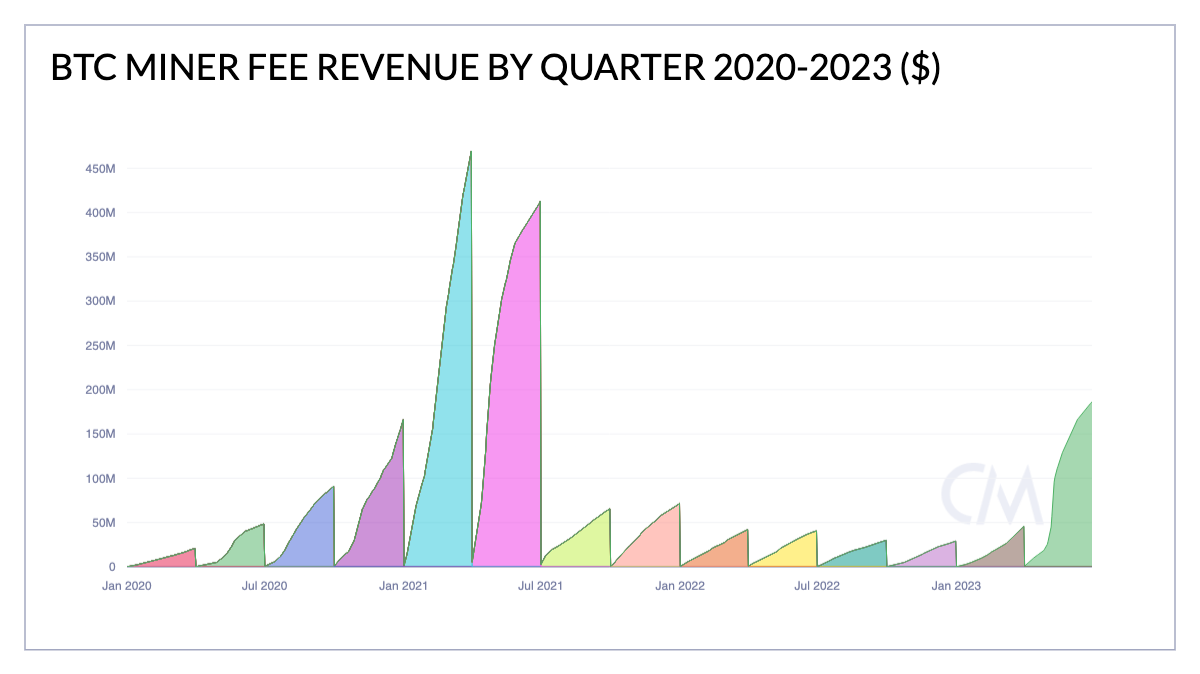

Additionally, a recent Coin Metrics report revealed that BTC miners earned US$184 million from transaction fees over Q2 this year, representing more than the five preceding quarters combined.

Overall, BTC closed the week at US$30,326, down 2.5% over the last seven days.

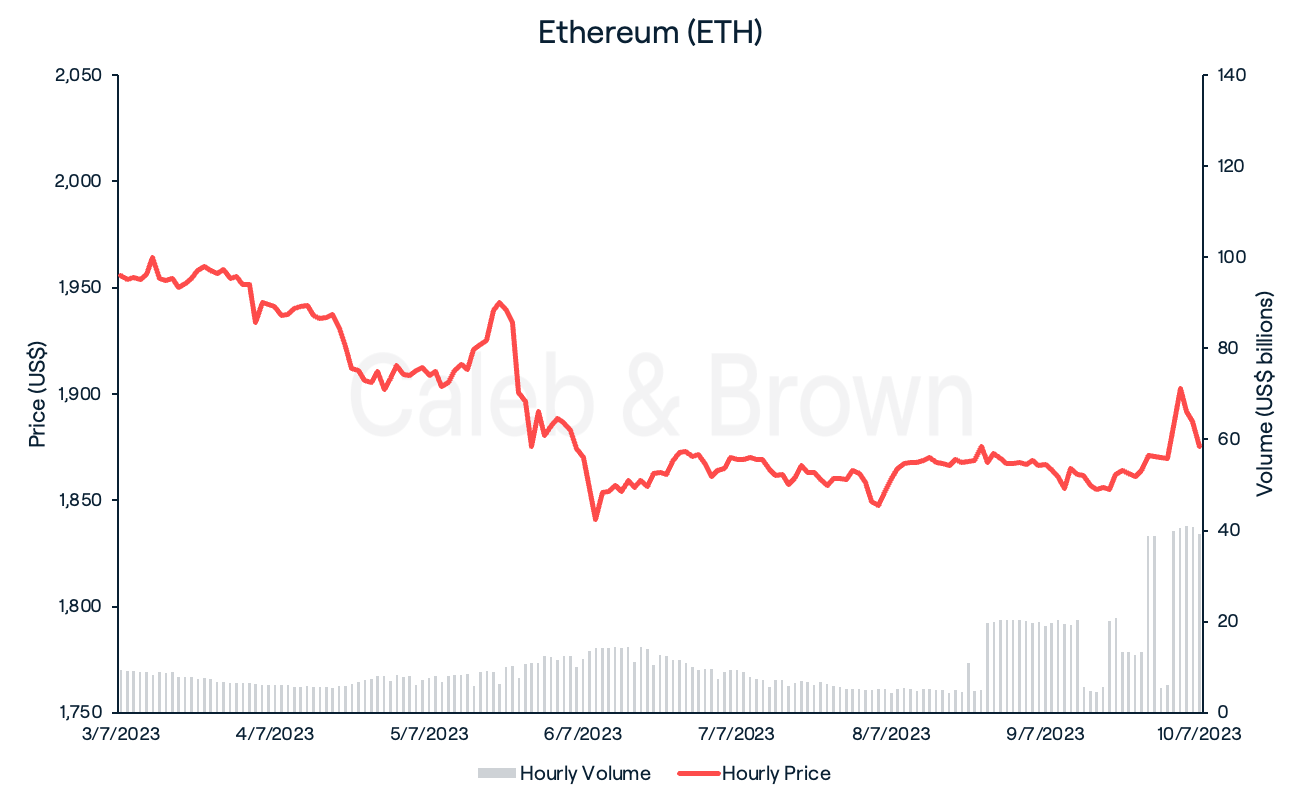

Ethereum

Ethereum (ETH) posted a bigger loss this week, moving in step with BTC as it hit an intra-week high of US$1,976 before tumbling over the weekend.

That same weekend, during ETH Barcelona, Ethereum core devs highlighted that the next big upgrade, dubbed "Dencun," is nearing its final stages of planning. It will introduce proto-danksharding and allow the network to scale up to 100,000 transactions per second.

ETH closed at US$1,875 for a weekly loss of 4.1%.

Altcoins

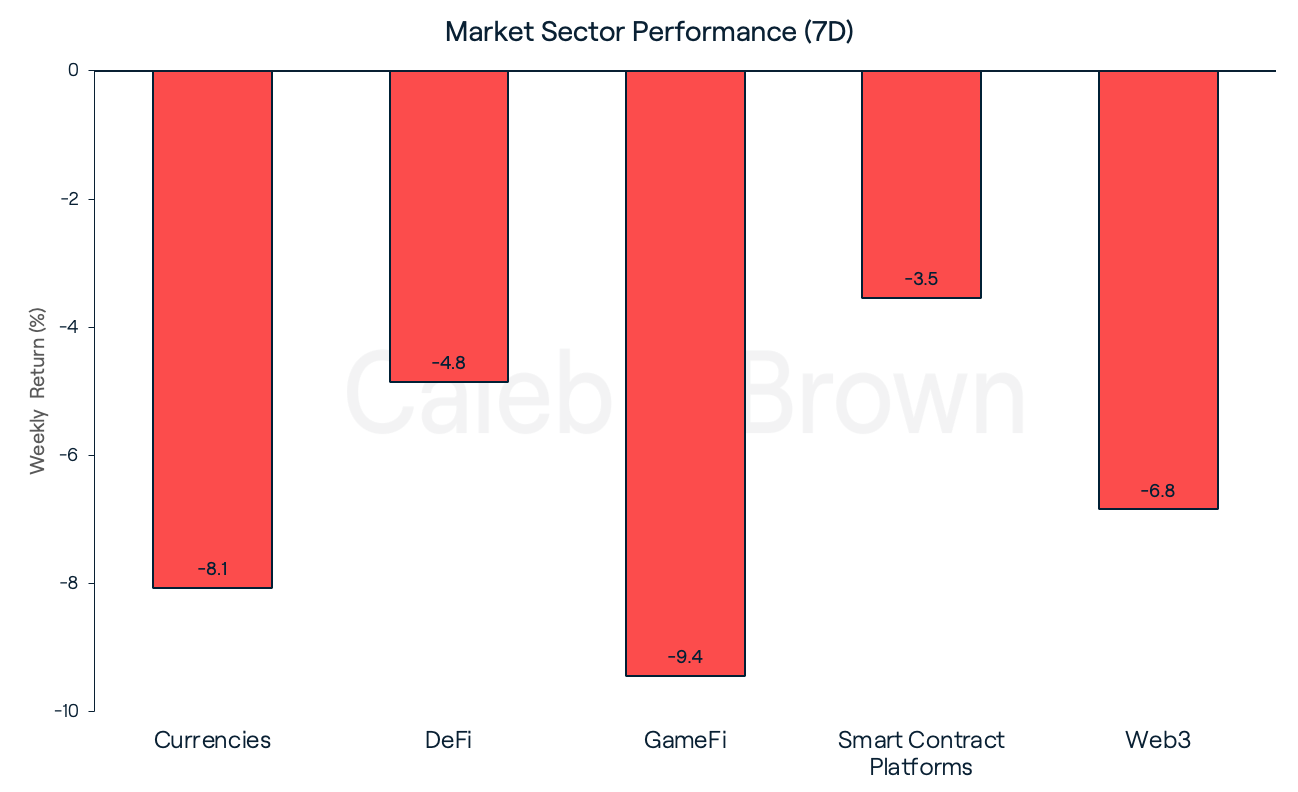

With BTC and ETH falling this week all market sectors were in the red. GameFi took the largest hit falling 9.4% week-on-week while Smart Contract Platforms held on to a 3.5% loss.

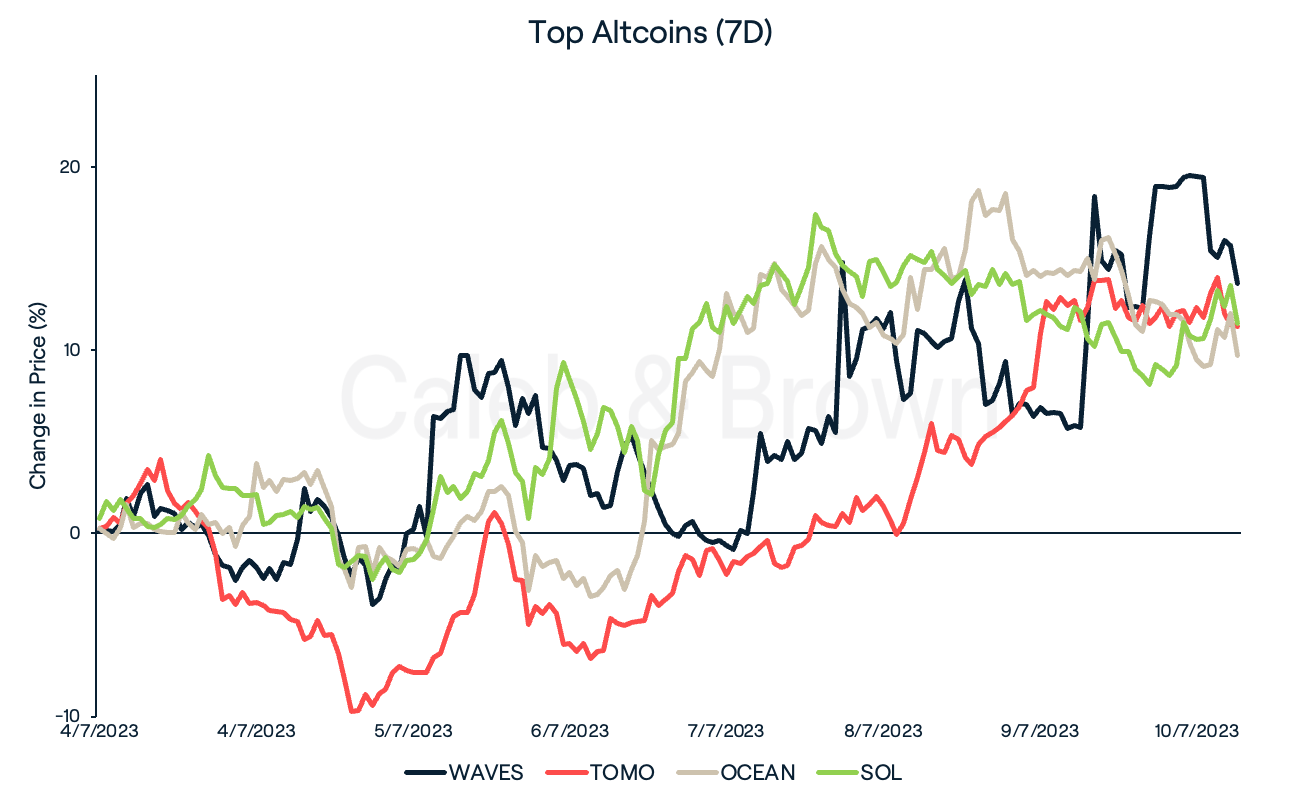

Despite the wave of red, a handful of tokens managed to defy the trend and achieved double-digit gains. Layer-1 protocols Waves (WAVES) and TomoChain (TOMO) increased by 13.7% and 11.3%, respectively over the last seven days. Waves recently underwent a network upgrade that adjusted block reward distributions.

AI-driven data-sharing platform Ocean Protocol (OCEAN), and Solana (SOL) also added 9.7% and 11.4%, respectively. Coca-Cola Serbia recently partnered with Solana-based NFT marketplace SolSea, to launch Coca-Cola themed NFT’s and merchandise.

In Other News

- Circle, the official issuer of USDC, announced a new programmable crypto wallet service for developers. The service will allow those building applications to “embed secure wallets within minutes.”

- Blockchain bridge, Multichain fell victim to another hack on Friday after US$126 million of funds were moved to unknown addresses. The funds included Wrapped Bitcoin (wBTC), Chainlink (LINK), and stablecoins USDC, USDT, and DAI. In an attempt to hamper the hacker’s efforts, Circle was able to freeze US$63 million worth of USDC.

Regulatory

- On Thursday, the Commodity Futures Trading Commission (CFTC) ordered Reichenthal and Levine, two men accused of running multi-million dollar Bitcoin fraud scheme, to pay US$5.375 million in restitution as part of their settlements.

- Gemini co-founder Cameron Winklevoss announced on Saturday that Gemini has filed a lawsuit against Digital Currency Group (DCG) and its CEO Barry Silbert, citing "false, misleading, and incomplete representations and omissions to Gemini.”

Recommended reading: Its price is up more than 100% in 2023! But what exactly is Solana all about? We teach you all there is to know about Solana in this blog.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2FDWnizUy0ul6l0qdGDtQIp%2F3fc51bff8b46964a187882267ce3426c%2FWeekly_Rollup_Tiles__4_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-07-12T02%3A25%3A58.282Z)