Market Highlights

- Bitcoin hit an all-time high of $123,000, fuelled by record spot ETF inflows and corporate treasury buys

- U.S. Congress began “Crypto Week”, advancing landmark bills on stablecoins and digital asset classification

- Grayscale filed confidentially for an IPO with the SEC.

- Trump Media "Crypto Blue Chip ETF" holding BTC, ETH, SOL, XRP & CRO.

- ISO 20022 goes live: Fedwire upgrade puts XRP, Stellar, Algorand & others in spotlight

Markets Overview

Wall Street hovered near record highs this week as investors shrugged off President Trump’s latest tariff plans, which target over 20 countries with steep duties effective Aug. 1. The S&P 500 is roughly flat so far in July, after surging 26% since April. The Nasdaq closed at a fresh record on July 14 as traders looked beyond near-term trade uncertainty.

Investors are awaiting key economic reports to gauge the Fed’s next moves. U.S. inflation for June (released July 15) is expected to uptick to ~2.7% year-on-year from 2.4% in May, due to tariff-related price pressures. Retail sales and industrial production data for June, alongside the kick-off of Q2 corporate earnings season, are also on tap. Despite lingering tariff tensions, market sentiment remains supported by hopes that cooling inflation will allow the Fed to hold rates steady at its upcoming July 30 meeting.

Weekly performance: S&P 500 0.6%, Dow Jones 0.2%, Nasdaq 0.9%.

Looking ahead:

- U.S. June CPI data – July 15.

- U.S. June producer price index – July 16.

- Q2 Earnings Season – week of July 14.

- Federal Reserve FOMC meeting – July 30

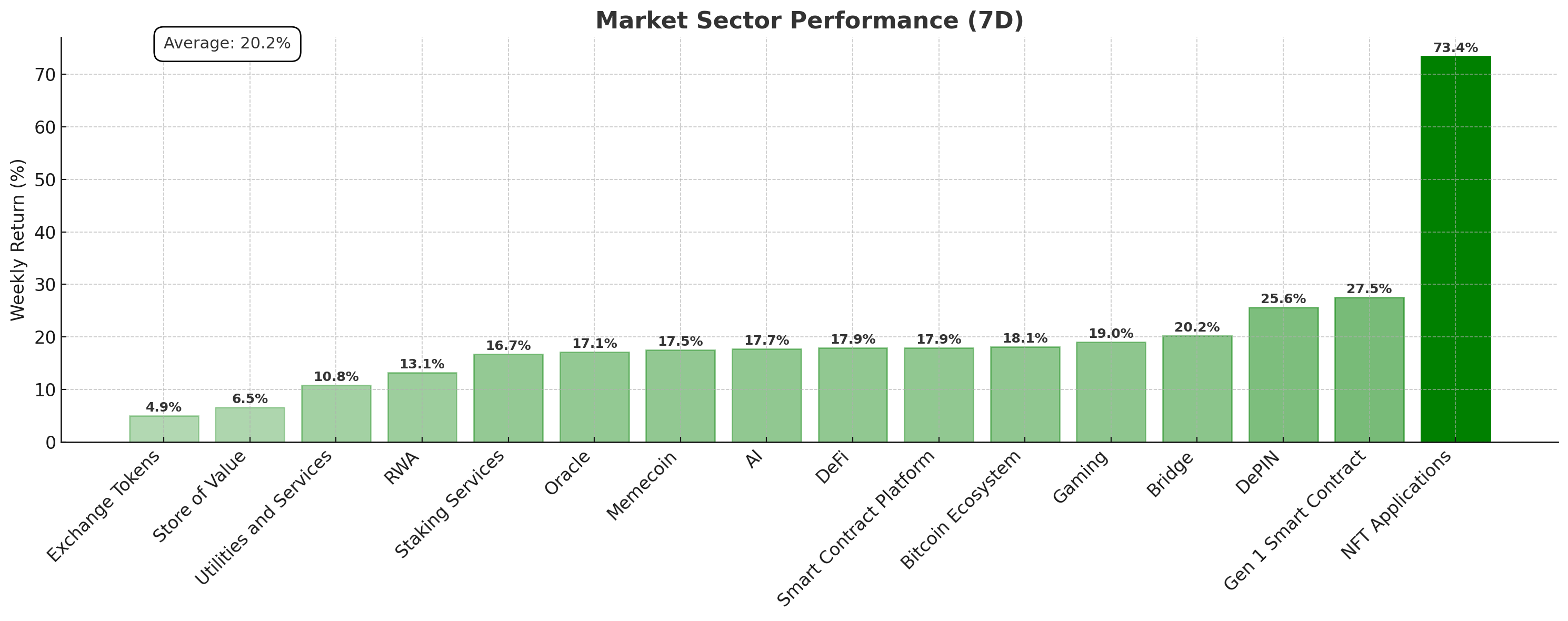

Crypto Market Sector Performance

Crypto sectors broadly rallied this week, driven by Bitcoin's breakout to new highs and institutional enthusiasm around U.S. regulatory developments.

NFT-related projects saw strength, with utility sectors performing well, while exchange tokens lagged behind.

-

NFT Applications: Pudgy Penguins (+73.4%) surged on increased adoption in tokenisation and ETF speculation.

-

Exchange Tokens: BNB (+4.9%) lagged potentially due to regulatory scrutiny.

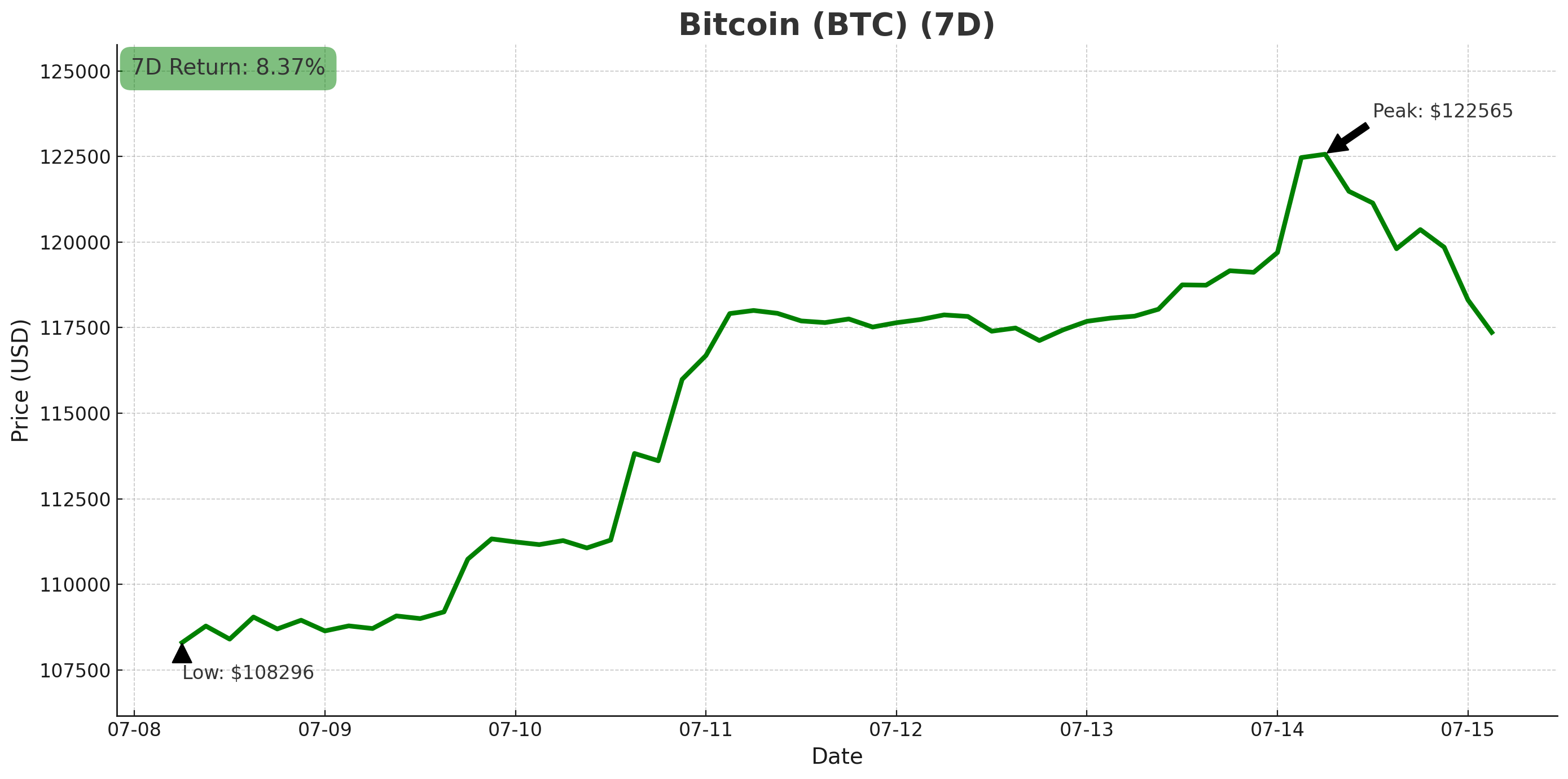

Bitcoin (BTC)

- Bitcoin’s market capitalisation now exceeds US$2.4 trillion, vaulting past the value of silver

- Opened the week around US$108,000 and soared to over US$123,000 on July 14, before modestly easing. (+11% 7D)

- US$2.7 billion inflows to Bitcoin investment products last week (second-largest weekly inflow on record), pushing total AuM to $179.5 billion.

- Corporate treasuries bought 4,700+ BTC

Investors are also growing optimistic about the regulatory outlook. Congress’ focus on crypto legislation during “crypto week” is viewed as a step toward U.S. regulatory clarity, potentially unlocking sidelined institutional capital. This policy momentum, combined with no Fed hikes expected in coming months, created a perfect macro mix for Bitcoin. Whale accumulation remains strong, addresses holding ≥1,000 BTC have increased, and long-term holders appear unfazed by volatility.

In bitcoin buying news:

- Strategy reported its latest acquisition of 4,225 BTC for $472.5 million, financed through stock sales. The firm now holds 601,550 BTC ($72B) at an average cost of $71,268. The company’s stock (MSTR) jumped 3.5% on the week

- Vanguard now holds over $20 million Strategy (MSTR) shares through its index funds, becoming the largest shareholder in this bitcoin proxy stock. This passive accumulation shows bitcoin quietly entering traditional portfolios via equity indexes.

- Metaplanet added another 3,002 BTC to its holdings (now 16,352 BTC total)

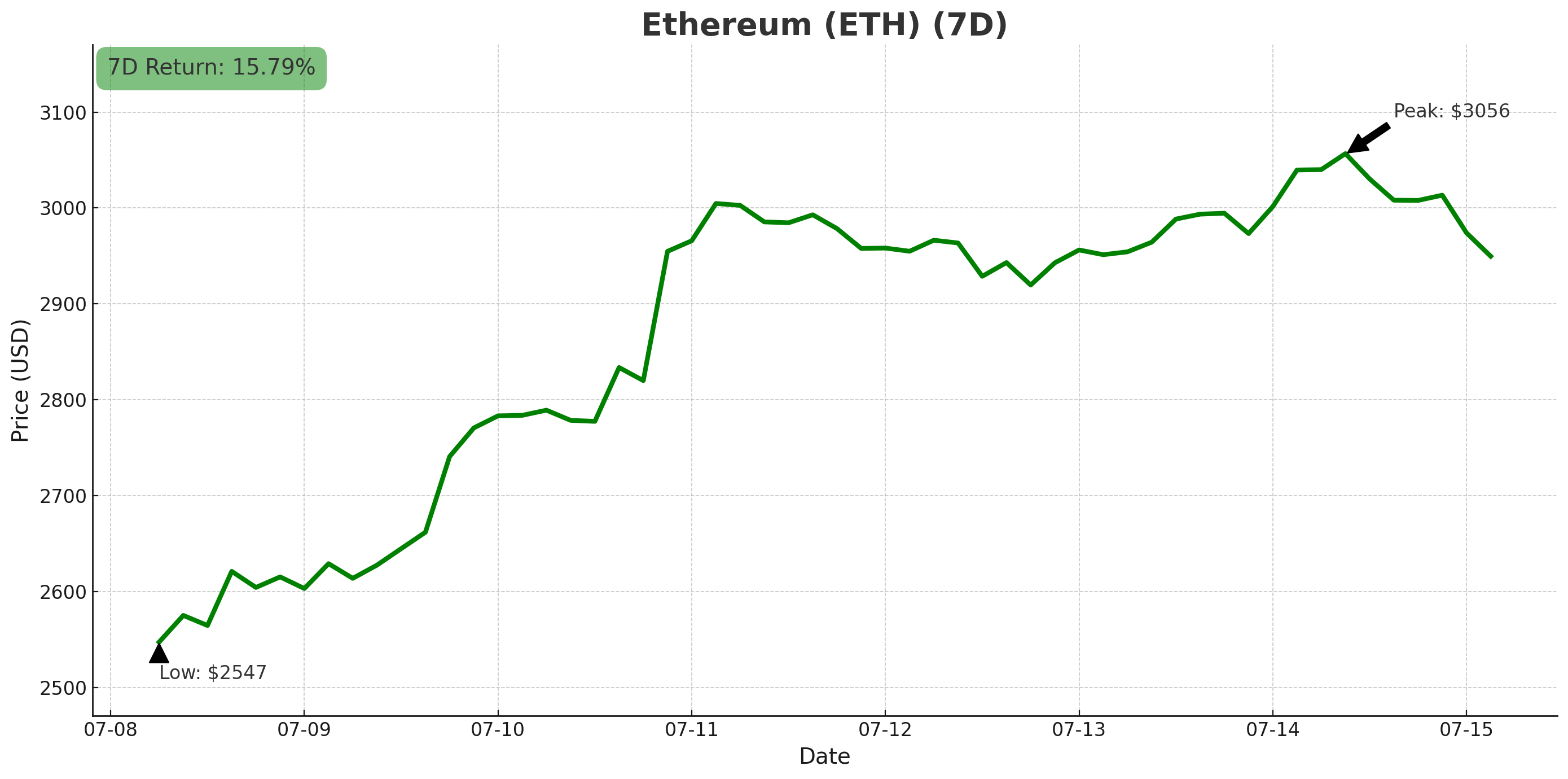

Ethereum (ETH)

- Opened the week at US$2,600 and rallied above US$3,000, reaching its highest price since January (+18% 7D)

- US$990 million of inflows went into Ethereum-focused funds, the 4th-largest weekly inflow on record.

Ethereum broke above $3,000 amid growing network activity and investor interest. Layer-2 solutions (like Arbitrum and Optimism) on Ethereum now process more transactions than the mainnet, with users drawn to lower fees and improved performance. These scaling solutions enhance Ethereum's utility while the network progresses toward further improvements like EIP-4844 to increase capacity.

The supply of ETH staked on the network hit a new all-time high of 29.44% of total supply. Over 35.7 million ETH are now locked in staking contracts, reflecting growing long-term conviction from holders. This week’s Ethereum rally coincided with a spike in staking deposits, as more investors chose to lock up ETH to earn yield rather than trade it, signaling confidence in Ethereum’s roadmap.

BitMine Immersion Technologies' stock crashed 60% after announcing plans to issue $2 billion in new shares, following last week's 30x surge from its Ethereum treasury strategy. This mirrors Sharplink Gaming's earlier 90% plunge after a similar ETH play.

SharpLink Gaming has officially overtaken the Ethereum Foundation as the largest known corporate holder of ETH, amassing 270,000 ETH, over $800M at current prices after a $49M buy this week. Backed by Ethereum co-founder Joe Lubin, the firm is modeling its strategy on MicroStrategy’s BTC playbook, with most of its holdings staked and acquired OTC to avoid market disruption.

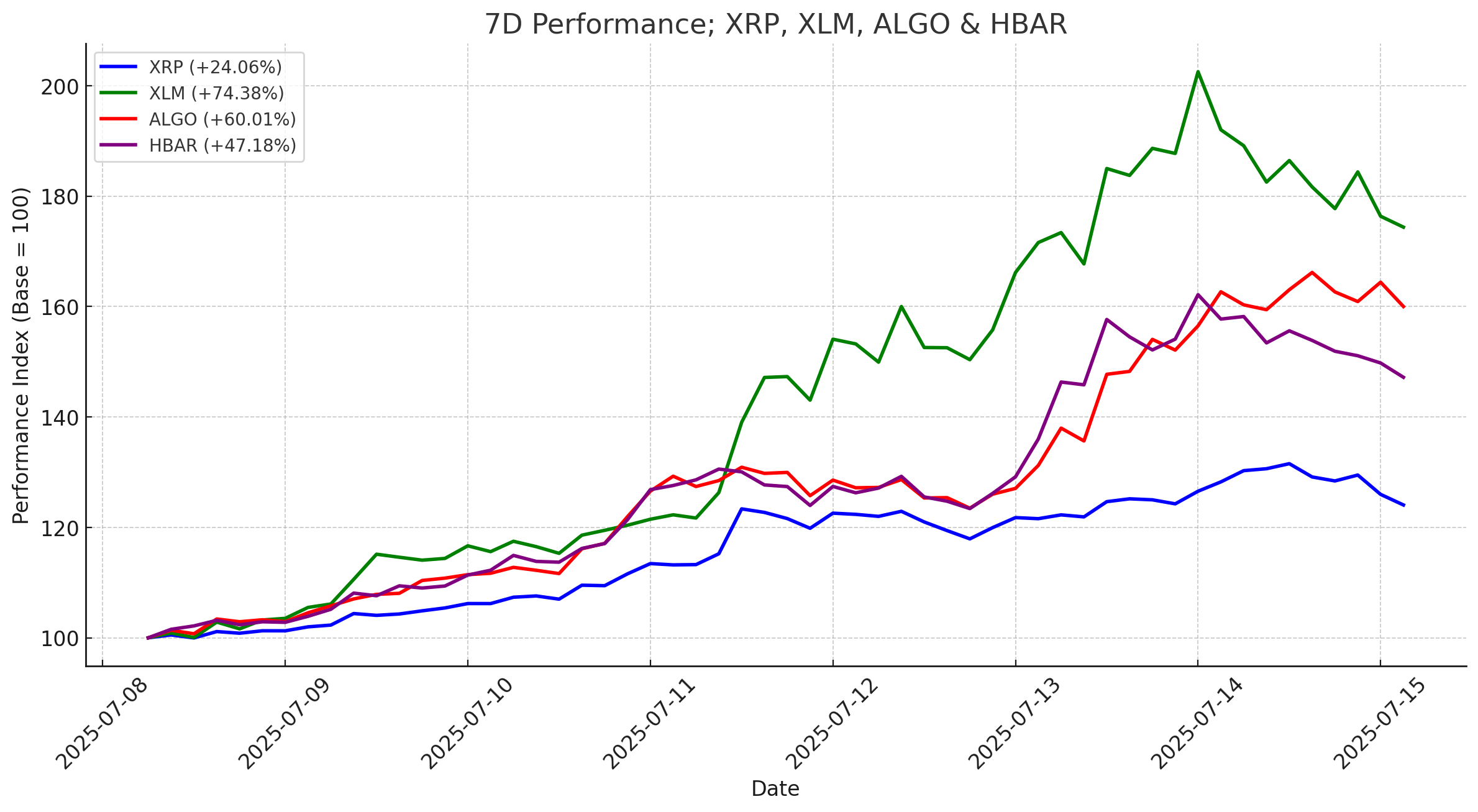

Altcoins

The altcoin market sprang to life, with several large-caps and niche tokens posting double-digit gains alongside Ethereum. The Altcoin Season Index nudged up to 32 (out of 100) from 26 last week. Bitcoin’s dominance dipped only slightly (around 64.5% → 63.5%), yet the 1% share shift spurred outsized moves in certain alts.

The recent adoption of ISO 20022 by Fedwire has drawn renewed attention to ISO-compliant blockchain networks, including XRP, Stellar, Algorand, Hedera, Cardano, and Quant.

- Pump (PUMP) – Pump.fun’s new token launched with a 53% jump above its public sale price after raising $500 million in minutes. The surge underscores persistent demand for meme-themed tokens amid a maturing market.

- Hedera (HBAR) – Up 50% this week after announcing a partnership with Accenture and EQTY Lab to launch “Verifiable Compute” on Hedera’s blockchain—tracking AI agent activity in defense/public-sector settings. The initiative, powered by NVIDIA GPUs, cements HBAR’s role in secure AI infrastructure.

- Stellar (XLM) – Gained 83% following the rollout of Protocol 23 (featuring Soroban smart contract upgrades), a surge in DeFi TVL (~$120M), and renewed interest tied to PayPal’s PYUSD integration on the network.=

- XRP – Extended its rally, up 29% as various ETF’s are set to launch. However, institutional investors appear to be taking profits, with XRP funds seeing ~$104 million in outflows.

Crypto ETF News

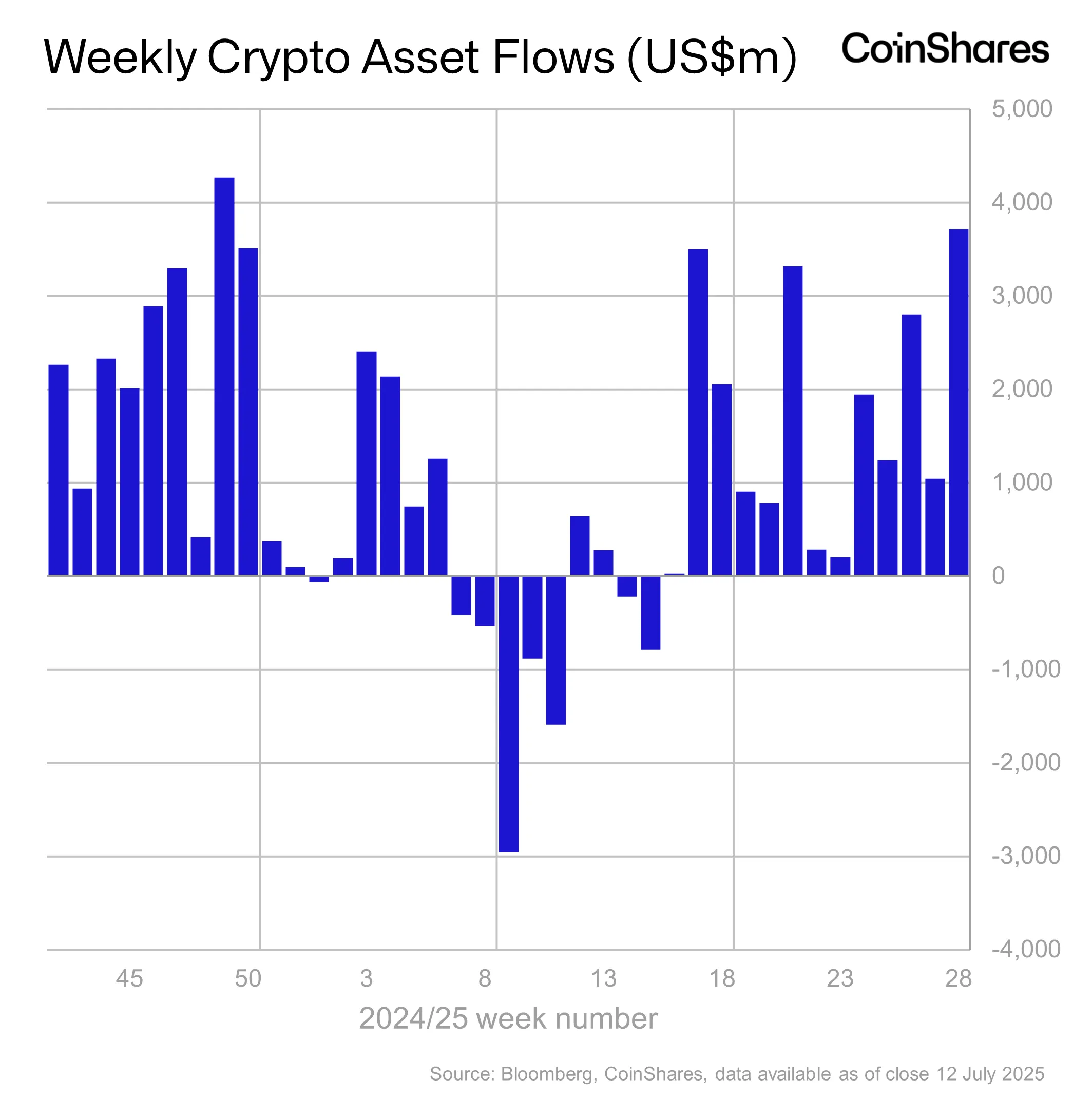

Digital asset investment products saw US$3.7 billion of inflows this week – the second-highest weekly inflow on record. Total crypto assets under management in ETFs and ETPs leapt to a new all-time high of US$211 billion.

Bitcoin funds dominated with US$2.7B in inflows. Spot Bitcoin ETFs have now amassed over $140B in assets since launching in 2024, and this week recorded one of their largest single-day inflows (~$1.18B on July 11).

Ethereum products also drew nearly US$1B. This extends ETH funds’ streak to 12 consecutive weeks of inflows, totaling ~19.5% of ETH’s fund assets, a much higher proportionate increase than Bitcoin’s over the same period. Analysts attribute this to growing confidence in an eventual ETH spot ETF approval and Ethereum’s pivotal role in DeFi and tokenisation.

XRP-based ETFs are hitting U.S. markets for the first time. ProShares launched a 2x leveraged XRP futures ETF on July 14, with more futures products on the way. Tuttle Capital’s XRP fund ($XRPV) takes effect July 16, and Volatility Shares plans to launch a spot XRP ETF on Nasdaq by July 21—potentially the first spot altcoin ETF in the U.S. The wave of fund activity follows greater regulatory clarity around Ripple, pushing XRP above $3 for the first time in over a year.

Trump Media (parent of Truth Social) filed a registration for the Truth Social Crypto Blue Chip ETF. The proposed fund will hold a basket of the five largest cryptos – 70% Bitcoin, 15% Ether, 8% Solana, 5% Cronos, 2% XRP – and seek to capture staking yield on certain assets. The ETF would list on NYSE Arca, pending SEC approval.

Grayscale is also pressing the SEC to allow its multi-crypto Digital Large Cap Fund (GDLC) to list publicly, citing potential investor harm if it remains untradeable.

Other crypto news

- U.S. lawmakers launched “Crypto Week” with a slate of landmark bills that could reshape the digital asset landscape. Leading the charge is the GENIUS Act, which would create the first federal framework for stablecoins, requiring 1:1 reserve backing and monthly transparency reports. With bipartisan Senate approval already secured, the bill is expected to pass the House and head to President Trump, who has declared strong support. Two other major proposals are also in play: the CLARITY Act, aiming to define when a digital token is a security or a commodity, and the Anti-CBDC Act, which would prohibit the Federal Reserve from issuing a U.S. central bank digital currency.

- The House Ways and Means Committee scheduled a July 16 hearing titled “Making America the Crypto Capital of the World” to examine how to properly tax digital assets. The panel will consider proposals to simplify crypto taxation, including a $300 de minimis exemption for low-value transactions and ending double taxation of mining/staking rewards – many of which mirror a new bill introduced by Senator Cynthia Lummis. Legislators aim to craft a clearer tax framework to reduce compliance burdens and encourage crypto innovation in the U.S.

- Grayscale Investments confidentially filed a draft S-1 with the SEC for an IPO with ~$33 billion AUM across 35+ crypto products, aiming to go public amid bullish crypto momentum. Other players like Circle, eToro, Galaxy Digital, and Gemini are also preparing IPOs, fueled by favorable policy stances and regulatory progress.

- The U.S. Treasury Department and IRS formally repealed a controversial “crypto broker” reporting rule that would have affected DeFi platforms. The rule, originally introduced in 2021, sought to require decentralized exchanges and wallet providers to collect user information and report transactions to the IRS. After Congress voted to nullify the mandate, regulators withdrew it on July 10. The repeal removes a potential compliance burden on DeFi developers and affirms that non-custodial entities will not be treated as brokers for tax purposes.

- The Reserve Bank of Australia initiated Phase 2 of Project Acacia, a pilot for CBDC and stablecoin technology with major banks and tech firms. The project runs into early 2026 .

- The U.S. Senate confirmed Jonathan Gould (former chief legal officer at Bitfury) as the next Comptroller of the Currency (OCC) in a 50-45 vote. His confirmation fills a key banking regulator role that oversees national banks and crypto custodians. The OCC under Gould could revisit pending applications like those from Ripple and Circle for national trust charters.

- Ant International, the global arm of Ant Group (backed by Alibaba’s Jack Ma), announced plans to integrate Circle’s USDC stablecoin into its blockchain network. The rollout will occur once USDC meets full U.S. regulatory compliance. Ant is also reportedly applying for stablecoin issuance licenses in Hong Kong and Singapore, aiming to introduce yuan-pegged stablecoins to challenge USD-dominated tokens.

- NRW.Bank, a German state-owned development bank, issued a €100 million two-year bond on the Polygon blockchain. It’s the first major public-sector bond to use Polygon under Germany’s eWpG electronic securities law. The bond’s registration on-chain (facilitated by fintech Cashlink) demonstrates growing institutional adoption of blockchain for traditional finance.

- Trump’s Truth Social plans to launch a “Truth Token” to reward user engagement through in-app activity. Unlike earlier meme coin rumors, this utility token may be used for platform features or trading marking another step in Trump's growing embrace of crypto, following NFT drops and a recent crypto ETF filing.

- Ripple secured BNY Mellon as custodian for its RLUSD stablecoin, enhancing institutional access to Federal Reserve payment systems.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.